Whats The Benefit Of Joining The Scheme And Why Is My Credit File Important

Making your payments on time could see your credit history improve, therefore making it easier to prove your identity and apply for credit products.

Think of your credit file as your financial CV. It gives potential lenders an insight into your spending history, allowing them to make an informed decision as to whether they want to take you on as a borrower.

Building your credit history through your rental payments will make you more attractive to a lender. Showing you can meet payments on time will improve your credit score, though lenders wont see this. Theyll have their own scoring system and will take into account your affordability. And as mortgage payments could end up being more affordable than your current rent, you could see yourself on the property ladder far sooner.

See our for full info on what a credit rating is and how to improve it.

Things To Keep In Mind

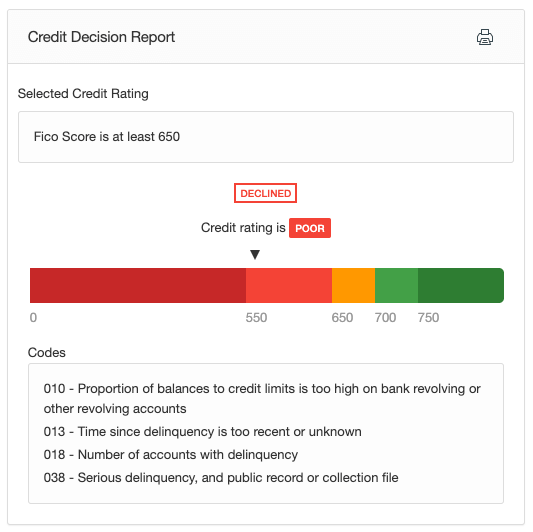

While reporting rent on your credit report sounds like a good idea for every payment on time, you can strengthen your score digging into how it actually pans out reveals some interesting caveats.

For example, a string of reddit posts discussing consequences of reporting rent payments reveal exactly how Experian reports them on a credit report. Reddit user flymd claims his credit score dropped 20 points one month after opting to report his rent payments to the bureau.

The only thing different I could find on my report was that it was now categorizing my rental payments as a brand new loan account with an age of < 1 month, which has significantly altered my average age of accounts and hit my score, flymd writes.

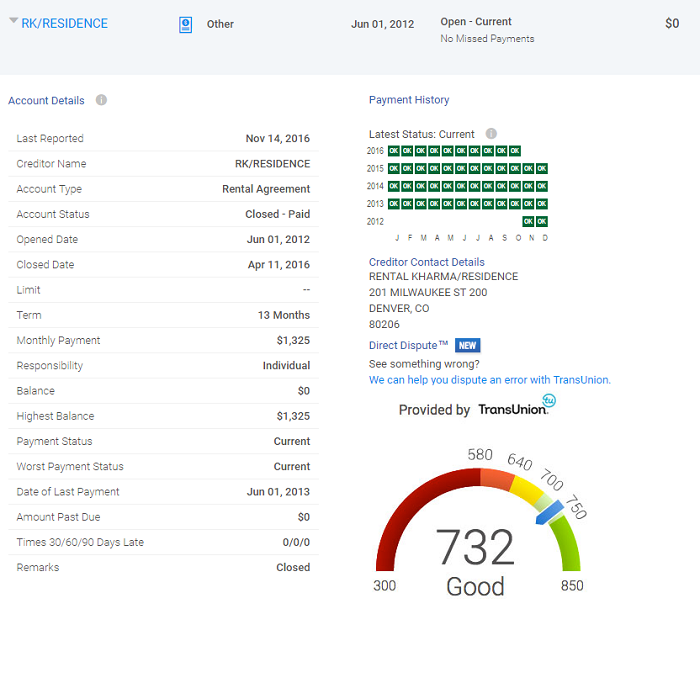

In a statement provided to Forbes, TransUnion explained exactly how rental payment histories are recorded on credit reports.

Rental payments are reported as portfolio type Open and account type Rental Agreement.. They show up in the tradelines section among all the other tradeline types . It will show up as a new account if it was not previously reported but may not be a new loan as rental agreements could have been open previously and are just now being reported on.

