What Can I Do With A 796 Credit Score

796 credit score puts you just one level below the top-tier credit range of exceptional. So, as you may guess, you should have access to most credit and loan options you apply to. And while you may not secure the best interest rates or loan terms possible on the market , you’ll often get very competitive offers.

Need to know your credit score? Find out with our free Credit Assessment

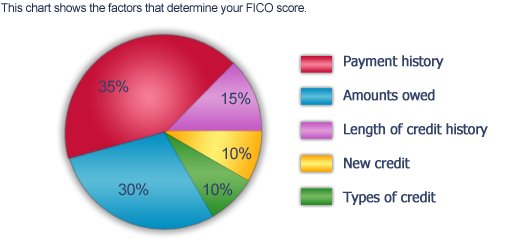

Vantagescore Vs Fico Credit Score Calculation Methods

VantageScore and FICO take the same factors into account to produce your score, but they weigh them slightly differently . Here are just a couple of the differences between FICO and VantageScore: 3

- VantageScore groups the length of your credit history and your credit mix into one category called Depth of Credit.

- In addition to your credit utilization , VantageScore also looks at your current balances and your remaining available credit .

The tables below show how the models weigh your financial decisions to produce your score:

| -16 | 688 |

Given time, you can get your credit score into the top ranges. This can mean developing your credit profile if you dont have much of a credit history or recovering from negative marks that brought your score down.

Now You Qualify For The Lowest Interest Rates And Best Credit Cards

Thomas J Catalano is a CFP and Registered Investment Adviser with the state of South Carolina, where he launched his own financial advisory firm in 2018. Thomas’ experience gives him expertise in a variety of areas including investments, retirement, insurance, and financial planning.

If youve got your credit score over 800, well done. That demonstrates to lenders that you are an exceptional borrower and puts you well above the average score of U.S. consumers. In addition to bragging rights, an 800-plus credit score can qualify you for better offers and faster approvals when you apply for new credit. Heres what you need to know to make the most of that 800-plus credit score.

Recommended Reading: How Fast Can Credit Score Go Up

What Is Considered As A Poor Credit Score

According to Capital One, a FICO score that falls below 580 is considered to be a poor credit score. Lower credit scores can make it difficult to get approved for credit cards or loans as approximately 61 percent of those with low credit scores fall behind on their loans11.

Come up with a credit card debt or loan repayment plan to reduce debt and credit utilization, look for accounts that build credit, and find other ways like Experian Boost to improve your score if you have negative items contributing to your bad credit.

Experian also offers free credit score checks to help you stay on top of your score and payment history. Your credit card balance doesnt have to stop you from moving forward financially.

How To Keep On Track With A Very Good Credit Score

To achieve a 796 credit score, you’re probably disciplined in your financial habits, with solid debt-management skills. You can still increase your score, however, and of course you’ll want to avoid losing ground. To those ends, it’s a good idea to keep an eye on your score, and avoid behaviors that can bring it down.

Factors that affect credit scores include:

. To determine your on a credit card, divide the outstanding balance by the card’s credit limit, and then multiply by 100 to get a percentage. Calculate the utilization for all your cards, and then figure out your total utilization rate by dividing the sum of all your balances by the sum of all your borrowing limits . You probably know credit scores will slip downward if you max out your credit limit on one or more cards by pushing utilization toward 100%. You may not know that most experts recommend keeping your utilization rate below 30% for each of your cards and for all your revolving accounts overall. Credit usage is responsible for about 30% of your FICO® Score.

Timely bill payments. This may seem obvious, but there’s no greater influence on your FICO® Score: Late and missed payments hurt your credit score, and on-time payments benefit your score. Payment history accounts for as much as 35% of your FICO® Score.

. The FICO® scoring system generally favors borrowers with a variety of credit, including both installment loans and revolving credit . Credit mix can influence up to 10% of your FICO® Score.

Read Also: When Does Charge Off Drop From Credit Report

Percent Of The Us Population That Has A Fico Score Below 550

Fortunately, a low percentage of the U.S. population appears to have low FICO scores. Data released by FICO in 2019 reveals that only 11.1 percent of the U.S. population has a FICO score ranging between 300 and 54913.

