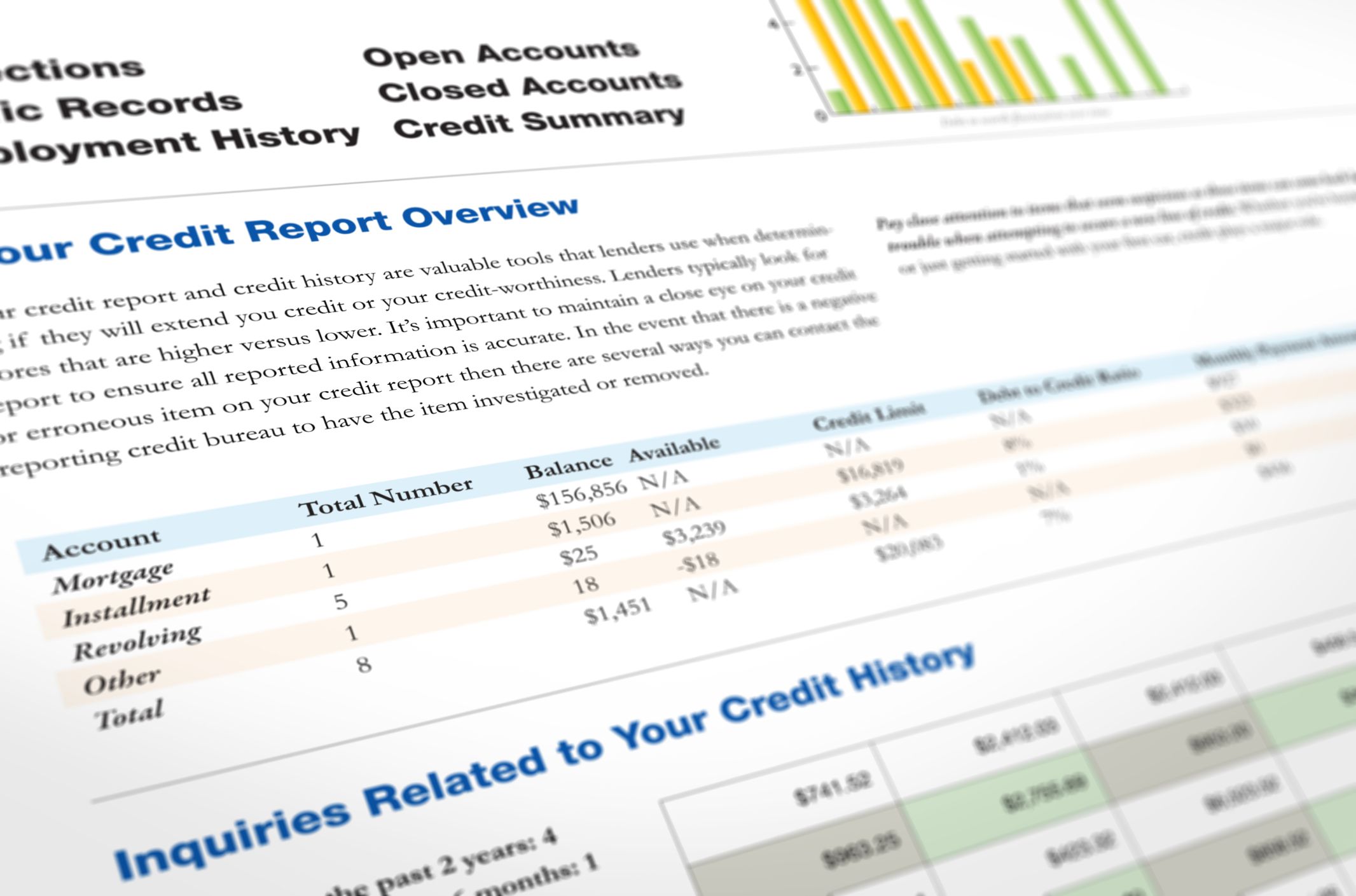

What Information Do Lenders See On Your Credit Report

Your credit report includes things like:

Full Credit Report Services

Remember

You can apply for your credit record as often as you like without harming your chances of getting credit.

You can get free 30-day trials of more comprehensive credit checking services from Experian and Equifax. These include your full credit report.

However, you normally have to give your credit or debit card details when you sign up to the free trial. Money will be taken from your account unless you cancel in time.

Correct An Inaccuracy On Your Equifax Credit Report

If you find any information that you believe is inaccurate, incomplete or a result of fraud, you have the right to file a dispute with Equifax Canada. You will need to complete the enclosed with your package. You can also review how to dispute information on your credit report for additional details on the Equifax dispute process.

Also Check: Does Paypal Credit Report To The Credit Bureaus 2019

What Is A Credit Score

A credit score is a number. It is based on your credit history. But it does not come with your free credit report unless you pay for it.

A high credit score means you have good credit. A low credit score means you have bad credit. Different companies have different scores. Low scores are around 300. High scores are around 700-850.

How A Credit Score Is Calculated

Its impossible to know exactly how much your credit score will change based on the actions you take. Credit bureaus and lenders dont share the actual formulas they use to calculate credit scores.

Factors that may affect your credit score include:

- how long youve had credit

- how long each credit has been in your report

- if you carry a balance on your credit cards

- if you regularly miss payments

- the amount of your outstanding debts

- being close to, at or above your credit limit

- the number of recent credit applications

- the type of credit youre using

- if your debts have been sent to a collection agency

- any record of insolvency or bankruptcy

Lenders set their own guidelines on the minimum credit score you need for them to lend you money.

If you have a good credit score, you may be able to negotiate lower interest rates. However, when you order your credit score, it may be different from the score produced for a lender. This is because a lender may give more weight to certain information when calculating your credit score.

Also Check: Is 524 A Bad Credit Score

How To Log A Dispute

The National Credit Act provides you with the right to dispute any factually incorrect information on your credit report generated by a credit bureau and to have this information corrected.

Logging a dispute with Experian is free of charge. Why pay one of the many credit clearing companies that charge money for doing something that you could do for free? Once you have logged a dispute with us, we have 20 business days to investigate the dispute. To find out more about logging a dispute at Experian, please visit our blog by clicking here.

In the event that you are not satisfied with the outcome of the dispute, you may refer the matter as follows:

Bank account information:

- National Credit Regulator 0860 627 627

Retail and other non-bank information:

How Do I Get Credit

Do you want to build your credit history? You will need to pay bills that are included in a credit report.

- Sometimes, utility companies put information into a credit report. Do you have utility bills in your name? That can help build credit.

- Many credit cards put information into credit reports.

- Sometimes, you can get a store credit card that can help build credit.

- A secured credit card also can help you build your credit.

Don’t Miss: 611 Credit Score

How Your Credit Score Is Calculated

Your credit score is calculated based on what’s in your credit report. For example:

- the amount of money youve borrowed

- the number of credit applications youve made

- whether you pay on time

Depending on the credit reporting agency, your score will be between zero and either 1,000 or 1,200.

A higher score means the lender will consider you less risky. This could mean getting a better deal and saving money.

A lower score will affect your ability to get a loan or credit. See how to improve your credit score.

What Is A Credit Bureau

A credit bureau, also known as a consumer reporting agency, collects and stores individual credit information and provides it to creditors so they can make decisions on granting loans and other credit activities. Typical clients include banks, mortgage lenders, and credit card issuers. The three largest credit bureaus in the U.S. are Equifax®, Experian®, and TransUnion®.

Also Check: Open Sky Unsecured

Errors On Your Credit Report

If you find errors on your credit report, write a letter disputing the error and include any supporting documentation. Then, send it to:

Find a sample dispute letter and get detailed instructions on how to report errors.

The credit reporting agency and the information provider are liable for correcting your credit report. This includes any inaccuracies or incomplete information. The responsibility to fix any errors falls under the Fair Credit Reporting Act.

If your written dispute does not get the error fixed, you can file a complaint with the Consumer Financial Protection Bureau .

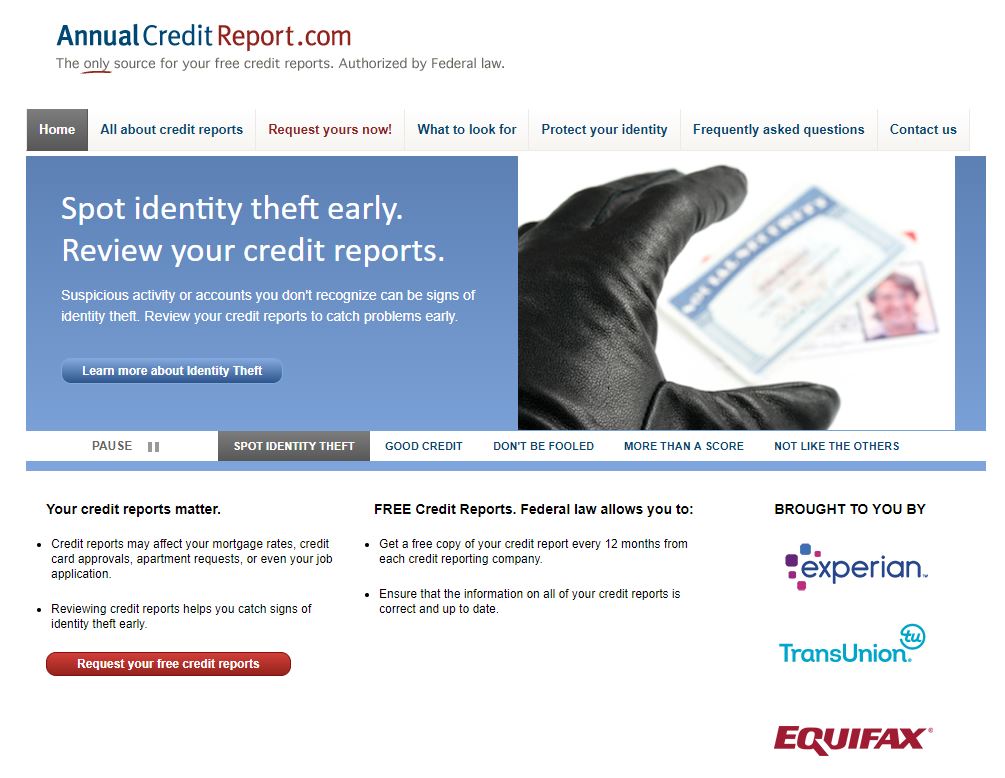

Where Do I Get My Free Credit Report

You can get your free credit report from Annual Credit Report. That is the only free place to get your report. You can get it online: AnnualCreditReport.com, or by phone: 1-877-322-8228.

You get one free report from each credit reporting company every year. That means you get three reports each year.

Don’t Miss: What Is Syncb Ntwk On Credit Report

Full Lowdown On What Mse Credit Club Offers:

- Our Credit Hit Rate. This shows your chances of success, as a percentage, of grabbing our top cards and loans.

- Eligibility tool. It reveals the likelihood of you getting top credit cards or loans .

- Your credit profile explained. It shows the key factors affecting your score and how to improve them.

Or alternatively…

Experian’s CreditExpert free 30-day trial*. CreditExpert offers new customers a “free 30-day trial, then £14.99 a month” service. It’s different from MSE’s Credit Club in that it gives you real-time access to your credit report . It also offers an eligibility checker. You can only do the free-trial once. To cancel your subscription, log into your account and go to ‘My Subscriptions’.

Experian’s Credit Score free subscription to your score. If you don’t want to pay a subscription to see your credit report, you can sign up for free to see your Experian Credit Score. You won’t have to pay anything, but the information is limited to seeing your credit score, as opposed to credit report. The score updates every 30 days.

