What Does Current Balance Mean

Unlike your statement balance which represents the purchases and payments on your card during a set period, your current balance reflects all the charges and payment activity on your credit card account up to the date the statement was generated.

Your current balance is not fixed the same way as your statement balance. Your current balance updates every time you use your credit card and gives you a better representation of the total amount you owe on your credit card at any given time.

Other Strategies To Help You Build Your Credit Score

Payment history and credit utilization make up 65% of your score. Because these two factors alone comprise the majority of your score calculation, you should maintain a low balance and never miss a payment to beef up your score. If you’re already following these principles, here are four more strategies to help you build your credit score:

- Never cancel your first credit card. Unless it has an annual fee, you want to keep your oldest line of credit as long as possible, as this will help your average account age.

- Ask for a credit-limit increase, but don’t increase your spending. Call your credit card company for a credit-limit increase if you want to reduce your credit utilization ratio. This tactic will help your utilization score by decreasing your ratio.

- Open a new credit card and then set a recurring bill and automatic payment to that card. Setting up this small recurring payment will help both your overall utilization and your payment history.

- Pay off all your credit cards a few days before each statement closes if you’re applying for a loan soon. Paying off your cards early will decrease your overall utilization and boost your credit score for a few days.

Re: Exactly When Do Cc Companies Report Balances To Credit Bureaus

* Credit is a wonderful servant, but a terrible master. *– Done credit hunting having fun with credit gardening.3

A more general question is:

Why are the inner workings of the credit agencies such seemingly covert operations?

Everyone’s always trying to figure what the impact of X, Y, or Z on their score will be, and usually no one seems to have a clear answer.

How did we get into such a situation where secretive computer algorithms weild massive control over our major life decisions?

Every situation is different, and it seems that often a computer-generated score may not accurately depict our true credit risk.

I think the algorithms should be made public, to enable the people to have the power to better control their own financial destiny.

Of course, I wouldn’t expect Fair-Isaac to take kindly to the idea…

The information that comprises a credit score is known, but the exact way that the score is calculated is proprietary information. The FICO models were developed over years of research and is continually being refined. I have no idea what the “formula” looks like – it is certainly a very complex mathematical model, but even if this were made publicly available, I don’t it would necessarily shed any more light about what is known about FICO scores and how they generally react to different factors.

As I have said before, do what is correct for your credit and the scores, any score, will take care of themselves.

Don’t Miss: How To Raise Credit Score Quickly

Whether You Have Recent Missed Payments Or Defaults On Your Report

Missed payments can stay on your credit report for seven years and bankruptcies for 10. You will more than likely need to re-establish a history of making payments on time, as well as reducing your principle debt every month, by paying more than the minimum payment due. Although missed payments stay on your report for seven years, their impact fades over time. All may not be lost if you’ve missed your payment by a few days. If the missed payment is an exception rather than the rule, then pay the bill as soon as you can and ask the lender if they could refrain from reporting the late payment to the bureaus this one time. There’s no guarantee this will work, but it mightyou could set up automatic payments in return, as a goodwill gesture. Just be sure that you catch that missed payment as soon as possible, because its impact on your credit score will get worse with every day it’s in default.

How Often Do Credit Cards Report To Bureaus

As explained above, credit card companies typically report to the bureaus once per month. But again, this can vary from lender to lender. You may want to consider reaching out to your credit card company to figure out when and how often they report to the credit bureaus.

It’s also worth noting that credit card companies may not report to all three bureaus at once. Or they may only report to one or two of them, not all three.

Overall, an important thing to remember is that you should keep your accounts in good standing. Keeping your accounts in good standing not only establishes a strong credit history, but it reduces the need for you to worry about when your credit card company will report your information to the bureaus.

Don’t Miss: How To Pull A Free Credit Report

Why Credit Utilization Is Important

The reason lowering your balances can increase your FICO® Score is that your has a big effect on your credit score. Utilization is your revolving debt balances compared to your credit limits, or the amount of your available credit currently being used. It’s calculated for each card and overall.

Let’s say, for example, that you have the following balances and limits on a portfolio of four cards:

| $6,000 | $24,000 |

In this case, your total utilization rate would be 25% — $6,000 divided by $24,000. Your utilization on Card 3, however, is 50%. Your credit score will suffer if any one card is maxed out or nearly maxed out.

But you can have good credit with a utilization ratio of 30% or even more if other factors are strong.

To understand this better, here are the factors that affect your FICO® Score according to their weighting, most to least:

- Payment history: 35%

- Length of credit history: 15%

- New credit accounts : 10%

- : 10%

Utilization is the second-most critical component of your , next to payment history, and its weight is nearly equal.

How Long Does It Take For A New Credit Card To Be Reported

Brand-new credit card accounts don’t usually show up on your reports for at least 30 to 60 days. If after that you still don’t see a new card report, it may be due to a glitch in the system, an identification mix-up or your new card may be one of the rare few who don’t report to Equifax, TransUnion, or Experian.

