Getting Denied For Employment

Certain jobs, especially those in upper management or the finance industry, require you to have a good credit history. You can actually be turned down for a job because of negative items on your , especially high debt amounts, bankruptcy, or outstanding bills.

Note that employers check your credit report and not your credit score. They’re not necessarily checking for bad credit, but for items that could affect your job performance.

Before Applying For New Credit

Its also not a bad idea to begin checking your credit score 3-6 months before applying for any new credit card or loan. This gives you ample time to try and boost your score or correct credit report errors before you apply. Since you can see your credit score for free, checking your score several months in advance is no longer a large expense like in the recent past.

Knowing your current score gives you a firm idea of what your approval odds are and what your interest rate can be.

Most banks report the hard credit pull for a credit card or loan application even if you dont get approved. Your score drops unnecessarily in this instance.

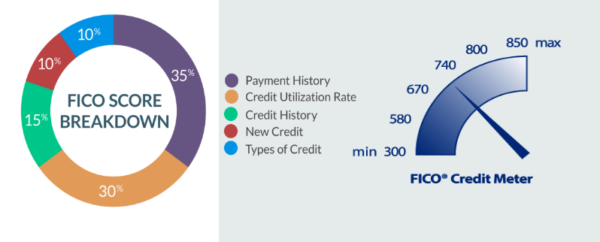

For example, you should apply for the best credit cards within your credit score. Having a 740 credit score lets you qualify for many of the best credit cards. If your score is in the 600s your approval odds can be slim.

The lender or bank might also provide your credit score when they do a hard pull. However, you only see your score after you apply and authorize a hard credit inquiry. By then, it can be too late to make any changes to improve your score.

Why Do Hard Inquiries Hurt Your Credit Score

Your credit score is based on the information in your credit report, including credit inquiries and the age of your credit account. For FICO scores, new credit inquiry information contributes to 10% of your credit score. Though it’s a small percentage, perhaps, it can impact your score.

According to FICO, one hard inquiry will only knock about five points off your credit score for 12 months. The VantageScore credit scoring model also factors in hard inquiries when calculating your credit score, but the negative impact doesnt last as long.

Many hard inquiries on your account over a short period may have a greater impact on your credit score. Why? Because it suggests to lenders that you may be short on cash or about to rack up debt. In their eyes, youre a higher-risk customer.

Recommended Reading: Ccb On Credit Report

How To Get Your Credit Report

You can check your credit score for free using the Chase Credit Journey, and if you want to do a deeper dive into your credit history, you can review your credit report using this feature as well.

You can get a free copy of your credit report once a year from each of the three major credit bureaus at annualcreditreport.com

You have the right to a free credit report from AnnualCreditReport.com or 877-322-8228, the ONLY authorized source under federal law.

What Is A Soft Credit Check

A soft credit inquiry, also called a soft credit check or soft pull, is usually done by you or another authorized person, like an employer. Soft credit inquiries don’t affect your credit score because you’re not actually applying for credit, and these types of inquiries don’t necessarily require your permission.

These can occur when you request a copy of your credit report or check your credit score. Other types of soft credit inquiries include a landlord or employer checking your credit or a creditor checking your credit to offer you pre-approval or pre-qualification.

Don’t Miss: Does Drivetime Pre Approval Affect Credit Score

Myths About Credit Score

08 min read.

Due to lack of knowledge, many myths about credit score keep spreading. People find it difficult to verify the validity and applicability of these myths and rumours. However, believing in the myths can lead you to trouble at times. Therefore, here is a compilation of the most popular myths and a reality check on them.

You Are Paying Off A Large Purchase

Remember that credit cards dont work very well as short-term loans even though theyre convenient. The interest rates they charge are simply way too high. If you need to purchase new home appliances, pay for a major repair to your home or cover surprise medical bills and you have to borrow money, youre likely better off taking out a personal loan with a much lower APR. Note that personal loans offer low fixed interest rates, a fixed monthly payment and a fixed repayment timeline, whereas credit cards offer pricey variable rates that can go even higher over time.

When it comes to financing a large purchase, you can also consider credit cards that offer 0% APR on purchases for a limited time. let you avoid interest on purchases you make for a limited time , although your interest rate will reset to the regular variable rate after the introductory offer is up. Many cards in this category even let you earn rewards on your spending along the way, making them a good option if you want to rack up points and know you can pay off your large purchase in a fairly short amount of time.