My Free Report And Score Frequently Asked Questions

How do I get my free credit report?

Experian offers South African consumers free unlimited access to their My Credit Check and My Credit Expert credit reports and credit scores.

- Visit www.mycreditcheck.co.za for your Experian Sigma credit report.

- Visit www.mycreditexpert.co.za for your Experian credit report.

What is Experian Sigma?

The My Credit Check portal references data from the Experian Sigma database, which is the historical Compuscan bureau database. Your My Credit Check credit report and credit score are generated from the Experian Sigma database.

Can anyone view my free credit report?

Your credit report cant be viewed by just anyone! The information contained in your credit report is confidential, and companies and individuals who wish to view your report may only do so for a prescribed purpose. The National Credit Regulator has set out specific guidelines in accordance with the National Credit Act that deal with prescribed purposes. Experian prides itself on protecting your privacy and we always comply by the rules and regulations provided by the NCR.

Is my free credit report stopping me from getting a job?

Do I need to check my free credit report if I pay all my debt on time?

Yes. It is important that you check your credit report regularly to ensure that the information is being reported to the credit bureau correctly. Also remember to use your credit report to detect any fraudulent activity against your record.

You May Like: Les Schwab Credit Score Requirement

What Are The Top Ways To Rebuild Your Credit Score Quickly

A low score is a result of poor credit management, or life events such as divorce or serious illness. Your credit history reflects that you are missing or have missed payments and/or you have too much debt. These two occurrences will make it very hard to earn a high score because they drive about 65% of the points in your credit scores.

The only way to rebuild your credit scores is to address why they are low in the first place. Sounds obvious but youd be surprised how many people take a shot in the dark approach at rebuilding their credit scores. Or, they are guided by misinformation and/or unscrupulous individuals that promise a better credit score in exchange for a fee. Formulating a plan to rebuild your credit scores is not difficult. Heres how to do it:

How Does A Bankruptcy Impact My Fico Score

A bankruptcy is considered a very negative event by FICO® Scores. As long as the bankruptcy is listed on your credit report, it will be factored into your scores. How much of an impact it will have on your score will depend on your entire credit profile. As the bankruptcy item ages, its impact on a FICO® Score gradually decreases. Typically, here is how long you can expect bankruptcies to remain on your credit reports :

- Chapter 11 and 7 bankruptcies up to 10 years.

- Completed Chapter 13 bankruptcies up to 7 years.

These dates and time periods refer to the public record item associated with filing for bankruptcy. All of the individual accounts included in the bankruptcy should be removed from your credit reports after 7 years.

Recommended Reading: Does Klarna Affect Your Credit Score

Where Can I Get My Credit Report

Your credit report is available in a few different places and formats. The federal FACT Act entitles you to one free copy of your credit report from each of the three major credit reporting agencies TransUnion, Equifax and Experian every 12 months. It also entitles you to additional free credit reports if you were recently denied credit, employment or insurance or if youre a victim of fraud, unemployed or on public welfare assistance.

As part of TransUnions commitment to supporting all Americans during and after the COVID-19 health crisis, were pleased to offer you free weekly credit reports through April 20th, 2022 at the same place you would go for your free annual reports: annualcreditreport.com.

Another way to access your credit report information is through a subscription based credit monitoring product such as TransUnion Credit Monitoring. and become a member to get instant online access to your credit report and score with updates available daily. Youll also get interactive tools, key information and alerts to help you understand and stay on top of critical credit report changes and protect your report with just a click.

What If I Find A Problem Or Mistake On My Credit Report

If you have no plans to apply for new credit, it’s a good idea to review your credit report from each bureau on an annual basis. Check to ensure that your identifying information is correct, and that the credit accounts listed in your report are accurately represented.

If you do plan to apply for a new loan or credit card, it’s vital that you check your credit reports beforehand in case there is anything that needs to be cleared up. Negative information in your credit reports can lower your credit scores, and you want your credit scores to be the best they can be before applying for new credit.

Under the Federal Credit Reporting Act, both the credit reporting bureau and the information provider are responsible for correcting any inaccurate or incomplete information in your reports. To get information corrected, you must initiate a dispute with the credit reporting agency. This typically involves submitting your dispute in writing. The credit reporting agency must investigate your dispute within 30 days of your submission.

Experian makes it easy to initiate a dispute online through our Dispute Center. You can also initiate a dispute at Experian by phone or mail see “How to Dispute Credit Report Information” for more details.

Recommended Reading: What Credit Report Does Paypal Pull

What Is A Credit Freeze Should I Freeze My Credit

A credit freeze also called a security freeze lets you restrict access to your credit report. It enables you to take control of your financial information by preventing the release of your credit score and detailed reports by credit reporting agencies.

A credit freeze means potential creditors will be unable to access your credit report, making it more difficult for an identity thief to open new lines of credit in your name. A credit freeze does not affect your credit score, and its free.

The three major U.S. credit bureaus Equifax, Experian, and TransUnion are a source of credit information for other companies. Mortgage lenders, credit card companies, car dealerships, and other agencies buy access to your credit history to decide if you are a good credit risk.

Lenders are unlikely to approve loans unless they know youre a good credit risk, and that requires them to review your credit reports. So, a credit freeze can help protect against, for example, an identity thief taking out a mortgage or other debt in your name.

What if youve been the victim of a data breach?

If your Social Security number has been exposed during a data breach, a credit freeze is considered a strong move to help keep anyone from opening new credit accounts in your name. Lenders and furnishers wont be able to access your credit file, and as a result would be unlikely to grant credit to anyone using your Social Security number.

It’s Easy To Be In Control

Sign up for MyCredit Guide at no charge to see your detailed TransUnion credit report, updated weekly upon log in, get alerts, and use the credit score simulator.

Already enrolled to MyCredit Guide? Log In Here

Articles about Credit

Here is how to check your credit score for free and get the most accurate picture of your credit.

Enroll with MyCredit Guide to get a free credit report that you can access at anytime or you can request a copy of your credit report 3 credit bureaus once a year.

Learn about credit score ranges from FICO and VantageScore, and how they classify Excellent, Good, or Poor credit score.

Tips to Improve Your Credit Score

The better your credit score, the better chance you may have to secure a mortgage for a house or get approved for that premium credit card. Watch this short video from American Express to learn how to improve your credit score.

Recommended Reading: Carmax Credit Score Requirements

How Do I Check My Credit Score

CIBC clients can check their credit score using the CIBC Free Credit Score Service in the CIBC Mobile Banking® App.

You can also contact one of Canada’s credit bureaus to receive a copy of your credit report by mail, free of charge. For a fee, you can view your credit report online.

For more information, contact one of the credit bureaus directly at:

- Equifax Canada: www.equifax.ca

How Does Applying For New Credit Impact My Fico Score

Applying for new credit only accounts for about 10% of a FICO® Score. Exactly how much applying for new credit affects your score depends on your overall credit profile and what else is already in your credit reports. For example, applying for new credit may have a greater impact on your FICO® Scores if you only have a few accounts or a short credit history. That said, there are definitely a few things to be aware of depending on the type of credit you are applying for. When you apply for credit, a credit check or inquiry can be requested to check your credit standing.

If you don’t see the answers to your questions:

Read Also: Syncb Amazon Credit Inquiry

Why Is Wells Fargo Displaying Your Fico Score

Wells Fargo is displaying your FICO® Score for educational purposes and as a benefit to support your awareness and understanding of FICO® Credit Scores and how they may influence the credit thats available to you. Wells Fargo does not calculate your FICO® Score we are displaying a score that is provided to us by the credit bureau indicated on your score display. Your FICO® Score is provided through Wells Fargo Online® at no additional cost beyond your standard internet/mobile carrier fees.