You May Like: How To Get Hospital Bills Off My Credit Report

How Often Do Issuers Report To Credit Bureaus

Broadly speaking, all issuers have a vested interest in keeping credit profiles current . So they tend to report on a regular basis. Capital One’s reporting rate is not out of the ordinary.

This does not mean, however, that they always do so. There is no legal mandate to report cardholder activity, and there are issuers out there that don’t bother. Additionally, some credit card issuers report to one bureau, or two, but not all three.

So at the end of the day, there is no single reporting standard. Different issuers report at different paces, and at different times.

Nevertheless there are numerous situations in which you might want to know this information, like when you’re:

- About to apply for a job that requires a credit check

- Trying to get a mortgage

- Thinking about applying for a new credit card

In such instances, it’s good to know when those reporting dates occur . Take a few moments to contact your issuer to learn these particulars, then try to pay off chunks of your debt in advance of the reporting date if you have the means. Reducing balances always makes your credit file look better. It should also help raise your score.

High Balance On Credit Report

In addition to your last reported credit card balance, your credit report also includes a high balance. This balance is the highest balance ever reported to the credit bureaus for that credit card account.

The high balance remains the same each month unless a higher credit card balance is reported. While some creditors and lenders may include the high balance in a manual evaluation of your creditworthiness, this balance isn’t currently included in your credit score.

Don’t Miss: What Is The Best Credit Score You Can Have

Fact: Your Balance Has More Than One Interest Rate

Your account may include balances with different interest rates . And that points to another good reason to pay more than the minimum due: When you do, your card issuer has to apply any amount above the minimum to the balance with the highest ratewhich can help you reduce that higher-rate debt more quickly, saving you money, according to Experian.

Understand Cash Back Vs Points Vs Miles

Next, you should consider which types of rewards you’re looking for. There are three main types of rewards currency: cash back, points and miles. It may make sense to earn points and miles through travel rewards cards if you like to travel. If you prefer to earn cash rewards, look at cashback cards instead.

Below, we’ve hand-picked our favorite beginner rewards credit cards that are easy to use and offer excellent returns:

| Card | ||

|---|---|---|

| Rotating categories | $0 | 5% cash back on up to $1,500 in combined purchases in bonus categories each quarter you activate. Enjoy new 5% categories each quarter! Plus, earn 5% cash back on travel purchased through Chase Ultimate Rewards®, 3% on dining and drugstores, and 1% on all other purchases. |

Don’t Miss: Which Credit Score Do Mortgage Lenders Use

What You Can Do

If youre concerned about your credit utilization in relation to credit reporting, you might consider asking your credit card issuer for a higher credit limit. Having more credit available and not using as much may help boost your credit. Just be sure to do your research first. And keep in mind that having more available credit could actually hurt your scores if it tempts you to rack up more debt.

Additionally, you can make multiple payments throughout the month to lower your overall balance. That way, when the balance is reported to the bureaus, your credit utilization is in good shape.

If you want to get a better handle on your credit, you can always check your credit reports from Equifax and TransUnion on and dispute any errors you see.

When You Should Make A Credit Card Payment

Youll be in good shape if you can pay off your credit card by the due date, especially if you pay your entire balance. Paying at least part of your bill before the closing date could be even better if you want a good credit score.

But the best time to make a credit card payment may be whenever your credit utilization ratio exceeds 30%. By tracking your credit utilization ratio and keeping it as low as possible, you can protect your credit score. And you wont have to worry about remembering the date when your credit information will be reported.

To calculate the credit utilization ratio for an individual credit card, you can take your credit card balance and divide that number by your credit line. Then multiply that number by 100.

Don’t Miss: When Does Capital One Report Credit Utilization

How To Find Out What’s In Your Credit Report

As an American user of credit, you are entitled to view your credit reports for no charge at least once per calendar year, explains the Federal Trade Commission. To see your report, visit each agency and make a written request. Alternately, you can ask for all three reports at the same time in the Annual Credit Report.

Your Credit Scores Can Update Whenever The Information In Your Credit Reports Changes

Your credit scores are based on the information in your credit reports. And your credit scoresâlike your reportsâcan change over time. But how often do they change?

The short answer: It depends. Read on to learn about when your credit scores might change and to get tips for improving your scores and monitoring your credit.

Recommended Reading: What Is A Good Credit Score In California

How Often Your Credit Score Updates

Credit scores continually go up and down as information on your gets updated. New balance amounts, bill payments and account openings are only a few factors that appear on your credit report and influence your credit score.

You can generally expect your credit score to update at least once a month, but it can be more frequently if you have multiple financial products. Each time any one of your creditors sends information to any of the three main Experian, Equifax and TransUnion your score may refresh.

That means your creditor may send updated information to Experian today, then Equifax next week, and TransUnion the following, which creates variations in your credit score.

Taking a look at my recent credit score updates through *Experian Boost, my score changed four times in October. The fluctuations were due to a new auto loan being reported on my credit report, as well as changes in my credit card balances.

Your credit score may also fluctuate when you check different credit score services that work with different credit bureaus. As stated above, the credit bureaus may receive information at varying times throughout the month, so if you check your scores with Experian and TransUnion today, they may differ if one has info the other doesn’t.

