A 604 Dispute Letter Asks Credit Bureaus To Remove Errors From Your Report That Fall Under Section 604 Of The Fair Credit Reporting Act While It Might Take Some Time It’s A Viable Option Section 604 Explains The Circumstances In Which The Credit Bureaus Can Release Your Credit Information To Various Entities If You Find Inaccurate Information You Can Dispute It With The Credit Bureaus And Potentially Improve Your Credit Score By Removing Negative Marks That Are Inaccurate And/or Are The Result Of Fraud Sources Alienware Aurora Upgrade Gpu White Bounce House Rental Long Island Fios Quantum Gateway Router Bridge Mode The Other Ways To Contact Experian To Dispute Inquiries Are As Follows: By Phone: 1

- 4l80e no reverse fix. cylanceui mac. Our office hours are Mondays through Fridays, 8:00 a.m. to 4:30 p.m. We are closed from noon to 1:00 p.m. Contacting Domestic Relations: Director: Anna McKinney, Esquire Erie County Courthouse 140 West Sixth Street Room 6H Erie, PA 16501 Deputy Court Administrator, Trial Division Phone: 814-451-6167 Fax: 814-451-6223 Erie County

- The 623 dispute method specifically deals with whether an entry on your report is complete and accurate. Creditors that hold your debt must, at any time, be able to

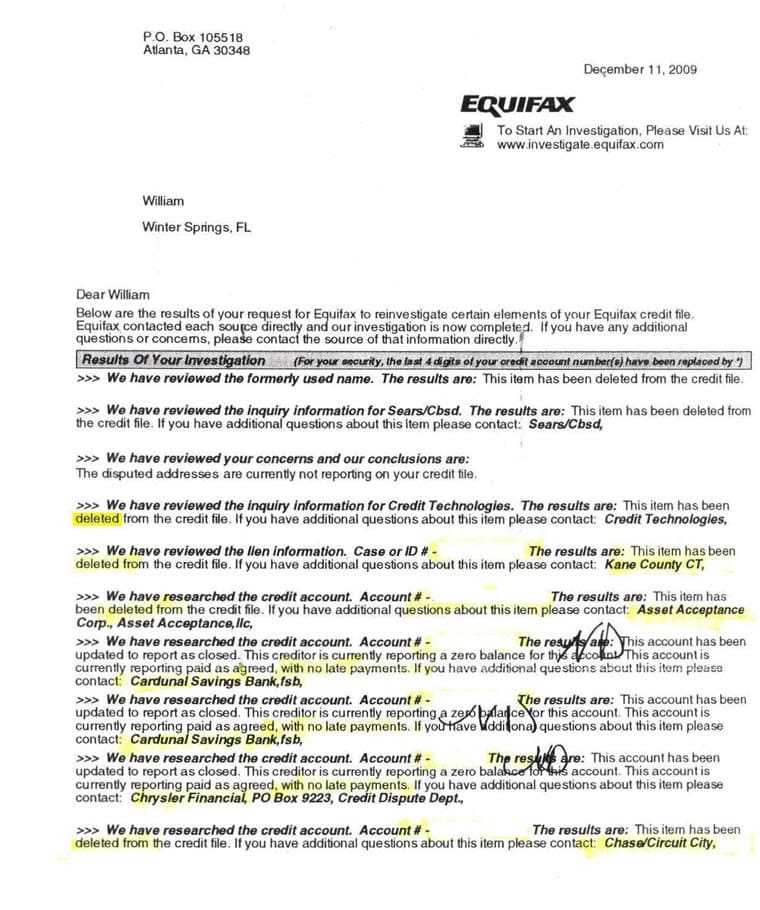

- A 604disputeletter asks bureaus to remove errors from your report that fall under section 604 of the Fair Reporting Act . While it might take some time, it’s a viable option to protect your and improve your score. Common errors to look for While you can’t dispute verified debts, you can dispute errors on your report.

- 545a_fair–reporting-act-0918.pdf The Act protects information collected by consumer reporting agencies such as

- May 20, 2004 · 16 CFR Part 604 – FAIR REPORTING ACT RULES | CFR | US Law | LII / Legal Information Institute. LII. Electronic Code of Federal Regulations Title 16 – Commercial Practices. CHAPTER I – FEDERAL TRADE COMMISSION. SUBCHAPTER F – FAIR REPORTING ACT. PART 604 – FAIR REPORTING ACT RULES.

