What Is My Real Credit Score

Companies can choose which score to purchase and use when reviewing applications and managing customers’ accounts, which is one reason there’s competition in the credit scoring world. With this in mind, there isn’t a single, “real” credit score.

For example, when you’re shopping for an auto loan, you may try to get offers from several lenders. One lender might use a FICO® Score 8, another a FICO® Auto Score 2, and a third a VantageScore 4.0. Your scores may vary, but each is very real in the sense that the lender is using it to determine if you qualify for a loan and the rates and terms to offer you.

Generally, you won’t know which of your three credit reports or which credit score a lender will use. However, because credit scores all rely on the same underlying data, building positive credit can help you get good credit scores regardless of the model. Conversely, negative items, such as late payments or a bankruptcy, could hurt all of your credit scores.

What Is A Good Credit Score In Canada For A Mortgage

Many young Canadians dream about purchasing a home. Apart from the down payment and closing costs, it is essential to find an affordable mortgage option. A good credit score allows you to access the best mortgage options at low-interest rates. Are you worried about finding a mortgage with a bad credit score? We will discuss the mortgage options available to borrowers with a bad credit score.

Nearly Perfect Credit: Credit Score Above 800

If your credit score is above 800, you have an exceptionally long credit history that is unmarred by late payments, collections accounts, liens, judgments, or bankruptcies. Not only do you have multiple credit accounts, but you have or have had experience with several different types of credit, such as a car loan, mortgage, or revolving lines of credit. You also likely have a high credit limit on your credit cards, mostly unused, which helps keep your credit utilization ratio low.

Simply stated, you are an A+ borrower in the eyes of all lenders big and small, and will have no trouble securing a loan of your choosing. Be prepared to receive the best interest rates, repayment terms, and lowest fees available.

Insurance companies love people like you because theyre confident youll pay your premiums on time and pose virtually no risk of insurance fraud. Plus, prospective employers love you because you have proven that personal and financial responsibility are of the utmost importance to you.

Recommended Reading: Does Speedy Cash Report To Credit Bureaus

Is Your Credit Score Good Enough To Buy A Car

In general, with a credit rating of 700 or higher, you can find cheap car loan terms. If your credit rating is lower, you will likely be offered a higher interest rate. And the lower it is, the more likely it will pay. If your credit score is very low, below 450, you will not be able to get a car loan.

How To Check Your Current Credit Score

Your credit score is easily the most influential factor for financial health, so make it a habit to check it regularly.

Here are a couple of methods:

Everyone in the US is also entitled to one free credit report every year from the three major credit reporting bureaus. The report doesnt calculate the score, but it is important to know what is in it and report any discrepancies.

Don’t Miss: Is Creditwise Accurate

What Is The Average Credit Score In Canada And How Do You Compare

What is the average credit score in Canada, and how do you rank among average Canadian credit scores? More so, what is a good credit score in Canada?

Often, Canadians want to know how they measure up to other people when it comes to their credit score. Is your credit score better than the average credit score? Maybe its worse?

First, let’s answer the question you are here to find out:

Cnbc Select Explains What Is A Good Credit Score How Good Credit Can Help You Tips On Getting A Good Credit Score And How To Get A Free Credit Score

Selects editorial team works independently to review financial products and write articles we think our readers will find useful. We may receive a commission when you click on links for products from our affiliate partners.

Credit scores range from 300 to 850. Those three digits might seem arbitrary, but they matter a lot. A good is key to qualifying for the best credit cards, mortgages and competitive loan rates.

When you apply for credit, the lender will review your to determine your eligibility based on this information, which includes that three-digit number known as your .

That magic number tells lenders your potential credit risk and ability to repay loans. Credit scores consider various factors, such as payment history and length of credit history from your current and past credit accounts.

There are two main credit scoring systems: FICO and VantageScore, and they aren’t created equal. FICO Scores are more valuable, as lenders pull your FICO Score in over 90% of U.S. lending decisions.

Below, CNBC Select explains what is a good for FICO and VantageScore, how good credit can help you, tips on getting a good credit score and how to check your score for free.

