What Does Writing Off Debt Mean

When a creditor writes off a debt, it means they agree not to pursue you for payment. Each creditor follows their own guidelines, but they usually only write off debts in exceptional circumstances where there is very little chance of getting their money back in full. For example, if you are facing a long-term illness , are permanently unable to work, or the debt agreement is invalid or fraudulent.

To Answer That Question Lets Look At The Science

Shopify, a company that helps retailers sell online, recently reported 21% of users would abandon checking out online if the process took too long.

The more time we have, the more likely we are to reconsider or change our minds entirely. Its why companies like Amazon have introduced features like one-click pay.

Its also why buy now, pay later options are popping up and tackling one of the biggest drawbacks of online shopping, for retailers and customers alike not being able to try before you buy.

How Do Debt Management Plans Work

An alternative to a debt relief program is a Debt Management Plan . Credit counseling companies such as credit.org offer Debt Management Plans to borrowers who are struggling to make multiple or high monthly payments.

Unlike many third parties, credit.org works directly with every client to determine the best ways to handle every financial situation. If you qualify for a DMP, a debt coach will negotiate with creditors on your behalf to help get you lower interest rates and monthly payments.

When you agree to take part in a debt management program, you also agree close all of your current credit accounts. A notation is made on your credit history to indicate to lenders that you are on a DMP and cannot have any new lines of credit. This notation is removed once you complete or exit your DMP.

Don’t Miss: What Credit Bureau Does Affirm Use

If You’ve Got Debt Problems But Are Not In A Debt Crisis

Don’t visit a debt counselling agency. Not just because they’re heavily oversubscribed especially during these unprecedented times and should be left to those in urgent need, but more importantly, the solution they use isnt for you.

Debt counselling involves negotiating with creditors and even bankruptcy, individual voluntary arrangements or debt relief orders . These are serious measures, designed for those with limited alternatives, in effect drawing a line and saying “this person is no longer within the system”. The result is the debilitation of your credit score and less access to financial and some consumer products. Instead, there are a couple of sources of help:

-

Take time to go through the checklist. The debt help checklist below is designed to take you through every single way to take on your debts, cut the costs, and speedily pay them back. So take some time and go through each to check whether it applies to you.

-

Help and support from those in the same boat. Want help, or want to talk about it? There are many people in the Debt-Free Wannabe forum in a similar boat, all supporting and helping each other reach what they call their “debt-free day” after going through the checklist. This is an amazing resource.

Deal With Problem Debts

If you can’t cut the cost of the debts, or if after doing that you’re still struggling, it’s time to consider some more severe measures.

- Talk to your lender. It’s very important to get on top of debts as soon as possible. Don’t default or miss payments. It’s always better to let your lender know if you’re going to be unable to pay. Of course, preventative measures such as reducing interest, expenditure and being a smart consumer are the best form of action. If you’ve received a letter asking you to pay more on your credit card, have a look at our Persistent debt guide for specific help.

- Is a debt management plan right for you? A debt management plan is an agreement between you and your creditors to pay your debts. You make regular payments to a licensed debt management company, the company then shares this money out between your creditors. This is one the least serious of the debt solutions options, as it’s the only one that doesn’t go through the courts. DMPs rely on you having spare cash to repay your creditors, and for them to accept they’ll get their money over a longer period than set out in your credit agreement. For full information, see the Debt solutions guide.

Read Also: Does Self Lender Do A Hard Inquiry

Is It Worth Shifting My Debt To My Mortgage

An obvious idea is to shift credit card and other loan debts onto your mortgage if it’s cheaper. On the surface this looks like a no-brainer. The debt is cheap, and as it’s over a long time the amount you pay each month will be lower.

But it’s not quite that simple. Technically you are shifting unsecured debt to secured debt, so there’s an increased risk of losing your home if you can’t repay. We explain this fully in our Remortgage guide.

Plus it may increase your life assurance and other associated mortgage costs, and it may not actually be cheaper. Repaying over a longer period means you end up paying more interest for example, 5% over 20 years is much more expensive than 10% over five years. Affordability checks have also made it more difficult to increase mortgage debt, so this may not be an option for you.

Don’t be totally put off though. If the other routes above haven’t worked, it’s still worth considering. Do the numbers especially if you’ve a flexible mortgage so you can pay off the debts quicker.

What If A Creditor Refuses To Write Off My Debt

If a creditor refuses to write off your debt, we suggest you go back to them to see what else they can do to help.

