The Importance Of Having A Good Credit Score

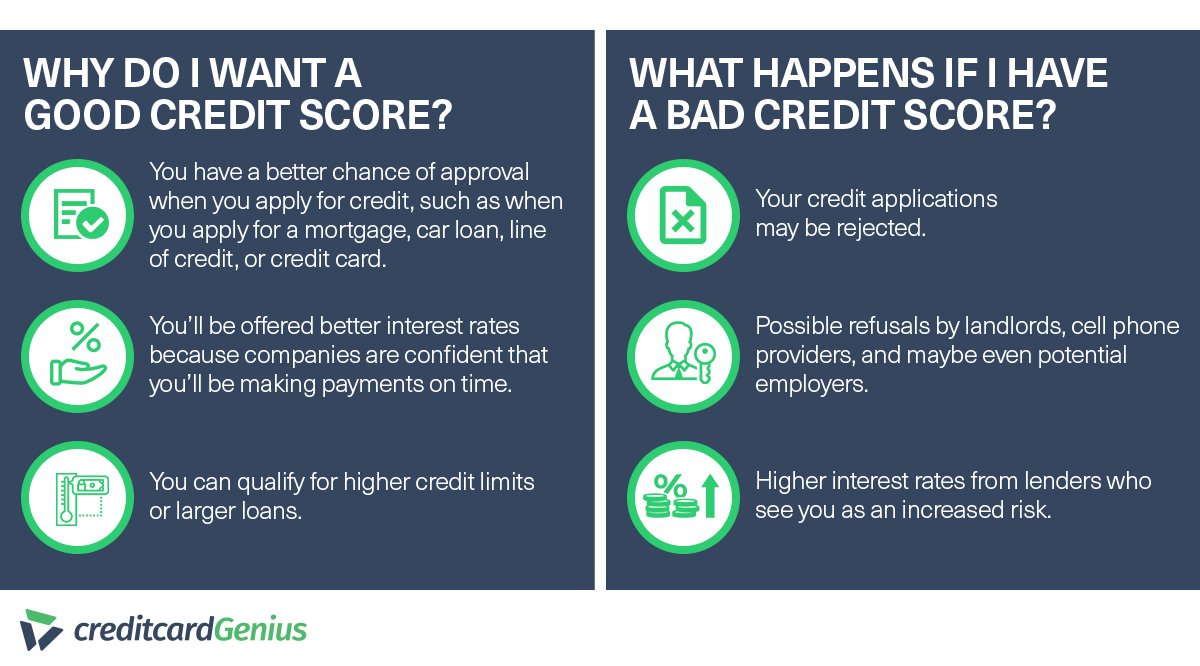

Your credit score is based on your past and present credit transactions. Having a good credit score is important because most lenders use credit scores to evaluate the creditworthiness of a potential borrower. Borrowers with good credit are presumed to be more trustworthy and may find it easier to obtain a loan, often at a lower interest rate. Credit scores can even be a deciding factor when you rent an apartment or apply for a new job.

How is your credit score determined? The three major credit reporting agencies track your credit history and assign you a corresponding credit score, typically using software developed by Fair Isaac Corporation .

The most common credit score is your FICO score, a three-digit number that ranges from 300-850. Whats a good FICO score? For the most part, that depends on the lender and your particular situation. However, individuals with scores of 700 or higher are generally eligible for the most favorable terms from lenders, while those with scores below 700 may have to pay more of a premium for credit. Finally, individuals with scores below 620 may have trouble obtaining any credit at all.

It Can Affect Your Finances

Financial institutions look at your credit report and credit score to decide if they will lend you money. They also use them to determine how much interest they will charge you to borrow money.

If you have no credit history or a poor credit history, it could be harder for you to get a credit card, loan or mortgage. It could even affect your ability to rent a house or apartment or get hired for a job.

If you have good credit history, you may be able to get a lower interest rate on loans. This can save you a lot of money over time.

