Tips To Create A Personal Budget

An efficient personal budget boosts your potential to save, earn, and spend. These are a few practical tips that can help you create a personal budget:

Make a List of Each and Every Expense: Bills are a vital part of any personal budget, but you must be making several other expenses every month that have no record. While creating a budget, you must note down every expense you make in a month, whether you get a receipt for it or not. From food and events to entertainment and repairs, make sure to record every penny you spend. Make a diary or install an app to track your expenses, as it will help identify the biggest and unnecessary expenditures each month.

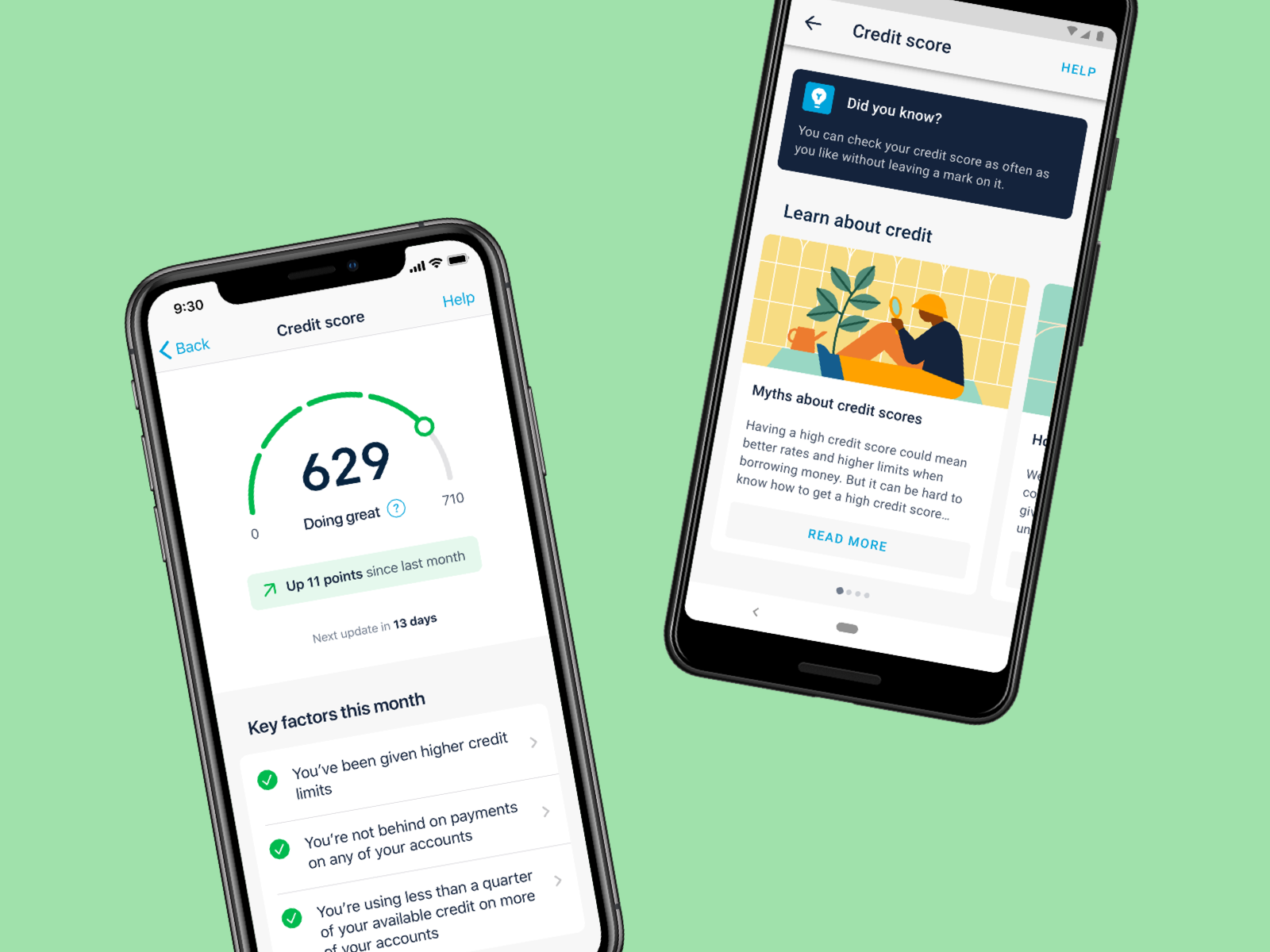

Start Saying No: While creating a budget, you do not need to punish yourself for each expense. However, the idea is to track your expenses and make wiser spending decisions. Start saying no to luxuries and unnecessary expenses and restrict entertainment to limited days. Start being selective with where you spend your money. It will help boost your personal and financial growth and make you more diligent in your spending decisions. As a result, you stay regular with your bills and EMIs, and your credit score improves gradually.

