Improving Your Credit Score

Fair credit scores can’t be made into exceptional ones overnight, and bankruptcies, foreclosures and some other negative issues that contribute to Fair credit scores only resolve themselves with the passage of time. But no matter the cause of your Fair score, you can start handling credit more, which can lead in turn to credit-score improvements.

Seek a secured credit card. A secured card can benefit your credit score, even if you don’t qualify for traditional credit cards. Once you’ve confirmed that the lender reports card activity to the national credit bureaus, you put down a deposit in the full amount of your spending limittypically a few hundred dollars. When you use the card and make regular payments, those activities will be recorded in your credit files. And as long as you keep your usage rate on the card below about 30%, and stay on schedule with your monthly payments, they’ll help you build stronger credit.

Pay your bills on time. If you could do only one thing to improve your credit score, nothing would help more than bringing overdue accounts up to date, and avoiding late payments as you move forward. Do whatever you can to remind yourself to pay the bills on time: Use automatic payments, set calendar alarms, or just write yourself notes and pin them where’s you’ll see them. Within a few months you’ll train yourself in habits that promote higher credit-scores.

Among consumers with FICO® credit scores of 600, the average utilization rate is 78.2%.

Tips To Improve Your Credit

This is especially important when youre in the fair credit range, for at least two reasons:

- If youre at the bottom of the fair credit range, youll want to move toward the top, and

- Your goal should be to move above the fair credit range.

When rebuilding fair credit, take time to learn the right way to rebuild credit yourselfknow your rights and the signs of a credit repair scam. If its too good to be true, it probably is.

Here are tips to help you do just that.

Can You Get A Personal Loan With A 600 Credit Score

Yes, you can get a personal loan with a 600 credit score there are even lenders that specialize in offering fair credit personal loans.

However, keep in mind that if you have a credit score between 580 and 669, youll generally be considered a subprime borrower meaning lenders might see you as a more risky investment.

Because of this, youll likely pay a higher interest rate than borrowers with good to excellent credit.

Tip:

Even if you dont need a cosigner to qualify, having one might get you a lower interest rate than youd get on your own.

Here are Credibles partner lenders that offer cosigned personal loans:

If you decide to take out a personal loan, remember to consider as many lenders as possible to find a loan that fits your needs. Credible makes this easy you can compare your prequalified rates from multiple lenders in two minutes.

Ready to find your personal loan?

You can use Credible to compare rates from multiple lenders in 2 minutes. Just keep in mind, you wont be able to get a personal loan with a cosigner through Credible.

- Free to use, no hidden fees

- One simple form, easy to fill out and your info is protected

- More options, pick the loan option that best fits your personal needs

- Here for you. Our team is here to help you reach your financial goals

Learn More: How to Get a $5,000 Personal Loan

Don’t Miss: Does Speedy Cash Do Credit Checks

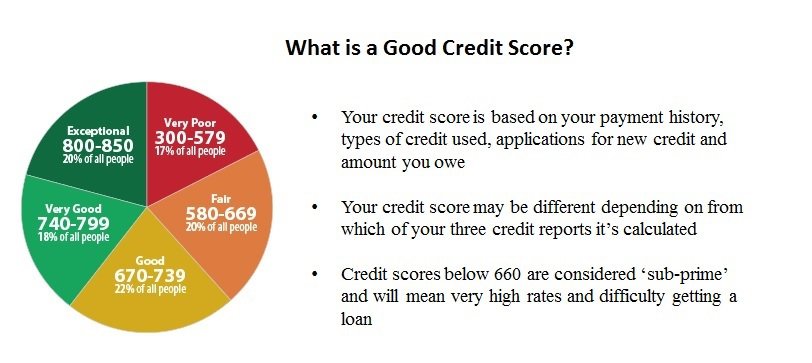

What Factors Influence Your Credit Score

FICO Score

VantageScore

How To Improve Your Credit Scores

To improve your credit scores, focus on the underlying factors that affect your scores. At a high level, the basic steps you need to take are fairly straightforward:

- Make at least your minimum payment and make all debt payments on time. Even a single late payment can hurt your credit scores and it’ll stay on your credit report for up to seven years. If you think you may miss a payment, reach out to your creditors as quickly as possible to see if they can work with you or offer hardship options.

