Should I Use Credit Karma

Many folks are afraid to use Credit Karma because it requires things like a social security number to sign up. This is totally personal preference if someone is comfortable with giving out personal information in exchange for a convenient way to track their credit score. Without a social security number, it would be impossible for anyone to know what your credit history is like.

Many folks who are considering a home purchase will be giving their social security number to their mortgage lender to run their credit score. When the mortgage lender runs the credit score it will count as a hard inquiry on your credit report. When you give Credit Karma your social security it will not count as a hard inquiry as you are only using the Credit Karma service to gather information.

For all home buyers monitoring your credit is essential to your ability to buy a home. First-time homebuyers especially since they likely have not had the opportunity to build up as much of credit history as someone who is older.

At the end of the day, if youre looking to monitor your credit score you should sign up for Credit Karma.

Dont Miss: Is 524 A Good Credit Score

Why Fico Scores And Credit Scores Matter

A bad credit score can haunt you by making it difficult to rent an apartment, get an affordable mortgage, or land a job. Even if youre able to qualify for a loan, your interest rates will be higher than if you had good credit scores.

And that has costly ramifications: On a $150,000 mortgage, for example, a 1% higher interest rate could cost you $31,000 over 30 years.

On the other hand, good credit scores open all kinds of doors. Not only will you find it easier to borrow money when you need it, theyll also qualify you for lucrative credit card offers.

Yes, irresponsible credit card use can lead to a damaging debt spiral but responsible credit card use can reward you immensely for your everyday spending.

If you have high credit scores, you could get cards like the Chase Sapphire Reserve® , which offers a signup bonus worth hundreds in travel, or the Citi® Double Cash Card 18 month BT offer , which offers 2% cash back on every purchase .

Not there yet? Dont worry. Focus on building credit slowly and strategically. The best credit cards will be waiting for you when youre ready.

Recommended Reading: Does Klarna Affect Your Credit Score

How To Maintain A High Credit Score

Finally, I would be remiss if I didnt remind you of all the things you can do to keep your credit in good shape: pay your bills on time, every time. Keep your within about 25% of your total credit, but know that those people with the best scores keep theirs in the single digits.

Dont close old accounts, unless you have a compelling reason to do so, since length of credit history is worth 15% to your FICO score .

If you only have credit cards in your file, you may be lacking in credit mix, so consider adding an installment-type loan to help this part, which counts for 10%. But remember to only apply for new credit when you need it and when you are confident you will be approved because this category counts for 10% of your score. And hard inquiries can lower your score whether you are accepted or not.

Remember to keep track of your score!

Editorial Disclaimer

The editorial content on this page is based solely on the objective assessment of our writers and is not driven by advertising dollars. It has not been provided or commissioned by the credit card issuers. However, we may receive compensation when you click on links to products from our partners.

Essential reads, delivered straight to your inbox

Stay up-to-date on the latest credit card news from product reviews to credit advice with our newsletter in your inbox twice a week.

Read Also: How Long Does Repo Stay On Credit Report

Is Capital One Credit Wise Accurate

Yes, this service provides accurate information. However, they use a VantageScore 3.0 from TransUnion, which isnt the most common score used by lenders to make lending decisions.

While Capital Ones data is accurate based on the scoring model they offer, there are other versions of your credit reports and scores you need to be aware of, too.

You have two other credit reports and scores from the other bureaus, Equifax and Experian.

What questions do you have after reading our Capital One Credit Wise review free credit score program? Let me know in the comments and Ill address them the best I can.

You May Like: Is 524 A Good Credit Score

How Creditwise Stacks Up

Compared with other free credit-monitoring products, CreditWise favors depth over breadth. It offers only one credit score, from TransUnion, but its credit simulator is among the most comprehensive weve seen.

With the credit simulator, you can choose from any combination of 17 credit-influencing events. For example, you could see what might happen to your score if you canceled your oldest card. Or you could see what might happen to your score if you canceled your oldest card and charged $517 to another account and were 30 days delinquent on a payment. Its unusual to see a credit simulator thats so customizable.

