Rebuilding Your 600 Credit Score

A Credit Repair company like Credit Glory can:

Your Credit Score Counts

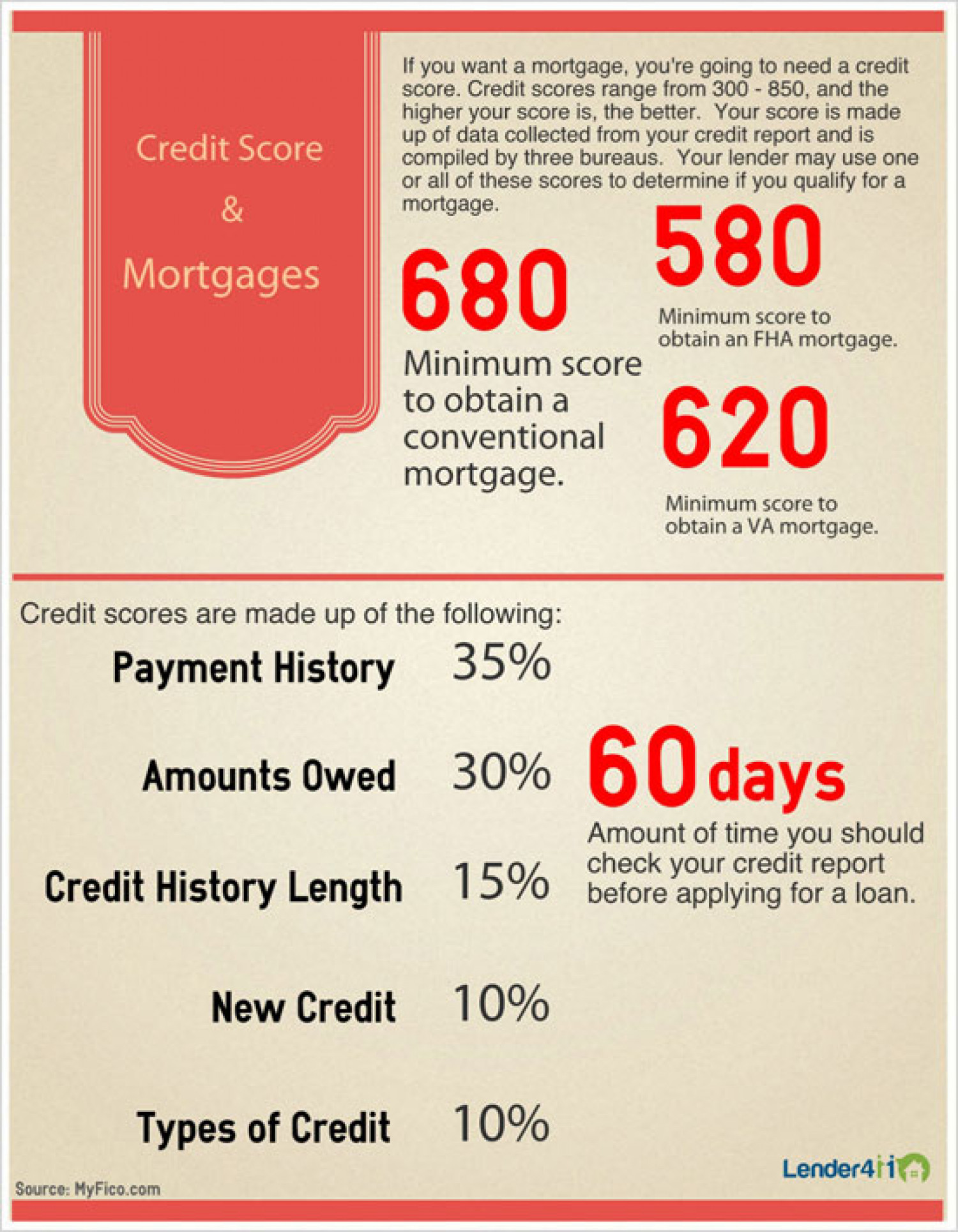

Credit scores are a measure of financial health, and its important to understand what credit score is needed to qualify for a mortgage loan. While its possible to qualify for a conventional loan with a minimum 620 credit score, individual mortgage lenders may set the bar higher. The higher your score is, the better your loan terms could be. But even if your credit score isnt ideal, you could still have some mortgage loan options to choose from.