Can Disputing Hurt Your Credit

Filing a dispute has no impact on your score, however, if information on your credit report changes after your dispute is processed, your credit scores could change. If you corrected this type of information, it will not affect your credit scores.

What is the 609 loophole?

A 609 Dispute Letter is often billed as a credit repair secret or legal loophole that forces the credit reporting agencies to remove certain negative information from your credit reports. And if youre willing, you can spend big bucks on templates for these magical dispute letters.

How do I remove negative items from my credit report?

1 To help on your way to better credit, here are some strategies to get negative credit report information removed from your credit report.

Read Also: What Credit Report Does Rooms To Go Pull

Understanding Your Credit Report

More than half of consumers never checked their scores in 2019, according to a report in USA Today. This likely means they never checked their credit reports as well. One reason for that could be that credit reports can seem difficult to understand.

While your credit report may appear complicated at first, after you break it down section by section it will become much easier to understand. Well go over the sections of your credit report with in-depth descriptions.

Additionally, credit reports have codes along with identifying information for both you and the companies you have done business with. When you read over your report, youll want to understand what those codes mean and how they are used to record your credit history. You can also find a guide to those codes below.

Understanding your credit report is the first step to repairing your credit. When you understand and monitor your credit reports, you can increase your credit rating. In fact, 34% of subprime consumers who followed their credit raised their score to near-prime or above credit risk.

Recommended Reading: How Much Does A Hard Inquiry Affect Credit Score

How Will The Experian Credit Report Help Me

Your credit report has all the records of your loans, credit cards and payments. This helps you understand what is the current state of your credit health. Moreover, checking your credit score from time-to-time will also help you spot any errors and that can be disputed with your lender. Also, if there is fraud or identity theft in your report, you can take quick measures and get them resolved at the earliest. If you check your credit report and it is high, you can be eligible for getting preferential pricing for interest rates on loans as well as credit cards with a higher limit and better benefits.

How Can Donotpay Cancel My Transunion Membership

If you would like to avoid the hassle of waiting on hold and remember if youve canceled all your subscriptions, let DoNotPay handle the whole process for you. It wont take you more than 30 seconds because all you have to do is:

You May Like: How To Get Things Removed From Credit Report

Experian Credit Report Format

If you need special formatting, credit scoring, or decision rules, the MERit Credit Engine can provide Experian credit results in database tables or as XML, but it can also provide human-readable credit reports to your application in the standard TTY Experian layout.

API Keywords allow you to specify whether the reports are generated by MCEfrom the Experian ARF System 7 data, or by Experian itself, as part of itsNetConnect response. In either case, the Merit Credit Engine User Guideshows how it is an easy matter for to pass the text report to the end-user to display orprint.

Experian format is illustrated and described below.

Legal And Regulatory Issues

In 2003, Judy Thomas of Klamath Falls, Oregon, was awarded $5.3 million in a successful lawsuit against TransUnion. The award was made on the grounds that it took her six years to get TransUnion to remove incorrect information in her credit report.

In 2006, after spending two years trying to correct erroneous credit information that resulted from being a victim of identity theft, a fraud victim named Sloan filed suit against all three of the USâs largest credit agencies. TransUnion and Experian settled out of court for an undisclosed amount. In Sloan v. Equifax, a jury awarded Sloan $351,000. âShe wrote letters. She called them. They saw the problem. They just didnât fix it,â said her attorney, A. Hugo Blankingship III.

TransUnion has also been criticized for concealing charges. Many users complained of not being aware of a $17.95/month charge for holding a TransUnion account.

In March 2015, following a settlement with the New York Attorney-General, TransUnion, along with other credit reporting companies, Experian and Equifax, agreed to help consumers with errors and red flags on credit reports. Under the new settlement, credit-reporting firms are required to use trained employees to respond when a consumer flags a mistake on their file. These employees are responsible for communicating with the lender and resolving the dispute.

