Is 620 A Good Credit Score

12 min read

Wondering if your credit score is up to snuff?

If you have a 620 credit score, you arent alone. Tens of thousands of borrowers in the U.S. are in the same boat usually for the same reasons. While a 620 credit score could use some improvement, if youre looking for guaranteed approval with competitive rates, it does fall into the fair credit score range. This article breaks down the factors that could be contributing to your 620 credit score, walks you through your personal finance lending options and shares some surefire strategies for boosting your lower credit score.

Recognize That Your Rates Can Increase

Currently, credit card companies cannot raise your credit rate for at least one year after you have opened your account, unless any of the following circumstances apply:

- A six month introductory rate exists

- You are late paying your bill by sixty days

- You have a card with a variable rate that is tied to an index and that index increases

You need to recognize that your credit rates will increase in the future, at least after the initial twelve months, and you need to establish with your potential creditor exactly when your rates will increase, by how much, and if there is anything you can do to lower your rates.

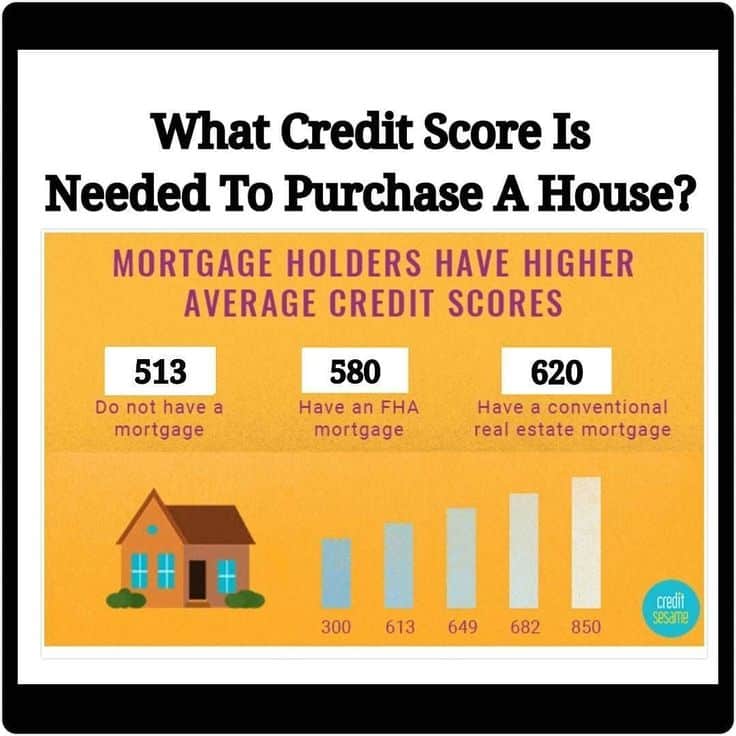

What Credit Score Is Needed To Buy A House

For most loan types, the credit score needed to buy a house is at least 620. However, a higher score significantly improves your chances of approval. Borrowers with scores under 650 tend to make up just a small fraction of closed purchase loans.

Applicants with scores of 740 or higher generally get the lowest interest rates.

If your credit score is on the low side, it may make sense to work on building it up before buying. Due to current economic uncertainty, many lenders have raised minimum credit score requirements on loans, even those that allowed for lower scores in the past.

You May Like: What Is The Free Credit Report Site

How To Improve Your Credit Score

To boost your credit score for your upcoming mortgage approval, first, check your credit report to learn whats comprising your score. All consumers get access to a free annual credit report at AnnualCreditReport.com.

You can also check your credit score by getting pre-approved.

If youve never reviewed a credit report, it can feel overwhelming. There are public resources that can help you, or you can ask for help in our chat. Well consider the factors that impact your credit score and discuss ways to make improvements, like opening a secured credit card account or shifting balances between charge cards.

