Why Does A Good Credit Score Matter

A good or excellent credit score will save most people hundreds of thousands of dollars over the course of their lifetime. Someone with excellent credit gets better rates on mortgages, auto loans, and everything that involves financing. Individuals with better credit ratings are considered lower-risk borrowers, with more banks competing for their business and offering better rates, fees, and perks. Conversely, those with poor credit ratings are considered higher-risk borrowers, with fewer lenders competing for them and more businesses getting away with criminally high annual percentage rates because of it. Additionally, a poor credit score can affect your ability to find rental housing, rent a car, and even get life insurance because your credit score affects your insurance score.

Start Creating A Good Credit History

Itâs hard to get credit if you donât have a credit history. But you canât have a credit history if youâve never had credit. Itâs a bit of a chicken and egg situation.

So what can you do instead? Here are some ideas:

Consider asking your bank for a small overdraft facility

An overdraft allows you to borrow money from your bank account. Since itâs a form of credit, it shows up on your credit report.

Some current accounts feature a small automatic overdraft facility, so itâs worth checking if yours has one. If it doesnât, try explaining your situation to your bank and ask them what your chances of being approved would be if you were to apply.

You donât have to use your overdraft. In fact, itâs usually better not to, as overdrafts tend to be expensive due to the interest you pay. The point is to build your credit history by adding more information to your credit report.

Put your utilities, broadband and other household bills in your name

More and more, companies such as utilities and broadband providers are sharing data with credit reference agencies. If you donât have a credit history, putting these bills in your name is your opportunity to start building your score.

For best results, check that your name is spelled correctly and always write your address in the same format. Even something as simple as a misspelled street name could lead to inaccuracies in your report.

Pay by direct debit whenever possible

How Long Does It Take To Rebuild A Credit Score

There’s no set timeline for rebuilding your credit. How long it takes to increase your credit scores depends on what’s hurting your credit and the steps you’re taking to rebuild it.

For instance, if your score takes a hit after a single missed payment, it might not take too long to rebuild it by bringing your account current and continuing to make on-time payments. However, if you miss payments on multiple accounts and you fall over 90 days behind before catching up, it will likely take longer to recover. This effect can be even more exaggerated if your late payments result in repossession or foreclosure.

In either case, the impact of negative marks will diminish over time. Most negative marks will also fall off your credit reports after seven years and stop impacting your scores at that point if not sooner. Chapter 7 bankruptcies can stay for up to 10 years, however.

In addition to letting time help you rebuild your scores, you can follow the steps above to proactively add positive information to your credit reports.

Also Check: Usaa Credit Card Credit Score

Add To Your Credit Mix

An additional credit account in good standing may help your credit, particularly if it is a type of credit you don’t already have.

If you have only credit cards, consider getting a loan a can be a low-cost option. Check that the loan you’re considering adding reports to all three credit bureaus.

If you have only loans or have few credit cards, a new credit card may help. In addition to improving credit mix, it can reduce your overall credit utilization by providing more available credit.

Impact: Varies. Opening a loan account is likeliest to help someone with only credit cards and vice versa. And there’s more potential gain for people with few accounts or short credit histories.

Time commitment: Medium. Consider whether the time spent researching providers and applying is worth the potential lift to your score. Weigh what you’d pay in interest and fees, too, if you’re getting a loan or card strictly to improve your credit.

How fast it could work: Fast. As soon as the new account’s activity is reported to the credit bureaus, it can start to benefit you.

Someone with a low score is better positioned to quickly make gains than someone with a strong credit history. Paying bills on time and using less of your available credit limit on cards can raise your credit in as little as 30 days.

Know What Goes Into A Good Credit Score

Five key pieces of information are used to calculate your credit scoreyour payment history, credit utilization ratio, credit age, mix of credit, and new credit.

Unfortunately, the credit scoring system does not always accurately portray a persons lending risk, especially for those with lower incomes, many of whom are people of color. Current scoring models have been criticized for perpetuating bias inherent in the financial system by, for instance, incorporating mortgage payments but typically not rent, which works against racial minorities who have not been able to enjoy homeownership at the same rate as White people because of redlining.

On the bright side, there are now services like Experian Boost, which allow consumers to have utility payments recorded on their credit reports. Other services can get your rent payments onto your credit report. But lenders might use a credit score that doesnt work with these services, so you still need to pay attention to the way traditional scoring systems work in order to maintain your good credit score.