It also reveals a downward trend, indicating that the average FICO score is on the rise and the average credit card debt and other debts are on the decline for Americans.

How Your 796 Credit Score Was Calculated

As mentioned earlier, the two main credit scoring models are FICO and VantageScore. Although the two models have minor differences, both calculate credit scores based on the following factors:

- Payment history:Late payments lower your credit score. The later the payment, the more damage it will do. Charge-offs, collection accounts, and bankruptcies are even more damaging to your score.

- : This refers to the proportion of your available credit that youre using . A lower utilization rate is better for your credit score. Many experts recommend keeping yours below 30% . VantageScore recommends keeping your credit utilization even lower, under 10% if possible. 1

- Length of credit history: This is determined by the age of your oldest and newest credit accounts as well as the average age of all of your accounts. Old accounts that youve had for many years boost your credit score, whereas new accounts lower it.

- : Your credit score will be lower if you dont have a balanced mix of revolving credit accounts and installment accounts .

- New accounts: When you apply for a credit card or loan, the lender will run a credit check. This will trigger a hard inquiryHard inquiries take a few points off your credit score, and the effect lasts for up to 12 months. 2 Actually opening the account can further hurt your score and have even longer-lasting effects.

Recommended Reading: Is 783 A Good Credit Score

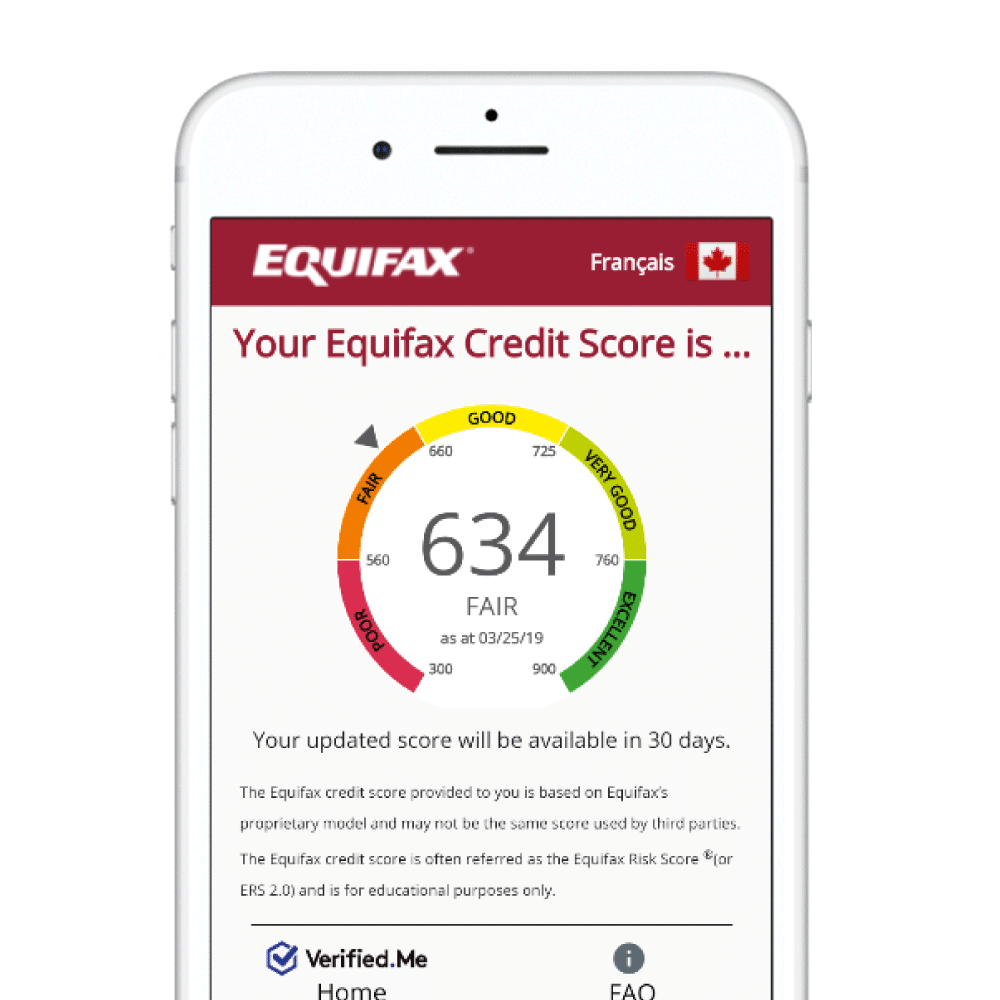

Whats A Good Credit Score

So, what is a good credit score, anyway? Lets start at the beginning.

