Contact The Credit Bureaus

Both Equifax Canada and TransUnion Canada have forms for correcting errors and updating information. Fill out the form to correct errors:

Before the credit bureau can change the information on your credit report, it will need to investigate your claim. It will check your claim with the lender that reported the information.

If the lender agrees there is an error, the credit bureau will update your credit report.

If the lender confirms that the information is correct, the credit bureau will leave your report unchanged.

In some provinces, the credit bureau is required to send a revised copy of your credit report to anyone who recently requested it.

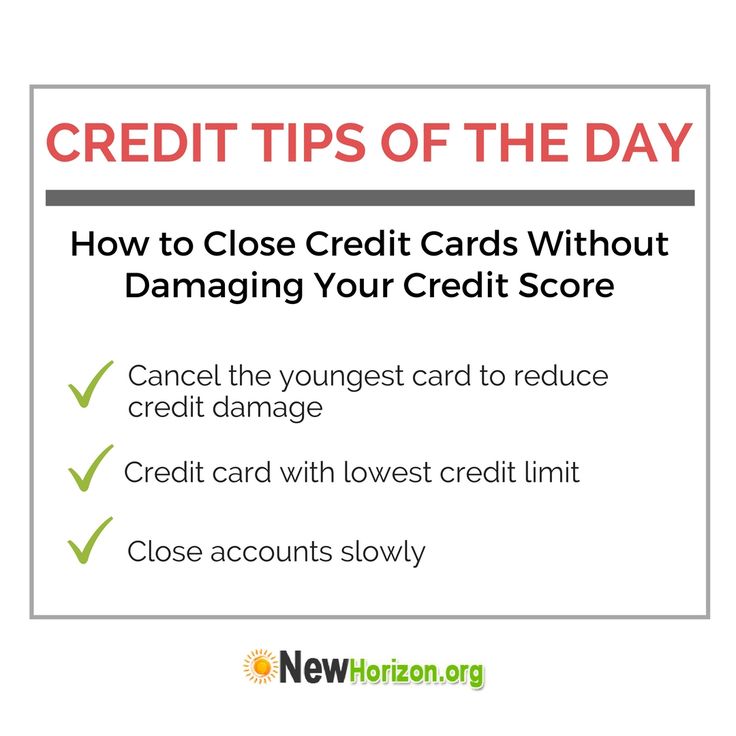

Ways To Safely Close Your Credit Card

Closing a credit card may seem simple enough. But before you break out the scissors to snip your card in two, here are some things to consider:

- Pay down your balance first. While you can close a credit card with an active balance, you may want to consider paying down your balance first. Even if you close your account, youâre still responsible for any remaining balance, interest and fees that might be charged. Plus, paying down your balance first will help keep your credit utilization under control. And that can help minimize impacts on your credit scores.

- Double-check your payoff amount. In some cases, the payoff amount for your card may be more than just the statement balance because of fees and interest. Be sure you check with your credit card issuer to confirm what you owe.

- Get confirmation of your cancellation. With some credit card companies, you can simply sign in to your account to close it. Or you may be able to call your card issuer to make the request. Either way, consider getting confirmation in writing. That way, you have a permanent record in case anything gets called into question.

- Check your credit report. After closing your card, you might also want to check your credit report. You can get free copies of your credit reports with credit scores from all three major credit bureausâvisit AnnualCreditReport.com to learn how.

If you still have questions about closing your account, check your cardholder agreement for more details.

Removing Collection Accounts From A Credit Report

Whether your attempts to pay for delete are successful can depend on whether youre dealing with the original creditor or a debt collection agency. As to the debt collector, you can ask them to pay for delete, says McClelland. This is completely legal under the FCRA. If going this route, you will need to get that in writing, so you can enforce it after the fact.

What to keep in mind, however, is that pay for delete with a debt collector may not remove negative information on your credit history that was reported by the original creditor. The creditor may claim that its contract with the debt collection agency prevents it from changing any information that it reported to the credit bureaus for the account. That said, some debt collection agencies take the initiative and request that negative account information be deleted for customers who have successfully paid their collection accounts in full.

Before taking this step, consider how collection accounts may be impacting your credit score. The FICO 9 credit scoring model, for instance, doesnt factor paid collection accounts into credit score calculations. So if youve paid off or plan to pay off a collection account, then you may not need to pursue pay for delete if your only goal is improving your credit score.

