Resolve Incorrect Information On Your Report

Incorrect information appears on your report for four reasons:

- Someone stole your identity and opened new accounts in your name.

- Someone stole one of your existing accounts, and started using it.

- The bank made an error and reported a delinquency or default that never happened.

- A collection agency made an error and reported a collection item on debt that was never yours.

If someone stole your identity

Incorrect information due to identity theft is a serious issue that you need to resolve as soon as possible. These are some common signs of identity theft:

- You dont get your bills or other mail because someone has changed the mailing address on your accounts.

- Debt collectors call you about debts that arent yours.

- Medical providers bill you for services you didnt use.

- Your health plan rejects your legitimate medical claims because records show youve reached your benefits limit.

- The IRS notifies you that more than one tax return was filed in your name.

- You are arrested for a crime someone else allegedly committed in your name.

Warning: A common form of identity theft is when a family member steals your Social Security number and uses it to apply for credit.

Below we detail some important action items you can take.

If someone stole your account

Use Your Credit Card As A Debit Card

Now, this one seems to go against the rules. However, it certainly doesnt, if you know how to go about it.

First, as per our first tip, avoid using your credit card for purchases that you cant afford, leading to overspending. But, since there are expenses that you must incur every month, like gas, groceries, subscriptions, and utility bills, using a credit card on these might be helpful.

But how? Well, these are expenses that you usually clear at the end of every month. This means that despite using your credit card throughout the month, the closing balance is always low, and the card is always active. This alone ensures that issuers dont reduce your credit limit or close the card citing inactivity.

One thing to note, though! If you have committed to reducing your debt balance, use a different credit card for your daily purchases. This will help you avoid keeping a balance.

Use Credit Monitoring To Track Your Progress

are an easy way to see how your credit score changes over time. These services, many of which are free, monitor for changes in your credit report, such as a paid-off account or a new account that youve opened. They typically also give you access to at least one of your credit scores from Equifax, Experian, or TransUnion, which are updated monthly.

Many of the best credit monitoring services can also help you prevent identity theft and fraud. For example, if you get an alert that a new credit card account that you dont remember opening has been reported to your credit file, you can contact the credit card company to report suspected fraud.