As mentioned above, you could see if theyâll accept a payment holiday, a reduced payment plan, or ask if theyâll freeze interest and charges for a set period. But remember, paying less than the agreed amount each month may impact your credit score – unless the creditor agrees otherwise. Organisations like Citizens Advice or StepChange can give you free, non-judgemental advice, and help find the best solution for you.

Also Check: Experian.com Viewreport

How Do I Enroll In A Debt Management Plan

Online research is the easiest place to find companies that do DMPs. It is suggested that you look for National Foundation for Credit Counseling approved non-profit agency. Credit counselors at NFCC approved agencies must be trained, certified and adhere to strict quality standards in developing debt payment plans.

What Is The Process For Setting Up A Debt Management Plan

Generally speaking, youâll need to:

- Manage your priority debts Since DMPs cover non-priority debt, youâll need to handle your priority debts first. These include things like your mortgage, rent, council tax, income tax, National Insurance, court fines and TV licences.

- strong> If youâd like to get impartial advice, you can contact organisations like National Debtline andStepChange.

- Bear in mind that paying for a company to help you with your DMP will add to your outgoings.

- Figure out your budget Itâs important that you know how youâll be able to make repayments on a DMP. A debt management company can help you with the budgeting.

- Choose a debt management company Select and contact a debt management company to speak to about your circumstances.

Read Also: Does Marriage Affect Credit

Can I Improve My Credit Rating While Im On A Dmp

Ive been asked in the past whether you should try and improve your credit rating while on a DMP, so youll be more creditworthy once the DMP is complete. My honest opinion is that its not worth stressing yourself out over.

When it comes to repairing your credit file through your DMP, consistency and transparency are your best friends. So:

- Do your best to stay on top of your DMP payments. This shows that youre committed to your plan. If youre going to struggle, let your DMP provider know as soon as possible. This is always preferable to missing your payment altogether without any explanation why

- Review your budget at least once a year, or whenever you have a change in circumstances. This proves to your creditors that youre paying as much as you can afford towards your debt

If you do these two things, youll eventually start to look like a more attractive prospect to future lenders.

And a major benefit of being debt free is that youll feel better in yourself as well.

What Is Your Credit Rating

When you apply for a loan or other type of credit, the lender has to decide whether or not to lend to you. Creditors use different things to help them decide whether or not you are a good risk, including a credit rating they work out from your .

Your credit reference file is held by the three credit reference agencies and contains information about you, including how you’ve managed existing bank accounts and credit commitments, whether you’ve ever had your home repossessed and people you’re financially linked to. When you apply for credit, the credit provider will search your credit reference file to see how much of a risk it is to lend to you.

Recommended Reading: How To Get Repos Off Your Credit

Is A Dmp Better Than An Individual Voluntary Arrangement

An individual voluntary agreement can help you pay off your debts by combining them into one monthly payment, usually over a period of five or six years. You can also have the option of making a one-off payment, known as a lump sum IVA.

But IVAs are different from DMPs as they are a legally binding agreement between you and your creditors.

You can only get an IVA through an Insolvency Practitioner . Theyâll examine your situation and make arrangements with your creditors, and then oversee the IVA once itâs set up. But this comes at a cost â an Insolvency Practitionerâs fees can be £5,000 or more. Partly because of these fees, IVAs are only normally used in cases where the debt is at least £10,000.

For more details, see our guide to IVAs. If youâre unsure whether an IVA is right for you, you can get free advice and support from professional debt charities.

How F& f Settlements Affect Credit Ratings

A reader has asked how Full & Final settlements would affect her credit rating which is currently looking good as her debts were all defaulted and have dropped off her credit record.

A full and final settlement happens when the creditors agrees to accept an amount which is less that the total owed to settle a debt, and agrees that the debtor will not be pursued for the remainder. For more details, see this Guide to Full & Final settlements.

This article looks at how F& Fs are shown on a credit record in the two different situations:

- where the debts are still showing on your credit record, and

- where the debts have already disappeared.

Lenders often say that a partial settlement will be very bad for your credit record but often it wont be! So its good to know all the details.

Read Also: What Credit Bureau Does Comenity Bank Use

My Circumstances Arent That Bad

Although we speak to people that realise they need debt help, our advice is not always welcome. During our last debtday tweetathon, 20% of the clients advised that day were recommended some form of insolvency .

