Ensuring An Accurate Credit Report

Your credit reports are the official place to confirm your credit score and complete history of credit activity, but even then, errors may abound both when youre requesting your reports, and afterward.

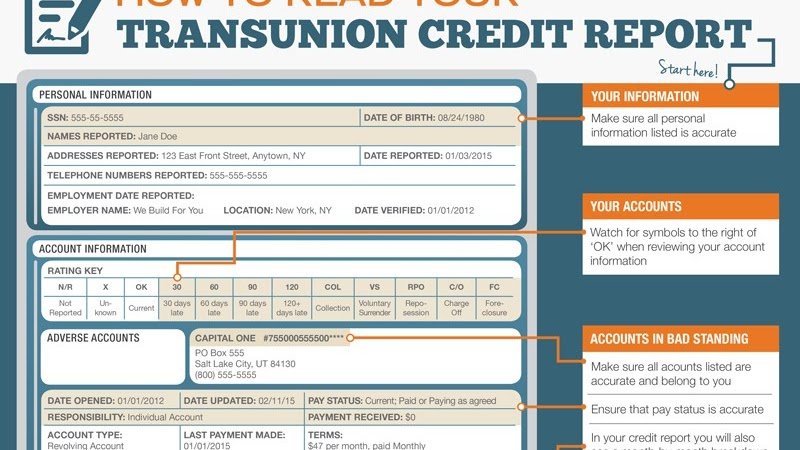

Double check your personal information. A misspelled word or an inverted number in your address or Social Security number could prevent you from accessing your report. Make sure all your personal information is correct before sending out your application.

Manage trick questions. There may be some deliberate trick questions during the verification process used by AnnualCreditReport to verify that you are actually you. They may ask if youve lived at any of the three listed addresses or had a car or student loan through a list of lenders. If none apply, remember to click none of the above. If youre unsure, its best to go back and confirm your own personal history, like where youve lived, if youve rented/owned, where youve worked, and whom youve had credit with, especially if the information is several years old and hard to remember.

Dont worry if you cant get copies of all three credit reports just yet. But if youre looking for credit through a certain bank, request the credit report from the reporting agency they tend to use most often.

Heres what to look for:

Follow these links to each credit bureaus credit report dispute/investigation process:

Do Any Lenders Use Equifax

As a result, PenFed Credit Union only uses Equifax credit data for its lending services. Credit bureaus that you will follow generally arent able to tell you in advance how they plan to treat you. A lender may pull your credit report from two or even all of the major credit bureaus in some instances.

Increase Your Available Credit Limit

Increasing your credit limit will reflect on your credit file and improve your credit score as it shows lenders are willing to trust you with more money as well as reducing your current credit utilization .

You can ask your current card provider to increase your credit limit or let you know if you will be eligible for a credit limit. Also ask if they intend to run a hard credit search on you and do not consent to this unless they will pre-approve you for a credit limit increase.

Recommended Reading: What Company Is Syncb Ppc

How Do You Check Your Credit Report

On AnnualCreditReport.com you are entitled to a free annual credit report from each of the three credit reporting agencies. These agencies include Equifax, Experian, and TransUnion.

Due to the COVID-19 pandemic, many people are experiencing financial hardships. To remain in control of your finances, you can get free credit reports every week through April 2022.

Request all three reports at once or one at a time. Learn about other situations when you can request a free credit report.

Request Your Free Credit Report:

By Mail: Complete the Annual Credit Report Request Form and mail it to:

Annual Credit Report Request Service

PO Box 105281

Atlanta, GA 30348-5281

If Your Request for a Free Credit Report is Denied:

Contact the CRA directly to try to resolve the issue. The CRA should tell you the reason they denied your request and explain what to do next. Often, you will only need to provide information that was missing or incorrect on your application for a free credit report.

If you can’t resolve your dispute with the CRA, contact the Consumer Financial Protection Bureau .

Most Lending Institutions Require At Least A 600 Credit Score To Approve An Auto Loan Without A Downpayment

However, it is possible to purchase a vehicle with a score a score as low as 400. There are a lot of factors that determine your loan eligibility and what interest rate you are eligible for. These factors include:

- Are you paying money up-front. How much is the downpayment?

- Have you had past auto loans and did you pay them well?

- How much of a percieved risk is the bank taking to extend you this loan?