Recommended Reading: Business Credit Cards That Don T Report To Personal

How To Repair Your Credit And Improve Your Fico Scores

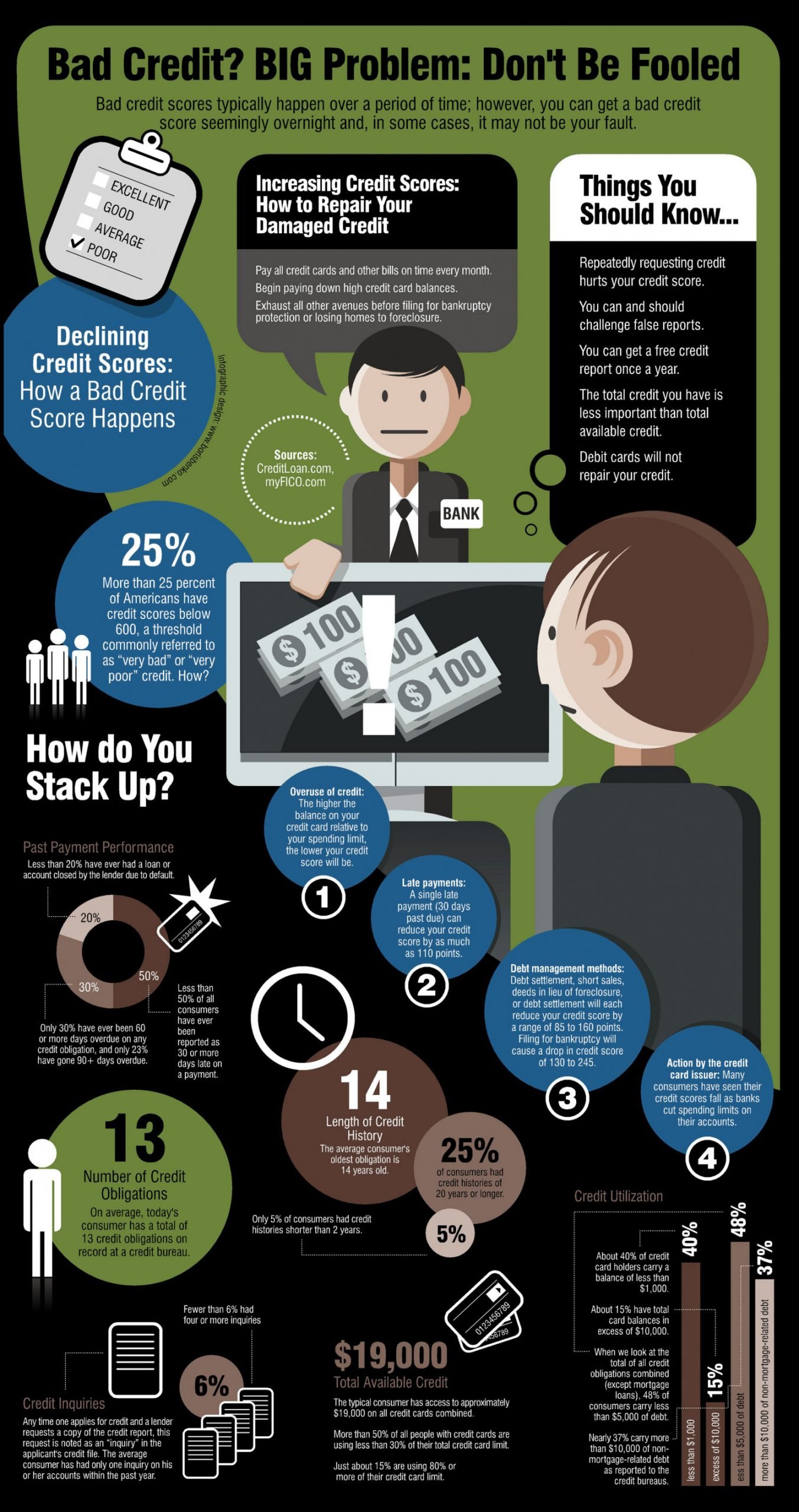

You can improve your FICO Scores by first fixing errors in your credit history and then following these guidelines to maintain a consistent and good credit history. Repairing bad credit or building credit for the first time takes patience and discipline. There is no quick way to fix a credit score. In fact, quick-fix efforts are the most likely to backfire, so beware of any advice that claims to improve your credit score fast.

The best advice for rebuilding credit is to manage it responsibly over time. If you haven’t done that, then you’ll need to repair your credit history before you see your credit score improve. The following steps will help you with that.

If You Find Errors Dispute Them

The next step in credit repair is to dispute incorrect information on your credit report.

Errors arent common, but they happen. Of course, sometimes bad credit is just your fault. You shouldnt try to argue accurate information, but if you do see errorseven small onesits worth cleaning them up. Heres how:

Once you have the copy of your full credit report in hand, check your identity information , and credit history.

Review the list of credit cards, outstanding debts, and major purchases. If you see any mistakes or questionable items, make a copy of the report and highlight the error.

Next, gather any information that you have to back you up, such as bank account statements, and make copies of these as well. This is important! The credit bureaus wont do anything without proof.

Write a letter to the specific credit reporting agency that shows the falsehood, whether it is Experian, Equifax, or TransUnion. Explain the mistake and include a copy of the highlighted report along with your documentation. Although certain bureaus now let you submit disputes online, its not a bad idea to send this letter by certified mail, and keep a copy for yourself. The reporting agency has 30 days from the receipt of your letter to respond. The Federal Trade Commission provides advice on contacting the credit bureaus about discrepancies. Here are the contact numbers and web sites for the three credit bureaus:

- Equifax: 800-685-1111 www.equifax.com

Don’t Miss: How To Unlock My Experian Credit Report

Safely Check Your Credit With Our Secure Credit Check

The first step to financial independence is knowing where you stand. You can get your free credit report with our Secure Credit Check and start rebuilding your credit with support from our team. All you have to do is fill out the form on our website and one of our financial managers will book an appointment to review your score and help you plan your financial goals.

