What Credit Score Do Car Dealers Use

There are two credit scoring models available: FICO® and VantageScore®. Its important to understand that your credit score may vary slightly between the two models. Both of the latest models, FICO 8® and VantageScore 3.0®, use the same five factors to calculate your score . The difference comes from what weight the models give each factor. For example, while payment history makes up 30 percent of FICO credit scores, it accounts for 40 percent of VantageScore credit scores.

If you have slightly different scores between the two models, you can ask your potential lender which scoring model they typically use. This will help you estimate what kind of score theyll see when they check your credit.

Additionally, auto lenders may opt to use the industry-specific FICO Auto Score®. This score takes your traditional FICO score and adjusts it after considering auto data. As a result, lenders get a more specific score that speaks to the consumers chances of making auto payments reliably. While the FICO 8 scoring model ranges from 300 to 850, FICO Auto Scores range from 250 to 900.

How To Improve Your Credit

Maybe your credit score isnt quite where it needs to be to get a good interest rate. How can you improve your credit score? The most important factor that is considered in determining your credit score is payment history. The best thing you can do is make on-time payments on your credit cards every month. Try to pay them off in full every month, or at least as much as you can. Additionally, keep your credit utilization under 30%. Basically, if you have $1,000 of available credit, dont use more than $300. Finally, dont open any new credit accounts that you dont need. Any time you apply for new credit, a hard inquiry will appear on your credit report, which can lower your score.

It may take a few months, but if you follow that advice, you should be well on your way to getting a good credit score to buy a car!

How To Boost Your Credit Score

There are many ways you can begin boosting your credit score before you consider applying for a car loan. Check out these guidelines to get you started.

Pay Your Bills On-Time

Since your plays a massive role in your final score, its essential to pay your bills on time. If you make sure you at least pay the minimum on your loans and credit cards, and dont make late payments, this should have a positive impact on your score.

Follow The 30% Rule

If you have numerous credit cards that are all maxed out, this rings alarm bells to your potential lenders. Its vital to ensure you keep outstanding balances on your credit cards below 30% of your overall limit. This will demonstrate to your banks or financial institutions that youre not low on cash and that youre responsibly for handling your finance.

Keep Credit Card Accounts Open

Its a common myth to think that if you close your credit card accounts, your credit score will increase. Thats not necessarily true. Whereas closing your credit card accounts will help you to fight the temptation of spending, it will affect your .

For example, if you have three credit cards and only one is maxed out, youve used less of your total available credit limit. But if you only have one credit card that one is maxed out, you have no available credit, therefore your credit utilization ratio is very high and your credit score will be negatively affected.

Written by Grace Gearon from | Contributing Writer for Loans Canada

Also Check: 672 Credit Score Auto Loan

Improving Your Credit Score

Fair credit scores cant be turned into exceptional ones overnight, and only the passage of time can repair some negative issues that contribute to Fair credit scores, such as bankruptcy and foreclosure. No matter the reason for your Fair score, you can start immediately to improve the ways you handle credit, which can lead in turn to credit-score improvements.

Look into obtaining a secured credit card. A secured credit card requires you to put down a deposit in the full amount of your spending limittypically a few hundred dollars. Confirm that the As you use the card and make regular payments, the lender reports your activity to the national credit bureaus, where they are recorded in your credit files. (Making timely payments and avoiding maxing out the card will favor credit-score improvements.

Consider a credit-builder loan. Available from many credit unions, these loans take can several forms, but all are designed to help improve personal credit histories. In one popular version, the credit union places the money you borrow in a savings account, where it earns interest but is inaccessible to you until the loan is paid off. Once youve paid the loan in full, you get access to the funds and the accumulated interest. Its a clever savings tool, but the credit union also reports your payments to national credit bureaus, so regular, on-time payments can lead to credit-score improvements.

Read Also: Does Paypal Credit Show On Credit Report

Is It Possible To Buy A Car With Bad Credit Or No Credit

If you have bad credit, its still possible to get a car loan. In fact, there are some lenders that work specifically with people with lower credit scores. Research your options and consider a co-signer or making a large down payment if youre having trouble getting approved or finding acceptable rates.

If you dont have any credit history, getting a car loan will be more difficult. You will need to show that you can repay the loan in other ways. Consider some of the following to demonstrate to lenders you are not a risk without any credit history:

- A full-time, secure job with regular income

- A high enough income to comfortably make the repayments on the loan

- No history of dishonour fees, late payments on bills, or failed payments

Read Also: Does Pre Approval Hurt Credit Score

Understanding Auto Loan Credit Scores

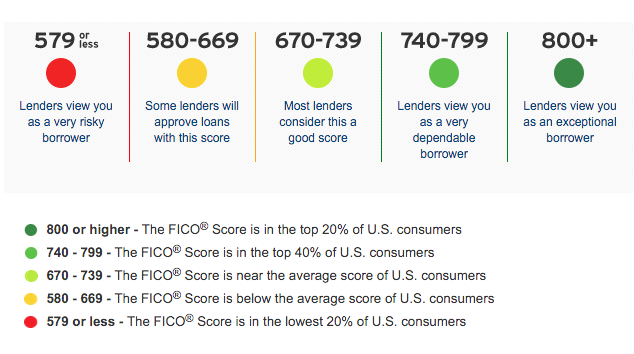

Your credit score is how lenders measure your financial stability and determine how well you can pay back debt. Credit scores are broken into tiers. Experian gives the following tiers and score ranges for auto loans.