Don’t Miss: What Credit Score Do You Need For Amazon Prime Visa

How To Build A Good Credit Score

Building a good credit score comes down to using credit responsibly over time. The same is true when it comes to maintaining a good credit score. Here are five things the CFPB says you can do:

When it comes to monitoring your credit, makes it easy. Itâs free for everyoneânot just Capital One customers. And checking wonât hurt your scoreâa major plus if youâre working to improve a bad credit scoreâso you can check it as often as you like.

Learn more about Capital Oneâs response to COVID-19 and resources available to customers. For information about COVID-19, head over to the Centers for Disease Control and Prevention.

Average Credit Score In The Us Reaches A Record High

Despite the overall economic decline, the average FICO® Score in the U.S. climbed 1% in 2020, reaching a record score of 710, according to Experian data from Q3 2020. Compared with the average growth seen over the past 10 years, the increase in 2020 is unusually high.

| Snapshot: Consumer Credit and Debt |

|---|

| 2019 |

| +$248 |

For the past decade, the average FICO® Score has grown at around one point per year. Before 2020, the largest increase in points was a spike of 3.8 points between 2015 and 2016.

In 2020, 69% of Americans had a “good” credit score of 670 or above. That’s a 3 percentage point improvement since last year, and shows that the recent growth in scores is helping many Americans move their credit into favorable territory.

“Missed payments reported are down, consumer debt levels are decreasing and the significant steps taken by both the government stimulus spending and private sector lender payment accommodations to help consumers affected by COVID-19 are all contributing to this trend in average score,” says Tom Quinn, vice president of scores for FICO.

