Hard Vs Soft Credit Inquiries

Hard inquiries are the only type of credit pull that can affect your credit score, and they’re the only ones that businesses will see on your credit report. Credit inquiries that don’t affect your score and don’t appear on your report are called soft pulls. Examples of soft inquiries include you checking your own report and a potential employer accessing it during a background check. And credit card issuers may do soft inquiries when they are preparing promotional card offers.

Credit inquiries carried out by insurance companies when you’re seeking quotes for various kinds of policies are considered soft inquiries and do not show up on your credit report.

What If You Dont Recognize A Hard Inquiry On Your Credit Report

Just because you cant recognize a hard inquiry doesnt mean you didnt approve it. Here are some examples of what unfamiliar credit checks might look like:

- If youve ever provided your Social Security number to a business or vendor you might be financing with, they might have assumed you were giving permission to pull your credit.

- Its common for mortgage or auto lenders to disperse your loan/credit application to several lenders. Theyre only trying to help you land a favorable interest rate, but it could appear like multiple credit checks on your report.

- Times when a credit check, like that from applying for a store credit card, might seem unrecognizable on your credit report. While it may not be in error, its always worth contacting your credit bureau if it seems suspicious.

Then there are credit checks that could point to fraud or ID theft. If you feel its on account of your credit or Social Security information being stolen, report it. If and when youve identified erroneous hard credit checks on your credit report, the good news is that you can dispute them with any of the credit bureaus. And, you can take the steps needed to remove them from your credit report.

First You Need To Know The Difference Between Hard And Soft Inquiries

Soft inquiries do not impact your credit score because, most often, soft inquiries have nothing to do with heavy lending and repayment. So there isn’t an inherent heavy risk associated with soft credit checks.

Soft inquiries are categorized by the following events:

- Whenever you check your credit score

- When turning on utilities, companies may run your credit

- Car insurers may run a soft inquiry to determine what premiums are necessary

- It’s also common for credit card companies with whom you already have a credit history to run soft inquiries for the purpose of suggesting and marketing new cards to you, as well as approving new cards.

In comparison, a hard inquiry is also known as a “hard pull” or “hard credit check” because these types of checks occur whenever a person applies for any of the following:

-

Mortgage application

Don’t Miss: 611 Credit Score Mortgage

What Hard Inquiries Can Do To Your Credit Report

According to Credit Karma, you lose some credit score points whenever your lender requests your credit report from the credit bureaus. No matter how strong and positive your credit ratings are, your chances of securing any type of loan, be it mortgage or auto loan, will decrease the moment your lender fishes out your credit report from the credit bureaus. However, if you demonstrate commitment to improving your credit history, this decrease is only short-lived.Hard inquiries are fortunately not long-termed because they only last for up to two years before they disappear from your credit history. Hard inquiries are generally not bad as they may seem to appear because sometimes your credit account may feature hard inquiries since your lender just wants to be sure of the best terms and conditions for granting the new loan you have just applied for. It can be difficult to remove a genuine hard inquiry but if you notice a hard inquiry that you did not authorize you should consider removing it as soon as you can.

Does Removing Hard Inquiries Increase Your Credit Score

Because youâre likely looking at a decrease of not more than five points on your credit score for a hard inquiry, removing it will only have a minimal effect. However, if you have a credit score thatâs hovering near poor or below average, then those five points could be very precious indeed and it would certainly be worth your time to get the hard inquiry removed from your file.

Read Also: Banks And Credit Card Companies Use Credit Scores To Brainly

What Is A Credit Inquiry

When you apply for a new credit card or loan, the lender usually wants to look at a copy of your credit report before it makes a lending decision.

There are three major credit bureaus: Experian, Equifax, and Transunion. The lender will reach out to one or more of these bureaus and ask for a copy of your .

Your credit report includes a numerical credit score as well as information about your interactions with credit and debt. This includes your payment history, the amount of debt you have, and the different credit accounts you have open, such as credit cards, auto loans, personal loans, and your home mortgage.

Your credit report also includes information about your recent applications for credit.

When a lender asks a credit bureau for a copy of your report to use when making a lending decision, the credit bureau makes note of that request. That note is called a hard inquiry and appears on your credit report. Lenders can see hard inquiries on your credit report and each hard inquiry reduces your credit score by a few points.

If you apply for a lot of loans in a short period of time, youll have a lot of hard inquiries on your credit report, which can have a major impact on your score.

Its important to note that credit bureaus only add hard inquiries to your report based on applications for loans or credit cards. Checking your own credit using one of the many services that let you do so does not count as a hard inquiry.

Exceptions To The Impact On Your Credit Scores

If you’re shopping for some types of loans, such as a mortgage loan, multiple inquires for the same purpose within a certain period of time are generally counted as one inquiry. The timeframes may vary, but range from 14 days to 45 days, depending on the credit scoring model being used. All inquiries will show on your credit reports, but generally only one within the specified period of time will impact your credit scores. This exception does not apply to credit cards.

You May Like: Can You Get An Eviction Removed From Your Credit

What To Do When You Suspect Fraud

If you think that because hard inquiries do not significantly affect your credit score, you should leave suspicious entries as they are, think again. Any unauthorized activity on your credit report most likely indicates identity theft or other types of abuse of your personal information. If you presume fraud, act quickly and contact all credit bureaus with your concerns.

Even if someone did not receive a loan in your name, they might be luckier next time. Besides reaching out to credit reporting agencies, additional steps should be taken to prevent further issues:

- A fraud alert on your credit reports will minimize the risk of granting a loan to an unauthorized user in the future. You, and everyone else using your social security number, will be questioned to establish your true identity.

- Federal Trade Commission should be notified about identity theft.

- Do not skip filing a police report.

