Who Can See And Use Your Credit Report

Those allowed to see your credit report include:

- banks, credit unions and other financial institutions

- offer you a promotion

- offer you a credit increase

A lender or other organization may ask to check your credit or pull your report”. When they do so, they are asking to access your credit report at the credit bureau. This results in an inquiry in your credit report.

Lenders may be concerned if there are too many credit checks, or inquiries in your credit report.

It can seem like you’re:

- urgently seeking credit

- trying to live beyond your means

How Do I Make Sure Financial Account Information Included In A Bankruptcy Or Insolvency Is Marked As Satisfied And Closed

Financial account information included in a bankruptcy or insolvency will not be marked as closed and satisfied until after your bankruptcy or insolvency has been completed or discharged and the lender has been notified of this.

You can contact your lender with evidence of the bankruptcy or insolvency ending in order to mark these accounts as closed and satisfied.

Understanding Your Credit Score

Determining your score is more complicated than just weighing the different aspects of your credit history. The credit scoring process involves comparing your information to other borrowers that are similar to you. This process considers a tremendous amount of information, and the result is your three-digit credit score number.

Remember, no one has just one credit score, because financial institutions use several scoring methods. For some credit scores, the amount you owe might have a larger impact on your score than payment history.

View all of your credit reports annually to help ensure the information is accurate. You may also want to use a credit monitoring service year-round. TransUnion offers some of the latest and most innovative credit monitoring services, to help you spot inaccuracies, potential fraud and other blemishes that could lead to higher interest rates.

Don’t Miss: Does Comenity Bank Report To Credit Bureaus

Why Does My Credit Score Differ Across Different Credit Reference Agencies

Your TransUnion, Experian and Equifax scores are likely to be different as each of these companies use their own credit scoring system with different maximum scores .

Each CRA assembles your report from information sent to them by lenders, credit card issuers and courts and local authorities. Lenders will have their own scoring criteria like CRAs, and will calculate a credit score based on their perception and interpretation of the information they hold.

Full Lowdown On What Mse Credit Club Offers:

- Our Credit Hit Rate. This shows your chances of success, as a percentage, of grabbing our top cards and loans.

- Eligibility tool. It reveals the likelihood of you getting top credit cards or loans .

- Your credit profile explained. It shows the key factors affecting your score and how to improve them.

Or alternatively…

Don’t Miss: Paypal Credit Help Credit Score

What Does This Mean When I Apply For Credit

Any application for credit might be subject to further checks to prove your identity. As this is often a manual check, if youre applying for credit your application could be delayed.

Having a marker under this section wont automatically mean your application will be rejected. Its there to protect you from being a victim of fraud.

How To Get A Free Credit Report

Order a copy of your credit report from both Equifax Canada and TransUnion Canada. Each credit bureau may have different information about how you have used credit in the past. Ordering your own credit report has no effect on your credit score.

Equifax Canada refers to your credit report as credit file disclosure.

TransUnion Canada refers to your credit report as consumer disclosure.

Recommended Reading: Credit Report Inquiries Removal

How To Check Your Credit Report

- Check your Experian credit report through their partner website, MoneySavingExperts Credit Club

- Check your Equifax credit report through their partner website, ClearScore

- Check your TransUnion credit report through their partner website,

Its often worth getting a copy of your credit report from all three main CRAs if you havent applied for it before or if you havent checked it for some time.

Thats because they might have different information from different credit providers, although there is quite a lot of overlap between them.

If youd prefer a paper copy of your credit report, you can contact the credit scoring agencies direct:

Find out more about how to get a written copy of your credit report from the Information Commissioner’s Office

What Is A Credit Rating

A credit rating is a measure of how dependable you are in repaying your debts. Most credit-reporting agencies will give you a rating on a scale of 1 to 9, others will assign letters corresponding to the type of credit you’re using. For example, a rating of “1” means you pay your bills within 30 days of the due date, while a rating of “9” can mean that you never pay your bills at all.

An “R” rating is also included in your credit score. This rating is assigned by lenders based on your past history of borrowing and paying off debts, and it can range from 1 through 9. An R1 rating is the best, meaning you pay your debts on time, within 30 days, and an R9 is the worst.

Your credit rating is not established by the government or by financial institutions – it is established by you. If you don’t pay your bills on time or fail to repay a loan, you may be reported to a credit bureau.

Read Also: Can Overdraft Affect Credit Score

Is A Free Credit Score Really Free

- Avoid falling into the trap. There are many websites that claim to offer free credit scores.

- The best sites for free credit reports. While some websites use the term loosely, there are actually more places than ever where you can get a truly free credit report.

- Top sites for free credit assessments.

- Bottom line.

Is A Fico Score Of 8 Good

FICO 8 also handles individual late payments more thoroughly than previous versions. If the late payment is an isolated incident and other accounts are in good shape, FICO said, a score of 8 would be milder. FICO 8 also divides consumers into different categories to provide a better statistical representation of risk.

You May Like: Does Paypal Credit Help Your Credit Score

How Can I Dispute The Accuracy Of Information On My Credit Report

If you see something on your credit report you believe isnt being reported correctly, you can let us know by raising a dispute. To find out how to dispute an item on your credit report, you can read our Dispute FAQs.

Once weve received your dispute, along with any supporting evidence weve requested,* well begin our investigation and make any amendments where necessary. Youll receive an outcome within 28 days of the dispute being raised.

*For some disputes, youll be required to provide supporting evidence. In the event evidence is not provided within a 28-day timeframe, well be unable to process your dispute further.

How To Access Your Credit Report

You can access your credit report through one of the CRAs. You can request a copy of your credit report online, in writing or verbally. If you do ask verbally, it can be useful to follow this up in writing.

You can make online requests directly from one or all of the 3 CRAs at:

You may need to create an account with each of the providers to be able to access your credit report.

-

your name

-

your full address

-

your date of birth

If you’re requesting a copy of your credit report in writing, you can write to the CRAs at:

Recommended Reading: Does Walmart Do Klarna

How Can I Check My Credit Score In The Uk

If you are unsure of your current credit score and are searching for ‘how to check my credit score in the UK’, you can find this out using a number of free or paid credit reporting or reference agencies. The UKs main credit agencies are Experian, Equifax and TransUnion, however, companies such as ClearScore could also be used for a quick, free insight into your credit status.

How Is A Fico Score Different From A Credit Score

Your FICO score can change from month to month and even week to week as information about your credit report changes. For example, if you’re late on your credit card payment, a late payment can show up and change your FICO score within a day. Conversely, if you reset your late payment history to its current status, your FICO score will increase.

Read Also: Credit Cards For 611 Credit Score

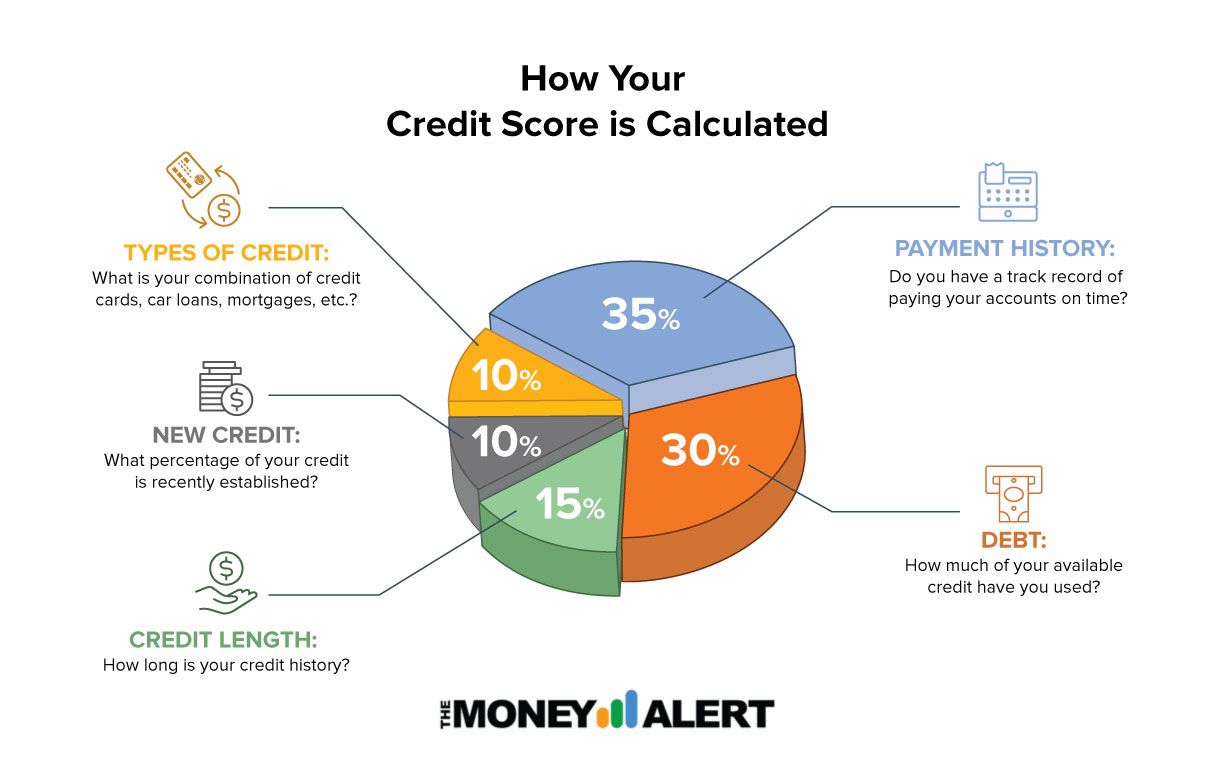

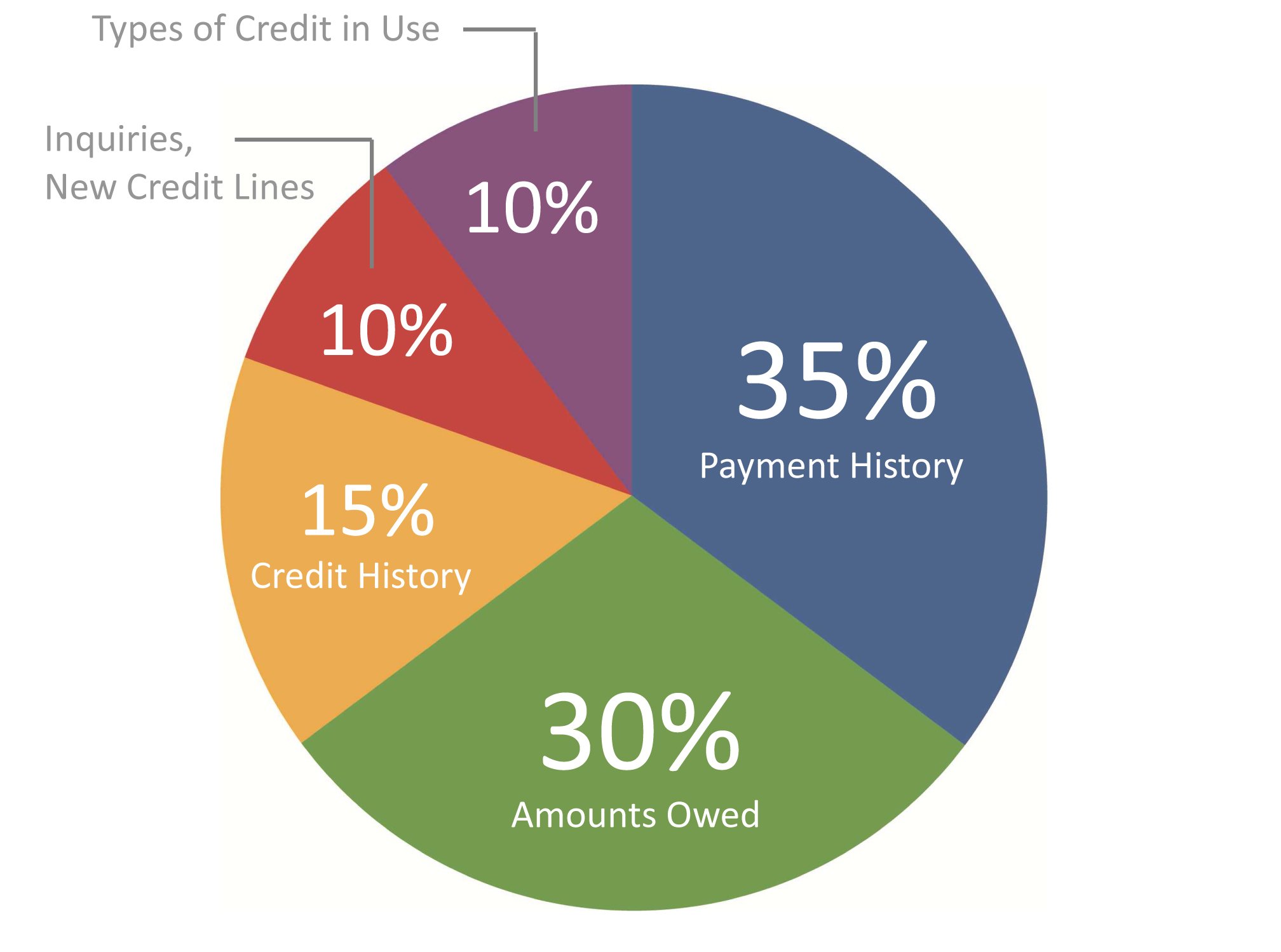

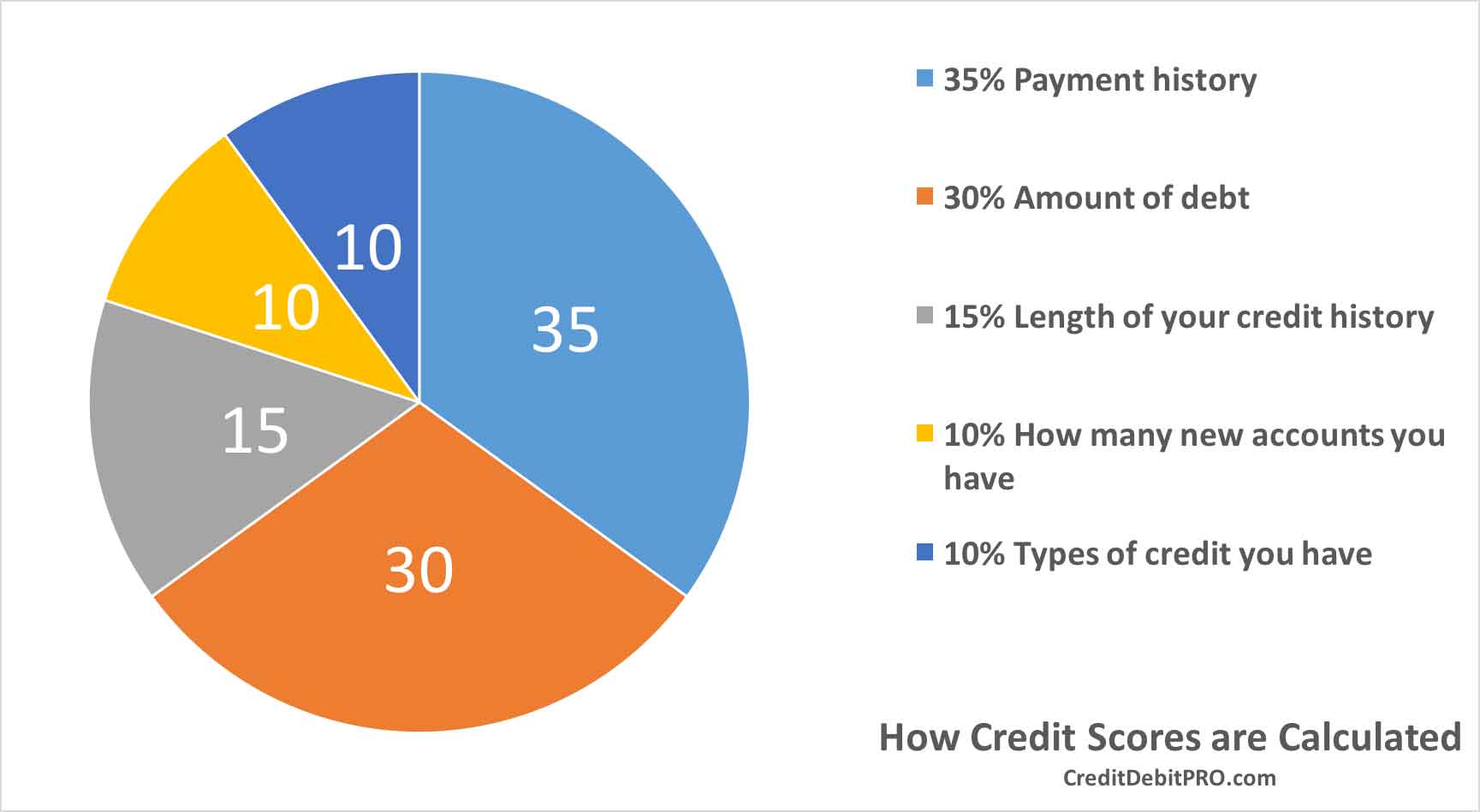

How Your Fico Score Determined

- Payment history 35%. Payment history is the most important factor in your FICO score and has the greatest impact.

- The amount to be paid is 30%. The amount you currently owe to your creditors.

- 15% credit history term. As simple as it may sound, this is the time when your credit accounts have been open.

What Does Your Fico Credit Score Really Mean

Credit scores range from good to bad, but how does this affect you? Fundamentals of solvency. Your credit score is a number that represents the risk a lender takes when borrowing money. Exceptional credit rating: 800 to 850. Very good credit rating: 740 to 799. Good credit rating: 670 to 739. Average credit rating: 580 to 669. Low credit rating: Less than 580. No credit. Bottom line.

Also Check: Stoneberry Credit Score

Fico Weighs These Five Components To Come Up With Your Score

The often referred to as a FICO score is a proprietary tool created by FICO, the data analytics company formerly known as the Fair Isaac Corporation. FICO is not the only type of credit score available, but it is one of the most common measurements lenders use to determine the risk involved in doing business with a borrower. Here’s a look at what FICO examines to come up with its credit scores.

