Free Credit Score Resources

Most credit card issuers provide free credit score access to their cardholders making it easier than ever to check and know your score.

Some issuers, such as Citi and Discover, provide free FICO Scores, while others, such as Chase and Capital One, provide free VantageScores.

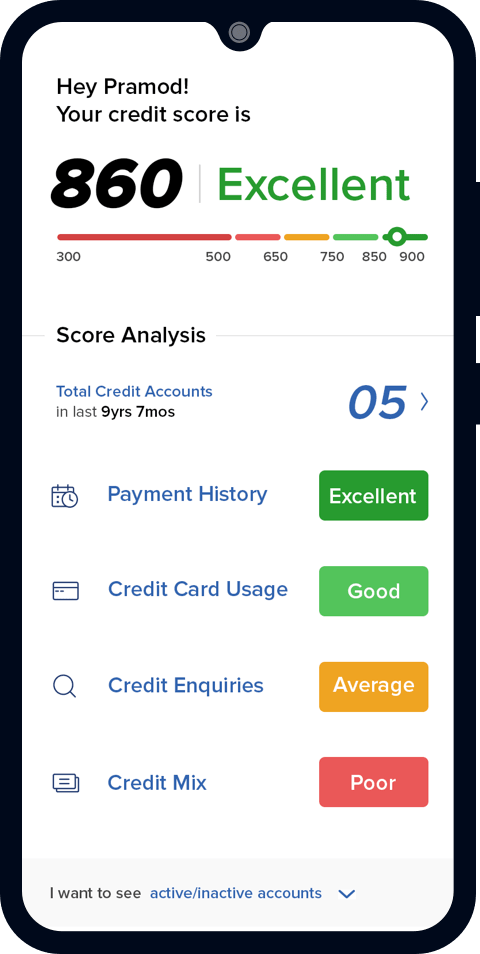

You can check your credit score in less than five minutes by logging into your credit card issuer’s site or a free credit score service and navigating to the credit score section. There will typically be a dashboard listing your score and the factors that influence it.

FICO and VantageScore will pull your credit score from one of the three major credit bureaus, Experian, Equifax or TransUnion.

Here are some free credit score resources that you can access, whether you’re a cardholder or not:

What Other Free Tools Does Credit Karma Offer

Free credit reportsOn Credit Karma, you can check your free credit reports from Equifax and TransUnion. And as with your credit scores, you can check your free credit reports as often as you like.

Free credit monitoringCredit Karmas free credit-monitoring service can alert you to important changes on your Equifax and TransUnion credit reports. Along with checking your credit scores regularly, this feature sends you an alert so you can sniff out any suspicious activity.

Mobile appThe allows you to check your credit scores on the go. The app also features tools ranging from the newRelief Roadmap to opt-in push notifications that help alert you to potential changes on your Equifax or TransUnion credit reports.

How To Improve Your Credit Rating

There are many ways you can boost your credit score, including:

- Checking your credit report regularly: to ensure it has no mistakes and is showing any new payments youve made.

- Reporting any errors to your lender: so your report can be updated. You can also add a statement to your record, for example, to explain why an account is in arrears.

- Clearing any arrears: and then making all future payments in full and on time.

- Reducing your outstanding credit: before applying for more, so that you meet lenders affordability checks.

- Waiting to apply for credit: from when your arrears have been cleared, to reduce your chances of being declined by lenders.

- Minimising credit checks by lenders: by researching what their lending criteria is. Too many checks may negatively affect your credit rating.

Recommended Reading: Unlock My Experian Account

Information Held On The Databases

What loans are included?

- Tax liabilities

Consent for personal information to be included on adatabase

Under data protection regulations, organisations that hold your personalinformation must show why they are holding it.

Central Credit Register

The legal basis for the Central Bank to collect and hold personalinformation in the Central Credit Register is set out in the Credit ReportingAct 2013 and the Regulations.

Since 2017, lenders must submit your personal and credit information to theCentral Credit Register.

Irish Credit Bureau

The ICB relies on the principle of legitimate interests under the GeneralData Protection Regulation as the legal basis to collect and processyour personal and credit information.