Our offices have reopened though if youd prefer to shop from the comfort of your home, you can with our Buy From Home program. Your entire buying experience will be 100% contactless from the loan approval and vehicle shopping to the test drive and delivery. Youll even get a $1000 rebate and other added benefits. Visit our Buy From Home page for details.

Review Your Credit Report Regularly & Check For Any Potential Error

You may have a very good score and history, in rare case scenarios, there can be certain errors present in your credit history due to wrong information reported by your lenders to the Credit Bureaus. As a result of these errors, your score can be reduced considerably.

For instance, suppose you have completely paid off a particular loan and closed that loan account, however, your credit report of Credit Bureau may still show it as unpaid. For these kinds of errors, you can either request a correction from any Credit Bureau or your lender.

Also Check: How Long Does A Repossession Stay On Your Credit Report

Is That Fix For Real

You should be wary of any organisation that promises to do these things. These credit repair companies often charge large fees for a service that most people can do themselves, for free.

They will often overstate their ability to improve a credit report, given that if information on a credit report is correct, it cant be removed. Theres a good chance that you may end up thousands of dollars out of pocket without any real improvement in your credit report. Often they sign you up to contracts with unfair terms, such as big termination fees which penalise you for terminating the contract.

Defaults don’t last forever. They fall off your credit report after 5 years. In the meantime, you can still make yourself look better to credit providers by trying to pay off the default, and keeping up your repayments on any other loans.

Some credit repair services may also try to convince you to enter into insolvency arrangements which may not be suitable for your circumstances, or to consolidate your debts with a high-interest loan. Often these loans are either offered by the credit repairers themselves, or by an associated company. This may end up costing you more than if you had negotiated directly with your credit provider.

Sign Up For Experian Boost

If your low score is primarily the result of being new to the credit-seeking game and you are timely with your payments for utilities and your cell phone, ask the lender to pull a report from Experian, using its Experian Boost plan. This hybrid model draws on what the industry calls alternative credit data non-traditional payments that provide lenders useful insight into an applicants creditworthiness.

The way forward gets a little steeper from here, so its a good idea to know what youre up against.

Don’t Miss: Does Lending Club Show On Credit Report

How To Get 800 Credit Score

Disclosure: This post may contain affiliate links, meaning I get a commission if you decide to make a purchase or sign up through my links, at no cost to you. Please read my disclaimer for more info.

Are you tired of your low credit score? Do you want to improve this? Learn how to get an 800 credit score and maintain it up there in the next few steps.

Whenever the word credit comes up, so does . Whether you seek a personal loan, an auto loan, or a home equity loan, lenders will always want to know your credit score. This is the measure of your creditworthiness, as rated by various credit scoring agencies.

Generally, the main credit scoring agencies like FICO and VantageScore put this score between 350 and 850. 350 is the lowest score and 850 the highest. The higher your credit score is, the better your chances are of getting your loan application approved.

So, how hard is it to hit that high score?

Well, your credit score is determined by various factors, including payment history, credit mix, credit utilization, etc. Credit scoring agencies get this data from the credit bureaus like Experian, Equifax, and TransUnion, to help give you a score.

The fact is achieving a high credit score isnt easy, as its also not too complicated. Today, we explore various strategies on how to get 800 credit score and above. Therefore, if you seek to manage your personal finance and improve your credit score, here is what you need to do.

What Is My Credit Score

Your credit score is a numerical rating that tells a lender how responsible you are when you borrow money. High credit scores tell lenders that you pay your bills on time and you dont borrow more money than you can pay back.

On the other hand, low credit scores might also tell lenders that you sometimes miss payments, you overextend your line of credit regularly, your account is very young, or your spending habits are unpredictable.

Equifax®, Experian and TransUnion®, the three major reporting bureaus, gather data on your spending habits and calculate a score for you based on your unique spending and bill-paying habits. Some factors that go into your credit score include your payment history, credit utilization, how much total credit you have, how old your account is and how often you apply for new credit lines.