- Keep your credit card balances low. Your is an important scoring factor that compares the current balance and credit limit of revolving accounts such as credit cards. Having a low credit utilization rate can help your credit scores. Those with excellent credit scores tend to have an overall utilization rate in the single digits.

- Open accounts that will be reported to the credit bureaus. If you have few credit accounts, make sure those you do open will be added to your credit report. These could be installment accounts, such as student, auto, home or personal loans, or revolving accounts, such as credit cards and lines of credit.

- Only apply for credit when you need it. Applying for a new account can lead to a hard inquiry, which may hurt your credit scores a little. The impact is often minimal, but applying for many different types of loans or credit cards during a short period could lead to a larger score drop.

Also Check: Synchrony Networks On Credit Report

Personal Loan Fees To Know

There are a few potential fees you may encounter when taking out a personal loan.

- Origination fee: This is a one-time cost thats charged upfront when your loan is processed. It may also be referred to as an underwriting fee.

- Late fee: If you make late payments on your personal loan after the scheduled due date, you may be charged a late fee, which typically costs $25 to $45. Not paying your bill on time can also negatively affect your credit score.

- Early repayment penalty: Some lenders may charge you a penalty fee if you pay your loan back ahead of schedule.

If you have good or excellent credit, lenders might waive some of these fees. But those with fair or poor credit are generally stuck paying these personal loan fees, if applicable.

How To Raise Your Credit Score

If you can wait to take out a loan, spending some time improving your credit score first could help you qualify for lower interest rates and better loan terms.

Keep in mind that having a lower interest rate could help you save money on your loan over time.

Here are several ways to potentially build credit:

- Pay your bills on time. Your payment history accounts for 35% of your credit score. Paying all of your bills such as utility and credit card bills on time could help improve your credit over time, especially if youve missed payments in the past.

- Reduce existing debt. Your credit utilization makes up 30% of your credit score. If you can pay down the balances on your accounts, you might see a boost to your credit.

- Dispute issues on your credit report. One in five people have errors on their credit reports, according to the Federal Trade Commission. If youre one of these people, you could end up with less favorable loan terms or even damaged credit. Take some time to review your credit report and dispute any issues with the major credit bureaus.

What credit score should I aim for?

If you want to improve your fair credit score, aiming for a score anywhere from 670 to 739 is a good place to start this will put you in the good credit range and will likely qualify you for better rates and terms.

Keep Reading: No Credit Check Personal Loans

You May Like: How To Remove Repossession From Credit Report

The Most Important Features Of Credit Cards If Your Fico Score Is Between 600 And 649

If your FICO Score is between 600 and 649, shopping for a credit card is different than it would be if your score was say, over 700. Youll be less concerned with factors like cash rewards, travel benefits, and 0% introductory APRs. Your needs will be more basic, and will focus on a combination of the cost and usability of the card.

The main purpose of getting a credit card in this credit score range is to use it as a tool to improve or rebuild your credit score. Only then will you be eligible for the more generous credit card offers.

Here are the factors that are most important:

Why Is My Credit Score Low

Lower credit scores arent always the result of late payments, bankruptcy, or other negative notations on a consumers credit file. Having little to no credit history can also result in a low score.

This can happen even if you had established credit in the past if your credit report shows no activity for a long stretch of time, items may fall off your report. Credit scores must have some type of activity as noted by a creditor within the past six months.If a creditor stops updating an old account that you dont use, it will disappear from your credit report and leave FICO and or VantageScore with too little information to calculate a score.

Similarly, consumers new to credit must be aware that they will have no established credit history for FICO or VantageScore to appraise, resulting in a low score. Despite not making any mistakes, you are still considered a risky borrower because the credit bureaus dont know enough about you.

You May Like: Zebit Report To Credit Bureau

Lending Products And Industries

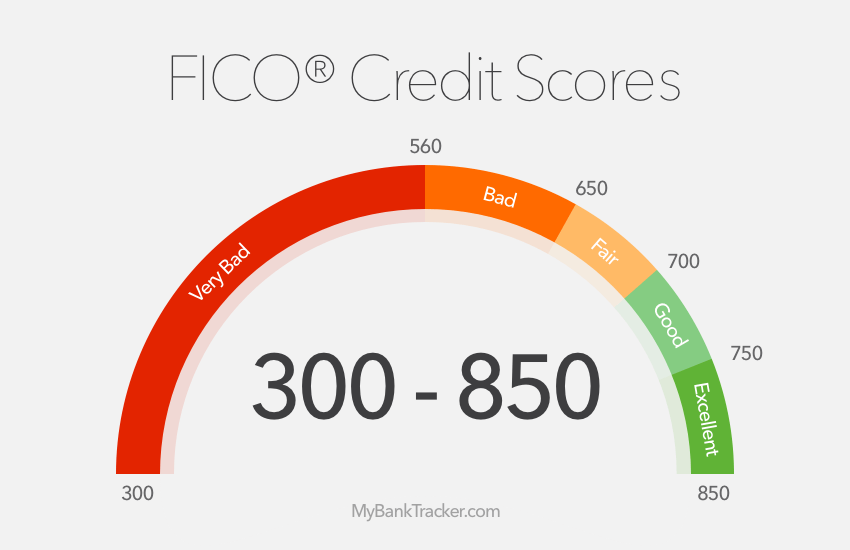

As if things werent complicated enough, there are special scores for different types of lenders, too. For example, in addition to its most widely used FICO Score 8, FICO has the following industry-specific scores:

- FICO Auto Score: Used in the auto industry

- FICO Bankcard Score: Used in the credit card industry

- FICO Score 2, 4 and 5: Used in the mortgage industry

For its base scores, FICO uses a range of 300 to 850. But it uses a range of 250 to 900 for its industry-specific scores.

While there are various ways to see your base FICO Score for free, youll need to pay a subscription fee to access your industry-specific FICO Scores.

How To Improve A 600 Credit Score

The best approach to improving a 600 credit score is to check the of your free WalletHub account. This will tell you what problem areas to focus on and how to correct them. If your grades are similar to those earned by the average person with a 600 credit score, improving your credit utilization and paying your bills by the due date every month should be among the first orders of business.

There are four ways to improve your credit utilization, which refers to how the balances listed on your credit card statements each month compare to the credit limits for those accounts. You can spend less, make bigger payments or pay your bill multiple times per month to bring down your statement balances. You can also request higher credit limits, but thats harder for you to control.

On-time payments are important because your payment history accounts for a lot of your credit score, and success in this area is directly within your control. The best approach is to set up automatic monthly payments from a bank account. This will at least save your score from taking a hit just because you lose track of time.

Below, you can get a feel for how your credit analysis might look as well as what your other top credit-improvement priorities might be.

600 Credit Score Sample Scorecard:

Was this article helpful?

Related Scores

Recommended Reading: Syncb Inquiry

How To Get A Loan With A 600 Credit Score

So what can you do with a 600 credit score? That depends on what you want to do

If youre looking for a mortgage or a loan over $40,000 then your options are going to be limited. Youll need a 650 credit score or higher to even get in the door at a traditional bank for a loan.

Banks cant loan to borrowers with very low scores because the loans dont qualify to be resold to investors, something the bank does to get cash needed to make more loans.

There is a solution though, one that will get you the money you need and help increase your credit score.

Its called a debt consolidation loan. You might have heard about consolidation loans as a way to pay off your high-interest loans but there are a couple of other benefits that will help you as well.