How Are Credit Scores Calculated

FICO Score

VantageScore

The 6 Best Free Credit Reports Of 2021

- Best for Credit Monitoring:

- Best for Single Bureau Access:

- Best for Improving Credit:

- Best for Daily Updates: WalletHub

In 2003, a Federal law passed granting every consumer the right to a free report from all credit reporting agencies each year. AnnualCreditReport.com is the centralized site that allows every consumer to access their free credit report granted by Federal law.

The Consumer Financial Protection Bureau confirms that AnnualCreditReport.com is the official website that allows you to access each of your credit reports from all three of the major credit bureaus Equifax, Experian, and TransUnion at no cost. You can obtain one free credit report every 12 months through AnnualCreditReport.com, without signing up, creating an account, or entering your credit card information. Alternatively, you can call 1-877-322-8228 to order your legally free credit report.

Credit reports are available as a PDF download or you can request to have your credit reports mailed to you. The downside is that you receive your full credit report, which hasnt been formatted for user-friendliness. Depending on the length of your credit history and the number of accounts youve had, your credit reports can be dozens of pages each. You wont receive a credit score with your credit report from AnnualCreditReport.com.

Recommended Reading: What Does Cls Mean On Experian Credit Report

How Can I Check Credit Scores

Reading time: 2 minutes

Highlights:

-

You may be able to get a credit score from your credit card company, financial institution or loan statement

-

You can also use a credit score service or free credit scoring site

Many people think if you check your credit reports from the three nationwide credit bureaus, youll see credit scores as well. But thats not the case: credit reports from the three nationwide credit bureaus do not usually contain credit scores. Before we talk about where you can get credit scores, there are a few things to know about credit scores, themselves.

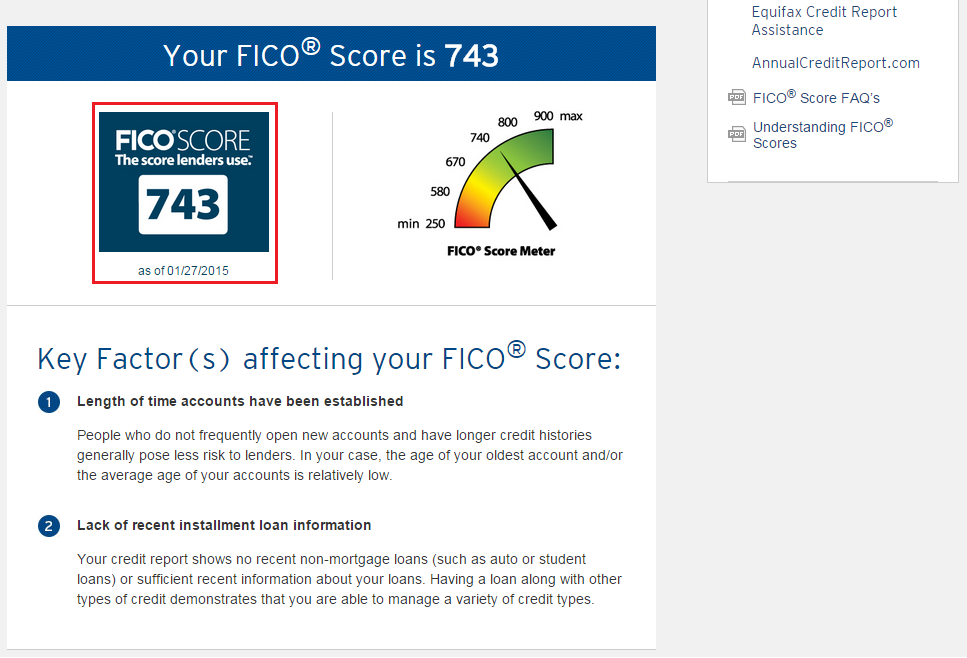

One of the first things to know is that you dont have only one credit score. Credit scores are designed to represent your credit risk, or the likelihood you will pay your bills on time. Credit scores are calculated based on a method using the content of your credit reports.

Score providers, such as the three nationwide credit bureaus — Equifax, Experian and TransUnion — and companies like FICO use different types of credit scoring models and may use different information to calculate credit scores. Credit scores provided by the three nationwide credit bureaus will also vary because some lenders may report information to all three, two or one, or none at all. And lenders and creditors may use additional information, other than credit scores, to decide whether to grant you credit.

So how can you get credit scores? Here are a few ways:

Does Credit Karma Offer Free Fico Credit Scores

The VantageScore and FICO modelsdiffer in several ways, but that doesnt mean one is better or more accurate than the other. Lenders may rely on different scoring models when evaluating an application, and other considerations can factor in, too.

