What To Do Before A Hiring Manager Runs Your Credit

If youre a job candidate and youve been asked to consent to a credit check, youll want to know exactly what the employer will see on your reports.

The best way to do this is by obtaining a free credit report from all three bureaus at AnnualCreditReport.com. Ordinarily, youre only entitled to one free report per year from each bureau, but due to the pandemic, you can receive a free report every week through December 2022. However, checking your reports this frequently probably isnt necessary.

Your credit reports are genuinely free on AnnualCreditReport.com. Unlike some sites, you dont need to fork over your credit card info for a temporary trial to obtain them.

If you find any inaccurate information, its vital that you dispute it pronto with the bureaus and let the hiring manager know that youre disputing it as well.

But when the report contains negative information thats correct, the proactive approach is best. If youve made mistakes in the past, ask to talk with the hiring manager before they run your credit.

If your credit troubles are the result of hardship, like a death in the family, a layoff or a divorce, you may want to explain the circumstances to the hiring manager, though be careful about offering TMI.

Youll be in a better position to make your case if you can explain how youre working to fix things and why your previous mishaps wont affect your job performance.

Where Can Employers Check My Credit Score

The issue of whether employers can check your credit report has been contested in several states and cities throughout the United States. Know that the Fair Credit Reporting Act requires employers to obtain consent before they pull an applicant’s or employee’s credit report. In other spots, credit reports can’t be checked unless an individual is applying for a very specific position.

Currently, 11 states place restrictions on an employers ability to use credit information for employment decisions California, Colorado, Connecticut, Delaware, Hawaii, Illinois, Maryland, Nevada, Oregon, Vermont and Washington.

You can use the list below to see the exact wording of the regulation for the state in which you live.

What You Can Do To Prepare For An Employment

If you arent sure your credit report will positively impact your chances of being hired, there are a few things you can do.

Todd Christensen, education manager with Money Fit by DRS, recommends starting by finding out exactly what is on your credit report and taking steps to dispute any inaccuracies. You can request a free credit report from each of the three credit reporting agencies once per year through AnnualCreditReport.com.

He also suggests getting up to date on late payments and addressing any balances in collections.

If you have outstanding collections, consider finding a way to pay them off or down, Christensen says. A paid-off collection account is not only ignored by the most common credit scoring models, but a zero-balance collection looks like less of a threat to your productivity on the job than a collection account with balances.

Once these initial areas are addressed, be sure to stay on top of your payments. Paying your bills on time has a substantial impact on your credit, according to Alligood. Setting up autopay or adding your payment dates to your calendar may be a good way to help stay current with all your payments.

Finally, try to reduce your , which means either paying down existing debt or reducing spending on credit accounts. If you always max out your credit lines, then it can indicate that you don’t handle money responsibly, Alligood explains. She recommends aiming to use less than 30% of your available credit.

Recommended Reading: Does Having A Overdraft Affect Credit Rating

What Employers Look For In Background Checks: A Complete Guide

Editors note: Nothing in Checkrs Blog should be construed as legal advice, guidance, or counsel. Companies should consult their own legal counsel about their compliance responsibilities under the FCRA and applicable state and local laws. Checkr expressly disclaims any warranties or responsibility or damages associated with or arising out of information provided.

Applying for a job is a complex process. It typically begins with an application, continues with two or more interviews or phone screenings, then moves into references and a background check. Hiring, onboarding, and training any candidate is a big investment in time and resources. In fact, hiring the wrong person can cost employers about 30% of a candidates first-year salary on average.

Background checks are a simple and useful way for employers to ensure a safe work environment and give all candidates a fair chance at available opportunities. And most employers do take advantage94% of businesses conduct background checks. But what do employers look for in background checks?

A background check can sound scary, but employer screenings are common, simple, and should be pain-free. The process is even easier if you know what to expect.

These Credit Checks Are More Common In Certain Industries

As far as how likely your credit is to impact your chance at getting hired, it depends.

Some employers will pass over an applicant due to problems on a credit report, especially within certain industries, Black outlined. Additionally, if you and another applicant are equally qualified for a position a great credit report might make you stand out among the competition. Negative marks on your credit reports do unfortunately have the potential to cost you a job.

And what are the sorts of industries Black is alluding to? Financial, mainly. As McLean said: Companies that run a pre-employment credit check are typically hiring for positions in the financial services industry where the employee would manage money, or has access to money on a daily basis.