Don’t Miss: Do Pre Approvals Affect Credit Score

Not All Credit Inquiries Leave Your Score Untouched

Sienna is a self-proclaimed credit card nerd who has been creating personal finance content for more than seven years. She joined The Balance as a staff writer and is now managing special projects to further engage readers in important topics. Sienna’s work has been cited by major news outlets and government agencies. She holds a journalism degree from the University of Wisconsin Oshkosh.

No, checking your credit score does not lower your score. In fact, its essential to regularly check your score so you can track how different credit activities impact the number.

However, if a lender checks your credit score, that action may temporarily lower your score. Heres why.

How To Improve A Bad Credit Score

If you have bad credit, take some time to review your credit score and identify the cause. Perhaps you’ve missed payments or carried a balance past your bill’s due date. In order to achieve a fair, good or excellent credit score, follow the below.

- Make on-time payments. Payment history is the most important factor in your credit score, so it’s key to always pay on time. Consider setting up autopay to ensure on-time payments, or opt for reminders through your card issuer or mobile calendar.

- Pay in full. While you should always make at least your minimum payment, we recommend paying your bill in full every month to reduce your utilization rate, which is the percentage of your total credit limit you’re using. To calculate your utilization rate, divide your total credit card balance by your total credit limit.

- Don’t open too many accounts at once. Every time you submit an application for credit, whether it’s a credit card or loan, and regardless if you’re approved or denied, an inquiry appears on your credit report. Inquiries temporarily reduce your credit score by roughly five points, though they rebound within a few months. Try to limit applications as needed and shop around with prequalification tools that don’t hurt your credit score.

Read Also: Care Credit Credit Score For Approval

How To Access Your Report

You can request a free copy of your credit report from each of three major credit reporting agencies Equifax®, Experian®, and TransUnion® once each year at AnnualCreditReport.com or call toll-free 1-877-322-8228. Youre also entitled to see your credit report within 60 days of being denied credit, or if you are on welfare, unemployed, or your report is inaccurate.

Its a good idea to request a credit report from each of the three credit reporting agencies and to review them carefully, as each one may contain inconsistent information or inaccuracies. If you spot an error, request a dispute form from the agency within 30 days of receiving your report.

What Does This Mean When I Apply For Credit

Any application for credit might be subject to further checks to prove your identity. As this is often a manual check, if youre applying for credit your application could be delayed.

Having a marker under this section wont automatically mean your application will be rejected. Its there to protect you from being a victim of fraud.

You May Like: How To Get A Repossession Off Your Credit Report

Student Loans Don’t Affect My Credit Score

False. Your credit score isn’t just impacted by your credit card bills. You need to pay all your bills on time, which includes your utilities, student loans, mortgage and any medical bills you might have.

“Default on a few student loans, and you’ll see just how much student loans affect your scores,” Ulzheimer says.

If you struggle to remember to pay your bills each month, there’s an easy fix: autopay. In the case of student loan companies, some give you a discount on your interest rate if you set up autopay.

Reasons To Check Your Credit Score Regularly

Going without checking your credit score, or checking it every few years, isn’t enough. To have control over your credit and your financial life, you must check your credit score regularly. Here are a few reasons why.

Don’t Miss: What Is A Factual Data Credit Inquiry

Review Your Credit Reports

To improve your credit, it helps to know what might be working in your favor . Thats where checking your credit history comes in.

Pull a copy of your from each of the three major national credit bureaus: Equifax, Experian, and TransUnion. You can do that for free once a year through the official AnnualCreditReport.com website. Then, review each report to see whats helping or hurting your score.

Factors that contribute to a higher credit score include a history of on-time payments, low balances on your credit cards, a mix of different credit card and loan accounts, older credit accounts, and minimal inquiries for new credit. Late or missed payments, high credit card balances, collections, and judgments are major credit score detractors.

How To Check Your Credit Score

Historically, it’s been difficult to get access to your credit score for free. But it’s gotten much easier in the past few years.

For example, many financial institutions offer free FICO® Score or VantageScore access to their customers for free as a benefit. If you don’t have an account with this perk, you can check your FICO® Score through Experian for free. A handful of other services offer this benefit as well.

