How To Check Your Credit Score

So now that you know exactly whats considered a good credit rating, how can you find out your own credit score? You can get a free credit score online at . You can also check with your credit card company, since some offer a free credit score as well as credit reports so you can conduct your own credit check.

Another way to check whats on your credit reportincluding credit problems that are dragging down your credit scoreis to get your free copy at AnnualCreditReport.com. Each credit-reporting agency may also provide credit reports and scores, but these may often entail a fee. Plus, you should know that a credit report or score from any one of these bureaus may be detailed, but may not be considered as complete as those by FICO, since FICO compiles data from all three credit bureaus in one comprehensive credit report.

Even if youre fairly sure youve never made a late payment, 1 in 4 Americans finds errors on their credit file, according to a 2013 Federal Trade Commission survey. Errors are common because creditors make mistakes reporting customer slip-ups. For example, although you may have never missed a payment, someone with the same name as you didand your bank recorded the error on your account by accident.

How Is A Credit Score Calculated

- Your debt repayment history.

- Types of credit applied for and how often.

- How long your accounts have been open.

- How much of your available credit youre using.

- Whether there is any history of you not honouring a debt obligation that resulted in bankruptcy or a judgment against you.

The credit bureaus wont only be looking at your repayments history. Theyll be able to access your employment history and income as well and calculate your credit score according to a complex formula.

Whats The Best Way To Improve Your Credit

Whether you have a credit score of 850 or 550, there are several steps you can take to prepare yourself to meet with a mortgage lender as you begin your search for a new home. Improving your credit isnt a one-and-done project but rather something you can and should be doing at all times to be better prepared for significant purchases.

Recommended Reading: What Credit Report Does Paypal Pull

Can You Get A Home Loan With Bad Credit

Its possible to qualify for a mortgage even if your credit score is low. Its more difficult, though. A low credit score shows lenders that you may have a history of running up debt or missing your monthly payments. This makes you a riskier borrower.

To help offset this risk, lenders will typically charge borrowers with bad credit higher interest rates. They might also require that such borrowers come up with larger down payments.

If your credit is bad, be prepared for these financial hits. You can qualify for a mortgage, youll just have to pay more for it.

At A Glance: Additional Key Findings

| Among our members who recently bought a home, those living in West Coast cities tend to have higher average VantageScore 3.0 credit scores, ranging from 704 in Stockton, California, to 782 in San Francisco, California. |

| Among our members, the average amount people owe on a recently opened mortgage varies widely across states, from a low of $126,321 in West Virginia to a high of $384,524 in Hawaii. |

| The average age of Credit Karma members who recently opened a mortgage ranges from 35 in Boston, Massachusetts, to 43 in Scottsdale, Arizona. As a generation, millennials have the highest average mortgage balance at $216,382. |

Don’t Miss: 8773922016

Improving Your Credit Score

Theres a lot that goes into determining your credit score, including your repayment history, the total balances on your accounts, how long youve had those accounts, and the number of times youve applied for credit in the last year. Improving in any of these areas can help increase your score.

You can:

- Pay down your existing debts and credit card balances

- Resolve any credit issues or collections

- Avoid opening new accounts or loans

- Pay your bills on time, every time

You should also pull your credit report and check for any inaccuracies you might see. If you find any, file a dispute with the reporting credit bureau, and include the appropriate documentation. Correcting these inaccuracies could give your score a boost.

What Else Do Lenders Look At When You Apply

As we mentioned, your credit score is not the only factor lenders examine before they approve or decline your application. They also want to see a favourable history of debt management on your part. This means that on top of your credit score, lenders are also going to pull a copy of your to examine your payment record. So, even if your credit score is above the 600 mark, if your lender sees that you have a history of debt and payment problems, it may raise some alarms and cause them to reconsider your level of creditworthiness.

Other aspects that your lender might look at include, but arent limited to:

- Your income

- The amount youre planning to borrow

- Your current debts

- The amortization period

This is where the new stress-test will come into play for all potential borrowers. In order to qualify, youll need to prove to your lender that youll be able to afford your mortgage payments in the years to come.

Theyll also calculate your monthly housing costs, also known as your gross debt service ratio, which includes your:

- Potential mortgage payments

- Potential cost of heating and other utilities

- 50% of condominium fees

This will be followed by an examination of your overall debt load, also known as your total debt service ratio, which includes your:

Don’t Miss: Does Paypal Credit Report To Credit Bureaus

The Credit Score You Need To Buy A House

Learn why your credit score matters and what lenders look for in your credit history when you apply for a home loan.