So now you know theres a chance your credit score will impact your odds of getting the job. How can you mitigate the possibility of bad credit impacting your hiring prospects?

Don’t Miss: Is Fico Score Same As Credit Score

Can You Be Trusted With Money

If you’re applying for a job where you’ll be managing a company’s money, there’s a good chance your potential employer will take a look at how you handle your own finances.

“Any missed payments or bankruptcies could signal signs of being irresponsible elsewhere and negatively separate you from the competition,” Jill Gonzalez, an analyst at WalletHub, tells CNBC Make It.

Griffin agrees: “Financial difficulties reflected in the credit report could indicate additional review is necessary.”

Which Jobs Typically Require A Credit Check

Some companies run credit checks on all their applicants while others only run them for certain positions. But jobs that require security clearance or access to money are the most likely to use them.

For example, banks or other financial institutions usually require credit checks for all their employees. And this stands to reason since almost every position will handle money in some way.

But they also want you to understand credit and be able to deal with customers and their financial needs.

Also, many government jobs require credit checks, including military and political positions. This is because so many of them require security clearance and a high demonstrated level of trustworthiness.

Recommended Reading: How Long Do Negative Items Stay On Your Credit Report

What Shows Up On A Credit Check For Employment

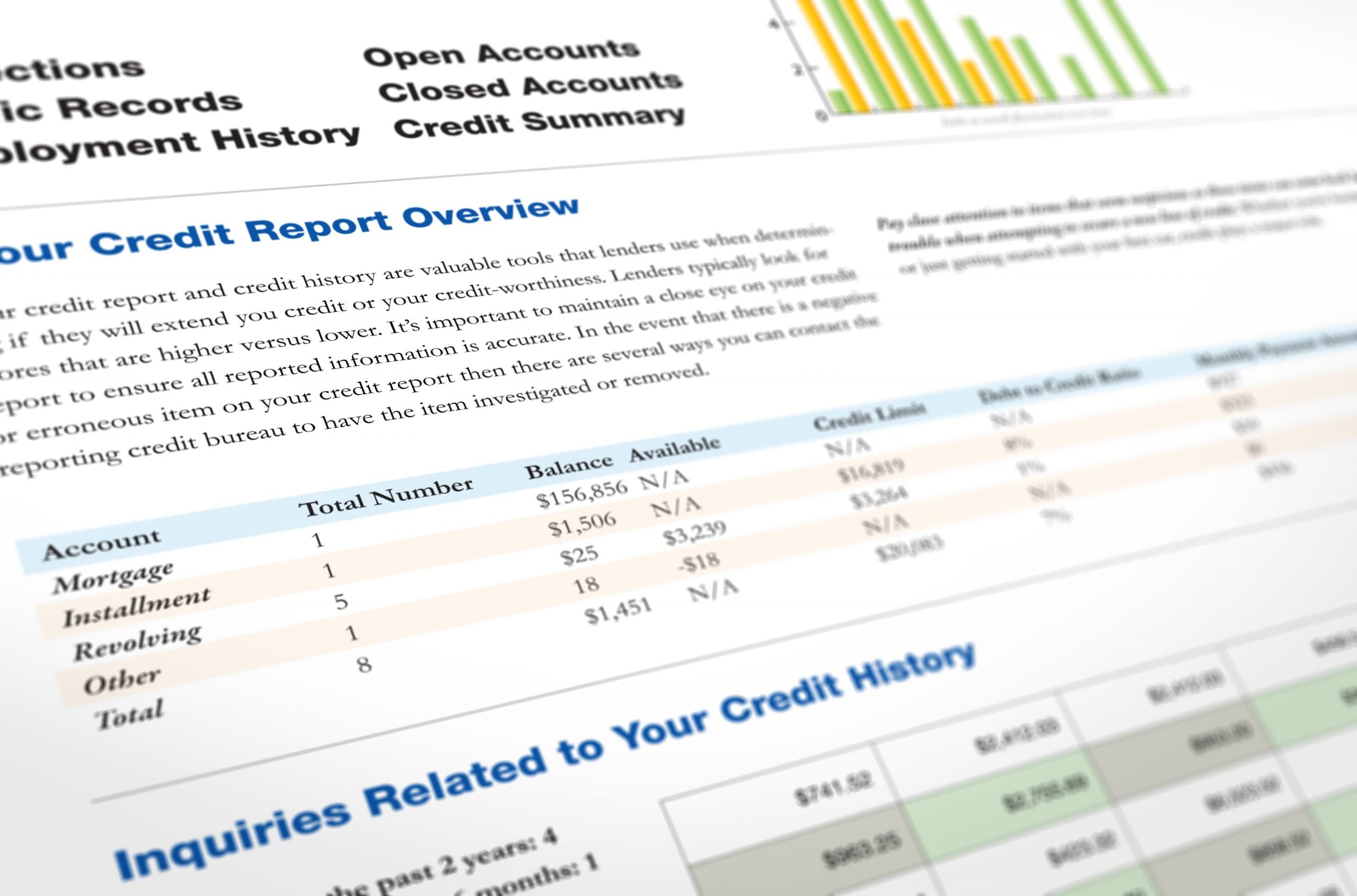

While federal laws allow credit checks for employment, this only allows companies to see your . Background checks often include pulling a copy of your credit report, but employers will receive a modified version called an employment report.

An employer credit check wont include the following, for example:

Income

Your credit accounts and payment history

Identification and address information

Employment information, including past work history

Public record details, including bankruptcies or liens

Talk To An Expert Fcra Attorney In Fort Lauderdale

If you are unsure of how to handle a pre-employment credit check, a trusted FCRA attorney may be able to help. Attorney Jibrael S. Hindi of the Law Offices of Jibrael S. Hindi has dedicated his career to protecting the rights of consumers in the Fort Lauderdale area. He and his team of legal professionals advocate for their clients so they can stand up to any company that has violated their rights. Our firm takes cases on a contingency basis whereby the firm does not get paid unless a recovery is obtained on your behalf. To schedule a free consultation with a member of our highly-qualified team, call us today at or reach out through our contact form.

Read Also: Do Pre Approvals Affect Credit Score

What Positions Do Credit Checks Typically Apply To

David Sawyer, president of the background screening company Safer Places Inc., says You almost never see someone turned down just on their credit report. Although if someone is applying for a chief financial officer position and has bad credit, its unlikely theyll be hired for that position.