Ally Home simplifies the homebuying process.

Tip #: Pay Off Outstanding Debt

One of the best ways to increase your credit score is to determine any outstanding debt you owe and pay on it until its paid in full. This is helpful for a couple of reasons. First, if your overall debt responsibilities go down, then you have room to take more on, which makes you less risky in your lenders eyes.

Lenders also look at something called a credit utilization ratio. Its the amount of spending power you use on your credit cards. The less you rely on your card, the better. To get your credit utilization, simply divide how much you owe on your card by how much spending power you have.

For example, if you typically charge $2,000 per month on your credit card and divide that by your total credit limit of $10,000, your credit utilization ratio is 20%.

Also Check: Affirm Credit Score Requirement

First Lets Talk About Credit Scores

Your credit score can range from 300 at the low end to 850 at the high end. A score of 740 or above is generally considered very good, but you dont need that score or above to buy a home. Credit scores are maintained by the national credit bureaus and include debt like credit cards, auto loans or student loans.

Your score is influenced by many factors, but the two biggest are whether you pay your bills on time and how much debt you owe. Having a credit score based on these factors gives lenders a quick way to see if youre likely to pay your future bills like your mortgage, for example.

Excellent Credit Score Home Loans

An excellent credit score of 750 and above is the best place to be when youre shopping for a mortgage. It will help you get the lowest interest rate whether you want a conventional, USDA, VA, or FHA loan:

- Conventional loan: With an excellent credit score, youll be able to get competitive bids from multiple lenders on a conventional loan. And, if youre putting down less than 20%, an excellent credit score will help you get the most favorable PMI premiums.

- USDA or VA loan: Qualifying borrowers with excellent credit might still choose a USDA or VA loan if they dont have a down payment.

- FHA loan: Theres little reason to get an FHA loan when you have excellent credit. You will probably qualify for a conventional loan and avoid paying the FHAs mortgage insurance premiums. An exception might be if your DTI ratio, including your proposed mortgage payment, is 45% to 50% and youve been rejected by multiple lenders for a conventional loan.

Find Out: 800 Credit Score Mortgage Rate: What Kind of Rates Can You Get?Other factors your lender will consider for your mortgage rate:

- Income: Youll need a documented history showing two years of steady income in the same line of work.

- Debt: Your debt cannot consume so much of your income that your mortgage and living expenses wont be manageable.

- Down payment: The higher your down payment, the less risky you are to lenders. The gold standard is 20% or more.

Find Out: How to Get the Best Mortgage Rates

You May Like: What Credit Score Do I Need For Ashley Furniture

Can I Get A Car / Auto Loan W/ A 600 Credit Score

Trying to qualify for an auto loan with a 600 credit score is very expensive. Theres too much risk for a car lender without charging very high interest rates.

Even if you could take out an auto loan with a 600 credit score, you probably dont want to with such high interest.

There is good news though.

This is completely avoidable with a few simple steps to repair your credit.

Your best option at this stage is reaching out to a credit repair company to evaluate your score and see how they can fix it.

