What Credit Score Do You Need To Buy A House In 2021

Credit scores can be a confusing topic for even the most financially savvy consumers. Most people understand that a good credit score boosts your chances of qualifying for a mortgage because it shows the lender youre likely to repay your loan on time.

But do you know the minimum credit score you need to qualify for a mortgage and buy a house? And did you know that this minimum will vary depending on what type of mortgage you are seeking?

The Importance Of FICO®: One of the most common scores used by mortgage lenders to determine credit worthiness is the FICO® Score . FICO® Scores help lenders calculate the interest rates and fees youll pay to get your mortgage.

While your FICO® Score plays a big role in the mortgage process, lenders do look at several factors, including your income, property type, assets and debt levels, to determine whether to approve you for a loan. Because of this, there isnt an exact credit score you need to qualify.

However, the following guidelines can help determine if youre on the right track.

You May Like: Does Paypal Credit Report To Credit Bureaus

First Lets Talk About Credit Scores

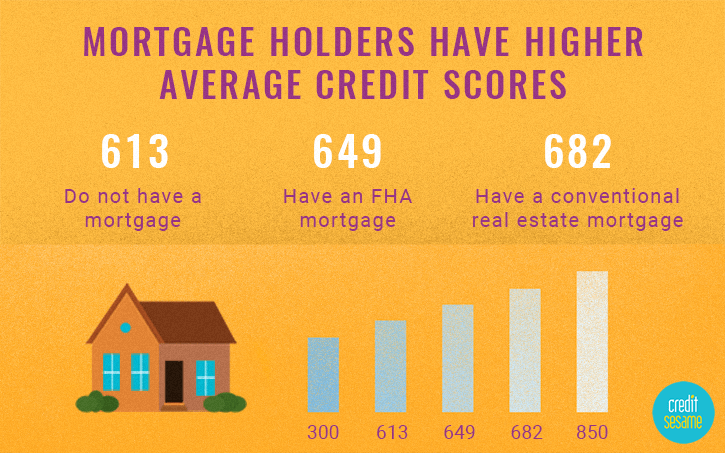

Your credit score can range from 300 at the low end to 850 at the high end. A score of 740 or above is generally considered very good, but you dont need that score or above to buy a home. Credit scores are maintained by the national credit bureaus and include debt like credit cards, auto loans or student loans.

Your score is influenced by many factors, but the two biggest are whether you pay your bills on time and how much debt you owe. Having a credit score based on these factors gives lenders a quick way to see if youre likely to pay your future bills like your mortgage, for example.

Know Your Breakeven Point

An important calculation in the decision to refinance is the breakeven point: the point at which the costs of refinancing have been covered by your monthly savings. After that point, your monthly savings are completely yours. For example, if your refinance costs you $2,000 and you are saving $100 per month over your previous loan, it will take 20 months to recoup your costs. If you intend to move or sell your home within two years, then a refinance under this scenario may not make sense.

Also Check: What Credit Score Do You Need For An Apple Card

Individual Circumstances Are More Important Than Current Mortgage Rates

Lea Uradu, J.D. is graduate of the University of Maryland School of Law, a Maryland State Registered Tax Preparer, State Certified Notary Public, Certified VITA Tax Preparer, IRS Annual Filing Season Program Participant, Tax Writer, and Founder of L.A.W. Tax Resolution Services. Lea has worked with hundreds of federal individual and expat tax clients.

Kirsten Rohrs Schmitt is an accomplished professional editor, writer, proofreader, and fact-checker. She has expertise in finance, investing, real estate, and world history. Throughout her career, she has written and edited content for numerous consumer magazines and websites, crafted resumes and social media content for business owners, and created collateral for academia and nonprofits. Kirsten is also the founder and director of Your Best Edit find her on LinkedIn and Facebook.

While low mortgage interest rates may incentivize many homeowners to restructure their finances, the decision to refinance your mortgage should be made based on your personal financial circumstances. This weeks mortgage rates should not be the deciding factor in whether or not you refinance.

There are nine key considerations to review before applying for a home refinance.

How To Improve Your Credit Score Before Applying To Refinance Your Home

The most important thing to do is to understand how your credit score works. Once you have that down, you can take the necessary steps to improve your score. And because your recent credit history is weighted more heavily, you should ensure you have several clean months of credit history before applying for a refinancing loan.

