Can Applying For A Credit Card Improve Your Credit Score

Applying for a credit card, in and of itself, wont improve your credit score. It will actually lower your credit rating for several months. That said, being approved for a credit card and, more importantly, using it wisely can boost your credit score. In time.

Numerous requests can make lenders wonder why you want or need so much credit.

Whether youre a credit card first-timer or a veteran of paying with plastic, you can use your card to build credit. The key is to create healthy habits early on and stick with them for the long haul. This includes:

- Setting reasonable spending limits

- Charging only what you can afford

- Making on-time payments each month

- Keeping credit utilization below 30%

- Limiting applications for new credit

Any lender who rejects your application must provide an explanation within 60 days.

What Credit Score Do I Need For A Mortgage

Mortgage lenders typically require borrowers to have a credit score of at least 680 to qualify for a home loan. The higher, the better. Some mortgage providers may approve your mortgage application if your score is between 600 and 680, though its highly likely that youll be charged a higher interest rate.

How To Increase Your Odds Of Being Approved

Wait! How can you be sure that you will be approved? Didnt I just say there are no guarantees? I did, but there are actions you can take to increase your chances of being approved when you need or want to take on new credit.

You do this by paying your bills on time and as agreed each and every month because you know that payment history is important to your score. You also keep an eye on how much of your available credit you have used and keep that number below 25 percent across the board . You dont close old accounts without a good reason to preserve your length of credit history. You have a healthy mix of both revolving and installment accounts to demonstrate your ability to handle both variable and fixed payments.

This also means you need to be careful not to apply for too much credit at one time. An increase in your credit score may lead you to think you need to strike while the iron is hot and get every credit card you can. This is a strategy that will cause a lot more harm than good, so it should be avoided at all costs.

Don’t Miss: How To Remove Settlement From Credit Report

How Can I Improve My Credit Score

You can improve your credit score by tackling the issues that affect it. Payment history makes up 35% of your credit score, so bring delinquent accounts up to date first if you’re behind on any payments or have accounts in collections. Amounts owed make up 30% of your credit score, so do your best to pay down your balances. Check your credit report to ensure that it doesn’t contain any errors, like accounts that don’t belong to you.

What To Consider Before Applying For A New Credit Card

Itâs hard to pinpoint exactly how opening a new credit card could impact your credit scores. But a new card could give you a credit-building opportunity with lots of benefits.

Introductory offers, rewards programs, interest rates and eligibility requirements are a few important factors to consider. The Consumer Financial Protection Bureau recommends only applying for the credit you need. So, focusing on the credit card features best suited to you can help you narrow down your search. And looking at your pre-approval odds helps you explore your options before you applyâwithout affecting your scores.

When you open your new credit card, a small and temporary drop in your credit scores is possible. But using your card responsibly can help offset this impact. Making consistent on-time payments and avoiding high balances can have a positive impact on your credit scores over time.

Checking your credit for accuracy is also a good idea. lets you access your TransUnion® credit report and VantageScore® 3.0 credit scoreâwith no impact on your credit scores. CreditWise is free for everyone, and you donât have to be a Capital One cardholder to use it. You can also get free copies of your credit reports from each of the three major credit bureaus at AnnualCreditReport.com.

