Self Visa Credit Card Review

TJ Porter has over seven years of experience as a personal finance writer covering investing, stocks, ETFs, banking, credit, and more. He has written for a wide variety of personal finance websites during his career.

The Self Visa Credit Card is a unique take on secured credit cards. It is secured by the balance youve built in one of Selfs credit builder loans, giving you the opportunity to access some of the money youve saved and offering another opportunity to build credit.

In this review of the Self Visa Credit Card, well cover everything you need to know about the card and whether its right for you.

Can I Use My Redcard Anywhere

Your Target RedCard can be used for purchases only at Target stores in the U.S. and at Target.com. As a store credit card, its designed to help you save money on all Target purchases, whether in-store or online. So if you prefer to shop at Walmart or another big-box store, another rewards card would be a better option.

Can You Use Your Ein To Get A Loan

Is it possible to get a loan through just my business ei? In some cases, the lender may not consider your credit score, but only your EIN as an indicator of eligibility. Due to the variety of factors that must be considered, you are not required to have your EIN in order to qualify for a small business loan.

Itin Loans Available To Those Without Ssns

Individuals who do not have social security numbers are assigned an Individual Tax Identification Number to track them. The number, which can also be referred to as an Individual Tax Identification Number , is used to identify individuals. Individuals who do not have U.S. social security numbers can obtain ITIN loans. If a borrower has an ITIN card, he or she can qualify for a mortgage as long as the eligibility requirements are met. People who do not have social security numbers and are in good standing can apply for ITIN loans.

Don’t Miss: How To Get Paid Items Removed From Credit Report

How The Target Redcard Debit Card Stacks Up

The Target RedCard Debit Card is a tough act to follow. Its one of the best retail debit cards around, in fact.

But its not perfect, so its worth comparing against other popular retail payment cards. Heres how the RedCard Debit Card stacks up against another big-name option: the Amazon Prime Rewards Visa Credit Card.

| Target RedCard Debit Card |

| Yes |

Better Cards To Use At Target

Getting a percentage off of your purchase is a big draw toward the Target REDcard, especially for consumers that spend a lot of their budget there. But if your shopping trips often take you to other stores, you wont be able to use your card all day long. You can get just as much savings with a traditional cash back credit card and the use of the latest Target coupons to cover most purchasing needs.

Cardholders report multiple issues with customer service, ranging from locked up cards to delays in processing payments. Many issues seem centered around the online portal for accessing and scheduling payments.

Read Also: Does Running Your Credit Lower Your Score

Your Credit Limit Grows Over Time

You can choose whatever credit limit youd like for the card as long as the limit is at least $100 and less than your credit builder loans savings progress.

That means that each payment you make toward your credit builder loan can increase your credit limit. As your credit score improves, Self may also offer to increase your credit limit.

How To Prevent Late Charges

Paying on time or making the minimum payment each month will prevent the $27 late fee from piling up. Another strategy is to set up alerts or reminders to pay your credit card bills on time. Here are some pointers to assist you to avoid paying expensive late fees.

- Make payments automatically.

- Make use of digital statements.

- Dont just pay the minimum.

- Use a calculator for credit cards.

- Always look at the deadline.

Read Also: What Is Erc On My Credit Report

How To Make Your Costco Credit Card Payment

Online or by phoning customer care at 378-6467 are the two simplest methods for making a Costco Credit Card payment. As an alternative, you can pay by mail or using the mobile app. You can select whatever is most convenient from a variety of possibilities.

To assist you in making that decision, we will go through each payment method in further detail below. Heres how to use your Costco credit card to make a payment:

What’s Your Easiest Way To Find Any Inaccurate Items: Diy Or W/help From Credit Glory

Handling the dispute process on your own is tedious and time-consuming. An easier way? Let Credit Glory â a dispute expert â handle the whole process .

Choosing Credit Glory for help with your dispute provides:

- A tested dispute process – Credit Glory uses a refined dispute process, with success removing negative items.

