What Is The Difference Between Vantagescore And Fico

VantageScore® 3.0 is a credit score that was designed by the three credit bureaus as an alternative to other scores, such as FICO. According to VantageScore, this credit score model is used by more than 2,500 lenders and 20 of the top 25 financial institutions for various purposes.

The FICO Score was developed by FICO, a company that specializes in predictive analytics. Like your VantageScore, your FICO score is based on information in your credit report and is calculated as a three-digit score that ranges from 300 to 850.

FICO and VantageScore arent the only credit score models either. Each of the main credit bureaus also produce their own versions of a credit score.

Despite being different models, each of these different credit scores are all based on the same five factors:

Vantagescore And Fico Ranges

Both credit-scoring models have evolved over the years, resulting in multiple versions of each. FICO generates two types of scores base and industry-specific scores.

FICO® base scores help predict a consumers ability to repay a debt based on their overall credit profile, and they range from 300 to 850. Industry-specific scores help predict a consumers ability to repay a specific type of debt, such as an auto loan or mortgage, and they range from 250 to 900.

Unlike FICO, the VantageScore® model doesnt generate industry-specific scores. It only calculates base scores. When it was first introduced in 2006, the scoring model had a range of 501 to 990. That changed when VantageScore® 3.0 was released, with a range of 300 to 850. And it continues today with VantageScore® 4.0, making it easier for consumers to compare their VantageScore® and FICO® credit scores.

The Apps Upsell Products You Dont Need Or Want

The point of all this data collection is that it can be used to make predictions about youinformation that can be used to sell you products and services, says Carrillo at Yale.

Indeed, all of the apps CR looked at other than myFICO use this data collection to send users ads, financial offers, promotions, and marketing materials.

CRs experts, as well as consumers who use these apps, say they were sometimes overwhelmed by offers for credit cards, personal loans, and other financial products and services.

For example, a CR staffer who subscribed to Credit Sesame for this project received an email from the app recommending a new credit card that could help you increase your credit score and decrease your credit usage.

While opening a new credit card account could improve your credit score because it would mean you have more available credit, thats not true in all cases, nor would all consumers qualify for the offer regardless.

Moreover, the act of applying for credit can hurt a persons score, because the credit card company checks the applicants credit report, doing whats called a hard pull, which counts against you, says Chi Chi Wu, staff attorney at the National Consumer Law Center. That damage occurs even if the credit card company grants you credit.

Read Also: Bp Syncb

Fico Vs Vantagescore: Which Is Better

VantageScore and FICO are both software programs that are used to calculate credit ratings based on consumers’ spending and payment history. FICO, for Fair Isaac Corp., is the older and better-known model, having been introduced in 1989. VantageScore, released in 2006, was developed by the three leading consumer credit agencies, Experian, Equifax, and TransUnion.

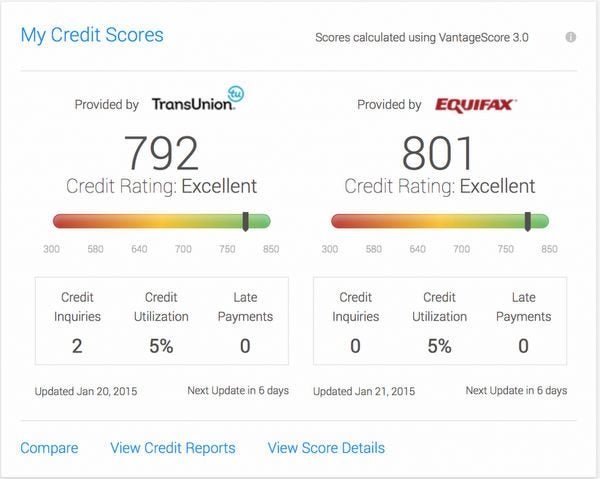

Because they are different models, your VantageScore will inevitably be a little different from your FICO score. For that matter, you may get a different FICO score from various sources at any given time, depending on whether the source uses a specialized variety of FICO or the most-often-used base model, and which of its many versions is used.

The key point is, your score should be in the same range on any or all of those models. You should not have a “good” VantageScore and only a “fair” FICO score.

Extra Features From Credit Karma:

1) Credit Score Simulator: Credit Karma includes a tool that helps estimate what will happen to your credit score under certain scenarios. Those scenarios run from ho-hum activities, like opening a new credit card or getting a credit limit increase, all the way to the truly boot-shaking-scary, like having your wages garnished or going into foreclosure.

2) Free unclaimed cash: This is a weird one, but actually more common than you think. When businesses owe you money, a lot of time they will turn that cash over to the state. Credit Karma lets you run a search for your name and state to see whether, say you skipped town before your internet provider got a chance to return your over-priced deposit for their crummy wireless router. Not that Id know anything about that

3) Miscellaneous calculators: The dashboard includes handy links to a few different calculators, like a mortgage repayment calculator, debt refinance calculator, etc. These arent anything groundbreaking, and all can be found in a million places with a quick google search, but it cant hurt to have.

