How To Build Credit Without A Credit Card

While credit cards are a great tool for building credit, they aren’t your only option. Since your credit score is a reflection of how well you’ve managed debt in the past, any accounts you have that are reported to credit bureaus in good standing have the potential to help you boost your score.

Even if you’re just starting out and don’t yet have any credit accounts, there are other ways you can build your score over time. Here are four strategies for building credit without a credit card:

Why Do I Need To Build My Credit Score

A good can help increase your chances of successfully applying for a mortgage or loan. Itcan also improve your likelihood of being offered lower interest rates for repayments, or a higherspending limit on credit cards.

A low score may negatively impact your chances of being offered credit, as well as affecting the ratesand terms of the loan – which can be a financial obstacle for the future.

Learn more about what factorscan positively and negatively affect your , or you can access your Equifax Credit Report & Score to review your and get an indication of you creditworthiness free for 30days and £7.95 per month afterwards.

Related Articles

Use Credit Monitoring To Track Your Progress

are an easy way to see how your credit score changes over time. These servicesmany of which are freemonitor for changes in your credit report, such as a paid-off account or a new account that youve opened. Also, they typically give you access to at least one of your credit scores from Equifax, Experian, or TransUnion, which are updated monthly.

Many of the best credit monitoring services can also help you prevent identity theft and fraud. For example, if you get an alert that a new credit card account that you dont remember opening has been reported to your credit file, you can contact the credit card company to report suspected fraud.