- Unmatched 100% Money-Back Guarantee – Qualify for a full refund if Credit Glory can’t remove inaccurate negative items in 90-days.

- Best-in-class customer support – Disputes are generally complicated and involve waiting. Credit Glory beats DIY by a mile providing access to comprehensive customer support.

Don’t Miss: Can Medical Bills Go On Credit Report

What Credit Score Do I Need To Get A Target Redcard

Credit eligibility for the Target RedCard varies, as the company weighs income, outstanding debt, and credit history when deciding whether to approve an application. Many cardholders report having fair credit score at the time of approval. According to a Target customer representative, Target doesnt use just one credit agency to evaluate creditworthiness. They choose which agency to request reports from at random, with Equifax coming up most often.

Can You Prequalify For A Macy’s Card

You cannot qualify for a Macy’s Store card pre-approval. You can, however, get approved within minutes if you apply online or at a Macy’s store. Keep in mind, though, that applying for a credit card will most likely result in a hard inquiry on your credit, lowering your score for a short period of time…. continue reading

Don’t Miss: How To Boost My Credit Score 100 Points Fast

How Do You Apply For A Target Mastercard

You can apply for the Target Credit Card online, by phone at 659-2396, by mail, or in person at a local Target store. When you apply online, you may be approved instantly, or your application may require additional review.

What credit score do you need to open a Target card?

Youll need to have at least fair or average credit a credit score over 580 to qualify for the Target RedCard. Since its a closed-loop store card , it may be easier to qualify for than a typical credit card.

Can I get a Target credit card with a 600 credit score?

Qualify with even fair credit You only need fair credit to qualify for the Target RedCard, which means its possible to get approved with a credit score of just 620. You can see if youre in the ballpark by checking your credit score for free on WalletHub.

What Is The Credit Limit On A Target Redcard

Your Target Credit Card credit limit will be determined based on your overall creditworthiness, including income and credit score. Initial credit limits tend to be in the vicinity of $500, but they will vary according to each approved applicant’s creditworthiness and overall financial situation…. view details

Recommended Reading: What Is The Role Of Credit Rating Agencies

Disadvantages Of The Target Redcard Debit Card

No debit card is perfect, and the Target RedCard debit card is no exception. The biggest drawback, aside from key exceptions to the 5% discount rule, is the fact that this card only works at target. In effect, its a store debit card.

- Important Exceptions to the 5% Discount Rule. The 5% RedCard discount isnt quite universal. Notable exceptions include restaurants inside Target stores, prescriptions and clinic services at Target pharmacies, Target gift cards and prepaid cards, and gift wrap.

- Doesnt Work Outside Target. The Target RedCard Debit Card isnt part of a payment processing network such as Visa or Mastercard, so its only eligible for use at Target stores and at Target.com. This is a major drawback for applicants hoping to replace their bank-issued debit card entirely.

- No Way to Carry a Balance from Month to Month. While its best to pay off credit card balances in full by your statement due date, carrying a balance is sometimes unavoidable or even advisable. You cant do that with this debit card. If you qualify, the Target RedCard Credit Card does allow carried balances.

- Doesnt Build Credit. On the bright side, you dont need to submit to a credit check when you apply for this card. On the other hand, this card wont build your credit or improve your credit score.

Target Redcard Mistake #: Using Your Card For All Target Purchases

Although the Target 5% discount applies to nearly all purchases, there are a few exceptions. Prescription copayments and clinic services are excluded, as are eye exams at Target Optical. Since you wont get a discount, youre better off paying for these purchases with a credit card that earns rewards. An HSA or FSA can also provide benefits for these health-related purchases.

Another noteworthy exclusion is the purchase of Target gift cards. If you need to buy a gift card for someone else, you may as well purchase it with a different credit card in order to earn a few rewards.

For the most part, you can expect the discount any time youre buying merchandise from Target shelves. However, youll want to read the full list of exclusions before you whip out your RedCard for every purchase.