Here are the best habits to improve your credit score:

- Pay your bills on time Payment history accounts for 35% of your FICO credit score

- Lower your credit utilization Increase your debt payments temporarily or request a credit limit increase

- Avoid new credit lines Hard credit inquiries are performed for a new line of credit and can affect your credit score for the next six months

- Dont close old accounts Keep old credit lines open and catch up on old payments or delinquencies

- Be patient It can take up to 6 months to make big changes in your credit score, so do the work and wait it out

Learn more about how to fix your credit to buy a home.

How To Increase Your Credit Score

Now that you know a little bit more about credit scores, you might be motivated to increase yours. Luckily, there are many ways that you can work to improve your score. Dont be discouraged if youre unable to increase your credit score overnight. It will take some time, but it will happen with intentional steps.

You May Like: How Long Does Information Stay On Credit Report

Learn And Grow Your Credit Score

While everyone with a FICO® Score of 620 gets there by his or her own unique path, people with scores in the Fair range often have experienced credit-management challenges.

The credit reports of 41% of Americans with a FICO® Score of 620 include late payments of 30 days past due.

Credit reports of individuals with Fair credit cores in the Fair range often list late payments and collections accounts, which indicate a creditor has given up trying to recover an unpaid debt and sold the obligation to a third-party collections agent.

Some people with FICO® Scores in the Fair category may even have major negative events on their credit reports, such as foreclosures or bankruptciesevents that severely lower scores. Full recovery from these setbacks can take up to 10 years, but you can take steps now to get your score moving in the right direction.

Studying the report that accompanies your FICO® Score can help you identify the events that lowered your score. If you correct the behaviors that led to those events, work steadily to improve your credit, you can lay the groundwork to build up a better credit score.

You Won’t Enjoy The Best Rewards Credit Cards

The best rewards credit cards require the highest credit scores. When your score is good or excellent, you can access the best introductory offers and cash-back incentives available among credit products today.

Some higher tier credit cards also give away special invitations to exclusive concert and event pre-sales, reward you with cash back on streaming services and more.

Whether you’re a sports fan, a movie buffs or an adventure seekers, one of CNBC Select’s top picks for cash-back cards is the Capital One Savor Cash Rewards Credit Card. It offers a competitive 4% cash back on dining and entertainment, 3% at grocery stores and 1% on all other purchases. New cardholders can earn a one-time $300 cash bonus once they spend $3,000 on purchases within the first three months from account opening.

You May Like: How Can You Clean Up Your Credit Report

Have Your Rent Payments Reported To The Credit Bureaus

If you dont own a home, but want to demonstrate your ability to make timely payments each month, ask your landlord to report your rent payment history to the three credit bureaus . 620 Credit Score

This may involve an extra fee, but it can have a significant effect on your score. A positive history of making consistent, on-time payments such as rent makes up more than 30 percent of your credit score.

Benefits Of A High Credit Score

Credit scores range from 300 to 850. Since its the highest credit score, 850 is considered a perfect score. An 850 credit score is difficult to achieve, but not impossible. And while it would feel pretty great to be able to say that you have a perfect credit score, you dont need to achieve it to reap the benefits of a high credit score. These benefits include:

- More favorable loan terms

- Lower interest rates, which can save you money

- A better chance of qualifying for loans and credit cards

The reason higher scores come with these benefits is because a high credit score shows a lender that youre good at handling your debt and are a responsible borrower. Lenders are able to offer better terms because youre seen as less of a risk.

Read Also: How To Get Paid Items Removed From Credit Report

Past Deeds Feed Your Credit Score

Late and missed payments are among the most significant factors to your credit score. More than one-third of your score is influenced by the presence of late or missed payments. Lenders want borrowers who pay their bills on time, and individuals who have missed payments are statistically more likely to default than those who pay their bills on time. If late or missed payments are part of your credit history, you can do yourself and your credit score a favor by developing a routine for paying your bills promptly.

Utilization rate on revolving credit is responsible for nearly one-third of your credit score. Utilization, or usage rate, is a technical way of describing how close you are to “maxing out” your credit card accounts. You can measure your utilization on an account-by-account basis by dividing each outstanding balance by the card’s spending limit, and multiplying by 100 to get a percentage. You can also calculate your total utilization rate by dividing the sum of all balances by the sum of all spending limits.

| Balance | |

|---|---|

| $20,000 | 26% |

Most experts agree that utilization rates in excess of 30% on individual accounts and all accounts in totaltend to lower credit scores. The closer any of these utilization rates gets to 100%, the more it hurts your credit score.