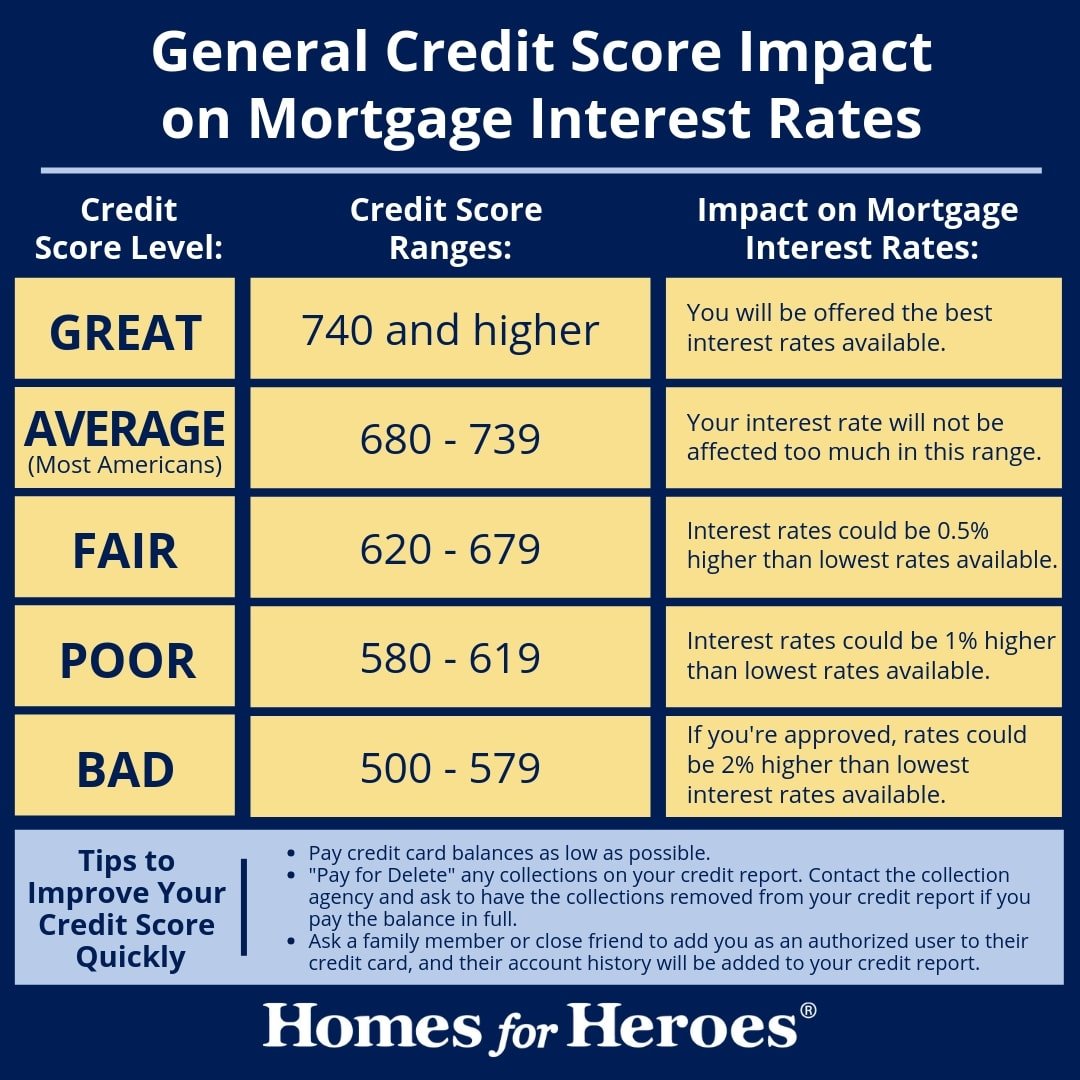

How Your Credit Score Affects Your Interest Rates

Knowing your credit score is the first step in getting the best rates on your mortgage. While mortgage interest rates are currently at an all-time low, they drop even lower when your credit score is above 760.

According to FICO, the current interest rate for a 30-year fixed mortgage is 2.377% APR for a 760+ borrower, and 3.966% for a borrower with a score between 620 and 639 .

This 1.589% savings in APR may seem negligible. But it means saving about $260 per month on your mortgage, or $3,120 per year and roughly $93,600 over the lifetime of the loan.

If you currently have a mortgage and are interested in seeing if you can switch to a better rate, look into the pros and cons of refinancing your home.

Also Check: Does Care Credit Check Your Credit Score

Ways To Help Strengthen Credit Scores To Buy A House

If your credit scores need work before you buy a house, consider these ways to help improve your scores:

- Make on-time payments. FICO and VantageScore both say your track record of making on-time paymentsâyour payment historyâcan be a significant factor in determining your credit rating. You could use email reminders or calendar alerts to remind yourself. And setting up automatic payments can ensure you donât miss a payment due date.