Also Check: Approval Odds For Care Credit

Why Should I Refinance My House

Before you can answer the question of what credit score you need to refinance your home, you should know why you might want to refinance in the first place.

In laymans terms, refinancing a mortgage means taking out a second loan worth the balance of the first loan but with different terms, using it to pay off the first one, and then proceeding to pay off the second one. In other words, if you need to change the terms of your mortgage arrangement in any significant way, refinancing your house is commonly the best way to do it.

Refinancing a home can be part of a debt settlement, but its more commonly done for one of three reasons:

While the first two types of refinancing arrangements dont usually differ much in terms of credit score, the third is an exception. If you want to do a cash-out refinance, the credit union or other lending institution will typically prefer a higher credit rating than you would need for the other types.

If you want to know how much youd be paying every month after a refinance, use a handyrefinance payment calculator like the one on Solaritys refinance page.

Loan Master Dickson Tn

1. LoanMaster in Dickson, TN The Guaranteed Loans! Find complete information about LoanMaster in Dickson 1828 TN-46, Dickson, TN 37055, United States: photos, phone, address, E-mail, working hours! Get directions, reviews and information for Loanmaster in Dickson, TN. Loanmaster. 1828 Highway 46 S, Dickson, TN 37055. 441-3422.

Recommended Reading: How To Check Credit Score With Itin Number

How To Refinance Your Mortgage With Bad Credit

Jun 4, 2021 But you still have to find FHA-approved lenders to access these loans, and those lenders can add extra minimums on top of what the FHA requires.

Sep 8, 2020 There are two types of FHA streamline refinance loans: credit-qualifying and non-credit-qualifying. The credit-qualifying option requires a

Mortgage In Good Standing Refinance Requirements

This requirement is nearuniversal. Youre highly unlikely to get approved for a refinance if you still owe late payments on your original mortgage.

Rules vary by mortgage program and lender. But just about everyone has a requirement that your existing mortgage is current. And some may block applications from homeowners who have recent late payments .

Streamline Refinances

The Streamline Refinance program is available to homeowners with existing governmentbacked home loans including FHA, VA, and USDA loans.

Streamline Refinances are relatively quick, easy, and inexpensive compared to mainstream ones. And they usually have easier requirements for example, the lender might not check your credit or current employment.

But you must be current on your mortgage payments to qualify for a Streamline Refi.

Heres what two of the government agencies backing these mortgages say:

- The mortgage to be refinanced must be current . Federal Housing Administration

- Lenders must verify the mortgage was paid as agreed for 12 months prior to the refinance application. U.S. Department of Agriculture

VA Streamline exception?

The VA doesnt explicitly have a mortgageingoodstanding requirement in its rules for streamline refinances . But, even with one of these, youd be lucky to find a lender willing to ignore a delinquent mortgage statement.

You May Like: 830 Credit Score Mortgage Rate

How Your Credit Score Affects Your Mortgage

Your credit score can have a positive or negative impact on your mortgage. A high credit score will work in your favour, while a low score or no credit history will work against you. This is because your credit determines how much of a risk you are for defaulting on your mortgage loan.

If your credit score indicates that you dont have a lot of debt and make regular, timely payments, youll have a higher credit score and will be seen as low-risk. If you have lots of debt and pay your bills late, youll have a lower score and will be seen as high-risk.

Understandably, banks dont want to lend lots of money to someone they deem as potentially unlikely to pay it back. If they do, it will be at a much higher interest rate that reflects that risk. Those higher interest rates mean higher mortgage payments and a larger cost over time.

Should You Refinance Your Mortgage With Bad Credit

Even if you technically could refinance with a credit score in the 600s, whether or not you should is another matter. Someone with worse credit is also going to have a higher interest rate than someone with perfect credit, Goldberg says. If your credit is poor enough, you have to analyze the numbers to see if its worthwhile to proceed.

Figure out what you hope to accomplish by refinancing, whether its a lower monthly payment, changing your loan term, pulling equity from your home, or dropping your PMI . You should weigh the pros and cons of mortgage refinancing and feel certain about your employment situation before moving forward.