Don’t Miss: How To Remove Santander From Credit Report

What Credit Score Is Required To Get A Macy’s Card

Suggested credit score Most applicants who are approved for a Macy’s Credit Card have a FICO® Score of 600 or higher. If you’re aiming for the Macy’s American Express® Card, you’ll likely need a score of at least 670, and a score of 700 or higher will give you much better odds…. see more

The Target Credit Card sends information about cardholder activity to all three major credit bureaus, TransUnion, Experian, and Equifax…. view details

Target Rewards: Save 5% All The Time

One of the most valuable benefits of both Target cards is the 5% discount you get every time you use the card at Target.

This discount isnt limited to certain types of purchases or spending and is automatically applied at checkout.

You also dont have to save up points or cash back. And, you don’t have to remember to redeem the rewards.

Of the rewards programs offered with credit cards, this is one of the easiest and most convenient, requiring you to do nothing except use your card whenever youre at Target.

You May Like: When Will Chapter 7 Bankruptcy Be Removed From Credit Report

How Long Does It Take To Get Approved For Target Redcard

The RedCard credit application is on the Target.com website. You must verify your employment and income, review terms, and create a pin. You may be approved to shop online instantly, or you may have to wait for seven to ten days to get your card, depending on if Target approves you automatically…. see details

You Asked We Listed: Top 5 Target Redcard Credit Card Common Questions

- Why should I get the debit-card version of this product? The debit card might be valuable if you dont want to deal with paying off your credit card bill. The card will draw funds directly from your linked bank account. Use it to get cash at checkout.

- What purchases are eligible for discounts?Some Target purchases that also allow for a the card discount include:

- Clearance items

- Same-day delivery orders through Shipt when you order on Target.com

Don’t Miss: How Good Is A 700 Credit Score

Target Redcard Benefits And Perks

- Generous savings: Receive 5% off your purchases at Target when you pay with your Target RedCard. If you combine this benefit with offers from Target Circle and other Target cashback secrets, you can save loads of money while shopping at Target. The 5% back also applies to specialty gift card purchases, in-store Starbucks purchases, Target subscription orders, and Shipt deliveries from Target.com. Plus, cardholders can save 10% on hotel stays booked through Hotels.com until December 31, 2020.

- No annual fee: With a $0 annual fee, its easy to save more money without worrying about an annual cost.

- Free standard shipping: Standard shipping is free on Target.com purchases when you pay with your Target RedCard. If you upgrade your shipping method, shipping fees will apply. You may also receive free two-day shipping on eligible items.

- Extended return policy: Receive 30 additional days to return products youve purchased with your Target RedCard at Target stores or Target.com. This does not include Target Optical purchases or non-returnable items.

- RedCard exclusive extras: Cardholders receive exclusive offers and gifts. These offers can vary between RedCard holders and may include special items or discounts or early access to certain products.

Citi Double Cash Card

The currently awards 1% cash back on all purchases, and when you pay your bill, you get another 1% cash back.

With this card, you could earn 2% cash back on all purchases, including the ones at Target.

*See Rates & Fees. Terms Apply.

The awards 6% cash back at U.S. supermarkets on up to the first $6,000 spent annually in this category 1% thereafter .

Although Target is not classified as a supermarket, many consumers have found that if they use the card to purchase Target gift cards at grocery stores, they can effectively earn cash back on their Target purchases.

It is an extra step but, for some people, it is worth it. An additional benefit of the Citi and American Express cards is that they can both be used anywhere and arent limited to just Target stores.

Otherwise, most other credit cards cannot compare to the Target REDcard because they don’t have a rewards program that offers 5% back at Target.

The reason is that many rewards credit cards exclude superstores such as Target and Walmart from their rewards program.

Even though they may be considered “supermarkets” or “grocery stores,” most rewards credit cards won’t consider them as such.