- Pay more than the minimum. Making only your comes with a cost: interest charges. And interest can add up and cost you more money in the long run. Interest can even make it harder to pay off debt. So consider this from the CFPB: âPaying off your balance each month can help you get the best scores.â

- Keep your balances low. The CFPB recommends that you not spend more than 30% of your available credit. A low âa measure of how much of your available credit youâre usingâcould be a sign that youâre using your credit responsibly and not overspending. And that could help you improve your score.

- Apply only for the credit you need. As the CFPB explains, âCredit scoring formulas look at your recent credit activity as a signal of your need for credit. If you apply for a lot of credit over a short period of time, it may appear to lenders that your economic circumstances have changed negatively.â

Get Up To Speed With Payments

Late payments also negatively affect your credit score. Make a financial plan to catch up and stay caught up with your payments. Consider different payment strategies like the avalanche method and snowball method to effectively pay off your debt. Depending on your situation, you may also want to consider consolidating your debts or settling some of your debts.

Recommended Reading: Comenity Bank Uses What Credit Bureau

Improving Your Credit Score Can Get You A Better Rate And More

Improving your credit score for a home loan can benefit you in other ways besides lower mortgage rates. For example:

So, its always a good idea to improve your credit score if you can to ensure you have the best options for a home loan.

Here are a few ways you can raise your score:

How To Get Pre

The process of getting approved for a mortgage loan and buying a home is a long one with a considerable number of steps. Youre going to need to have the money for a down payment ready, and get your financial documents ready for submission to your lender. Youre going to need to make certain that your credit score is high enough to inspire confidence in your lender, and if thats not the case, youll need to begin to take the steps to improve it.

Finding a home that you and your family love is, obviously, an important step in the home-buying journey, but its far from the first one. In todays increasingly competitive housing market, its important to be prepared. Unless youve already been pre-approved for a loan, you might be disappointed when you find a home you love, even if you can afford it.

The very first step in buying a home is, above all else, doing your research. If youre new to the process, you likely have a lot of questions, such as what it means to be pre-approved, and how that differs from being actually approved. You might also be wondering how pre-approval differs from pre-qualification, and what documents are needed. To help you along in your home buying journey, we asked lending experts to answer some common questions about securing the mortgage for the home of your dreams.

Read Also: Aargon Collection Agency Bbb

Nonqualified Mortgage : Minimum Credit Score 500580

The qualified mortgage rule, also known as the QM Rule, went into effect in 2014.

The federal government set the QM Rule to create safer loans by prohibiting or limiting certain highrisk mortgage products.

This rule is the reason most loans require a minimum credit score in the 600s as well as a down payment and/or private mortgage insurance.

But there are still some nonQM loans available that have more flexible rules.

When banks dont sell their mortgages to investors, theyre free to set their own criteria like lower minimum credit score requirements.

Thus, some nonQM loans can be found with credit scores as low as 500. But like with an FHA loan, youre much more likely to find a lender who will approve you with a FICO score of 580 or higher.

The downside is that nonQM loans usually have significantly higher rates than conforming mortgages. So if your credit score is a little too low for a mainstream home loan, it might be worth waiting to buy until you can raise your credit score and lower your borrowing costs.

If youre interested in a nonQM loan, check out the specialty mortgage programs some banks and credit unions offer that are neither conventional loans nor governmentbacked. Or, work with a mortgage broker who can recommend products from various lenders that might fit your needs.

What Credit Score Do You Need To Buya House

You dont need perfect or even good credit to buy a house. In fact, the minimum credit score to get a mortgage is 580 which is considered only fair.

Remember, mortgage lenders dont look at your credit score in a vacuum.

They also look at your credit report, debts, and down payment. The stronger you are in these areas, the more likely you are to get away with a low credit score.

The downside to lower credit is that youll pay a higher interest rate. But many buyers with low scores choose to buy now and refinance for a better rate when their credit improves later on.

You May Like: Discover Fico Score Accurate

Interest Rates And Your Credit Score

While theres no specific formula, your credit score affects the interest rate you pay on your mortgage. In general, the higher your credit score, the lower your interest rate, and vice versa. This can have a huge impact on both your monthly payment and the amount of interest you pay over the life of the loan. Heres an example: Let’s say you get a 30-year fixed-rate mortgage for $200,000. If you have a high FICO credit scorefor example, 760you might get an interest rate of 3.612%. At that rate, your monthly payment would be $910.64, and youd end up paying $127,830 in interest over the 30 years.

