How To Apply For A Free Credit Score

Applying for your credit score online is an easy process.

Simply visit their website and enter your basic personal details. Your social insurance number or credit card details are not required.

You may be asked to answer a few questions to validate your identity. Once completed, your credit score becomes available online. The entire process takes 3 minutes or less.

Also, checking your credit score using these online portals is considered a soft inquiry and does not adversely affect your score in any way.

It is advisable to check both your Equifax and TransUnion credit scores. Sometimes, lenders report to one and not the other and your credit scores may vary.

What A Good Credit Score Can Do For You

A good credit score offers more than just bragging rights. Having a high score makes it easier to be approved for credit cards and loans, qualify for lower interest rates, and get higher credit limits and loan amounts. Not only that, your credit score opens up a range of credit card options, including top-tier rewards credit cards.

Many auto insurers use a to calculate your insurance premium, too. So having a good credit score allows you to pay less for insurance than if you had a lower credit score.

Add cellphone retailers to the list of companies that use your credit score. With smartphone price tags commonly topping $1,000, paying for a phone in installments is budget-friendly. Depending on your carrier, your credit score may be used to determine whether you can finance a new phone and the amount you’re able to finance. A good credit score may allow you to finance the phone of your choice with a low or no down payment.

How Do Student Loans Affect Your Credit Score

Now that we know the answer to the question do student loans affect credit score? we should do a deep dive into how.

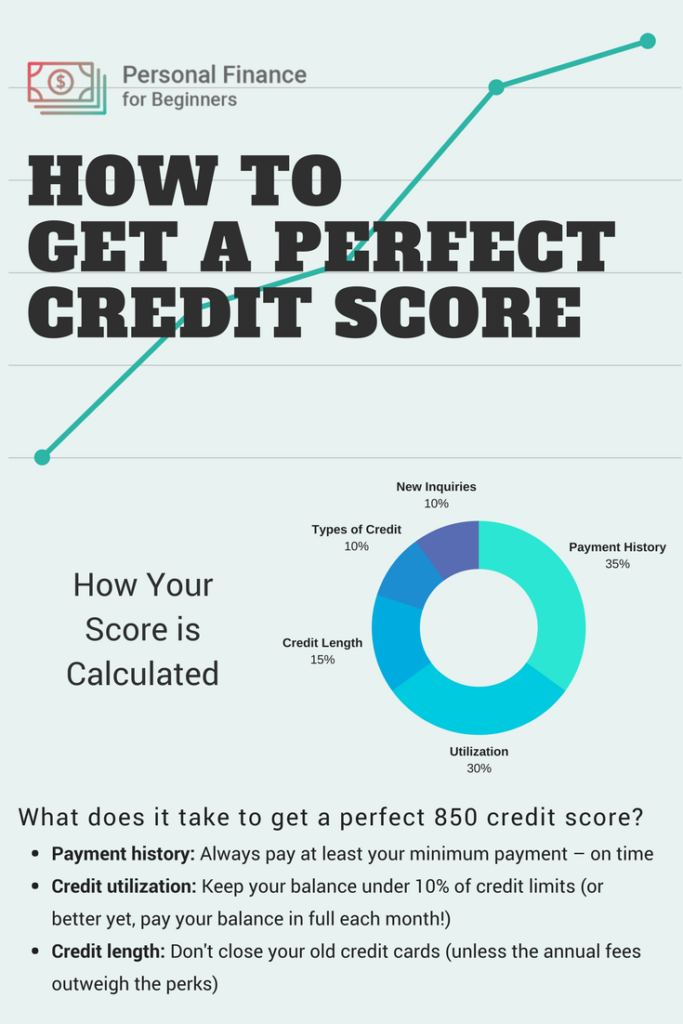

Firstly, its important to establish how a credit score is calculated so you can have a better idea of how a student loan can affect your score. Your FICO score is calculated by using data that are separated into five categories:

- Payment history 35%

- Length of your credit history 15%

- Any new credit you have 10%

These scores are calculated using both positive and negative data taken from your credit report. The percentages show how important each section is in calculating your overall credit score.

Now that you know more about credit score calculation, lets take a look at the importance of student loan debt and factors that affect credit score when taking out a student loan.

How student loans boost your credit mix

Although credit mix only accounts for 10% of your credit score, its still important. Having both revolving credit, such as a , and installment credit, such as a car loan, can give your credit score a boost. If you pay your student loan off and it was your only installment credit, you may experience a slight dip in your credit score. However, you can opt for other types of installment credit and still maintain a good credit mix.

Student loans may lengthen credit history

How defaulted loans affect your credit score

Also Check: Does Paypal Report To Credit Bureaus

Getting Your Free Credit Score In Canada

These four companies will provide your credit score for free:

Borrowell: They offer access to a free Equifax credit score and credit report. There are no fees and your credit score and report are updated on a weekly basis. Learn more about them in this Borrowell review.

Mogo: This company offers access to your free credit scores when you apply for its free prepaid card. The score is updated on a monthly basis. Get more details about Mogo in this review.

: They offer access to free credit scores . Your credit report is also provided.