Emily Christiansen, director of Experian Rent Bureau, adds that a diversified credit report will benefit consumers in the long run, regardless of the initial dip.

Will Adding Your Child To Your Credit Card Help Establish Her/his Credit

Adding a minor as an authorized user can help build the minors credit. In some cases, card issuers report to the credit bureaus the payment histories of every individual who has a card in their name cardmembers and authorized users alike. So adding your child as an authorized user can help a young person build credit: the minor gets to piggyback on the good credit behavior of the original cardmember.

Not every credit card company will report authorized user payment history to the credit bureaus, however, so talk to your card issuer to find out their policies.

The authorized user approach works both ways: Good credit behavior can enhance users credit history, while bad behavior such as missed payments can hurt it. Only add a minor as an authorized user if you can be confident youll make regular and on-time payments on the card.

Recommended Reading: Chase Sapphire Preferred Credit Score Needed

Recommended Reading: How To Dispute A Charge Off On Credit Report

How Rental Kharma Works

Rent appears as a tradeline on your credit report it might appear classed as a rental agreement or open account, depending on which credit bureau supplies the information. That differs from the revolving and installment tradelines traditionally used to calculate credit scores.

Cullen Canazares, co-founder and CEO of Rental Kharma, says that the addition of rental data can establish a credit score for a previously unscorable consumer within a couple of weeks.

The company can report a payment history, looking backward, of up to two years if youve moved around, leases will appear as multiple tradelines. Canazares says the addition of back rent payments increases the average age of accounts, which is factored into your credit score.

The company helps its users leverage their new credit scores by pointing out which credit card issuers accept the scores that show rental history. Applying for those credit cards and using them responsibly can further build a credit score.

Canazares says his company has helped about 5,000 customers to qualify for major purchases, such as cars and homes.

You May Like: Does Speedy Cash Report To Credit Bureaus

Establishing Credit When You Dont Have Credit

Reading time: 4 minutes

- Consider a secured or student credit card or secured loan

- You can become an authorized user on a credit card account, or get a co-signer

- Ask about getting your on-time rent or utility payments reported to the three nationwide credit bureaus

Its a situation many young adults face when theyre just starting out how to build a when you dont have a credit history. After all, you cant show that youve demonstrated responsible credit behavior when a lack of credit history means you cant get credit meaning a loan or a credit card. There are, however, a handful of options when youre just starting to establish responsible credit behaviors.

Consider a secured or student credit card. A secured credit card requires you to make a deposit up front, possibly the same amount as your credit limit. You can use secured credit cards just like an unsecured credit card to make purchases and make regular payments. If you fail to pay the balance of a secured credit card off each month, it will incur interest. And when you close the account, you receive your deposit back.

Because a secured credit card is meant to help a consumer establish a credit history, its not meant for long-term use. Its important to make sure your secured credit card company reports to the three major credit bureaus Equifax, Experian and TransUnion.

Again, as with any loan, youll want to ask whether the finance company reports payment information to all three nationwide .

Don’t Miss: What Is A Good Credit Score Rating

Does Paying Rent Improve Your Credit Score

Although landlords and property management companies arent required to report payments to the credit bureaus, a perfect payment pattern is still something to strive for. Not only will that information be appealing to anyone reviewing your credit report, adding a well-managed lease to your reports can cause your credit scores to rise.

Payment history is the weightiest scoring factor in both the FICO® Score and VantageScore® models, so the more evidence that you have been paying your bills on time, the better. Bear in mind that only the newest versions of the FICO® Score and VantageScore® models consider rental data, and some lenders still use older versions.

However, for the most current credit scoring systems that do take rental history into account, your on-time rental payments can give your scores a lift, especially if your credit history is young or youve had some credit problems in the past. According to Experians study, 75% of study participants who were scoreable before rental data was included on their credit files found that adding rental history increased their credit score. On average, those who saw an increase experienced a VantageScore 3.0 increase of 29 points.

What To Keep In Mind When Reporting Your Rent

Adding on-time rent payments to your report almost always results in positive changes to your credit, but be aware that its possible you may see a slight drop in your score initially. This is because whenever you add a new account whether its rent, a car loan, or a credit card it takes time for the bureaus to process this information.