We recommend looking at your credit scores as a guide to your credit health rather than as a definitive number that determines whether youll be approved or denied for credit.

You May Like: How To Remove Repossession From Credit Report

The Way We Deal With Credit Scoring And Reporting Is Flawed

The current credit system is far from perfect, and critics have long pointed to its many flaws, ranging from it being dominated by sometimes irresponsible private interests to the ways it entrenches inequalities in the financial system.

For one thing, credit reports often contain mistakes a lot of them. A 2013 FTC study found that one in five consumers had an error on at least one of their three reports. Of the more than 300,000 complaints specifically about credit and consumer reporting the CFPB received in 2020, approximately two out of three pertained to incorrect information on the reports.

When there are errors in credit reports, it can be very difficult to get them corrected. For some people, the errors can work in their favor. But for others, they do not if someone with the same name gets sent to a debt collector and it shows up on your report, it can hinder you from getting that apartment or a good rate on your car loan.

The credit bureaus are not incentivized for accuracy, theyre incentivized for volume and speed, Klein said. As long as the errors are symmetric, in the aggregate, their data will still be right. theres going to be a group of people who are getting harmed and a group of people who are benefiting.

Getting Your Credit Score Is Simple

The CIBC Free Credit Score Service is a feature in the CIBC Mobile Banking App which allows CIBC clients to subscribe to get their credit score from Equifax Canada.

The Equifax credit score is based on Equifaxs proprietary model and may not be the same score used by third parties or by CIBC in certain instances to assess your creditworthiness. The provision of this score to you is intended for your own educational use. Third parties and CIBC will take into consideration other information in addition to a credit score when evaluating your creditworthiness.

You should always get the most up-to-date credit information and credit scores from Equifax Canada to ensure accuracy before making a major financial decision.

You May Like: Removing Child Support From Credit Report

Ask For A Credit Limit Increase

If youve been regularly making required payments on your credit card, you may want to try asking the credit card company for a credit limit increase. You wouldnt necessarily want to do this to finance a purchase you otherwise wouldnt have been able to make. But if your monthly balance is relatively steady, you could decrease your utilization rate by increasing your credit limit.

For those who may not know, the is the amount of credit available to you that youre actually using. Its basically your balance divided by your credit limit. So, if you increase your credit limit and keep the balance the same, the utilization rate will be lower. And that can translate into how to improve your credit score.

Whats A Good Or Average Credit Score

We consider a âgoodâ score to be between 881 and 960, with âfairâ between 721 and 880. However, thereâs no âmagicâ number that will guarantee lenders will approve an application if you apply.

If your credit score is poor, youâll probably find it harder to borrow money or access certain services. We consider a âpoorâ score to be between 561 and 720, with âvery poorâ between 0-560. But remember, lenders may have different views of what an ideal customer looks like to them, which will be reflected in how they calculate your credit score.

Your free Experian Credit Score is intended as a useful guide to give you an idea of how lenders may view your credit history. Knowing your score can help you make more informed choices when it comes to credit.

You May Like: What Credit Bureau Does Klarna Use

Negative Information In A Credit Report

Negative information in a can include public records–tax liens, judgments, bankruptcies–that provide insight into your financial status and obligations. A credit reporting company generally can report most negative information for seven years.

Information about a lawsuit or a judgment against you can be reported for seven years or until the statute of limitations runs out, whichever is longer. Bankruptcies can be kept on your report for up to 10 years, and unpaid tax liens for 15 years.

What Is My Credit Score And Why Does It Matter

Your credit score is a number lenders and credit card issuers use to help them decide whether to approve your credit application. The higher your score, the better your chances. With a low score, you may still be able to get credit, but it may come with higher interest rates or require a co-signer or security deposit. You also may have to pay more for car insurance or put down deposits on utilities. Landlords might use your score to decide whether they want you as a tenant. But as you add points to your score, you’ll gain access to more credit products and pay less to use them. Borrowers with scores above 750 or so have many options, including the potential to qualify for 0% financing on cars and credit cards with 0% introductory interest rates.

Recommended Reading: How To Remove Repossession From Credit Report

What Is A Credit History

Sometimes, people talk about your credit. What they mean is your credit history. Your credit history describes how you use money:

- How many credit cards do you have?

- How many loans do you have?

- Do you pay your bills on time?

If you have a credit card or a loan from a bank, you have a credit history. Companies collect information about your loans and credit cards.

Companies also collect information about how you pay your bills. They put this information in one place: your credit report.

How Do I Fix Mistakes In My Credit Report

- Write a letter. Tell the credit reporting company that you have questions about information in your report.

- Explain which information is wrong and why you think so.

- Say that you want the information corrected or removed from your report.

- Send a copy of your credit report with the wrong information circled.

- Send copies of other papers that help you explain your opinion.