Winner: Credit Sesame. Credit Karmas simulator and other features are really neat, but as far as Im concerned, SHOW ME THE MONEY! A free $50,000 insurance policy is incredible, and enough to convince me that everybody should take the 90 seconds to sign up for Credit Sesame.

Read Also: How To Check Your Credit Score With Itin

Why Your Credit Karma Credit Score Differs

There are multiple reasons why your credit score differs between what a personal finance website tells you and what your credit card company or a prospective lender find.

This is mainly because of two reasons: For one, lenders may pull your credit from different , whether it is Experian, Equifax or TransUnion. Your score can then differ based on what bureau your t is pulled from since they don’t all receive the same information about your credit accounts. Secondly, different credit score models exist across the board.

As it states on its website, Credit Karma uses the VantageScore® 3.0 model. VantageScore may look at the same factors that the other popular FICO scoring model does, such as your payment history, your amounts owed, your length of credit history, your new credit and your credit mix, but each scoring model weighs these factors differently.

For this reason, VantageScore and FICO Scores tend to vary from one another. Your VantageScore® 3.0 on Credit Karma will likely be different from your FICO Score that lenders often use.

If you plan on applying for credit, make sure to check your FICO Score since there’s a good chance lenders will use it to determine your creditworthiness. FICO Scores are used in over 90% of U.S. lending decisions.

Editorial Note:

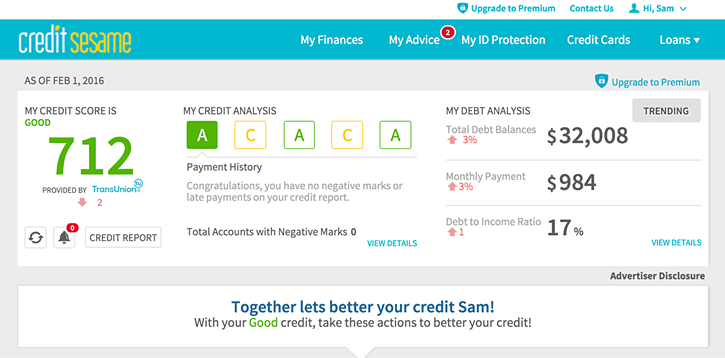

How Does Credit Sesame Calculate Credit Score

, a scoring model provided by TransUnion, one of the three major credit bureaus. VantageScore® 3.0 was developed by all three of the credit bureaus to be an alternative to other commercial scoring models like FICO. According to Vantage, its scoring system is used by more than 2,400 lenders and 20 of the top financial institutions.

VantageScore® 3.0 is a completely different scoring model than FICO. That said it can be easy to mix the two up since they both use the same scoring range of 300-850 that the average consumer is used to seeing and reading.

Compared to FICO score, VantageScore® 3.0 avoids assigning exact percentages when weighting the different factors that go into your credit score calculation. Instead, different factors are described in terms of their influence on your score. That said, TransUnion does provide some percentage distributions, which we listed below:

VantageScore 3.0 Weights and Factors

| VantageScore Factors |

|---|

You May Like: Syncb Ppc Account

Are The Scores Really Free

With most credit monitoring services there is a free trial period and then you start being billed monthly once it finishes. Credit Sesame doesnt have a trial period, it starts off free and never stops being free. They dont require a credit card to sign up, so there is no way for them to charge you even if they wanted to start.

Did Credit Sesame Mislead Consumers

No. In early 2017, the Consumer Financial Protection Bureau ordered TransUnion and Equifax to pay big fines for deceiving customers about credit scores and credit reports. The CFPB says that TransUnion and Equifax told customers that they were purchasing the same score lenders use to make credit decisions when in fact they were not. Also, those companies lured consumers into free or $1 trial memberships without clearly disclosing that the memberships converted to monthly subscriptions that were automatically billed to the customers credit cards.

Image Source | www.creditsesame.com

In addition to free credit scores, Credit Sesame members get free credit monitoring , a free credit report card , and free identity theft protection .

Premium services are available to consumers who want to purchase them. Pro and Platinum Protection plans include daily monitoring of your information on file with all three major credit bureaus and $1 million of identity theft insurance. Our Basic plan includes daily monitoring of your TransUnion credit report. For Platinum Protection members, we also monitor your Social Security number, public records and black market websites. All of our paid plans include 24/7 support for dealing with credit reporting inaccuracies.

You May Like: How To Remove Repossession From Credit Report

Third Stop: Credit Scores At Myficocom

Still curious I decided to actually purchase my credit score through MyFico.com. It cost me $25 bucks, but I didnt care. I was on a mission.