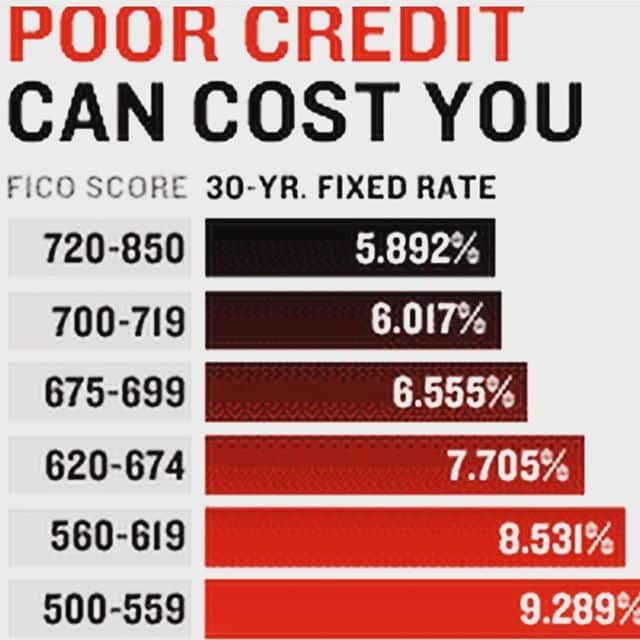

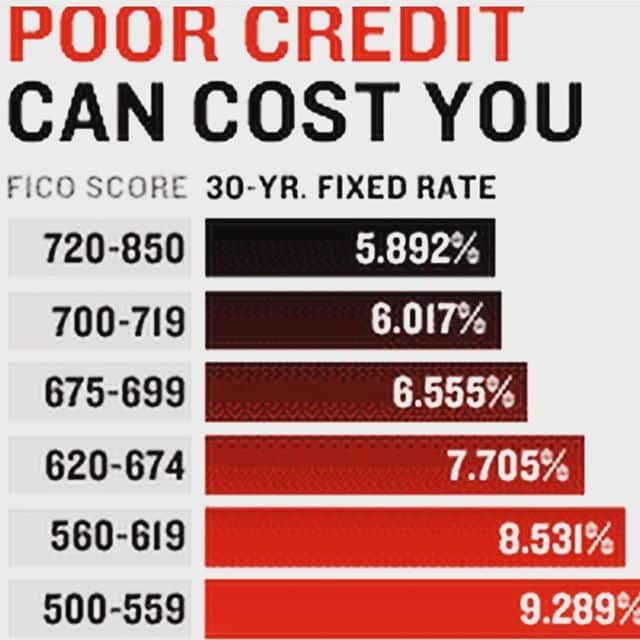

Recommended Reading: How To Get A Mortgage With Poor Credit Rating

Apply Online Credit Card Approval With 3 Easy Steps 2022

SBI card || HDFC credit card online apply || SBI credit card apply online || SBI credit card payment online || HDFC credit card status kaise check Karen

, , , |

How The Target Credit Card Works

The Target RedCard comes in multiple forms including a Target credit card and a Target Mastercard . Target also offers a debit card that automatically draws from your checking account. Each card has similar perks.

Retailers like Target typically partner with a financial institution to offer a branded credit card in which the store and bank share in the interest and fees paid by the customer. Target credit cards are issued by TD Bank USA, N.A.one of the largest banks in the United States and a subsidiary of The Toronto-Dominion Bank of Toronto, Canada.

The Target RedCard charge card can be used at Target retail locations and for online purchases on Target’s website. The RedCard with the Mastercard logo can be used anywhere. Typically, there are sign-up incentives for those who have been recently approved for a new RedCard.

Note that store charge cards can be issued as private label or closed-loop cards, which are different from general-use credit cards that carry the Visa or Mastercard logo. Store charge cards may only be used at the store’s retail locations and the store’s website, while cards that carry the Visa or Mastercard logo can be used at any merchant.

Read Also: Does Paying Collections Help Credit Score