Read Also: Protectmyid Deluxe Reviews

Re: Who Uses Transunion

I’m in Oregon and Chase used TU – Subaru uses Chase.

What I did was call around all the dealers, asked to talk to the Finance Manager and asked which report they pulled, and whether they used regular FICO or auto-enhanced FICO.

My TU was WAYYY higher, and somehow, by some miraculous occurance, the dealer talked the local credit union into going w/ my TU score even though they use EQ!

Remove Negative Financial Links

You should check your credit file for financial links that you dont recognise. Some financial links can reduce your credit file as this might mean your credit score is going down due to someone elses bad credit behaviour.

Any financial links which seem out of the blue can be removed from your credit file. Financial links can be generated by just sharing apartments with someone else, getting a loan with someone else etc. You should ask the credit bureaus to correct this.As you remove these negative financial links your credit score should improve.

Read Also: What Do I Need To Become A Mortgage Broker

Read Also: Synch Ppc

Why Does This Matter To Consumers

If it were up to a credit card applicant to decide, they obviously would want a card issuer to pull a report that contains the most favorable information most notably their credit score.

However, an applicant has no say in the matter. Therefore, a card issuer could pull your report from Experian, for example, and it shows a credit score of 680, while your Equifax report puts your score at 700 and your TransUnion report puts it at 710.

As such, the Experian report indicating a credit score of 680 might lead to less desirable terms, such as a higher APR for a credit card.

Ted Rossman, industry analyst for CreditCards.com, says which credit bureau is used also might come into play if youve set up a credit freeze with one bureau but not the two others.

Furthermore, he says, one or more credit bureaus might supply inaccurate information such as a late payment on a credit card account when you actually had no late payments that could hinder your ability to get credit.

See related: How to dispute an error in your Experian credit report

Fraud Alerts And Credit Freezes

You can also reach out to any of the CRAs to place a fraud alert or credit freeze on your credit report if you have reason to believe that you’re a victim of identity theft. A credit freeze blocks access to your report, so you can’t apply for credit if you’ve put one in place. This service is often free, and you can lift the freeze at any time.

Placing a fraud alert works in much the same way, and it stays in effect for one year. An alert is always free, but you might have to pay to place a credit freeze in some states. It’s a good idea to freeze your account with all three major credit bureaus if you think there’s a problem.

Read Also: Aargon Collection Agency Bbb

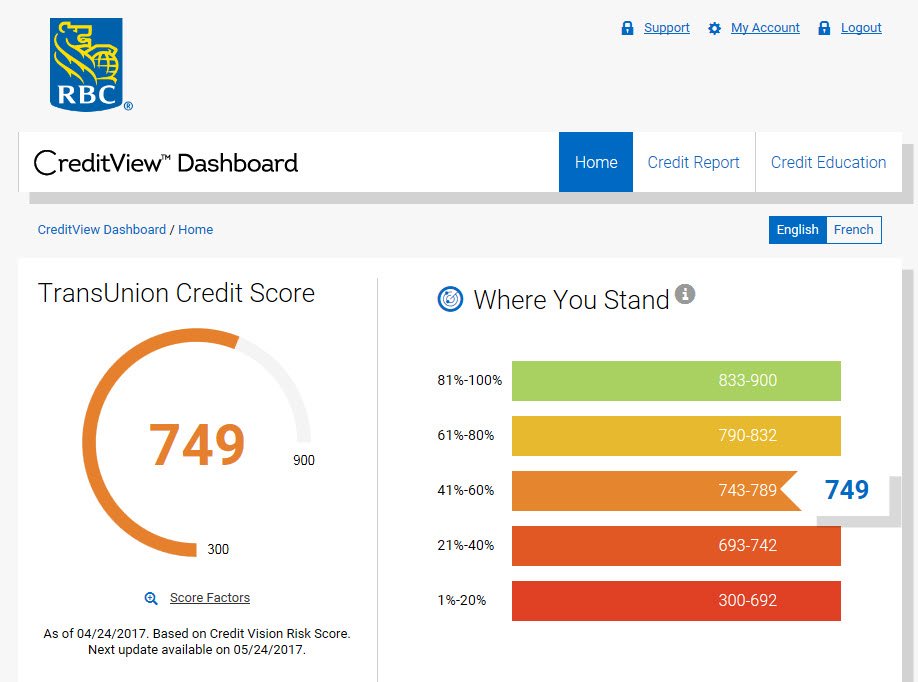

Checking Your Credit Score

For ongoing credit monitoring, free scores like those from Credit Karma, Credit Sesame, and WalletHub are useful for seeing where your credit stands.

