How Many Recent Inquiries You Have

An inquiry is when a lender makes a request for your credit report or score. Although FICO Scores only consider inquiries from the last 12 months, inquiries remain on your credit report for two years. FICO Scores have been carefully designed to count only those inquiries that truly impact credit risk, as not all inquiries are related to credit risk.

There are 3 important facts about inquiries to note:

- Inquiries usually have a small impact

- Many types of inquiries are ignored completely

- The score allows for “rate shopping”

Remember: It’s OK to request and check your own credit report.

Checking your credit report won’t affect your FICO Scores, as long as you order your credit report directly from the credit reporting agency or through an organization authorized to provide credit reports to consumers, such as myFICO.

How Often Is Your Credit Score Updated

Your credit scores are always based on an analysis of one of your credit reports. Rather than being updated at specific intervals, a credit score is created when you checks your credit report. New information could be added to your credit report at any time, which means the resulting score could change.

You may also see different scores if you’re checking credit reports from different credit bureaus, as it’s not uncommon for there to be differences between your credit reports. Or, even if you’re checking the same report at the exact same time, you could get different scores depending on which scoring model analyzes the report.

Consent And Credit Checks

In general, you need to give permission, or your consent, for a business or individual to use your credit report.

In the following provinces a business or individual only needs to tell you that they are checking your credit report:

- Prince Edward Island

- Saskatchewan

Other provinces require written consent to check your credit report. When you sign an application for credit, you allow the lender to access your credit report. Your consent generally lets the lender use your credit report when you first apply for credit. They can also access your credit at any time afterward while your account is open.

In many cases, your consent also lets the lender share information about you with the credit bureaus. This is only the case if the lender approves your application.

Some provincial laws allow government representatives to see parts of your credit report without your consent. This includes judges and police.

Don’t Miss: Do Collection Agencies Report To Credit Bureaus

What Credit Score Is Needed For A Home Improvement Loan

Most lenders require that applicants have a credit score of at least 660 to qualify for unsecured home improvement loans. Borrowers with a score lower than 660 may still be able to qualify for a secured home improvement loan. However, interest rates, loan terms and available loan amounts are less competitive for borrowers with low credit scores.

Where Do Credit Scores Come From

The information contained in your credit reports is the basis of your credit score. Creditors submit this information voluntarily in reports to the three major credit reporting companies: Experian, Equifax and TransUnion.

If youd like to get a copy of your credit report know that each credit reporting company is obligated to provide you with one free credit report every year.

Not all creditors report to all three of these companies, and they may report on different schedules. That means that your three credit reports will often be slightly different, and may be significantly different.

- FICO, or the Fair Isaac Corporation, has been in business since 1956 and is the dominant provider of credit scores. Most lenders use FICO scores to assess creditworthiness.

- VantageScore was initiated in 2006, a joint project of Experian, Equifax, and TransUnion. Most providers of free credit scores use VantageScore.

Your lender is probably using a FICO score and your free credit score provider is probably using VantageScore. That means you may be looking at different scores, which could cause some confusion.

Your credit score is not held on file and updated on a schedule. Each score is generated as a response to a request. Its a snapshot of your credit file at the time of a given request, and it can change from day to day as new information is reported.

You May Like: Do Soft Inquiries Affect Credit Score

Length Of Credit History

In general, having a longer credit history is positive for your FICO Scores, but is not required for a good credit score.

Your FICO Scores take into account:

- How long your credit accounts have been established, including the age of your oldest account, the age of your newest account and an average age of all your accounts

- How long specific credit accounts have been established

- How long it has been since you used certain accounts

What Is The Average Interest Rate On A Home Improvement Loan

Home improvement loan interest rates usually range from 5% to 36% for personal loans but are lower for secured financing like HELOCs. The actual rate a borrower qualifies for depends on several factors, including their credit score and the loan type, term and amount. Some borrowers may opt to finance home improvements with a 0% introductory rate credit card, which can further decrease the cost of borrowing.