Read Also: Does Opensky Report To Credit Bureaus

Check Your Refinance Rates

All the rules laid out above might sound intimidating. But plenty of homeowners navigate the refinance process successfully. And many are eligible to refi, but dont know it yet.

Refinancing might be worth it even if you already refinanced in the past couple years.

Freddie Mac reports that out of all the homeowners who refinanced in 2020, 10 percent did so more than once in a 12month period.

So how scary can refinancing be if that many homeowners refinanced at least twice within one year? Not very.

The key is to know your loan options, shop around, and find the best rate to maximize your savings.

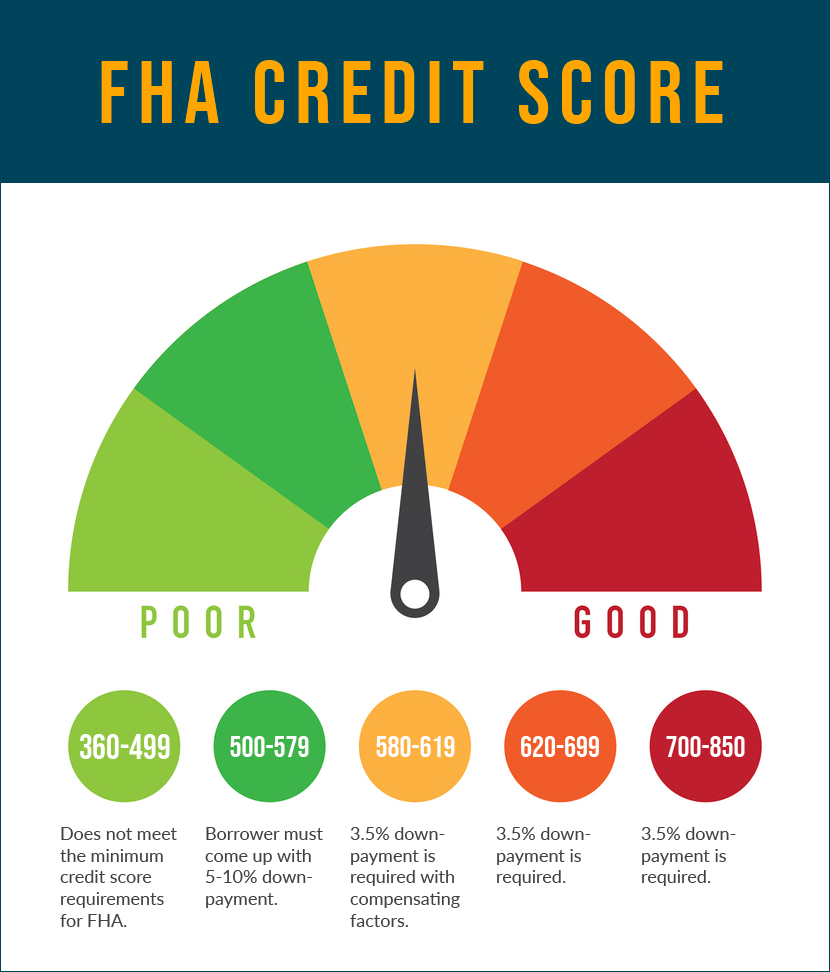

Minimum Credit Score Requirements

Youre getting a whole new mortgage when you refinance. And lenders will look at your credit score and credit history just as closely as when you last applied.

As with a home purchase loan, youll have an easier time qualifying for a refinance with a good credit score and clean credit report. A great score could even earn you a lower interest rate.

Again, theres an exception for most Streamline Refinances. Often, these require no credit checks.

If youve let your credit score slide since you became a homeowner, its a good idea to boost it before you apply for a refinance. Check out our Guide to improving your credit score for quick hits. Sometimes, even a small improvement can make a big difference to the rate you pay.

Don’t Miss: How To Remove A Repo From Credit Report

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our mortgage reporters and editors focus on the points consumers care about most the latest rates, the best lenders, navigating the homebuying process, refinancing your mortgage and more so you can feel confident when you make decisions as a homebuyer and a homeowner.

Minimum Credit Score Required For Mortgage Approval In 2022

Home \ Mortgage \ Minimum Credit Score Required For Mortgage Approval in 2022

Join millions of Canadians who have already trusted Loans Canada

Getting approved for a mortgage these days can be a real challenge, especially with housing prices constantly on the rise. In Toronto, for instance, youll be paying over $820,000 for a home, which is nearly $100K more than the average price the year before.