Amount Of Money Families Are Getting Each Month

The way the child tax credit payments will be divided between 2021 and 2022 might be confusing. For each qualifying child age 5 and younger, up to $1,800 will come in six $300 monthly payments this year. For each kid between the ages of 6 and 17, up to $1,500 will come as $250 monthly payments six times this year.

The IRS bases your child’s eligibility on their age on Dec. 31, 2021, so a 5-year-old turning 6 in 2021 will qualify for a maximum of $250 per month. For both age groups, the rest of the payment will come with your 2021 tax refund when you claim the remainder of the credit in 2022.

If you have dependents who are 18 years old, they can qualify for $500 each. Dependents between the ages of 19 and 24 may qualify as well, but they must be enrolled in college full time. Here’s more on the financial details for qualified dependents.

Note that some parents who did not get payments in prior months might get adjustments made subsequently, which could translate to higher amounts.

You May Like: How To Get Credit Report With Itin Number

How To Get A Good Credit Score For Free

How to Improve Your Credit Score for Free First, check your credit report to see how many negative things can affect your credit score. If you see negative articles that are errors, make credit adjustments to refute them. Pay all debts on time as creditworthiness is the most important determinant. Keep credit card balances to a minimum.

Who Creates Your Credit Report And Credit Score

There are two main credit bureaus in Canada:

- Equifax

These are private companies that collect, store and share information about how you use credit.

Equifax and TransUnion only collect information from creditors about your financial experiences in Canada.

Some financial institutions may be willing to recognize a credit history outside Canada if you ask them. This may involve extra steps. For example, you may request a copy of your credit report in the other country and meet with your local branch officer.

Don’t Miss: Is 672 A Good Credit Score

Care About Your Credit Score Get Strategic With Card Limits

f you have credit cards in your wallet, you might track your balances to keep your budget in check, but knowing each card’s credit limit off the top of your head is another story. However, actively managing how much of your credit limits you are using — also known as your credit utilization ratio — can make a big impact on your credit score.

Your credit score is a mix of many factors, including your credit usage. If you want to build your credit score, focusing on using less of your credit limits is a powerful way to do it. People with excellent credit tend to have low credit utilization ratios.

According to credit expert John Ulzheimer, utilization is one of the more actionable ways to improve your credit: “To the extent you have the ability to pay down your credit card debt, then your ratios are going to go down. That’s just a fact.”

Even if you can’t reduce your balances, a few other strategies can help reduce credit utilization.

What is a Credit Limit and Who Determines It?

Your credit limit is the maximum amount you’ve been approved to spend by a creditor, based on factors like your payment history, income and credit score. A credit limit is not set in stone and is likely to change over the life of the account: Your card issuer can increase or decrease your limit without warning, and you can also ask for a credit limit increase .

The Way You Use Your Credit imits Can Help Your Score

The COVID Connection

RELATED LINK:

If Parents Haven’t Filed Taxes Can They Still Get The Child Tax Credit

Payments are automatic for those who filed their 2020 tax returns . The deadline, however, is past for parents who didn’t file taxes to get their payments this year. Parents who didn’t file taxes can claim their full child tax credit payment when they file taxes in early 2022.

Parents who get too much child tax credit money this year may have to repay the IRS.

Don’t Miss: Bp Visa Syncb Pay Bill

What Is A Credit Score

Your credit score is a number based on your credit history that reflects how well you manage your debts. Lenders use it to determine the level of risk they would take when putting their money into an investment by you, typically through giving you a loan. The higher the score, the lower the risk for them.

There are basically four levels of credit scores:

If you have a bad or poor credit score, your chances of getting approved for a loan or credit card will be very low. And in case you still manage to get one, the interest rates will be very high.

On the other hand, if you have an excellent credit score, your chances of getting approved for loans or credit cards are higher. You will even be able to get lower interest rates.

With these in mind, its clear that having a good credit score can help you save money and gain significant advantages when applying for various financial products.

Now you know more about credit scores, lets explore how they can be improved through credit cards.

What Should My Credit Score Be To Get A Loan

Typically, your lender will consider three credit scores provided by each of the three credit bureaus: Experian, TransUnion, and Equifax, then use the median of the three for your application. Borrowers should expect a minimum of 680 points, which is usually the minimum number of points needed to approve regular loans.

Don’t Miss: Does Paypal Pay In 4 Affect Credit Score

Get Your Credit Score

A lender will use your credit score to determine if they will lend you money and how much interest they will charge you to borrow it. Your credit score is a number calculated from the information in your credit report. It shows the risk you represent to a lender compared to other consumers.

Knowing your credit score before a major purchase, such as a car or a home, may help you to negotiate lower interest rates.

You usually need to pay a fee when you order your credit score online from the two credit bureaus.

Some companies offer to provide your credit score for free. Others may ask you to sign up for a paid service to see your score.

Make sure you do your research before providing a company with your information. Carefully read the terms of use and privacy policy to know how your personal information will be used and stored. For example, find out if your information will be sold to a third party. This could result in you receiving unexpected offers for products and services. Fraudsters may also offer free credit scores in an attempt to get you to share your personal and financial information.