Recommended Reading: Does Stoneberry Report To Credit Bureau

How To Build A Good Credit Score

Building a good credit score comes down to using credit responsibly over time. The same is true when it comes to maintaining a good credit score. Here are five things the CFPB says you can do:

When it comes to monitoring your credit, makes it easy. Itâs free for everyoneânot just Capital One customers. And checking wonât hurt your scoreâa major plus if youâre working to improve a bad credit scoreâso you can check it as often as you like.

Learn more about Capital Oneâs response to COVID-19 and resources available to customers. For information about COVID-19, head over to the Centers for Disease Control and Prevention.

Pay Credit Card Balances Strategically

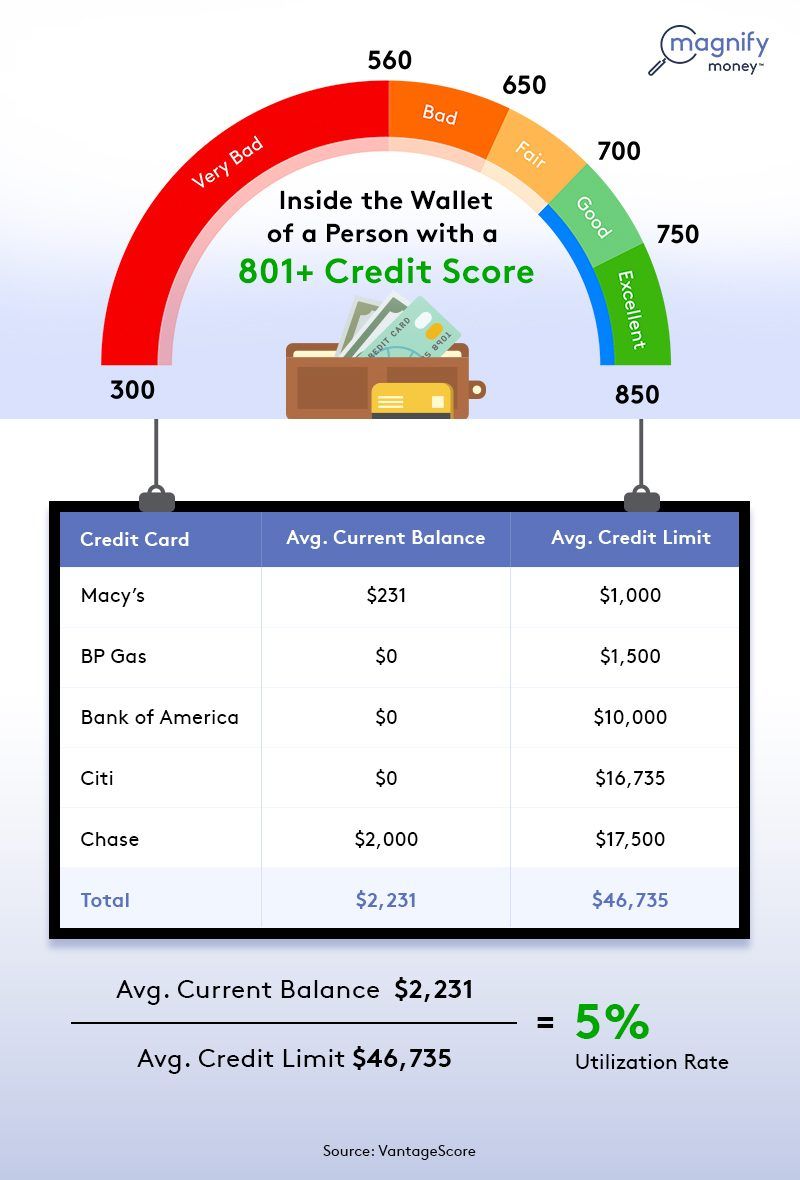

The portion of your credit limits you’re using at any given time is called your . A good guideline: Use less than 30% of your limit on any card, and lower is better. The highest scorers use less than 7%.

You want to make sure your balance is low when the card issuer reports it to the credit bureaus, because that’s what is used in calculating your score. A simple way to do that is to pay down the balance before the billing cycle ends or to pay several times throughout the month to always keep your balance low.

Impact: Highly influential. Your credit utilization is the second-biggest factor in your credit score the biggest factor is paying on time.

Time commitment: Low to medium. Set calendar reminders to log in and make payments. You may also be able to add alerts on your credit card accounts to let you know when your balance hits a set amount.

How fast it could work: Fast. As soon as your credit card reports a lower balance to the credit bureaus, that lower utilization will be used in calculating your score.