You May Like: Aargon Agency Scam

Also Check: What Credit Score Is Needed For A Conventional Loan

What Happens When You Remove A Closed Account From Your Credit Report

In general, if your request is approved your credit score will reflect the change in about 30 days. However, there are some scenarios where deleted credit report items reappear after a dispute has been filed. This typically happens if the information claimed was not verified by the credit agency in a timely manner or if the information is incorrect altogether.

If this situation happens to you, simply contact the credit reporting agencies as you did before to follow up on the status of your claim.

Why Credit Is Important For Home Buyers

When interested buyers apply for a mortgage, they should understand how their credit history is used in the process. Your credit score and report make up a big portion of your ability to qualify for a mortgage, as well as the type and possible size of that mortgage.

To determine whether youre approved for a mortgage and what interest rate to charge, lenders will examine your credit report, which includes:

- The number of loans or credit accounts you have: This includes closed accounts, like a student loan youve already paid off.

- The amount you owe on each account: Having debt doesnt necessarily tarnish your credit report. However, if you are using a lot of your available credit, lenders may believe youre overextended and at risk of defaulting.

- The types of credit accounts you have: Lenders like to see a variety of accounts on your credit report, such as installment loans and revolving loans .

- Your payment history: Lenders want to know that youll be responsible for making regular, on-time payments. Your payment history helps lenders calculate the amount of risk they will take on by offering you a home loan.

- Your credit score: Credit scores are quick snapshots of your credit health determined by your payment history, the amount of credit you owe, the length of your history, the types of accounts you have, and whether youve recently opened any new credit accounts. In general, the higher your credit score, the better terms youll get on a mortgage.

Read Also: What Does A Credit Report Look Like

How Closing Accounts Can Hurt Your Credit Score

The act of closing a credit account has its own effects on your credit score, depending on the type of credit account it is. For example, closing a credit card will probably hurt your credit by increasing your credit utilization ratio .

To a lesser extent, the same thing can happen when you close an installment loan. Specifically, paying off debt can sometimes hurt your credit because some credit scoring models reward consumers for having loans that are mostly paid off. 2

Who Falls Into The Different Credit Score Categories

Unsurprisingly, few individuals have achieved the Holy Grail-like credit score of 850.

Data shows that of the 200 million U.S. adults with credit scores, only 1.4% have a perfect credit score. The average U.S. credit score is 700, according to FICO, while the number of Americans with credit scores over 800 number stands at 41 million in 2018 – the highest number since 2010.

The vast majority of U.S. adults have a credit score in the 550-to-639 range, which is deemed as “fair” according to credit scoring standards, according to data from TransUnion.

From a percentage standpoint, here’s how Credit Sesame breaks down Americans and their credit scores, calculated from seven million site users:

- A credit score of 499 and lower = 8% of Americans.

- A credit score of 500 to 549 = 14% of Americans.

- A credit score of 550 to 639 = 33% of Americans.

- A credit score of 640 to 719 = 33% of Americans.

- A credit score of 720 to 850 = 19% of Americans.

You May Like: Why Is It Important To Check Your Credit Report

Does Closing An Account Hurt Your Credit

If you’re considering closing one of your credit cards because you don’t use it anymore, think twice before contacting your card issuer. While it might seem like holding fewer credit cards could help your credit, losing the available credit limit on the closed account can increase your utilization rate, which can hurt credit scores. If you’re considering closing a bank account, however, be assured that it will have no direct effect on your credit. Here’s what to know about how closing an account can affect your credit.

Monitor Your Credit Utilization

Speaking of credit utilization, having high debt in relation to available credit will typically make your credit score go down. For example, someone who owes $4,000 on a card with a $5,000 limit has an 80% credit utilization rate. Another person who owes $1,000 and the same limit has a credit utilization rate of 20%. Lower credit utilization usually means a higher credit score.

Some people try to game the system by opening new credit cards and applying for a balance transfer. This could be a risky choice for those who want to buy a home within a year or two.

While a balance transfer could decrease your credit utilization rate which may increase your credit score such short-term gains may not last. You may be enticed to run up your old card with a lot more debt, and opening new accounts may decrease your credit score by reducing your average credit age and placing a hard inquiry on your credit report.

Also Check: What Credit Score Is Needed For Best Buy Credit Card

Wait For The Closed Account To Be Removed

If the above two options dont work, the last step is to wait out the closed account. Eventually, the closed account will fall off your credit reporteither in seven or 10 years. And while that may sound like a long time, as the years go on, the closed account will have less and less of an impact on your credit.

XXXXXX

You can remove closed accounts from your credit report in three main ways: dispute any inaccuracies, write a formal goodwill letter requesting removal or simply wait for the closed accounts to be removed over time. That said, removing closed accounts can affect your credit score, so make sure you consider your situation first.