How To Improve Your Credit Score

Ready to improve your credit score? Building credit takes time. But itâs possible to build and keep a good credit score if you practice responsible financial behaviors like paying your bills on time and staying well below your credit limits.

It can help to monitor your credit regularly. Aside from showing you where you stand, monitoring your credit can help you spot reporting errors and potential fraud attempts. Errors and fraud could hurt your scores.

makes that easy. The free tool lets you monitor your TransUnion® credit report and your VantageScore® 3.0 credit score. And checking it wonât hurt your scoreâa major plus if youâre working to improve a bad credit scoreâso you can check it as often as you like. The built-in CreditWise Simulator even lets you explore the potential impact of your financial decisions before you make them.

Learn more about Capital Oneâs response to COVID-19 and resources available to customers. For information about COVID-19, head over to the Centers for Disease Control and Prevention.

Government and private relief efforts vary by location and may have changed since this article was published. Consult a financial adviser or the relevant government agencies and private lenders for the most current information.

The CreditWise Simulator provides an estimate of your score change and does not guarantee how your score may change.

You May Like: Paypal Credit Bureau

States Where You Can Get Denied For Mlo License Due To Bad Credit

I live in Kenosha County, Wisconsin which is the border of Wisconsin and Illinois and my branch office is in Illinois, which is about an hour from where I live. Since I live in Wisconsin, I applied for my Wisconsin mortgage loan originators license in April 2013. I figured it would be no big deal in getting my Wisconsin mortgage loan originators license approved. I just assumed it would be a cakewalk because I had no issues with the state of Illinois and the state of Florida.

Unfortunately, two weeks after I have submitted my Wisconsin mortgage loan originators license application, I get an email from a Wisconsin mortgage regulations investigator telling me that I cannot qualify for a Wisconsin mortgage loan originators license.

Why Is My Credit Score Low

Lower credit scores arent always the result of late payments, bankruptcy, or other negative notations on a consumers credit file. Having little to no credit history can also result in a low score.

This can happen even if you had established credit in the past if your credit report shows no activity for a long stretch of time, items may fall off your report. Credit scores must have some type of activity as noted by a creditor within the past six months.If a creditor stops updating an old account that you dont use, it will disappear from your credit report and leave FICO and or VantageScore with too little information to calculate a score.

Similarly, consumers new to credit must be aware that they will have no established credit history for FICO or VantageScore to appraise, resulting in a low score. Despite not making any mistakes, you are still considered a risky borrower because the credit bureaus dont know enough about you.

Read Also: Does Snap Finance Report To Credit Bureau

What Is A Good Credit Score In California

Some cards offer more than a year of 0% apr and have incentives for transferring balances from other cards. Whether your number is low or high, these simple steps and tips from experts can increase your score. In fact, in an environment with historically low interest rates, creditors are at a disadvantage and debtors are at an advantage. When interest rates are low, financing your business or personal expenditures on credit becomes much cheaper.

Whether your number is low or high, these simple steps and tips from experts can increase your score. Beyond knowing that it relates to your credit cards and student loans, you might not fully understand what this term i. Here are some tips to get you started. There are a few easy ways to check your own credit score online.

Fixing a low credit score is vital to restoring your go. Many of the offers appearing on this. A low score can prevent you from buying a car, obtaining a mortgage or even getting a job. As soon as you enter the wonderful world of being an adult, you’re likely to start hearing a lot about your credit score.

Use our easy tool kit to learn how you can improve your credit score and get good credit. Fixing a low credit score is vital to restoring your go. Beyond knowing that it relates to your credit cards and student loans, you might not fully understand what this term i. As soon as you enter the wonderful world of being an adult, you’re likely to start hearing a lot about your credit score.

Why Having A Good Credit Score Is Important

In general, having good credit can make achieving your financial and personal goals easier. It could be the difference between qualifying or being denied for an important loan, such as a home mortgage or car loan. And, it can directly impact how much you’ll have to pay in interest or fees if you’re approved.