The legitimate interests include supporting a full and accurate assessmentof loan applications, helping to avoid over-indebtedness and supporting faster,consistent lending decisions. You can read more about what entitles theICB to process your personal data .

Consent for a lender to check your credit history

When you apply for a loan, the lender must check the Central Credit Registerif the loan is for 2,000 or more. Lenders can also check the Central CreditRegister if the loan application is for under 2,000.

Your consent is not required for lenders to check the Central CreditRegister.

What information about you is held on the databases?

How far back does the information go?

Central Credit Register

Irish Credit Bureau

How long is information kept?

What Personal Details Do Not Affect My Credit Score

Now that you have an idea of what goes into your score, it’s good to know what doesn’t factor into your score. A recent survey from the Consumer Federation of America found that out of 1022 adult respondents, 40% believed marriage status influenced credit scores, while 43% thought age also played a part.

Your score is a representation of how you manage financial responsibility, not a testament to you as an individual. Things like age, ethnicity, religion and marital status are excluded in the calculation of your score. Your employer, salary and occupation are likewise not included in the equation.

Also Check: Does Carvana Report To The Credit Bureaus

What Is A Credit Score In Nigeria

September 25, 2021 by Finance Writer

What is a Credit Score in Nigeria? A credit score is a unique credit rating system that shows lenders how risky it is to lend to an individual. Developed by the Fair Isaac Corporation , an American data and analytics company, it helps individuals to know what their credit status is and lenders to make quick and informed decisions. Your credit score is dependent on the information on your credit report, which is your credit history over a period.

How Is The Credit Score Calculated

a credit score is calculated differently by the various credit information bureaus. general factors on the basis of which your credit score is calculated are mentioned below:

payment history – 35% of your credit score is calculated on the basis of your payment history. your payment history shows how timely youve made the payments, how many times you’ve missed on the payments or how many days past the due date youve paid your bills. so you can score high if you have a higher proportion of on-time payments. make sure you never miss out on payments as this would leave a negative impact on your score.

how much you owe – about 30% of your credit score depends upon how much you owe on loans and credit cards. if you have a high balance and have reached the limit of your credit card then this would lead to a drop in your credit score. while small balances and timely payments would help in increasing the score.

the length of your credit history is accountable for 15% of your credit score. if your history of on-time payments is long then definitely you would have a higher credit score. having said that, at some point, you must apply for a credit card or loan rather than avoiding it so that you also have a credit history for banks review.

how many products you have – the products that you have is responsible for the 10% of your credit score. having a mix of various products like installment loans, home loans, and credit cards help in increasing your credit score.

Don’t Miss: How To Unlock My Experian Credit Report

It Can Affect Your Finances

Financial institutions look at your credit report and credit score to decide if they will lend you money. They also use them to determine how much interest they will charge you to borrow money.

If you have no credit history or a poor credit history, it could be harder for you to get a credit card, loan or mortgage. It could even affect your ability to rent a house or apartment or get hired for a job.

If you have good credit history, you may be able to get a lower interest rate on loans. This can save you a lot of money over time.

Option : Get Instant Online Access To Your Credit Report And Score

Both Equifax and TransUnion are now providing online access to your credit report for free. Equifax is also including a credit score as part of this free package. We’re not sure how long this offer will last, but it’s worth taking advantage of if you’re looking for either your credit report or your score. Here is where you can access Equifax’s free online credit score and report and TransUnion’s free online credit report. If either of these options don’t work for you, don’t worry. It doesn’t mean you’ve done anything wrong, it just means that you’ll have to try one of the other methods listed below. It’s possible that for some reason the information you entered doesn’t perfectly match the credit reporting agency’s records.

You May Like: Does Increasing Credit Limit Hurt Score

A Lesser Premium For Insurance

Insurance is another financial instrument that rides mainly on trust and credibility, whether it is life cover, medical insurance, or others. Your repayment history, claims history, and general handling of debts and dues â all these are tracked carefully by the insurance companies. This helps them determine if you can enjoy a lower premium compared to others policyholders with a low credit score.