Recommended Reading: Aargon Agncy

Easy Ways To Increase Your Credit Score Fast In Canada In 2021

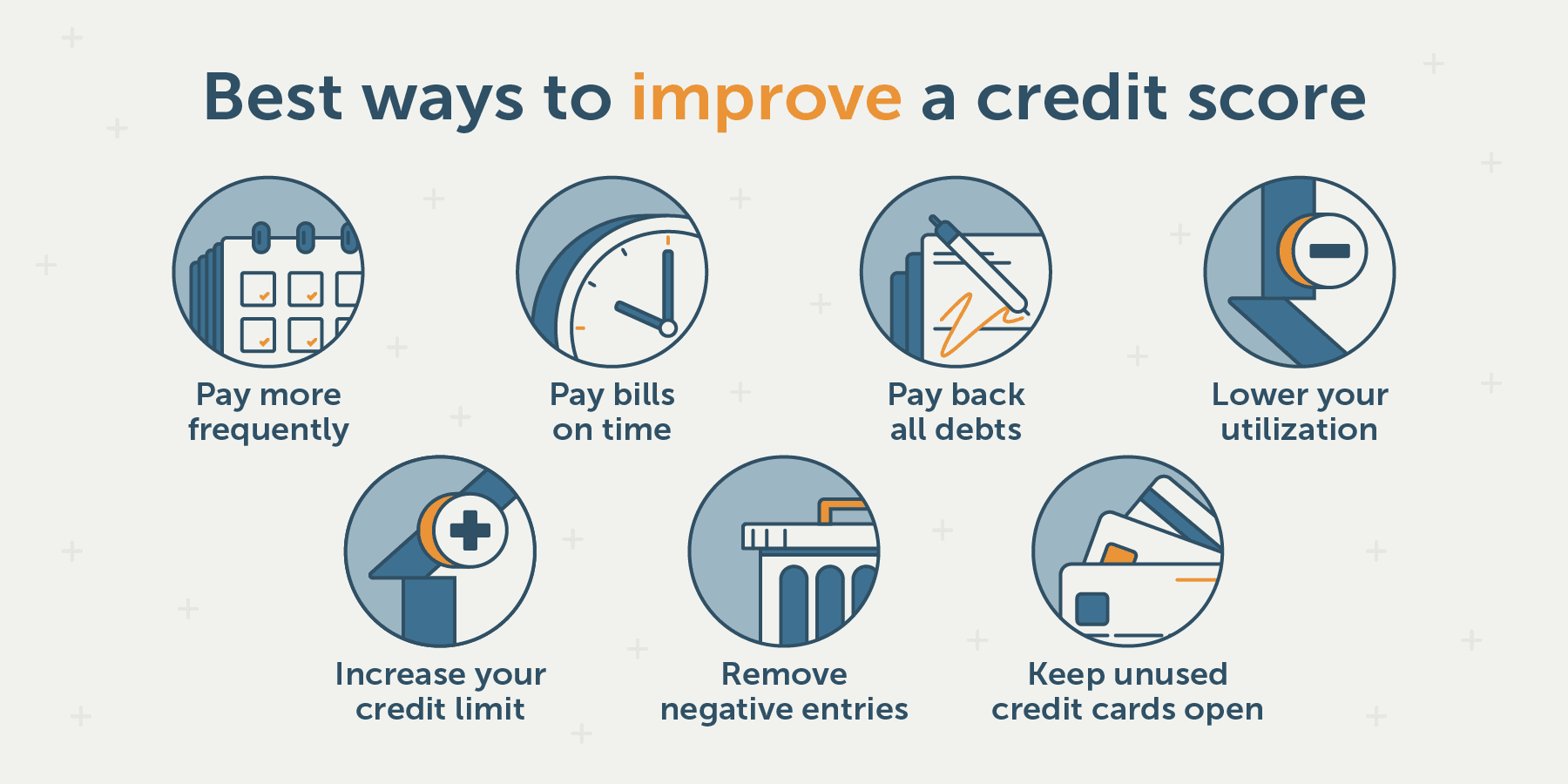

An excellent credit score is your key to lower rates and easy approval for credit cards and loans. If your credit score has taken a hit, there are some simple strategies you can implement to improve your credit score quickly, starting today.

How long does it take to improve your credit score? It varies and will depend on how bad your credit score is to start with. With the right approach, you can start seeing significant improvements in your credit score in as little as 30 days.

No matter how bad your credit score is, following the right strategy can increase it by 100 to 200 points in no time at all.

Consider Consolidating Your Debts

If you have a number of outstanding debts, it could be to your advantage to take out a debt consolidation loan from a bank or credit union and pay off all of them. Then youll just have one payment to deal with, and, if youre able to get a lower interest rate on the loan, youll be in a position to pay down your debt faster. That can improve your credit utilization ratio and, in turn, your credit score.

A similar tactic is to consolidate multiple credit card balances by paying them off with a balance transfer credit card. Such cards often have a promotional period when they charge 0% interest on your balance. But beware of balance transfer fees, which can cost you 3%5% of the amount of your transfer.

Also Check: How Long Is An Account Considered New On Your Credit Report

Join An Account As An Authorized User

You can also improve credit by joining a trusted family member’s or friend’s credit card account as an . You’ll be able to use the card to make purchases, and the card’s payment history will show up on your credit report. That makes it crucial to pick someone whose credit you will benefit from. Work with the primary cardholder to pay them for your purchases, as they’ll be ultimately responsible for any balance on the card.

It’s Legal But Can Create Personal Privacy And Security Risks

Low credit scores can have far-reaching effects. If youre shopping around for a mortgage or another kind of loan, a low credit score can lead to a higher interest rate or worse, denial. Some consumers have found a loophole or so they think.

Also Check: Minimum Credit Score For Amazon Prime Rewards Visa

Avoid Requests For New Credit

If youre looking to increase your score around the time you want to buy a house or car, you wont want to open up a new line of credit, like a retail card, credit card or loan. Thats because hard credit inquiries like those can lower your score, and sometimes it comes down to a few points over whether youre approved or what your rate will be, Nitzsche said.

Soft credit inquiries, like when an employer checks your credit or when you pull your own report, wont affect your score.

Existing Access To Credit

If you already have a significant amount of credit available, for example if you have multiple creditcards or a large overdraft, lenders may view this as a negative. If you already have access to credit,why would you need to apply for more?

If you have credit cards you never use, it may help to close these accounts. Its also important toremember though that what you owe should not make up a high proportion of your overall limit. It may bewise to balance paying off debts, with closing old accounts.