Thinking there would only be only one true credit score, it gave me two. One from TransUnion and the other from Equifax, which were 779 and 770 respectively.

Really? Two Credit Scores?!

So heres what Im looking at so far: 758, 776, 765, 773, 779, and 770. At this point I have no clue which one is the real deal. No more messing around. It was time to break out the big guns.

What Scores Are Needed To Qualify For The Best Refinancing Or Loan Rates

FICO credit scores are often divided into five categories from worst to best as follows:

- Very poor : It is essentially impossible to get credit with these scores.

- Fair : These are subprime borrowers and generally qualify for the worst rates.

- Good : These applicants qualify for better rates, and it is assumed only about 8% of them are likely to be delinquent.

- Very good : These applicants usually qualify for better-than-average rates.

- Exceptional : Anyone with a score in this range should have no problem qualifying for the best rates.

The VantageScore scale runs as follows:

- Very poor : Applicants are unlikely to be approved for any credit.

- Poor : Applicants may qualify for some of the worst rates and may have larger down payments.

- Fair : These applicants are usually approved for credit but dont get the best rates.

- Good : These applicants stand a good chance of getting more competitive rates.

- Excellent : Those in the top range qualify for the best rates and offers.

Recommended Reading: Is 672 A Good Credit Score

Vantagescore Or Fico: Does It Matter

VantageScore is not FICO, for Fair Isaac Corp. They are the two biggest competitors in the business of creating scoring models that are used to rate the creditworthiness of consumers. To complicate matters, both update their models occasionally, and lenders use different versions with slightly different results.

You don’t have a credit score. You have many credit scores, each calculated by a lender based on one of many models or versions of models. The important thing is, they should all be in the same range, such as “good” or “very good.”

Your score should be roughly the same on either model. One model may put slightly more weight on unpaid medical debt. One may take longer to record a loan application. But if your credit is “good” or “very good” according to one system, it should be the same in the other.

Extra Features From Credit Sesame:

1) A free $50,000 worth of Fraud Insurance: If youre a Credit Sesame member and your ID is stolen, Credit Sesame automatically provides $50,000 of ID Theft insurance and a free helpline to talk with experts.

In a world of constant data breaches, this is awesome, and in my opinion, absolutely worth the free sign up by itself.

Also Check: How To Get A Repo Removed From Your Credit

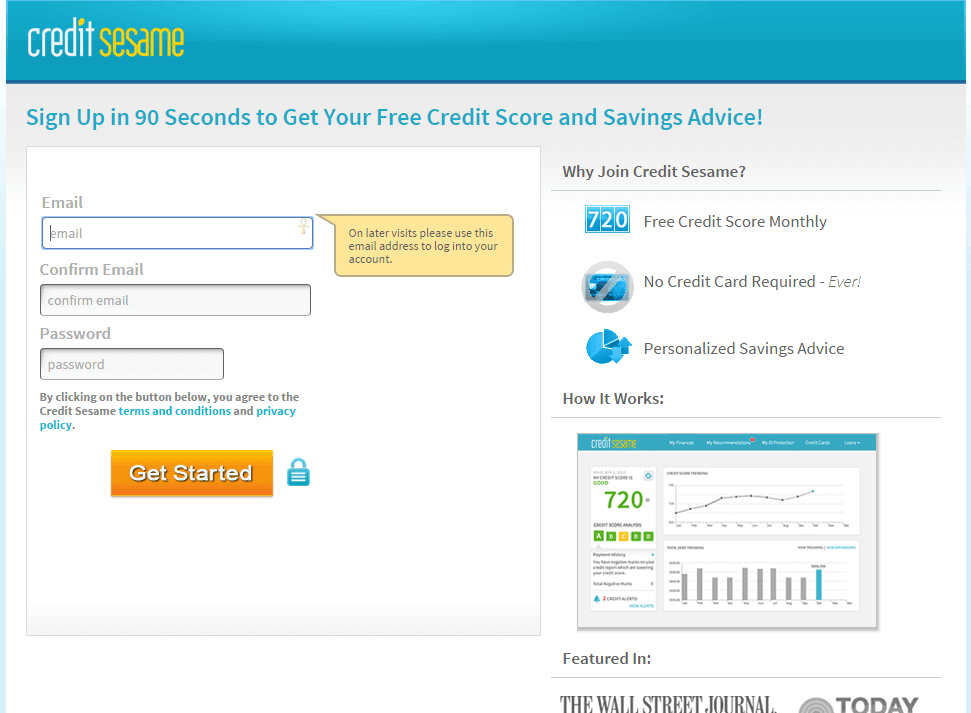

Is Credit Sesame Free

Folks often ask: Is Credit Sesame really free? Yes. Its 100% free. And its not sneaky, either. You dont even have to enter your credit card information when you sign up, which means you dont risk unintentionally signing up for some sly autopay subscription.