Otherwise, if someone is applying for a position such as salesperson or delivery driver and has marginal credit, but the rest is good, I tell them not to worry about it, Sawyer says.

They also may be conducted for certain sensitive positions, such as working with caustic chemicals. Credit checks are seen as a way to help verify someones identity. Its a security step rather than a financial issue, he says.

When it comes to credit checks, each company is different. They value certain things about a candidate, depending on their role, says Elizabeth McLean, compliance attorney at GoodHire, a company that conducts background checks for employers.

Because it costs a company extra to check a prospective employees credit report, it makes employers less likely to pull the credit reports of all potential hires, McLean says.

See related: 6 myths about credit report checks by employers

State & City Laws Also Apply

Several states and a few cities like New York and Chicago have restrictions on how employers can use employment credit checks in hiring. Typically, the use of credit history is prohibited unless the employer or employee falls into special categories, such as an employee who would:

- Handle large amounts of money

- Work in a managerial capacity

- Have access to trade secrets

- Work in a field in which regulations require credit reports

Resources

Read Also: Does Checking Credit Karma Hurt Your Score

Assess Your Online Presence

You may also want to look yourself up on Google and make sure that youre comfortable with the information you find about yourself online.

Next, review your social media feeds. You can set your social media accounts to private. If this wont work for you, you may want to edit posts or images you think may create a wrong impression about your ability to succeed in the workplace.

When Do Employers Do Credit Checks

For a lot of applicants, a credit check is unlikely to be an issue. A 2020 survey of more than 1,500 human resources professionals by the National Association of Professional Background Screeners found that just 6% of companies ran credit checks on all employees.

Obviously, credit checks are most common for roles that involve handling money or sensitive information. If your personal finances are in trouble, employers may worry youre more likely to embezzle money or commit fraud.

But some companies run credit checks simply because they think that if you can manage your own money well, its a sign that youll be a good employee though a growing number of state and local governments oppose the practice. At least 11 states, Washington, D.C., plus Chicago, New York City and Philadelphia, limit the use of credit checks for candidates who dont deal with finances or sensitive data.

Employers usually do credit checks at the end of the hiring process. Most do them after a conditional job offer has been made, though some conduct them following a job interview.

Under the Fair Credit Reporting Act, you have to consent in writing for an employer to pull your credit.

