Understanding The Scoring Models

FICO and VantageScore arent the only scoring models on the market. Lenders use a multitude of scoring methods to determine your creditworthiness and make decisions about whether or not to give you credit. Despite the numerous options, FICO scores and VantageScores are likely the only scores youll ever see yourself.

Heres what FICO uses to determine your credit score:

- Payment history. Whether or not you pay your bills in a timely manner is critical, as this factor makes up around 35% of your score.

- . How much of your open credit you have usedwhich is called credit utilizationaccounts for 30% of your score. Keeping your utilization below 30% can help you keep your credits core healthy.

- Length of credit. The average age of your creditand how long youve had your oldest accountis a factor. Credit age accounts for around 15% of your score.

- Types of credit. Your credit mix, which refers to having multiple types of accounts, makes up around 10% of your score.

- Recent inquiries. How many entities have hit your credit history with a hard inquiry for the purpose of evaluating you for credit is a factor for your score. It accounts for about 10% of your credit score.

VantageScore uses the same factors, but weighs them a little differently. Your VantageScore 4.0 will be most influenced by your credit usage, followed by your credit mix. Payment history is only moderately influential, while credit age and recent inquiries are less influential.

What Is My Real Credit Score

Companies can choose which score to purchase and use when reviewing applications and managing customers’ accounts, which is one reason there’s competition in the credit scoring world. With this in mind, there isn’t a single, “real” credit score.

For example, when you’re shopping for an auto loan, you may try to get offers from several lenders. One lender might use a FICO® Score 8, another a FICO® Auto Score 2, and a third a VantageScore 4.0. Your scores may vary, but each is very real in the sense that the lender is using it to determine if you qualify for a loan and the rates and terms to offer you.

Generally, you won’t know which of your three credit reports or which credit score a lender will use. However, because credit scores all rely on the same underlying data, building positive credit can help you get good credit scores regardless of the model. Conversely, negative items, such as late payments or a bankruptcy, could hurt all of your credit scores.

How To Improve Your Experian Credit Score

A high Experian score will ensure that you are able to easily avail credit whenever you require it. Since you can easily check your Experian report at any time through online means, it is best to keep an eye on it and assess your strengths and weaknesses on a regular basis. If you notice that your Experian score is slipping, it is essential that you take remedial steps to improve it. Otherwise, you will be left struggling for credit when you most require it. Read on to learn how you can best improve your Experian score.

Don’t Miss: Does Changing My Name Affect My Credit Rating

Why Your Credit Score Changed

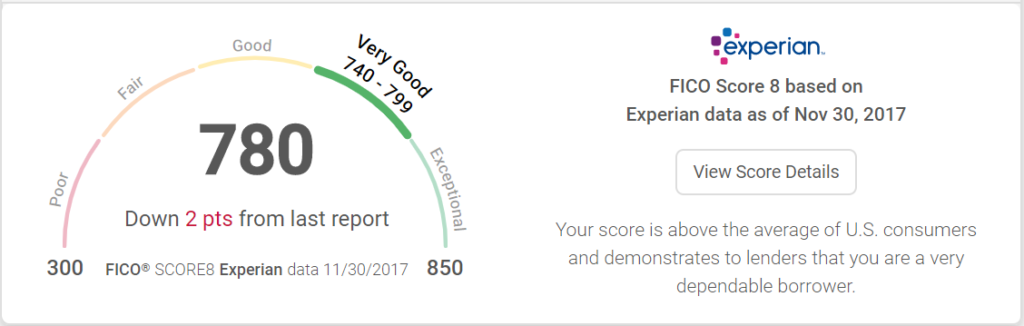

Your credit score can change for many reasons, and it’s not uncommon for scores to move up or down throughout the month as new information gets added to your credit reports.

You may be able to point to a specific event that leads to a score change. For example, a late payment or new collection account will likely lower your credit score. Conversely, paying down a high credit card balance and lowering your utilization rate may increase your score.

But some actions might have an impact on your credit scores that you didn’t expect. Paying off a loan, for example, might lead to a drop in your scores, even though it’s a positive action in terms of responsible money management. This could be because it was the only open installment account you had on your credit report or the only loan with a low balance. After paying off the loan, you may be left without a mix of open installment and revolving accounts, or with only high-balance loans.

