How Resolve Can Help

If youre dealing with debt and not sure what to do, were here to help. Become a Resolve member and well contact your creditors to get you the best offers for your financial situation. Our debt experts will answer your questions and guide you along the way. And our platform offers powerful budgeting tools, credit score insights and more.Join today.

Submit A Dispute To The Credit Bureau

The Fair Credit Reporting Act is a Federal law that defines the type of information that can be listed on your credit report and for how long . The FCRA says that you have the right to an accurate credit report and because of that provision, you can dispute errors with the credit bureau.

are easiest when made online or via mail. To make a dispute online, you must have recently ordered a copy of your credit report. You can submit a dispute with the credit bureau who provided the credit report.

To dispute via mail, write a letter describing the credit report and submit copies of any proof you have. The credit bureau investigates your dispute with the business that provided the information and removes the entry if they find that is indeed an error.

Get All Three Of Your Credit Reports

Your three credit reports from consumer reporting agencies Equifax, Experian and TransUnion are not identical.

The old debt in question might be listed in some credit reports but not others. To find out, get a copy of all three of your reports. Federal law entitles you to request a free copy of each report once every 12 months. You can download them for free at AnnualCreditReport.com.

Once you find out which bureaus are listing the debt, contact them. Your credit report will include contact information and dispute instructions. Equifax, Experian and TransUnion will give consumers free weekly credit reports until April 20, 2022.

Why this is important: If youre only looking at the copy of your credit report from one credit bureau, you may be missing inaccurate information that is on another report.

Who this affects most: Mistakes with credit reports can happen to anyone with old debt on any of your credit reports.

Don’t Miss: How Can I Check My Credit Score With Itin Number

How To Dispute A Charge

To dispute an error on your credit report, you should contact each credit reporting agency directly. All three major bureaus allow you to initiate a dispute online . You can also download the appropriate dispute form and mail it in.

Once the credit bureau receives your dispute, it is usually required to investigate within 30 days, then provide you with a response within five days of the investigation.

Can Debt Collectors Remove Negative Information From My Reports

Unfortunately, negative information that is accurate cannot be removed and will generally remain on your credit reports for around seven years. Lenders use your credit reports to scrutinize your past debt payment behavior and make informed decisions about whether to extend you credit and under what terms. Therefore, it’s just as important for them to see your negative credit history as your positive history.

If you discover, however, that negative information is still on your credit reports after seven years and you have paid off the amount as agreed, you should immediately file a dispute.

You can dispute the negative information sooner if it appears on your credit reports multiple times. You can also dispute the information if it’s a result of fraud or identity theft. It’s important to report the fraud or identity theft immediately to the three nationwide credit bureaus so that you can get your financial life back on track.

Be warned that there are many companies that claim they can have negative information removed from your credit reports for a fee. However, neither you nor a third party can get negative but accurate information removed.

You May Like: What Bank Is Syncb Ppc

When Do Lenders Report Accounts As Delinquent

When you have a delinquent account, your lender or credit card issuer might:

- Day 1: Charge you a late fee.

- Day 30: Report your account as late to the three major credit bureaus and charge you another late fee if you miss a second payment.

- Day 60: Start charging you a higher penalty APR on future purchases , charge you more late fees if you miss additional payments, and report you as 60-days late to the credit bureaus.

- Day 90: Close your account, assess another late fee, and report you as 90-days late to the credit bureaus.

- Day 120-180: Charge-off the account, sell or assign the account to a collection agency, charge additional late fees, and report you as 120 or 180-days late to the credit bureaus.

The actions above are examples of what could happen when you dont pay a credit card or loan as agreed. But your lender or credit card issuer might follow a different timeline when you have a delinquent account.

For example, some student loan lenders wont report late payments to the credit bureaus until your account is a full 90-days past-due. Meanwhile, some creditors might opt to sell your delinquent account to a collection agency sooner. Others might not work with collection agencies at all.

