Missed Payments And Late Payments Are 2 Different Things

Find Out:

Although you shouldnt make a habit of it, you can pay your credit card bill after its due date without it affecting your credit, provided youre within the 30-day window. You can expect a late payment fee, but if its a one-time mistake, you can probably get that fee waived just by asking.

You Ask Bev Answers: How Long Do Late Payments Stay On My Credit Reports

Reading time: 3 minutes

In a time of great uncertainty, a voice of knowledge and reassurance can make all the difference. Beverly Anderson, President of Global Consumer Solutions at Equifax, answers your questions based on her years of experience in the consumer finance industry. You can post a question for Bev on Equifaxs Facebook page. Bev regrets that she cannot answer every question individually.

Question: I’ve recently made several late credit card payments due to a Covid-19 related job loss. How long do late payments stay on my credit reports?

Answer:Generally, a late payment on your credit card account will remain on your for up to seven years, even if you pay the past-due balance in full. The late payment will usually appear on your credit reports starting from the date of the missed payment.

If you have already missed a payment or been late making a payment, you might consider adding a consumer statement to your credit reports. A consumer statement is a brief explanation of your situation, in this case to clarify why you were late making your payment.

Heres an example of a consumer statement: Be advised that the negative accounts on my credit report are related to a temporary reduction in income due to the Covid-19 pandemic. I intend to make these up as soon as I can. Learn how to add a statement to your Equifax credit file here.

What If I See A Mistake On My Credit Report

You can dispute mistakes or outdated things on your credit report for free. Both the credit bureau and the business that supplied the information about you to a credit bureau are responsible for correcting inaccurate or incomplete information in your report. Make sure the information in your report is accurate, complete, and up to date before you apply for a loan for a major purchase like a house or car, buy insurance, or apply for a job.

Read Also: Can You Remove Hard Inquiries Off Your Credit Report

How Do Late Payments Affect Credit Scores

People have multiple credit scores, and everyoneâs situation is different. So itâs impossible to say exactly how a late payment will affect your credit. But payment history is an important scoring factor for two of the most popular scoring companies: FICO® and VantageScore®.

FICO says it uses three criteria to judge late payments: severity, frequency and recency. That means a few things when it comes to its credit scores:

- A payment reported 30 days late could have less impact than one reported 60 days late and so on.

- Being late multiple times, including across multiple accounts, could have a bigger impact than a single delinquency.

- A late payment that happened more recently could have a bigger effect than one from years ago.

How Can I Avoid Late Payments

Avoiding late payments can be easy if you set up a plan and have the resources to cover your expenses. One tactic you can use is set up automatic payments to pay the minimum amount due each month so you will never be late. You can always opt to pay an additional amount at any time.

Of course, not everyone likes having automatic payments taken out of their bank accounts. If thats not your style, you can simply open your favorite calendar app and set recurring reminders to pay each bill before the due date. Just dont forget to add a reminder each time you open a new account or when your payment date changes.

Another way to reduce the possibility of missing a payment is reducing the number of bills you pay each month.

Rather than juggle multiple credit card payments each month, you may want to explore whether a balance transfer credit card could help you consolidate high-interest credit card debt into a single card with a single bill. Alternatively, if a balance transfer credit card isnt the right choice for your situation, a personal loan may be an option to help lower your overall debts interest rate and consolidate your bills into a single payment. In the end, youll have fewer payments to keep track of each month and you may even reduce how long it will take to repay your debt.

Read Also: Does Zzounds Report To Credit Bureau

How Long Late Payments Stay On The Credit Report

Late payment may stay on your credit reports for up to 7 years and can affect your credit scores during the whole period it is there.

Late payments tend to have a big effect when they first appear, and you could work to build your credit while waiting for late payments to fall off your credit reports.

What To Expect After Sending A Goodwill Letter

There is no guarantee that a person can get the creditor to remove late student loan payments from their record. However, it’s a good idea to try.

The information has already been reported, so it may take time before the new loan information shows up on the report. Lenders must send back a letter stating if they are going to remove it from the loan and from the credit bureau agency.

Recommended Reading: Carmax Credit Requirements

Request A Goodwill Adjustment From The Original Creditor

The idea is simple, and it works surprisingly well.

Many times creditors are happy to grant goodwill adjustments if your previous payment history is relatively good and you have established a good relationship with the creditor.

This is probably the easiest and surest way to get a late payment removed from your credit report.

The process involves writing the creditor a letter explaining your situation and asking that they forgive the late payment and adjust your credit report accordingly.

The easiest way to get started is to use this goodwill/forgiveness letter template that I created. This method might not work if you have multiple late payments.

Positive And Negative Information On Your Credit Reports May Affect Your Credit Scores But There Are Time Limits To Keep In Mind

Ever heard the saying that knowledge is power? When it comes to your credit, that can absolutely be true. So letâs start by asking a few questions and gaining some knowledge. What exactly is a credit report? What kind of negative information can be on it? And how long does it stay?