This can be a great shock for someone that didnt realise that this would be an option for them. Frequently, the primary reason for not wanting to accept a debt solution is because of the adverse affect that it has on their credit rating.

Although a formal solution like bankruptcy will stay on your credit file for six years the health of your credit file isnt reason enough to avoid it when its recommended as the best solution.

Even if the main reason for saving a credit file from bankruptcy is to secure a mortgage , the first step in buying a house is to save for a deposit and thats not an option while debts still exist.

There are obvious positives for having a positive credit rating, but the overriding priority should always be to concentrate your debts first.

What Services Can You Avail Through Payplan

You could get advice on any type of debtthrough PayPlan. Moreover, your financial situation and the advice given remains strictly confidential between you and the advisor.

Moreover, you will be able to track your debt solution through online processings. This could reduce the amount of calls you get from your creditors.

If you are self employed, Payplan could help with other debt solutions including: Debt Management Plan and an Individual Voluntary Arrangement .

Furthermore, PayPlan could help you if you apply for a Debt Arrangement Scheme or for Sequestration.

You May Like: Mprcc On Credit Report

Dmp Alternatives And Credit Reports

Would any of the alternatives to a DMP have been better from the credit rating point of view? Debt Relief Orders, IVAs and Bankruptcy are forms of insolvency and all have the same effect on your credit rating: a notice is placed on your credit record and all debts that havent previously defaulted will have a default date of the start of your insolvency, dropping off after six years. After the defaults have dropped off, most people who have chosen one of these three options then struggle to rebuild their credit record for several years, often finding it difficult to open bank accounts and having to get bad-credit cards such as Vanquis to try to rebuild a good credit rating.

Going for one of these insolvency options would not have been a sensible alternative to the temporary DMP in scenario . One of three would almost certainly have been better than the long DMP in scenario , although here the credit rating problem is just a minor side-effect of being stuck with unmanageable debt for far too long.

The interesting case is where the DMP lasted 4 years but the footprint remains on the credit file for a further 6 years is this ageing trace of a DMP more or less damaging than having gone insolvent? I think most people would say that the DMP is preferable from the credit rating point of view.

What Is A Debt Management Plan

A debt management plan is a type of repayment plan that’s set up and managed by a credit counseling agency. Many credit counseling agencies are nonprofit organizations that offer education and assistance to help people better manage their finances.

When you work with a credit counseling agency, you’ll meet with a counselor who will review your financial situation and help you understand your options. If a DMP is a good fit, the counselor can negotiate with your creditors on your behalf to create new payment plans.

As part of the negotiation, creditors may waive fees and lower the interest rate on your accounts if you agree to repay the debt through a DMP. With many DMPs, the goal is to have your debts fully repaid within three to five years, which is easier to do when less interest accrues each month.

Once you start the DMP, you’ll make a single monthly payment to the counseling agency, which will then distribute the money to your creditors. The agency may also charge you a small monthly fee for the service, but your interest savings could more than cover the cost.

Generally, DMPs are only available on accounts that aren’t backed by collateral, such as credit cards. And while you may be able to pick and choose which accounts you want to include in your DMP, you’ll need to close all the credit cards that are part of the DMP.

Recommended Reading: Removing Repossession From Credit Report

Debt Management Program Pros And Cons

| Doesnt directly impact credit | Will not be able to get new credit |

| Provides debt solution without direct impact to credit score | Affects the length of credit history |

| Consistent monthly payments improve credit score | All credit account will be closed |

| Amount of debt will be significantly reduced | |

| Debt is paid off significantly faster |

Enrollment in a debt management plan doesnt affect ones credit score. However, certain facets of the program timely payments, closing accounts, smaller amounts owed, and changes in utilization rate may impact ones score in both negative and positive ways.

Ultimately, clients who graduate from our Debt Management Plan have little trouble securing new credit and loans. If youre ready to take control of your financial freedom, contact our expert debt coaches today.