You cant control how or when a creditor will respond when you fall behind on payments. But if you can keep your bills on time and avoid delinquent accounts, you shouldnt have to worry about any of these negative side effects.

Wait For The Settled Account To Drop Off

Say you looked into the account and cant find any inaccuracies.

Or youve sent a goodwill letter trying to find common ground but the lender wont budge.

We hate to tell you, but if youve tried both of these approaches and the account wont be removed from your account, you will have towait it out.

7 years may seem like a long time, but its not forever.

In at most 7 years from the first date of your missed payment or the date you paid the account in full, it will drop from your report.

If the settled account isnt affecting your score in any way, it may just be best to wait it out instead of going back and forth with credit bureaus and the lender.

Don’t Miss: How Many Years Does An Eviction Stay On Your Record

What Happens After 7 Years Of Not Paying Debt

Unpaid credit card debt will drop off an individual’s credit report after 7 years, meaning late payments associated with the unpaid debt will no longer affect the person’s credit score. … After that, a creditor can still sue, but the case will be thrown out if you indicate that the debt is time-barred.

How Do Settled Accounts Affect My Credit Score And History

If you settle an account for anything less than the full amount owed to the borrower, then there will be negative impacts on your .

This is because you did not pay back what was taken and are most likely breaking a contract you signed stating you would pay the amount back in full within a certain amount of time.

If you close an account like a can also be negatively affected.

Your credit score is based on available credit, payment history, and the age of your accounts.

Since you are taking away an account that effects your available credit, this limit will be lowered, causing a drop in your credit score.

When it comes to loans that you have paid in full with no late payments, these will still appear and affect your credit history.

A history of your payments will remain on your credit report for 7 years for reference.

This will not lower or heighten your credit score.

Don’t Miss: Aargon Com

Dispute By Mail Or Phone

Its fast, free and easy to manage a dispute online, but if youd prefer to dispute by mail or phone youll find instructions below.

To complete a dispute by mail, provide as much of the following information as possible:

- Personal Information: Name, DOB, Address, SSN

- Name of company that reported the item youre disputing and the partial account number

- Reason for your dispute

- Any corrections to your personal information

Send your documents to:

Please note: We accept either standard or certified mail.

How To Dispute Credit Report Errors

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandheres how we make money.

Errors on your credit reports can cause your credit scores to be lower than they should be, which can affect your chances of getting a loan or credit card and how much interest you pay. Disputing credit report errors and getting those negative items removed can be a quick route to a better score.

Heres how to dispute credit report errors and have them removed in four steps.

Read Also: Does Having More Credit Cards Help Your Credit Score

Also Check: Is Mrs Bpo Legit

How Long Do Collection Accounts Stay On Your Report

Paid or unpaid collection accounts can legally stay on your credit reports for up to seven years after the original account first became delinquent. Once the collection account reaches the seven-year mark, the credit reporting companies should automatically delete it from your credit reports.

If your collection account doesnt fall off of your credit report after seven years, you can file a dispute with each credit bureau that lists it on your report.

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

At Bankrate we strive to help you make smarter financial decisions. While we adhere to stricteditorial integrity, this post may contain references to products from our partners. Heres an explanation forhow we make money.

Recommended Reading: Unlock Experian Account

Derogatory Mark: Missed Payments

If you are at least 30 days late, expect a derogatory mark on your credit report. Missed payments typically stay on your credit reports for 7½ years from the date the account was first reported late. The later the payment goes moving to 60 days late, 90 days late and so on the greater the damage to your credit scores.

What to do: Pay your bill as soon as you can afford to. If youve never or rarely been late before, you might be able to get the creditor to drop the late fee. Call the customer service number, explain your oversight and ask if the fee can be removed. You can also write a goodwill letter. If paying the bill is not an option, call your creditor and let them know about your financial situation to see if you can work out a hardship plan.

The negative effect on your credit scores will fade over time. Try to stay on top of all your payments so positive information in your credit reports dilutes the effect of the missed payment.

