How Do I Get A Copy Of My Credit Reports

You are entitled to a free credit report every 12 months from each of the three major consumer reporting companies . You can request a copy from AnnualCreditReport.com.

You can request and review your free report through one of the following ways:

- Mail: Download and complete the Annual Credit Report Request form. Mail the completed form to:

Annual Credit Report Request ServiceP.O. Box 105281Atlanta, GA 30348-5281

You can request all three reports at once or you can order one report at a time. By requesting the reports separately you can monitor your credit report throughout the year. Once youve received your annual free credit report, you can still request additional reports. By law, a credit reporting company can charge no more than $13.50 for a credit report.

You are also eligible for reports fromspecialty consumer reporting companies. We put together a list of several of these companies so you can see which ones might be important to you. You have to request the reports individually from each of these companies. Many of the companies in this list will provide a report for free every 12 months. Other companies may charge you a fee for your report.

You can get additional free reports if any of the following apply to you:

Fix Mistakes In Your Credit Report

When you get your credit report, check that:

- all the loans and debts listed are yours

- details such as your name and date of birth are correct

If something is wrong or out of date, contact the credit reporting agency and ask them to fix it. This is a free service.

Some companies may try to charge you to get all negative information removed from your credit report. The only thing they can ask the credit reporting agency to remove is wrong information. And you can do that yourself for free see .

If there are loans or debts in your report that you know nothing about, it could mean someone has stolen your identity. See identity theft for what to do.

Why Should I Check My Credit Report

Your credit report has information that can affect whether you’re approved for a loan or credit card and the amount you’ll be approved for. Getting a copy of your credit report is valuable to:

- Make sure the information is accurate, complete and updated before applying for a line of credit

- Help protect yourself from identity theft

You May Like: What Is The Fico Credit Score Range

What Can Lenders See On Your Credit Report

Your creditreport provides a detailed summary of your credit history. It includes your personal information and lists details on your past and current credit accounts. It also documents each time you or a lender requests your credit report, as well as instances where your accounts have been passed on to a collection agency. Financial issues that are part of the public record, such as bankruptcies and foreclosures, are included, too.

Successfully Answer Security Questions

For each report request, youll be asked a few questions about your finances that presumably only you can answer for instance, the approximate amount of your mortgage payment or who holds your auto loan and when you took it out.

Some consumers have reported difficulty using the site, particularly answering security questions about accounts that are several years old. If you cant recall those details, you can request your reports by mail or phone this process doesnt require security questions.

Recommended Reading: How To Unfreeze My Credit Report

Through December 2022 Everyone In The Us Can Get A Free Credit Report Each Week From All Three National Credit Bureaus

Also, everyone in the U.S. can get six free credit reports per year through 2026 by visiting the Equifax website or by calling 866-349-5191. Thats in addition to the one free Equifax report you can get by visiting the Annual Credit Report website.

To maximize your protection from fraudulent activity, order one report from a different company every fourth month.

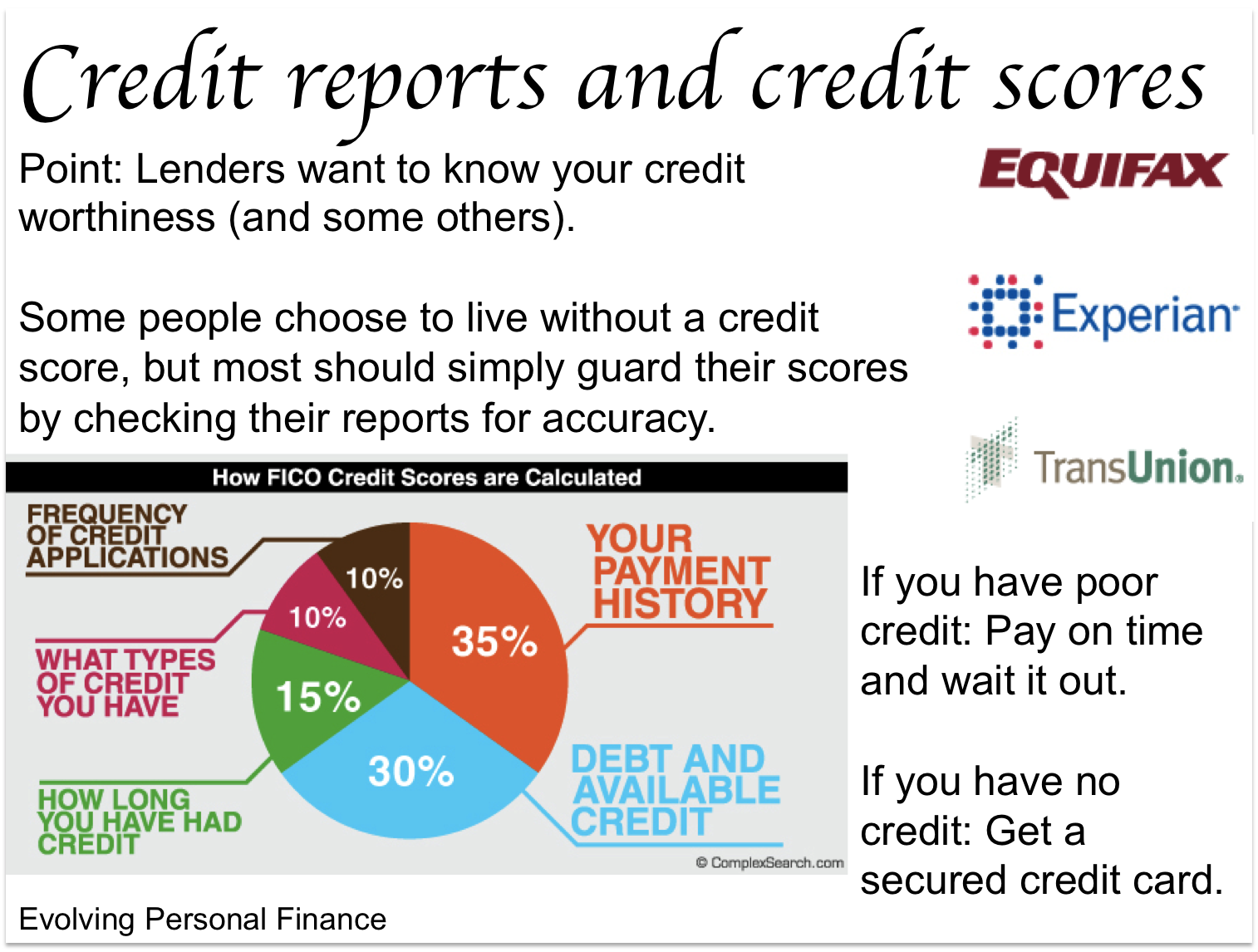

It is important to check all three reports because not all businesses report to all three credit reporting companies thus, the information on your reports may vary. It is also important not to confuse your credit score with your credit report. Your credit report and your credit score are not the same thing.

Your credit report contains information that a credit reporting company has received about you. Your credit score is calculated by plugging the information in your credit report into a credit score formula. You may have multiple credit scores based upon who provided the score, and whether the company providing the score used their own scoring model or used a model available from a third party.

Federal law gives you the right to ask for a copy of your credit report from each nationwide credit reporting company every year for free. However, the law does not require the credit reporting companies to provide a free credit score.

How To Get Your Free Credit Reports From The Major Credit Bureaus

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

Federal law gives you free access to your credit reports from the three major credit bureaus: Equifax, Experian and TransUnion. Using the government-mandated AnnualCreditReport.com website is the quickest way to get them, but you can also request them by phone or mail. Until the end of the year, those reports which had been limited to once a year are available weekly to help consumers manage their finances.

Your credit reports are a detailed record of your past use of credit but they do not include your credit score. NerdWallet offers a free credit score and report, updated weekly using TransUnion data. Checking your score does not damage your credit.

Heres how to use AnnualCreditReport.com.

Read Also: How To Remove Late Payments From Credit Report Uk

Read Your Reports And Fix Errors

-

Accounts that arent yours or you didnt authorize.

-

Incorrect, negative information.

-

Negative information thats too old to be included. Most negative information, other than one type of bankruptcy, should be excluded after seven years.

These errors have the potential to hurt your credit score, says Chi Chi Wu, a staff attorney with the National Consumer Law Center. You might see other types of errors, such as out-of-date employment information, she says, but those arent factored into your score.

If you find errors, dispute them. The credit bureaus will investigate and must remove information that they cant verify.

Using Annual Credit Report

Overall the process pretty intuitive, however as you navigate through each of the credit agencies, you are presented with upsell links to purchase either your credit score or credit monitoring. As we go through the sites, we will highlight areas which attempt to sell you to these services.

Prior to starting this process, we highly recommend having a PDF printer on your system so you can save a copy of your credit reports for your records. If you do not already have one installed, follow our guide for installing a PDF printer first.

When you go to AnnualCreditReport.com, select the state where you current live and click Request Report.

You will need to provide some personal information so fill out the form and click Continue. For your convenience, this information will be automatically sent to each credit agency which you request a report from so you dont have to retype it.

When prompted for credit bureaus, select all three and click Next.

Before visiting the first selection, you will be prompted with a notice of how to navigate back to AnnualCreditReport.com from within the credit agencys site. Click Next to get your first credit report.

TransUnion

When you visit TransUnion, the information you see along the bottom in the Information You Have Provided section should mimic what you first entered in AnnualCreditReport.com. Verify this is correct and click Continue.

Once you have saved your credit report, click the Return to AnnualCreditReport.com link across the top.

Also Check: Will A Sim Only Contract Improve Credit Rating

Does Checking My Credit Report Hurt My Credit Score

Checking your credit report is a soft credit check so it doesn’t affect your credit score. A soft credit check occurs when you check your own credit report or a creditor or lender checks your credit for pre-approval. A hard credit check occurs when a company checks your report when you apply for a line of credit.

Annualcreditreport.com is the only website legally authorized to fill orders for your free annual credit report. Any other website claiming to offer free credit reports” could be falsely claiming to be part of the free annual credit report program. Be mindful of websites trying to trick you with subtle differences.

Errors On Your Credit Report

If you find errors on your credit report, write a letter disputing the error and include any supporting documentation. Then, send it to:

Find a sample dispute letter and get detailed instructions on how to report errors.

The credit reporting agency and the information provider are liable for correcting your credit report. This includes any inaccuracies or incomplete information. The responsibility to fix any errors falls under the Fair Credit Reporting Act.

If your written dispute does not get the error fixed, you can file a complaint with the Consumer Financial Protection Bureau .

You May Like: How To Remove Freeze Off Credit Report

The 6 Best Free Credit Reports Of 2022

- Best for Credit Monitoring:

- Best for Single Bureau Access:

- Best for Improving Credit:

- Best for Daily Updates: WalletHub

AnnualCreditReport.com makes it simple to review your Equifax, Experian, and TransUnion credit reports all in one place.

-

Reports from three major bureaus available

-

No account requirement

-

Only accessible once a year

-

No credit score access

In 2003, a Federal law passed granting every consumer the right to a free report from all credit reporting agencies each year. AnnualCreditReport.com is the centralized site that allows every consumer to access their free credit report granted by Federal law.

The Consumer Financial Protection Bureau confirms that AnnualCreditReport.com is the official website that allows you to access each of your credit reports from all three of the major credit bureaus Equifax, Experian, and TransUnion at no cost. You can obtain one free credit report every 12 months through AnnualCreditReport.com, without signing up, creating an account, or entering your credit card information. Alternatively, you can call 1-877-322-8228 to order your legally free credit report.

What Can Help Your Credit Score

| Your credit report is a summary of all of your credit history over time. | Your credit score is a formula used by bureaus to determine how creditworthy you are. | |

| Where can you get it? | You can get your report with Credit Sesame or with a major credit bureau. | You can get your credit score from Credit Sesame or other places such as myFico. |

| What kind of information does it show? |

|

|

| Who uses which? | Your creditor will typically do a hard credit inquiry to see if there is risk to giving you credit. | Your utility or phone company will do a soft credit inquiry before making a decision if you have to make a downpayment or not. |

You May Like: What Credit Score Do You Need For Best Buy

How Your Credit Score Is Calculated

Your credit score is calculated based on what’s in your credit report. For example:

- the amount of money youve borrowed

- the number of credit applications youve made

- whether you pay on time

Depending on the credit reporting agency, your score will be between zero and either 1,000 or 1,200.