Recommended Reading: What Credit Score Is Needed To Buy A House

State And Local Employment Credit Check Laws

Most states allow employers to utilize credit reports in a fair and equitable manner within the hiring process. However, some locations have regulated the use of credit reports and placed restrictions on how the information can be used. California, Colorado, Connecticut, Hawaii, Illinois, Maryland, Nevada, Oregon, Vermont, Washington, and the District of Columbia have statutes on the books limiting the use of credit reports.

In these states, the use of credit checks is restricted to specified occupations or situations where financial transactions or confidential information are involved. Many other states have legislation pending that might prohibit the use of credit reports by employers, or place restrictions on their use.

In addition, some localities also have restrictions and prohibitions on job applicant credit checks. For example, New York City prohibits credit checks on most job applicants. Exceptions include police officers and executive-level candidates with fiduciary responsibilities. Chicago and Philadelphia also restrict the use of employment credit checks.

You can access your credit reports for free from Equifax, Experian, and TransUnion once per week through April 2021.

Check Your Credit Before You Apply

Before you apply for a job, Griffin recommends requesting a copy of your credit report so you know whats there and can identify what you might want to work on, such as correcting errors or catching up on late payments. That will put you in a better position to qualify so you can get the job of your dreams.

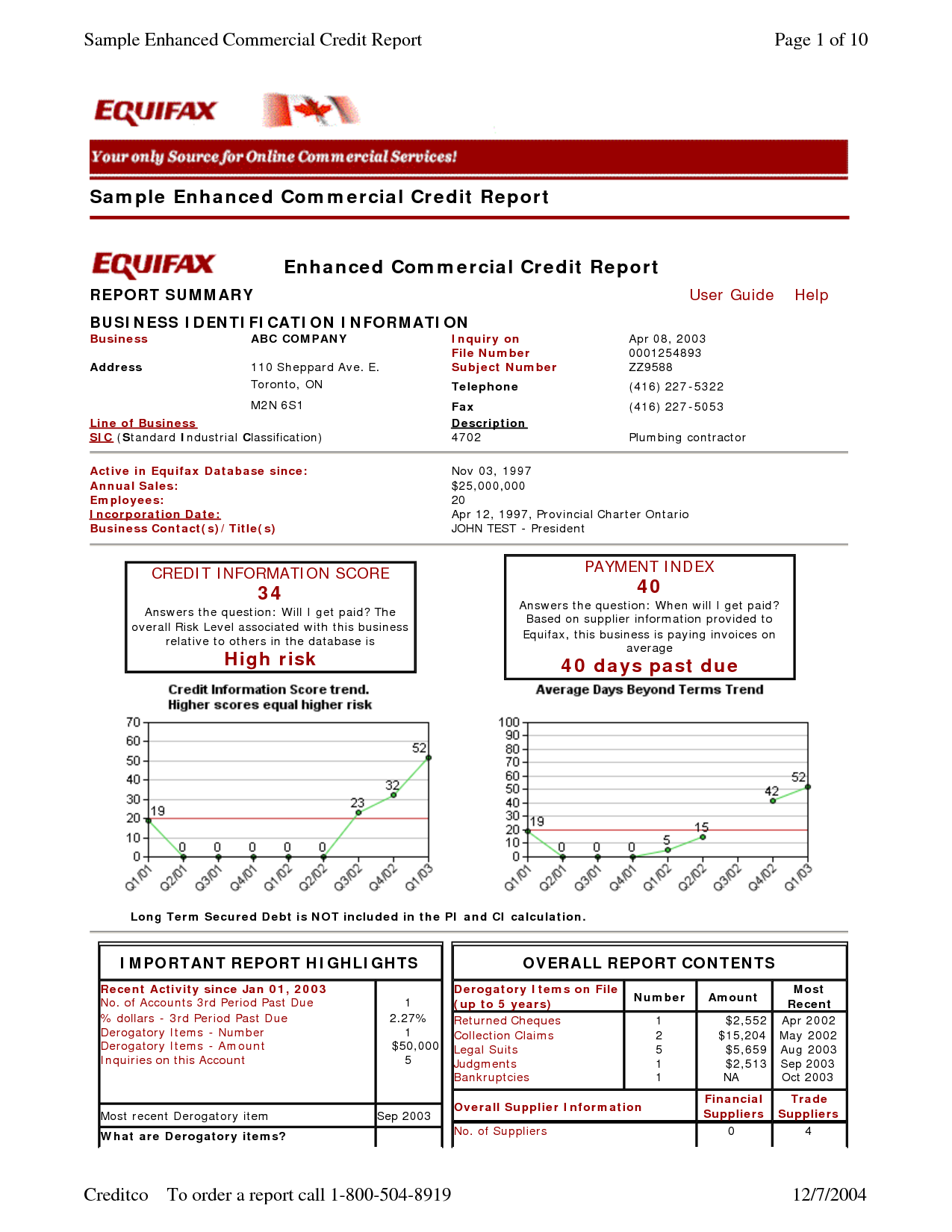

The FCRA requires that each of the three national credit reporting companies Experian, Equifax and TransUnion provide you with a free copy of your credit report once every 12 months. If you are unemployed, you can get an extra free copy. You can request your report at AnnualCreditReport.com.

To help protect themselves from identity theft, some consumers have been paying a fee to have freezes put on their credit reports. As of September, the freezes are free. A freeze blocks a lender from checking your report and can help prevent criminals from opening up accounts using your personal information. You have to lift the freeze to allow a lender to check your credit.

However, employers can still check your credit with your written consent, and you dont have to worry about lifting the freeze, Griffin says.

Editorial Disclaimer

The editorial content on this page is based solely on the objective assessment of our writers and is not driven by advertising dollars. It has not been provided or commissioned by the credit card issuers. However, we may receive compensation when you click on links to products from our partners.

Read Also: What Is The Max Credit Score

Can Employers Check Credit History In Every State

The use of consumer credit information is subject to federal and state laws regarding use of such information during the hiring process.

Some states may limit the use of credit reports for pre-employment screening purposes. In certain states and cities, regulations regarding the use of credit reports can impact the way employers utilize this information. In addition, some cities have passed laws that also impact the way employers use this information.