Always check to see if a website is secured before providing any of your personal information. A secured website will start with https instead of http.

How Much Is Owed

When you apply for credit, how much you already owe really matters to a lender. Your current payments will determine if you can manage any more payments in your budget for the additional money you borrow.

While you might think that you can handle more credit, statistically speaking, theres a chance you might not be able to. If you are close to maxing out all of your credit cards or your line of credit, it means that you are a higher risk to lenders. Higher risk to a lender means that theres a greater chance that you wont keep up with your payments.

Another aspect of this part of your credit score reflects how much of your available credit limits you use on an ongoing basis. If you usually use 60% or more of your credit limit on a credit card or line of credit, it will impact your credit score negatively. This is because if something were to happen to your income and you owe a lot of money, you would find yourself struggling to keep up with payments.

Also Check: How To Get Rid Of Repo On Credit

What If I’m Still Waiting On A Check To Arrive

One thing to keep in mind is that the IRS is targeting specific payment dates . If you have direct deposit set up with the IRS, you might see a pending payment before the actual closing date. That means you might not be able to access the money right away, but that it’s in process. Unfortunately, the advance credit isn’t without the usual hiccups. Around 15% of families that received July’s payment by direct deposit were mailed paper checks in August because of a technical issue.

It could take longer for your payment to arrive if you’re receiving the check by mail. If enough time has passed and you’re concerned there may be a problem, you can use the IRS Update Portal to correct your banking information or address. You can also file an IRS payment trace if you’re worried. Check here for more information about missing payments.

Establishing Or Building Your Credit Scores

Depending on your experience with credit, you might not have a credit report at all. Or, your credit report might not have enough information that credit scoring models are able to assign you a credit score.

With FICO® Scores, you need to have at least one account that’s six months old or older, and credit activity during the past six months. With VantageScore, a score may be calculated as soon as an account appears on your report.

When you don’t meet the criteria, the scoring model can’t score your credit reportin other words, you’re “credit invisible.” As a result, creditors won’t be able to check your credit scores, which could make it difficult to open new credit accounts.

Some people may be in a situation where they’ve only opened accounts with creditors that report to only one bureau. When this happens, they may only be scorable if a creditor requests a credit report and score from that bureau.

If you’re brand new to credit, or reestablishing your credit, revisit step one above.

Recommended Reading: Does Opensky Report To Credit Bureaus

How To Build Your Credit Score

There are several ways to build your credit score so you can enjoy the benefits of good credit. If you already have a credit card or loan, making your monthly payments on time will help tremendouslypayment history is 35% of your credit score.

With credit cards, maintaining a healthy balance is important30% of your score is based on the amount of debt you have, which includes the balance you’re carrying on credit cards.

Your , which measures how much of your available credit you use, is an important part of the debt calculations that make up 30% of your score. For example, if you have three credit cards with $3,000 limits each, you have $9,000 of available credit. The general rule of thumb is to keep your balances below 30% of your credit limits.

The earlier you start building your credit score, the better15% of your credit score is based on the length of time you’ve been using credit. When you’re just starting your credit use, your credit age will be pretty low, but as you gain experience, having well-established accounts will increase the average age of your accounts.

If you’re brand new to credit and don’t have any accounts in your name, consider opening a secured credit card. This account requires a security deposit as collateral for the credit line, but is easier to open for those who are new to credit.

What Makes Up Your Credit Score

It is important to know how your credit score is calculated if you want to improve it. In Canada, a credit score is impacted by these factors:

Payment history : Lenders want to know whether you pay your bills on time. If you have missed or late payments, they affect your credit score negatively.

Amounts owed : This refers to your credit utilization ratio which is how much of your credit balance is currently in use. For example, if you have a $10,000 credit limit and are owing $4,000, your credit utilization ratio is 40%. Aim to keep your account balance at 30% or less of your credit limit.

: The longer your credit history, the better. When closing credit accounts, consider keeping the older ones as they may fetch you more points.

New credit inquiries : If you have multiple hard inquiries on your credit file within a short period of time, lenders may think you are desperate for cash and this could affect your ability to pay back debt. Dont apply for credit if you dont need it.

: A combination of different types of credit accounts can strengthen your credit profile. For example, a mix of a credit card, personal loan, mortgage loan, and line of credit in good standing can build up your credit score. They show how well you can manage credit.

Don’t Miss: Does Paypal Credit Help Your Credit

Can My Credit Limit Be Lowered

Card issuers can make the decision to reduce your credit limit without notice. This action lowers their risks and commonly occurs if your card is inactive. Credit card companies may also reduce your limit if they’ve suddenly determined you’re a higher lending risk or if your payment habits have changed.

For example, if you’ve always made regular full payments but then switch to making monthly minimums, it may spook your credit card company and cause them to lower your limit.

If they lower your credit, you can call a representative to understand why they did so and possibly change their minds.

A reduced limit won’t generally lower your credit score. However, it can reduce your credit utilization ratio, which is linked to your credit score.