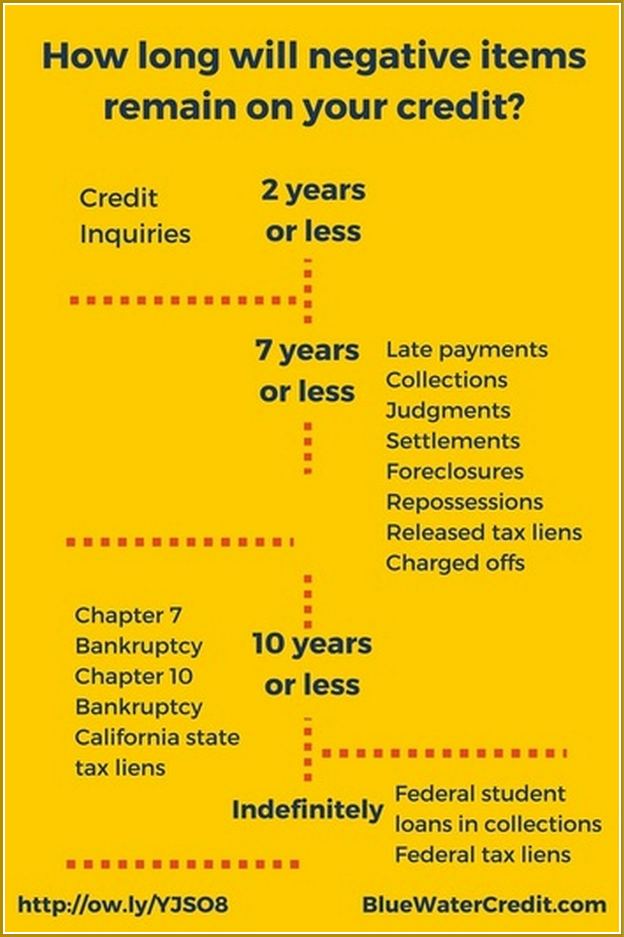

Essentially, you can think of a as a statement thatâs filled with information on your credit activitiesâthings like your history of making on-time payments. Your reports can also contain negative information that could impact your credit scores. And some negative information could stay on your reports for up to 10 years. Read on to learn more.

Also Check: How To Get Credit Report Without Social Security Number

What To Do For Minimizing The Impact Of A Late Payment

First things first: If your bills are past due, the sooner you could pay them off, the good. The damaging impacts of a late payment on your credit scores can increase if you allow the delinquency drag on.But say you need to go a step more and try to eliminate a late payment from your credit reports. There are many ways you can try to go about this, and they differ depending on the specific condition.

Write a goodwill letter. There is no guarantee itll work, but you could try writing a goodwill letter that explains your history with the lender, your condition as well as the fact that you take responsibility for the error. In most cases, this can be sufficient but do not count on it. You can have good luck with this method if you have an otherwise stellar history of making payments on time.Negotiate. Another potential way for removing a late payment is negotiating with your lender. Your lender can eliminate the negative mark if you agree to a partial settlement and to pay off the debt in full. If you reach an agreement, ensure to get it in writing.

First I Contacted The Creditor

I logged into my Amazon store credit card account I started a chat with customer service. I know I couldnt actually admit to forgetting to update my linked bank account. So, I told the agent that a late payment was reported to my credit report, and I did not think it was right.

Maybe not the most moral thing Ive ever done, but I needed to see what would happen. I was told that they would have their department look into it and get back to me with their decision.

Read Also: Does Paypal Credit Affect My Credit Score

How To Avoid Late Credit Card Payments

You likely have a busy life, and sometimes, it can be easy to forget a payment. One solution is to set up an automatic payment from your checking account to be sure you make your credit card payments on time. You can also check with your issuer to see if you can set up text and/or email alerts to remind you when your bill is due. For example, with Discover you can login to your account and navigate to the Manage Alerts page to view your options and set up the alerts that best serve you.

How To Remove Late Payments From Your Credit Reports

that reporting of an account which has been included in a chapter 13 bankruptcy as past due or late is a per se violation of the automatic stay, because reporting late payments or past due balances is classic collection activity under § 362 .

Rental Kharma will add up to six months of past rent payments to your credit report. The registration fee is $50 per person and the monthly charge is $8.95 as of March 2020. Your entire rental history can be added for a fee of $30 or $60, depending on how long youve been at your current address.

The Experian Credit Score can give you an idea of how companies see you. Its based on information in your credit report, and is the UKs most trusted score*. If youve been late with payments, check your Experian Credit Score to understand how your ability to get credit may have been affected.

There are late payments, collection accounts, judgments or bankruptcies on your credit history. The name and address on your credit report donât match the name and address youâve provided on your mortgage application. There are discrepancies between the employment history you report to the mortgage lender and whatâs listed on your credit reports.

Every situation is different, but negative factors like late credit card payments might show up on your credit report for years. And while the exact impact of late payments is hard to predict, payment history is a factor used to determine your credit score.

You May Like: Does Speedy Cash Report To Credit Bureaus

Offer To Sign Up For Automatic Payments

In some instances, a creditor may agree to delete a late payment if you agree to sign up for automatic payments.