Your FICO Auto Score, which most lenders use to evaluate car loan applications, may be lower or higher than your regular credit score depending on your previous auto loans – how much you borrowed and how well you made the payments.

Your exact FICO Auto Score can even vary from lender to lender. Each lender reviews your credit report information and weighs it according to what they think is the most important.

How To Check All Versions Of Your Fico Auto Score

If you want to finance a car with an auto loan, signing up for one of the FICO® Basic, Advanced or Premier credit monitoring services can help.

All three FICO Basic, Advanced and Premier plans offer access to 28 versions of your credit score so you can use it when applying for any type of credit, including auto loans, mortgages and credit cards. These three services will also alert you of potential fraud, such as someone opening a new loan in your name or a sharp spike in your credit card balance.

If all you want are the multiple versions of your FICO Score, sign up for Basic, the lowest tier, to save more money each month. Learn more about the differences between each FICO credit monitoring service.

-

$19.95 to $39.95 per month

-

Experian for Basic plan or Experian, Equifax and TransUnion for Advanced and Premier plans

-

Yes, for Advanced and Premier plans

-

Identity insurance

Yes, up to $1 million

Terms apply.

You May Like: What Does Serious Delinquency Mean On Credit Report

Buy A Car Now Or Work On Your Credit

The bottom line is that there is no set minimum FICO® Score to get a car loan. There’s actually a good chance that you can get approved for an auto loan no matter how bad your credit is.

Having said that, subprime and deep-subprime auto loans can be extremely expensive, so just because you can get a car loan with bad credit doesn’t necessarily mean you should. The savings from a moderate score increase can be substantial, so it could be a smarter idea to wait for a bit and work on rebuilding your credit before buying your next car.

Avoid Additional Bad Credit Items

In the months leading up to your loan application, be on your best behavior. Pay everything on time. Don’t take on any other major credit obligations, opening new credit cards or charging high credit card balances. Potential red flags for an auto lender include late rent payments, charge-offs, debt collections, bankruptcy, tax liens, and lawsuit judgments.

Recommended Reading: Will Paypal Credit Help My Credit Score

Have A Good Down Payment Or Trade

Putting money down or trading in a car on your loan can reduce how much you borrow, saving you money on interest charges over the life of the loan. Depending on the situation, it could also lower your interest rate because the lender is taking on less risk with a smaller loan.

It can take time to save money for a down payment, so start sooner than later. And keep in mind that selling a car to a private party could net you more cash than a trade-in, so if that’s possible, opt for that instead.

What Is A Good Credit Score For An Auto Loan

While lenders can set their own standards when assessing an individual’s FICO score, generally accepted standards across the board for multiple lenders. According to Experian, “higher scores represent better credit decisions and can make creditors more confident that you will repay your future debts as agreed.”

So what’s a “good” credit score? Anything above 700 will at least allow borrowers to be in a good position to obtain auto loans. Once you build your score over 800, you can pretty much be assured of your excellent credit and an ace up your sleeve when negotiating your annual percentage rate and your loan terms. However, if you credit score is higher than 600 and lower than 750, you’re in line with most borrowers. The average credit score in America is 657.

Recommended Reading: Does Titlemax Report To Credit Bureau

How Your Credit Score Affects Your Interest Rate

Lenders like banks or auto financing companies use your income, credit score, and other factors to rate you as a credit applicant. Ideally, youâll want to be a prime or super-prime credit candidate. This means you have a FICO credit score of 661 or higher. Those borrowers get lower interest rates than borrowers that are nonprime, subprime, or deep subprime. They also routinely get approved for a higher loan amount.

Hereâs how these categories break down by FICO credit score:

-

Super prime: 781-850

-

Deep-subprime: 300-500

Interest Rates and Risk

These ratings help creditors understand how risky you are as a borrower. It gives them a sense of how likely you are to pay back the loan. Having a super-prime rating means youâll qualify for the best terms and lowest loan interest rates because you are less of a financial risk to the lender. By contrast, deep subprime borrowers are riskier for lenders. Their credit scores have suffered because of negative items on their credit report like missed payments, repossessions, and bankruptcies. This indicates to the lender that the borrower might struggle to repay the loan. As a result, subprime borrowers get higher interest rates.