Why A Dmps Credit Score Impact Can Be Positive Or Negative

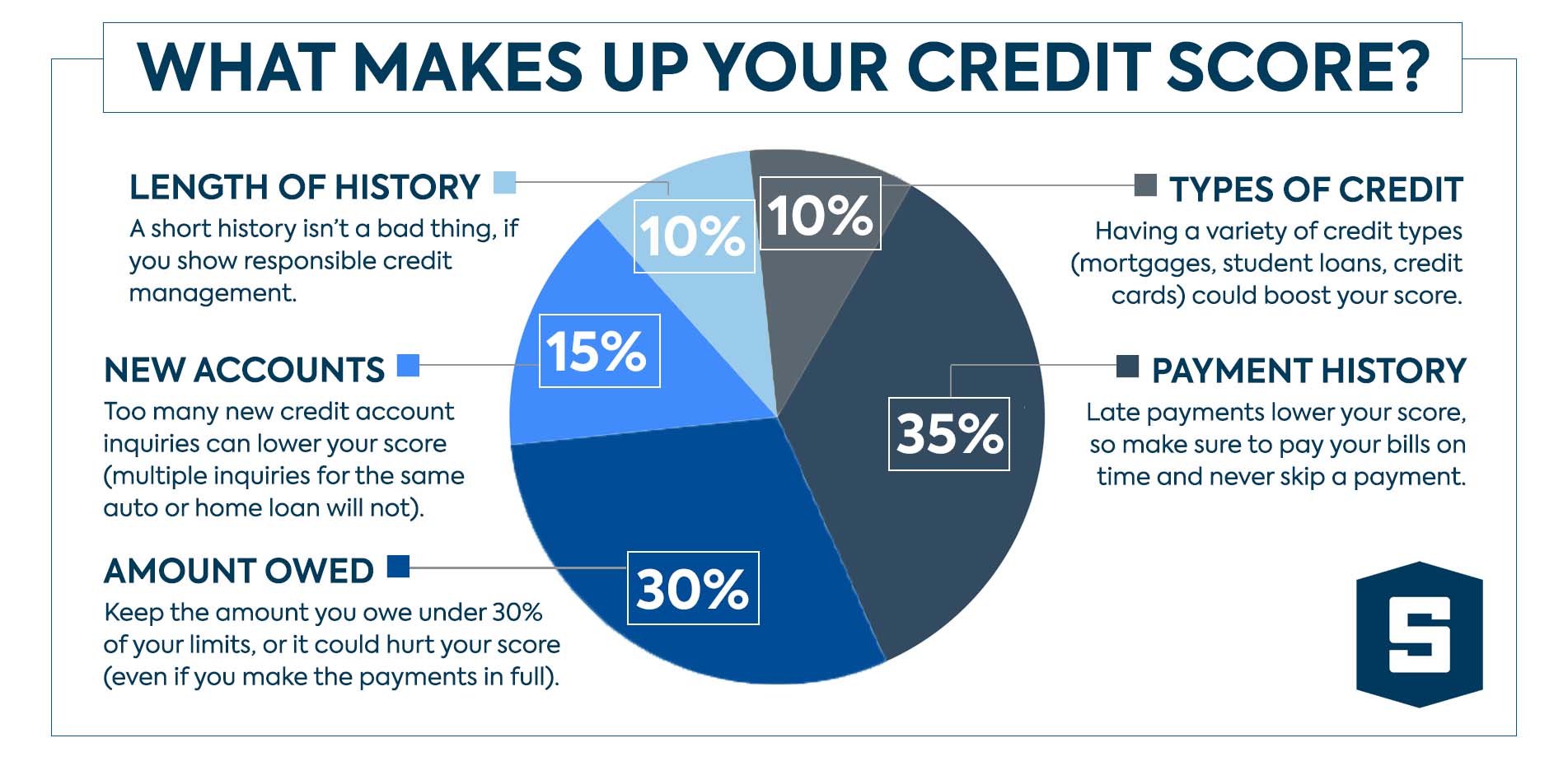

There are five factors used to calculate credit scores, including FICO and VantageScore. Each factor has a different weight for how much in impacts your final score.

- Account history 35%

- New applications 10%

A debt management plan has positive effects on some factors, particularly the biggest factor. The program helps you build a positive payment history on each account you include.

At the same time, the program has some negative effects on other factors, but mostly minor ones. The biggest negative impact comes from having to close your accounts. However, since the factors that effects dont carry as much weight, the negatives can often be outweighed by the positives.

If your score is low when you start a debt management plan, the program will usually have a positive impact.

On the other hand, if your score is extremely high when you start the program, then you may see your score drop slightly when you complete the program. In this case, you may want to consider other options, such as a debt consolidation loan.

Assess your debt and options for relief with a trained specialist.

Read Also: Wipe Your Credit Clean