How Does A Consumer Proposal Affect Your Credit

There are various ways a consumer proposal can affect your credit. That said, keep in mind that these implications are only temporary.

When your consumer proposal is filed and approved, the Office of the Superintendent of Bankruptcy will obtain it and inform the credit bureau. This action will result in several things.

- You will likely receive either an R7 credit rating . Bankruptcy, on the other hand, results in an R9 score.

- The proposal will show up on two sections of your credit rating for three years .

- Each creditor will indicate that your account was included in a proposal

- The date of the filing is recorded and then updated upon completion.

- On occasion, your creditors may indicate a bankruptcy on your credit report instead of a proposal. You can request an update to rectify this.

These implications are removed once your consumer proposal is completed, leaving you with a fresh slate to rebuild your credit and achieve financial wellness. The sooner you complete the proposal, the sooner you can start rebuilding.

Keep Your Credit Utilization Ratio Low

Another key credit score factor is your it accounts for 30% of your FICO Score. Your credit utilization ratio measures how much of your credit you use versus how much you have available. For example, if your available credit is $10,000 and you use $2,000, your credit ratio is 20% .

Although its often recommended that you keep your ratio below 30%, you may be able to rebuild your credit faster by keeping it closer to 0%.

What Information Do You Need To Confirm My Address

Any two of the following documents are acceptable proof of your current mailing address:

- Drivers license

- Bank or credit union statement

- Cancelled check

- Signed letter from homeless shelter

- Stamped post office box receipt

- Utility bills

Mail a copy of your documents along with your request to confirm/update your address to:

TransUnion LLC

P.O. Box 1000

Chester, PA 19016

When providing proof of your current mailing address, please ensure that any bank statements, utility bills, cancelled checks, and letters from a homeless shelter are not older than two months. All state issued license and identification cards must be current and unexpired. P.O. Box receipts may not exceed more than one year in age. Please note that any electronic statements printed from a website cannot be accepted as proof of address.

Read Also: 611 Credit Score Auto Loan

How Soon Will My Credit Score Improve After Bankruptcy

By FindLaw Staff | Reviewed by Bridget Molitor, J.D. | Last updated June 30, 2021

You can typically work to improve your credit score over 12-18 months after bankruptcy. Most people will see some improvement after one year if they take the right steps. You can’t remove bankruptcy from your credit report unless it is there in error.

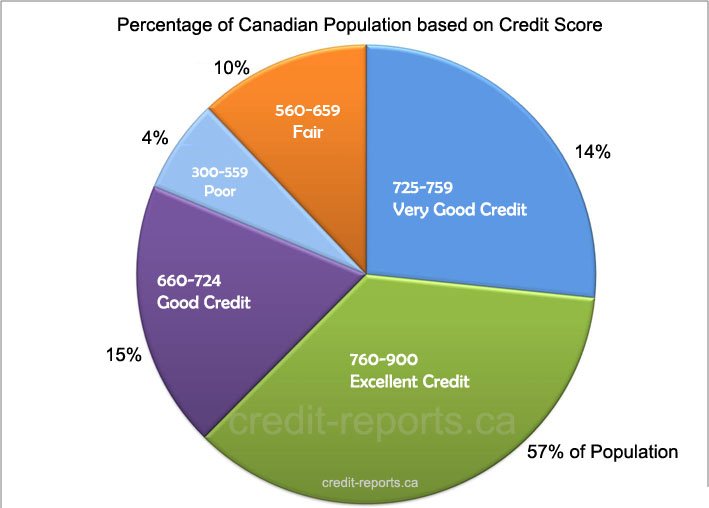

Over this 12-18 month timeframe, your FICO credit report can go from bad credit back to the fair range if you work to rebuild your credit. Achieving a good , very good , or excellent credit score will take much longer.

Many people are afraid of what bankruptcy will do to their credit score. Bankruptcy does hurt credit scores for a time, but so does accumulating debt. In fact, for many, bankruptcy is the only way they can become debt free and allow their credit score to improve. If you are ready to file for bankruptcy, contact a lawyer near you.

Does Bankruptcy Clear All Debts

Bankruptcy eliminates most unsecured debts. People often file bankruptcy because they are no longer able to keep up with the minimum payments on their credit cards or may be struggling in a cycle of payday loans. However, bankruptcy discharges a wide range of legal obligations including:

- unsecured lines of credit and bank loans

- financial company and installment loans

- unpaid bills

- accounts in collection

- judgments and lawsuits

- government obligations including tax debts and student loans if you have been out of school for 7 years.

There are however a few debts not discharged by bankruptcy include family responsibility arrears , court fines, traffic tickets and debts due to fraud.

An unsecured creditor is required to file a proof of claim to be eligible to receive a dividend from your bankruptcy estate. However, even if they do not file a claim, unsecured debts included in your bankruptcy that exist at the date of bankruptcy are erased.

Bankruptcy also does not affect a secured creditor. As long as you keep up with your mortgage or car loan payment, you can continue to keep that asset. If you miss payments, bankruptcy does not prevent secured creditors from enforcing their rights to foreclose on your home or repossess your vehicle. If there is equity in any property beyond any exemption limit, for example substantial equity in your home, your trustee can provide you with options to keep your house or car if you can afford the monthly payments.