Don’t Miss: When Does A Closed Account Drop From Credit Report

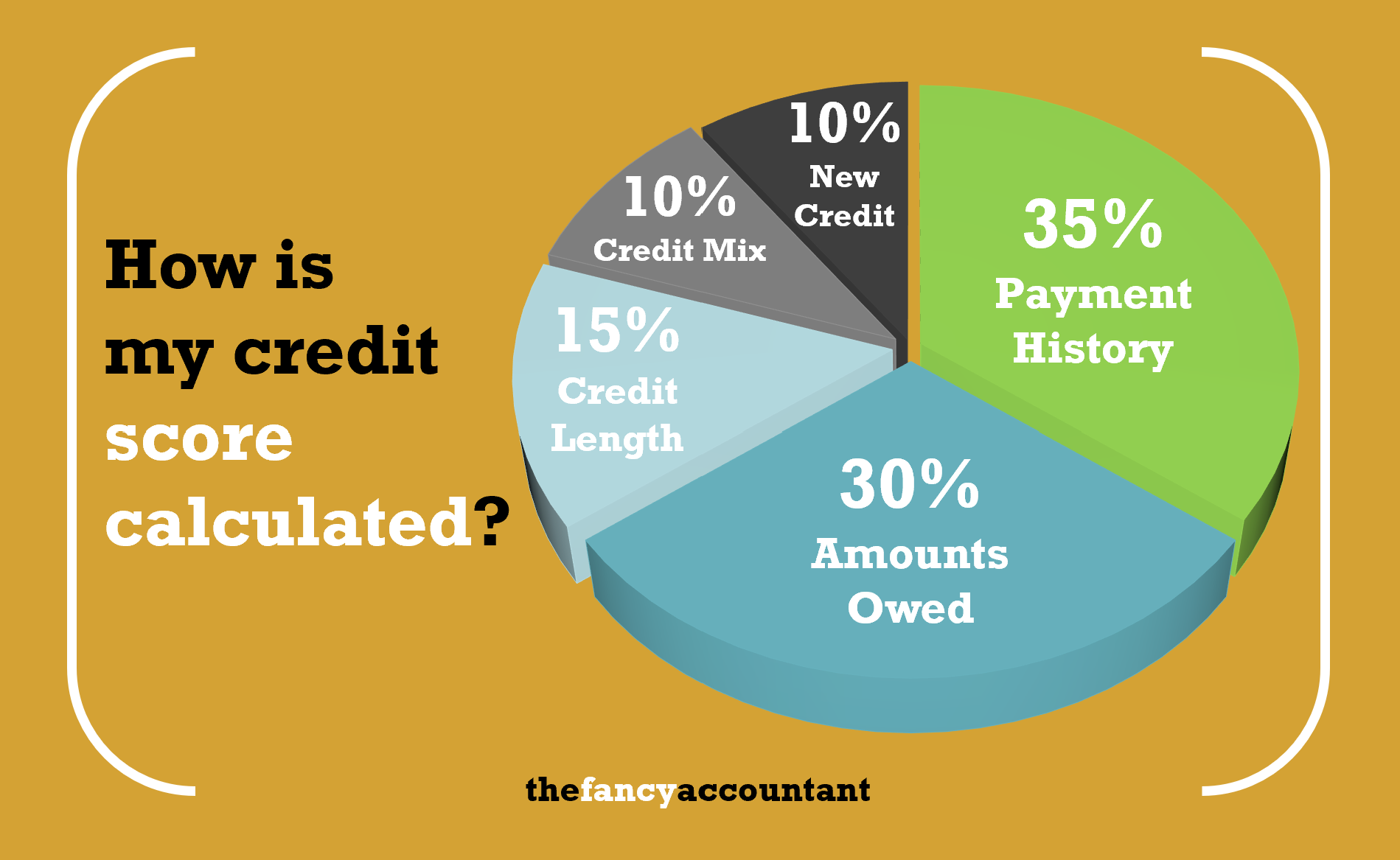

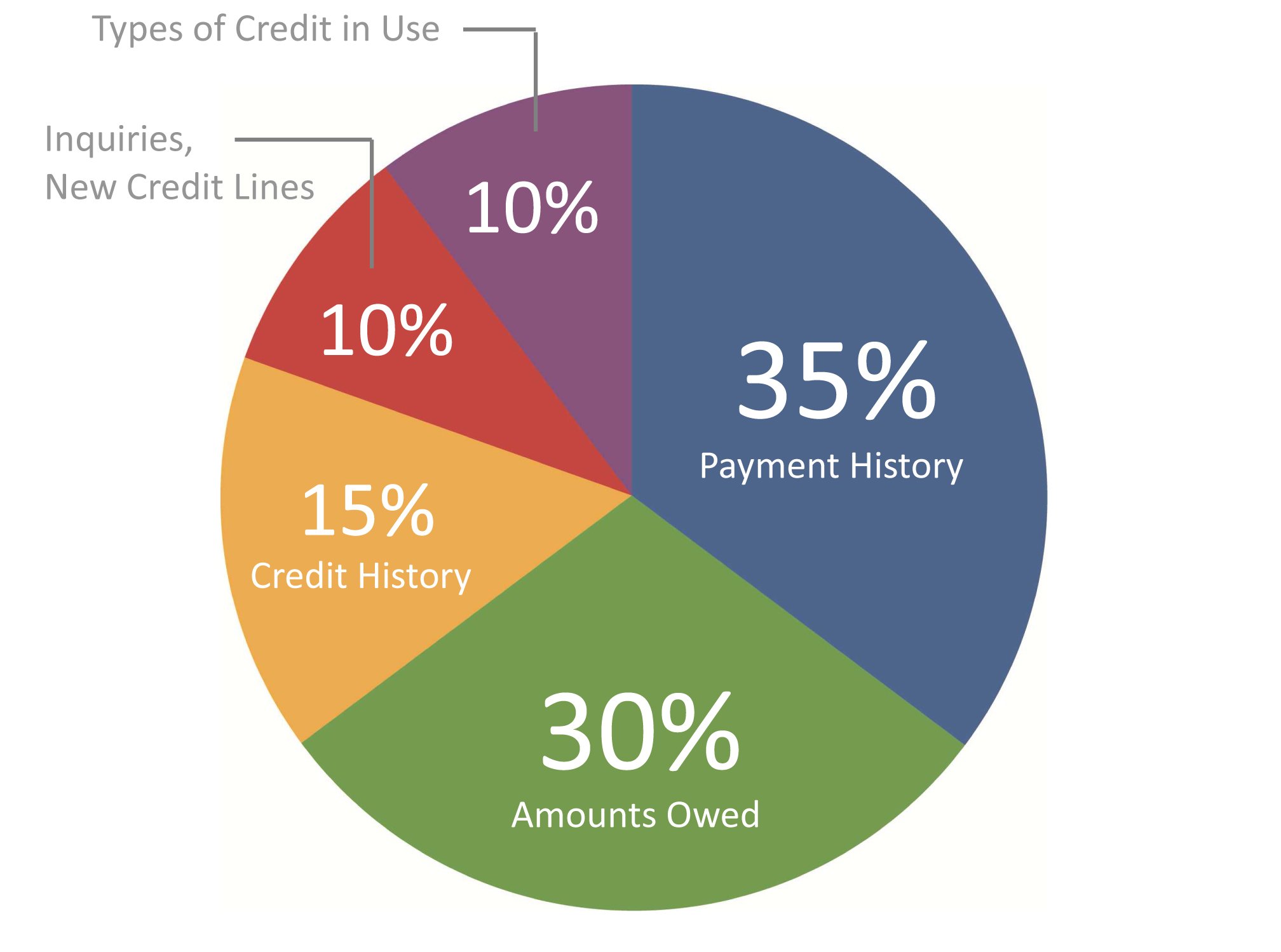

What Goes Into A Credit Score

Because some parts of your bill-paying history are more important than others, different pieces of your credit history are given different weights in calculating your credit score.

Even though the specific equation for coming up with your credit score is proprietary information owned by FICO, we do know what information is used to calculate your score.

| What Makes Up Your FICO Credit Score | |

|---|---|

| Payment history | |

| New credit | 10% |

Payment history: Lenders are most concerned about whether or not you pay your bills on time. The best indicator of this is how youve paid your bills in the past.

Late payments, charge-offs, debt collections, and bankruptcies all affect the payment history portion of your credit score. The better your history of paying debtssuch as loan payments or credit card billson time, the higher your credit score.

More recent delinquencies hurt your credit score more than those in the past.