Unless youre rolling in cash, thats a lot of money to have to come up with in order to purchase a home. Moreover, a lot goes into getting a mortgage. Lenders look at a number of factors when theyre assessing a borrower for a mortgage such as a sizeable down payment, a good income and, of course, a favourable credit score.

A high credit score, in particular, will not only get you approved for the mortgage but a favourable interest rate as well. Being that credit scores are such a significant part of the lending process, its no wonder that we get so many inquiries about what qualifies as an acceptable score in terms of getting approved for a mortgage.

Also Check: What Is Cbna On A Credit Report

Options For Refinancing A Mortgage With Bad Credit

If your credit score falls under the 620 threshold, you may not be able to compare offers from multiple conventional lenders, but you still have options:

How Your Mortgage Rate Is Set

Interest rates are set partly based on your riskiness as a borrower. The riskier you are to a lender, the higher your interest rates will be. Mortgage lenders use credit scores to determine whether you qualify for the mortgage and to determine risk and the likelihood that you will default on your mortgage loan. The higher your credit score, the lower the risk that youll default on your loan, and the lower the interest rate youll qualify for.

A high credit score demonstrates responsibility with your previous credit obligations. Youve made your payments on time, youve kept your balances low, and youve avoided major credit blunders like debt collections and charge-offs.

A low credit score, on the other hand, is the result of falling behind on credit card payments, keeping high balances, and perhaps having major delinquencies on your credit record.

This chart illustrates the relationship between credit scores and interest rates, and how one impacts the other:

Also Check: Does Snap Report To Credit Bureaus

Better Rates If You Hire An Appraiser

Even if you do not need an appraisal, it may be in your best interest to get one. Borrowers with a high LTV have more refinancing products available to them, and you’ll save money if an independent appraisal confirms that your LTV is low enough to avoid paying mortgage insurance. An increase in your home’s value evidenced by a professional appraisal may also enable you to refinance to a loan with a better interest rate.

References

How Can I Check My Credit Score Before Applying For A Mortgage

Equifax and TransUnion are the two credit reporting bureaus in Canada. They both charge you to view your credit score. Free online alternatives are available, such as Credit Karma, Borrowell, and Mogo, as well as at some major banks. For example, RBC, CIBC, and BMO all allow you to view your credit score for free online.

Your credit report contains a list of inquiries made by lenders. TransUnion allows you to view your credit report for free once every month, whileEquifax Canadaalso allows you to request your credit report for free.

Also Check: Does Square Capital Report To Credit Bureaus

What If I Fall Short On Credit Requirements

Potential VA loan borrowers neednt abandon their dreams of homeownership due to a low credit score. The best feature of credit is its fluidity. Your credit changes constantly.

Improve your fiscal habits, and your credit score will gain positive momentum. But knowing what improvements to make can be tricky. Should you pay off high-interest debt? Should you cancel certain credit cards? How should you handle that bankruptcy looming over your credit report?

If youre considering a VA loan but need help navigating your credit options, get some free help from the Veterans United credit consultant team.

Our credit consultants work on behalf of service members who fall short of VA loan requirements. Working with a credit consultant is a no-cost process, but not necessarily an easy one. Improving your credit requires commitment and hard work. If youre ready to make the necessary changes to pursue a VA home loan, partner with a helpful advocate.

Dont Miss: What Credit Score Does Carmax Use

How Does Credit Score Affect Refinance Rates

Your credit score doesnt just impact your refinance approval. It also affects the interest rate lenders will offer you. Everything else being equal, a high score should earn you a lower rate while a bad credit score means youll pay more for your refinance loan.

You can use FICOs loan savings tool to give you a rough idea of just how much your credit score affects your mortgage rate and monthly payment. In turn, this will have a big impact on your total interest cost over the life of the loan.

We show one example below using a 30-year, fixed-rate mortgage with a $400,000 loan amount.

| $2,490 | $495,270 |

*Annual percentage rates reflect the nationwide average according to FICO.com on April 26, 2022. Interest rates change daily and rates shown here do not reflect the rate you will be offered.

Recommended Reading: Dla Meaning Credit Report