I always tell people to not look at their scores immediately, Griffin says. Give it a billing cycle or two, so that the information can stabilize, and then youll see that your scores will go back up to where they were, or improve in the case of rent reporting, he adds.

Experian, TransUnion and Equifax also dont exchange information with one another and use different credit scoring criteria. This means that you may get a different score from each bureau, even if they receive the same information.

Besides that, some rent reporting services only share your data with certain agencies. For example, PayYourRent reports your payments to all three credit bureaus, while Rock the Score only reports them to TransUnion and Equifax. So, make sure to check this information before you enroll.

Finally, if youre using your credit card to pay your rent, Minor recommends looking into your credit limit first, to make sure this transaction wont max it out, as this could temporarily impact your credit utilization and hurt your score.

Recommended Reading: What Does Closed Collection Mean On Credit Report

Www Ihmississippi Valley Credit Union

Category: Credit 1. IH Mississippi Valley Credit Union Home | Facebook IH Mississippi Valley Credit Union, Moline, Illinois. 23755 likes · 189 talking about this · 399 were here. Youre on a journey to financial success. Compare IH Mississippi Valley Credit Union Savings Account, Money Market, and CD rates

Why Havent We Been Reporting Rent All Along

If you own a home and have a mortgage, that particular housing payment can have a significant impact on your credit score. So it might stand to reason that your rent history should play a similar role.

However, theres effort and usually some expense involved with reporting account activity to the credit bureaus. You may be surprised to know that no one is actually required to report your account activity to the credit bureaus, including creditors and lenders. So while landlords certainly can make a monthly report, historically there hasnt been enough of an incentive for the practice to become widespread.

Recommended Reading: Is 699 A Good Credit Score

Do Rent Payments Help Build Credit

Rent payments do have the possibility to help you build credit, but thats only if you are actively making sure that your payments are being reported. If your payments are being reported, they can have a positive effect on your payment history and add another element to your credit profile, increasing your credit mix.

But remember, rent payments will only really have a positive effect if you are consistent with your payments. Falling behind on your rent payments can lead to negative reporting and a decrease in your credit score, especially if your debt is sent to a collections agency.

How To Easily Report Your Rent Payments To The Credit Bureaus

Last updated Aug. 25, 2022| By Lee Huffman

FinanceBuzz is reader-supported. We may receive compensation from the products and services mentioned in this story, but the opinions are the author’s own. Compensation may impact where offers appear. We have not included all available products or offers. Learn more about how we make money and our editorial policies.

Building your credit score can be a challenge when you’re first starting out or if you are recovering from past financial mistakes. Your monthly rent is likely to be one of your largest bills, yet it is not automatically included in your credit report. Wouldnt it be helpful if your history of paying rent on time was included in your credit history?

Many people don’t know this, but you could potentially improve your credit score by requesting that your positive rent payment history be added to your credit report. And depending on which service you work with, its not even a benefit you necessarily have to pay for.

In this article, we’ll show you how to report rent payments to the credit bureaus.

Recommended Reading: What Is Experian Credit Score

Where Do You Find People To Fill Authorized User Slots

There are a lot of people who have bad credit due to poor financial decisions or out of control credit limits. Unfortunately, these people face grotesquely-high mortgage interest rates. To qualify for lower interest rates, theymust find a way to improve their credit scores. Most methods to improve credit scores involve years of waiting and discipline.

A faster solution is becoming an authorized useron a card with a healthy credit history.

When an authorized user is added to a card with a seasoned history their credit score receives a boost. For example, a card that has been opened for over 5 years, with a $10,000 credit limit, and good payment history will have a significant positive impact on the authorized users score.

People who are want to build up their credit score fast are looking for people who have excellent credit and willing to rent their authorized users slots. Priority Tradelines acts as a trusted middleman for buying and selling authorized user slots.

Why Landlords Should Report Rent Payments To Credit Bureaus

Rent Reporting Benefits Both Landlords and Tenants

Rent reporting to credit bureaus is one of the easiest ways for Landlords to reduce income loss and reward their responsible Tenants with good credit. Landlords can lower payment delinquencies by 36%, while Tenants have reported bumps of more than 40 points in their credit score in a matter of months.