Also Check: Serious Delinquency Credit Report

Hire A Credit Repair Service

Disputing errors can be a time-consuming process, especially if your history has several mistakes or if you were a victim of identity theft. Reputable credit repair companies such as , Lexington Law or Sky Blue may be viable solutions if your file is riddled with inaccuracies.

Credit repair services can help you dispute inaccurate negative information and handle creditor negotiations. However, if you decide to hire a credit repair agency, bear in mind that there are consumer protection laws regulating how they operate and what they can do. The establishes the following regarding credit repair services:

- They cannot provide false or misleading information concerning a persons credit status and identification

- They must provide a detailed description of the services they provide

- They cannot charge for their services until they has been completed

- There must be a written contract detailing the services theyll provide, the time frame in which these services will be provided and the total cost for them

- They cannot promise to remove truthful information from your record before the term set by law

- You have three days in which to review the contract and cancel without penalty

Before signing up with one of these companies, its important to understand what they can and cannot do. For example, any company that promises to remove accurate negative items or create a new credit identity for you is most likely engaging in illegal practices or a scam.

Q Why Are Some Of My Accounts Showing As Joint Even After A Divorce

A. The creditor is currently reporting the disputed information as a joint obligation. When co-signing for credit, you are equally responsible for repayment of that obligation. Unless you and the creditor agree to remove your name from the account, we will report these debts and subsequent credit information in the names shown on the contract or application. If the creditor agrees to release you from any obligation, please notify us immediately and we will re-investigate the account.A divorce decree does not override an original contract with a creditor. Any credit history established jointly before a divorce can be reported under both names shown on a contract or an application. If you have notified the creditor and they are willing to release you from your obligation, please notify us and we will re-investigate the account.

You May Like: How To Get A Repo Off Your Credit

Q How Do I Initiate A Dispute

A.There are three ways you can launch a dispute into item on your report:

- Online: to visit our self-service website.

- Over the telephone: simply call 1-800-663-9980 to reach one of our TransUnion representatives for assistance with your inquiry.

- In writing: for mailing instructions and TransUnion requirements.

Q How Do I Know If Im A Victim Of Fraud

A. If a creditors fraud department, government agency or law enforcement agency referred you to the TransUnion Fraud Victim Assistance Department , you may already know that you are a fraud victim. Otherwise, you may merely suspect that fraud has occurred. If you are the victim of a credit fraud crime, you should take certain steps to protect yourself and your rights.Common Signs of FraudSigns of Fraud can vary but typical indicators of fraud and / or stolen identity include:

- One of your creditors informs you that they have received an application for credit with your name, address and/or Social Insurance Number.

- Telephone calls or letters state that you have been approved or declined by a creditor to which you never applied.

- You no longer receive your credit card statements or you notice pieces of mail are no longer delivered to you.

- Your credit card statement includes unusual purchases.

- A collection agency informs you they are collecting for a defaulted account that has been established with your identity but not opened by you.

Don’t Miss: How To Get Evictions Off Your Credit

Am I Allowed To Have A Bank Account If I Declare Bankruptcy In Canada

If you have more than $999 in your account and want overdraft protection, you must notify your bank that you are bankrupt. In order to prevent creditors from taking money from you, it is recommended that you open a bank account at an institution where you do not owe money. Only use your new bank account and do not use any accounts that were active prior to your bankruptcy.

Q How Can I Place A Fraud Warning On A Deceased Consumer File If Fraud Has Occurred

A. In order to release personal information on a deceased person, TransUnion requires a copy of the Death certificate or the will/certificate of appointment, stating that this person is the next of kin or executor/executrix. The request must also include two pieces of the identification of the next of kin or executor/executrix requesting the file as well as one piece of identification for the deceased that verifies address. If the deceased address is noted on the Death Certificate, TransUnion will accept it as viable address verification for the deceased. Additonally, if the appropriate information has been given, the file will be processed and sent to the executors/next of kins address. If the Death Certificate has a Social Insurance Number , the SIN will be added to a High Risk Fraud Alert database to indicate that the SIN is deceased. The SIN number will remain in a protective state indefinitely and a note will also be placed onto the credit report to indicate that the consumer is deceased.

Note: If there is more than one appointee, TransUnion requires identification for each executor/executrix to process the request unless they receive an additional letter of direction that the executor/ executrix can act separately.

Also Check: Open Sky Not Reporting

Can You Ask Creditors To Report Paid Debts

Positive information on your credit reports can remain there indefinitely, but it will likely be removed at some point. For example, a mortgage lender may remove a mortgage that was paid as agreed 10 years after the date of last activity.

Its up to the lender to decide whether it reports your account information to the three credit bureaus. That includes your debt thats been paid as agreed. You can call the lender and ask it to report the information, but it might say no. However, you can add positive information to your credit reports by using your existing credit responsibly, like paying off credit card balances each month.

Negative Credit Report Entries That Impact Your Score The Most

Most accurate negative items stay in your file for around seven years. Fortunately, their impact diminishes as time goes by, even if they are still listed on the report.