How To Improve Your Credit Score

The best things you can do to improve your credit score are to manage your money wisely using a realistic spending plan and to deal with your debts. Despite what some might claim, there is no quick-fix for factual but negative information on your credit report. Time and living within your means are what it takes to improve your credit rating. However, in some situations there may be a couple of things you can do to improve your score more quickly.

Don’t Miss: Opensky Payment Processing Time

What Exactly Is A Fico Score

FICO scores are the most important credit scores to check as they are mainly used by banks and lenders to determine your creditworthiness. The credit rating scale for FICO scores ranges from 300 to 850, with higher scores considered excellent and lower scores considered poor.

Whats a good credit score to buy a carWhat’s the lowest credit score you can have to buy a car? A credit score of 660 or higher should get you a car loan at a good interest rate, but borrowers with a score of only 600 or even 500 have options.Can I buy a car with a poor credit score?Yes really! You can buy a car with bad credit, but you may have to pay a higher annual rate or need a family member or friend as collateral. Yes really! You can

Facts About Risk Factors

All credit scoring models you’re likely to encounter are broadly sensitive to many of the same basic : Late and missed payments, high credit card balances and excessive debt tend to lower scores on all models, while timely payments, low credit balances and a wide variety of credit accounts tend to promote higher scores.

Risk factors show you which specific influences are lowering your scores and can help you focus your efforts on improving them.

When going over your risk factors, it’s helpful to understand their context and how they’re generated. That knowledge can give you some perspective on how to prioritize your actions. Understanding your risk factors will also help you figure out which ones you can do something about now and which ones will require patience and persistence to address.

Here’s some context and background on credit score risk factors:

Don’t Miss: What Is Aargon Agency

How Do I Get A Bankruptcy Or An Iva Marked As Discharged Or Completed

To mark a bankruptcy as discharged, we’ll need to see the relevant Certificate of Discharge. For an IVA to be marked as completed, we’ll need written confirmation from your insolvency practitioner. In either instance, please also raise a dispute against the data on your credit report prior to supplying us with your evidence.

Who Creates Your Credit Report And Credit Score

There are two main credit bureaus in Canada:

- Equifax

These are private companies that collect, store and share information about how you use credit.