Can You Remove Negative Information From Your Credit Reports

Reading time: 2 minutes

Your credit reports are like a financial report card an extremely useful record that helps lenders evaluate the risk involved in loaning money to you.

They contain information about your credit history including some bill repayment activity and the status of your credit accounts. This information includes how often you make your credit card or loan payments on time, how much total available credit you have, how much of that credit you’re currently using and whether you have outstanding debt.

If you’re delinquent on your loan payments, your debt may be transferred or sold to a collection agency. At that point, a new lender will be added to your credit reports, meaning your debt will appear twice: once with the original lender and again with the collection agency. You will have a set period of time to pay off the debt with the collection agency. The debt will stay on your credit report for as long as it remains unpaid and can only be removed approximately seven years from when you were first found delinquent.

Also Check: What Credit Score Needed For Chase Sapphire Preferred

Dispute With The Business That Reported To The Credit Bureau

Now, you can completely bypass the credit bureau and dispute directly with the business that reported the error to the credit bureau, e.g., the credit card issuer, bank, or debt collector. You can make the dispute in writing, and the business is required to do an investigation just like the credit bureau.

When the business determines that theres indeed an error on your credit report, they must notify all the credit bureaus of that error so your credit reports can be corrected.

Can A Creditor Remove A Delinquency

If you dispute the incorrect late payment with your creditor, they typically have 30 days to investigate. If the creditor stands by the reported late payment, it won’t remove or update the information. But if it agrees that the information is incorrect, the creditor has to tell the credit bureau to update or remove it.

You May Like: How Long Does Repo Stay On Credit Report

Review The Claim Results

Reporting agencies and lenders usually take around 30 days to investigate disputes. Once they make a decision, they must notify you within five days of completing their review. The notice will inform you if the disputed item was found to be inaccurate or not.

If the disputed information was, in fact, inaccurate, the bureau must update or delete the item. They should include a free copy of your file if the dispute results in a change.

If the bureau or lender considers the disputed information isn’t a mistake, you can file an additional claim. Review your initial claim for any errors and correct those. If possible, you should include additional documents to support your request as this can help the bureau evaluate any data it might have missed the first time around.

What Is Credit Card Delinquency

When using a credit card, you must pay a certain fraction of your balance each month to stay current on your account. By giving you a line of credit, the credit card issuer is basically providing you with a loan that you must pay down little by little each month. By failing to make required monthly minimum payments, you, as the cardholder, are breaking the terms of your agreement with the lender, and the account becomes delinquent.

Delinquency is divided into levels, which are indicative of how many payments the cardholder has missed. These levels are often referred to in terms of days. For example, the day after you miss your first payment, you are one day delinquent. After you miss your second payment, you are 30 days delinquent, and so on.

Technically, a consumer becomes delinquent after missing a single monthly payment. However, delinquency is not generally reported to the major until two consecutive payments have been missed. Consumers are thus provided a buffer zone and are allowed one misstep without suffering significant repercussions.

How Credit Card Delinquency Works

Don’t Miss: Lowes 0 Financing For 18 Months

Send A Pay For Delete Offer To Your Creditor

You have to approach accurately reported negative information differently. Credit bureaus wont remove accurate, verifiable information even if you dispute it , so you may have to negotiate to have some items removed from your credit report.

Pay for delete offer is a technique you can use with delinquent, or past due, accounts. In pay for delete negotiation, you offer to pay the account in full in exchange for having the negative details removed from your credit report. Some creditors will take you up on the offer.

Fixing Credit Report Errors

To ensure mistakes are corrected as quickly as possible, contact both the credit bureau and organization that provided the information to the bureau. Both these parties are responsible for correcting inaccurate or incomplete information in your report under the Fair Credit Reporting Act.

Keep in mind that all three of the credit bureaus now accept the filing of disputes online, with Experian now only accepting online submissions.