Recommended Reading: Navy Federal Auto Loan Pre Approval

Pay Off Cards With The Highest Balances First

In addition to limiting your future spending, work on paying off your credit cards. If you have several cards with a balance, focus on the highest card balance to reduce your credit utilization ratio.

Paying down your outstanding debt can also improve your debt-to-income ratio, which is not a factor in your credits core but is used by many lenders.

Don’t Panic If Your Credit Score Drops Slightly With One Of The Agencies It’s Actually What’s On Your Credit Report That Matters

The idea that getting accepted for credit is all based on a simple score given to you by one of the credit reference agencies is false. At best, it’s a guide to roughly how good or bad a risk you are. As we say above, lenders will judge you on three main criteria when you apply for credit:

Yet the first two aren’t factored in to your credit score so it’s based on incomplete information. Plus, different lenders are looking for different things. When you apply, they assess you based on their own ‘ideal customer’ scorecard and each lender is different. Just because one lender rejects you doesn’t mean another will do the same. So bear in mind:

- Rather than thinking “I have a great credit score so I’ll get any credit I apply for”, it’s actually best to check how you stand with different lenders before you apply. A way of doing this is to use our . That way, you’ll have a better indication of which lenders are likely to accept you .

- If you get lots of high percentages then you’re doing reasonably well but NO ONE is ever likely to be accepted for every card or loan. If our calculator shows you’re not likely to be accepted for many cards or loans, see our tips to boost your creditworthiness.

The impact of a slight credit score drop is near meaningless

You May Like: Usaa Credit Check And Id Monitor

Raise Your Credit Limits

If you tend to have problems with overspending, dont try this.

The goal is to raise your credit limit on one or more cards so that your utilization ratio goes down. But again, this works in your favor only if you dont use the newly available credit.

I dont recommend trying this if you have missed payments with the issuer or have a downward-trending score. The issuer could see your request for a credit limit increase as a sign that youre about to have a financial crisis and need the extra credit. Ive actually seen this result in a in credit limits. So be sure your situation looks stable before you ask for an increase.

That said, as long as youve been a great customer and your score is reasonably healthy, this is a good strategy to try.

All you have to do is call your credit card company and ask for an increase to your credit limit. Have an amount in mind before you call. Make that amount a little higher than what you want in case they feel the need to negotiate.

Remember the example in #1? Card A has a $6,000 limit and you have a $2,500 balance on it. Thats a 42% utilization ratio .

If your limit goes up to $8,500, then your new ratio is a more pleasing 29% . The higher the limit, the lower your ratio will be and this helps your score.

Don’t Close Your Cards

Once you’ve paid off a card, it can be really satisfying to cut it up! But don’t close your account. Keeping your credit card account open but unused helps give you a long, established credit history, and can improve your overall credit utilization ratio. . Although sticking the credit card in a drawer has it benefits you may also be able to request a credit card freeze. You may be familiar with a credit card freeze since it used whenever you report your credit card lost or stolen. In this case, you may use a credit card freeze if you want the card open in your name but don’t want or need to use the credit card for purchases.

Read Also: Does Titlemax Report To Credit Bureau

Use Experian Boost To Report Council Tax And Netflix Subscriptions

In November 2020, Experian launched a new tool to help people quickly improve their credit scores.

Experian Boost uses open banking to allow you to grant Experian access to your current account information.

The tool allows you to unlock previously hidden information on your salary, council tax payments, savings habits and even your subscription payment information.

Experian says that 17 million people could boost their credit scores by up to 66 points by using the tool.

Find out more:Experian Boost explained

How To Control The Number Of Credit Checks

To control the number of credit checks in your report:

- limit the number of times you apply for credit

- get your quotes from different lenders within a two-week period when shopping around for a car or a mortgage. Your inquiries will be combined and treated as a single inquiry for your credit score.

- apply for credit only when you really need it

Recommended Reading: Delete All Inquiries

How To Use Your Credit Card Properly

The smartest way to use your credit card is to pay it off every month and collect your rewards. If you must carry a balance, make every single payment on time. Set your account to autopay your minimum payments. Make additional payments to pay down your debt as quickly as possible, particularly if it comes at a high interest rate.