A higher score means the lender will consider you less risky. This could mean getting a better deal and saving money.

A lower score will affect your ability to get a loan or credit. See how to improve your credit score.

Get The Latest Personal Finance News Sent Straight To Your Inbox

Well send you top stories and timely tips every Tuesday and Thursday.

A credit report shows your credit history and the status of the accounts you have open. A credit score boils all of the information down into a three-digit score. The higher your score, the more likely that you’d pay back a loan.

Before you try borrowing money, applying for a job or renting an apartment, you’ll want to get your hands on your credit reports and scores to see what the decision-makers will see. Here’s how to do that for free.

Read Also: Does Aarons Report To Credit

Do I Have To Pay For My Credit Report

It depends. There are many free credit report resources available, but there are several that also charge fees. With so many free resources available, there really isn’t any need to pay for your credit report. Just make sure you access your credit report through a verified site, such as those listed in this guide and sites that start with “https.”

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Read Also: What’s My Credit Score

Why You Should Have Credit Monitoring

While there is plenty to love about getting a credit report and score, most people would actually benefit far more from a .

These services include continuous credit monitoring and credit alerts when there is suspicious activity on your credit account. This means that if fraud or errors happen, you can catch it early and take steps to protect yourself before the issue becomes costly.

You can also dispute errors on your credit report. Basically, the more you pay attention to your credit, the easier it is to improve your score.

Checking your credit score and the contents of your credit reports is important in understanding your financial options.

Sponsored

What Is Credit Monitoring

Canadas credit bureaus, as well as many credit card issuers and financial institutions, offer credit monitoring services. These services provide you with a notification after certain updates to your credit file, such as a credit inquiry.

You could consider using this service if you think youve been the victim of fraud or if you have been affected by a data breach. This can help you see if somebody is trying to apply for credit in your name.

You usually need to pay for these services.

Also Check: Will Paying Off Closed Accounts Help Credit Score

*warnings When Ordering Online:

Misspelling the annualcreditreport.com site or using another site with similar words will take you to a site that will try to sell you something or collect your personal information. Even one mistyped letter could take you to a fraudulent website that looks and feels like a place to order credit reports but in fact has been set up by ID thieves to steal your information. Other sites with similar names exist and may try to sell you credit monitoring services.

Remember, only one website is authorized to fill orders for the free annual credit report you are entitled to under lawannualcreditreport.com. Other websites that claim to offer free credit report,, free credit scores, or free credit monitoring are not part of the legally mandated free annual credit report program.

Beware of emails, banner ads, pop-up ads, and telemarketing calls that promise to obtain your free annual credit report on your behalf. In particular, beware of email messages or internet ads claiming to be from annualcreditreport.com.

Also beware of any free offers for your credit score. One wrong click on an enticing ad for a free look at your credit score may have you signed up for costly or unnecessary credit monitoring or sharing your personal information with a thief.

Annualcreditreport.com will not send you an email asking for your personal information do not reply or click on any link in the message. Its likely a scam, leading to potential ID theft. Forward scam emails to the FTC .

The Importance Of Knowing Your Score

As we mentioned above, you shouldn’t go through life without knowing your credit score. This number is updated regularly. It goes up or down usually every month, but it may even be changed more frequently based on who’s reporting.

Knowing your score means you’re more likely to make better decisions about your finances. Having a lower score may make you more cautious about applying for new credit as there’s a good chance you’ll be denied. If you have a lot of inquiries and very few accounts, your score drops, and lenders may refuse to grant you a new account. On the other hand, knowing you have a higher credit score makes you a more attractive applicant to .

Keep in mind that checking your credit score isn’t the same as checking your . Your credit report provides a detailed history of your financial life, including any accounts you have, how often you’ve paid them on time, any delinquencies, bankruptcy reports, flags and messages, write-offs, and inquiries. The report also includes the dates of any changes to your credit history. You can use this history to account for and report any discrepancies.

You can start by going to the three major credit bureaus, Equifax, Experian, and TransUnion first by logging on to AnnualCreditReport.com to check your report for free. Each agency gives you access to your report once every 12 months. You’ll have to pay them if you want your credit score. But why pay when you can get your score for free?

You May Like: Which Of The Following Most Impacts Your Credit Score