Your payment history refers to how often you make the minimum payments on your credit card, auto loan and/or student loans. Credit utilization ratio refers to what percentage of your credit you use every month compared to how much total credit you have.

Visit AnnualCreditReport.com and request your free credit report. You can also order your credit report by calling 1-877-322-8228 or by completing the Annual Credit Report Request Form and mailing it to Annual Credit Report Request Service, P.O. Box 105281, Atlanta, GA 30348-5281.

Take the first step toward the right mortgage.

Apply online for expert recommendations with real interest rates and payments.

You May Like: What Score Do You Need For Care Credit

Ways To Build Credit Fast

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

If your credit score is lower than you’d like, there may be quick ways to bring it up. Depending on what’s holding it down, you may be able to tack on as many as 100 points relatively quickly.

Scores in the “fair” and “bad” areas of the could see dramatic results leading to more access to loans or credit cards, and at better terms.

Consider A Debt Consolidation Loan

A debt consolidation loan or balance transfer takes all of your outstanding debts on different accounts and combines them into a single monthly payment. Debt consolidation loans help improve your credit utilization rates, your credit mix and can help you avoid missed payments. A debt consolidation loan or balance transfer can be a great option for you if you have multiple lines of credit that you have trouble keeping up with.

You make a hard inquiry on your credit report when you apply for a debt consolidation loan. This means that your credit score will usually drop by a few points immediately after your inquiry. Focus on making on-time payments above the minimum required amount after you get your debt consolidation loan.

Read Also: What Is Syncb Ppc On My Credit Report

Pay Attention To Credit Utilization

Your credit utilization rate is the amount of revolving credit youre using divided by the amount of revolving credit you have available. It makes up 30% of your credit score and is often the most overlooked method of improving your score. For most people, revolving credit just means credit cards, but it includes personal and home equity lines of credit as well. A good credit utilization rate never exceeds 30%. So, if you have a credit limit of $5,000, you should never use more than $1,500.

Stay Away From Multiple Loans Or Credit Card Applications

Whenever someone applies for any loan or credit card with any Bank or NBFC, that financial institution retrieves the credit score and history from one or multiple Credit Bureaus. Based on your credit score and history, they evaluate your ability to repay the loans or credits on time.

Each of these inquiries requested by any financial institution is recorded by the Credit Bureau where that particular inquiry was made. Therefore, if a financial institution detects multiple inquiries on your credit history, they may consider you to be less reliable in repaying on time.

Therefore, you should apply to only one or max two loans or credit card applications at a time.

You May Like: Speedy Cash Late Payment

Avoid Expensive Credit Repair Companies

You might see adverts from firms that claim to repair your credit rating. Most of them simply advise you on how to obtain your credit file and improve your credit rating but you dont need to pay for that, you can do it yourself.

Some might claim that they can do things that legally they cant, or even encourage you to lie to the credit reference agencies.

Its important to not even consider using these firms.

How To Control The Number Of Credit Checks

To control the number of credit checks in your report:

- limit the number of times you apply for credit

- get your quotes from different lenders within a two-week period when shopping around for a car or a mortgage. Your inquiries will be combined and treated as a single inquiry for your credit score.