Related: 10 commandments for travel rewards credit cards

Youll want to keep any balance you do carry to under 30% of the cards limit, since credit utilization how much of your cards available credit youre using at any given time factors into your credit score. Shop around for interest rates and dont be afraid to contact your lender and ask for a decrease if you have a track record of on-time payments, especially during this period of exceptionally low interest rates.

Related: How important is my credit utilization ratio?

Check Your Credit Report For Errors

One way to quickly increase your credit score is to review your credit report for any errors that could be negatively impacting you. Your score may increase if you are able to dispute them and have them removed.

About 25% of Americans have an error on their credit reports, so it’s important to take the time to review. Some common errors to look out for include fraudulent or duplicated accounts, as well as misreported payments.

“Most of the clients we meet with have not reviewed their report within the past year, and are often surprised by what we find to discuss with them,” says Thomas Nitzsche, a financial educator at MMI.

You can get a free credit report from the three major credit bureaus on a weekly basis by going to AnnualCreditReport.com now through April 2021.

Also Check: Can You Remove Hard Inquiries Off Your Credit Report

How To Check Your Credit Report

You can get a free copy of your report at annualcreditreport.com.

Under normal circumstances, you would be able to get one free report from each of the three major credit reporting bureaus per year. However, in response to COVID-19 you can access a free weekly report from any of the bureaus through April 2022.

Check your which could be dragging your score down. If you find mistakes, such as payments that havent been recorded, you can have them removed by disputing the information directly with the credit bureau. They are obligated to investigate any dispute and resolve it within a reasonable amount of time. Keep in mind, however, that only incorrect information can be removed from your report.

According to Richardson, each credit report will have the information you need to improve your score. There are four or five bulleted statements about your credit profile that can help you make a road map of what to do if youre really in a position where you need to improve your score, he says.

You may also find a numerical or text code in your report, but no additional information as to what it represents. These are factor codes and represent items that may be dragging your score down. VantageScore has a free website, ReasonCode.org where you can enter the code from any credit report and get an explanation of what it stands for and advice on how to resolve the issue.