Sometimes, your credit card issuer will also provide a free copy of your FICO score with your monthly billing statement. Make sure to check before purchasing a credit score.

If youre preparing to apply for a loan in the next several months, its worth buying a FICO Score 1B Report, or the ongoing monitoring product. A one-time, three-bureau report is currently priced at $59.85 from myFICO. Purchasing directly from FICO gives you the option to look at the scores your auto lender is most likely to receive.

Doing research before you go car shopping can help you optimize your credit score before applying for an auto loan, and improve your overall understanding of the complex variables in the loan approval process. Above all, you should ensure that the information in your credit report is verifiable and accurate, and dispute any errors you find. If youre diligent about building and maintaining your credit, your report will show that you have excellent standing, regardless of what scoring model an auto lender might choose.

You Are Leaving The Wells Fargo Website

You are leaving wellsfargo.com and entering a website that Wells Fargo does not control. Wells Fargo has provided this link for your convenience, but does not endorse and is not responsible for the content, links, privacy policy, or security policy of this website.

Do you know the difference between your credit report and your credit score? It may be easy to see these two related items as one and the same. However, if you take a closer look, you may start to understand some key differences between the two.

Also Check: Does Capital One Report Authorized Users To Credit Bureaus

Know Your Credit Scores Long Before Applying For A Mortgage

- Its very important to check all 3 of your credit scores

- 3-6 months before you apply for a home loan

- To know exactly where you stand credit-wise

- And to give yourself time to fix any errors/problems that come up

Before you actually head out to get a mortgage, its good practice to view your credit scores long before you apply.

Im talking several months in advance because any necessary credit score changes/improvements take time. Potentially a lot of time.

For example, any mistakes holding your credit score down may take months to get cleared up.

And you wont want to leave anything to chance. Yes, the credit bureaus are bureaucratic, so nothing happens all that quickly.

You May Like: How To Modify Mortgage Loan

What Are Older Fico Models

FICO 8 and 9 arent the only versions in use. Some lenders and industries use older versions like FICO 2, 4, and 5. In fact, these are still used by the mortgage industry when assessing creditworthiness for new mortgages and deciding on interest rates.

FICO 2, 4, and 5 are very similar. The main differences between the three is that 2, 4,and 5 use data from Experian, TransUnion, and Equifax respectively. Mortgage lenders pull one of each and compile the reports in a document called a Residential Mortgage Credit Report. Duplicate data is screened and removed, and the middle score of the three is picked to represent your worthiness to pay back the mortgage.

FICO 8 and 9 use data from a single credit bureau, so using FICO 2, 4, and 5 together gives mortgage lenders a more complete view of your creditworthiness because they can see the history of every account youve opened. This is especially helpful for mortgage lenders as many creditors donât report account history to all three credit bureaus.

Donât Miss: What Is The Federal Interest Rate For Mortgage

You May Like: Does Cashnetusa Report To Credit Bureau

When Are Single Pulls Favorable

Some situations are more favorable to single pulls. Lenders who process a large volume of near-instantaneous applications via automated systems will often use only one bureau, as the cost and time requirements can become prohibitive for multiple pulls. Likewise, smaller lending institutions may find it cost prohibitive to pull from multiple sources and might be more likely to use the information from just one credit report, reveals CNBC.

Open A New Credit Card Account

Opening a new credit account will be your next option if your current credit card provider will not increase your credit limit. You essentially accomplish the same things as your available credit limit increases.

You must repay your balances on your credit card account every month and avoid using over 30% of your available credit. This is a good option if you want to improve your credit score.

Don’t Miss: How Long Repossession Stay On Credit Report

Get A Credit Strong Credit Builder Loan

One of the best ways to build payment history is to get a Credit Strong credit builder account. Credit Strong is part of an FDIC insured bank and offers credit builder loans. Credit builder loans are special types of loan accounts that build credit easily.

When you apply for a loan from Credit Strong, you can select the term of the loan and the amount of the monthly payment. Credit Strong does not immediately release the funds to you. Instead, the company places the money in a savings account for you.