Let us look at why Tenants value good credit and how Landlords can help their renters boost credit. At the same time, Landlords can improve their ability to run profitable rental businesses.

Recommended Reading: How Can You Increase Your Credit Score

How Rentreporters Is Different

RentReporters doesnt require its clients to pay rent online or change the way they pay their rent, as is the case with some competitors, such as RentTrack.

Simpson says the companys educational resources set it apart, because many customers dont understand how credit works. “We want to help people and educate them, he says. RentReporters has a blog, newsletter and Facebook Live sessions to help clients build credit and avoid missteps. We dont want people to go get a card and charge it to the limit,” which would damage their scores.

Will Rent Reporting Help You

Ultimately, the choice to use a rent reporting service comes down to cost versus benefit. If you need to build strong credit quickly , then the cost of rent reporting may be outweighed by the long-term savings youll get by having strong credit when you start looking for a home.

On the other hand, if you dont have any major purchases on the horizon, you may be just fine building credit slowly through credit cards and other, more traditional means.

If you have questions about your credit history and want to learn more about how strong credit is built, connect with one of MMIs trained credit counselors for a one-on-one credit report review.

Also Check: Can Your Credit Score Be 0

How To Check Your Rental History

Checking your rental history report gives you the opportunity to review what landlords are likely to see when they check your file. It could also help you spot any inaccuracies that may appear and have them corrected. There are multiple companies that provide this type of report, so you may want to find out which reporting agency your prospective landlord uses if you think its important to see the exact report theyre accessing.

You can request a copy of your Experian RentBureau report by completing a request form and mailing it in, or by calling 877-704-4519. The other major companies that provide tenant history reports are LexisNexis, CoreLogic and Tenant Data.

Or Follow The Instructions Below

From your RentRedi tenant app, tap the “Rent” icon

On the rent page, tap the “Report Rent” text

Select your preferred plan

Tap the “Boost Credit Now” button

You also have the option to report past rent payments. Tap “Add Past Payments” or “Continue Without Past Payments”

Select or enter in a payment method

Done!

Reporting on-time rent payments can boost your credit score by as much as 26 points in some cases!

Don’t Miss: How To Print Free Credit Report

What Can I Do If The Information On My Rental History Is Wrong

Once you get a copy of your rental history report, check it carefully to make sure its accurate. And dont let anything slip byincorrect dates for even one apartment could jeopardize your chances for a new place, because it could erroneously show late rent payments. If any information on the report is wrong, you can dispute it. Supply the company with supporting information, and theyll review the issue and fix any problems.

Why You Can Trust Bankrate

At Bankrate, we have a mission to demystify the credit cards industry regardless or where you are in your journey and make it one you can navigate with confidence. Our team is full of a diverse range of experts from credit card pros to data analysts and, most importantly, people who shop for credit cards just like you. With this combination of expertise and perspectives, we keep close tabs on the credit card industry year-round to:

- Meet you wherever you are in your credit card journey to guide your information search and help you understand your options.

- Consistently provide up-to-date, reliable market information so you\’re well-equipped to make confident decisions.

- Reduce industry jargon so you get the clearest form of information possible, so you can make the right decision for you.

At Bankrate, we focus on the points consumers care about most: rewards, welcome offers and bonuses, APR, and overall customer experience. Any issuers discussed on our site are vetted based on the value they provide to consumers at each of these levels. At each step of the way, we fact-check ourselves to prioritize accuracy so we can continue to be here for your every next.

Read Also: How To Update Employment On Credit Report

Best Rent Reporting Services In 2021

Summary: Not all rent reporting services are created equal. We review ten rent reporting options and how to choose the right one for you.

Many people do not realize that their rent payments are not usually reported to the three major credit bureaus. This is unfortunate because the reporting of your monthly payments could have a positive influence on your credit score.

You can fix this problem.

You can pay a Rent Reporting service to report your monthly payments. For an additional fee, many services will report 24 months of previous rental payments. Thats a quick way to establish a credit history.

When choosing a rent reporting service, the two most important factors to consider are their reputation, the number of credit bureaus that they report to,and their initial cost, including the reporting of 24 months of previous rental payments.

In this post: