Using Apple Card With Apple Pay

Apple Card is designed to work with any other credit or debit card stored in the Wallet app for use with Apple Pay. You can set it as the default card and use it for in store purchases on iPhone and online purchases on Apple Watch, iPhone, iPad, and Mac.

How To Increase Your Chances Of Getting Approved For Apple Financing

Getting approved for Apple Financing requires a little planning. When applying for new credit, its important to know your credit scores and whats on your credit reports.

Apple Financial Services wants to see a strong credit history, steady income, and low credit utilization. If youre using too much of your existing revolving credit, its a sign that you may not pay them back. Its also important to make sure that you havent applied for too much credit in the recent past. Having too many credit inquiries can lessen your chances of getting approved.

Accept The Offered Terms

If your application is approved, you have 30 days to accept the offer. If you do so, a hard inquiry will be performed on your credit and your credit scores may be affected. Once you accept, you get instant access to the card in Apple Wallet. You can request a physical card and, if you want to share your account by adding a co-owner or authorized user, you can set up Apple Card Family.

Recommended Reading: How To Remove Repossession From Credit Report

How To Maximize Your Rewards

Maximizing rewards with the Apple Card is all about strategic spending. First, you’ll want to use the card to pay for any Apple purchases you plan to make, including things like recurring subscription services. This will get you that juicy 3% Daily Cash rewards rate.

Next, you can continue earning 3% Daily Cash by using your card at that short list of partner merchants mentioned above. If you spend $20 a day on Uber and Uber Eats, for example, that’s $219 a year you could pocket.

Using your card with Apple Pay everywhere else is the third way to maximize rewards, scoring you that cash back at the 2% rate.

What you might want to consider, however, is skipping using this card at merchants or websites that don’t accept Apple Pay. For example, if you regularly buy groceries from a gourmet grocery in your neighborhood that doesn’t take mobile payments you might be better off with a card that pays 2% or 3% back at supermarkets instead.

Their Algorithm Is Not Ai But It Can Evolve

As Goldman managing director Andrew Williams made clear, the companies acceptance/rejection algorithm is a pretty simple decision tree, not AI. This means its built to use basic financial metrics to reach a yes or no decision. The key input is a TransUnion credit report, notably evaluated using the FICO Score 9 rating system, though the specifics of that evaluation arent completely transparent. It also considers your reported annual income to determine how much cash you will likely have left after paying your monthly debt obligations.

Williams emphasized that the Apple Card has been available for less than a year and that the companies are still working to evolve their credit policy and add additional customers. In other words, an applicant rejected last August might be accepted in the future without personally making any changes. But my impression is that the simple decision tree wont change much unless the companies decide to open their gates wider. The Path to Apple Card is there to help more people meet Goldmans prior creditworthiness standard, rather than to ease that standard.

Read Also: Is 778 A Good Credit Score

Why Are Credit Scores Significant

For what reason is it critical to make progress toward a higher credit score? Basically, those with higher credit scores for the most part get more ideal credit terms. Which may convert into lower payments and less paid in interest over the existence of the record.

Keep in mind, however, that everybodys financial and credit circumstance is extraordinary. Various lenders may likewise have various rules with regard to giving credit. Which may incorporate data like your income.

The kinds of credit scores utilized by lenders and creditors may differ depending on their industry. For instance, in case youre purchasing a vehicle, an auto moneylender may utilize a credit score that places more emphasis on your payment history with regard to auto loans.

The Simplicity Of Applein A Credit Card

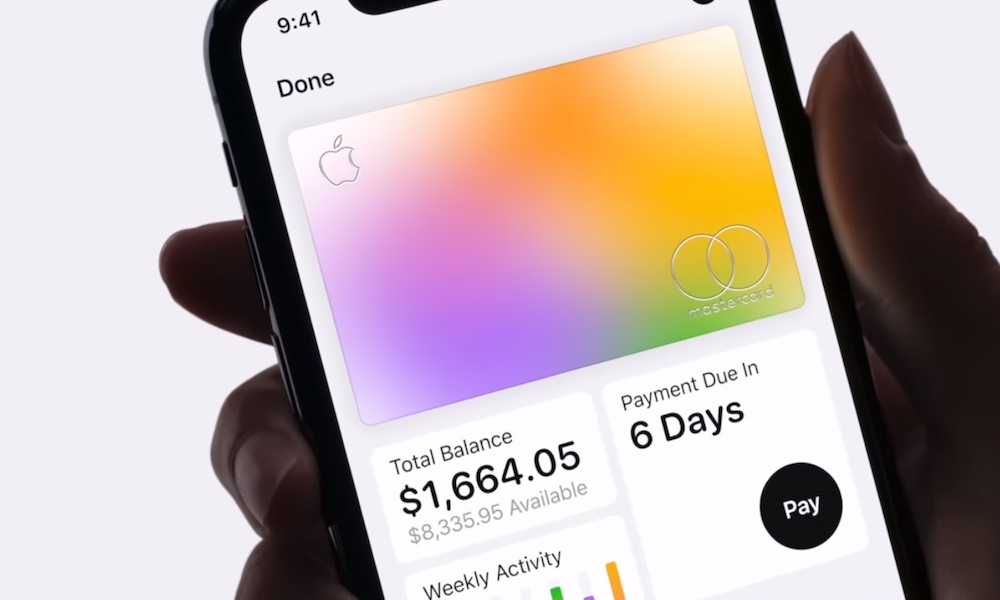

With Apple Card, we completely reinvented the credit card. Your information lives on your iPhone, beautifully laid out and easy to understand. We eliminated fees and built tools to help you pay less interest, and you can apply in minutes to see if you are approved with no impact to your credit score. Advanced technologies like Face ID, Touch ID, and Apple Pay give you a new level of privacy and security. And with every purchase you get Daily Cash back. Apple Card. Its everything a credit card should be.

Read Also: How To Get Credit Report Without Social Security Number

You Shop Primarily At Stores That Don’t Accept Apple Pay

Some major retailers, including Walmart, dont accept Apple Pay. And while Costco does, you can only use Visa cards there the Apple Card runs on the Mastercard payment network. This is to say nothing of the much smaller merchants where you may run into issues: Food trucks, mom and pop stores, bodegas and others simply may not be equipped to handle Apple Pay.

» MORE: How the Apple Card stacks up against the competition

Is The Card For You

Although the Apple card offers some unique features that can help motivate cardholders to stay on top of their debt, the rewards program can easily be bested by other cards. Theres a bushel of other no-annual-fee rewards cards that offer welcome bonuses, intro APR offers and other perks. Choose one of those options over this bad apple.

To view rates and fees of the Blue Cash Preferred® Card from American Express, please visit this page.

Read Also: How To Unlock My Experian Credit Report

How Do I Find Out My Credit Score

There are a number of ways you can find out your credit score, and a lot of them are free. For a long time, people were only able to check their credit score once per year for free and would have to pay a fee each additional time. That has since changed, and there is now a multitude of services that allow you to track and check your credit score as many times as you would like without paying anything. A few of these services, like , provide your credit score for free as well as a host of other things like free tax returns, unclaimed money, and help with disputes on your credit. A lot of credit cards have started to provide free credit scores to their cardholders as well, so check with your card providers to see if it is an included benefit with your card.

Is The Apple Card Right For You

If you already use Apple Pay for the majority of your purchases, the Apple Card might be a good choice for you. If you dont use Apple Pay and dont plan on using Apple Pay in the future, the Apple Card wont be as good of a fit and you might want to consider a different cash back rewards card instead.