Perhaps you decide to stop using your credit cards after paying off the balances. Avoiding debt is a good idea, but lack of activity in your accounts could lead to a lower score. You may want to use a card for a small monthly subscription and then pay off the balance in full each month to maintain your account’s activity and build its on-time payment history.

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

Also Check: How To Get Credit Report Without Social Security Number

What Factors Make Up My Credit Scores

There are a few factors that make up your credit scores, whether youre looking at FICO or VantageScore scores. Its worth briefly covering these to help you better understand your credit scores.

- Payment history Having a history of on-time payments is most important for credit scores and gives lenders an indication of how likely you are to pay back a loan.

- is how much of your total credit youre using compared to the amount youve borrowed. Lenders might view a higher credit utilization rate as a sign you have too much debt to pay back a new loan or credit card balance.

- Length of credit history A longer credit history may help your credit scores by demonstrating a history of more on-time payments.

- Having a mix of different types of credit can help show lenders you have experience with different types of loans.

- Recent credit The number of hard inquiries on your credit reports can signal to lenders that youve been actively seeking credit and might be a riskier borrower.

Does Experian Boost Work

Now lets talk turkey. Does Experian Boost actually work? ;The answer is yes!

But how much does it really help?

It depends on your starting credit score. The average consumer saw their credit score go up 14 points.; If your credit is 579 or less, you could see an even bigger increase. Eighty-six percent of people in this range saw an average increase of 21 points.

Considering how easy it is, thats a significant increase.

Recommended Reading: What Is Credit Score Out Of

Your Credit Score Range Explained Totallymoney

Experian provide credit scores out of 999, and define a good credit score as anything thats 881 or above. You can see all their classifications in the table;Score: Band0550: Very Poor628710: Excellent551565: Poor

Credit reports and score ranges: Equifax, TransUnion, and Experian. When you apply for a loan or credit card, a lender may check your credit report and an;Average FICO Score : 577Average Number of Credit Cards: 2.3Average Credit Card Balance: $5,685Average Auto Loan Balance: $18,429

The Main Three Credit Bureaus

Data maintained by Experian, TransUnion and Equifax is used to calculate credit scores. Credit bureaus gather information about your credit accounts, including credit cards, loans and lines of credit. They record your payment history, balances, available credit, late payments, accounts in collections and bankruptcies.

Credit reports also include identifying information such as your name, Social Security Number, current and former addresses, and current and past employers that have been reported to the bureaus by the creditors. They dont include financial information unrelated to debt, such as your income or bank account balance. In the case of Experian, to help protect you from identity theft, they do not list your actual SSN on your personal credit report.;

Also Check: Is 611 A Good Credit Score

How Does My Credit Score Affect My Ability To Get Credit

-

Can I use a credit score as leverage for a lower interest rate when seeking a loan or line of credit?It is never a bad idea to work with issuers and lenders to reduce your interest rate. You definitely have more leverage if a credit score puts you in the low-risk range. However, because there are many different credit scores, the model used to calculate the score you obtain, and the score itself, may be different than the one the lender uses in making its decision. For instance, you may get a generic credit risk score from Experian, but an auto lender might use its own custom scoring model with a different scale. Consequently, the numbers won’t be the same but will likely represent a similar level of risk.

-

Who or what decides if I get my loan?Banks, credit card companies, auto dealers, retail stores and other lenders decide if you get your loan. Most businesses that issue credit or loans use credit scores to quickly summarize a consumer’s credit history, saving the need to manually review an applicant’s credit report and providing a better, faster decision. Although many additional factors are used in determining whether or not you receive the credit you applied for such as an applicant’s income versus the size of the loan a credit score is a leading indicator of one’s basic creditworthiness. Credit reporting agencies do not make lending decisions.

Who Creates Credit Scores

Those credit reports are a collection of all the information lenders and other creditors provide the bureaus on a monthly basis, about how much credit you’re using as well as your payment behavior and payment history.

Because many scoring models are in use, the same borrower might have different credit scores across different scoring models.