People wanted to see how certain decisions were going to affect their credit, Solomon says. When designing the app, we really wanted to demystify what goes into credit scores.

Like many free credit-scoring services, CreditWise doesnt offer FICO scores, which most lenders use, but it offers VantageScore 3.0 scores, which are based on similar factors. VantageScores are used by seven of the 10 largest banks, according to the VantageScore website.

The CreditWise apps biggest drawback is that it gives you only one credit score from one bureau. If you want to know your FICO scores or your Experian or Equifax VantageScores, youll have to look elsewhere.

You May Like: Can A Repo Be Removed From Credit Report

Alternatives To Chase Credit Journey

Chase Credit Journey is a good credit monitoring service, but its far from your only choice.

Whether youre looking for an app that tracks your FICO score or one that gives you more expansive card offers, take a look at the top free alternatives to Chase below:

- Experian: With free access to your Experian score and alerts, Experian could be worth adding to your toolbox. You can also upgrade to see all your scores for a low monthly price.

- : Another free service, Credit Sesame gives you your Experian score and loads of credit card offers from various lenders and creditors.

- : Credit Karma has the best of both worlds, showing you your Equifax and TransUnion scores, along with alerts, card offers, and tools.

What Is The Most Accurate Credit Score

Although there are many different scores and scoring models, there is a light at the end of this confusing tunnel.

Among all the credit score models, the FICO credit score is used by more than 90% of major U.S. lenders.

You might have a different score calculated by a different scoring model with a different provider.

However, it’s very likely that the lender or creditor will use the FICO score to determine if they’ll approve your application for a new line of credit.

Because of this, you might want to keep your eye on your FICO score, rather than many of the others that are available, simply because this is the number the lenders care about most. A FICO score ranges from 300 to 850 .

Don’t Miss: Is 586 A Bad Credit Score

Which Fico Score Version Is Important To Me

Consider these guidelines:

Financing a new car? You’ll likely want to know your FICO® Auto Scores, the industry specific scores used in the majority of auto financing-related credit evaluations.

Applying for a credit card? You’ll likely want to know your FICO® Bankcard Scores or FICO Score 8, the score versions used by many credit card issuers.

Purchasing a home or refinancing an existing mortgage? You’ll likely want to know the base FICO® Score versions previous to FICO Score 8, as these are the scores used in the majority of mortgage-related credit evaluations.

For other types of credit, such as personal loans, student loans and retail credit, you’ll likely want to know your FICO® Score 8, which is the score most widely used by lenders.

Estimate your FICO Score range

Answer 10 easy questions to get a free estimate of your FICO Score range

Your Credit Karma Score May Be Insufficient

Credit Karma updates its scores once per week. For most people, that’s plenty, but if youre planning to apply for in the near future, you may need a more timely update.

Although VantageScore’s system is accurate, its not the industry standard. Credit Karma works fine for the average consumer, but the companies that will approve or deny your application are more likely to look at your FICO score.

Read Also: Affirm Financing Credit Score Needed

Similarities Between The Credit Bureaus

All the four credit bureaus in the country are licensed by the Reserve Bank of India . Lenders like banks and non-banking finance companies send your credit information to all the credit bureaus. They do not differentiate between the bureaus and share all your details related to your credit with them. Each credit bureau has their own algorithm which they use to calculate your credit score. Therefore, credit scores from all the credit bureaus are considered as valid. Although, the algorithm to calculate credit score can be different for different bureaus, the five components that are taken into consideration while calculating the credit score remain the same. Credit bureaus consider factors like repayment history, type of credit, age of credit, credit exposure, and credit inquiries while calculating the credit score. It must be noted that credit scores from two credit bureaus can be different, however, they will be accepted as valid. A marginal difference in credit scores from two different bureaus is common. A difference of around 50-60 points in the credit score is generally observed by banks and NBFC.

Theres Far More Than Just One Credit Score

There are dozens of different credit scores used today. Not only are there three major credit bureaus , but each one has a database of consumer information and a scoring system. In the United States, every consumer has at least 60 different credit scores, though most never use nearly that many.

