While Your Card Is Locked

When your card is locked, all cash advances, purchases and withdrawals either online or in person will be declined.

You can still make payments to your credit card, pre-authorized payments will continue to be paid and you can use your RBC Rewards points while itâs locked.

When your client card is locked, pre-authorized payments, INTERAC Online Payments, mobile deposits, online refunds, and Apple Pay and Android Wallet transactions will continue to be active and processed.

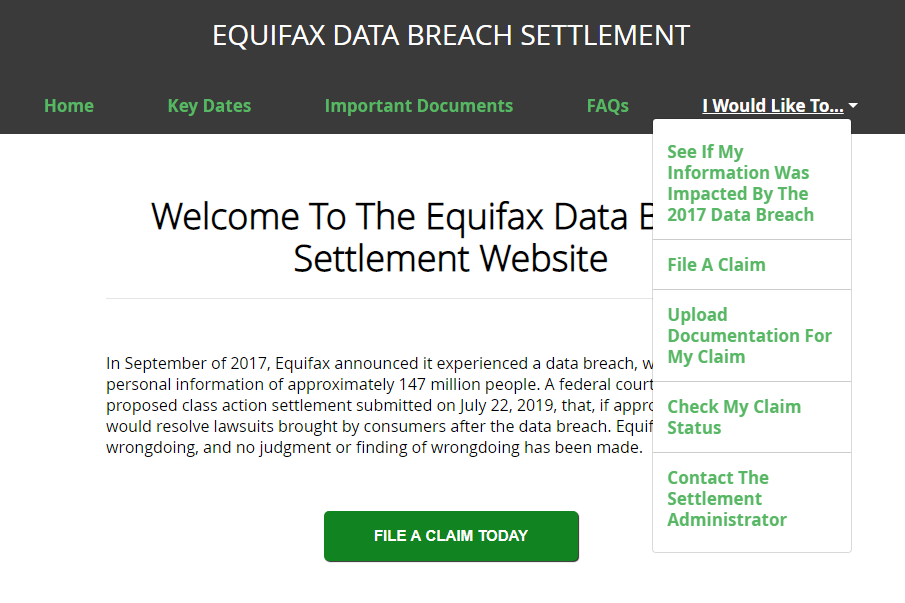

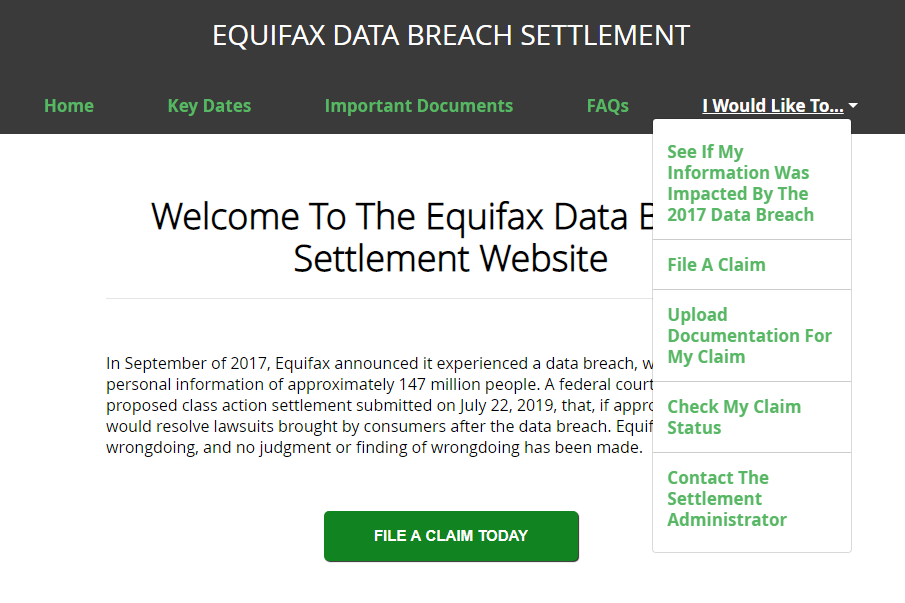

How To Unfreeze An Equifax Report

You can remove a security freeze on your Equifax credit report online by creating a myEquifax account.