Equifax and TransUnion only collect information from creditors about your financial experiences in Canada.

Some financial institutions may be willing to recognize a credit history outside Canada if you ask them. This may involve extra steps. For example, you may request a copy of your credit report in the other country and meet with your local branch officer.

Read Also: Itin Credit Report

Is Knowing Your Own Credit Score Important

Some people really want to know what their credit score is. However, it changes often, so be prepared. Also, keep in mind that your credit score is intended to reflect the likelihood that you will repay any money that you borrow. Most people dont need a score to know if they will pay themselves back the money they lend themselves. Instead, focus on managing your money carefully with a budget and only apply for credit that you need your score will take care of itself.

Getting a copy of your credit report, however, is important and can be done for free. It will allow you to spot concerns, inaccuracies, or potential fraud.

Your Credit Score & So Much More

- Your credit score will be updated every 30 days, if you log in

- See credit cards and personal loans you are more likely to be accepted for. We’re a credit broker, not a lender

- Free and easy access to your account with our Experian mobile app

- New Clear overview of how much you owe across all your credit cards, loans or mortgages.

Read Also: Will Removing Authorized User Hurt Their Credit

How To Raise A Dispute On Your Credit Report

Checking your credit report regularly can help you make sure the information it holds is accurate. If theres incorrect information, you can raise this.

To raise a dispute, youll need to contact the CRA directly. Each CRA will have a different method for raising a dispute, but you should be able to contact them online or in writing. Theyll be able to let you know the next steps you need to take.

How Do I Find My Fico Score

1) Examine your credit card. One of the best ways to access your FICO Credit Score for free is with the Discover Credit Scorecard. 2) American Express credit cards. American Express offers cardholders access to their free FICO Score and 12 months of FICO Score history. 3) Citibank credit cards. Citibank is another credit card issuer that provides your FICO account for free . 4) Bank of America. Bank of America offers eligible cardholders free access to their FICO score. The score provided is based on your TransUnion credit report and is updated monthly. 5) Savings and credit cooperatives. If you don’t want to use credit cards, you can also get free FICO points through a credit union. 6) Union Bank.

You May Like: Credit Report Itin Number

How Your Credit Score Is Used

When you apply for a credit card or loan, the creditor or lender uses your credit score to inform their decision on whether to issue you credit or not. The credit score gives a snapshot of how reliable you are as a borrower, which lets lenders know whether you are a good risk for a loan or credit card or not.

Lenders aren’t the only ones who check credit scores, however. Your utility company, landlord, and cell phone company may all check your credit score to get a picture of how reliable and financially stable you are.

These higher interest rates are designed to lower the risk that lenders take on by offering loans or credit cards to less reliable borrowers.

What Are Fico Scores And How Do They Work

FICO scores are based on information collected from individual consumers by the three major credit bureaus, including their payment history, credit usage, and the age of their accounts. FICO scores were introduced in 1989. The company uses information from individual consumer credit reports to calculate creditworthiness.

Don’t Miss: How Long Is Carmax Pre Approval Good For

What Goes Into A Credit Score

Because some parts of your bill-paying history are more important than others, different pieces of your credit history are given different weights in calculating your credit score.

Even though the specific equation for coming up with your credit score is proprietary information owned by FICO, we do know what information is used to calculate your score.

| What Makes Up Your FICO Credit Score | |

|---|---|

| Payment history | |

| New credit | 10% |

Payment history: Lenders are most concerned about whether or not you pay your bills on time. The best indicator of this is how youve paid your bills in the past.

Late payments, charge-offs, debt collections, and bankruptcies all affect the payment history portion of your credit score. The better your history of paying debtssuch as loan payments or credit card billson time, the higher your credit score.

More recent delinquencies hurt your credit score more than those in the past.

Amounts owed: The amount of debt you have in comparison to your credit limits is known as . The more money you already owe, the less flexible your spending is, which makes it riskier for you to take on new debt, which lowers your credit score.

Keep your credit card balance at about 30% of your or less to improve your credit score.

Length of credit history: Having a longer credit history is favorable because it gives more information about your spending habits. A longer history of reliable borrowing means your score will be higher.