Affirmation No Exact Point Exacltly What The Credit Rating Is

Guaranteed Payday Advances No Authentic Topic Exacltly What The Credit History Is

Yet again, affirmation for invest times money never come formerly fully guaranteed. Having a greater credit rating typically facilitate, but loan providers which happen to be most not look at your own credit rating. They generally create verify your own job from using they. Also they check additional info to make sure you may choose to and can payback the mortgage loan. Consider, payday improvements are usually refunded within cover this is certainly on the next occasion. Thus, theyve been crisis, short term installment financial loans and could basically be used by cash crunches.

Eligibility for Certain Financial Products for Bad Credit

Training for almost any type of obligations is different regarding the applicant and the provided recommendations we deliver in the funding want kind. Because you will find no guaranteed financing for below-average credit score rating probably the most easily of use strategy would be to offer precise facts and just relate with one give

looking at How Could You DECLARE Certain Financing for Below-average Credit On The Web

Manage assured recognition lending options for everyone with a decreased credit history also Exist

So just how to improve the likelihood of getting a bad credit score rating Payday Loan

Read Also: Does Afterpay Affect Credit Score

Who Can See And Use Your Credit Report

Those allowed to see your credit report include:

- banks, credit unions and other financial institutions

- offer you a promotion

- offer you a credit increase

A lender or other organization may ask to check your credit or pull your report”. When they do so, they are asking to access your credit report at the credit bureau. This results in an inquiry in your credit report.

Lenders may be concerned if there are too many credit checks, or inquiries in your credit report.

It can seem like you’re:

- urgently seeking credit

- trying to live beyond your means

Small Business Loan Disbursals Increased 40% In Fy21

The latest edition of the Sidbi TransUnion Cibil MSME Pulse Report has been published and it shows that loans worth Rs.9.5 trillion have been disbursed by the lenders to micro, small, and medium enterprises for the current financial year.

This number is 40% more than the previous years disbursal of Rs.6.8 trillion. The report suggests that the interventions from the government such as Emergency Credit Line Guarantee Scheme have played a major role in the surge of the credit disbursement to the MSMEs.

11 August 2021

You May Like: How To Print My Credit Report Credit Karma

Canadian Credit Scoring Model

Equifax and TransUnion generate credit scores on a scale that ranges from 300 to 850 or 900 . The score is a ratio that indicates, over the next 12 24 months, what the likelihood is that youll be able to repay your debts. For example, if your score is 680, it means that 680 out of 850 people are likely to repay their debt. If your score is 500, the likelihood that youll repay your debt goes down. So, the higher your score, the better, but not at all costs. Keep in mind, that if your finances are tight right now and your score dips, it will recover as your financial situation recovers.

A low score may prevent someone from obtaining credit while a high score makes it easier to obtain credit. Since a credit score also reflects an individuals likelihood of repaying a debt, people with higher credit scores can sometimes obtain better interest rates, while people with low credit scores are sometimes charged higher interest rates because they are deemed to be a higher risk.

Alternate Credit Scores Launched By Lexisnexis

On 9 February, LexisNexis Risk View Spectrum and Risk View Optics were unveiled by LexisNexis Risk Solutions. Risk View Spectrum and Risk View Optics are FCRA-compliant credit scores that offer a larger view on consumer credit worthiness. The new tools that are used can improve financial inclusion by finding out more credit-worthy consumers. Over 90% of individuals who do not have a regular credit score can get a score from Risk View Spectrum and Risk View Optics. Lenders can provide better offers to individuals whose credit scores are from Risk View Spectrum and Risk View Optics.

10 February 2021

Recommended Reading: Syncb Ppc Closed

What Is A Credit Rating & A Credit Score

Your credit rating is a measure of your financial health and financial trustworthiness. From a statistical point of view, your credit rating reflects how likely you are to make your payments on time and repay your debts.

If you apply for credit, lenders wont send out a personal investigator to check up on you. They probably wont try to call your friends and family, talk to your neighbours or call your boss to find out if they can trust you. That would be a lot of work and in the end, the information they glean might be very subjective. It is much more efficient for lenders to create a record of some of your financial activities and then assign scores to these financial activities based on whether those types of activities are deemed to potentially help or hurt your overall financial situation. A collection of all of these financial activities is called a credit report, and the score a credit report generates based on all of your activities is called a . Your credit score and your credit report together form your credit rating.