You can check the status of your security freeze through your myEquifax account as well. You can also use the consumer credit reporting agency’s automated system to unlock your credit report by calling 349-9960.

Equifax gives consumers a third option for lifting credit freezes by mail.

“If you are temporarily lifting or permanently removing a security freeze, you will need the 10-digit PIN you received when the freeze was initially placed,” the credit agency says on its website.

Just download this form, and once the agency receives your request and verifies your identity, you’ll get a confirmation.

Contact info: Equifax Equifax Security Freeze, P.O. Box 105788, Atlanta, GA 30348.

How Do I Freeze Or Lock My Credit

Consumers can ask for a credit freeze at all three major credit bureaus, either online or by phone.

To begin the process, youll need to provide some personal information to set up an account and obtain a PIN. Remember to keep PINs on file for when youre ready to unfreeze.

Heres how to get started with each bureau:

- Equifax: Create a MyEquifax account to place or lift a security freeze online, or call 1-800-349-9960

- Experian: Visit Experians security freeze center or call 1-888-EXPERIAN

- TransUnion: Add a freeze at transunion.com/credit-freeze or call 1-888-909-8872

Following these same steps, parents, guardians, and those with power of attorney can obtain a freeze for their dependents.

You May Like: Klarna And Credit Score

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

How Do I Freeze My Credit

If you want to freeze your credit, you need to do it at each of the three major credit bureaus: Equifax , TransUnion and Experian . If you request a freeze, be sure to store the passwords youâll need to thaw your credit in a safe place.

Whether or not you choose to freeze your credit, fraudsters could still take advantage of you by getting things like your credit card number or passwords to online accounts. Make sure youâre taking the proper steps to secure your information so that it doesnât fall into the wrong hands.

Recommended Reading

Recommended Reading: Does Paypal Credit Report To Credit Bureaus

Is There A Way To Speed Up The Process

An hour isnt long, but if you have an urgent need for a credit thaw because you’re vying for a coveted apartment rental or applying for a loan to pay for an emergency vet bill, you may be able to speed things up by explaining the circumstances to a phone representative at the credit bureau. If you need to send in your request, you can pay extra for overnight mail.

You may also be able to prepare ahead of time to minimize any delays or problems. TransUnion, for instance, allows you to schedule the end of a credit freeze 15 days in advance.

Your Credit Speaks A Lot About You

Your credit profile doesnt leave much to the financial imagination. With a couple of inquiries, banks can know about most of your buying and payment habits. They know where you live, what car you drive , your home price, what credit cards you have, and much more. Its a deep look into your borrowing lifestyle. Since Americans love to borrow, credit reports and scores have become very valuable.

Many believe that keeping a high credit score and clean report is not necessary unless you are looking to get a loan. Well, thats not necessarily true. Many car insurance agencies run your credit. They approve you and give you rates partly based on your credit. A potential employer can look to see if you have credit issues. Those issues could cost you a job. You might not be able to rent a place to live based on your credit, or purchase a cell phone plan. Your credit is used in more ways than most think. Its imperative to keep a high credit score and a clean report.

If you want to base your good credit on borrowing alone, you never know when you might need to borrow. If your car dies and you need a loan to get another one, good credit will keep your rates low. While its always a nice dream to have enough in cash to buy another car, most people are not in that situation. Having good credit offers you opportunities to do things with money other people cant.

You May Like: How To Get Credit Report Without Social Security Number

How To Lock Your Credit Report At Experian

Experians program, CreditLock, is offered as part of a larger service, Experian CreditWorksSM Premium. It costs $4.99 the first month, and $24.99 a month after that. The program comes with other perks, like credit monitoring for all three bureaus, monthly FICO® credit scores and reports for all three bureaus, up to $1 million in identity theft insurance, and a dedicated agent to help you if you think youre a victim of fraud or identity theft. You can enroll on Experians website.

Placing A Credit Freeze On Your Credit Reports Can Help Reduce Your Risk Of Identity Theft But Sometimes Youll Need To Lift The Freeze For Credit Or Job Applications

If your identity is stolen, an immediate action plan is essential to try to make yourself not to mention your finances whole again. You should probably place a on your credit reports right away. And, to help keep your personal information secure, its a good idea to leave the freeze in place.