You May Like: How To Report A Death To Credit Bureaus

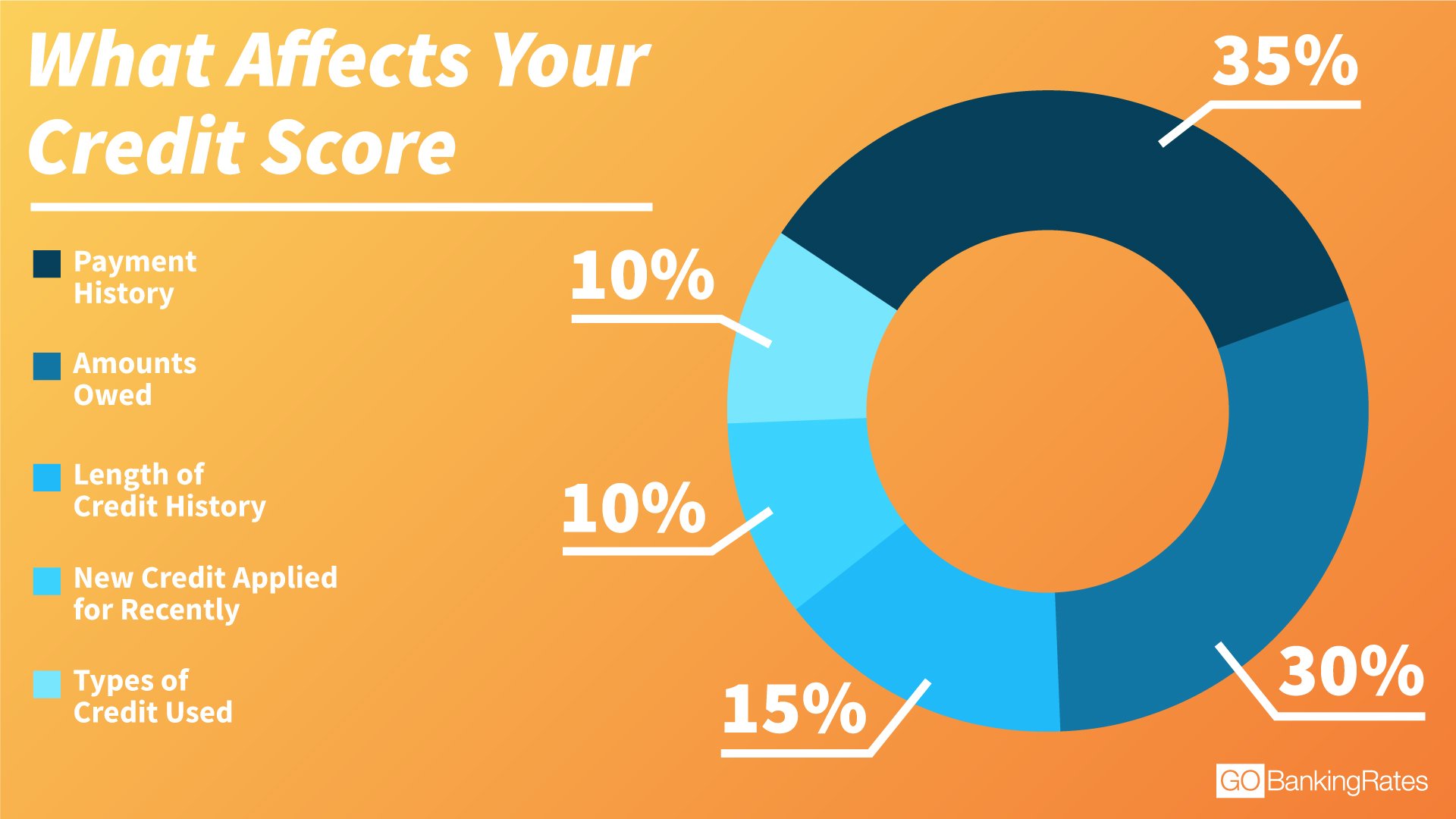

Factors Affecting Credit Ratings And Credit Scores

For individuals, a high numerical credit score from the credit-reporting agencies indicates a stronger credit profile and will generally result in lower interest rates charged by lenders. A number of factors are taken into account for an individuals credit score, some of which have greater weight than others. Details on each credit factor can be found in a .

These five factors are included and weighted to calculate a persons FICO credit score:

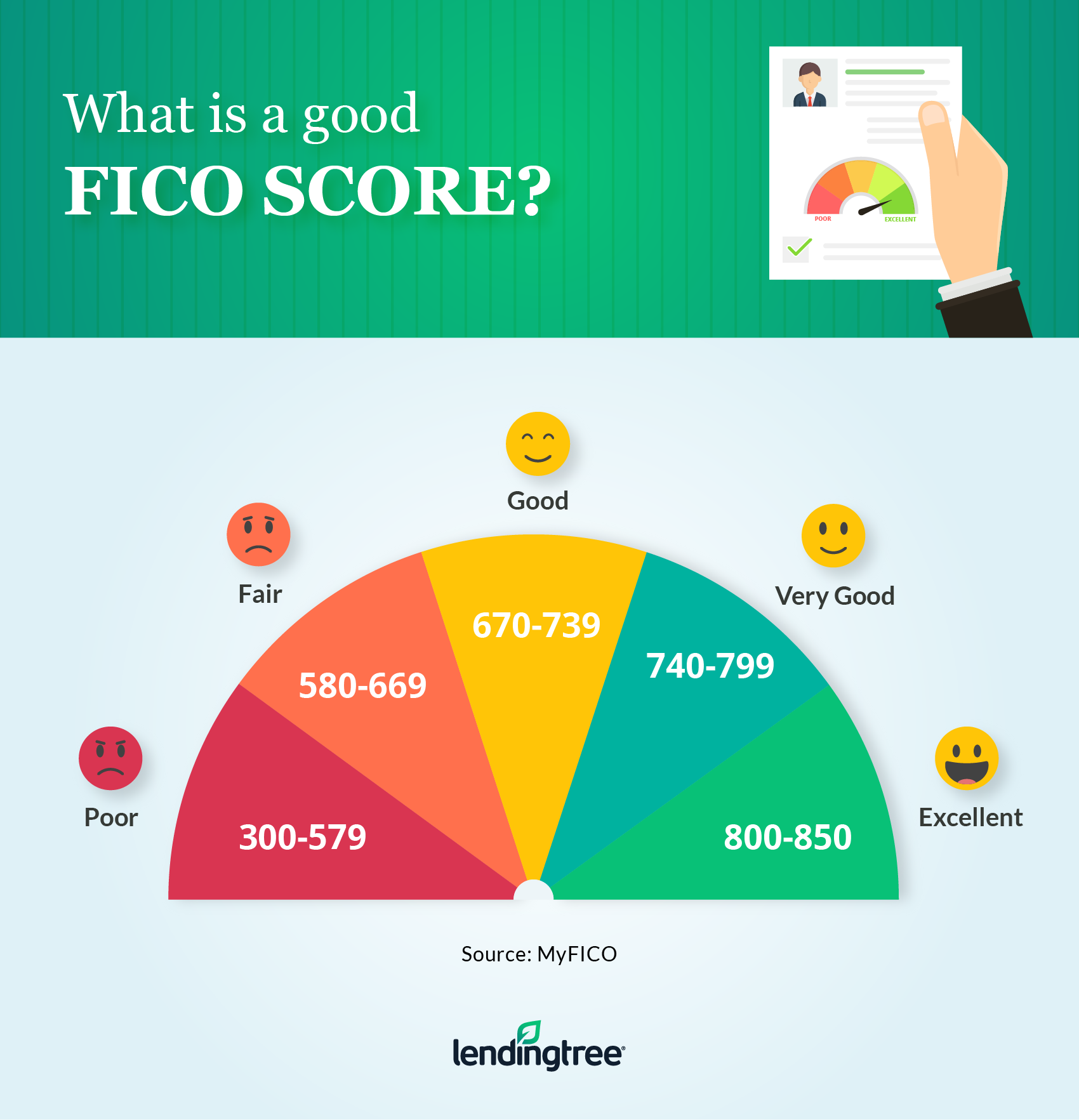

As noted above, FICO scores range from a low of 300 to a high of 850a perfect credit score that is achieved by only about 1% of the borrowing public. A very good credit score is generally one that is 740 or higher. This score will qualify a person for the best interest rates on a mortgage and the most favorable terms on other lines of credit.

With a credit score that falls between 580 and 740, financing for certain loans can often be secured but with interest rates rising as the credit score falls. People with credit scores below 580 may have trouble finding any type of legitimate credit.

FICO likes to see established accounts. Young people with several years’ worth of credit accounts and no new accounts that would lower the average account age can score higher than young people with too many accounts or those who have recently opened an account.

Importance Of Credit Ratings

Credit ratings for borrowers are based on substantial due diligence conducted by the rating agencies. Though a borrowing entity will strive to have the highest possible credit rating because it has a major impact on interest rates charged by lenders, the rating agencies must take a balanced and objective view of the borrowers financial situation and capacity to service and repay the debt.

A credit rating determines not only whether or not a borrower will be approved for a loan but also the interest rate at which the loan will need to be repaid. As companies depend on loans for many startup and other expenses, being denied a loan could spell disaster, and a high-interest-rate loan is much more difficult to pay back. A borrower’s credit rating should play a role in determining which lenders to apply to for a loan. The right lender for someone with great credit likely will be different than for someone with good or even poor credit.

Also Check: What Is Syncb/ppc

Where Can I Check My Credit Score Before Buying A Car

Even if you have not yet bought a car, it is wise to periodically check your creditworthiness. Under federal law, consumers can receive a free annual report from one of the three major credit bureaus, Equifax, Experian, and TransUnion. Banks and credit card providers often offer their customers free credit assessments.

Different Scores At Each Credit Bureau

Because each credit bureau could have different information on file about you, your credit scores will most likely differ for each of the three credit bureaus: Equifax, TransUnion and Experian.

Sometimes the difference is just a few points. Other times, the difference in your credit scores from each bureau can be vast due to an error or mistake in your credit report. These differences can cost you thousands over the life of a loan. Be sure to check your reports regularly or sign up for alerts to be notified when your score changes.

You May Like: Syncb Ppc On Credit Report

Fewer Consumers Had Subprime Credit In 2020

One effect of the 2020 average FICO® Score increase was the reduction in the number of consumers with subprime credit. This designation is typically given to those with scores between 580 and 669, but for the purposes of this analysis, we include all consumers with scores under 670.

Since 2019, the portion of consumers with a subprime score has decreased from 33.8% to 30.9%a nearly 3 percentage point drop. This improvement is significant and is three times as large as the improvement between 2018 and 2019, when the ratio decreased by less than 1 percentage point.