The types of financial activities that are recorded on a credit report include all types of revolving credit . Mortgages are sometimes reported on credit reports by some financial institutions, but this doesn’t always happen.

What Is A Canadian Business Credit Report

The break down of a business credit report is different than a personal credit report. Business credit reports are also more complex than personal credit reports, the subsections are discussed below.

- Business Information: The companys legal name, address and phone number are displayed here. There is also a section with additional business information such as the number of employees and sales volumes.

- Score Summary:Using visual graphs, this section displays a brief summary of the businesss score. Below this section, there is another section which highlights details of the report such as the number of accounts, credit limits, number of collections, the number of legal items, and various other details.

- Score Details: This section deep dives into the factors that are used to calculate the credit score.

- Industry Summary: In order to better understand the companys activity, information about the companys industry is provided in this section as a benchmark.

- Company Details: In this section, very detailed information is provided about the business regarding specific activity such as returned cheques, accounts in collections, legal information, inquiries, and banking, among many other details.

You May Like: Shopify Capital Complaints

Is My Free Credit Score On Credit Karma Accurate

The free credit scores you see on Credit Karma come directly from Equifax or TransUnion. Its possible that more-recent activity will affect your credit scores, but theyre accurate in terms of the available data.

If you see errors on your credit reports that may be affecting your credit scores, you have options to dispute those errors.

More Bargaining Power On Interest Rates

Are you aware of the fact that the interest rates vary for different loans at different banks? Some people end up getting a better deal than others. A higher CIBIL score enables you to bargain with banks for a better rate or deal. You can easily compare the offers from lenders and authoritatively negotiate as creditworthy customers are assets for any financial institution.

Don’t Miss: How To Get Credit Report Without Social Security Number

Understanding Your Credit Report And Correcting Mistakes

Once you receive a copy of your credit report, it will contain explanations to help you understand the details of your credit report. It should also let you know how to correct mistakes or dispute information that you think is incorrect. The Government of Canada has also published a guide called Understanding Your Credit Report and Credit Score to help Canadians understand how the credit reporting system works in Canada. It contains all sorts of helpful info including how long information stays on your credit report.

How To Check Credit Score Online

Perform free credit score check online with Tata Capital. Steps for credit score check-

-

As a new customer, to get online CIBIL score, input your first name and last name, date of birth, gender, email ID, PAN number, mobile number, address, state, city, and pin code.

-

As an existing customer, find your CIBIL score checkyour report online as well by providing your registered mobile number. Use the OTP to check your online CIBIL score.

-

In the CIBIL score check online process, confirm that all your details are correct. Click on Submit. Get your online credit score and credit report for free with Tata Capital.

Also Check: Can You Remove Hard Inquiries Off Your Credit Report

Submit Your Request By Mail:

First, you’ll need to download and complete the Canadian Credit Report Request Form.

Second, you must provide a photocopy of two pieces of valid, non-expired Canadian Government-issued identification. At least one of the two IDs must include your current home address. Examples of acceptable documentation include:

- Driver’s license

- Birth certificate

- Certificate of Indian Status

In order to protect your personal information, we will validate your identity before mailing your credit report to your confirmed home address. If your address is not up-to-date on either identification, you must also provide additional documentation that shows your current home address . Your copy should show the date of the document, the sender, your name, address and your account number.

- Documents must be less than 90 days old

- We recommend you blackout any transactional details.

- If you provide a credit card statement or copy of your credit card as proof, please ensure to blackout your CVV.

While providing your Social Insurance Number is optional, it helps us avoid delays and confusion in case another individual’s identifying information is similar to your own. If you provide your S.I.N., we will cross-reference it with our records to ensure that we disclose the correct information to you. We will not use it for any other purpose or share it with any third party.

As a last step, you will need to submit your completed form and proof of identity

Kindly allow 5 – 10 days for delivery.