According to data from Experian, one of the three major credit reporting bureaus, here are the average annual percentage rates for borrowers in each category:

| New Car Loan |

|---|

Getting A Car Loan With Your Bank Vs The Dealer

In general, there are two ways to borrow money to pay for your car. You can take out a loan from the dealer that sells you your vehicle, or you can borrow from a third-party lender, such as your bank or credit union.

The difference between the two usually comes down to convenience vs. price. While its easier to apply for a loan through the dealer, theyll usually charge you more than your bank or credit union would.

The truth is that dealerships make the majority of their profits through their loans, not the profit margins on their cars. They really want you to get your loan through them so they can finance your purchase directly or go out and secure a loan on your behalf.

Either way, theyll charge you quite a bit for their services. Youll pay much less if you get prequalified with your bank, credit union, or an online auto lender before you even walk onto the dealership lot.

That way you can get a better picture of your options ahead of time and avoid getting pressured into paying for the additional financing fees of a dealership when its time to buy.

However, not every bank engages in auto lending, and not every dealer allows you to get third-party car financing. Youll have to do your due diligence to find the right car, lender, and dealer before buying.

Recommended Reading: Ccb Ppc Credit Inquiry

Go To A Dealer That Specializes In Buyers With Poor Credit

If you cannot qualify for a loan at a traditional dealership, you may be able to get financing from one that specializes in buyers with poor credit. Typically advertised as buy here, pay here dealerships, they offer in-house financing for used vehicles.

However, these dealers tend to charge very high interest rates to offset the risk of lending to borrowers with lower scores. As of 2020, the average interest rate offered by independent dealers to deep subprime borrowers was 21.31%.

Apply For A Loan With A Cosigner

If your score is in the nonprime to deep subprime range, you might consider applying for a car loan with a cosigner. A cosigner is someone, such as a family member, who is willing to apply for a loan with you and, ideally, has good to excellent credit. A cosigner shares responsibility for the loan, reducing the lenders risk. Youre more likely to qualify for a loan and get a lower interest rate than if you applied on your own. But if you’re unable to make the loan payments, your cosigner will be stuck with the bill.

Also Check: Does Monroe And Main Report To Credit Bureaus

How To Raise Your Credit Score For A Car Loan

If you are worried about being subprime and getting approved or just want to save money with a lower interest rate, you can take action today to improve your credit score. First step? Check your credit report from the credit reporting agencies to see where you stand and how you can improve your credit rating.

Budget For A Higher Interest Rate

Experts recommend that you keep your total transportation costs to less than 10% of your budget. If you have a low credit score, you will pay more in interest, so you should aim for a less expensive car and/or have a high down payment.

Experian reports that successful auto loan applicants with subprime credit scores financed lower average amounts approximately $29,000 to $35,000 compared to those with higher credit scores who had larger loans roughly $34,000 to $39,000.

For example, if you can afford a $450 payment for a 72-month term, heres how much you should finance, based on the average auto loan APR for your credit score. Note that the credit bands are different based on the data source.

| Prime |

You May Like: Comenity Capital Mprc

How To Improve Your Credit Score

If you have a low credit score, or you have a high credit score but want it to be even higher, you may be looking for ways to improve it. If buying a car right away isn’t a top priority, and you feel like you can hold off for a few months, do your best to improve that credit score. It may even help you afford that better car you’ve had your eye on.

Improve your credit by:

Current Auto Loan Interest Rates

| Dates | |

|---|---|

| 4.14% | 4.44% |

Note: Actual interest rates are based on many factors such as state, down payment, and verification of credit score. Car loan interest rates provided by Bankrate.

Even with a credit score of around 652 or 657, your score is considered Fair credit and you will have multiple auto loan options to choose from.

Usually, people will obtain automobile financing from one of four places:

- Car Dealership

- Online Lender

The vehicle loan options and payment conditions can vary quite a bit by which lender you choose.

We will discuss the pros and cons of each lender option and guide you to the best rates with your credit score.

Inside you will find the estimated monthly payment for commonly borrowed auto loan amounts and the different term options for people with credit scores between 650 and 659.

While a 650 credit score isnt bad, there still is a lot of room for improvement and financial incentives for you to improve it.

Read Also: Does Paypal Credit Report To Credit Bureaus

Recommended Reading: Is Cbe Group Legit

How Much Of Your Paycheck Should Go Towards Your Car Payment

If you dont want to worry about eating out or going to see that movie that caught your eye, and you also want to put away money to invest, many experts recommend only 10%.

Thats rightonly 10%.

Now, for most Americans, thats not a lot to spend on a car at all, but its a safe amount. But, consider that the average income in the U.S. is only $52,000 a year, and it becomes apparent people need to be more frugal especially in this economy.