Amounts owed: The amount of debt you have in comparison to your credit limits is known as . The more money you already owe, the less flexible your spending is, which makes it riskier for you to take on new debt, which lowers your credit score.

Keep your credit card balance at about 30% of your or less to improve your credit score.

Length of credit history: Having a longer credit history is favorable because it gives more information about your spending habits. A longer history of reliable borrowing means your score will be higher.

Check Your Credit Score For Free

FICO® and VantageScore create the most widely used credit scoring models in the U.S., and each company creates multiple scoring models. Fortunately, consumer credit scores tend to move together, as they’re using the same underlying information to try and predict similar outcomes.

If you have a good credit score generated by FICO® and based on your Experian credit report, you’re unlikely to then have a bad score generated by another scoring model based on a credit report from one of the other bureaus. With Experian, you can check your FICO® Score 8 for free, track it over time and get a breakdown of the factors that are most impacting your score.

Read Also: What Does Fraud Alert Mean On Credit Report

How Important Is Credit Score

In todays economy, borrowing money is based fundamentally on credit, or your ability to repay an amount borrowed. Simply put, your credit score represents the current state of your personal financial situation, summarised by your credit report. This report allows lenders historical access to your finances in order to make an appropriate decision on any new financial applications.

A higher credit score will mean less risk to lenders, it will potentially result in better rates as well as a higher chance of approval. However, lower credit scores could impact your ability to borrow money. This extends to most forms of lending including car, property, and other forms of lending. Because credit scores can have such a drastic impact on your financial decisions, it is very important to nurture and take care of your credit report.

However, we at Go Car Credit are experts in helping you find the right solution when it comes to car finance and review each application based on a number of factors, even if you have bad credit.

Learn more about what a good credit score looks like.

How Does A Credit Scoring System Work

- Have you paid your bills on time? If your credit report shows that youve paid bills late, had an account put in collections, or declared bankruptcy, thats likely to affect your score negatively.

- Are you maxed out? Many scoring systems look at the amount of outstanding debt you have compared to your credit limits. If the amount you owe is close to your credit limit, its likely to hurt your score.

- How long have you had credit? Generally, scoring systems consider your credit track record. A short credit history may hurt your score, but paying bills on time and having low balances can offset that.

- Have you applied for new credit lately? Many scoring systems look at inquiries on your credit report to see whether youve applied for credit recently. If youve applied for too many new accounts recently, it could hurt your score. Not every inquiry is counted: for example, inquiries by creditors who are monitoring your account or making prescreened credit offers arent counted against you.

- How many credit accounts do you have, and what kinds of accounts are they? Although its generally considered a plus to have established credit accounts, too many credit card accounts may hurt your score. Also, many scoring systems consider the type of credit accounts you have. For example, under some scoring systems loans to consolidate your debt but not loans for buying a house or car may hurt your credit score.

Also Check: What Is A Good Credit Rating

The 5 Factors That Make Up Your Credit Score

When you apply for a loan, a cellphone or any number of other activities, lenders and potential creditors will look at your credit score to help gauge your financial stability and thus the risk of you defaulting on a financial responsibility. The better your credit score is, the higher your chances are for getting approved.

There are many different types of credit scores, but the FICO® score is the most common credit scoring model today and the one that is used by most lenders.

FICO scores range from 300 to 850 points. Typically, a score more than 650 is considered “fair,” a score more than 700 is considered “good” and a score more than 750 is considered “excellent.”

The primary factors that affect your credit score include payment history, the amount of debt you owe, how long you’ve been using credit, new or recent credit, and types of credit used. Each factor is weighted differently in your score.

Let’s take a closer look at the factors that make up your FICO credit score and the importance of each in how the model calculates your score.

How Your Credit Score Is Used

When you apply for a credit card or loan, the creditor or lender uses your credit score to inform their decision on whether to issue you credit or not. The credit score gives a snapshot of how reliable you are as a borrower, which lets lenders know whether you are a good risk for a loan or credit card or not.

Lenders aren’t the only ones who check credit scores, however. Your utility company, landlord, and cell phone company may all check your credit score to get a picture of how reliable and financially stable you are.

These higher interest rates are designed to lower the risk that lenders take on by offering loans or credit cards to less reliable borrowers.

