Does Paying Off A Loan Help Or Hurt Credit

Paying off a loan frequently hurts credit because it impacts your credit history and your credit mix. If the loan that you have paid off is your oldest credit line, then the average age of your credit will become newer and your score will drop. If the loan that you pay off is your only loan, then your credit mix suffers.

How Your Credit Score Is Calculated

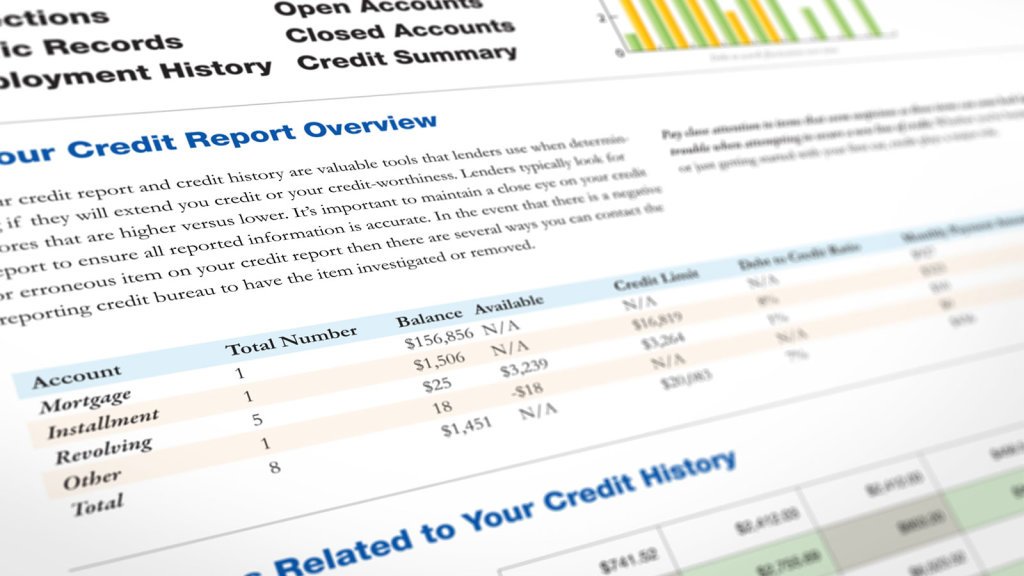

Your credit score is calculated based on what’s in your credit report. For example:

- the amount of money youve borrowed

- the number of credit applications youve made

- whether you pay on time

Depending on the credit reporting agency, your score will be between zero and either 1,000 or 1,200.

A higher score means the lender will consider you less risky. This could mean getting a better deal and saving money.

A lower score will affect your ability to get a loan or credit. See how to improve your credit score.

Summary Of Moneys Guide On How To Get Your Credit Report

- AnnualCreditReport.com is the best place to start to get your free credit reports from Equifax, Experian and TransUnion all in one spot.

- Because of the pandemic, Equifax, Experian and TransUnion are all offering free weekly credit reports also available through AnnualCreditReport.com until April 20, 2022.

- If you have exhausted all of your free credit reports from the major bureaus, you may contact them directly to purchase additional reports. They legally cant charge you more than $13 per report.

- While Equifax, Experian and TransUnion are the most popular credit bureaus, theyre not the only places to provide credit reports. According to the CFPB, you are also eligible for free annual credit reports from dozens of other credit-reporting agencies, most of which specialize in a niche credit topic.

Chris Huntley contributed to this article.

You May Like: Syncb Inquiry

Medical Id Reports And Scams

Use your medical history report to detect medical ID theft. You may have experienced medical iD theft it if there is a report in your name, but you haven’t applied for insurance in the last seven years. Another sign of medical ID theft is if your report includes medical conditions that you don’t have.

How Do I Improve My Credit

Look at your free credit report. The report will tell you how to improve your credit history. Only you can improve your credit. No one else can fix information in your credit report that is not good, but is correct.

It takes time to improve your credit history. Here are some ways to help rebuild your credit.

- Pay your bills by the date they are due. This is the most important thing you can do.

- Lower the amount you owe, especially on your credit cards. Owing a lot of money hurts your credit history.

- Do not get new credit cards if you do not need them. A lot of new credit hurts your credit history.

- Do not close older credit cards. Having credit for a longer time helps your rating.

After six to nine months of this, check your credit report again. You can use one of your free reports from Annual Credit Report.

Don’t Miss: Is 586 A Good Credit Score

Review The Claim Results

Reporting agencies and lenders usually take around 30 days to investigate disputes. Once they make a decision, they must notify you within five days of completing their review. The notice will inform you if the disputed item was found to be inaccurate or not.

If the disputed information was, in fact, inaccurate, the bureau must update or delete the item. They should include a free copy of your file if the dispute results in a change.

If the bureau or lender considers the disputed information isn’t a mistake, you can file an additional claim. Review your initial claim for any errors and correct those. If possible, you should include additional documents to support your request as this can help the bureau evaluate any data it might have missed the first time around.

