Use Your Credit Cards Responsibly

Dont carry large balances month over month. If you can afford to, pay off your credit cards in full every month. Contrary to popular belief, you dont need to carry a balance over to maximize your benefit: you just need to use it and pay the payment when its due.

Your credit utilization ratio is what truly matters, which is equal to your balance divided by your available credit limit. Keep your credit utilization ratio below 30% if you can help it!

Read More:

Be Mindful Of Your Credit Utilization

Your is a measure of how much of your available credit youre using, and is calculated by dividing your total credit used by your total credit available. For instance, if you have $10,000 in available credit and have credit card balances of $4,000, your credit utilization rate is 40%.

In general, you should keep your credit utilization ratio below 30%. But if youre chasing an 850 credit score, you will want to keep it above 0% but below 10%.

S To Improve Your Credit Score Right Now

Having a solid credit score is more important than ever.

Since the start of the year, interest rates have increased substantially on all types of loan products from mortgages to , personal loans and student loans. The higher your credit score, the lower the interest rate you will qualify for when you take on new debt. Improving your credit score could make it possible to refinance debt at a lower rate. A lower interest rate means lower monthly payments.

If your credit score can use some work, the sooner you take steps to improve it the better. Building up your score takes time and patience, but is well worth the effort in the long run.

Follow these steps to get started on the path towards a better financial future.

Recommended Reading: Chase Sapphire Preferred Credit Score Requirement

How Can You Steer Your Credit Score Toward 850

Is it realistic to believe you can boost your credit score all the way up to 850?

Why not? After all, three million Americans have climbed the Mount Everest of credit score figures. If they can pull it off, why can’t you do the same? At the very least, you can take the steps to improve your score.

Actually, you can – if you apply these six steps with all diligence and persistence. If you can earn an “excellent” grade in each of the six categories, you can hit the magical 850 credit score mark.

Open A Secured Credit Card

![How to Get an 850 Credit Score [Infographic]](https://www.knowyourcreditscore.net/wp-content/uploads/how-to-get-an-850-credit-score-infographic-tradeline-supply-company.jpeg)

If you dont qualify for unsecured credit cards, then a secured card could be the way to go. Secured credit cards are backed by a cash deposit, so even borrowers with poor credit scores can get one. Through this card, youll be able to improve your credit score by proving your creditworthiness with on-time payments.

Also Check: How To Unlock My Experian Credit Report

And Do You Need A Good Credit Score

The highest credit score you can get is 850 and the lowest credit score is 300. Having an excellent score can help you negotiate a better deal with lenders or find another lender that will reward you for your good credit history.

Raising your credit score to a perfect score , however, will not happen overnight. It can take a while.

Follow these tips to get the best credit score possible.

In no particular order, this is how to raise your credit score to 850.

Explore Your Refinancing Options

Now may be a good time to refinance your car loan or your mortgage. Doing so can save you money in the long term and potentially help your credit by making it easier to keep on top of future payments.

Although it is possible to refinance when you have bad credit, youll reap much greater rewards with a top credit score. For example, youll get better interest rates, which will save you money and may allow you to pay off the loan quicker.