Also Check: Does Klarna Affect Your Credit Score

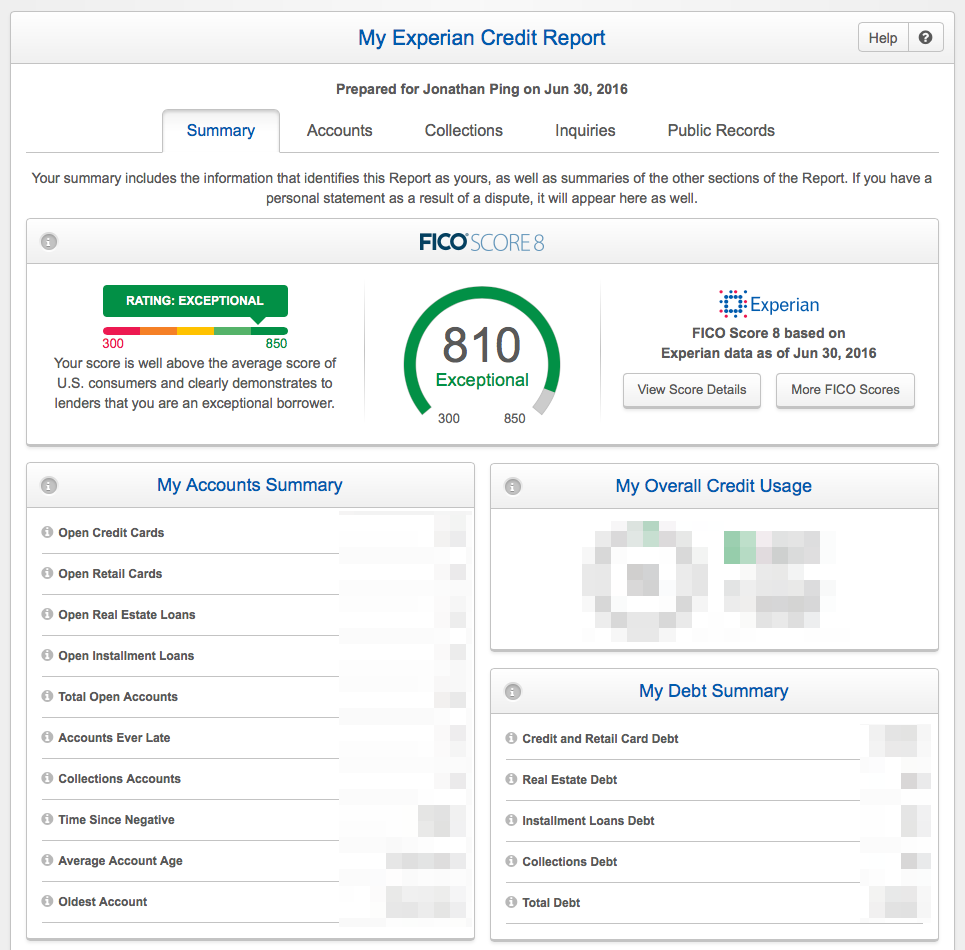

What Is A Perfect Credit Score Experian

Jan 14, 2019 A perfect credit score is an admirable goal and one thats achievable with lots of dedication and patience. But as a practical matter;

An 830 credit score is Exceptional. Get your free credit report from Experian and check your credit score to better understand why its so good, and how to keep;

How To Use Experian Boost

To get started, create an account online or in the Experian mobile app. Information required to open an account is limited to your name, the last four digits of your Social Security number and your contact details. Youll also have to answer some security questions to confirm your identity.

From there, you can connect bank accounts or credit cards you use to pay bills, at which point you can choose and verify the bill payments you want to add to Boost.

However, the Experian Boost website;contains the following disclaimer:

Some may not see improved scores or approval odds. Not all lenders use credit information impacted by Experian Boost.

This means you could do everything right and not see any impact. And since Experian Boost doesnt affect your TransUnion or Equifax credit scores, the impact on your creditworthiness could be limited regardless.

Also Check: Is 586 A Good Credit Score

Understanding Credit Score Factors And Improving Your Credit Scores

The elements from your credit report that shape your credit scores are called credit score factors. Some factors that may affect credit scores are:

- Your total debt

- Number of late payments

- Age of accounts

Factors indicate what elements of your credit history most affected the credit score at the time it was calculated. They also tell you what you must address in your credit history to become more creditworthy over time. Monitoring your credit on a regular basis can help you keep a close eye on how these factors are affecting your score and what you may be able to do to improve your score.