Posted May. 21, 2021

Have you ever wondered what credit score is needed to buy a house? Even if you thought you had bad credit, you might wonder if your credit score is high enough to qualify for a mortgage. Credit scores are important, but you may still be eligible for a mortgage even with less-than-stellar credit. Think of your credit score like the score in a football game. It gives a good idea of performance, but you need to watch the game to get the full story.

Here is what lenders are looking for in your credit history and what you can do to improve your credit score to buy a house:

How Do Credit Scores Affect The Home Buying Process

Lenders will do their best to get a wide-angle view of your financial well-being before they agree to lend. Although your FICO score is central to landing a mortgage deal, its not the only factor that banks consider when making that decision. Does your credit score affect your mortgage rate? Yes it can, but other data plays a key role as well.

Heres a list of other key indicators that mortgage brokers and direct lenders will use to determine loan eligibility:

- Your monthly budget and how much youre spending on all other loans and credit card debt

- The size of your down payment

- The current interest rate

- The loan-to-value ratio of the down payment vs. the total loan amount

- The amount of money you have in savings

- Your income

Also Check: Does Speedy Cash Do Credit Checks

Is Your Credit Score High Enough To Buy A House

If your credit score is above 580,youre in the realm of mortgage eligibility. With a score above 620 you shouldhave no problem getting credit-approved to buy a house.

But remember that credit is only onepiece of the puzzle. A lender also needs to approve your income, employment, savings,and debts, as well as the location and price of the home you plan to buy.

To find out whether you can buy ahouse and how much youre approved to borrow get pre-approved by a mortgagelender. This can typically be done online for free, and it will give you averified answer about your home buying prospects.

Popular Articles

Step by Step Guide

Fico Score Vs Credit Score

The three national credit reporting agencies Equifax®, ExperianTM and TransUnion® collect information from lenders, banks and other companies and compile that information to formulate your credit score.

There are lots of ways to calculate credit score, but the most sophisticated, well-known scoring models are the FICO® Score and VantageScore® models. Many lenders look at your FICO® Score, developed by the Fair Isaac Corporation. VantageScore® 3.0 uses a scoring range that matches the FICO® model.

The following factors are taken into consideration to build your score:

- Whether you make payments on time

- How you use your credit

- Length of your credit history

- Your new credit accounts

- Types of credit you use

Also Check: Does Paypal Working Capital Report To Credit Bureaus

Monitor Your Credit Reports

Each year, youre entitled to one free credit report from each of the Big Three credit bureaus Experian, Equifax, and Transunion. And in light of the pandemic, you can view your report for free weekly through April 2021. It can pay off big time to get those reports and read them carefully, according to Karra Kingston, a New York bankruptcy lawyer. Why? Because even credit bureaus make mistakes, and a mistake on your credit report could cost you a mortgage. You should always be up-to-date on what has changed and why something has changed, Kingston says.

The bureaus make it possible to fix errors in your reports with online forms you can fill out and submit. There are also a number of for-profit companies that will monitor your credit and alert you if there are significant changes, but in most cases, youll be able to do this monitoring yourself for free.

The Most Important Numbers

The illustrated pie chart above shows a breakdown of the approximate value that each aspect of your credit report adds to a credit score calculation. Use these percentages as a guide:

- Your payment history35%

- Amounts you owe 30%

- Length of your credit history15%

- Types of credit used 10%

- New credit10%

Read Also: Does Paypal Bill Me Later Report To Credit Bureau

Finding The Right Mortgage

As we said, if your credit score is below your lenders standards, its possible that your first mortgage application wont be approved but, dont give up right away. If everyone with a score under 680 got rejected for mortgages, the population of homeowners in most cities would be sparse, to say the least. That being said, before applying for a mortgage with any lender, its best to improve your credit score as much as you can, since doing so will help you gain access to better interest rates.

Remember, applying for a mortgage is the same as for any other credit product, in the sense that the lender will have to make a hard inquiry on your credit report, causing your score to drop a few points. So, when youre starting to get serious about buying a house, make sure to do some research in advance to find the best lender for your specific financial needs. Loans Canada can help match you with a third-party licenced mortgage specialist that meets your needs, regardless of your credit.

Note: Loans Canada does not arrange, underwrite or broker mortgages. We are a simple referral service.

Rating of 5/5 based on 87 votes.

Home Loan Options For Buyers With Bad Credit

The two primary types of mortgage loans are going to be loans backed by the government and conventional loans.

The difference between the two is that a conventional loan isnt backed by or insured by the federal government, but government-backed loans are.

You will find that a loan backed by the government will have lower requirements for your down payment, your credit and your debt-to-income ratio.

These loans are also less risky for lenders.