Keep in mind that most lenders use your FICO® Score in credit decisions. So if you’re looking at a different credit score, it likely isn’t the one lenders will see when they do a hard credit check. Even with a FICO® Score, different lenders may use different versions of the score, such as an industry-specific version for certain types of loans. But you’ll still have a good idea of where your credit stands.

Also Check: How Long Do Repo Stay On Your Credit

How Do You Check Your Credit Report

You can also request a copy of your credit report from a credit reporting body. Your credit report is a record of your credit history. It includes your personal details, as well as financial information including any credit or loan products youve had, your repayment history, applications for credit or loans and information about any bankruptcies, defaults or court judgments in your name.

There are three main credit reporting bodies in Australia: Equifax, Experian and Illion. You will have to provide identification information to get a copy of your credit report. For example, you may need to provide documents such as copies of your drivers licence and Medicare card.

Checking your credit score and credit report does not have an impact on your score. But bear in mind that if you apply for credit or a loan, the creditor or lender will normally check your credit report to determine your creditworthiness and this can affect your score.

When Does Checking My Credit Score Lower It

Hard inquiries, also called hard pulls, are the kind that can cost you points. They happen when someone pulls your credit for the purpose of deciding whether to extend credit to you. These hard inquiries should not happen without your knowledge or consent.

You can review your hard inquiries on NerdWallets free credit report summary, which updates weekly. You can also check your free credit reports at AnnualCreditReport.com to see who has looked at it in the past two years. Consumers currently have access to those reports weekly.

A hard inquiry might cost you up to five points according to FICO, the creator of the most widely used scoring formulas. With VantageScore, an increasingly popular credit scoring model, a hard inquiry is likely to cost even more.

In contrast, a soft inquiry or soft pull occurs when you or a creditor looking to preapprove you for a loan or credit card checks your score. A soft inquiry has no effect on your credit score.

So, if you apply for several credit cards close together, you might see a significant drop in your credit scores. Before you begin applying, take time to conduct research on the best credit cards for your specific financial needs, while keeping eligibility requirements in mind.

A hard inquiry stays on your credit report for two years, but any effect on your credit score fades sooner than that.

Also Check: When Do Things Fall Off Your Credit Report

Full Lowdown On What Mse Credit Club Offers:

- Our Credit Hit Rate. This shows your chances of success, as a percentage, of grabbing our top cards and loans.

- Eligibility tool. It reveals the likelihood of you getting top credit cards or loans .

- Your credit profile explained. It shows the key factors affecting your score and how to improve them.

Or alternatively…

Why Good Credit Scores Are Important

Having a good credit score is important because it helps you borrow money at lower or 0% interest rates. For example, if you have excellent credit, you might qualify for a 0% APR credit card, which offers no-interest financing for an extended period of time. Using this type of card can save you a lot of money in interest. It also can help you get out of debt faster if you transfer a balance from another high-interest card.

In addition, if you have a good credit score, you can avoid some security deposits and pay lower down payments on some loans. This can free up some of your cash to put toward other financial goals and expenses.

When you add up all the savings, a good credit score can save you thousands of dollars over your lifetime.

Also Check: Check Credit Score Without Ssn

A Credit Report Agency Can Fix Your Score

You may come across credit repair agencies when you are looking for measures to fix your low credit score. Based on the name, some people may mistake such agencies for firms that can repair a low score and build it up to a good score overnight by spending some money. However, it does not work that way.

A credit repair agency helps you file disputes with a credit rating agency if you can find errors on your credit report. The error can range from a mistake in your name to a mistake in a transaction registered under your name in the report. If you do not have the time or knowledge as to how you can dispute the errors, a credit repair agency can help you by doing the needful on your behalf.

Related Articles

How To Improve Your Credit Scores

Even though you have dozens of credit scores, they are all based on the same three credit reports. That means you dont have to focus on improving dozens of credit scores you only need to focus on three credit reports. If you have three great credit reports then youre going to have countless great credit scores.

using four or five factors, depending on the score type and from where you got it. These factors are the basis for your credit scores and will act as a roadmap to help you determine how to improve your scores.

For example, if your top score factor indicates you have too much credit card debt, then making extra payments on your truck loan isnt going to improve your scores much. However, if you pay off or pay down your credit card debt, then youre going to get much more of a return from your investment.

The scoring factors listed with your score will answer the question, How can I improve my credit scores?

You May Like: Unlock Transunion Credit Report