Check Your Credit Reports To Understand Your Scores

Its a good idea to check your credit reports periodically to make sure there arent any errors or mistakes that could be affecting your scores. Its also important to check your reports so you can spot any potential signs of identity theft.

If you do spot any inaccuracies, you can dispute them directly with the credit bureaus. Credit Karma even lets you dispute errors on your TransUnion report directly with our Direct Dispute feature.

Don’t Miss: How To Increase Credit Score With Credit Card Payments

What Is A Good Credit Score Range

Good credit score = 680 739: Credit scores around 700 are considered the threshold to good credit. Lenders are comfortable with this FICO score range, and the decision to extend credit is much easier. Borrowers in this range will almost always be approved for a loan and will be offered lower interest rates. If you have a 680 credit score and its moving up, youre definitely on the right track.

According to FICO, the median credit score in the U.S. is in this range, at 723. Borrowers with this good credit score are only delinquent 5% of the time.

A Good Credit Score Is In The Eye Of The Beholder

Although the FICO and VantageScore charts above display a general idea of how lenders may interpret different credit score ranges, lenders and other companies can, and often do, differ in their opinions of creditworthiness.

For example, just because youre considered to have a good credit score to an auto dealer doesnt mean a mortgage lender would consider that same score to be a good credit risk. Each lender has their own criteria for credit scoring as well as their own thresholds for a good score vs. a bad score.

Read Also: What Does Closed Derogatory Mean On Credit Report

Is Creditkarma Accurate

The credit scores and reports you see on Credit Karma should accurately reflect your credit information as reported by those bureaus. This means a couple of things: The scores we provide are actual credit scores pulled from two of the major consumer credit bureaus, not just estimates of your credit rating.

Can I Get A Mortgage

With a credit score of 620, you could qualify for a conventional mortgage.However, your options may be limited. At this level, or even with a higher score in the Fair range, your mortgage will likely be a federally-insured loan, backed by Fannie Mae or Freddie Mac.

If you have a credit score in the Fair range and can afford the down payment, it might be a good idea to apply for that mortgage now while interest rates are quite low. With a positive payment history on an approved mortgage and with some equity built up over time, you could qualify to refinance at an even lower rate at a future point in time.

An important thing to consider is how mortgage lenders apply the information they receive from the credit bureaus to their decision on your loan application. Mortgage lenders pull information from all three credit bureaus, then use the middle score in their decision.

Each bureau will return a different score because they have slightly different information about you and use varying scoring models. So, for example, if the bureaus return scores of 615, 620, and 635, the mortgage lender will use 620 as the score they will apply to your loan application. What credit score do you need to buy a house? Your guide to credit and mortgages

Recommended Reading: Does Paying Off Credit Cards Help Credit Score

What Is A Good Credit Score For A Credit Card

Like other lenders, credit card issuers will consult your credit score to determine the risk of doing business with you before approving you for a new credit card. If you want to open a premium travel rewards credit card, you may need good and perhaps even excellent credit scores to qualify. For other types of credit cards, even some with 0% introductory APR offers, a good credit score may be sufficient to be approved for the card.

Beyond qualifying for a credit card, your score can also have a significant impact on the APR and other terms of your account. Credit card issuers not only rely on credit scores to help them determine whether or not to approve applications, but they also use scores to set the pricing on the accounts they approve.

Take this list of top credit cards, for example. Youll notice that every credit card offer features not a specific rate, but rather an APR range. A card issuer might advertise an APR of 13.49% to 24.49%. The reason for that range is because the card issuer will base the final rate it offers you on the condition of your credit.