For example, the difference between taking out a 30-year, fixed-rate $250,000 mortgage with a 670 FICO® Score and a 720 FICO® Score could be $72 a month. That’s extra money you could be putting toward your savings or other financial goals. Over the lifetime of the loan, having a good score could save you $26,071 in interest payments.

Additionally, credit scores can impact non-lending decisions, such as whether a landlord will agree to rent you an apartment.

Your credit reports can also impact you in other ways. Some employers may review your credit reports before making a hiring or promotion decision. And, in most states, insurance companies may use credit-based insurance scores to help determine your premiums for auto, home and life insurance.

Recommended Reading: What Credit Card Is Syncb Ppc

Despite Scores Differing Heavily No State Falls Below A ‘good’ Rating

Ward Williams is an Associate Editor with over four years of professional editing, proofreading, and writing experience. Ward is also an expert on government and policy as well as company profiles. He received his B.A. in English from North Carolina State University and his M.S. in publishing from New York University.

Economic conditions can vary widely among states. It’s difficult to get a complete picture of a given area without taking all the key factors into consideration. In the case of credit scores, knowing the average can help residents of a state see how they compare to their neighborsand make it simpler for those considering a move to that state to learn more about how they’d fit in economically. It can also be a factor in assessing business opportunities within a state.

How Your Credit Score Impacts Your Loan Interest Rates

Now letâs talk about what your credit score actually means for you. Letâs start with how your credit score impacts your personal loan rates.

When applying for a loan, the first lender step is to check your credit score.

While many other variables are considered, your credit score plays an important role in determining the loan terms, and most importantly, the cost of borrowing.

The below table shows the average interested rate people should expect based on their credit score.

| Bad | 15% â 35.99% |

At the end of the scale, borrowers with too low credit scores often face diminishing prospects when obtaining a personal loan. As a result, they get payday loans, which average at 400%, and auto title loans, which average 300%.

Tips from us! Avoid payday loans and auto title loans. On our site, you will find many alternative options, even if you are with bad credit.

In addition to these high values of APR that we show, consumer studies also show:

- Roughly 20% of people who get auto title loans end up losing their car.

- The average American debt cycle is 200 days.

Don’t Miss: Paypal Credit Reporting To Credit Bureaus

But What Is A Credit Score Exactly

Definition:Credit scores are three-digit numbers that represent how a person has in the past borrowed money and paid it back. Such figures are determined on the basis of details contained inside credit reports of an individual. There are different kinds of models for scoring. The FICO credit score ranges from 300 to 850. The better the higher.

If in the past you were responsible for your borrowing you should have a strong ranking. It would boost the odds of securing a loan. At the other hand, former credit-problem lenders appear to have lower ratings.

Such three-digit numbers help mortgage lenders understand the probability of an individual paying back a loan obligation. These are used to determine the possible risk faced by lending money to a particular borrower and to prevent or minimize losses due to the default of the borrower.

What Is A Good Credit Score

For a score with a range between 300 and 850, a credit score of 700 or above is generally considered good. A score of 800 or above on the same range is considered to be excellent. Most consumers have credit scores that fall between 600 and 750. In 2020, the average FICO® Score in the U.S. reached 710an increase of seven points from the previous year. Higher scores can make creditors more confident that you will repay your future debts as agreed. But creditors may also set their own definitions for what they consider to be good or bad credit scores when evaluating consumers for loans and credit cards.

In part, this depends on the types of borrowers they want to attract. Creditors may also take into account how current events could impact consumers’ credit scores, and adjust their requirements accordingly. Some lenders create their own custom credit scoring programs, but the two most commonly used credit scoring models are the ones developed by FICO® and VantageScore®.

You May Like: Report A Death To Credit Bureaus

Do You Need A Real Estate Agency That Specializes In Residential Sales

Sexton Group Real Estate Property Management in Berkeley, California is a boutique real estate company specializing in residential sales as well as property management services for properties throughout the San Francisco Bay Area. We have 2 offices to serve you, one in the heart of Berkeley and the other in the heart of Lafayette, California. The Sexton Group encompasses the essence of Berkeleys charm and Lafayettes family-oriented vibe all with a relaxed, down-to-earth nature. We are an amazing group of agents whose wealth of experience spans more than 25 years in the industry. Looking to buy or sell a home in Contra Costa or Alameda County? Contact us today for your free consultation!