How To Get Your Annual Credit Reports From The Major Credit Bureaus

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

Federal law gives you free access to your credit reports from the three major credit bureaus: Equifax, Experian and TransUnion. Using the government-mandated AnnualCreditReport.com website is the quickest way to get them, but you can also request them by phone or mail. Until April 20, 2022, those reports which had been limited to once a year are available weekly to help consumers manage their finances.

Your credit reports are a detailed record of your past use of credit but they do not include your credit score. NerdWallet offers a free credit score and report, updated weekly using TransUnion data. Checking your score does not damage your credit.

Heres how to use AnnualCreditReport.com.

You May Like: Does Les Schwab Report To Credit Bureaus

How Can I Find And Dispute Errors On My Credit Reports

If you notice any big discrepancies between your credit reports, there might be an error. There are a number of ways to find and dispute these errors. Lets take a look at a few.

Free credit monitoring from Credit KarmaCredit Karmas free credit monitoring tool can help you stay on top of your credit and catch any errors that might impact your scores.

If we notice any important changes on your Equifax or TransUnion credit report, well send an alert so you can review the changes for suspicious activity. If you dont recognize the information and think it might be associated with an error or identity theft, you can file a dispute.

How to dispute errors on your Equifax credit reportIf you spot an error on your Equifax credit report, youll have to file your dispute directly with Equifax.

Start by reviewing your free report from Equifax on Credit Karma. If you come across an error, scroll down to the bottom of the account in question and click Go to Equifax. Youll have a chance to review your dispute before submitting it to Equifax.

How to dispute errors on your TransUnion credit report with Credit Karmas Direct Dispute featureCredit Karmas Direct Dispute tool makes it easy to file a dispute directly with TransUnion. If you come across an error on your TransUnion report, you can submit a dispute without leaving Credit Karma.

What Makes Up Your Credit Score

Your is calculated using different scoring models, such as the VantageScore and FICO. These are the two most widely used credit-scoring models, and each has its own proprietary metrics and criteria. However, both models have one thing in common: they use data from the major credit reporting agencies to generate your score.

If you want to repair bad credit, it’s important to understand what factors VantageScore and FICO evaluate when generating scores.

VantageScore 4.0 Scoring Model

VantageScore prioritizes total credit usage, balance and available credit. Basically, the model first evaluates the amount of credit you have available to use and how much of it you’re using. Using 30% or more of your available credit can lower your score since lenders usually consider it a red flag.

Other factors considered include your credit mix, payment history, credit history length and new accounts.

FICO Scoring Model

The FICO score is the industry standard its the oldest credit scoring model and what most lenders use to evaluate a person’s creditworthiness. FICO’s scoring has five categories, each with a percentage value indicating how much weight they place on each:

You May Like: How To Unlock My Experian Account

What To Do If You Find Errors In Your Credit Report

If you find errors in your credit report, it is important to take action immediately to make sure the information is accurate. You can contact the reporting agencies that issued the report to dispute the errors. You can also contact the creditor that is listed on the report to get more information about the error.

It is important to keep track of all communications related to the dispute and to make sure that you receive a response from the credit bureau or creditor within 30 days. If you do not receive a response, or if you are not satisfied with the response, you can file a complaint with theConsumer Financial Protection Bureau.

Make The Most Of A Thin Credit File

Having a thin credit file means that you dont have enough credit history on your report to generate a credit score. An estimated 62 million Americans have this problem. Fortunately, there are ways to fatten up a thin credit file and earn a good credit score.

One is Experian Boost. This relatively new program collects financial data that isnt normally in your credit report, such as your banking history and utility payments, and includes that in calculating your Experian FICO credit score. Its free to use and designed for people with limited or no credit who have a positive history of paying their other bills on time.

UltraFICO is similar. This free program uses your banking history to help build a FICO score. Things that can help include having a savings cushion, maintaining a bank account over time, paying your bills through your bank account on time, and avoiding overdrafts.

A third option applies to renters. If you pay rent monthly, there are several services that allow you to get credit for those on-time payments. For example, Rental Kharma and RentTrack will report your rent payments to the credit bureaus on your behalf, which in turn could help your score. Note that reporting rent payments may only affect your VantageScore credit scores, not your FICO score. Some rent-reporting companies charge a fee for this service, so read the details to know what youre getting and possibly purchasing.

Recommended Reading: Does A Closed Account Affect Credit

How Do I Establish A Good Credit Rating

The easiest way to establish a good credit rating is to pay your bills on time. If you don’t have a credit card, apply for one, and use it responsibly. If you make your minimum payments, you can develop a good credit history. This will have a positive impact on your ability to borrow in the future.

To find out more about establishing credit, talk to a CIBC advisor.

How To Remove Items From Your Credit Report In 2022

Your credit report is meant to be an accurate, detailed summary of your financial history however, mistakes happen more often than you may think.

Whether its accounts that dont actually belong to you or outdated derogatory information thats still being reported, incorrect information could be bringing your score down unnecessarily.

Read on to learn how to remove erroneous information from your credit report and some tips on how to handle those negative items that are dragging your score down.