One of the most common scoring systems, FICO, has several credit scores of its own, including:

- General-purpose score

- NextGen risk score

- Small Business Scoring Service

The VantageScore, introduced by the credit bureaus in 2006, is another popular credit score. Along with this, certain lenders rely on other credit scores for additional insight into peoples financial habits and creditworthiness. Non-VantageScore and non-FICO scores include:

- PRBC alternative credit score

- ChexSystems Consumer Score

A persons credit score plays a major role in many facets of society. It can determine whether a lender or creditor will lend to them. Plus, it can help a prospective landlord decide whether to lease to them and what deposit to demand. It can even come into play in certain employers hiring decisions.

Some people view certain credit scores as more or less accurate than others. However, this primarily depends on what its used for and the information included. Overall, credit scores serve one purpose, and that is to determine a persons credit risk and track their credit history.

You May Like: Does Carmax Accept Itin Number

Where Can I Get Accurate Fico Credit Scores

There are a few ways that you can get a FICO score.

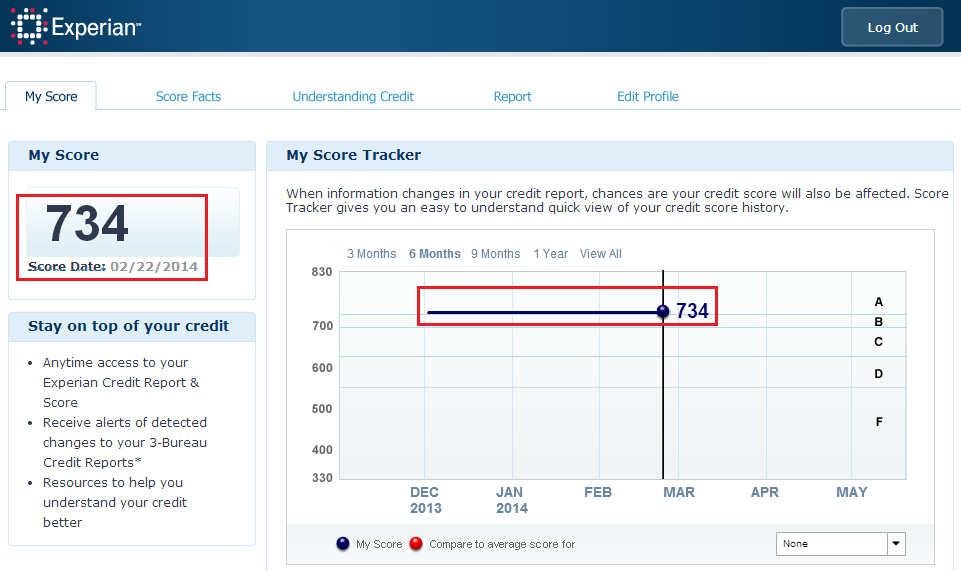

Many find it easy to sign-up for Experian.com and utilize that to get their FICO score . If you are just in it for the free score, make sure that you cancel your membership.

Sometimes MyFICO offers a free trial so be on the lookout for that.

You can also get one free from each of the three major credit bureaus once every 12 months from annualcreditreport.com. But note that that is usually just the report .

Many credit card issuers will now allow you to check your FICO score for free. So if you have a credit card account with any of the major issuers like Chase, American Express, Discover, Capital One or many others you should look into checking for a free score.

Re: What Is The Most Accurate Credit Score Website

The cap1 score is completely useless. That is a TU new account score. Literally NO ONE will ever use that score. CK offers Vantage 3.0 scores, which may be used by a very select number of credit companies. FICO scores are still the king, 90 percent of lenders will use some version of a fico score.

You May Like: Credit Score Needed For Les Schwab Account

Is Credit Karma Accurate Yes But With Limitations

However, if youre gearing up to apply for a loan or mortgage, you might want to seek additional information. Track down your FICO scores and monitor them alongside your Vantage 3.0 score.

That way, you wont have to wonder how accurate Credit Karma is. Youll have the fullest picture of your financial profile as you work to improve your credit score.