- apply for credit only when you really need it

Don’t Miss: Open Sky Unsecured

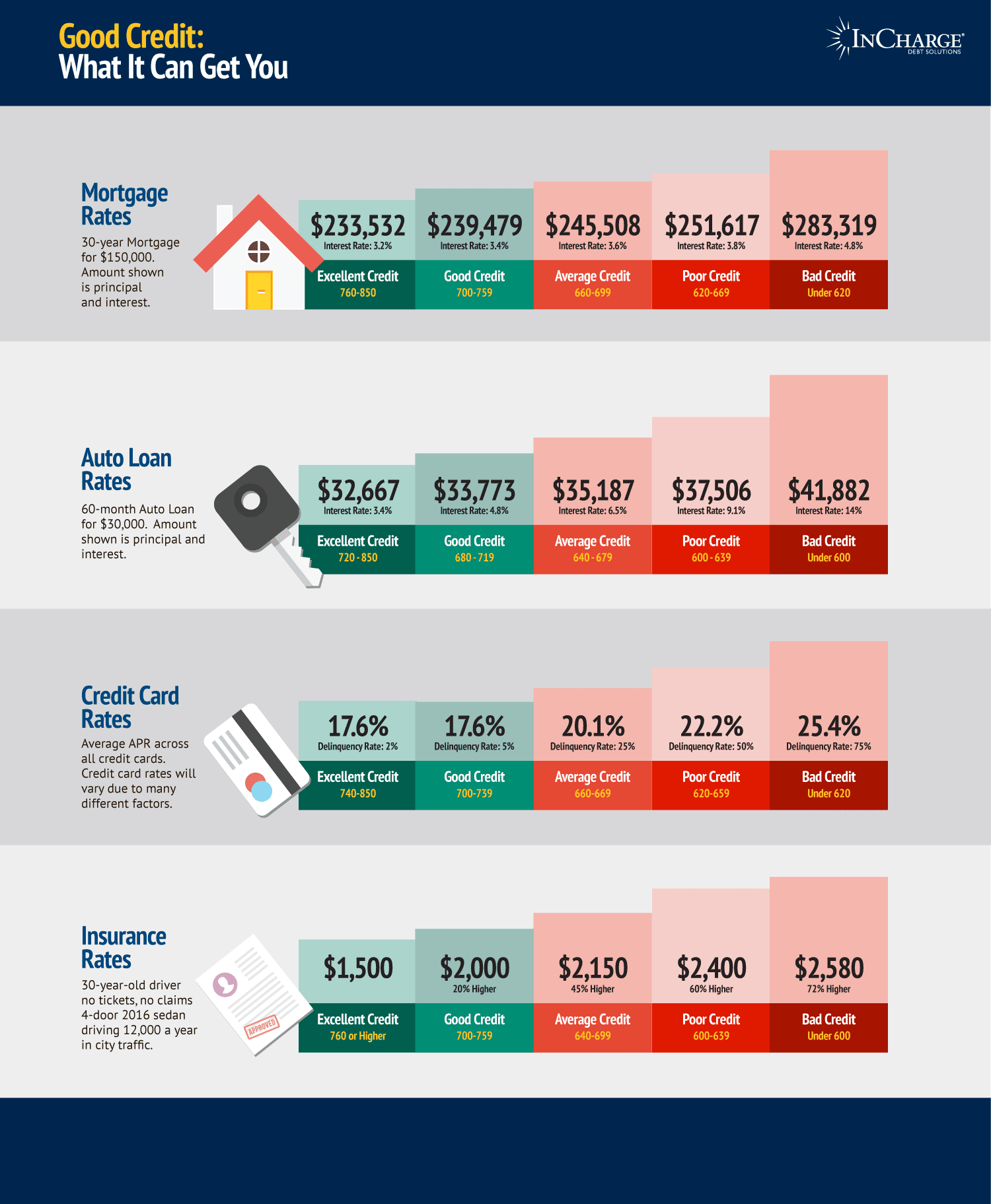

You Get Lower Insurance Premiums

Several insurance companies consider checking your credit score before deciding your premiums. In case if you live in a city where credit-based insurance is possible, having an 800 credit score can get you discounts on your homeownersâ insurance or car insurance.

For example, if you have car insurance, you may save more than $1500 in your premiums if you have a good credit score. Whereas in case of a bad credit score, you may save up to $580 in your insurance.

Quick Ways To Fix Your Credit Score

Why do I have a bad credit score to begin with?

- Lack of financial management this includes any negative or neglectful financial behaviour, such as:

- Not paying bills on time or not paying at all

- Missing on loan repayments

- Having your home foreclosed

- Any court judgment on financial payments

What are the consequences of a low credit score?

- You might not be approved for credit or loans

- It could be difficult to get approved for a mortgage

- You may have to pay higher interest rates for loans

- Loan applications to start a business could be denied

- It may be hard to finance the purchase of a new car

- Utility and telco providers may not accept your application to switch to them

- Your applications to rent property, whether residential or for business, could be denied

So, how can you fix your credit score?

Read Also: How To Remove Repossession From Credit Report