Defining a specific number that a credit card issuer defines as a good score is tough for two reasons:

A 620 Credit Score Can Be A Sign Of Past Credit Difficulties Or A Lack Of Credit History Whether Youre Looking For A Personal Loan A Mortgage Or A Credit Card Credit Scores In This Range Can Make It Challenging To Get Approved For Unsecured Credit Which Doesnt Require Collateral Or A Security Deposit

| Percentage of generation with 300639 credit scores |

|---|

| Generation |

| 27.3% |

Poor score range identified based on 2021 Credit Karma data.

Your credit scores are numbers calculated by credit bureaus, like FICO and VantageScore. Lenders use scores as at-a-glance information to help decide how risky they think you might be to lend to.

If your credit history includes signs of past credit challenges, such as late or discharged payments or accounts in collections, or little to no credit at all, you may find it more difficult to be approved for new credit. And if you are approved, you may find that approval comes with high rates and fees.

Building your credit scores can help. That said, theres no specific credit score that will guarantee approval or better terms or offers. Not only do you have multiple credit scores that are calculated using data from several possible , but its not always clear which score a lender might choose to check or what its criteria might be for approval.

We recommend thinking of your credit scores as a gauge to help you understand what lenders see when they check your credit. Understanding the factors that go into your scores can help you learn which ones to focus on to improve your overall credit picture in lenders eyes.

Heres what you need to know about building your credit and how to navigate credit applications in the meantime.

| 7.3 |

Ranges identified based on 2021 Credit Karma data.

Also Check: Does Closing Checking Account Affect Credit Score

Can I Get A Car Loan

Like mortgages, car loans are secured loans, where the property you are purchasing serves as collateral for the loan used to finance that purchase. Its much easier to qualify for a car loan than for a mortgage because auto dealers and the banks and finance companies they work with are eager to offer financing to consumerseven those with abysmal credit scores. These eager lenders air commercials that loudly announce that if you can push, pull, or drag that trade-in to the dealership, you can qualify for crediteven if you make as little as $300 a month.

However, this financing comes with some caveats. First, with a credit score of 620 your interest rate will fall somewhere around 11 percent. CFPB – Borrower risk profiles So be sure to factor that in before going to the dealership.

When financing an automobile purchase, focus on the loan term and not just the monthly payment amount. That payment is certainly important, but can be misleading. Car dealers emphasize monthly payment amounts in an effort to put a reasonable-sounding number in front of a prospective buyer and persuade them to buy.

What Is A 600 Credit Score Credit Sesame

Individuals with scores over 620 are considered less risky and are even more likely to be approved for credit. Struggling to get your credit score from poor to excellent? A credit score of 620 isn’t good. it’s not even fair. rather, a 620 credit score is actually considered bad, according to the standard 300 to 850 . Whether you’re looking for a .

680 to 699 · average/ok credit score: Individuals with scores over 620 are considered less risky and are even more likely to be approved for credit. 700 to 850 · good credit score: Check out these 10 tips that will help you improve your credit score.

A fico credit score of 620, as reported by the three major credit reporting bureaus, equifax, transunion and experian, is considered fair. a . Check out these 10 tips that will help you improve your credit score. 680 to 699 · average/ok credit score: A 620 fico® score is considered fair.

You May Like: What Is Revolving Debt On My Credit Report

Boosting Your Credit Score

If you have bad credit but are a first-time home buyer, start maximizing your score before you begin house hunting. Check your credit score so you know where you stand, review your credit history to make sure its accurate and remember to consistently pay your bills on time. You can check your credit score for free with our tool if youre a current U.S. Bank customer.

When lenders see multiple applications for credit reported in a short period of time, it can discourage them from giving you a loan. So heres a short list of things to try to avoid when applying for a mortgage so that you can keep your options open.

- Avoid opening new credit cards.

- Avoid closing credit cards .

- Avoid applying for new loans.

- Avoid co-signing on any new loans.

Looking for more ways to improve your credit score? Here are some .

You dont have to have a top credit score to get a mortgage, but it will help you compete for the house you want by potentially giving you more financing options. So, take steps to try to boost your credit, avoid applying for credit products at the same time youre house hunting and talk over your options with a mortgage loan officer who can help.

Connect with us to make homeownership a reality.

An experienced mortgage loan officer is just a phone call or email away, with answers for just about any home-buying question.