Is A Low Down Payment Conventional Mortgage Better Than Fha

FHA loans are backed by the federal government and issued by participating lenders.

When you get a conventional loan, there are no such governmental guarantees. That means the full risk of your potential default on the loan is assumed by the lending bank or loan company rather than shared by a government agency.

Combined with the smaller down payment requirements, the mortgage lenders exposure is simply higher on these low-down payment conventional loans. So they dont issue them to just anyone.

That means the underwriting guidelines are tougher. To qualify, borrowers will need a pretty good credit score, lower loan-to-value ratio, good income and future income, and a nearly unblemished credit history.

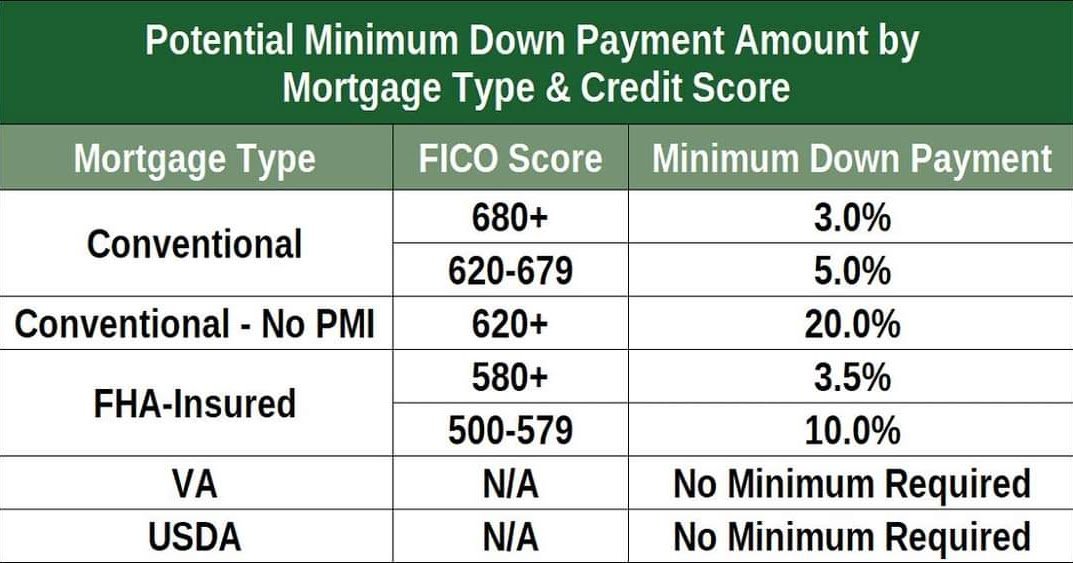

If you plan on getting one of those 3 percent down payment conventional loans offered by Fannie Mae or Freddie Mac, you need at least a 680-700 credit score, and you need to pay your bills on time, Stevenson says.

Its a great program. If you are approved, you can get your down payment through gift money, too, she says. The guidelines have been tweaked. It used to be that if you were putting down 5 percent on a conventional loan, that 5 percent had to come from you.

How To Buy A House With No Money Faqs

With the right loan type, many first-time home buyers can buy a house with no up-front costs. You dont need to save a 20 percent down payment.

When you buy a house with no money down, you can lock in your housing payment long term, protect yourself from rent increases, and you can build wealth with a similar monthly payment as your rent.

Conventional Loan Vs Government Loans

Home buyers have dozens ofmortgage loan options today.

In general, though, mortgagescan be divided into two broad categories government-backed loans andconventional loans.

The rule of thumb is that ifyou have good credit and a large down payment , aconventional loan is often best. If you have lower credit and/or a smaller downpayment, a government-loan can help.

But those are not universalrules. The best type of mortgage for you will depend on your budget, yourcredit, and your home buying goals.

To help guide you in the rightdirection, heres a broad overview of conventional vs. government loans, andwho theyre best for:

If youre not sure which type of loan is best for you, read up on your options or chat with a loan officer about what you might qualify for.