Recommended Reading: Sprint Collections Agency

How Is Your Credit Score Calculated

A variety of factors are taken into consideration when calculating your credit score. The most popular criteria as utilized by FICO are:

A. Payment history: This makes up 35% of your credit score and is the most important factor influencing your score.

B. The amount owed: This makes up about 30% of your credit score.

C. Length of credit history: The longer this is, the better. It makes up about 15% of your credit score.

D. New credit history: The recent activity on your credit histories, such as new accounts and inquiries account for approximately 10% of your credit score.

E. Types of Credit: The different types of credit accounts you have opened make up the remaining 10% of your credit score.

How Do I Get My Credit Score Up 100 Points In One Month

Increasing your credit score by 100 points in a single month is almost impossible, especially if youre starting from nothing. However, if you have a significant mistake on your credit report, like a default that never happened or a credit card that doesnt belong to you, removing it can boost your score significantly.

Also Check: What Is Coaf On Credit Report

Fraud Scoring As Well As Credit Scoring Can Cause Rejection

When you apply for a product, it isn’t just a case of assessing whether you’re desirable, but also checking the application is legitimate. So, as well as the credit reference agencies, lenders also use completely separate anti-fraud agencies to try to weed out problems. For more information on ID fraud protection, see our Free ID Fraud Help guide, but here is how the two big agencies work:

National Hunter

This rarely mentioned system is much less factual, and so is prone to greater errors. However, it’s used by almost all major banks and building societies, receiving 96,000 applications a day, and has a real impact.

CIFAS: Lists confirmed past fraud

It is simply a record of known fraud, so if you’re on there, in general, you should know about it. It’s also the organisation to speak to if you think you’ve been a victim of ID fraud. Worryingly, any fraud committed at your address in the past could appear on your CIFAS file, even if it was nothing to do with you.

Limit Your Number Of Credit Applications Or Credit Checks

Its normal and expected that you’ll apply for credit from time to time. When lenders and others ask a credit bureau for your credit report, its recorded as an inquiry. Inquiries are also known as credit checks.

If there are too many credit checks in your credit report, lenders may think that youre:

- urgently seeking credit

- trying to live beyond your means

Also Check: How Long Does A Dismissed Bankruptcy Stay On Credit

Do Not Remove Old Accounts From Report

Some people tend to remove old accounts or deactivated accounts or accounts with negative history from their credit report to make it look good. Some even try to get their old debts removed from their reports once they pay them. This may not be a very smart thing to do. Agreed that negative things are bad for the score, but they are automatically removed from the credit report after a period of time. Getting old accounts removed may harm your score a lot as they may have a good repayment history. Also, if you have paid your debts, then you should keep them in your report as they will improve your score and also show your creditworthiness.

How To Obtain Your Free Credit Score And Report

While you can obtain a credit score for about $20 from Equifax and TransUnion, theres no need to do so. You can now obtain your free score and report from companies like:

In Canada:

Borrowell: Get a free credit score and report . It is updated weekly.

: They give you a free credit score and report .

United States:

Checking your credit score does not impact it in any way.

If you prefer, you are entitled to one free credit report every year from TransUnion and Equifax. You can obtain them as follows:

TransUnion: Online, via mail, in-person, or by phone at 1-800-663-9980

Equifax: In person, via mail, or by phone at 1-800-465-7166

You May Like: Syncb/ppc On Credit Report

Watch Your Credit Report

Just because you do everything right with your credit doesnt mean everyone else will. Errors could end up on your leading to a drop in your credit score.

Identity theft and credit card fraud also can lead to inaccurate information on your credit report. Checking your credit report throughout the year helps you detect these mistakes sooner so you can correct them and maintain a good credit score.