You May Like: How To Dispute Old Addresses On Credit Report

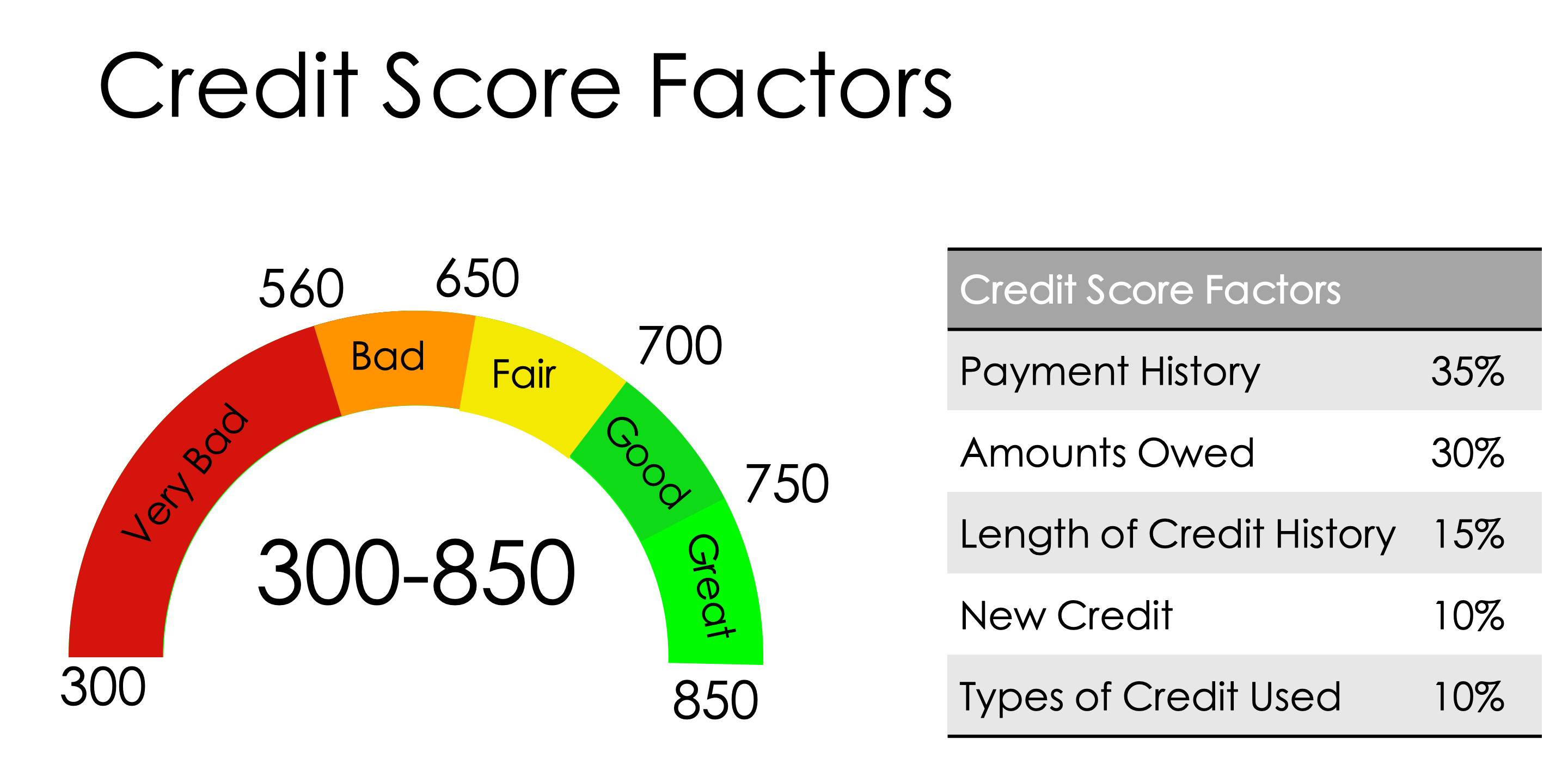

How Your Credit Score Is Calculated

Learn what your credit score is based on and the many ways you can improve it.

Your credit score is one of the most important measures of your creditworthiness. For your FICO® Credit Score, it’s a three digit number usually ranging between 300 to 850 and is based on metrics developed by Fair Isaac Corporation. The higher your score is, the less risky you are to lenders. By understanding what impacts your credit score, you can take steps to improve it.

What Is A Good Credit Score For A Mortgage

Your credit score arguably matters more on a mortgage application than with any other type of personal financing. With a mortgage, a good credit score might save you thousands of dollars in interest every year.

For example, say you have a FICO credit score around 640 when you apply for a $350,000 mortgage. FICOs Loan Savings Calculator estimated that in June 2020, your APR would be around 3.957% on a 30-year, fixed-rate loan. Your monthly payment would be $1,662, and youd pay $248,424 in interest over the life of your loan.

Now, imagine you work to improve your FICO Score to 680. With the higher score, you might qualify for an APR of 3.313%. Based on the lower rate, your monthly payment would be $1,535 for the same home. You would pay $202,726 in interest over your 30-year loan term. Because you improved your credit score from fair to good, you would save:

- $127 per month

- $1,524 per year

- $45,698 over the life of the loan

If youre aiming to qualify for a mortgage lenders lowest rates, that generally falls under a FICO Score of 760 or higher. Of course, getting a great mortgage rate requires more than just a brag-worthy credit score. But the three-digit numbers sold alongside your credit reports are a key factor that mortgage lenders consider when you apply for financing.

Read More:How Your Credit Score Affects Your Mortgage Rates

You May Like: Does Paypal Bill Me Later Report To Credit Bureau

Is A 830 Credit Score Good

A FICO® Score of 830 is well above the average credit score of 711. An 830 FICO® Score is nearly perfect. You still may be able to improve it a bit, but while it may be possible to achieve a higher numeric score, lenders are unlikely to see much difference between your score and those that are closer to 850.