This plan works well if youve had trouble making payments in the past but arent significantly delinquent on your account. Youll have better luck negotiating this deal if you can show that youre financially able to make your payments.

It also helps if youve overcome whatever financial hurdle held you back from making payments in the past. Like requesting a goodwill adjustment, this is also ideal for longer-term customers.

Will A Late Payment Affect Your Credit Score

Is a tight budget making it hard for you to pay bills on time? Many people have experienced financial difficulties since the pandemic and sometimes ends just dont meet.

What will happen if you dont make a payment by your due date? Will one late payment affect your credit score? Also, what can you do to fix it? Here are some answers that can help you understand and possibly even improve your score.

Don’t Miss: Does Klarna Report To Credit Bureaus

How Do I Know Whats In My Credit Report

Each of the national credit bureaus Equifax, Experian, and TransUnion is required to give you a free copy of your credit report once every 12 months if you ask for it at AnnualCreditReport.com, or by calling 1-877-322-8228. Otherwise, a credit bureau may charge you a reasonable amount for another copy of your report within a 12-month period.

Consider getting your reports at least once a year. You can get your free reports from each of the credit bureaus at once, or you can spread them out throughout the year. Some financial advisors say staggering your requests during a 12-month period may be a good way to keep an eye on whether the information in your reports is accurate and complete. But since each credit bureau gets its information from different sources, the information in one credit bureaus report may not be completely the same as information in your reports from the other two credit bureaus.

Through the pandemic, everyone in the U.S. can get a free credit report each week from all three national credit bureaus at AnnualCreditReport.com. Also, everyone in the U.S. can get six free credit reports per year through 2026 by visiting the Equifax website or by calling 1-866-349-5191. Thats in addition to the one free Equifax report you can get at AnnualCreditReport.com.

Youre also entitled to another free report each year if

Hard Inquiry: Two Years

A hard inquiry, also known as a hard pull, is not necessarily negative information. However, a request that includes your full credit report does deduct a few points from your . Too many hard inquiries can add up. Fortunately, they only remain on your credit report for two years following the inquiry date.

Limit the damage: Bunch up hard inquiries, such as mortgage and car loan applications, in a two-week period so they count as one inquiry.

Recommended Reading: Does Paypal Working Capital Report To Credit Bureaus

How Do I Know If Im Dealing With A Credit Repair Scam

Heres how to know if youre dealing with a scammy credit repair scam company:

- Scammers insist you pay them before they help you.

- Scammers tell you not to contact the credit bureaus directly.

- Scammers tell you to dispute information in your credit report you know is accurate.

- Scammers tell you to lie on your applications for credit or a loan.

- Scammers dont explain your legal rights when they tell you what they can do for you.

These are not just bad ideas, theyre also scams and theyll hurt your credit if you buy into the scam. If a company promises to create a new credit identity or hide your bad credit history or bankruptcy, thats also a scam. These companies often use stolen Social Security numbers, or they get people to apply for Employer Identifications Numbers from the IRS under false pretenses. They do that to create new credit reports. If you use a number other than your own to apply for credit, you wont get it. And you could face fines or prison.

Improve Your Business Credit Score

Once youve strengthened your personal credit score, you can focus on building your business credit score. To improve your business credit score, you can:

- Make sure all business information is relevant and up-to-date. For example, provide new details to Companies House should your address change.

- should your address change.

- Avoid submitting multiple applications that perform hard credit checks. Soft credit checks should be okay as they wont impact your business credit score.

Remember, your credit history goes back for six years, so information older than seven years wont remain on your report. While the above steps wont change your credit score overnight, they will signal to lenders that youre a legitimate business and decrease associated risks.

Read Also: What Is Aargon Agency

Why A Goodwill Letter May Not Work

Weve heard from some readers who have said their credit card issuers say its illegal for them to remove late payments, or provide other similar reasons.

Its not illegal for a creditor or lender to change any information on your credit reports including late payment history. Credit reporting is a voluntary process. Theres no law that requires a lender or creditor to furnish data to credit bureaus. Theres also no law that requires the credit bureaus to accept the data a lender/creditor provides and include it on your credit reports.

Companies like lenders, creditors, and collection agencies must apply to be data furnishers with the credit bureaus. The application must be approved before a company can have information about their customers included on a credit report. When a company is approved to furnish data to the credit bureaus, the company has to sign agreements with Equifax, TransUnion, and Experian. The agreements say what a data furnisher is and isnt allowed to do when it comes to credit reporting.

Often, the credit bureaus will include language in their agreements which says a data furnisher agrees not to change accurate, negative account information. This is commonly the case for debt collectors, for example, who must agree not to delete a paid but accurate collection account simply because theyve received payment from a consumer.

Have A Professional Remove The Late Payments

We understand that credit repair can be overwhelming.

If youd rather have a professional credit repair company help, I suggest you check out Lexington Law.

will typically charge a monthly subscription fee while you work with them but theyre also easy to cancel and theres no long-term commitment.

For someone with items that can be challenged, most times, progress can typically be made in 45 or 90 days.

Also Check: Why Is There Aargon Agency On My Credit Report