As you make your monthly payments, it improves your credit by building your payment history. Credit Strong will report your payments to each credit bureau.

When you finish paying off the loan, Credit Strong will give you access to the savings account it established for you, making the program a sort of forced savings plan that also helps you build credit.

Ultimately, with interest and fees, youll pay a bit more for the loan than youll get back at the end, but this can still be a solid option for a borrower who wants to improve their credit while building savings.

Unlike some other credit builder loan providers, Credit Strong is highly flexible, letting you choose from a variety of payment plans. You can also cancel your plan at any time so you wont damage your credit by missing payments if you fall on hard times.

See the credit builder loan pricing and plans here.

Is 600 Transunion A Good Credit Score

There are various areas considered fair, ranging from a low of 580 to a high of 669. A score of 600 on the FICO scale means the person has a poor credit history. The Fair credit classification generally has negative aspects for lenders and they may reject credit applications by fair credit consumers.

Don’t Miss: How To Get Repossession Off Credit

List And Benefits Of Credit Cards Used By Transunion

TransUnion is one of the largest credit- reporting firms in the United States. Along with Equifax and Experian, it is one of three that provide such services to individuals and institutions. Each of these companies has an alternative credit review based on your FICO score. A MasterCard application can have one, two, or all three reviews.

Knowing which creditors use TransUnion data can put you in a better financial position. If you are someone whose FICO review comes from this company, you can apply for a MasterCard that only uses TransUnion for company endorsements, to give an example.

Youre probably wondering, Which credit cards only use TransUnion? The first thing you should know is that no card only uses TransUnion here, we will explain further below.

Do Credit Card Companies Use Fico Or Transunion

Each of the three major credit reporting bureaus collects your data independently and combines it with your own personal data, based on the reports available from Equifax, Experian, and TransUnion. It is not common for issuers of credit cards to use the same bureaus score. Several of the FICO scores will be comparable, except in most instances for the third score.

Read Also: What Credit Score Do You Need To Get Care Credit

How To See Your 3 Credit Reports

You have a right to view your credit reports and receive a free one from each of the major CRAs once a year. Visit AnnualCreditReport.com to make the request, or call 877-322-8228. You can also get a copy of your report at no charge if you’ve been turned down for credit, but you have to request it within 60 days of being declined.

Additional credit reports can be purchased directly from any of the CRAs at any time if you want to check where you stand more than once a year. Although they’re separate entities, Equifax and Experian offer credit reports that include some information from the three major CRAs in a single document.

Why Looking For Mortgage Lenders That Use Transunion Is Pointless

Looking for mortgage lenders that use only Transunion is essentially pointless.

Most mortgage lenders will use all three credit bureaus and looking for a particular mortgage lender who only uses Transunion will mean that you are marginalising yourself from a host of other mortgage lenders who use other credit bureaus and may offer you better mortgage rates.

The other reason why looking for only mortgage lenders who use Transunion is that all credit bureaus will usually hold similar data if not the same data and hence you may not find any advantage in looking for mortgage lenders who use only Transunion.

If you are adamant that looking for a mortgage lender who uses only Transunion will be beneficial to you then a mortgage broker could potentially help you in finding such a mortgage lender.

Don’t Miss: Credit Check Without Permission

Negative Information In A Credit Report

Negative information in a can include public records–tax liens, judgments, bankruptcies–that provide insight into your financial status and obligations. A credit reporting company generally can report most negative information for seven years.

Information about a lawsuit or a judgment against you can be reported for seven years or until the statute of limitations runs out, whichever is longer. Bankruptcies can be kept on your report for up to 10 years, and unpaid tax liens for 15 years.

What Is A Good Equifax Credit Score What Is A Bad Equifax Credit Score

Equifax scores range from 300 to 850, and are measured in increments. An excellent score is one that ranges between 800 and 850. Scores that range between 740 and 799 are considered very good. A good score is between 670 and 739, and a fair score from 580 to 669. Anything below 580 is a poor score and one you’ll want to work to repair before applying for most loans.

Many lenders are happy to work with consumers who boast scores of 670 and higher, considering them low-risk applicants. Applicants who fall within the fair-reporting range are subprime and may still be able to secure a loan but may pay higher interest fees as a result.

You May Like: Kroll Factual Data Complaints