The Following Example Shows How The Credit Reporting Timeline Of A Charge

1/1/15: You become 30-days late on a payment to Imaginary Bank and Trust . 7/1/15: At 180-days past-due, IBT closes your account and marks it as a charge-off.1/1/22: The charged-off account must be deleted from your credit report by this date.

The credit bureaus and creditors can make mistakes. Whether on purpose or intentional, a mistake could result in a charge-off remaining on your credit report for too long.

Do you think a charge-off has been on your credit report longer than seven years? You or your credit repair professional may need to dispute the outdated account to try to fix the problem.

What Do I Do When My Account Is Charged

When an account is charged-off, you still owe the debt and it can be collected by the original creditor or by a collection agency.

The original creditor might make an attempt to recover it, but usually hires a collection agency to go after the debt. Even more frequently, the creditor sells the debt to the agency and steps away from the matter altogether.

Once you receive notice that your account has been charged-off, there are several options available:

- Find a way to resolve the debt with the original creditor or collection agency

- Attempt a debt settlement for less than the amount due

- Do nothing and wait seven years for the account to be removed from your credit report

How Long Will A Charge

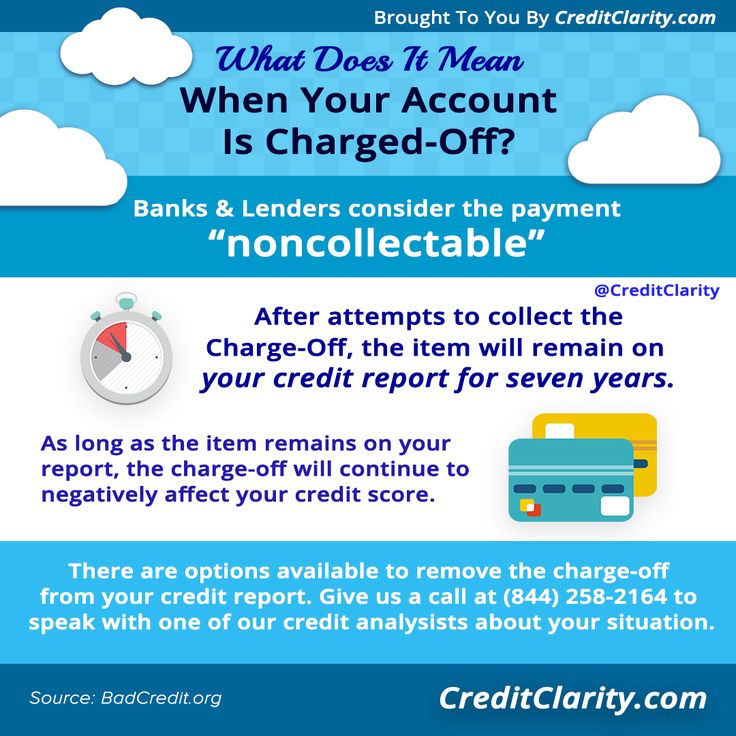

The Fair Credit Reporting Act lets charge-offs remain on your credit reports for up to 7 years. As long as a charge-off appears on your reports, it has the potential to affect your credit scores in a negative way.

Its worth pointing out that the 7 year credit reporting clock starts ticking on the date of the original terminal delinquency. Thats the date the original account became 180 days past due.

If a collection agency buys the debt, this seven-year clock does not start over. Making a payment doesnt restart the seven-year statute of limitations either.

Nothing can legally restart the credit reporting time clock when it comes to charge-offs or any other negative item on your credit reports. If a creditor tries to manipulate the date of a charged-off account to keep it on your credit reports for more than seven years, you should dispute it and possibly speak with an FCRA attorney.

The good news is that youre not doomed to a life of bad credit for the entire 7 years a charge-off is on your reports. Credit scoring models place more emphasis on recent events.

So, a charge-off that took place last month will have a much bigger impact on your credit scores than a charge-off from several years ago.

Recommended Reading: Who Can Check My Credit Report

How Does Charged Off Debt Affect Your Credit

Charged-off debts can affect your credit both directly and indirectly. When your debt is charged-off, you receive a charge off notation in your credit history. This notation stays on your credit report for seven years, starting from the date of the last scheduled payment you didnt make.

Paying the charged-off amount will not remove the notation from your credit report. Instead, the notation will be changed to charged-off paid or charged-off settled. This notation will remain on your report for the remaining 7 years after the final missed payment.

When your creditor charges off your debt, they may sell it to a collections agency. If it is sold, youll have an account in collections notation on your credit report. This will cause your credit score to drop.

How To Avoid A Charge

Knowing the timing of a charge-off puts you in a better position to avoid such a serious delinquency. With each missed payment it gets harder to catch up again with fees and interest added to your balance due. If you fall behind, get caught up on any missed payments as quickly as possible.

If you foresee problems making your credit card payment, contact your credit card issuer sooner rather than later. You may be able to make a payment arrangement that would allow you to avoid a charge-off. Or, if youre having financial trouble, your credit card issuer may allow you to enter a hardship payment plan with reduced monthly payments.

You May Like: How Long Does Chapter 13 Stay On Credit Report

What Happens To A Charge

Unpaid credit card debt will drop off an individuals credit report after 7 years, meaning late payments associated with the unpaid debt will no longer affect the persons credit score. After that, a creditor can still sue, but the case will be thrown out if you indicate that the debt is time-barred.

Can You Remove Charged Off Accounts From Credit Reports

It is possible to have charged off accounts removed from your credit report. You can submit a dispute to the credit bureau reporting the charge off and provide evidence that the account has been paid in full. If the credit bureau cannot verify that the account has been paid in full, the charge-off will be removed from your credit report.

If you are unable to get the charge off removed from your credit report, you can try to negotiate with the creditor. Explain that you have been working on improving your credit score and would like to have the charged off account removed from your credit report. Be prepared to offer a payment plan or settlement amount if the creditor agrees to remove the charge off from your credit report.

Should I pay charged off accounts

The first thing to consider is whether or not the charged-off account is valid. If theres a charged-off account on your credit reports, the first step is to double-check the details.

Here are a few things to look for when verifying the accuracy of your charge-off information.

Also Check: Is 796 A Good Credit Score

Do You Still Have To Pay A Charged

Even though the credit card issuer has declared a loss on your account, you’re still responsible for repaying the debt. The creditor can still attempt to collect the debt and might even assign or sell the debt to a third-party debt collector who will pick up the collection activities.

Rather than having the convenience of paying your balance over time, the full balance of the charge-off is due. You may be able to negotiate with the creditor for a short-term installment plan, but this is ultimately at the creditor’s discretion. It all depends on how likely they think they are to get the full amount from you.

When To Negotiate With A Creditor

This likely won’t work if the charged-off account belongs to you and all the information being reported about it is accurate. In that scenario, you could try negotiating with the creditor or debt collector to update or remove the charge-off account from your credit file. This is called “pay for delete,” and essentially you’re asking for the account to be removed from your credit reports in exchange for a fee.

Pay for delete arrangements are legal under the Fair Credit Reporting Act, but there are a few things to know. First, creditors aren’t obligated to honor your request and remove charge-offs from your credit. So while you can ask for a pay-for-delete, there’s no guarantee that a creditor or debt collector will agree to it.

Second, if they do agree, you’ll likely need to pay the account in full. However, if an account has been delinquent for some time, the creditor may be willing to accept a settlement in which you pay less than the full amount. Either way, you’ll almost certainly have to pay something toward the debt.

Recommended Reading: What Credit Score Do You Need For An Fha Loan

When A Collection Agency Steps In

Charge-offs don’t end your obligation to repay the debt.

