Getting A Mortgage With A Thin Credit History

One option to boost yourcredit score is to become a credit card authorized user on someone elsesaccount. You can be added tohealthy credit card accounts, and that can boost your score.

This strategy can help you if youre new to managing credit and dont have many open lines of credit or tradelines.

Tradelines arecredit-lingo for accounts with creditors. When youre short on tradelines, itcan be hard for the credit bureaus to assign to you a credit score and hardfor lenders to know whether youre a good borrower.

Getting yourselfauthorized to use a family members credit card can be a terrific way toboost your own credit rating andqualify to buy a house sooner.

What If You Dont Have Any Credit At All

Building credit from scratch is challenging, but it can be done. Adding a co-signer to the mortgage loan application works for people with no credit as well as for those with poor credit. Another option is to start using a credit card responsibly.

Start off with a secured card and make your monthly payment in full each month to build credit. Or ask a close relative if you can be added as an authorized user on one of their credit cards.

You can agree not to spend anything . This simple step will add that credit cards entire length of use to your own credit report.

You can also show your lender that youve regularly paid other bills on time, like your cell phone, utilities, or rent. Another method is to make a bigger down payment to compensate for your lack of credit. Talk to your lender to see what else you can provide to make the loan work.

Lower Your Credit Utilization

Try to re-work your budget to pay off your credit card balances and other debt. This will lower your and ultimately increase your credit score.

Is your available line of credit really small? Ask an existing creditor to extend your maximum amount on one of your current credit cards. This will also lower your credit utilization.

Also Check: How To Remove Repossession From Credit Report

How Your Credit Score Affects Mortgage Rates

Your credit score plays a role in determining the interest rate and payment terms on a mortgage loan. That’s because lenders use what’s called a risk-based pricing model to determine loan terms.

The more likely you are to pay your bills on time, based on your credit history, the lower your interest rate may be. With a less-than-stellar credit score, however, you may end up paying more.

For example, let’s say you’re hoping to get a mortgage loan for $250,000 over 30 years. If you have great credit and qualify for a 4% interest rate, your monthly payment would be $1,371 , and you’d pay a total of $243,560 in interest over the life of the loan.

But if your credit needs some work and you qualify for a 5% interest rate instead, that increases your monthly payment to $1,446 and your total interest burden to $270,560a difference of $27,000.

Mortgage lenders don’t just look at your credit score when determining your rate, though. They’ll also consider your debt-to-income ratio how much of your gross monthly income goes toward debt paymentsas well as your down payment and available savings and investments.

So while it’s important to work on your credit score before you apply for a mortgage, avoid neglecting these other important areas of your financial situation.

What Is A Good Credit Score For Buying A House

So far we’ve only discussed the minimum credit score that a mortgage lender will consider. But what type of credit score could qualify you for the best rates? FICO breaks its credit scores into five ranges:

|

FICO Credit Score Ranges |

| 800 and above | Exceptional |

Aiming to get your credit score in the “Good” range would be a great start towards qualifying for a mortgage. But if you’re wanting to qualify for the lowest rates, try to get your score within the “Very Good” range .

It’s important to point out that your credit score isn’t the only factor that lenders consider during the underwriting process. Even with a strong score, a lack of income or employment history or a high debt-to-income ratio could cause the loan to fall through.

Recommended Reading: Does Speedy Cash Check Your Credit

Qualifying For A Mortgage With Nocredit Score

Its possible to qualifyfor a mortgage even with no credit history.

Many individuals havepurchased everything with cash, which is a sign of fiscalresponsibility. Thats why most lenders can help you build a non-traditionalcredit report if you have no credit score or history.

The lender will take historyfrom accounts like rent, utilities, and even cell phone bills tobuild a score for you.

As long as youve managed thesetypes of accounts well in the past, theres a good chance you can get amortgage even with no credit score.

Take Control Of Repairing Your Credit Score

The best route to a better credit score? First, know what makes a good credit score, which is a range between 621 740. Then, know what makes up your credit score, including payment history, current loan and credit card debt, length of credit history, account diversification and recent activity.

You can improve your credit score by taking the following actions or any combination of steps:

Theres no quick fix that will repair your credit overnight. However, there are plenty of small steps you can take every day that will lead to a better score over time. Visit Rocket HomesSM to get the resources you need to meet your financial goals. If you have additional questions, its important to work with a financial advisor before making any big financial moves.

Take the first step toward the right mortgage.

Apply online for expert recommendations with real interest rates and payments.