But if its free, how does Credit Sesame make money? The platform also offers premium paid services, which include features like black market website monitoring, Social Security monitoring and monthly credit score monitoring from all three credit bureaus .

However, its not necessary to sign up for these paid services you can still get your credit score and credit report card with the basic free version.

Additionally, Credit Sesame partners with other financial products to share product recommendations.

For example, your credit score might be low because you have a high credit utilization rate. Credit Sesame might recommend you open a balance transfer card to decrease that rate, and itll offer a few recommendations to help you get started.

How Do You Create An Account

You dont need to hand over any credit card information to open a free account with Credit Sesame, but you will need an email address, and youll have to enter your social security number. It will also prompt you to answer some questions related to your finances to verify your identity.

This might include something like entering your monthly payment amount on a specific loan or when you opened a particular bank account. Once your identity is confirmed, youll have access to all of the free features available on Credit Sesame.

Recommended Reading: Does Speedy Cash Report To Credit Bureaus

How Do I Sign Up And Use Credit Sesame

Using Credit Sesame is easy. You just need to , provide a few pieces of important information, and youll be all set! No credit card information is ever required since the service is totally free.

You will need to provide the last 4 numbers of your social security number so they can access your credit history for personal use.

It will also ask you some important identity verification questions to ensure the highest level of security and make sure your personal information is protected.

Once youve created your account, you can log in to your account using the website or mobile app .

Learn More About Loans Credit And How To Fund Your Education

The team at CollegeFinance.com is here to help you figure out the best way to pay for your college education, whether through scholarships, grants, or loans. While most federal student loans do not require a credit check, private student loans and some federal PLUS loans do. Learn more by visiting the resources on our website or signing up for our newsletter.

Recommended Reading: What Is Syncb Ntwk On Credit Report

What Credit Score Does Credit Sesame Use

Image Source | www.creditsesame.com

The credit score you see on Credit Sesame is based on the VantageScore® 3.0 scoring model and provided by TransUnion. It is a real credit score, and it is not the TransUnion Risk Score, which is a score that was merely an educational credit score and not used by lenders. The TransUnion Risk Score was designed by TransUnion to give a user an idea of what their credit score was.

Does Credit Sesame Have An App

Yes, Credit Sesame has an app for Apple users on the iTunes App Store and Android users on .

The app is easy to use and even allows you to sign in using Touch ID or a 4 digit PIN to access the app quickly while youre on the go.

Most find the mobile app easier to use and understand since it primarily focuses on the most important information, including your VantageScore and the factors that determine it.

You will be able to access your VantageScore, credit monitoring report , recommendations to improve or maintain your score, and personalized offers on other financial products.

The full website is great if you want to look deeper into their personalized financial recommendations and see what type of financial offers you may qualify for.

You May Like: Remove Repo From Credit

Pros & Cons Of Credit Sesame

offers useful and free-to-use credit monitoring services. Moreover, their unique identity theft insurance helps differentiate them from their competitors.

However, their free version only offers VantageScore 3.0 credit scores, which arent used as often as the FICO Score 8. Moreover, they only offer credit scores from one of the bureaus, TransUnion. Since each bureau is independent of each other, you cant see mistakes on your Experian and Equifax credit reports.

They also dont offer FICO Scores, but this is a problem almost every free-to-use credit monitoring platform faces.

Pros:

- Only one TransUnion credit report a month

What Is The Benefit Of A Good Credit Score

Having good credit is more than simply a point of pride. Rather, there are a number of practical real life benefits to having good credit. Not only does having good credit make it easier for you to buy the things you want and to get approved for loans, it also means better terms and interest rates on those loans.

To think of this another way, we compared the average interest rates of mortgage loans, auto loans, and credit cards for various score ranges. Heres what we found:

Comparing Credit Score Ranges of Credit Sesame Members

| Score Range |

|---|

| 11.87% |

As you can see above, the average interest rate for an auto loan for someone with excellent credit is 3.6 percent. For someone with a bad credit score, this number jumps to more than 15%. While these numbers alone sound startling, lets take a more practical look at how this breaks down.

Say you want to apply for a $45,000 loan to buy a new car. A 5-year auto loan with a 3.6 percent interest rate means a $821 monthly payment, for a total owed of $49,239 for the loan. If you have bad credit, these numbers are significantly higher. Now, youre looking at a $1,076 monthly payment, and a total of $64,573 paid for the same loan.

Of course, you should always keep in mind that there really isnt a single cutoff score used by all lenders, and there may be additional factors that lenders use to determine your actual interest rates. These can include your monthly income, family size, and even where you live

| 3 credit bureaus |

Recommended Reading: Does Titlemax Report To Credit Agencies