For example, a collection from a few years ago will carry less weight than a recent one especially if there arent any new negative items in your history. Improving your debt management after receiving a derogatory mark can show lenders you’re unlikely to repeat the issue and help increase your score.

These are the most common items that can lower your credit score:

Multiple hard inquiries

Multiple hard credit checks over a short amount of time are a red flag for lenders, as it tells them that you are applying for credit too often and, potentially, being denied.

However, there are some exceptions to this. For example, if youre looking to buy a home and want to compare interest rates between several lenders, you can. FICO and VantageScore, the two most commonly used credit scoring models, give consumers a window of around 14 to 45 to compare rates this is known as rate shopping. All credit inquiries done between this period of time will show up on your file as one item.

Delinquency

Foreclosure

Foreclosure can also cause a credit score to drop substantially. According to FICO, a score can drop up to 100 points from a foreclosure, depending on the consumers starting score. Foreclosures stay on your record for seven years.

Charge-offs

Repossessions

Judgments

Collections

Also Check: Walmart Klarna

How Long Do Accounts Remain On My Credit Report

The time limits listed below apply to federal law. State laws may vary.

Accounts:

In most cases, accounts that contain adverse information may remain on your credit report for up to seven years from the date of first delinquency on the account. If accounts do not contain adverse information, TransUnion normally reports the information for up to 10 years from the last activity on the account. Adverse information is defined as anything that a potential creditor may consider to be negative when making a credit-granting decision.

Bankruptcies:

Generally, bankruptcy and dismissed bankruptcy actions remain on file for up to 10 years from the date filed. A completed or dismissed Chapter 13 remains on file for up to seven years from the date filed. A voluntarily dismissed bankruptcy remains on your file for up to seven years from the date it was filed. The actual accounts included in bankruptcy remain on file for up to seven years from the date of closing/last activity regardless of the chapter pursuant to which you filed.

Inquiries:

Under law, we are required to keep a record of inquiries for a minimum of two years if related to employment and for one year if not employment related. It is TransUnion’s policy to keep a record of all inquiries for a period of two years.

Foreclosure public record:

Generally, foreclosures, both paid and unpaid, remain on file up to seven years from the date filed.

Forcible detainer:

Garnishment and attachment:

Q How Do I Receive A Free Copy Of My Transunion Personal Credit Report

A. You can obtain a free copy of your Consumer Disclosure online through our self-service website. to visit our self-service website.You can also request a copy of your Consumer Disclosure by phone or mail, and it will be mailed to you. To review the options for receiving a copy of your Consumer Disclosure, please refer to the Consumer Disclosure section of our website

Recommended Reading: Paypal Credit Report To Credit Bureau

Why Does Information Show Up On Your Credit Report For Years

Both good and bad credit information stays on your record for several years because it helps lenders determine your risk level when they consider approving you a loan.

Positive credit information, such as making your payments on time and in full, usually stays on your credit report for up to 10 years with Equifax and 20 years with TransUnion Canada.

Negative credit information, such as missed or late payments, accounts sent to collections, bad cheques, and so on, will show up on your credit for several years as well.

Equifax Canada starts counting the time from the date our debt was assigned to a collection agency and keeps the negative information on record for 7 years. TransUnion Canada starts counting from the date of your accounts first delinquency and keeps the negative information on record for 6 years.

However, different types of information stay on your credit report for different lengths of time. Heres a breakdown of how long different items show up on your credit report.

What Happens To Your Credit Score When Derogatory Marks Fall Off Your Report

Most negative items should automatically fall off your credit reports seven years from the date of your first missed payment, at which point your credit scores may start rising. But if you are otherwise using credit responsibly, your score may rebound to its starting point within three months to six years.

If a negative item on your credit report is older than seven years, you can dispute the information with the credit bureau and ask to have it deleted from your credit report.

Read Also: Does Self Lender Do A Hard Inquiry

Understanding Your Credit Rating History

The two agencies that report and keep a record of your credit history are TransUnion and Equifax. These agencies updated their retention policies for consumer proposals in 2019 to reflect the following:

TransUnion: TransUnion will remove a consumer proposal and any related accounts from your credit history after either a) three years after completing the proposal b) six years since the defaulting of the account. Whichever comes first will be applied. Equifax: Equifax will remove a consumer proposal from your report three years after you pay all debt or six years after filing the request. Whichever comes first will be applied.

Check Your Credit Report After Your Bankruptcy Discharge

Itâs important to get your free credit reports a few months after your bankruptcy discharge. You need to check to make sure that debts discharged in your bankruptcy are no longer showing. If some of these debts are still on the report as unpaid and owing, you should contact your bankruptcy attorney or a consumer attorney if you filed your own bankruptcy. This could lead to a claim under the Fair Credit Reporting Act. If you contact the credit reporting agencies to correct items on your credit report, itâs important that you use certified mail. Many credit bureau websites contain arbitration clauses in their terms of use. If you use the credit bureauâs website to dispute an issue on your credit report, you could be giving up your right to a day in court if the credit bureau doesnât fix an error on your report.

Also Check: Does Paypal Credit Affect Your Credit Score