Recommended Reading: What Is Factual Data On Credit Report

What Are The Credit Requirements For A Conventional Mortgage

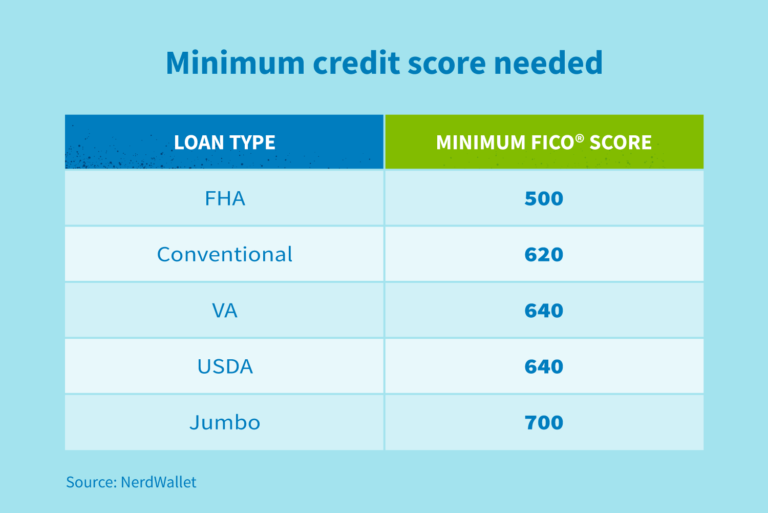

The additional insurance premium helps reduce the lender’s financial risk and, in turn, makes homeownership more affordable for borrowers who don’t have the money to pay the traditional 20% down payment or, in the case of the refinancing, less than 20% of it. the first payment. your equity.. Traditional loans require a credit score of 620 or higher in most cases.

How To Improve Your Credit Score

So, its clear that a good credit score is one of the more important factors when trying to gain mortgage approval. Since its also a factor in calculating the interest rate youll be given, a favourable score can also save you thousands of dollars over the course of your amortization. Therefore, its best to get your credit score in the best shape you can manage before you apply with any lender. If your score is lower than 600-650, or you would simply like to improve it as much as possible, there are a few simple tricks you can use.

- Paying bills on time and in full

- Do not carry a large amount of unpaid debt

- Use no more than 30% of your available credit card limit

- Dont apply for too much new credit in a short amount of time

- Review a copy of your credit report for mistakes or signs of identity theft

- Consider a secured credit card if youre building from the ground up

You May Like: What Is Synchrony Bank Ppc

The Basics Of A Credit Score

Several types of credit scores exist, and each scoring system is slightly different. Generally, scores range from 300 to 850. To get approved for a conventional mortgage, youll likely need a credit score of at least 620.

When calculating a credit score, the companies that do the math look at several aspects of your credit history:

- Payment history: Whether you pay your bills on time or have missed or late payments affects your score. Missing payments can lower your score.

- Amount of debt: How much debt you have already also contributes to your score. A lot of debt can reduce your score.

- Types of debt: The mix of debt you have plays a small part in determining your credit score. A variety of debt types, such as a car loan and a credit card, are preferable over multiples of the same type of debt.

- Length of credit history: How long youve had and used credit also contributes to your score the longer your credit history, the higher your score, usually.

- The number of new accounts: Opening several new accounts at once can cause your score to drop.

- Amount of credit used: How much of your available credit you use, such as your credit card balance, can affect your score usually, the lower your credit utilization, the better.

Conventional Loan Vs Usda Loan

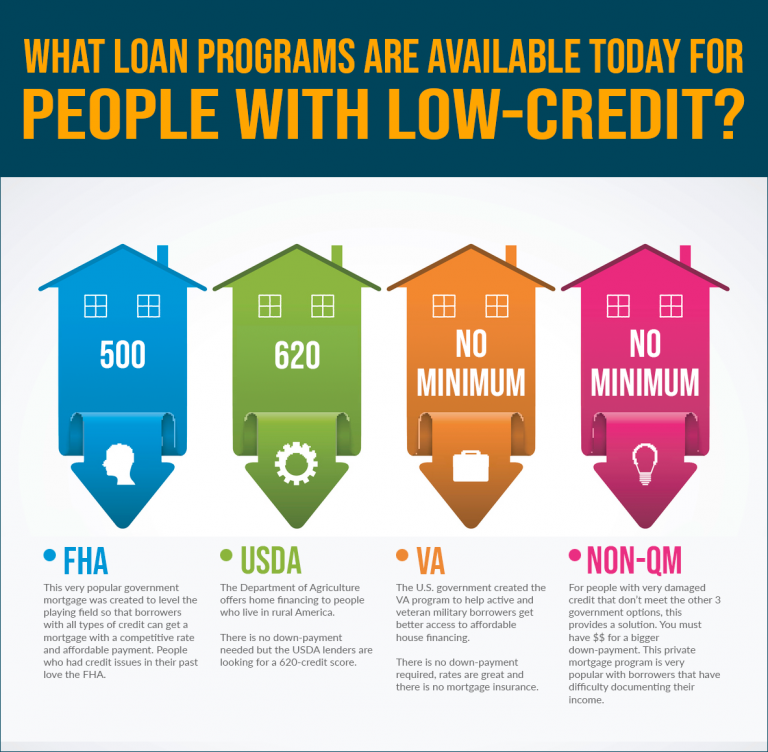

Depending on where in the country you want to buy a home, a USDA loan may be an option. You can get a USDA loan with little or no money down. The main criterion is that you need to purchase a home in a rural area that qualifies for the USDA loan program. If you want to buy in a city or a well-developed suburban area, a conventional loan is likely your better option.

Recommended Reading: Does Barclaycard Report To Credit Bureaus

Conventional Loans Vs Va Loans

While conventional loans are available to anyone who can meet the requirements, VA loans are only available to veterans, active-duty military members and their surviving spouses.

The requirements for VA loans are similar to that of conventional loans. VA loans, however, come with a few extra benefits.

First, VA loans dont require a down payment. Second, VA loans dont require you to pay mortgage insurance, regardless of how much money you put down.

If youre thinking about getting a VA loan instead of a conventional loan, here are a few things to consider:

- You cant use a VA loan to buy a second home. The Department of Veterans Affairs only guarantees a certain dollar amount for each borrower, so you typically cant have more than one VA loan at a time.

- Youll have to pay a funding fee. The funding fee offsets the cost to taxpayers of getting the VA loan. Certain groups are exempt from paying the funding fee, but most are required to pay it. The funding fee ranges from 1.25% to 3.3% of the loan amount and varies based on how much your down payment is, whether youre buying a home or refinancing, and which branch you served in.

Who Can Qualify For A Conventional Home Loan

In general, any borrower with solid credit and some money for a down payment will satisfy conventional loan qualification requirements.

However, because conventional loans arent insured or guaranteed by the government, their eligibility requirements for borrowers are usually tougher to meet than the requirements for government-backed mortgages. These include FHA loans, which are insured by the Federal Housing Administration VA loans, guaranteed in part by the Department of Veterans Affairs and USDA loans, the program run by the U.S. Department of Agriculture.

Also keep in mind that conventional lenders are free to enforce requirements that are stricter than the guidelines set by the FHFA, Fannie and Freddie. If youre applying for a conventional mortgage after foreclosure or bankruptcy, for example, you might have more trouble qualifying.

Read Also: Does Barclaycard Report To Credit Bureaus

Conventional Loans Vs Other Types Of Mortgages

Conventional loans are similar to other types of home loansespecially those that are government-backed, such as FHA and USDA loans. However, because conventional mortgages are issued by private lenders and may not be insured by the government, they typically require higher minimum credit scores in order to qualify.

The biggest difference between conventional mortgages and other government-backed home loans is that government-backed loans are typically designed to help low-to-moderate-income borrowers or those with lower credit scores. Conventional loans, on the other hand, are ideal for those with good credit, steady jobs and low debt-to-income ratios.

Conforming Vs Nonconforming Conventional Loans

There are actually two types of conventional loans: conforming and nonconforming.

Conforming conventional loans are the ones we mentioned earlier that conform to the guidelines set by Freddie Mac and Fannie Mae. The prime example of this conformity is how much a lender will offer for a conventional loan.

In 2020, Fannie May set the limit for a conforming conventional loan on a one-unit property at $510,400. Exceptions are made for Alaska, Hawaii, and the Virgin Islands, where the limit is set at $765,600. Therefore, if you apply for a conforming conventional loan, you should expect these limits to apply.

As the name suggest, nonconforming loans do not follow these kinds of guidelines. Nonconforming loans are meant for borrowers who wouldnt otherwise qualify under those guidelines. One reason might be that the borrower wants more than the $510,400 or $765,000 limit. Thats why these loans are sometimes referred to as jumbo loans.

Other types of nonconforming conventional loans are designed for borrowers who would be considered high risk. This might be because of:

- Excessive Debt

Recommended Reading: How Accurate Is Creditwise Credit Score

What Qualifies As A Good Credit Score

For those who arent as familiar with their credit score, its a three-digit number that encompasses all your credit-related activity into one cumulative average. In Canada, credit scores range anywhere from 300 to 900. The higher your credit score is, the better your chances are of getting approved for various loans and other credit products. Generally speaking, a score of 650 and above is considered good and means that you are a low default risk and a better candidate for lending. A credit score of 750 or higher is deemed excellent.

Loans Canada Lookout

Limits On Conventional Loans

A conventional loan can be either conforming or non-conforming. A conforming loan is any mortgage that meets Fannie Mae or Freddie Macs requirements.

For conforming loans, the Federal Housing Finance Agency sets a maximum each year for the amount people can borrow. The limit varies by county. For most counties, the limit is $510,400 in 2020. In expensive areas, the limit can be as high as $765,600.

Non-conforming loans, including jumbo loans, arent subject to these limits lenders can set their own limits, which can be in the millions of dollars.

You May Like: Does Zzounds Report To Credit Bureau

What Is A Conventional Loan

A conventional mortgage is a home loan not backed by a government agency such as the FHA, VA, or USDA.

Lenders often sell conventional loans to Fannie Mae or Freddie Mac, which are government-sponsored enterprises that help make mortgage financing available.

While GSEs have financial qualifications that determine who can borrow money for a home and what type of property the loan can finance, they are typically less restrictive than government agencies.

For example:

Learn More: FHA Loan Requirements and Qualifications

Lending Options For Your Credit Score

Once you have decided to purchase a home, partnering with the right lender is very important and makes all the difference. Home lending is made easy when you can cut out the middleman and work directly with your mortgage lender. We encourage you to compare mortgage rates to help you help decide what mortgage lender is right for you and use our mortgage loan estimator so you know just how much your dream home will cost.

GET TODAYS CURRENT MORTGAGE RATES

Terms and conditions apply. Rates are subject to change.

Now you know what a credit score is and how its determined. You also know three loan types and their credit score requirements, answering your question, what is a good credit score to buy a house? Now you can view our list of the most frequently asked mortgage questions to help you better understand the lending process.

At Wyndham Capital, a trusted mortgage company, were dedicated to making you feel right at home every step of the way. It would be our pleasure and privilege to work with you and provide you with all your home lending needs.

Read Also: Syncb/ppc Credit Card

What Is A Conventional Mortgage

A conventional mortgage is one thats not guaranteed or insured by the federal government.

Most conventional mortgages are conforming, which simply means that they meet the requirements to be sold to Fannie Mae or Freddie Mac. Fannie Mae and Freddie Mac are government-sponsored enterprises that purchase mortgages from lenders and sell them to investors. This frees up lenders funds so they can get more qualified buyers into homes.

Conventional mortgages can also be non-conforming, which means that they dont meet Fannie Maes or Freddie Macs guidelines. One type of non-conforming conventional mortgage is a jumbo loan, which is a mortgage that exceeds conforming loan limits.