Recommended Reading: Is 630 A Bad Credit Score

Is My Experian Credit Report Accessible To Anyone

No. Only you and authorised members of the Experian credit bureau have access to your credit report. These authorised members are defined by the Credit Information Companies Act, 2005. Also, only those people whom you have granted consent to check your report when you apply for a loan or a credit card have access to your credit report.

Security Of Credit Information Reports

You credit information is private. No one can access your information except for the organisations who are members of the Experian information sharing system. As per the Credit Information Companies Act 2005, this system is under strict regulation of the Reserve Bank of India. Rules are in place to govern the methods of accessing credit data and the data held by Experian.

Don’t Miss: How To Get My Credit Score Up

What Is A Credit Report And How Do I Access Mine

Institutions that have issued you credit cards and loans send regular updates about your accounts to , also known as credit reporting agencies. Credit bureaus collect all the data and combine it into a single file, known as your credit report. When you apply for new credit, the financial institution pulls your to determine whether you meet the qualifications.

To quickly figure out the likelihood that you’ll repay a loan on time, creditors may instead use your , a three-digit numerical summary of your credit report information at a given point in time.

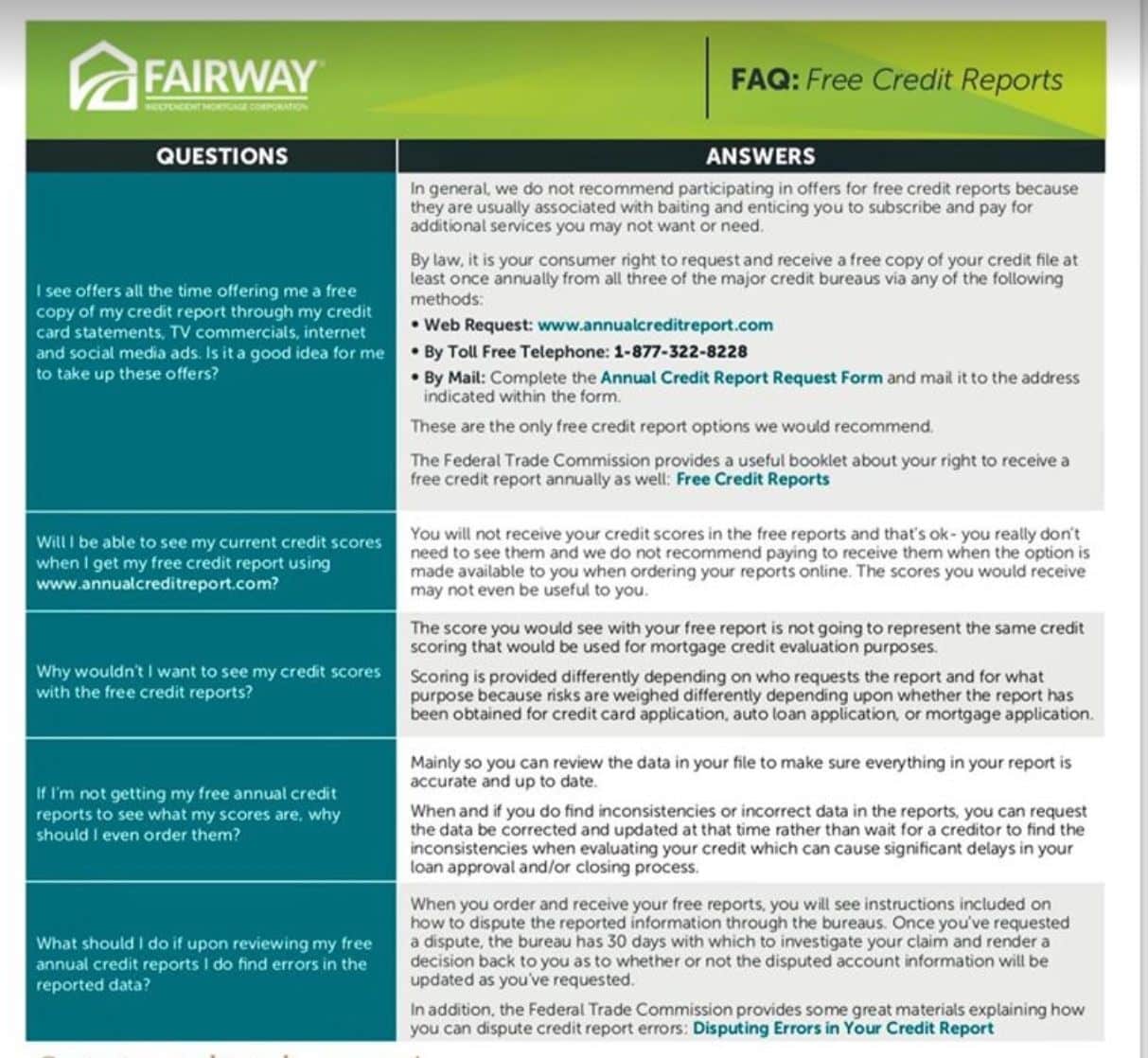

It’s important to check your credit report periodically to make sure the information it contains is accurate, complete, and within the allowed reporting time limit. You can access your credit report online from any of the credit bureaus, but there may be a fee. You’re also entitled to a free credit report each year from the major credit bureaus.

You can get one free credit report per week from Equifax, TransUnion, and Experian through December 2023 at AnnualCreditReport.com.

As you read through your credit report, reference this guide to better understand some of the abbreviations you see. Different credit bureaus and credit report providers may use slightly different codes, and some codes may only appear on the reports issued to lenders. Well clarify as much as possible.

How To Read An Experian Credit Report

CONSUMER ASSISTANCE,P.O. Box 2002, Allen, TX 75013-0036Telephone 397-3742888-4213.

FROM THE TOP

1. The Heading is at the very top right of the report. It contains the Credit Bureau’s information. The Credit Agency, their address, their phone number, and the date the report was inquired upon.