Where permissible by both state and federal law, ShareAble for Hires pre-employment screening services can help you gather the insight you need to make the right hire.

These consumer reports meet Fair Credit Reporting Act regulations and comply with the latest laws and regulations governing consumer reporting agencies.

Employer credit accounts are delivered straight from TransUnion, a trusted credit reporting agency that handles 230 million credit files domestically.

How Far Back Do Employers Look

Like credit checks related to loan and credit card applications, pre-employment credit checks are subject to the federal Fair Credit Reporting Act . Under the FCRA, pre-employment credit checks can consider no more than seven years of credit history, unless the job commands a salary of $75,000 or more, in which case up to 10 years of financial history can be reported. In addition, the FCRA allows bankruptcies to be reported for up to 10 years, no matter what the job in question pays.

The FCRA requires anyone running a credit check on you, including a prospective employer, to notify you in writing and get your written consent before doing so.

An employer who has checked your credit must also give you a chance to respond to any negative findings. If the results of your credit check are the reason an employer declines to hire you, the company must tell you so in writing.

Some states have additional laws that forbid or limit use of credit checks in the hiring process. These include California, Colorado, Connecticut, Delaware, Hawaii, Illinois, Maryland, Nevada, Oregon, Vermont and Washington, as well as cities including Chicago, New York and Philadelphia. For more information on rules governing pre-employment credit checks where you live, consult your state’s labor department.

Recommended Reading: What Credit Score Is Needed For An Amazon Credit Card

Take Steps To Repair Your Credit

Depending on the industry or position youre applying for, its possible that your financial history might become a factor in the hiring decision. Therefore, just as youd update your resume and polish your social profiles before a job search, you should spend some time getting your financial house in order.

1. Start by requesting and reviewing your credit report, which you can do for free once per year from each of the three credit bureaus: Experian, Equifax, and TransUnion. In addition, see if any of your credit card companies, banks, or financial apps provides you with a free credit score tool for further insight .

2. Comb through each credit report. Yes, it’s exhausting, but it’s necessary. You’re looking for credit history errors including accounts that don’t belong to you, duplicate accounts, fraud activity, and the like.

3. Dispute any errors. By doing this review prior to a hiring teams credit check, youll at least have the chance to fix any errors that might be on your reports, and address potential red flags that would concern a future employer. According to Credit.com, 79% of consumers who disputed errors on their credit reports were successful in removing them.

4. Repair what you can. For instance, if you have a delinquency listed, you can call that creditor to see what can be done to remove that item from your report.

If you do have spotty credit, be upfront with a prospective employer, and then illustrate how youre turning things around.