While its not always possible to remove a closed account from your credit report, it is straightforward to attempt to do so. However, its not always beneficial to remove closed accounts, and in some cases, it could even lower your credit score.

In general, you should try to remove a closed account with inaccurate negative information, but you should probably leave any accounts that are yours that are having a positive effect on your credit history.

Below, well talk about whether you should try to remove closed accounts from your credit report, how closed accounts may affect your credit score and how to remove closed accounts.

Dont Open New Lines Of Credit

Getting a mortgage to buy a home is a big step for most people. Even those who have gone through the process before may not always make the best credit choices leading up to their purchase. Lenders may notice a sudden change in an otherwise steady credit report and assume the applicant is about to change the way they handle their money.

New accounts are a good example of this. When you have a variety of new accounts on your report, lenders may wonder if youre going through financial trouble or if youre planning to take on other debt after you buy a home. New car loans, credit cards, or even loans for furniture or home repairs could negatively impact your credit score. Lenders often prefer that borrowers have no new accounts within the past year.

Don’t Miss: Do Insurance Companies Report To Credit Bureaus

Errors To Watch Out For On Your Credit Report

Once you get your report, check for:

- mistakes in your personal information, such as a wrong mailing address or incorrect date of birth

- errors in credit card and loan accounts, such as a payment you made on time that is shown as late

- negative information about your accounts that is still listed after the maximum number of years it’s allowed to stay on your report

- accounts listed that you never opened, which could be a sign of identity theft

A credit bureau cant change accurate information related to a credit account on your report. For example, if you missed payments on a credit card, paying the debt in full or closing the account won’t remove the negative history.

Negative information such as late payments or defaults only stays on your credit report for a certain period of time.

How To Cancel A Credit Card Without Dinging Your Credit Score

Thomas J Catalano is a CFP and Registered Investment Adviser with the state of South Carolina, where he launched his own financial advisory firm in 2018. Thomas’ experience gives him expertise in a variety of areas including investments, retirement, insurance, and financial planning.

Recommended Reading: How To Remove Late Payments Off Credit Report

Common Credit Report Errors

According to the Consumer Financial Protection Bureau, these are the most common errors consumers find on their credit history:

Mistaken identity

- Wrong name, address or phone number

- Accounts from someone with a similar name

- New credit accounts opened by someone who stole your identity

Incorrect account status

- Accounts wrongfully labeled as open, past due or delinquent

- Accounts that wrongfully listed you as the owner instead of authorized user

- Wrong date for the last payment received, date the account was opened or delinquency status

- Same debt listed multiple times

Data management

- Information that is not removed, despite already being disputed and corrected

- Accounts that are listed multiple times, with different creditors

Balance

- Incorrect credit limit

How Do Icancel My Experian Subscriptions Through An App:

As a member of the Experian account, it may be tricky in cancelling manually your subscription through email, phone number or online mode. You can choose another option for cancelling Experian subscription UK. Use the DoNotPay app to cancel the subscription.

You need to follow the instructions to complete the cancellation process:

Dont Miss: Does Paypal Credit Report To Credit Bureaus

Also Check: How To Make Your Credit Report Better

Can I See My Credit Report

You can get a free copy of your credit report every year. That means one copy from each of the three companies that writes your reports.

The law says you can get your free credit reports if you:

- go to AnnualCreditReport.com

Someone might say you can get a free report at another website. They probably are not telling the truth.

How Long Do Closed Accounts Stay On Your Credit Report Can They Affect Your Credit

Opening a credit account means that you can close it too, and each action influences your credit report differently.

Closed accounts, like a credit card account or a loan, remain in your file for several years, though the precise time frame depends on the accountâs history.

Read on to learn more about closing credit accounts, how it affects your credit, and how to go about removing it from your history.

Also Check: How To Clear A Default On My Credit Report

Does Closing A Credit Card Hurt Your Credit Score

There are many reasons you might be considering closing a credit card account. You may be trying to limit your amount of revolving debt. Or you might not be using a particular card any longer.

Whatever your goal, one question you might consider: Does closing a credit card hurt your credit score? The answer varies based on your personal circumstances, but there are things to keep in mind before deciding.

Key Takeaways

- Before closing a credit card, you may want to be aware of any impacts it may have on your credit report.

- Closing an account can affect the age of your credit and your credit utilization ratio, which may hurt your credit scores.

- Exploring the pros and cons of closing a card can help you make an informed decision about whatâs right for you and the impacts on your credit scores.