But at some point, youll probably want to open a new credit card, finance a car or even apply for a mortgage, which all require a credit check. And if youre applying for a job, some employers will check your credit as part of the hiring process. In that case, youll need to learn how to lift a credit freeze. Read on for more.

Recommended Reading: Does Speedy Cash Report To Credit Bureaus

How Do You Check If Someone Has Taken A Loan Out In Your Name

The best way to find out if someone has opened an account in your name is pulling your own credit reports to check. Note that youll need to pull your credit reports from all three bureaus Experian, Equifax and TransUnion to check for fraud since each report may have different information and reporting.

Read Also: Why Has My Credit Score Dropped

How To Freeze And Unfreeze Your Credit Report And Why You

What is unlock experian credit lock?

Fellas! Will you be Functioning to be a secretary in a corporation or Group? Absolutely sure, you might get in cost in all letters challenges. And Certainly, a unlock experian credit lock issue is among a detail you ought to be grasp in. Even Youre not an worker, a unlock experian credit lock is very important for any purposes if you wish to mail a proposal to other organization, corporation or maybe your teacher. Recognizing how essential unlock experian credit lock applications are, we have an interest to discuss it right now. Be sure to stay tuned and enjoy examining!A unlock experian credit lock is a proper and Qualified doc and that is created by private, Business or organization to its customers, stakeholder, enterprise, Firm and lots of more. This letter applications to provide any information, ask for, permission and several additional professionally with the basic and customary templates amongst men and women all over the entire world. Each a personal correspondent and enterprise want to build the Create excellent via your unlock experian credit lock in sake of demonstrating your Skilled business enterprise. Then how to really make it? Below we go.

What Need to Include things like in unlock experian credit lock?Nicely, its the critical components it is best to point out within your unlock experian credit lock. And, here the areas are:

Punctuation

Recommended Reading: Is 584 A Good Credit Score

Read Also: Is 517 A Good Credit Score

Lifting A Freeze For A Single Lender

Also Check: Keyword

How To Lock Your Credit Report At Equifax

Equifaxs credit lock program is called Lock & Alert, and its free. Once enrolled via the Equifax website, users can lock their credit themselves on the app or the website, without additional help from Equifax. If you want to apply for new credit, or a new employer or landlord needs to run your credit, you can temporarily unlock your credit report just as easily.

Read Also: Opensky Credit Card Delivery

When Do You Need A Pin To Unfreeze Your Credit

Two of the three major credit bureaus have recently changed their policies related to security freezes and PINs. As of 2018, if youre unfreezing your credit reports online through Equifax or TransUnion, you wont need a PIN at all. Youll only need to enter your account username and password.

However, you will need a PIN if youre unfreezing your Experian credit report. Youll also need one if you want to thaw out your Equifax or TransUnion credit report over the phone though it is possible to thaw an Equifax credit freeze over the phone without a PIN, as well explain below.

Do You Need A Pin To Unfreeze Your Transunion Credit Report

When you freeze your credit report with TransUnion, you have to create a 6-digit PIN for additional security. You dont need a PIN to unfreeze your TransUnion credit report online, but you need to have one if you lift the freeze via phone.

In case you lose your PIN, you can always unfreeze your credit report online. If you want to do it over the phone, you have to log into your online account and create a new PIN. Make sure to choose a PIN number that you can easily remember.

Recommended Reading: Syncb Bp

How To Freeze Your Childs Credit

There are rules about how old you have to be to get a credit card. And because most children canât open an account on their own, people might think thereâs nothing to worry about.

But fraud and identity theft can still happen to children. And just because theyâre underage doesnât mean scammers canât use their information to open credit cards, bank accounts and more.

If your child is 15 or younger, you can freeze their credit as a precaution. Once they turn 16, they can do it themselvesânot that you canât help.

In cases where a scammer has already used your childâs information, the FTC says you should immediately freeze your childâs creditâamong other steps.

If you decide to freeze your childâs credit, youâll need to make separate requests to each bureau. Those requests have to be done through the mail. Between that and gathering paperwork, the process can take a little time. And if you have more than one child, youâll have to submit separate requests.