Lets check out some of the loan options available and the average credit score requirements for each of them:

Don’t Miss: Does Paypal Credit Report To Credit Bureaus

What Is A Good Credit Score For Getting A Home Loan

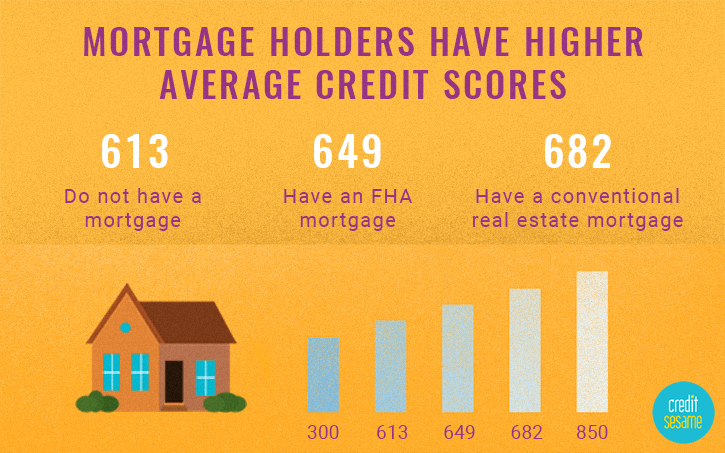

To qualify, youll need at least the minimum credit score to buy a house, which ranges from about 500 680, depending on the mortgage program. But a higher credit score can boost your chances of qualifying for a mortgage because it shows the lender youre likely to repay your loan on time.

During the application process, lenders commonly check the borrowers FICO® credit score, which grades consumers on a scale of 300 850, with 850 being the highest score possible. The best credit score to buy a house is 760 or higher. According to FICO® data, borrowers with a credit score in this range tend to get the best interest rates on a home loan.

Length Of Credit History

This category isn’t as weighty to lenders as the first two, but it’s still significant because it shows lenders how long you’ve had credit and built a history, The longer your history, the better your scores. This includes:

- The total length of time tracked by your credit report

- Length of time since accounts were opened

- The time that’s passed since the last activity

Read Also: Check Credit Score With Itin

Home Sweet Home: Buying Can Be Trying

Buying a new house is a major life achievement. From the perfect condo to the picket fence, the purchase of a new home is a personal milestone in your journey toward security, stability and independence. TransUnion can help you avoid unwanted setbacks by providing you with mortgage information on credit scores, fees, and more as you move to close the deal.

What Else Do Mortgage Lenders Look At To Determine Mortgage Terms

Your credit scores can be an important factor in getting approved for a mortgage and the rates you’re offered. However, mortgage lenders also go beyond your credit scores when evaluating a potential borrower’s application.

They’ll also take a close look at the information within your credit reportsnot just your scores. For example, even if you have a good credit score, the lender might deny your application if you recently filed for bankruptcy or had a home foreclosed on. Or if you owe too much money to collection agencies.

Mortgage lenders may also request various financial records, including recent bank statements, investment account statements, tax returns and pay stubs. They can use these to determine your income, debts and debt-to-income ratio, which can be an important factor.

Other factors, such as the loan amount, the home’s location, your down payment and loan type can all play into whether you’ll be approved and your mortgage’s terms. Lenders may also have unique assessments, which is one reason shopping for a mortgage can be important.

You May Like: Carmax Financing With Bad Credit

What’s A Good Credit Score

Borrowers with a credit score over 670 are typically offered more financing options and better interest rates, but don’t be discouraged if your scores are lower. There’s a mortgage product for nearly everyone.

According to a report from Experian, the average credit score in the U.S. reached a record high of 710 in 2020. Additionally, 69% of Americans had a “good” score of at least 670.

Qualifying For A Mortgage With Nocredit Score

Its possible to qualifyfor a mortgage even with no credit history.

Many individuals havepurchased everything with cash, which is a sign of fiscalresponsibility. Thats why most lenders can help you build a non-traditionalcredit report if you have no credit score or history.

The lender will take historyfrom accounts like rent, utilities, and even cell phone bills tobuild a score for you.

As long as youve managed thesetypes of accounts well in the past, theres a good chance you can get amortgage even with no credit score.

Also Check: Is 586 A Good Credit Score

Get Negative Items Removed From Your Credit Report

If you have a lot of negative marks on your report and feel overwhelmed, you might consider hiring a credit repair company.

Check out our list of top ranked credit repair companies in your area to find a reputable one to work with. Theyll take the lead in disputing negative accounts with the credit bureaus and getting them removed from your credit history. Once that happens, youll automatically see your credit score increase.

Even if you dont have the bare minimum credit score to qualify for a mortgage, there are a lot of ways to buy a house. From getting the right loan to improving your credit score, youll be able to quickly put yourself on the path to home-ownership.