Replies To How To Raise Your Credit Score To 850

Im really looking to raise credit limit to over 850.or more.and do the proper thing.that dave Ramsey always teaches. And also am going to listen to what Rachel cruze and also Chris hogan teaches. Ive literally listened to them and took all this on board what they have said and we are willing to do what they have been saying in there radio shows.myself and my husband are preparing to do what they are saying for people to do on the shows.which we love.we realise weve got work to do and are prepared to do whats asked.so we can get all of our lives sorted out.and also get all our finances sorted to and cant wait for that day to come when we can shout out that we are finally free.of all the crap people are having to endure through not being taught the proper ways while at either school or at home. As you have to work to your own devices and then learn the hard way.and now. This seems a very dear way of learning a lesson. That you pay hard and very dear for learning. Weve well and truly learned our lesson.and we are on our journey come hell or high water.as we are going to sort this right to the bitter end.and then save for future happiness and future and for retirement.and travelling as Ive got a hell of a lot to do and want to come to America when we can.but as soon as we can come we will be definitely coming over.

You May Like: What Credit Score Does Care Credit Use

Watch Your Credit Report And Resolve All Disputes

Creditors make mistakes, intentional and unintentional – all the time when reporting credit and payment history. It’s up to you to keep track of your credit report, although online credit reporting sites like Credit Karma and Experian can be a good help. Any error that isn’t resolved, and goes against you, will keep you short of an 850-credit score. Start by getting a free copy of your credit report either through annualcreditreport.com or from the credit reporting firms directly. Remember, the idea is to keep derogatory reports off your credit report to get to 850. If you see anything fishy, the solution may be to freeze your account.

Is 825 A Good Credit Score

A FICO® Score of 825 is well above the average credit score of 711. An 825 FICO® Score is nearly perfect. You still may be able to improve it a bit, but while it may be possible to achieve a higher numeric score, lenders are unlikely to see much difference between your score and those that are closer to 850.

Also Check: How To Unlock My Experian Credit Report

What Is The Highest Credit Score And How Do You Get It

There really isn’t a single “perfect” credit score, but there is a top-rated one – and here’s how to get it.

Is there such a thing as a perfect credit score?

The general consensus among financial experts is there “can” be a perfect credit score, although many of them don’t call it that.

That credit score is based on a formula created by and developed by FICO, and determined by the three national credit bureaus – Get Equifax Inc. Report , Experian and TransUnion – Get TransUnion Report ), who also hold and store personal credit scores.

The 850-credit score apex wasn’t always the gold standard for top credit scores.

The three credit scoring firms previously used a VantageScore credit calculation model that went as high as 990, but that model was adjusted to 850.

Meanwhile, lending and financial institutions like banks, credit unions and large insurance firms often rely on their own proprietary credit scoring systems, which differ from what companies like Experian and TransUnion are using.

Also, a credit score cannot be perfect, as any time an individual applies for credit, that credit score is dinged by a few points

Consequently, in technical terms, the 850 “perfect credit” score really doesn’t exist, although it does act as a great target for financial consumers and is considered by the three major scoring firms to be the highest credit score possible.

How To Increase Your Credit Score

Now that you know a little bit more about credit scores, you might be motivated to increase yours. Luckily, there are many ways that you can work to improve your score. Dont be discouraged if youre unable to increase your credit score overnight. It will take some time, but it will happen with intentional steps.

Recommended Reading: How Long Does Carmax Pre Approval Take

He Has Long Standing Credit History

The average age of Droske’s accounts is 10 years and 11 months on the report that CNBC Select reviewed. His oldest account is 34 years and 10 months old.

Length of credit history is a key factor FICO considers when determining your credit score, so it helps that Droske started using credit at a young age.

Droske learned early on about the impact of people’s credit on their purchases during his first job in finance at a car dealership’s lending department.

“I would see two people buying the same car on the same day, and one person gets 5% and the other person gets 19% based on credit,” Droske says. “That very quickly taught me the impact of credit, and then I was really curious about what made that number move.”

What Are The Benefits Of A High Credit Score

Here are the benefits of a high credit score.

- Lower interest rates on loans like mortgages, car loans, and personal loans. This lowers the overall cost of any loans you take. Learn how to prepare your credit for a mortgage.

- You are qualified for any that accepts your income level.

Aside from income, credit card issuers care greatly about FICO scores. A credit card issuer might reject your application for a credit card if your score is too low. Someone with an excellent credit score will not get rejected for a credit card, and some people may be able to get a card with no limit.

- You will get the most favorable terms, allowing you to stretch out your financing over a long period.

People with poor credit scores often cant get a mortgage for a long enough term for it to make financial sense.

- You will be able to personally guarantee initial business loans, and getting a loan from a bank will be very easy. Taking advantage of your ability to get more credit can give you a leg up financially in a business.