According to the Government of Canada, a credit score is a 3-digit number that represents how likely a credit bureau thinks you are to pay your bills on time.1 It can be an important part of building your financial confidence and security.1 For example, building a good credit score could help you get approved for loans and larger purchases, like a home.1 You may also be able to access more competitive interest rates.1

There are two main credit bureaus in Canada: Equifax and TransUnion.1 These are private companies that keep track of how you use your credit.1 They assess public records and information from lenders like banks, collection agencies and credit card issuers to determine your credit score.1

How To Check Your Cibil Score

If you are wondering where to check your CIBIL score, you can do it easily by visiting the credit information company’s website. Usually, you will need to pay a small fee to check your score. To get unlimited access to your credit score and report, you can pay Rs. 550 for one month or Rs. 1,200 for a year at the CIBIL MyScore page. You can also check your CIBIL Score for free on a one-time basis here.

Recommended Reading: How To Clear A Judgement On Your Credit Report

Is 782 A Good Cibil Score

Asked by: Ms. Jaquelin Parisian

A 782 credit score is Very Good, but it can be even better. If you can elevate your score into the Exceptional range , you could become eligible for the very best lending terms, including the lowest interest rates and fees, and the most enticing credit-card rewards programs.

Auto Loans For Excellent Credit

Having excellent credit can mean that youre more likely to get approved for car loans with the best rates, but its still not a guarantee.

Thats why its important to shop around and compare offers to find the best loan terms and rates available to you. Even with excellent credit, the rates you may be offered at dealerships could be higher than rates you might find at a bank, credit union or online lender.

You can figure out what these different rates and terms might mean for your monthly auto loan payment with our auto loan calculator.

And when you decide on an auto loan, consider getting preapproved. A preapproval letter from a lender can be helpful when youre negotiating the price of your vehicle at a dealership, but be aware that it might involve a hard inquiry.

If you have excellent credit, it could also be worth crunching the numbers on refinancing an existing auto loan you might be able to find a better rate if your credit has improved since you first financed the car.

Compare car loans on Credit Karma to explore your options.

Also Check: How To Fix Errors On My Credit Report

Average Credit Score By Income

According to American Express, the average credit score by income are as follows4:

- $30,000 or less per year: 590

- $30,001 to $49,999: 643

- $50,000 to $74,999: 737

The correlation between lower average credit scores and lower-income may be associated with factors like higher-income individuals being able to pay back credit card debts more easily as well as being able to maintain a lower credit utilization ratio.

Those with higher income may also have higher credit limits in comparison to those with lower income.

That being said, income is not the most accurate measurement of scores. Income is only one factor that plays a role in your score. You can still have a low income and have good credit. If you fall into a lower income bracket, dont worry. Your income doesnt determine your score.

Shopping For Credit Cards With A 796 Credit Score

When shopping for credit cards, make sure you explore all of your options. In other words, dont just sit down with one potential creditor and decide to accept their deal or not. Sit down with multiple potential creditors and compare and contrast them to find out what works best for you.

If you already have a credit card, but have been shopping for one that is cheaper, you can then go to your existing creditor and request them to either match or beat an offer from another credit card company. Tell them that you believe you are paying too much money in fees and interest, and ask them if they are willing to lower their rates and fees down to the other credit card company that you are thinking about switching to.

If they refuse, then you can switch accounts, but dont close your existing account immediately. You still want to make the minimum payment on. it while you are waiting for your balance to transfer to your new account. You only want to close a credit account when your balance is at zero.

You May Like: How To Pull Your Credit Report

Improving Your 796 Credit Score

A FICO® Score of 796 is well above the average credit score of 711, but there’s still some room for improvement.

Among consumers with FICO® credit scores of 796, the average utilization rate is 17.0%.

The best way to determine how to improve your credit score is to check your FICO® Score. Along with your score, you’ll receive information about ways you can boost your score, based on specific information in your credit file. You’ll also find some good general score-improvement tips here.