Uncertainty Of Getting My Nmls License Approved

Here I was, studying for the national NMLS exam for the next four weeks, investing more than 10 hours per day, 7 days a week with the uncertainty of not knowing whether I will ever get my license. I Googled search every day on the internet looking for answers on whether you can become a loan officer with bad credit and got conflicting answers. I must have contacted over three dozen states. I talked to their mortgage licensing division and got the same answer that they could not give me the answer to my question. The only thing that I can do is just pass the NMLS exam and apply for my mortgage loan originators license and that is the only way that I can find out.

Read Also: Creditwise Dispute

Whats The Minimum Credit Score You Need By Mortgage Loan Type

Before we dive into the average credit scores for recent homebuyers, you may be wondering what the minimum credit score is for a mortgage in 2020. The answer is that it depends on the type of mortgage.

Below is a breakdown of the minimum FICO ®scores typically required, based on type of mortgage loan Federal Housing Administration loans , U.S. Department of Veterans Affairs loans, or conventional loans through a private lender that are insured through Freddie Mac or Fannie Mae.

| Type of mortgage loan | |

|---|---|

| VA loan | No minimum credit score |

Note that the minimum scores listed above are for FICO credit scores, specifically this is the scoring model mortgage lenders typically turn to when considering applications.

Average Credit Score By Age

Millennials have an average credit score of 680, while baby boomers have an average credit score of 736.

The average FICO Score tends to improve with age.

The average credit scores coincide with the financial situations facing younger generations. Its usually around the millennial age range that major expenses and debt begin to rack up such as weddings and first mortgages, among others. Despite their ages, millennials hold an average of $4,322 in .

The other age group whose average credit score skews lower is Generation Z . A contributing factor to this is the limited access to credit this age group faces. Following the 2009 CARD Act, it became significantly harder for 18- to 21-year-olds to open new credit card accounts. As a result, many young adults dont begin building a credit file until later in life driving averages down.

Americans of all ages owe debt. In fact, U.S. household debt spiked to $14.35 trillion in the third quarter of 2020 the latest available data amid the coronavirus pandemic, according to the Federal Reserve Bank of New York. And that debt is growing while more people remain out of work. The federal unemployment rate was 3.5% in February 2020 before spiking to 14.8% in April 2020.

Also Check: When Does Usaa Report To Credit Bureaus

Why Your Credit Score Changed

Your credit score can change for many reasons, and it’s not uncommon for scores to move up or down throughout the month as new information gets added to your credit reports.

You may be able to point to a specific event that leads to a score change. For example, a late payment or new collection account will likely lower your credit score. Conversely, paying down a high credit card balance and lowering your utilization rate may increase your score.

But some actions might have an impact on your credit scores that you didn’t expect. Paying off a loan, for example, might lead to a drop in your scores, even though it’s a positive action in terms of responsible money management. This could be because it was the only open installment account you had on your credit report or the only loan with a low balance. After paying off the loan, you may be left without a mix of open installment and revolving accounts, or with only high-balance loans.

Perhaps you decide to stop using your credit cards after paying off the balances. Avoiding debt is a good idea, but lack of activity in your accounts could lead to a lower score. You may want to use a card for a small monthly subscription and then pay off the balance in full each month to maintain your account’s activity and build its on-time payment history.

Learn More About Your Credit Score

A 705 FICO® Score is Good, but by raising your score into the Very Good range, you could qualify for lower interest rates and better borrowing terms. A great way to get started is to get your free credit report from Experian and check your credit score to find out the specific factors that impact your score the most. Read more about score ranges and what a good credit score is.

Also Check: Unlock Your Experian Credit Report