How To Get Rid Of Closed Accounts

If you have inactive accounts that you want to delete from your credit report, there are several methods you can try.

Theres no guarantee that the methods below will workits generally up to the credit bureaus and your creditors, and youll have to abide by their decisions. However, it doesnt hurt to try. Ultimately, you have four main options.

Don’t Miss: Does Lending Club Show On Credit Report

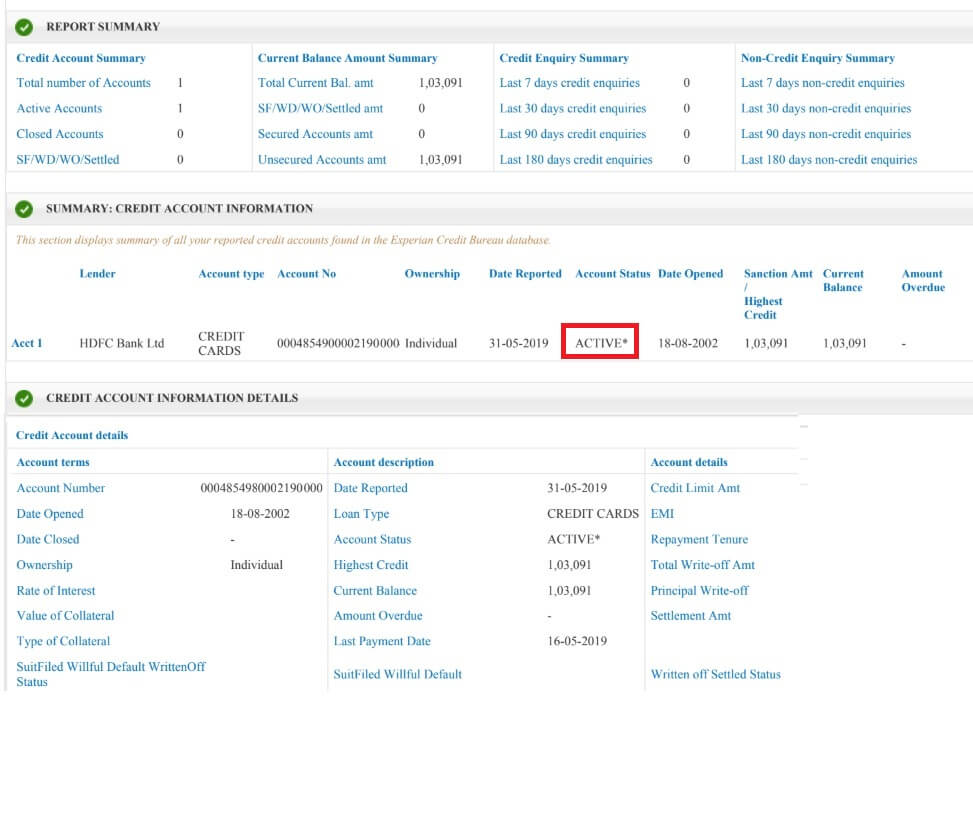

Experian Credit Disputes And Queries

While the credit information company, Experian, makes every effort to ensure that the information contained in a credit report is up to date and accurate, there can be times when the information you have and the information in the report dont match. The thing to remember is that in such cases, you are provided the option to dispute the information and get it corrected. To ensure that the complaints about a credit report are taken care of in the best way possible, you can either call up the customer care of initiate the process using the form. The main thing to remember here is that before you can go asking for a dispute settlement, you need to get your Experian credit report to check it for errors.

How To Remove An Account From A Credit Report

Step 1: Dispute inaccuracies. Once you check your credit score, you can dispute any inaccuracies in your record before making big decisions, like closing accounts. Investigating and then scrubbing that information from your report takes a bit of time, so do this as soon as it becomes necessary. It typically takes 30 days to resolve a claim.

You can file a dispute with the credit bureaus online or through the mail. Youâll have to provide your name, account number, the information you are disputing, and any supporting documents.

Step 2: Write a goodwill letter. Ultimately, this is an extremely polite way of asking a creditor to remove a closed account from your report. It isnât the same as a dispute because it doesnât usually require supporting evidence about why an account was closed, but still helps cover all your bases. Unfortunately, the creditor has no reason to access your request through these means.

Step 3: Wait it out. Sometimes, you just have to be patient.

Closed accounts donât remain on your file forever. If you canât have the account removed, you can focus on improving your credit and know that the record will eventually disappear.

Don’t Miss: How Long Do Things Stay On Credit Report Uk