Don’t Miss: Syncb/ppc On Credit Report

Using Credit For Home

Buying a house involves more than simply making payments on your mortgage. The simple truth is that when you own a home, you’re going to have house-related expenses. However, it’s not always possible to drop large amounts of cash on big-ticket items like new appliances, home repairs, or maintenance.

- Use a low-interest credit card: one convenient way to pay for immediate, unexpected, or emergency home costs is with a credit card. Consider getting a low-interest card that you set aside for this purpose while you build an emergency fund. Remember to apply for the card < em> after< /em> closing on your house, though, so you don’t impact your credit. This gives you the option to fund an unexpected housing cost immediately. Use a credit card for things like an emergency furnace repair or an appliance service call.

- Use a line of credit: another option for larger home expenses or repairs is a line of credit. A line of credit works like a credit card in that you can borrow up to a limit. You only pay interest on what you borrow, and then make monthly payments to pay it back. Line of credit rates are often lower than credit card interest rates, and a strong credit score could reduce your rate even further.

How Does Credit Score Affect Your Interest Rate

The interest rate you receive on a home loan is largely tied to your credit score. Generally, borrowers with higher credit scores qualify for lower mortgage rates, which can save them thousands of dollars over the life of a mortgage.

Every lender will have a different formula for setting your interest rate, but even a small difference on your credit score can help you save substantially. For example, bumping your credit score from 660 700 may help you shave $61 off your monthly payment on a $300,000 mortgage. Thats a difference of $21,960 over a 30-year mortgage term.

You May Like: What Is Syncb Ntwk On Credit Report

How To Find Out Your Credit Score

You can use ooba Home Loans Bond Indicator to access your credit score. This is a 100% secure, online tool that is available free of charge and without any obligations. Based on the information you provide, the tool will give you an indication of your credit rating, and how much you can realistically afford. The Bond Indicator tool will issue you with a Bond Indicator Certificate that will enable you to house hunt with confidence.

Can I Use My Credit Card After Closing On A House

For a home purchase, its best to wait at least a full business day after closing before applying for any new credit cards to make sure your loan has been funded and disbursed. Even if youve signed and received confirmation that your lender has funded, the title company still needs to disburse the money.

You May Like: Is 580 A Bad Credit Score

What Is My Credit Score

Your credit score is a numerical rating that tells a lender how responsible you are when you borrow money. High credit scores tell lenders that you pay your bills on time and you dont borrow more money than you can pay back.

On the other hand, low credit scores might also tell lenders that you sometimes miss payments, you overextend your line of credit regularly, your account is very young, or your spending habits are unpredictable.

Equifax®, Experian and TransUnion®, the three major reporting bureaus, gather data on your spending habits and calculate a score for you based on your unique spending and bill-paying habits. Some factors that go into your credit score include your payment history, credit utilization, how much total credit you have, how old your account is and how often you apply for new credit lines.

Your payment history refers to how often you make the minimum payments on your credit card, auto loan and/or student loans. Credit utilization ratio refers to what percentage of your credit you use every month compared to how much total credit you have.

Visit AnnualCreditReport.com and request your free credit report. You can also order your credit report by calling 1-877-322-8228 or by completing the Annual Credit Report Request Form and mailing it to Annual Credit Report Request Service, P.O. Box 105281, Atlanta, GA 30348-5281.

Take the first step toward the right mortgage.

Apply online for expert recommendations with real interest rates and payments.

What Score Is Needed To Buy A House In California

There is no standard “cut-off” point used in the mortgage industry for credit ratings. This is one common misunderstanding. The truth is that different lenders have different standards , different business models and different risk appetites. So the credit score required to buy a home in California would depend partly on who you work with.

In general terms emphasis on the word “generally” mortgage firms prefer to see a score of 600 or higher for approval of loans. That number, however, is not set in stone. It is just a phenomenon in the industry. So don’t be discouraged by dropping below that point. Either way please contact us. We’ll gladly review your financial situation to see if you are a good candidate for a home loan from California.