Shopping For The Best Rates On Loans And Credit Cards For A Credit Score Under 796

If you are ever on the market for high-priced items, such as home appliances, it is very common for people to walk into the store and get offered a discount or an otherwise excellent financing deal.. .but only if they open up a credit card account with that store.

Why do stores offer these credit cards? The reason why is because theres usually a high interest rate or multiple fees that go along with them. Those rates and fees can be found on the small fine print of the credit card deal, but of course, the store doesnt tell you.

A golden rule of credit cards is that you should only apply for credit that is a necessity for your financial life. When applying for a credit card from a retail store, youre probably only going to use it once, twice, or three times maximum. You could just as easily be using an existing credit card that you already have.

Heres why this is so critical: applying for multiple credit cards within a few months of each other will be very harmful to your overall credit score. Never apply for a credit card that you dont need.

Now, when you do decide to apply for credit cards and loans in general, there are a few factors that you will want to remember, including:

Recommended Reading: How To Get Free Credit Report From Transunion

Ask Your Current Creditor For Better Terms

If you have a revolving credit account with a good payment history, then consider contacting your creditor and asking for better terms, such as a higher credit limit or lower interest rate. Highlight your strong payment history and loyalty as a customer. Some creditors are willing to make accommodations to keep you from looking elsewhere for better terms.

In addition to helping your finances, this can help improve your credit score. For example, getting an increase in your credit limit will automatically reduce your credit utilization rate, as long as you dont start spending more.

The Average Fico Score Increase In The Last Decade

Between 2010 and 2020, the average FICO score has increased by approximately 24 points. The average FICO score in 2010 was 687, while todays average FICO score in the United States is 711.

This trend increase in credit score statistics also seems to appear in different age brackets, as illustrated in the data above in Experians and The Ascents reports.

Read Also: How To View My Credit Score

What Does Vantagescore Have To Say

Though there are no magic score numbers or strict cutoffs, VantageScore does provide some guidance on the quality of certain VantageScore 3.0 score ranges in this credit score chart:

The above grades/categories are meant to give a general idea of how a score stacks up, but again, it all depends on the lender, the loan and your entire application.

While you cant control how a lender might view your TransUnion credit score, you can control credit behaviors affecting your score. So make sure you use credit responsibly: pay your bills on time, dont borrow more than you can afford, and watch how frequently youre applying for credit.

See your credit trends, at a glance. Get smarter about your credit with our interactive score-trending graph.

How Long Does It Take To Build An 800 Credit Score

Depending on where you’re starting from, It can take several years or more to build an 800 credit score. You need to have a few years of only positive payment history and a good mix of credit accounts showing you have experience managing different types of credit cards and loans.

A good credit mix includes a few major credit cards, a real estate loan, and another type of installment loan. These accounts must be a few years old to show that you can handle a variety of credit responsibilities over a long period of time.

You May Like: How Long Does An Eviction Stay On Your Credit Report

How To Get A Loan Despite A Poor Credit Score

- Borrow from non-banks:While non-banking financial companies, like Bajaj Finserv, still need you to have a decent credit score, they tend to have relatively simpler eligibility criteria, which may help you raise funds fast and without too much effort.

- Apply with a guarantor or co-signer to your loan account:Adding a co-borrower to your loan application helps distribute the responsibility of repayment between you and the co-borrower. When your co-borrower has a good score, you will be able to borrow a larger loan amount and boost your chances of approval too.

- Try to find a secured loan:When a loan is unsecured, the lender is more stringent with the eligibility criteria by carefully filtering and selecting the most reliable borrowers. However, if you have collateral to offer, the significance of having a good credit score diminishes.

Additional Read: Get a personal loan on a bad CIBIL score

How To Improve Your Credit Score From 797 To 800+

A credit score of 797 is on the brink of perfection, and you probably wont have to change much to join the 800+ credit score club. Your personalized credit analysis from WalletHub will tell you what needs improvement and exactly how to fix it.

A few things in particular tend to stand between a credit score of 797 and perfect credit, though. And if you do nothing else, make sure to take the following steps.

Was this article helpful?

Don’t Miss: Is 721 A Good Credit Score