You May Like: Qvc Collection Agency

How Can I Check Credit Scores

Reading time: 2 minutes

Highlights:

-

You may be able to get a credit score from your credit card company, financial institution or loan statement

-

You can also use a credit score service or free credit scoring site

Many people think if you check your credit reports from the three nationwide credit bureaus, youll see credit scores as well. But thats not the case: credit reports from the three nationwide credit bureaus do not usually contain credit scores. Before we talk about where you can get credit scores, there are a few things to know about credit scores, themselves.

One of the first things to know is that you dont have only one credit score. Credit scores are designed to represent your credit risk, or the likelihood you will pay your bills on time. Credit scores are calculated based on a method using the content of your credit reports.

Score providers, such as the three nationwide credit bureaus — Equifax, Experian and TransUnion — and companies like FICO use different types of credit scoring models and may use different information to calculate credit scores. Credit scores provided by the three nationwide credit bureaus will also vary because some lenders may report information to all three, two or one, or none at all. And lenders and creditors may use additional information, other than credit scores, to decide whether to grant you credit.

So how can you get credit scores? Here are a few ways:

Work With A Credit Counseling Agency

Several non-profit credit counseling organizations, like the National Foundation for Credit Counseling , can help dispute inaccurate information on your record.

The NFCC can provide financial counseling, help review your credit history, help you create a budget and even a debt management plan free of charge. It also offers counseling for homeownership, bankruptcy and foreclosure prevention.

As always, be wary of companies that overpromise, make claims that are too good to be true and ask for payment before rendering services.

When looking for a legitimate credit counselor, the FTC advises consumers to check if they have any complaints with:

- Your states Attorney General

- Local consumer protection agencies

- The United States Trustee program

Recommended Reading: Account Closed Repossession

Where Can I Get My Credit Score

There are a few main ways to get your credit score, including from a credit card or other loan statement, a non-profit counselor, or for a fee from a credit reporting agency.

You actually have more than one credit score. Credit scores are calculated based on the information in your credit reports. If the information about you in the credit reports of the three large consumer reporting companies is different, your credit score from each of the companies will be different. Lenders also use slightly different credit scores for different types of loans.

There are four main ways to get a credit score:

Check your credit card or other loan statement. Many major credit card companies and some auto loan companies have begun to provide credit scores for all their customers on a monthly basis. The score is usually listed on your monthly statement, or can be found by logging in to your account online.

Talk to a non-profit counselor. Non-profit and HUD-approved housing counselors can often provide you with a free credit report and score and help you review them.

Buy a score. You can buy a score directly from the credit reporting companies. You can buy your FICO credit score at myfico.com. Other services may also offer scores for purchase. If you decide to purchase a credit score, you are not required to purchase credit protection, identity theft monitoring, or other services that may be offered at the same time.

Should I Order Reports From All Three Credit Bureaus At The Same Time

You can order free reports at the same time, or you can stagger your requests throughout the year. Some financial advisors say staggering your requests during a 12-month period may be a good way to keep an eye on the accuracy and completeness of the information in your reports. Because each credit bureau gets its information from different sources, the information in your report from one credit bureau may not reflect all, or the same, information in your reports from the other two credit bureaus.

You May Like: Does Klarna Hurt Your Credit Score

How Do I Get Credit

Do you want to build your credit history? You will need to pay bills that are included in a credit report.

- Sometimes, utility companies put information into a credit report. Do you have utility bills in your name? That can help build credit.

- Many credit cards put information into credit reports.

- Sometimes, you can get a store credit card that can help build credit.

- A secured credit card also can help you build your credit.

Errors On Your Credit Report

If you find errors on your credit report, write a letter disputing the error and include any supporting documentation. Then, send it to:

Find a sample dispute letter and get detailed instructions on how to report errors.

The credit reporting agency and the information provider are liable for correcting your credit report. This includes any inaccuracies or incomplete information. The responsibility to fix any errors falls under the Fair Credit Reporting Act.

If your written dispute does not get the error fixed, you can file a complaint with the Consumer Financial Protection Bureau .

You May Like: Credit Inquiry Removal In 24 Hour Free

Basics Of Credit Reports And Scores

Your are statements of your . And there are three major bureaus that compile credit reports: Equifax®, Experian® and TransUnion®. Each credit bureau compiles its own credit reports, so your credit reports may be slightly different.

Your are based on the information in those credit reports. Generally speaking, the higher the score, the better. FICO® and VantageScore® provide some of the most commonly used scores. But keep in mind that you have many different credit scores that different lenders use.

As the Consumer Financial Protection Bureau explains, âYour score can differ depending on which credit reporting agency provided the information, the scoring model, the type of loan product, and even the day when it was calculated.â

Why Is Credit Important?

Your because it gives lendersâand othersâa general idea of how financially responsible you are. And many companies use your credit to predict your future financial behaviors.

So the better your credit, the better your chances of qualifying for things like credit cards, loans, mortgages and other credit products. And the better your rates might be.