Understanding Your Fico Score

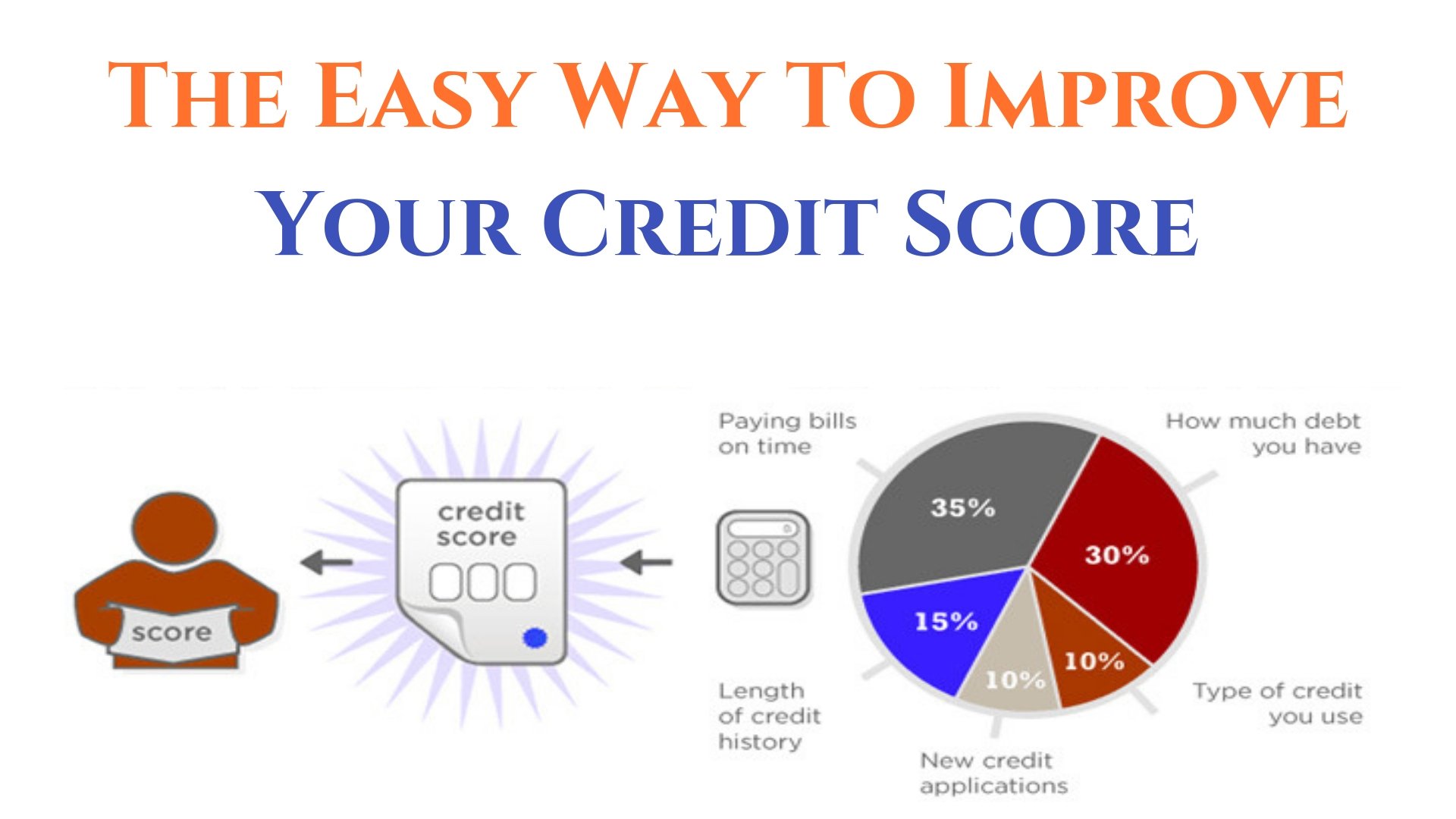

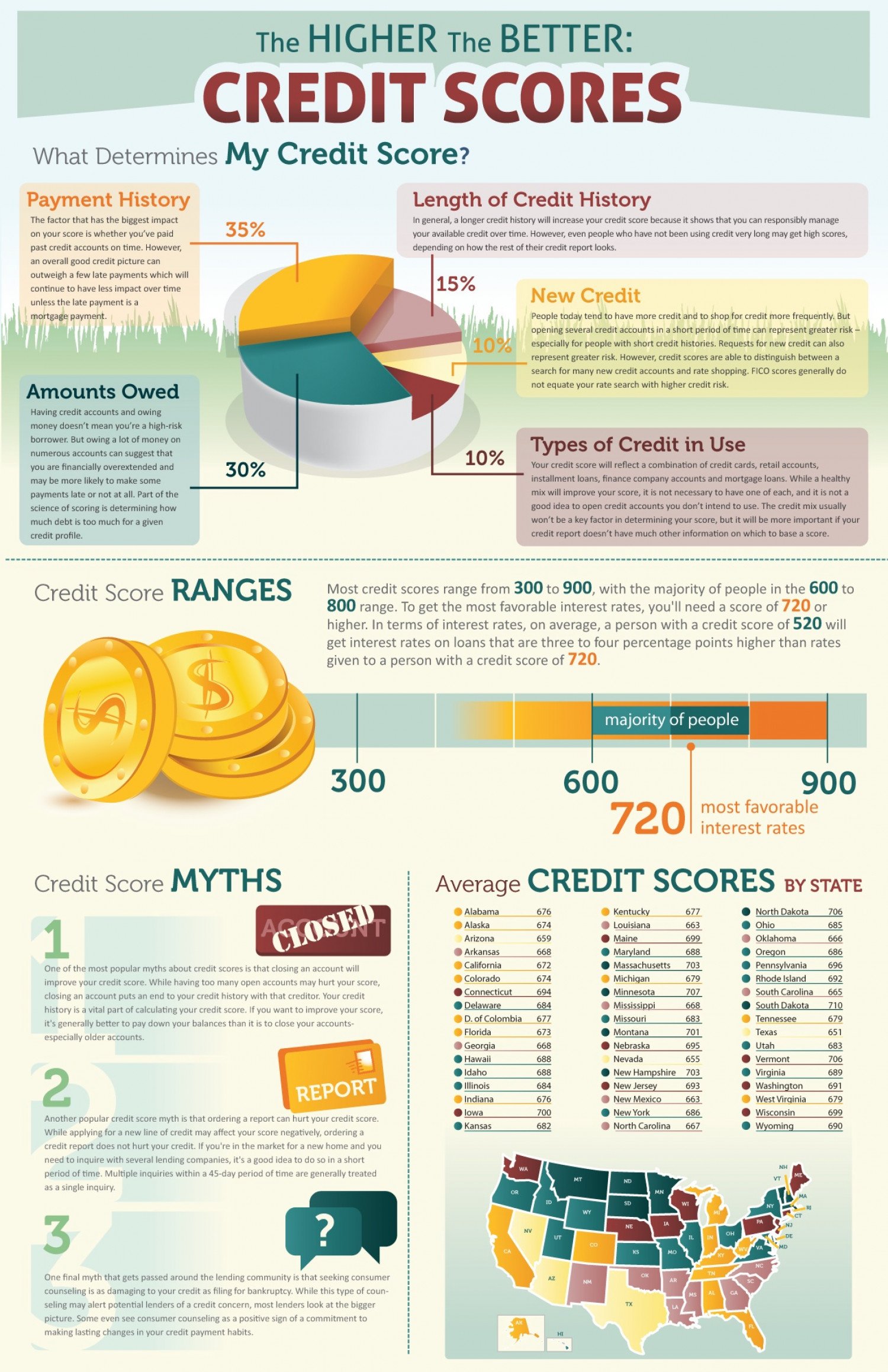

Your FICO score is based on the following:

- Payment history: 35%

- Account age/length of credit history: 15%

- New accounts/hard inquiries: 10%

The VantageScore, another consumer credit rating system, uses similar criteria, in a slightly different formula developed by three .

Clearly, the most important factors are establishing a history of on-time payments to all creditors and keeping debt low in relation to the amount of credit available to you .

Recommended Reading: How To Dispute A Hospital Bill On Credit Report

Don’t Let Your Partner Or Flatmate’s Score Wreck Yours

It’s not usually whether you kiss, hold hands, live together or even being married that links your finances, it’s simply whether you have a joint financial product.

If you are financially linked to someone on any product, that means their files can be accessed and looked at as part of assessing whether to accept you. Even just a joint bills account with flatmates can mean you are co-scored.

Therefore if your partner/flatmate has a poor history, keep your finances rigidly separate, and it should maintain access to good credit for you. If your finances are already linked and you’ve split up with your partner or moved out of your flat-share, make sure you take the time to financially de-link and ask the credit reference agencies for a notice of disassociation .

There are currently only four products that can infer financial linking a joint mortgage, a joint loan, a joint bank account , and in certain circumstances, your utility bills. Being jointly named on a bill with a flatmate shouldn’t mean you are financially linked this should only happen when the energy firm is confident you’re a couple .

It’s worth noting that while many people think they have a “joint” credit card, these technically don’t exist. It’s one person’s account, the other just has a second card to access it.

Pay Credit Card Balances Strategically

The portion of your credit limits you’re using at any given time is called your . A good guideline: Use less than 30% of your limit on any card, and lower is better. The highest scorers use less than 7%.

You want to make sure your balance is low when the card issuer reports it to the credit bureaus, because that’s what is used in calculating your score. A simple way to do that is to pay down the balance before the billing cycle ends or to pay several times throughout the month to always keep your balance low.

Impact: Highly influential. Your credit utilization is the second-biggest factor in your credit score the biggest factor is paying on time.

Time commitment: Low to medium. Set calendar reminders to log in and make payments. You may also be able to add alerts on your credit card accounts to let you know when your balance hits a set amount.

How fast it could work: Fast. As soon as your credit card reports a lower balance to the credit bureaus, that lower utilization will be used in calculating your score.

Recommended Reading: Eos Cca Bbb