Also Check: How To Clear Delinquency On Credit Report

How Does Applying For New Credit Affect My Credit Score

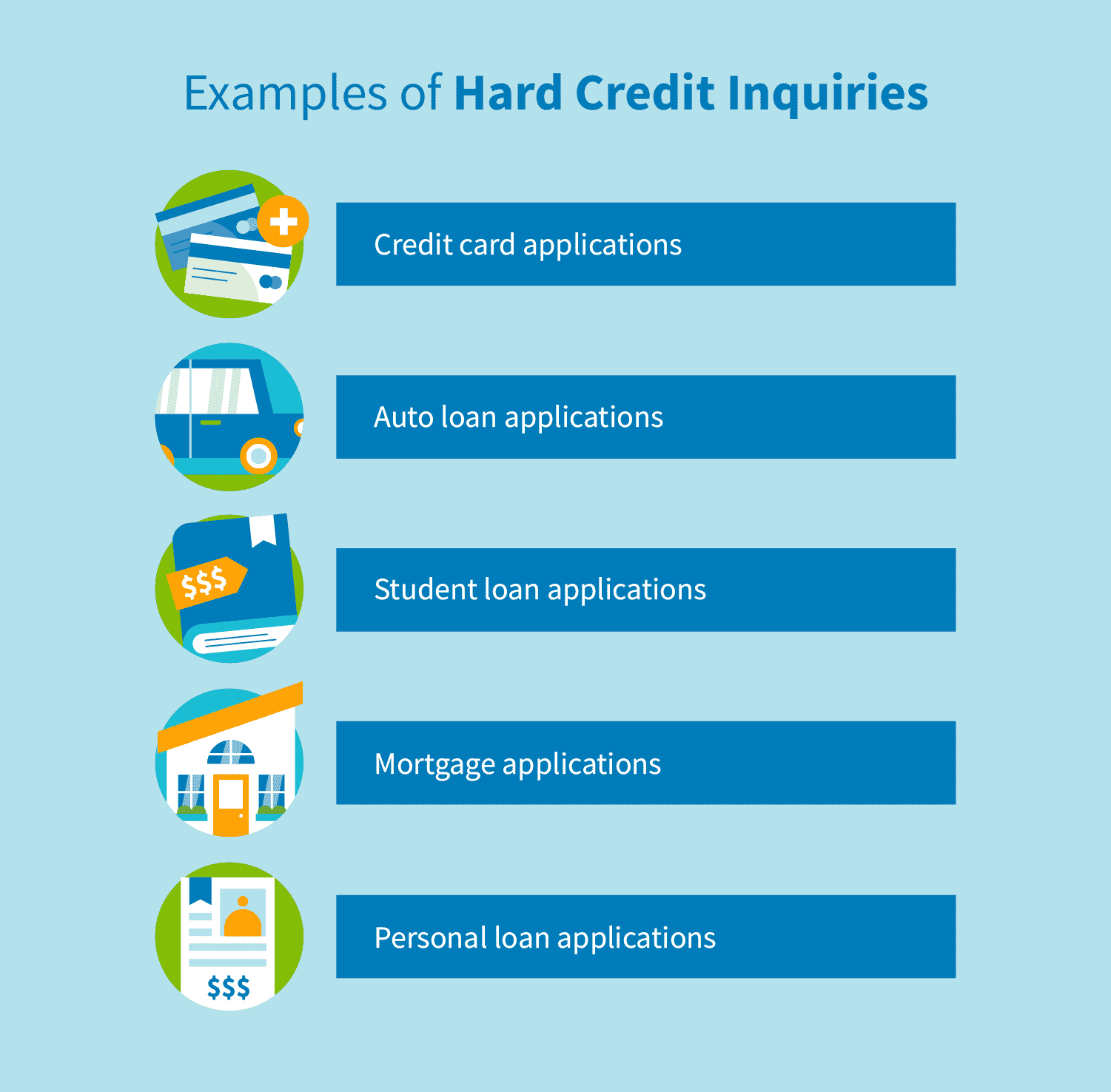

When you submit a new credit application, whether it’s for a or loan, there may be some affect to your credit score if the lender does a hard inquiry into your credit history.

Most credit applications result in a hard inquiry, which means the lender pulls your credit report from one of the main three , Experian, Equifax or TransUnion. Hard inquiries can cause your credit score to fluctuate slightly, compared to a soft inquiry, which doesn’t pull your credit and has no effect on your score.

“Not all inquiries will have a measurable impact on your scores,” John Ulzheimer, formerly of FICO and Equifax, tells CNBC Select. “But, if an inquiry is causing a score to be lower it’s no more than a few points.”

If your credit score drops a few points, you may wonder how quickly you can expect it to rebound. Thankfully, “score changes due to inquiries are usually minimal and scores recover quickly,” Griffin says.

When I recently applied for the Chase Sapphire Reserve®, my score dropped 5 points the day after I applied and rebounded soon after. In a little over a month, my credit score increased a total of 19 points . Take note, I was approved for a generous credit limit and paid off balances on a 0% APR card, which could be part of the reason my score increased.

“Having said that, too many inquiries within a short period of time may be seen as a sign of financial stress and can therefore negatively impact your credit,” Griffin says.

When Applying For A New Credit Card Can Help Your Credit Score

Applying for a new credit card generates a hard inquiry, and this affects the new credit category of your credit score. Note that this portion of your score only amounts to around 10 percent of the total scoring, but is still an important factor.

If you have a short , you should be careful not to open too many new accounts too fast, because multiple hard inquiries will likely lower your credit score.

However, if you have a long and established credit history, your FICO® Score may be affected differently. It doesnt mean that a hard inquiry cant affect your score, but there are other factors in play. Since you have already established your payment history and length of credit history, opening new accounts might help your credit score by changing your credit utilization ratio. How?

Say you owe $2,000 across three credit cards with a total credit line of $8,000. Thats a 25 percent utilization ratio. If you get approved for two new credit cards with a $2,000 line each, your total credit will increase to $12,000, and your utilization ratio will decrease to 17 percent. While it may sound like a good idea, just remember that responsible spending under these credit limits is important for overall credit health.

Recommended Reading: What Is Cbcinnovis On My Credit Report

Fact #: Applying For Credit Does Not Always Lower Credit Scores

Applying for new credit is not guaranteed to lower your scores it depends on the other information in your credit file at the time the scores are calculated. There is no rule in scoring algorithms dictating a certain number of points lost with each new hard inquiry. Generally, credit scoring algorithms divide people into risk categories based on statistical analysis. The category dictates how much impact the number, type and timing of hard inquiries may have on the final scores. For example, statistical analysis has shown that people with longer, solid credit histories dont tend to start missing payments when they take on new credit accounts. So, people in that category may be able to apply for a new credit account or two and not experience any drop in their scores. The same analysis has shown, however, that people with shorter or less solid credit histories may be more likely to start missing payments after they open additional credit accounts. So, people in this category may see a drop in their credit scores after applying for new credit accounts.

What Is Your Credit Score And How Is It Calculated

Your credit score, also known as your credit rating, is based on your financial history when it comes to credit, borrowing and repayments. It also takes into account how often youve applied for credit, and for what purpose. Lenders use your score as well as other risk-related criteria to determine whether to lend you money how much, and what interest rate to charge.

Your credit score is calculated by credit reporting agencies, and can be represented in different numerical ways but generally, the higher your score, the better. To reach this figure, reporting agencies examine:

- Your debt history, including any repayment issues you may have faced

- Loans and loan enquiries youve taken out to purchase, refinance or renovate houses

- Your current credit limit, as well as your credit cards and store cards

- Accounts you may have opened and/or closed

- Any history of default judgements or bankruptcy

Also Check: How To Check Credit Score With Itin Number

Strategies That Will Quickly Get You A Better Credit Score

Thomas J Catalano is a CFP and Registered Investment Adviser with the state of South Carolina, where he launched his own financial advisory firm in 2018. Thomas’ experience gives him expertise in a variety of areas including investments, retirement, insurance, and financial planning.

Your is one of the most important measures of your financial health. It tells lenders at a glance how responsibly you use credit. The better your score, the easier you will find it to be approved for new loans or new lines of credit. A higher credit score can also open the door to the lowest available interest rates when you borrow.

If you would like to boost your credit score, there are a number of quick, simple things that you can do. While it might take a few months to see an improvement in your credit score, you can start working toward a better score in just a few hours.

Applying For That New Credit Card

Now that weve explained why the headline isnt a typo, lets talk about what may happen to your credit scores when you apply for a new credit cardor any new credit account, for that matter. Many people are aware that applying for new credit can have a negative impact on scores but there is a lot of misinformation circulating, so lets establish a few facts.

You May Like: How To Get Missed Payments Off Credit Report

Calculating A Credit Score

Credit scores vary from a scoring model to another, but in general the FICO scoring system is the standard in U.S., Canada and other global areas. The factors are similar and may include:

Why You Might Want A Lot Of Credit Cards

The logical follow-up question is okay, you can have a lot of credit cards, but why would you want to?

Well, first and foremost my goal is for those of you who are exclusively using debit cards to instead switch to credit cards, assuming you can use your credit responsibly .

Way too many people only have debit cards, so its time to start building your credit and realize that applying for credit cards can potentially help your score, rather than hurt it. Pick up a card like the Chase Sapphire Preferred® Card or Chase Sapphire Reserve® Card , which offer easy to use points and great bonuses on spending.

If you dont want to get into points, pick up something like the Citi® Double Cash Card , which has no annual fee and offers 1% back when you make a purchase, and 1% back when you pay for that purchase . These rewards can even be combined with ThankYou points earned on other cards, like the Citi Premier® Card , to get even more value.

But why would you want to have many credit cards?

You May Like: Is An 850 Credit Score Possible

Review Your Credit Reports

To improve your credit, it helps to know what might be working in your favor . Thats where checking your credit history comes in.

Pull a copy of your from each of the three major national credit bureaus: Equifax, Experian, and TransUnion. You can do that for free once a year through the official AnnualCreditReport.com website. Then, review each report to see whats helping or hurting your score.

Factors that contribute to a higher credit score include a history of on-time payments, low balances on your credit cards, a mix of different credit card and loan accounts, older credit accounts, and minimal inquiries for new credit. Late or missed payments, high credit card balances, collections, and judgments are major credit score detractors.

Can Closing A Credit Card Impact Your Credit Score

When you close a credit card, you close down a line of credit available to you. This can in turn increase your credit utilisation ratio and subsequently decrease your credit score.

As a result, it is always recommended to keep your credit cards open and not get them permanently closed even if you wonât be using them for a while. By keeping your credit cards active, you increase the total line of credit available to you, as compared to the debt that you owe.

To keep the credit card active, you can add a small monthly recurring subscription to it like a gym membership or a streaming service.

Though it’s important to keep that if you are paying high annual fees and interest over a card that you do not even need, you may just be burning a hole in your bank account by keeping it active. Moreover, when you have a credit card, you end up using it some way or the other, even if you donât.

At the end of the day, you should only keep your credit card accounts open when you know you can manage them effectively.

Read Also: How To Find Out My Credit Score

How Many Credit Cards Is Too Many

Having at least one credit card is a good thing because it can help you build credit. But how many credit cards should you have? Theres no one-size-fits-all answer. For some consumers, one credit card is enough as long as it reports payment activity to the three credit bureaus. Other consumers may use two, three or even more in different spending categories.

Just be sure that however many credit cards you use, you can still keep track of your payment due dates. Some issuers allow you to request the due date of your preference, which means you might be able to arrange it so all your cards have the same due date. You could also set up email or text message alerts for when a due date is approaching, or activate autopay so at least the minimum payment is made automatically on-time payments are the most important factor of your credit score.

How To Get A High

Apply for a higher-limit card the same way you would any other credit card. To be approved, however, you must meet the card issuerâs criteria for the credit card and limit you seek. This is based largely on your current and past credit use. Most issuers do not allow a potential cardholder to request a specific credit limit upon application, however.

This means that the best thing you can do to secure a card with a high credit limit is to maintain good stats as a borrower, including and . Perhaps most important is simply having sufficient credit history and a good relationship with the lender if one already exists. Check out our guide to increasing your credit limit for more details on requesting a limit increase from card issuers.

While itâs clear card issuers will make their own judgements about an applicantâs creditworthiness , often overlooked is a cardholderâs own assessment of their fiscal discipline and whether it suits them to a high-limit card. Securing a new high-limit card or requesting a credit limit increase can easily lead to overspending, as the temptation to spend first and think later can grow as easily as a balance on a card with a high limit. Combined with making only minimum monthly payments and high interest rates associated with reward cards, overspending can lead to debt and credit damage.

Read Also: How To Remove Derogatory Items From Credit Report