Take the same loan, but now you have a lower credit scoresay, 635. Your interest rate jumps to 5.201%, which might not sound like a big differenceuntil you crunch the numbers. Now, your monthly payment is $1,098.35 , and your total interest for the loan is $195,406, or $67,576 more than the loan with the higher credit score. A mortgage calculator can show you the impact of different rates on your monthly payment.

The Best Mortgages For Buying A House With Lowcredit

If you have a low credit score, or past red marks on your credit report, the first type of mortgage you should look at is an FHA loan.

FHA loans

FHA loans are mortgages insured bythe Federal Housing Administration. This insurance protects mortgage lenders,making it possible for them to lend to borrowers with lower credit scores andsmall down payments.

In fact, the FHA mortgage programwas specifically designed for credit-challenged home buyers. It allows thelowest credit score of any loan program 500 although you need a 10% downpayment if your score is below 580. Those with a score above 580 onlyneed to put 3.5% down.

Conventional/conforming loans

Conventional loans also allow amodest credit score of 620 with a down payment of just 3%.

However, the cost of privatemortgage insurance can make conventional loans unattractive forlower-credit borrowers with less than 20% down.

Conventional and FHA loans both require mortgage insurance. The difference is that FHA charges the same mortgage insurance premiums for all borrowers, regardless of credit.

Conventional mortgages, on the otherhand, have steeply increased PMI rates for borrowers with low credit and alow down payment. As a result, FHA financing can sometimes be cheaper forborrowers with credit in the low- to mid-600s.

VA loans

For veterans and active-duty service members, a VA mortgage is normally the best bet.

Also Check: Does Amex Pay Over Time Affect Credit

Whats The Minimum Credit Score To Buy A House

Home buyers are often surprised by the range of low credit home loans available today.

Many lenders will issue governmentbacked FHA loans and VA loans to borrowers with credit scores as low as 580. Some even start at 500 for FHA .

With a credit score above 600, your options open up even more. Lowrate conventional mortgages require only a 620 score to qualify. And with a credit score of 680 or higher, you could apply for just about any home loan.

So the question isnt always, Can I qualify for a mortgage?, but rather, Which one is best for me?

Correcting Credit Report Errors

You can and should check yourcredit report before buying a house. Consumers can get one free credit reportper year on annualcreditreport.com.

In the event that you find errors on your credit report, take steps to correct them as quickly as possible.

First, contact the creditbureaus about the errors. You should also contact whichever creditors haveprovided the erroneous information.

Under the Fair CreditReporting Act, each of these parties is responsible for correcting inaccurateor incomplete information in your credit report.

For simplicity, disputes canbe managed online. If all three bureaus report the same error, though, rememberto report the error to all three bureaus. Equifax, Experian, and TransUnion donot share such information with each other.

The law requires creditbureaus to investigate the items in question, usually within 30 days, unlessyour dispute is considered frivolous. Note that you may need to includecopies of documents which support your position. Never send originals!

Within 45 days, the creditbureaus will notify you with the results of the investigation.

Then, youll want to obtain a new copy of your credit report in order to make sure that the errors have been corrected before applying for a mortgage.

Recommended Reading: Does Zzounds Do A Credit Check

How Can Credit Scores Affect Mortgage Interest Rates

The CFPB points out that your credit scores are a key ingredient in the mortgage qualification process and that higher credit scores generally help you qualify for lower interest rates. To see the potential impact of credit scores on mortgage interest rates, it helps to look at this example:

Letâs say two borrowers apply for a 30-year fixed mortgage for $200,000. Borrower A has a credit score in the 620 to 639 range, while Borrower B has a score between 760 and 850. According to FICOâs home mortgage rate comparison tool, the borrowersâ potential mortgage rates could differ by about 1.5%.

While that may not sound like much, according to the results of that tool, the borrower with the lower credit scoreâBorrower Aâpays $173 more every month. And that extra $173 every month adds up over time.