You May Like: How To Get A High Credit Score

How Is Credit Rating Calculated

The credit rating is calculated using proprietary algorithms that assess the data on your credit report. At Equifax, your score is calculated to a number from 0 to 1,200. Then your score is broken into different classifications : below average , average , good , very good , and excellent .

The lender may have their own risk assessment, and they may choose to only offer loans to people belonging to a specific range. However, they may choose to offer loans at a higher-than-average interest rate or a longer loan term to people with a bad credit history to offset their risk. It is recommended that you check your once per year to see if any changes have negatively affected your score. Understanding your current credit rating is an excellent idea if youre thinking about applying for a loan. The factors that go into calculating your credit rating can include the following:

- How many credit cards you have, and their maximum limit

- Existing loans for household items, personal purchases , or for family reasons

- Your current and past debt, which will include your repayment history and if you had problems making regular payments

- If there are default judgements or a bankruptcy record against your name

Who Calculates Your Credit Score

So, who are the credit bureaus that are responsible for compiling your credit report and calculating your credit score, and what exactly do they do?

In the U.S., there are numerous credit bureaus, also known as consumer credit reporting agencies. However, of these, only three are nationally important: Equifax, Experian and TransUnion. In Canada, Equifax and TransUnion are the two major agencies.

Each of these companies collects, analyzes and distributes consumers credit information. They obtain their information from creditors, such as credit card companies and banks, as well as courthouses and governmental agencies. Then, once theyve created your report and calculated your score, they distribute the information to lenders, insurance companies, service providers and anyone else who wants to look at your credit history including you. You can contact the credit bureau of your choice directly for a free annual credit report. Well take a closer look at that a little later.

You May Like: Is 691 A Good Credit Score

How To Lower Your Credit Utilization Ratio

- Spend minimally with your credit cards each billing cycle.

- Request a from your credit card issuer to give yourself more room to maintain low credit utilization.

- If you havent opened a new card account in a while, consider applying for a new card to raise your total available credit.

- If you have low limits on your cards, consider spreading your spending across multiple cards to keep your per-card credit utilization low.

- Monitor your utilization regularly to keep yourself from spending over your target threshold.

- Consider paying off your credit card balances as payments are posted instead of waiting until they are due.

See the online credit card applications for details about the terms and conditions of an offer. Reasonable efforts are made to maintain accurate information. However, all credit card information is presented without warranty. When you click on the “Apply Now” button, you can review the credit card terms and conditions on the issuer’s web site.

As seen on:

How To Establish Your Credit History

The big catch-22 of growing your FICO Score is that you need credit to get credit, and it’s difficult to open lines of credit to build your FICO Score if you don’t have a good FICO Score. Fear not. You can absolutely do some things to help grow the length of your credit history. Here are a few to get you started.

First, apply for a secured credit card. A secured card is a card where you provide cash collateral for the line of credit. FICO Scores look at secured cards the same as any credit card. Most banks and lending institutions not only offer secured cards, but most also report secured card activity to the credit bureaus.

Second, see if you can get a friend or family member with good credit to be a co-applicant with you – this will help you establish your credit history. Or, see if they are willing to authorize you on their card. It’s a lot to ask, but if they’re willing, it’s a good way to start growing your credit history.

Finally, adopt a mindset where you see the length of your credit history as part of your greater long-term credit strategy. Use your card, but keep the balances low and pay on time. If you do, you’ll find yourself well on the road to building a strong credit history that you can put to work when you need credit.

Recommended Reading: What Is Your Credit Score

What Credit Score Do I Need To Get Car Finance

All lenders will review your credit profile as part of the application process. Initially, we carry out a soft search to establish if you are suitable for our products based on your ability to repay credit. Having a high rating doesnt guarantee you will be approved for a loan, but it would indicate you have a higher chance than if you didnt have a high credit rating.

Each lender uses its own criteria, which might vary depending on which credit product youre applying for. Because we are specialists in providing bad credit car finance, we do some initial checks first but then your application is sent to our underwriting team to manual review the details. This means we can take into consideration extenuating circumstances and understand the full financial picture.

For your reference the 3 main credit reference agencies state the below as their credit score system:

580 669 = Fair300 579 = Poor

If your credit score isnt in the best shape, you can learn more on how to repair your credit.