Ive used PersonalLoans.com for a consolidation loan and a home improvement loan. They specialize in bad credit loans and offer interest rates you can afford. I like the online lender for two reasons. First, they offer different types of loans from peer-to-peer loans to personal loans and bank lending depending on your credit. The website also shops your loan around to different lenders to make sure you get the best rate possible.

Consolidation loans are available for between six and 72 months. I recommend a 36- or 60-month payoff. You want to spread your loan out enough that your payments are manageable but you want to pay it off as soon as possible.

What Is Considered A Bad Or Poor Credit Score

The exact meaning of a bad credit score will vary depending on who you ask, but generally speaking, a score below 580 can be considered bad or poor. People with bad credit have much higher loan costs, and they are often only considered for very risky loans with higher interest rates.

While it can still be possible to improve your credit score, it will take some effort, financial discipline, and a little bit of help.

Also Check: Speedy Cash Loan Extension

Can I Get A Mortgage & Home Loan W/ A 600 Credit Score

Getting a mortgage and home loan with a 600 credit score is going to be difficult. Can it be done? Maybe, but thereâs a few simple steps you can take to guarantee less headaches and higher chance of success.

The #1 way to get a home loan with a 600 score is repairing your credit.

After a few short months of repairing your credit , youâll be in a much better position to get your ideal home loan terms.

The Basis For Your Credit Score

Here’s a more detailed breakdown of the specific factors that influence your FICO® Score:

Public Information: If bankruptcies or other public records appear on your credit report, they can have severe negative impacts on your credit score.

Among consumers with a FICO® Score of 600, the average credit card debt is $5,908.

Payment history. Delinquent accounts and late or missed payments can harm your credit score. A history of paying your bills on time will help your credit score. It’s pretty straightforward, and it’s the single biggest influence on your credit score, accounting for as much as 35% of your FICO® Score.

. To determine your , add up the balances on your revolving credit accounts and divide the result by your total credit limit. If you owe $4,000 on your credit cards and have a total credit limit of $10,000, for instance, your credit utilization rate is 40%. You probably know your credit score will suffer if you “max out” your credit limit by pushing utilization toward 100%, but you may not know that most experts recommend keeping your utilization ratio below 30% to avoid lowering your credit scores. Credit usage is responsible for about 30% of your FICO® Score.

Total debt and credit. Credit scores reflect your total amount of outstanding debt you have, and the types of credit you use. The FICO® Score tends to favor a variety of credit, including both installment loans and revolving credit . Credit mix can influence up to 10% of your FICO® Score.

Recommended Reading: Synchrony Bank Ntwk

Credit Score Credit Card & Loan Options

Some lenders choose not to lend to borrowers with scores in the Fair range. As a result, your financing options are going to be somewhat limited. With a score of 600, your focus should be on building your credit and raising your credit scores before applying for any loans.

One of the best ways to build credit is by being added as an authorized user by someone who already has great credit. Having someone in your life with good credit that can cosign for you is also an option, but it can hurt their credit score if you miss payments or default on the loan.

What Goes Into A Credit Score Calculation

Your score is calculated by Canadaâs two major credit bureaus: Equifax and TransUnion. To calculate your score, credit bureaus use specific information found in your credit report. There are five key factors that impact your credit score, and each factor carries a specific weight towards your score. Here are the five main factors, along with how much of your credit score they account for:

-

Payment history

Payment History

Your payment history is the most important factor that impacts your credit score. Your credit report will show your payment histories for credit accounts, like credit cards and loans, along with other bills. If you miss a payment on one of your accounts, your lender might report it to the credit bureaus. The missed payment will be recorded on your credit report and can negatively impact your credit score. In general, negative payment information can stay on your credit report for seven years.

Your credit utilization rate is the second largest factor that impacts your credit score. Credit utilization is the amount of credit youâve used up compared to the total amount of credit available to you. For example, if you have a credit card with a balance of $50 and a total credit limit of $100, your credit card utilization would be 50%. Your credit report will show your credit utilization for all your credit accounts. Using up too much credit can drag down your credit score.

Don’t Miss: What Card Is Syncb/ppc