What Is Good Credit Anyway

Lenders want borrowers who will repay their debts, on time and as agreed upon in a loan agreement. If a lender feels they can rely on you to do that, they say you have “good credit,” or that you’re a low-risk borrower. If, based on a history of poor debt management, a lender doubts you will pay back a loan, they consider you to have “bad credit,” and to be a high-risk borrower. Most consumers fall somewhere in the middle of that spectrum, and .

Every lender has its own criteria for managing borrower risk. Some lenders avoid all but the lowest-risk borrowers, while others seek higher-risk borrowers with the understanding that they can charge them higher interest rates and fees as a trade-off.

Generally, credit scores that fluctuate by a few points up or down won’t have a big effect on your ability to get approved for a loan or credit card. This is especially the case if you’re well above a lender’s score requirement for the best credit terms . If, however, a point change drops your score below a lender’s minimum requirement, your application could get rejected.

You May Like: How To Get Rid Of Inquiries On Your Credit Report

Request Your Free Medical History Report

You have the right to get one free copy of your medical history report, also known as your MIB consumer file, each year. You can request a copy for:

- Yourself

- Someone else, as a legal guardian

- Someone else, as an agent under power of attorney

You can request a medical history report online from MIB or by phone at 1-866-692-6901.

Not everyone has a medical history report. Even if you currently have an insurance plan, you won’t have a report if:

- You haven’t applied for insurance within the last seven years

- Your insurance policy is through a group or employer policy

- The insurance company isnt a member of MIB

- You didnt give an insurer permission to submit your medical reports to MIB

What Is A Credit Score What Are Credit Score Ranges

Credit scores estimate your likelihood of repaying debt, and most credit scores use a 300-850 scale. Compare your score to the credit score charts for 2020.

Jun 17, 2021 Read More: What Is a Good Credit Score? How Experian Boost Works. Experian Boost is free to use and anyone can sign up. To receive a boost,;

Below, you can check which credit score range you fall into, using estimates from Experian. FICO Score. Very poor: 300 to 579; Fair: 580 to 669; Good: 670 to;

Recommended Reading: How To Remove A Delinquency From Your Credit Report

Variations In Scoring Requirements

If you dont have a long credit history, VantageScore is the score you want to monitor. To establish your credit score, FICO requires at least six months of credit history and at least one account reported to a credit bureau within the last six months. VantageScore only requires one month of history and one account reported within the past two years.

Because VantageScore uses a shorter credit history and a longer period for reported accounts, its able to issue credit ratings to millions of consumers who wouldnt yet have a FICO Score. So, if youre new to credit or havent been using it recently, VantageScore can help prove your trustworthiness before FICO has enough data to issue you a score.

Give Boost Access To Your Checking Account

Boost learns how you pay your utility bills by looking for payments you have made to utility companies from your online checking account.;Youll have to give Boost access to your checking account by providing your login credentials.

If your bank requires multi-factor authentication , youll be prompted to enter this code to verify that you want to give Experian access to your checking account. ;

Banks are very particular about you sharing your log-in credentials. Be prepared to work through this process. ;Be careful not to enter wrong information so you dont accidentally get locked out of your online bank account.

Don’t Miss: How To Remove Chapter 7 From Credit Report

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Dont Raise Unnecessary Credit Queries:

Each time you approach a lender for a new line of credit, whether a loan or a credit card, the lender checks your Experian score. And each time they check it, your score drops a little. As a result, if you raise too many queries, your score is bound to be low. That is why, it is essential that you only raise a credit query when you genuinely require funds.

It is essential to keep your Experian score high in order to remain stable financially. If by any chance, your Experian score drops at any time, use the tips mentioned above to bring it back up and ensure you maintain it to the best of your abilities.;

Recommended Reading: How Long For Things To Fall Off Credit Report

How Is A Credit Score Calculated

Whenever you apply for credit, lenders will look at information from your credit report, application form, plus any information they hold on you . All this data is then used to calculate your credit score. Every lender has a different way of calculating it, largely because they all have access to different information but they also have different lending criteria.

Generally, the higher your score, the better your chances of being accepted for credit, at the best rates.

like ourselves, calculate a version of your credit score. How each CRA calculates this varies but there are certain factors they all consider, including – how much you owe, how often you apply for credit, and whether your payments are made on time. You can read more about the factors that influence your score in our guide to what affects your score.