Whats A Credit Inquiry

A credit inquiry is simply a request for information about your credit history. Its the process in which a consumer asks their lender for permission to take out an additional loan. For this request, the consumers personal information is sent to the lending company.

This inquiry request does not affect ones creditworthiness, but the primary benefit of an inquiry is to provide data to potential creditors an example would be asking someone who may be considering applying for a mortgage loan whether they would like to see copies of previous loans.

A lenders check will be performed before deciding on providing finance. It is also used to track whether the applicant has changed address, or had more than one application with a lender recently , and it can also show how many different lenders have offered him credit lending some insights into how the applicant manages his money.

One large inquiry over 3 months, such as an all-inclusive holiday or vehicle purchase finance package, would not affect your overall score as much as if you were obtaining multiple consumer loan products from more than one lender in a short space of time.

Dont Miss: Does Paypal Credit Do A Hard Pull

Removing Negative Items After Seven Years

Check your credit report to learn when negative items are scheduled to be deleted from your credit report. When the seven years is up, the credit bureaus should automatically delete outdated information without any action from you.

However, if theres a negative entry on your credit report and its older than seven years, you can dispute the information with the credit bureau to have it deleted from your credit report.

Dont Open New Accounts All At Once

After a bankruptcy discharge, it might surprise you that youll get a lot of credit card offers. Many of these offers are for secured credit cards with sky-high interest rates. Companies now consider you a better risk because you dont have a lot of debts anymore. However, opening multiple new accounts at once could make it difficult for you to maintain regular payments and this could harm rather than help your credit score.

Also Check: Do Cash Advances Show On Credit Report

What Is Considered A Late Payment

Technically speaking, a payment is late as soon as its past the due date, even if its one minute past midnight. If youre looking for the nitty-gritty details, check your contract to see when your payment is specifically due. For example, your payment might be due by 5 p.m. instead of midnight.

However, once the deadline passes, many creditors have whats called a grace period for you to make your payment before charging a late fee. Once the grace period is overor if there is no grace period outlined in your contractyour provider will typically charge a late fee.

Read Also: Is 653 A Good Credit Score

What If I See Something On My Report That Shouldnt Be There

When you get and read your credit report from Borrowell, you might see something that doesnât look right! If itâs regarding a specific item, we recommend contacting the credit grantor or collections agency. If itâs regarding incorrect personal information, such as your date of birth or your address, please contact Equifax directly. You can reach them here: +1-866-828-5961. Here at Borrowell, we canât change or modify any information on your credit report.

Dont Miss: When Does A Bankruptcy Come Off Credit Report

Also Check: Does Taking A Loan Payment Holiday Affect Your Credit Rating

Payments Less Than 30 Days Late

If you miss a payment but catch it before youre 30 days late, youre in luck.

This means if you pay the bill before its 30 days late, it shouldnt affect your credit score at all. However, youre likely going to be hit with a late fee and a penalty APR .

Be aware that payments can process as quickly as the same day, but with other lenders, it can take much longer. To avoid encountering processing delays, try not to wait to pay until the 29th day your payment is late.

How Do Errors Impact Your Credit Score

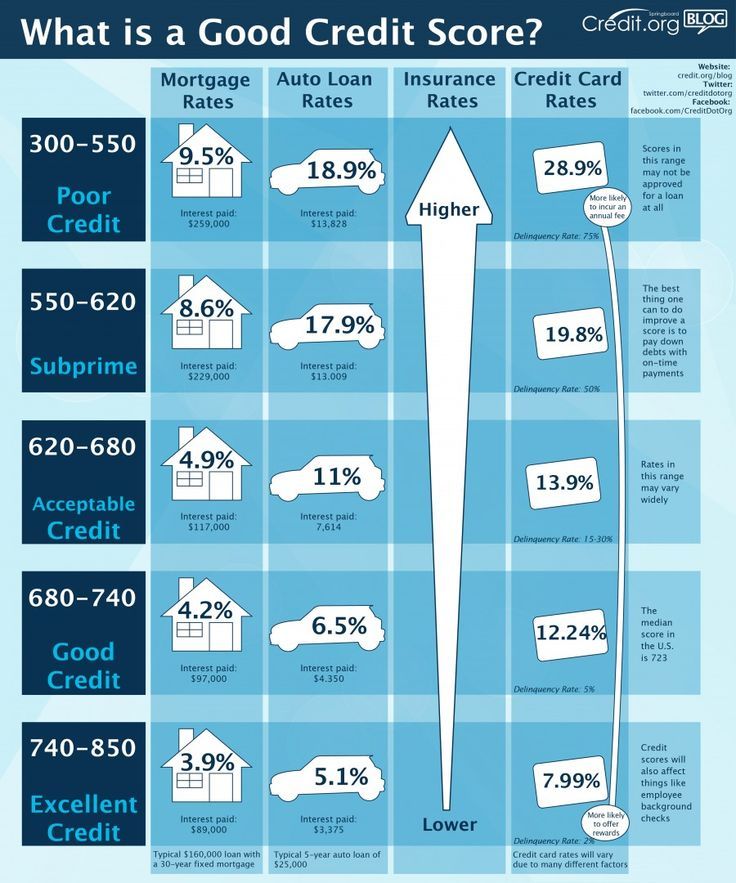

Your is calculated using different models such as VantageScore and FICO, the two most widely used credit-scoring models. Each model has its proprietary metrics and criteria. However, both use data from the major credit reporting agencies to generate your score.

Both scoring models also consider similar factors when calculating your score. These include your total credit usage and length of credit history, for example. But your payment history is the most important factor when determining your credit score.

Your payment history alone makes up around 35% of your FICO score and 42% of your VantageScore 4.0. Since payment history is so significant, a single inaccurate late payment could impact your score considerably. According to FICO, if your report has a 90-day missed payment, your score could drop by as much as 180 points.

Don’t Miss: Does Credit Karma Lower Your Credit Score

How Long Does A Collection Account Stay On A Credit Report

The Fair Credit Reporting Act lays out that the collection has to stay on your credit report for up to seven years from the date of default on the original account. This is to give lenders a clear picture of your financial behavior so they know the risks of lending you money.

However, on a credit report, a paid collection can still stay on your credit report for up to seven years, regardless of whether the account has a $0 balance.

After seven years, the paid collection will automatically drop off your credit report.

How Do Collections Affect Your Credit Scores

A collection account is a negative item that can hurt your credit scores. But the impact on your score can depend on the type of credit score and whether you’ve paid off the collection.

For example, the latest FICO® Score and VantageScore® models ignore paid collection accounts, while previous score versions may count paid collections against you.

But when you’re applying for a loan with a lender that uses older scoring modelssuch as a mortgage lenderpaying down your collections could still be important. Credit scores aside, the lender may review your credit history, and having unpaid collections could make it more difficult to qualify. While even paid collection accounts are negative, they may be viewed more positively by lenders than an account that remains unpaid.

You May Like: Does Refinancing Hurt Credit Score

How To Build Your Credit After Bankruptcy

A bankruptcy is a devastating and life-altering event that can leave some serious emotional scars. But just because youve got bankruptcy or other negative info clouding up your credit history, it doesnt mean your life is over. You can come back from a bankruptcy, and it starts with dusting yourself off and learning from your mistakes. Here are some ways to help rebuild your financial stability after a bankruptcy.

Late Payments And Defaults

Late payments can be notified to a credit agency when they are more than thirty days in default. Most late payments notified to the credit agencies are from either the credit card companies or the utility providers.

Not all utility companies report payments to credit reference agencies but the number that do is increasing. More and more lenders are starting to pass their data onto these agencies and you may soon see all your personal and household bill payments recorded on your credit file.

Open accounts stay on your report indefinitely and settled or closed accounts can remain on your credit file and available for future lenders to see for six years.

Recommended Reading: How Soon Will My Credit Score Improve After Bankruptcy

Are There Rules For Credit Repair Companies

Its illegal for credit repair companies to lie about what they can do for you, or charge you before they help you. Credit repair companies also must explain your legal rights in a written contract that also details the services theyll perform your three day right to cancel without any charge, and give you a written cancellation form how long it will take to get results the total cost youll pay any results they guarantee.

Also Check: Does Speedy Cash Report To Credit Bureaus

What Happens If A Bill Goes To Collections

If the original company is attempting to collect the debt themselves, the account information will show the phrase In Collections. If the creditor sold the unpaid debt to an outside, or third-party, company, that collections company will now be reporting the account to credit reporting agencies. Some accounts that dont normally show up on your credit reports, like those for phone or utility bills, can appear in collections when an outside collections agency has bought the debt from the original creditor.

The contact information for the collections agency, along with who they are collecting the debt for, will be listed with the rest of the account information on your credit report. When the collection has been paid, it will say Paid Collection in the account information. , but the change should be reflected in your report when the information is provided to the credit reporting agencies by the collections agency. This usually happens once a month.

Recommended Reading: How To Contact Free Credit Report Com

How Long Does Debt Settlement Stay On Your Credit Report

A settled debt with no late payments will stay on your credit report for seven years from the date it was settled accordingly to regulations outlined in the Fair Credit Reporting Act . A late payment on an account is called a delinquency. Delinquencies are reported to the credit bureaus after 30, 60, 90, and 120 days of being late. If you do make a late payment, it will stay on your report starting on the date it became a delinquent account and was never current again.

If the account that you settle is a collections account, then the negative item in your credit report would remain for seven years from the date the remaining balance was discharged.

To Remove A Bankruptcy From Your Credit Report Youll Need To Find Evidence That The Bankruptcy Was Reported Incorrectly Otherwise It Will Only Come Off After Seven Or 10 Years Depending On The Type Of Bankruptcy

Beyond the stress and inconvenience that comes with filing for bankruptcy, it can have a long-standing impact on your credit report and score.

Fortunately, that negative impact can be mitigated with the right help.

Don’t Miss: How To View Free Credit Report

Can You Remove Collections Accounts From Your Credit Report

You can’t get a correctly reported collection account removed from your credit report early.

Even if you pay off the debt, the collection account will stay on your credit report for up to seven years. The timeline depends on when your debt first went delinquent, not whether you still owe the money.

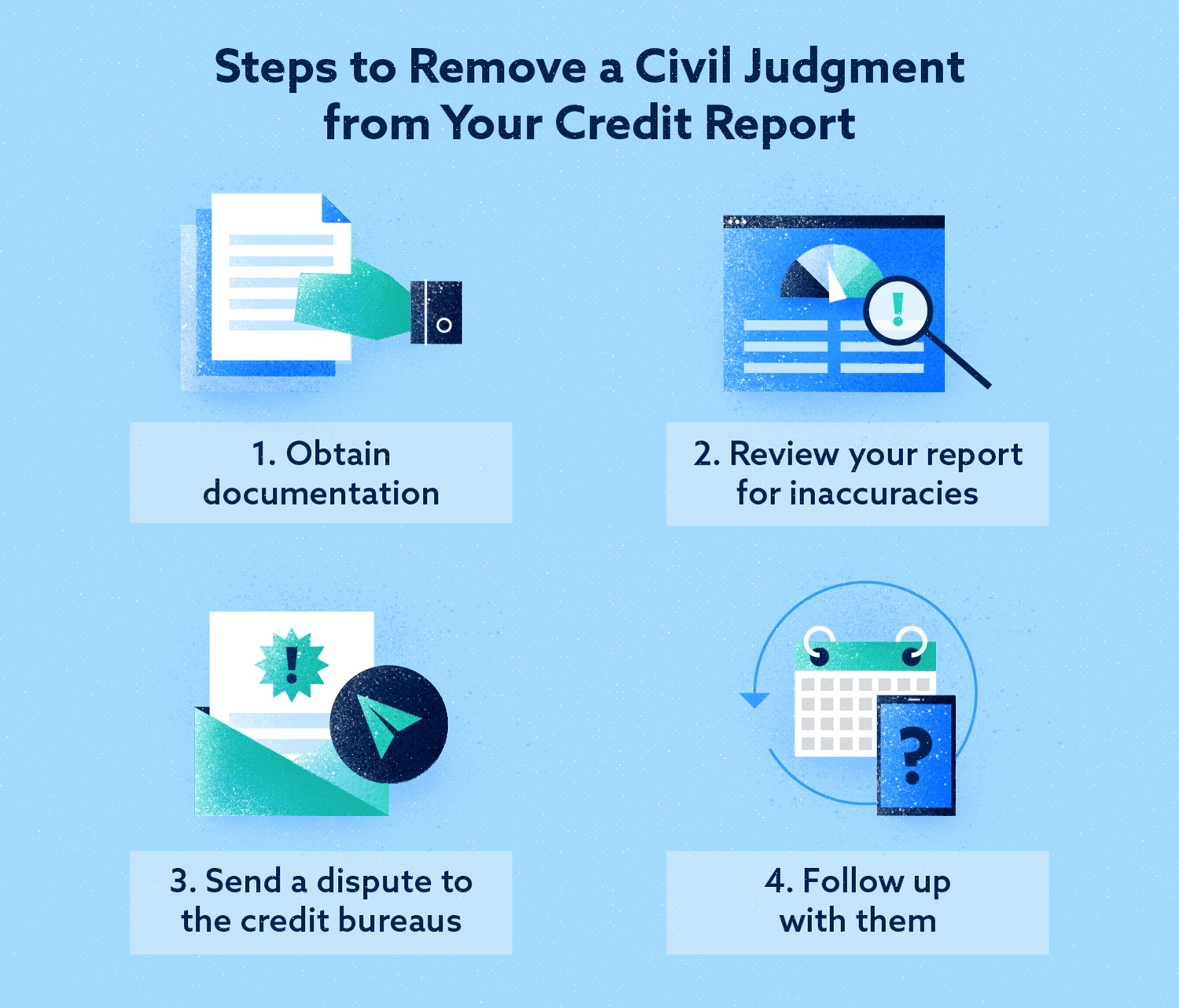

However, if you notice an error with the collection account, you can file a dispute with each of the credit bureaus to have the account corrected or removed from your credit reports.

For example, if the collection agency doesn’t send an update to the credit bureaus once you’ve paid off or settled the account, you may want to file a dispute.

If a collection account is removed from your credit reports early, the original account and late payments that led to the collection activity can remain. Those can continue to impact your credit, and the late payments will remain on your report for seven years from the date of first delinquency.

How Long Does A Delinquent Debt Stay On Your Credit Report

As you know, your credit score is calculated from information on your credit report. Credit card issuers report their customers histories to the , beginning with when you applied for the card. From there, your transactions are reported about every month. These include both the amounts of charges and payments you made and the dates those things happened. If you paid at least your minimum payment by the due date, you will get good marks for paying on time, as agreed.

But if you are late paying your bill, it may be reported, which can hurt your credit since payment history makes up 35% of your overall FICO score. This only happens if you go beyond the 30-day late mark. You will likely incur a late fee if you are even a day late, but you probably wont be reported.

For all other bills, if you dont make at least the minimum payment by the due date, you will be reported late after 30 days. If this continues, you will be reported the next month as 60 days late, with calls likely becoming more frequent. Eventually, you will be 180 days late and your account will be charged off. Now you run a serious risk of having your account turned over to or sold to collectors.

See related: How to pay off a debt in collection

You May Like: Do Insurance Companies Report To Credit Bureaus

What Can You Do To Improve Your Credit Before Negative Information Is Cleared

You do not have to wait for negative information to age enough to be removed to start a process of rebuilding your credit.

Your first step is to get a copy of your credit report and look for both negative and incorrect information. False information on your report can also lower your credit score. An example is if a creditor incorrectly reports a late payment.

Check your report for errors and file a dispute resolution with each credit reporting company to fix any incorrect information.

Next, consider the other factors that might be affecting your credit score:

- If you are not paying your bills on time, catch up on all payments.

- If you carry high credit card balances relative to your credit limit, pay them down or talk with a Licensed Insolvency Trustee about debt relief options if you cant do that on your own.

- If you have a lot of low-credit debt like payday loans or high-interest loans, this is something else that will be considered a negative by any potential lender. Again, talk with a trustee if you cant pay these off.

- Dont apply for credit too often. Too many loan applications will lower your score. If you apply at more than one lender in a very short window to shop around for better interest rates, TransUnion says their algorithm accounts for this and wont lower your score. However, applying for two or three credit cards in a matter of weeks will certainly hurt.

Dont Miss: 672 Credit Score

How Can I Avoid Late Payments

Focus on preventing problems with these strategies:

-

Many credit card issuers allow you to select payment due dates. You may want to stagger due dates to work with your paydays or bunch them up to help you remember.

-

Set up text alerts or calendar reminders about bills due in a few days. If you need more than one, set up multiple electronic nudges.

-

If you can do so without risking overdrafts, consider using automatic payments to pay at least the minimum as soon as a statement issues. You can go online later to pay more, but this way your account is never late.

-

Consider making payments on your credit cards throughout the month. Paying down the balance every week or so protects your credit two ways: Youve already paid by the time the due date hits. And keeping your balance low relative to your credit limit improves your , which is the second-biggest influence on your score.

Some creditors have hardship programs for people affected by things like natural disasters or a pandemic.

About the author:Bev OShea is a former credit writer at NerdWallet. Her work has appeared in the New York Times, Washington Post, MarketWatch and elsewhere.Read more

You May Like: What Credit Report Is Used For Security Clearance

How Long Does A Chapter 7 In Bankruptcy Stay On Your Record

Today were going to be talking about how long chapter seven bankruptcy impacts a consumers credit report. Hi, my name is Mike Ziegler. Im the managing attorney for The Debt Fighters. Were a Florida law firm focused on strategically eliminating serious debt. So lets answer this a few different ways. First, just like any good attorney I have to give you the answer, but then all of the exceptions to the rule. So the answer to the question is that bankruptcy stays on a credit report for up to 10 years. That is can be longer than most information stays on a credit report. Most other information stays on credit report for seven years. However, the misconception is that a credit report is in the garbage can for the duration of that 10 year period and thats just not true. Theres plenty that you can do proactively to improve your credit score. Most clients we work with have a better credit score than when they started, in about two years of filing for bankruptcy. And you can definitely get reasonable lending within a shorter period of time.

Dont Miss: Why Is There Aargon Agency On My Credit Report

Can You Dispute A Collection With The Credit Bureaus

You can absolutely dispute a collection if you think its erroneous. Formal disputes must be filed individually with each credit bureau and can usually be done online through each credit bureaus website. You should also dispute the information with the company that provided the information.

can help you dispute errors on your TransUnion® credit report. We can also help you file a dispute with Equifax directly if you see an error on your Equifax® credit report.

Also Check: Why Does My Credit Score Go Down