- A higher credit score can get you a higher credit limit than someone of a similar income with a lower credit score.

This can help you survive more difficult financial times by giving you access to credit when you need it.

Also, Read

You May Like: Does Speedy Cash Report To Credit Bureaus

Why You Should Be Pleased With An Exceptional Fico Score

Your 850 FICO® Score is nearly perfect and will be seen as a sign of near-flawless credit management. Your likelihood of defaulting on your bills will be considered extremely low, and you can expect lenders to offer you their best deals, including the lowest-available interest rates. Credit card issuers are also likely to offer you their most deluxe rewards cards and loyalty programs.

Late payments 30 days past due are rare among individuals with Exceptional credit scores. They appear on just 0% of the credit reports of people with FICO® Scores of 850.

An Exceptional credit score can mean opportunities to refinance older loans at more attractive interest, and excellent odds of approval for premium credit cards, auto loans and mortgages.

Is That High Score Worth The Effort

The good news is that many lenders consider 760 the cutoff for excellent credit. With a credit score above that number, you’ll receive most of the same benefits as someone with an 800 credit score. You’ll just have to work a little harder and wait a little longer if you also want the bragging rights.

Recommended Reading: Usaa Credit Repair

He Has No Missed Payments

Perhaps the most important factor in your credit score is on-time payments. In fact, both FICO and VantageScore list payment history as the top factor in calculating your , since paying your bills on time demonstrates that you pose a lower credit risk to lenders.

According to FICO, about 98% of “FICO High Achievers” have zero missed payments. And for the small 2% who do, the missed payment happened, on average, approximately four years ago.

So while missing a credit card payment can be easy to do, staying on top of your payments is the only way you will one day reach 850.

Of course, you don’t need to score an 850 to qualify for even the best rewards cards. With good or excellent credit, you could qualify for the American Express® Gold Card, which gives members 4X points per dollar on eligible purchases at restaurants, 4X points at U.S. supermarkets and 3X points on flights booked directly with airlines or on Amextravel.com. Terms apply.

Editor’s note: Scoring models have different algorithms, and credit scores can vary from day to day. This specific breakdown was based on Jim Droske’s credit report pulled on Dec. 18, 2018, which used the FICO 8 model. Jim Droske recently pulled a Wells Fargo credit rating using the FICO 9 on March 4, and it shows a perfect 850. But a credit report he pulled on March 11 using the FICO 8 model shows 842. A perfect credit score on one report doesn’t mean the same for every scoring model but it will probably be close.

Editorial Note:

Credit Tips From Someone With A Perfect Credit Score

by The Ascent Staff | Updated July 21, 2021 – First published on Nov. 20, 2018

It’s the Holy Grail of all credit scores: 850. On the widely used FICO credit score scale, approximately one in every 200 people achieves perfection, at least as of a 2010 estimate by the Fair Isaac Corporation, the company behind the aforementioned FICO score.

The perks of having a perfect or even excellent credit score are undeniable. It puts the ball completely in the corner of the consumer rather than the lender. You’ll often have lenders fighting for your business, and in nearly all instances, you’ll be offered the best interest rate by lenders, meaning you’ll have the lowest possible long-term mortgage and loan costs of any consumer.

So, what does it take to achieve this Holy Grail of credit scores? As one of the lucky 1-in-200 with a perfect credit score, I’d opine not all that much. Yes, it takes some dedication, but there’s no secret club or shortcuts to achieving credit score perfection.

Here are 10 I’ll share with you that should help in your pursuit of an 850 credit score.

Don’t Miss: Does Paypal Working Capital Report To Credit Bureaus

Mortgages You Can Get With An 850 Credit Score

Youre eligible for any type of standard mortgage if you have a credit score of 850. The following are all the mortgages you can get:

- FHA loan: Your credit score qualifies you for maximum financing on a mortgage backed by the Federal Housing Administration .

- Conventional mortgage: Youll meet the credit requirements for any conventional mortgage because your credit score is well above 620, which is the minimum score required by the Federal National Mortgage Association and Federal Home Loan Mortgage Corporation . 56

- VA loan: The US Department of Veteran Affairs backs VA home loans, and youll be eligible as long as youre a member of the military or a family member of someone who is.

- USDA loan: As long as you have two tradelines that have been open for 12 months in the past two years, youll meet the credit requirements for a USDA loan. 7

- Jumbo loan: Compared with conventional conforming mortgages, jumbo mortgages are larger, and they exceed the maximum value that Fannie Mae and Freddie Mac will accept when buying mortgages from lenders. Because jumbo mortgages come with a higher risk, lenders will only consider giving you one if your credit score is very good.