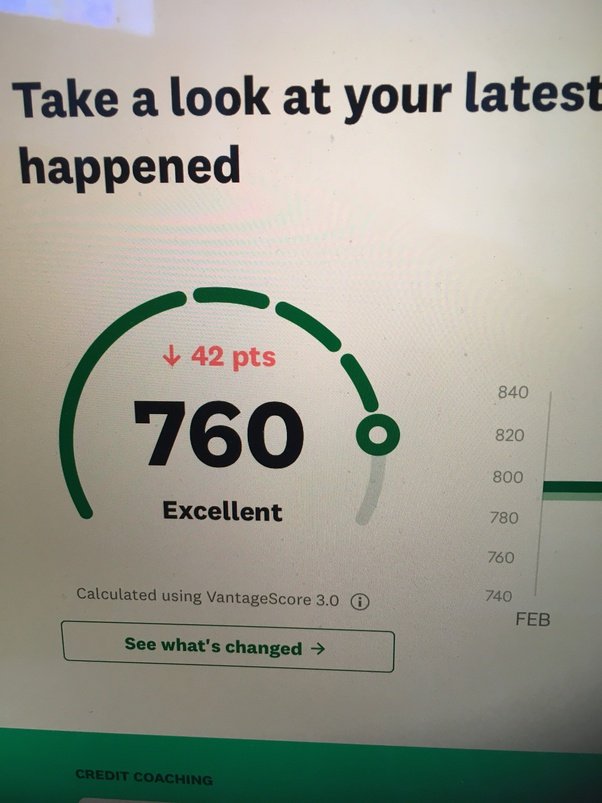

Track Your Credit Score

When you monitor your credit score, you can intervene quickly if it drops. You can address factors that influence your score, such as high balances, late payments or too many recent hard inquiries. There are many ways to check and monitor your credit score for free, including through your current credit card issuer or bank, or through Experian.

Also Check: Centurylink Collections Agency

Bonus Tip: Monitor Your Credit Report And Score Regularly

Building a great credit score takes time. The longer you keep using credit responsibly and paying on time, the more your score will improve. Itâs that simple.

Itâs also worth checking your credit report regularly. That way, you can stay on top of your score and fix any problems before they can have a negative impact. It only takes five minutes a month with our handy checklist.

Limit New Lines Of Credit

When you apply for a new credit card or loan, a hard inquiry will appear on your credit report, possibly leading to a brief dip in your score. Plan to apply only for the credit you truly need, after you’ve done enough research to understand which accounts you’ll likely qualify forand avoid new loans you may have difficulty payingso you can help your credit improve.

Also Check: Carmax Bad Credit Loans

How Long Will A Bankruptcy Filing Remain On A Credit Report

Once you file bankruptcy, it will appear on at least one credit report from the major credit bureaus. Information on your bankruptcy will appear within the account information section and under the public records section.

A Chapter 13 bankruptcy will remain on your credit report for seven years from the date of filing. At the end of seven years, information on your bankruptcy will fall off, and your credit score could increase. Unfortunately, you cannot remove a Chapter 13 bankruptcy from your credit report early. It is only possible to remove incorrect information from a credit report, such as a wrongful bankruptcy report.

How Do I Get The Highest Credit Score

While it is theoretically possible to achieve a perfect 850 score, statistically it probably wont happen. In fact, about 1% of all consumers will ever see an 850, and if they do, they probably wont see it for long, as FICO scores are constantly recalculated by the credit bureaus.

And its not like you can know with absolute certainty what is affecting your credit score. FICO says 35% of your score derives from your payment history and 30% from the amount you owe . Length of credit history counts for 15%, and a mix of accounts and new credit inquiries are factored in at 10% each. Of course, in actually calculating the score, each of these categories is broken down even further, and FICO doesnt disclose how that works.

The credit bureaus that create credit scores may also change how they make their calculationssometimes for your benefit. Changes were made in 2014 and 2017, for example, to reduce the weight of medical bills, tax liens, and civil judgments. However, changes made in January 2020 for FICO 10 involving trending data, credit card debt, personal loans, and delinquencies may make getting a higher score more difficult.

Don’t Miss: Does Affirm Report To Credit Bureau

Keep Paying Old Bills

That old student loan may feel like an albatross around the neck, but years of on-time payments and the age of the account will boost your score. An account in good standing factors into your score until 10 years after it’s paid off and closed, so dont miss payments or pay late.

Pay off collection accounts, too, since the newest version of the FICO score ignores paid collections .

Check Your Credit Reports

The three credit reporting agencies, active in many countries, are Experian, Equifax, and TransUnion. Theyre the companies that keep detailed records of your credit and make it available to people that request it.

Thanks to the Fair and Accurate Credit Transactions Act, all three companies are required to provide U.S. residents with a copy of their credit report if requested, once per 12 months.

They do so through the website AnnualCreditReport.com thats the only source for free credit reports authorized by this Act. They dont show you the scores for free, but they show you their records of your payment history, so you can check to make sure there are no mistakes. The website lets you check your detailed report one time from each of the three credit rating agencies per year.

If youre planning on making a big purchase, or if you are fixing severely bad credit or found some mistakes in one report, then you might want to check all three at once. On the other hand, if youre more in maintenance mode and just want to check your credit regularly for errors, then the optimal strategy is to check your report from one of the agencies every 4 months. That way, you can spread your three free reports out evenly over the year for the most up-to-date info.

You can also pay a fee to receive more information on that site, like the actual score, but there are better free ways to do that:

Read Also: Does Paypal Credit Show On Credit Report