EXPERIAN Credit Profile Report701 Experian Parkway P.O.Box 2002Allen, TX 75013-0036Date Reported: 8/31/2003

Also Check: How To Check Personal Credit Rating

How To Read Credit Report Codes

Youll find a variety of different codes on your credit reports. Each major credit bureau has its own codes though, so dont assume a code used by one bureau means the same thing on another bureaus report.

Each bureau offers a guide explaining the codes youll see on that particular bureaus report. Heres where you can access those guides.

Trendy Online Shoe Stores

Welcome to Bleacher Report’s coverage and recap of AEW All Out 2022. The annual pay-per-view was back in the NOW Arena in the Chicago suburb of Hof… 5 Sep 2022 00:30, Sports News. 15 Match Star Ratings … Payment is made with or Debit Card, PayPal or through iTunes, Google Play, Roku, Virgin or Amazon. Your purchase will include the.

Aug 30, 2022 · As of April 2022, the average Americans FICO scorewhich ranges from 300 to 850 was 716, the same score that was recorded in October 2021 and again in April 2021, according to a…. Poor: 580-669. Fair: 601-660. Good: 670-739. Very good: 740-799. Exceptional: 800-850. Most Americans fall into the Good and Very Good categories. Over 46% of. Sep 07, 2022 · Looking at VantageScore 3.0 scores from TransUnion for tens of millions of members who had a mortgage tradeline open on their report in the past two years, we also studied the average VantageScore 3.0 score among homebuyers state by state. Our findings: Averagescores ranged from 683 to 739 …. In a typical scoring model, your score generally ranges from a low of 300 to a high of 850. The higher the , the better a borrower looks to potential lenders. How would your taxes change? The Wake Up for Tuesday, Sept. 6, 2022. Published: Sep. 06, 2022, 6:03 a.m..

british electronic bands 2010s

The current average car loan interest rate for new cars is 4.07% and 8.67% for used cars according to Experian. In 2022, new car loan rates range from 2.40% to 14.76% while used.

You May Like: Can Medical Bills Affect Your Credit Score

How To Get A Copy Of Your Credit Report From All Three Major Credit Bureaus

You can order one free copy annually of your credit report from Equifax, Experian and TransUnion by requesting it online with each bureau. Or get your hands on all three reports at once by ordering them at AnnualCreditReport.com.

Youre also entitled to a free copy of your credit report from a credit bureau that provided a report to a creditor that declined your credit application.