Among people included in the subprime category, the average FICO® Score rose from 578 to 583 in 2020. This 5-point increase is aligned with the national growth, but illustrates the depth of change occurring throughout the country.

Typically, subprime designations are used by lenders to identify consumers who may have a harder time paying back their debt in full and on time. While some lenders work with subprime borrowers, others may not, and having a score in the subprime range could restrict some borrowers from obtaining credit.

The fact that the 2020 improvement in credit scores touched customers in lower credit ranges is especially impactful, as these people may have had severely restrained access to credit. An improved credit score in their situation could open previously closed doors to credit opportunities.

Student Loan Balances Saw Highest Increase

- 14% of U.S. adults have a student loan.

- The average FICO® Score for someone with a student loan balance in 2020 was 689.

- The percentage of consumers’ student loan accounts 30 or more DPD decreased by 93% in 2020.

Student loan balances saw the most significant spike in 2020, with consumers’ average debt growing by 9%. Much of this is attributable to the suspension of federal student loan repayment that was included in the CARES Act and subsequently extended through January 31, 2021. With fewer people actively paying down student debt, average balances will grow as others add new loans.

Student loans saw delinquency rates plunge, with the percentage of accounts 30 or more DPD decreasing by 93% in 2020. It’s important to view this number in context, however, as the automatic accommodations put in place obviously played a major role in the drop.

The CARES Act paused all federal student loan repayment, effectively placing these accounts in limbo. While paused, student loan accounts are being reported as current, although no payments are required. Once repayment begins, delinquencies may begin to climb again.

Don’t Miss: How To Get A Repo Off My Credit

Can I Buy A Car With A Poor Credit Score Loans

It is possible to get a bad credit car loan without a down payment, but it may not be the best option. Even a modest $100 down payment will lower your financing, lower your recurring payments and general interest charges. You can get a higher annual interest rate if you insist that no deposit is made.

Experian 2020 Consumer Credit Review

As Americans entered 2020, the economyas measured by consumer confidence, spending and stock market performancewas thriving. Two months into the year, however, the nation was struck by the COVID-19 crisis, and the economy slid into territory not seen since the Great Recession.

The coronavirus pandemic and resulting stay-at-home orders and other restrictions led to record unemployment, a plunging stock market, economic uncertainty and thousands of business closures throughout the U.S.

Despite those challenges, and perhaps partly due to relief measures enacted to combat the economic impact of the crisis, some consumers have seen certain aspects of their finances improve since the onset of the pandemic. The national average FICO® Score increased by seven points this yearthe largest annual improvement in at least a decade.

Major credit score components, such as and payment history, have also changed for the better, with average utilization rates and late payments decreasing at a record pace. Improvements of this kind add to consumers’ overall credit health and can cause scores to rise in a short period of time.

Read on for our insights and analysis.

You May Like: Does Paypal Pay In 4 Affect Credit Score

Which Credit Score Is Needed To Buy A Car

Those who borrowed money to buy used cars got an average score of 659. Borrowers who received financing to buy a new car in the third quarter had an average credit score of 714. Those who borrowed money to buy used cars , received an average score of 655 Average score The credit required to buy a car.

What Is An Excellent Credit Score Range

Excellent credit score = 740 850: Anything in the mid 700s and higher is considered excellent credit and will be greeted by easy credit approvals and the very best interest rates.Consumers with excellent credit scores have a delinquency rate of approximately 2%.

In this high-end of credit scoring, extra points dont improve your loan terms much. Most lenders would consider a credit score of 760 the same as 800. However, having a higher score can serve as a buffer if negative occurrences in your report. For example, if you max out a credit card , the resulting damage wont push you down into a lower tier.

You May Like: How Personal Responsibility Can Affect Your Credit Report

What Is A Good Credit Score And How Can I Build Mine

- Alice Grahns, Digital Consumer Reporter

- 4:42 ET, Jun 9 2021

YOUR credit score is important when you apply for a credit card, mortgage or loan.

Sometimes called a credit rating, the score determines your creditworthiness to lenders.

If your score is low, banks may refuse to lend you cash – or you’ll be given a worse rate or deal than is advertised.

But what’s considered a good score and how can you build yours? We explain all you need to know.