Even if your original creditor no longer owns the account, you’ll still owe the debt to the collection agency that acquired it. Charge-offs and other negative account history, such as late or missed payments, can stay on your for up to seven years.

Negotiating With Collection Agencies

The wording used on your credit report, as discussed in the last section, can certainly be a factor in the negotiation process. For example, if a debt collection agency offers you a settlement in writing, you can call them and say that you’ll write them a check right now if they’ll agree to permanently remove the account from your credit afterward.

If they say no, ask if they’ll at least report it as “paid in full” instead of “settled.”

You can often successfully negotiate a removal by offering to pay the debt in full — as this would be a win-win for both you and the collection agency.

In my experience, most collectors will jump at the chance for a quick payday. After all, once they get their money, what do they care what your credit report says? Just be sure to get the agreement in writing before paying the account.

Also Check: How To Check My Credit Score With Itin Number

Pay The Collections Agency

If the creditor has sold the account to a collections agency, then youd pay the agency. Before you do, write to the agency and ask for proof that it owns the account. After youve paid off the debt, the account will appear on your reports as paid collection, which may be viewed more favorably by lenders than an unpaid account.

Once youve paid off the debt, through the original creditor or the collections agency, or via settlement, make sure you ask for a final payment letter. And keep checking your credit reports if the account isnt shown as paid, youll have the letter as proof you can use to help get your reports corrected.

Is The Debt Past Its Statute Of Limitations

Ask the creditor for the last payment date noted on the account. Legally, theyre required to answer honestly if they know. If the debt is older than the statute of limitations in the presiding state, a debt collector can no longer sue you in court for repayment. However, in many places, debt collectors can still try to collect on old debts beyond the expiration of the statute of limitations and the account will still be reported on your credit report for seven years.

Consumers can ignore collection efforts and threats at this point, but creditors are free to try to collect old debt, says Sullivan.

Ultimately, if the charge-off account does belong to you, youre legally responsible for paying the debt. Some collectors agree to settle for a reduced amount, and you might decide to pay the settlement amount. Its best to consult with a debt attorney about the options available to you at this point.

Read Also: How To Dispute A Missed Payment On Credit Report

How Does A Credit Card Charge Off Affect My Credit

Having a charge off on your credit report will appear on your credit for up to seven years. The cardholder has the right to pay off the debt at any point after charge off, upon which time the amount will convert from an unpaid collection to a paid collection on their credit report. Payment does not remove the charge off from the credit report, however.

Negotiate With The Original Lender

If the original lender hasnt sold your debt, you can work with them to resolve the issue. Borrowers can agree to a new payment plan, catch up on existing payments, or enroll in a debt settlement program, like the Freedom Debt Relief Program. Lenders will mark the charge off as paid after you pay it off.

Don’t Miss: How To Report Rent To Credit

Should You Pay A Charged

First, it depends on whether or not the charged-off account is accurate. If theres a charged-off account on your credit reports, one of the first steps is to verify the information.

To make sure the information about your charge-off is correct, here are a few things to look for.

- Your account may be sold a few times through third-party collections agencies. Make sure each sold account is marked closed and has a zero balance. Only the most current collections account should be listed as open.

- Check the outstanding balance. If its more than you think it should be, ask the creditor to explain any additional costs or make the correction.

- Verify the charge-off date on the original account as well as any offspring accounts in collections. The charge-off date should be the date of your first delinquent payment on the original account.

Will Paying A Charge

Paying a charge-off will not automatically get it removed from your credit report. The status will change to show that it has been paid, but the mark remains on reports for seven years since the first missed payment.

Before you pay a charge-off, you can sometimes make an agreement with the credit issuer that they will remove the charge off in exchange for your payment. If you make this type of agreement, make sure to get it in writing.

Read Also: A Credit Score Is Intended To Measure

Dmp Can Assist With Charge

If dealing with charge-offs is overwhelming you, you should seek assistance from a non-profit credit counseling organization. may assist you in better understanding money management, creating a budget, and, if necessary, enrolling you in a debt management program .