- Send this information Certified Mail. Ask the post office for a return receipt. The receipt is proof that the credit reporting company got your letter.

The credit reporting company must look into your complaint and answer you in writing.

Don’t Miss: Cbcinnovis Credit Check

Check Your Credit Score

Your credit report will usually not show your credit score, and the law does not require the same free access to your credit score as your credit report. But there are several ways to access it. Most credit card companies provide your FICO score for free. Check your monthly bank statement or log into your account online. If you cant find it, call your bank or use their chat service to ask if they provide your credit score and where to find it.

Just remember, there are several versions of your credit score depending on which scoring model is used. The score you check via your bank or credit card account may not be the same score a lender uses to determine your creditworthiness.

How Do I Get Credit

Do you want to build your credit history? You will need to pay bills that are included in a credit report.

- Sometimes, utility companies put information into a credit report. Do you have utility bills in your name? That can help build credit.

- Many credit cards put information into credit reports.

- Sometimes, you can get a store credit card that can help build credit.

- A secured credit card also can help you build your credit.

Don’t Miss: Does Speedy Cash Report To Credit Bureaus

Warning About Impostor Websites

Only one website is authorized to fill orders for the free annual credit report you are entitled to under law: AnnualCreditReport.com. Other websites that claim to offer “free credit reports,””free credit scores,” or “free credit monitoring” are not part of the legally-mandated free annual credit report program.

In some cases, the “free” product comes with strings attached. For example, some sites sign you up for a supposedly “free” service that converts to one you have to pay for after a trial period. If you don’t cancel during the trial period, you may unwittingly agree to let the company start charging fees to your credit card.

Some “impostor” sites use terms like “free report” in their names others have URLs that purposely misspell Annualcreditreport.com in the hopes that you will mistype the name of the official site. Some of these “imposter” sites direct you to other sites that try to sell you something or collect your personal information.

Annualcreditreport.com and the nationwide credit reporting companies will not send you an email asking for your personal information. If you get an email, see a pop-up ad, or get a phone call from someone claiming to be from Annualcreditreport.com or any of the three nationwide credit reporting companies, do not reply or click on any link in the message. It’s probably a scam. Ensure you are on the right website by verifying through the Consumer Financial Protection Bureau .

How To Sign Up For Infoalerts

Your TransUnion Credit Score is provided by TransUnion Interactive, Inc. and is brought to you by Scotiabank at no additional charge. Accessing your TransUnion Credit Score will not impact your Credit Score. Scotiabank is not responsible for the TransUnion Credit Score or any of the information provided to you through TransUnion’s Credit Score services.

To access your TransUnion Credit Score, Scotiabank will share your personal information such as name, address and date of birth with TransUnion so that TransUnion can identify you and provide your Credit Score. Your information will not be used or disclosed by TransUnion for any other purposes.

The TransUnion Credit Score service is subject to certain terms and conditions that can be viewed here Terms of Use.

You May Like: Is 672 A Good Credit Score

Tips To Create A Personal Budget That Actually Works To Improve Your Credit Score

A credit score is one of the most important factors that lenders consider while approving your loan applications. Ranging from 300 to 900, the higher credit score you have, the more chances you have to getting loan approval easily. If you are looking forward to applying for a loan, you must check your online credit score and ensure that it meets your lenders minimum requirement. If it is low, you need to manage your finances by budgeting to see your credit score improve. However, giving up your hobbies, saying no to weekend plans, and refraining from your favourite food is not the right way to budget.

Most people freak out at the thought of creating a budget, as they assume that they will need to drastically alter their lifestyle. However, that is not true. If you aim at improving your credit score by managing your finances well, we are giving a few tips to create a personal budget without making your life boring.

Where Can I Get My Credit Score

You actually have more than one credit score. Credit scores are calculated based on the information in your credit reports. If the information about you in the credit reports of the three large consumer reporting companies is different, your credit score from each of the companies will be different. Lenders also use slightly different credit scores for different types of loans.

There are four main ways to get a credit score:

Check your credit card or other loan statement. Many major credit card companies and some auto loan companies have begun to provide credit scores for all their customers on a monthly basis. The score is usually listed on your monthly statement, or can be found by logging in to your account online.

Talk to a non-profit counselor. Non-profit and HUD-approved housing counselors can often provide you with a free credit report and score and help you review them.

Use a credit score service. Many services and websites advertise a free credit score. Some sites may be funded through advertising and not charge a fee. Other sites may require that you sign up for a credit monitoring service with a monthly subscription fee in order to get your free score. These services are often advertised as free trials, but if you dont cancel within the specified period , you could be on the hook for a monthly fee. Before you sign up to try one of these services, be sure you know what you are signing up for and how much it really costs.

Don’t Miss: What Is Syncb Ntwk On Credit Report