Hereâs how to get started with each bureau:

- Equifax has a dedicated page to answer questions about freezing your childâs report. It also has a minor freeze request form to help you get started.

- Experian also has a page that details the basics and a formal request form to help you get started.

- TransUnion provides step-by-step directions about how to freeze your childâs report and what to include with your request.

Should I Lock My Credit Report With Equifax

Locking your Equifaxyourfreezeyour credit reports

Should i lock my credit report?

Putting a freeze or lock on your credit report is just one way to begin reducing your risk of identity theft. Going forward, you should always monitor your credit reports from all three major consumer bureaus for any suspicious activity or incorrect reporting that may appear.

how do I lock my Equifax credit report?To lock your Equifax Credit Report:

Read Also: Does Barclaycard Report To Credit Bureaus

What Does It Mean To Put A Security Freeze On My Credit Report

Creditors typically won’t offer you credit if they can’t access your , so a security freeze, also called a credit freeze, prevents you or others from opening accounts in your name. Security freezes can be useful in preventing an identity thief from opening a new credit account in your name.

Only a limited number of entities can see your file while a freeze is in place, including:

- Certain government entities like child support agencies

- Companies that you’ve hired to monitor your credit file

Free Security Freezes

Under a federal law effective September 21, 2018, you can freeze and unfreeze your credit record for free at the three nationwide credit reporting companies Experian, TransUnion, and Equifax. The federal law requiring free security freezes does not apply to someone who requests your credit report for employment, tenant-screening, or insurance purposes. Other credit reporting companies, for example employment or tenant screening companies, might charge a fee to place and lift a security freeze based on your state laws.

You can place a “freeze” on your credit file at any time, but you must contact each credit reporting company. For more information, visit the nationwide credit reporting companies’ websites or call the numbers below:

- 909-8872

Security Freeze Notice and Timing

Temporary Lift of Security Freeze

Security Freeze for Protected Consumers

How To Unfreeze Credit With Equifax

You can unfreeze your Equifax credit report online by creating a “myEquifax” account. A PIN is no longer needed for online freezing or lifting an Equifax credit freeze. Equifax allows you to unfreeze your credit temporarily for a specific creditor or for a specified period, from one day to one year. You can also permanently unfreeze your credit, which NerdWallet does not recommend.

If you choose to unfreeze or reinstate a freeze by phone or mail at Equifax, you will need a PIN.

Contact info:Equifax Equifax Security Freeze, P.O. Box 105788, Atlanta, GA 30348 800-349-9960.

Read Also: How Long Does Missed Payments Stay On Your Credit

Why You Can Trust Bankrate

At Bankrate we strive to help you make smarter financial decisions. While we adhere to strict editorial integrity, this post may contain references to products from our partners. Here’s an explanation for how we make money. The content on this page is accurate as of the posting date however, some of the offers mentioned may have expired.

How To Lift A Credit Freeze At Each Of The Three Major Credit Bureaus

In order to place or remove a credit freeze on your credit reports, you must contact each of the three major credit bureaus individually. It might be worth asking your potential creditor or employer which bureau it uses for credit checks. That way youll only have to lift the freeze with a single bureau instead of all three.

You can request credit freezes and reversals . Youll likely need to provide your name, address, birthdate and Social Security number in order to place a freeze.

Each credit bureau will give you a unique PIN when you place a freeze on your file. Depending on how youre doing it, you may need the PIN to temporarily lift or permanently remove the credit freeze in the future, so be sure to find it before beginning the process of lifting your freeze.

Heres a rundown of how it works at all three major credit bureaus:

You May Like: Bp Syncb

How To Unfreeze Your Credit Report

Data breaches have unfortunately become a common occurrence. In the aftermath of breaches, some experts and pundits recommend consumers forgo fraud alerts and instead take the more aggressive measure of freezing their credit reports. If you’re unsure which method is best for you, read about the differences between a credit freeze and a fraud alert.

Freezing your credit report can be a good move to help protect yourself from fraudsters stealing your information, opening accounts and spending money in your name. It also means that when you want to apply for credit, you will first need to unfreeze your report.