A DMP is an agreement between both parties to pay off the debt in total over a certain period. The credit counseling organization may be able to persuade the lender to lower their interest rates and cut late fees and other penalties, allowing you to resolve the problem in three to five years.

You may ask the credit bureaus to alter the account status to “paid in whole, balance zero” once you’ve paid off the entire debt. Although the account will remain charged off for another seven years, your credit score will improve, and future lenders will view your situation more positively.

Another alternative is debt settlement, although it is fraught with danger. When a lender agrees to settle outstanding debt for less than what is owed often considerably less it is called debt settlement. Some financial institutions refuse to engage with credit counseling firms.

Another disadvantage of a debt settlement is that if a portion of your debt is forgiven or canceled, you may be required to record it as “income” and pay the necessary taxes.

Finally, debt settlement hurts , which can be significant. Before making a final choice, it is a viable option, exploring alternatives like debt consolidation and a debt management plan.

How Many Points Does A Charge

If a charge-off was just added to your reports last month, the account may have a significant impact on your credit scores. FICO, the most widely used credit scoring system says a charge-off can take up to 150 points off a credit score. The higher your score was to start with, the greater the damage will be.

Recommended Reading: How Long For Chapter 7 To Come Off Credit Report

Check Your Credit Report For Charge

The first thing youll want to do is understand the entirety of your potential charge-off account. So, the first thing youll do is check your You can get access to your free credit report online each year at annualcreditreport.com, from each credit reporting agency : TransUnion, Equifax and Experian.

From here, learn how to read your credit report and find the information you need about your charged-off accounts. The details you are looking for could be in the credit history and accounts section, where you can find information on missed or late payments and get a better handle on your outstanding debt and collection accounts.

Next, take a look at the negative information or public records section. Here youll find every negative items that can lower your , such as bankruptcies, foreclosures, charge-offs, delinquent payments or repossessions.

Before responding to a debt collection, check the statute of limitations in your state.

Its important to go through this information for accuracy. If you find anything reported incorrectly with the credit reporting agencies, you can take steps to update or remove the information .

What Is A Charge Off

Charge offs show up on some financially distressed borrowers credit reports. If you dont pay a loan for over six months, some creditors will give up on the debt. This is because they believe you wont repay it and will issue a charge off. Creditors charge off debt because they can write it off as a financial loss. This strategy helps the creditor save on taxes instead of sitting on the loss.

A charge-off does not eliminate debt. Any borrower remains obligated to pay debt until its fully paid, settled, or voided by bankruptcy. Some creditors sell bad debt to debt collection agencies. These agencies may use aggressive outreach tactics and can call you anytime between 8 am and 9 pm. Many scammers act as debt collection companies to prey on unsuspecting victims. If you receive a call, dont provide sensitive information and ask for a letter containing information about the total debt and original creditor. You can also ask for a caller to identify themselves and start the name of their collection agency.

You May Like: Is 656 A Good Credit Score

Charge Offs Will Drag Down Your Credit Score

Whether you call it a charge off or a write off or come up with some entirely new bit of fun financial jargon the impact to a credit score of a charged off account remains the same: big and bad. A super-powered delinquency, charge offs can eat several dozen points off your credit score and the higher your score before the charge off, the larger the number of points youll lose.

The best way to deal with a charge off is to avoid ever having one in the first place. Pay your credit accounts as agreed every month, and eliminate the hassle altogether.

Even if you do fall behind on your payments, as long as your account has yet to be charged off so, as long as you arent more than 180 days past due you can still recover your credit score by paying your balance and returning your account to good standing.

We all have financial ups and downs, and at times may feel like just ignoring all of our debts and payments. But this will only lead to more problems in the long run. While it may seem like an insurmountable obstacle at times, working to pay any balances before that 180 day point is well worth the effort it may take.