Other reasons for credit score differences include the credit scoring model used and errors on your credit report.

Fact: Paying Less Than The Minimum Is Still A Missed Payment

If you dont pay the total minimum payment on your credit card bill, your credit card company may report it as a missed payment. This can bring down your credit score and make it more difficult to qualify for credit in the future. Check your statement for the minimum amount due, and be sure to pay it on time to keep your account current. And remember: Paying more than the minimum amount due is a great way to pay down your debtand until you pay it off, interest will continue to be charged each month.

Also Check: What Is A Good Credit Score To Buy A Car

How Balances Affect Your Credit Score

The balance that’s reported to the credit bureaus appears on your and can affect your , which is the percentage of your total credit you’re using. The higher your balance, the higher your credit utilization rate, which can lower your .

To find your credit utilization rate, divide your total balance by your total credit limit. For example, if you have one credit card with a $1,000 balance and $5,000 credit limit, your utilization would be 20%.

Here’s the math: $1,000 / $5,000 = 0.2 x 100 = 20%

In order to maintain a low credit utilization rate, consider reducing your spending or making periodic bill payments throughout your billing cycle so you have a lower statement balance. The lower your statement balance, the lower your credit utilization rate, which can improve your credit score.

What To Look For In A Credit Card To Build Credit

Business owners looking for a credit card have many choices. Your primary goal may be to build credit, but that doesnt mean you should overlook other benefits of small business credit cards:

Rewards: Think of all the money you spend in your business, then think about all the credit card perks you may earn if you use a credit card to pay for those business expenses. For many businesses, it adds up quickly.

Cash back rewards are universally popular, as business owners can always use cash! Some cards offer bonus cash back for spending in bonus categories so its helpful to review your typical business purchases before you choose a card. Points are also popular, and are most often used for travel, but can be redeemed for other rewards such as gift cards.

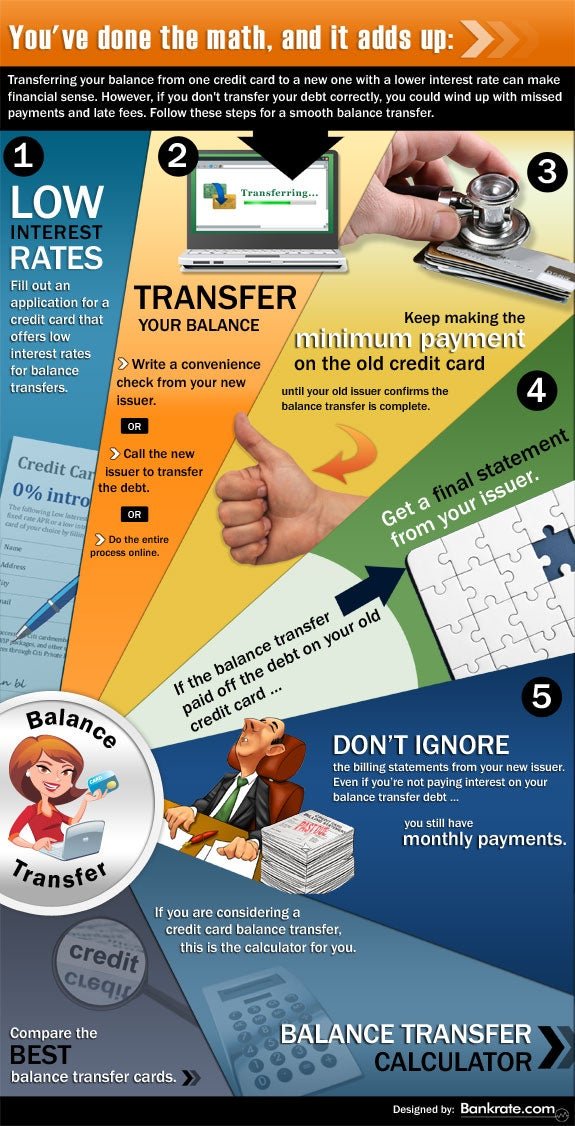

Financing: Dont overlook the fact that a business credit card is essentially a line of credit your business can use when needed. Unlike a business loan, no one will question why you need financing. Some cards even offer balance transfers or introductory for a year or longer. That low-cost financing can be very helpful to new businesses or any business that is experiencing tight cash flow.

Its essential, though, that you use this financing for essential business spending. Otherwise you may find your business with a credit card balance at a high interest rate once the introductory rate expires.

Don’t Miss: How To View Free Credit Report

Increase Your Credit Limit

Raising your credit limit isn’t a particularly daunting task. Although methods vary from issuer to issuer, a few clicks within your account management portal can usually lead you to a limit raise request. You can also typically ask for an increase via phone, or with a written request.

Oftentimes, your issuer will offer a credit increase in exchange for a small piece of information or two. It’s common for issuers to bump the limit for cardholders that update their annual income figure, for instance.

It’s also worth noting that your account needs to be in good standing to get a limit bump. Issuers won’t increase their exposure to you as a lender if you haven’t demonstrated you can pay your statements on time or be disciplined about your spending.