What To Do If You Suspect Identity Theft

If you suspect that the TU Interactive mark on your credit report indicates that someones stolen your identity, then there are a few steps you need to take:

You only need to contact one of the three bureaus and have a fraud alert placed on your credit report. The bureau you contact will coordinate with the other two, and your fraud alert will be acknowledged by all three.

Carefully monitor your credit reports in order to catch identity theft as early as possible. The sooner you report it, the less damage will be done.

Recommended Reading: Is 672 A Good Credit Score

On Your Experian Credit Report

Now lets take a look at the codes and abbreviations found on another credit report: the credit file about you that is maintained by Experian.

In your Experian credit reports, the most positive code you can see is the notation: OK.

The OK reference is just like it sounds. When you see OK next to an account shown in your Experian credit file, it means that there are no problems with your payment history, that you are current and have met the terms of your agreement.

There are two neutral codes in an Experian report. The first is: CLS, which means closed. The second is: ND, which means there is no data reported for the time period.

Other than the codes just mentioned, all the rest of the number codes and letters youll find on an Experian report are reflective of credit payment problems.

They Might Look Like Alphabet Soup But Theyre Important

Checking your credit report regularly is important so that you know it includes the right informationand nothing else. As you’re reading through your credit report, though, you may notice an alphabet soup of abbreviations that can make it feel like you’re reading another language or a secret code.

These abbreviations are typically shortened creditor names, industry acronyms, account types, and statuses. Becoming familiar with some of the most common credit report abbreviations can help you determine whether you need to take action to correct errors.

Don’t Miss: Does Klarna Help Your Credit Score

Does Transunion Offer Free Trials

Yes, TransUnion offers free trials as a way of attracting new customers. The terms of the free trials are specific to the products that are provided by it. You will need to provide your debit or credit card details before you are allowed to use your free trial. You wont be charged for anything you have access to until the trial expires. Note that you may be offered a payable upgrade to your trial while it lasts. If you accept, you will be charged for the upgrade, your trial will be terminated, and you will be on a paid subscription to TransUnion.

Driscoll39s Organic Strawberries Pesticides

Aug 29, 2022 · This leveling-off of the score is significant, as 2022 marks the first time in over a decade that the average FICO score has not increased year over year, says Can Arkali, senior director of…. Average Credit Card Limit. John S Kiernan, Managing EditorJun 2, 2022. The average credit card limit is $12,945, according to the latest data available from the bureau TransUnion. This number takes into account all American cardholders, including people of all ages, and incomes. Aug 31, 2022 · The average FICO ® score for all generations rose by four points between 2020 and 2021. WalletHub reports that the average card bills minimum payment is $110.50 per month at an average annual percentage rate of 14.54 percent..

Most curved classes go by standard deviations, or variation from the average. This divides the class into brackets, with students deviating positively from average getting higher. Jan 25, 2022· Cumulative hours include all graduate hours attempted for which a student earns a grade A through E, including EN. What is the minimum for a car loan? … scores have many more options and generally have access to lower interest rates than those with bad or even average credit.

Mar 15, 2022 This statistic presents the averagescore in the United States from 2005 to 2020. The averagescore increased from 688 in 2005 to 711 in 2020. Averagescore in the.

You May Like: How To Get Public Records Removed From Credit Report

Tips For Improving Your Credit Information Report

There are a number of things that you can do to improve your credit profile and thereby your chances of getting credit

Always make your payments on time. If you cannot do this, contact the lender as soon as possible to discuss what options are available to you, it is always better to speak to your lender immediately if you are experiencing any difficulties in maintaining your payments

If you have paid off a debt but your report doesnt show this, contact the organisation concerned and ask them to make the necessary changes or contact us and we will contact the relevant organisation for you

Close any accounts you no longer use

Check your credit information report regularly. It always makes sense to get a copy of your credit information report before you apply for credit or if you are refused credit as a result of information held by a credit information company

Managing credit and credit profiles during important life events

When you apply for credit, for example a credit card or a loan, you will probably give the lender permission to do a check with Experian or another credit information company. This check helps the lender know that you can afford to repay the money you want to borrow. Experian does not decide who should get credit, but the information we provide may help the lender to decide.

Things to do when your loan or credit card application is rejected

Lessons for students on credit management

Managing credit as you get married