Find out how to initiate a dispute online.

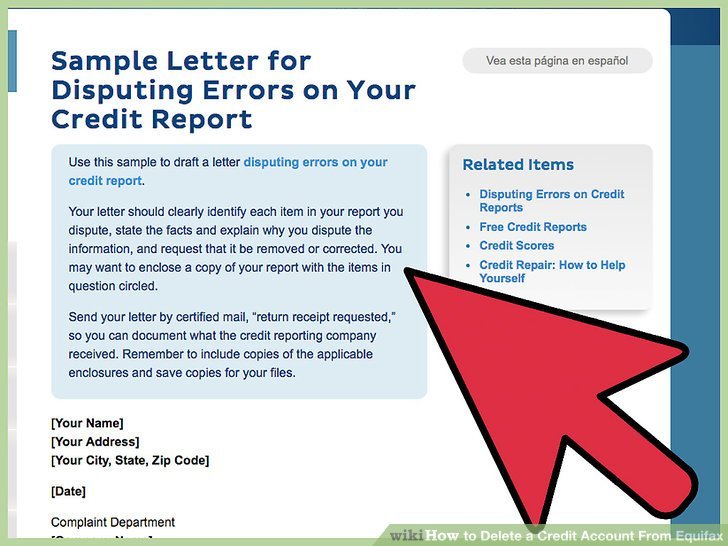

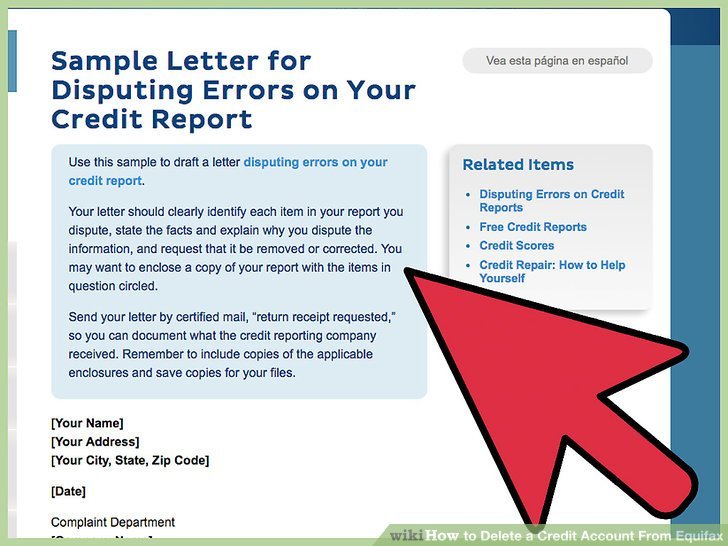

Begin by telling the credit bureau what information you believe is inaccurate. Credit bureaus must investigate the item in question-usually within 30 days-unless they consider your dispute frivolous. Include copies of documents that support your position. In addition to providing your complete name and address, your communication should:

- Clearly identify each disputed item in your report.

- State the facts and explain why you dispute the information.

- Request deletion or correction.

You may also want to enclose a copy of your report with the items in question circled. Your communication may look something like this sample.

If mailing a letter, send it by certified mail, return receipt requested, so you can document that the credit bureau did, in fact, receive your correspondence. Also, keep copies of your dispute letter and enclosures. If you want help disputing mistakes on your credit report, myFICO can help you write a free letter in minutes.

Don’t Miss: Credit Score Needed For Affirm

Get Free Credit Reports

Visit annualcreditreport.com to order or download a free credit report from each of the three major credit bureaus.

These reports wont show your credit score, but you can check them for inaccuracies and new credit applications you didnt make all of which affect your credit score.

Federal law gives you the right to one free credit report from each credit bureau each year.

Temporarily, because of the Covid-19 pandemic, you can get one free credit report from each bureau once a week.

This provision is scheduled to expire in April of 2021. After that, youll have access to a free credit report only once a year.