The Perspective Of Accuracy

There are several factors that determine which of your credit scores is the most accurate.

Mostly, the credit score with the least errors is the most accurate.

About one in five credit scores have one or multiple errors on it. Many people are unaware of them because they dont check their credit reports regularly.

Accuracy in terms of a credit score is a matter of perspective in the eyes of the beholder.

So, which credit score looks the most accurate to creditors and lenders?

The credit score with the most negative or positive information is by default the most accurate one to a creditor or lender.

Just as each credit scoring bureau has their own calculating algorithm to determine credit scores, each creditor or lender can choose a credit score that aids their own lending decisions and calculations relative to their applicants.

If you are aware of your credit scores from Equifax, Experian, and TransUnion, you can apply to lenders according to the scores you prefer.

However, your potential lender can choose one of your three scores that they prefer which could conflict with the score you presented on your application.

Accuracy, and perspective, is in the eye of the beholder.

Also Check: What Fico Score Does Carmax Use

Comparison Of The 4 Credit Information Companies In India

| Parameter | ||||

| 2006, license granted in 2010 | Received licence in 2010 | |||

| Rs.550 for Credit Report + Score. | Rs.400 for Credit Report + Score | Rs.399 for Credit Report + Credit Score) | Rs.399 Credit Report + Credit Score | |

| Scoring System | All credit bureaus in India offer a credit score between 300-900, 900 being the highest. A credit score of 700 and above is considered as ideal. | All credit bureaus in India offer a credit score between 300-900, 900 being the highest. A credit score of 700 and above is considered as ideal. | All credit bureaus in India offer a credit score between 300-900, 900 being the highest. A credit score of 700 and above is considered as ideal. | All credit bureaus in India offer a credit score between 300-900, 900 being the highest. A credit score of 700 and above is considered as ideal. |

| Products and Services |

|

|

|

|

| Time taken to receive credit report | The online credit report is delivered instantly after making the payment. | The online credit report is delivered instantly after making the payment. | The online credit report is delivered instantly after making the payment. | The online credit report is delivered instantly after making the payment. |

Why Should You Check Your Credit Score

A healthy credit score can make a big difference to your life. The better your credit score, the more likely you are to be accepted for different types of credit. Using CreditWise can help you understand and improve your credit score. You can see whats holding back your credit score and whats going well. Youll even get tips on how to improve your financial health. It also means you can spot any mistakes and get them sorted so they dont count against you.

Read Also: Open Sky Unsecured Credit Card

Also Check: Does Klarna Report To The Credit Bureaus

Do Any Lenders Use Fico 9

FICO Score 9 is already being used by hundreds of lenders, and eight of the nations top 10 lenders have either evaluated it, are in the process of evaluating it or plan to do so, according to FICOs Lee. He said he expects FICO 9 to overtake FICO 8, but lenders testing of the new model could take years.

Is Your Credit Score Accurate It Depends On Who You Get It From

If youre like most consumers, you have a vested interest in keeping your credit score high to make it easier to get mortgages and other loans. You also have more than just one credit score and might be confused about which one even matters.

Find: 10 Reasons You Should Claim Social Security Early

As Consumer Reports noted in a lengthy investigative article last week that looked into credit score apps, one of the problems with trying to access your credit information is figuring out which score to focus on. Its a pretty good bet that you have many credit scores even within the same credit reporting agency such as Equifax, Experian and TransUnion.

One person contacted by Consumer Reports last year had six scores from Experian alone, and those scores differed by as much as 100 points. The other two major credit agencies also provided multiple scores, none the same.

The five apps researched by Consumer Reports Credit Karma, Credit Sesame, Experian Credit Report, myFICO and TransUnion Score & Report provide a variety of different credit scores.

Find: How Rich Is Former President Donald Trump?

The truth is, there really is no such thing as a most accurate credit score because they are based on different models for different purposes.

Find: Top 10 Most Expensive Shoes Ever Made

And most do not provide access to the type of credit scores that can meaningfully help you, Consumer Reports said.

Don’t Miss: What Is A Leasingdesk Score