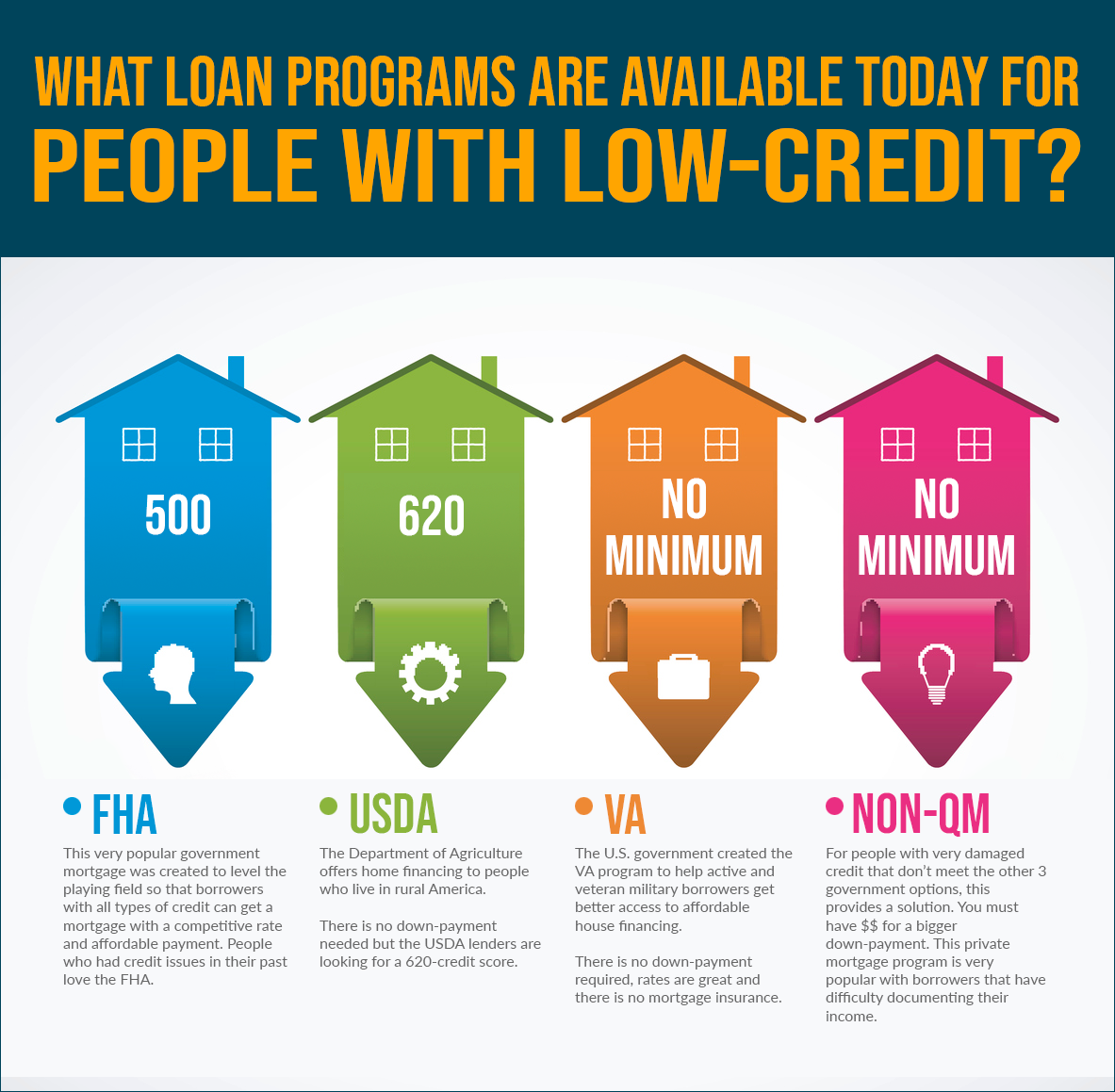

Here too, the type of home loan you use plays a role. For example , home loans from the Federal Housing Administration require a minimum score of 580, if the borrower wishes to take advantage of the 3.5 percent down payment option. Credit score requirements tend to be a bit higher for conventional mortgage loans, because there is no government insurance.

As described above, when assessing loan applications, the borrowers prefer to look at the big picture. Every lending scenario is different, because it is different for every borrower. So a low credit score may not necessarily be a deal-breaker by itself. Having said that, a higher credit score would usually increase a borrower ‘s chances of qualifying for a California home loan.

Also Check: Does Paypal Credit Report To Credit Bureaus

What Should Your Credit Score Be To Buy A House

What should your credit score be to buy a house? Here’s what you’ll have to know about your credit before signing the dotted line on your next home.

Sarita Harbour

If you’re even considering the possibility of buying a house in the near future, your mind is probably already buzzing with questions about the homebuying process, borrowing to buy a house, and how to pay for the costs that turn up after the place is yours. What should your credit score be to buy a house? What’s the best way to pay for furniture for your new house?

We’ve got answers! Here’s what you need to know about credit and buying a house.

How Long Does Negative Info Remain On Your Credit Report And Affect Your Credit Score

This depends on what the credit issue is. For instance, credit delinquencies will typically remain on your credit report for seven years. Bankruptcies will remain on your credit report for 10 years. Credit inquirieswhere someone pulls your credit report like a lender or credit card companyremain on your report for two years.