Ultimately, the Apple Card is best for people who are excited about using mobile wallets and who already make a lot of purchases with Apple and its selected retailers. However, since the Apple Card accepts applicants with fair credit and gives people who were initially declined the opportunity to improve their credit score and apply again, the Apple Card might also be a good option for people who want to use a credit card to help build their credit.

If you are interested in the Apple Card, apply and see what happens. If your application gets declined, you might be able to use the Path to Apple Card program to reapply successfully in the future. If your application gets accepted, remember to use Apple Pay for as many purchases as possible to maximize your Daily Cash and take advantage of everything the Apple Card has to offer.

The information about the Apple Card has been collected independently by Bankrate.com. The card details have not been reviewed or approved by the card issuer.

You May Like: Does Zzounds Report To Credit Bureau

Why You Can Trust Bankrate

At Bankrate we strive to help you make smarter financial decisions. While we adhere to strict editorial integrity, this post may contain references to products from our partners. Here’s an explanation for how we make money. The content on this page is accurate as of the posting date however, some of the offers mentioned may have expired.

About Apple Card Family

Apple Card Family lets you co-own your Apple Card account with one member of your Family Sharing group. You can share your credit line with a co-owner and build credit together as equals. You can even invite another Apple Card owner to combine credit limits with you and form one co-owned account.1 You can also share your Apple Card with members of your Family Sharing group, including teens and adults. Everyone on the shared account can use Apple Card and view their spending. Account owners and co-owners can see a participant’s activity, set transaction limits, and more. And there’s a single monthly bill.

Six people including you can be on a shared Apple Card account. You can invite up to five members of your Family Sharing group to join and one of those five can be an account co-owner. Participants must be 13 years or older and account co-owners must be 18 years or older.

Don’t Miss: How Long Do Inquiries Stay On Chexsystems

Essential Reads Delivered Weekly Your Credit Cards Journey Is Officially Underway Keep An Eye On Your Inboxwell Be Sending Over Your First Message Soon Why Was My Application Declined

As with any credit card application, your credit score and credit report will be key factors in deciding whether youre approved for the Apple Card.

That said, its still possible to be denied for a credit card with excellent credit, and Goldman Sachs considers a number of other criteria when evaluating Apple Card applications, including whether your identity can be verified and your income, banking history and debt obligations.

Heres a breakdown of the reasons you may be denied the Apple Card, according to Apple:

Good Money Habits Lead To Good Credit

You can do several things to boost your chances of approval:

When possible, pay at least the minimum amounts due on your debt payments.

Ensure that you have disposable income left over after your monthly debt obligations.

Avoid submitting applications to multiple credit issuers within a short time span.

Check your credit report its free to do once a year as it is the source material for your FICO Score 9. If something looks inaccurate, contact the creditor associated with your account and/or dispute the item with your credit bureaus.

The length of your credit history is an important aspect of your credit score and getting new credit. You can build credit by opening an account in your name, being an authorized user on someone elses account, and periodically using the accounts you already own and paying them on time.

Recommended Reading: Does Paypal Credit Help Your Credit Score

Why You Might Pass On The Apple Card

The 2% cash back on most purchases matches many of the highest flat-rate cash-back cards on the market. But it comes with a big asterisk, because you must use Apple Pay to get elevated rates. The physical card earns just 1% back on purchases, and that’s just not competitive when the industry standard is at least 1.5%.

Here are some reasons the card may not make sense for you:

What Are The Apple Card Requirements

You must meet certain requirements to be able to apply for an Apple Card. For example, you must be at least 18 years old and a U.S. citizen or lawfully residing in the U.S. You must own an iPhone that runs a compatible iOS. Also, if there’s a freeze on your credit report, you must lift it before you can apply for an Apple Card. Apple looks into your credit score when evaluating your card application.

Read Also: Is 698 A Good Credit Score

How Your Apple Card Application Is Evaluated

Learn about the key criteria used to determine whether your Apple Card application is approved or declined.