Because there are several different sets of guidelines that fall under the umbrella of conventional loans, theres no single set of requirements for borrowers. However, in general, conventional loans have stricter credit requirements than government-backed loans like FHA loans. In most cases, youll need a credit score of at least 620 and a debt-to-income ratio of 50% or less.

Take the first step toward the right mortgage.

Apply online for expert recommendations with real interest rates and payments.

The Three Main Types Of Credit:

- Revolving Credit This type of credit allows you to continually borrow and repay money from a credit line. Credit cards and other types of revolving credit have a maximum amount or limit. Keeping the amount you borrow against your revolving credit line under 30% of the maximum and making on-time payments, will help build your score.

- Installment Debt This type of credit is usually borrowed as a lump sum and then repaid over a set period of time in installments. A car loan, financing for furniture or appliances, student loans, business loans, and mortgages are all types of installment debts. Paying these bills on time is important to building a healthy credit score.

- Open Credit This type of credit involves a payment for goods and services that can vary from month to month. Examples of open credit are utilities, insurance payments, rent or lease payments, phone/wifi/data plans, and subscription services. Paying the bills for these goods and services on time will aid in building your credit score.

We are here to help you answer all of your mortgage related questions. If you are ready to buy a new home of refinance you current home, we can be the experts on your team. Reach out to us and speak with a licensed mortgage consultant about your goals.

If you would like to see more articles like this one about mortgage information and home ownership,

Also Check: Does Speedy Cash Report To Credit Bureaus

How Can I Save Money For A Down Payment

Down payment assistance programs help first-time and low-income buyers afford a home. Each program has specific eligibility requirements.

Some loans are flexible and accept down payments entirely funded through gifts, grants, and loans. You may not have to contribute your own savings. This includes DPA funds and assistance from family or friends.

Otherwise, the best way to save is with a comfortable budget and savings plan. Determine which loans youre eligible for and their down payment requirements to set a goal. Consider how much you can save each month to determine your home-buying timeline.

Conventional Loans With 3 Percent Down

Conventional loans are the most popular loan type among buyers. Standard conventional loans require a minimum 3 percent down payment with a credit score of 620 or higher.

Conventional loans require mortgage insurance with a down payment under 20 percent.

Conventional loans arent backed by the government, so lender requirements may vary. Conforming conventional loan limits follow FHFA standards. The current loan limit is $548,250 for single-unit homes in most U.S. counties.

Don’t Miss: Does Klarna Run Your Credit

Who May Not Qualify

Generally speaking, those who are just starting out in life, those with a little more debt than normal, and those with a modest credit rating often have trouble qualifying for conventional loans. More specifically, these mortgages would be tough for those who have:

- Suffered bankruptcy or foreclosure within the past seven years

- DTIs above 43%

- Less than 20% or even 10% of the homeâs purchase price for a down payment

However, if youâre turned down for the mortgage, be sure to ask for the bankâs reasons in writing. You may qualify for other programs that could help you get approved for a mortgage.

For example, if you have no credit history and youâre a first-time homebuyer, you may qualify for an FHA loan. FHA loans are loans that are specifically tailored for first-time home buyers. As a result, FHA loans have different qualifications and credit requirements, including a lower downpayment.

Donât Miss: How Much Usda Mortgage Can I Qualify For

Minimum Credit Score Required For Mortgage Approval In 2021

Categories

Getting approved for a mortgage these days can be a real challenge, especially with housing prices constantly on the rise. In Toronto, for instance, youll be paying over $820,000 for a home, which is nearly $100K more than the average price the year before.

Unless youre rolling in cash, thats a lot of money to have to come up with in order to purchase a home. Moreover, a lot goes into getting a mortgage. Lenders look at a number of factors when theyre assessing a borrower for a mortgage such as a sizeable down payment, a good income and, of course, a favourable credit score.

A high credit score, in particular, will not only get you approved for the mortgage but a favourable interest rate as well. Being that credit scores are such a significant part of the lending process, its no wonder that we get so many inquiries about what qualifies as an acceptable score in terms of getting approved for a mortgage.

You May Like: Is Fingerhut A Hard Inquiry