Want to learn more? Heres more detailed info on how long it takes to improve your credit score.

You May Like: Is Creditwise Score Accurate

Secure A Certificate Of Eligibility

Youll need this to be eligible for your VA loan. Youll need to provide proof of your military service based on your status.

Rocket Mortgage® can help you verify your eligibility and get your certificate. VA-approved lenders, like Rocket Mortgage®, can help you get your certificate quickly with proof of service.

Tell your lender you need your certificate of eligibility early in the process so they can help you get it.

What Are Rates For A Conventional Mortgage

Interest rates for conventional mortgages change daily. Conventional mortgage interest rates are usually slightly lower than FHA loan interest rates and slightly higher than VA loan interest rates. However, the actual interest rate you get will be based on your personal situation.While many sites can give you estimated conventional loan interest rates, the best way to see your actual interest rate for a mortgage is to apply. When you apply with Rocket Mortgage®, youll be able to see your real interest rate and payment without any commitment.

Also Check: How To Get Credit Report With Itin Number

Correcting Credit Report Errors

You can and should check yourcredit report before buying a house. Consumers can get one free credit reportper year on annualcreditreport.com.

In the event that you find errors on your credit report, take steps to correct them as quickly as possible.

First, contact the creditbureaus about the errors. You should also contact whichever creditors haveprovided the erroneous information.

Under the Fair CreditReporting Act, each of these parties is responsible for correcting inaccurateor incomplete information in your credit report.

For simplicity, disputes canbe managed online. If all three bureaus report the same error, though, rememberto report the error to all three bureaus. Equifax, Experian, and TransUnion donot share such information with each other.

The law requires creditbureaus to investigate the items in question, usually within 30 days, unlessyour dispute is considered frivolous. Note that you may need to includecopies of documents which support your position. Never send originals!

Within 45 days, the creditbureaus will notify you with the results of the investigation.

Then, youll want to obtain a new copy of your credit report in order to make sure that the errors have been corrected before applying for a mortgage.

What To Do If You Still Dont Qualify To Buy A House

If you still cant qualify, even for an FHA loan, then you need to take steps to make yourself more creditworthy. This means taking steps to improve your credit score and decrease your debt-to-income ratio. And, if your FICO score is below 550, it may take as little as six months or less to get where you need to be.

Often, its good to have a tool that tells you where you stand. tools give you access to your three credit reports, plus credit score tracking. This can make it easier to know where your score is, so you know exactly when its the right time to apply for a mortgage.

Is a low credit score keeping you from getting approved for a mortgage? Try Self Lender!

If you qualified for an FHA loan at a 560 FICO, then a few years down the road your credit score has improved to 700, consider refinancing! You are likely to qualify for a lower interest rate, which could also lower your monthly payments. Just be aware that other factors affect mortgage rates, such as prime rate changes by the Federal Reserve.

You May Like: When Does Usaa Report To Credit Bureaus

First Lets Talk About Credit Scores

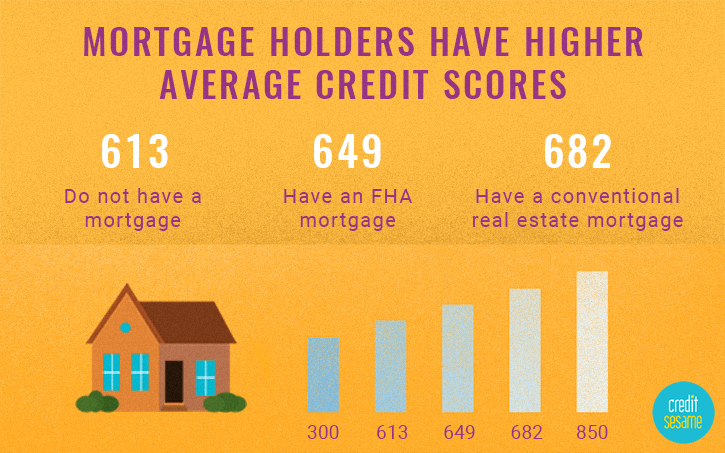

Your credit score can range from 300 at the low end to 850 at the high end. A score of 740 or above is generally considered very good, but you dont need that score or above to buy a home. Credit scores are maintained by the national credit bureaus and include debt like credit cards, auto loans or student loans.

Your score is influenced by many factors, but the two biggest are whether you pay your bills on time and how much debt you owe. Having a credit score based on these factors gives lenders a quick way to see if youre likely to pay your future bills like your mortgage, for example.