Goldman Sachs1 uses your credit score, your credit report , and the income you report on your application when reviewing your Apple Card application. This article highlights a number of factors that Goldman Sachs uses, in combination, to make credit decisions but doesn’t include all of the details, factors, scores or other information used to make those decisions.

If you apply for Apple Card and your application is approved, there’s no impact to your credit score until you accept your offer. If you accept your offer, a hard inquiry is made. This may impact your credit score. If your application is declined or you reject your offer, your credit score isn’t impacted by the soft inquiry associated with your application.

If your application was declined, learn what you can do to try and improve your next application.

If you’re combining accounts for Apple Card Family, some of the credit factors mentioned above may be considered for both co-owners when evaluating a combined credit limit for a co-owned Apple Card.2

Personal finance companies, like Credit Karma, might display various credit scores, like TransUnion VantageScore. While these scores can be informative, if they’re not the FICO score that’s used for your Apple Card application, they may not be as predictive of your approval.

You can also contact Apple Support if you have questions about applying for Apple Card.

If You’re Approved But Your Credit Limit Isn’t Enough To Buy A Device With Apple Card Installments

You can apply for Apple Card when you buy a new iPhone, iPad, Mac, or other eligible Apple product with Apple Card Installments. If your application is approved with insufficient credit to cover the cost of the device you want to buy, you can choose a different device that’s covered by your credit limit. You can also choose a different payment method or use Apple’s Trade-in program.

Don’t Miss: Bp Visa Syncb

Apple Card* Vs Citi Double Cash Card

The no-annual-fee Citi® Double Cash Card is a Forbes Advisor top pick for a cash back card for its easy-to-earn, easy-to-redeem structure. With this card, youll earn a net 2% cash back on every purchase1% when you make a purchase and another 1% when you pay the bill. Your earnings can be used as a statement credit, taken as a direct deposit, mailed to you as a check or converted to Citi ThankYou points.

Like most credit cards, you can opt to load it into your phones digital wallet and it doesnt have to just be on the Apple ecosystem. One potential snag: Minimum redemptions start at $25 on the Citi Double Cash and theres no minimum redemption on the Apple card.

This Card Is Best For

- Seeks to maximize cash back earnings across spending categoriesCash Back Strategist

- Resists or refuses an annual fee on principle or due to costAnnual Fee Averse

- Affinity creates desire for rewards and perks with particular brandBrand Loyalist

Apple Card is designed first and foremost for iPhone users who already use Apple Pay as their preferred digital wallet app. In terms of cash back potential, it’s most rewarding for a) people who are into all things Apple, from devices to downloads, and b) consumers people who regularly make purchases from their mobile device. And of course, Apple makes it as easy as possible to manage your account through the app so you don’t have to chase down paper statements or try to remember where you spent money.

Beyond that, you may like this card if you’re looking for cash back rewards with no annual fee and no foreign transaction fee.

Don’t Miss: Does Opensky Report To Credit Bureaus

Cons: Why The Apple Card Might Not Be For You

You prefer Android devices – One basic requirement of the Apple Card is that users need a compatible device. If youre not a fan of the iPhone, that might rule out the Apple Card right away.

Youre unlikely to max out the Apple product and Apple Pay rewards – Before you choose the Apple Card, its worth thinking about how and where youll likely use it. While the 3% headline rewards on Apple and partner spending is good, itll only pay off if youre actually shopping with these retailers often. The 2% level of reward for other Apple Pay purchases can be still competitive – but once again, think about whether the places you usually shop actually accept Apple Pay. If they dont, the lowest tier of Apple Card rewards, at 1%, might not be the best youll find out there.

The APR youre offered might not be attractive – You’ll be able to see in just a few minutes what credit line and APR you could get with an Apple Card. Make sure this is attractive for you before you sign up. Simply checking what the deal would be wont impact your credit score, so theres no harm in looking – but as the APR used with Apple is based on your personal credit score, it may be on the high side for some customers.