- In extreme cases, it might be wise to do a credit freeze or credit lock.

Every piece of information on your credit report should be screened for possible fraud, and that includes your personal information and inquiries. Despite having a minimal impact on your credit score, these are vital components that need regular monitoring for possible abuse, misuse, or inaccuracies.

What Is A Hard Credit Inquiry And How Does It Affect

A hard inquiry or a hard credit inquiry is when a lender gets access to your credit report and Credit Score from all three credit bureaus using your Social Security Number. In this scenario, they try to understand your overall eligibility for a loan or credit card. This kind of inquiry affects your loan application or credit approval. A hard inquiry can also affect your credit variable, which might account for 10% of your credit score.

In case you know your credit score and might not have an idea what it signifies, then you can have a quick look at the credit score chart below

Also Check: Aargon Agency Phone Number

Dont Worry About The Rest

Legitimate hard inquiries can ding your credit score, but not by much and not for long. Hard inquiries … represent potential new debt that doesnt yet appear in the credit report as an account, says Rod Griffin, Experians director of public education.

Typically, any impact drops off dramatically after a month or two, Griffin says, either because you did not add the debt, so theres no risk, or you did open an account and its now wrapped into other credit factors.

Some companies say they can remove even legitimate inquiries from your report for a fee but NerdWallet advises against using them. As long as youre not continuing to pile up applications, time will repair any damage to your credit.

Griffin advises keeping perspective because other things influence your credit score more .

Hard inquiries alone will never be the reason a person is declined for credit, he says. Inquiries may be the proverbial straw that broke the camels back, but they will not be the entire bale of hay.

About the author:Bev O’Shea writes about credit for NerdWallet. Her work has appeared in the New York Times, Washington Post, MarketWatch and elsewhere.Read more

Monitor Your Credit Reports Regularly

Its a good idea to monitor your credit reports for any sign of suspicious activity. Credit monitoring will help ensure you wont be surprised by any potential errors you might find.

Its also helpful to know your credit score before you apply for credit, so you can compare it to what lenders typically consider creditworthy. For instance, FICO credit scores are broken down as follows:

- Exceptional: 800 to 850

- Very good: 740 to 799

- Good: 670 to 739

Read Also: How Can I Check My Credit Score With Itin

Focus Your Credit Repair Efforts On More Serious Items

While having too many credit inquiries can hurt your credit score, they are the smallest scoring factor. In fact, each hard inquiry typically deducts about five points from your credit score.

We find that most people spend too much time worrying about credit inquiries. They usually have worse negative items on their credit report that have a much bigger impact on their credit score.

But if you apply for credit cards every month, either out of necessity or as a rewards bonus hack, you can really start to cause some damage.

Check Your Credit Report Regularly

It isn’t common to find inaccurate information on your credit report, but it can happen. To avoid letting fraudulent and other erroneous information go unchecked, make it a goal to check your credit report regularly. Review what’s listed and watch out for anything you don’t recognize.

Also keep an eye on your credit score , and watch out for sudden drops that could indicate fraudulent activity, such as a bogus account opened in your name that’s gone unpaid.

It’s not always possible to prevent identity theft, but as you keep track of your credit history, you’ll be in a better position to stop a difficult situation from getting much worse.

Also Check: How To Check Credit Score With Chase

Search For Unauthorized Hard Inquiries

Once you have copies of your credit reports, review them for mistakes, errors, and fraud. Search for credit accounts you dont recognize, incorrect credit reporting on valid accounts , and other mistakes. Finally, check your credit reports for unauthorized inquiries.

If you discover inquiries you dont recognize on your credit report, it could be a sign of identity theft. Make a list of any suspicious inquiries you find. Youll need this information to complete the next step.

Ner With A Credit Repair Company

do this day in and day out. They know what to say to the credit bureaus to get them to remove unauthorized credit inquiries.

It sounds simple, but of course, the credit bureaus and creditors do not make it easy. It takes a lot of back and forth and patience to get to the bottom of it.

Most people give up, which is why using a credit repair company is crucial they do not give up until they win.

Bonus Insight: is our favorite credit repair company. To date, they have removed thousands of hard inquiries and are affordable. They have helped thousands of hardworking Americans protect their credit score and build credit.

> > Still Not Sure? Read Our

Also Check: Check My Rental History Free

Get Your Inquiries Removed Professionally

In some cases, we recommend speaking with a Credit Repair professional to analyze your credit report. It’s so much less stress, hassle, and time to let professionals identify the reasons for your score drop.If you’re looking for a reputable company to increase your credit score, we recommend Credit Glory. Call them on or setup a consultation with them. They also happen to have incredible customer service.Credit Glory is a credit repair company that helps everyday Americans remove inaccurate, incomplete, unverifiable, unauthorized, or fraudulent negative items from their credit report. Their primary goal is empowering consumers with the opportunity and knowledge to reach their financial dreams in 2020 and beyond.

How Many Points Does A Hard Inquiry Deduct From Your Credit Score

As Canadaâs credit bureaus donât reveal the exact algorithms they use to calculate your credit score, itâs impossible to say exactly how much a hard inquiry will cause your credit score to decrease. Obviously, the higher your credit score, the better you are positioned to weather a few negative hits.

Read Also: Navy Federal Auto Loan Reviews

What To Do If You Spot A Problem

If you cant trace the reason for a hard inquiry or you believe it was done without your consent, you can dispute it online. If the credit bureau cant confirm it as a legitimate inquiry, its required to remove it. Contact each credit bureau individually:

If you suspect fraud, you can have a fraud alert added to your credit reports, which flags applications in your name as requiring extra scrutiny. Alert any one credit reporting agency it will share information with the other two.

Or, for the best protection, simply freeze your credit with all three bureaus to stop anyone from opening new credit in your name.

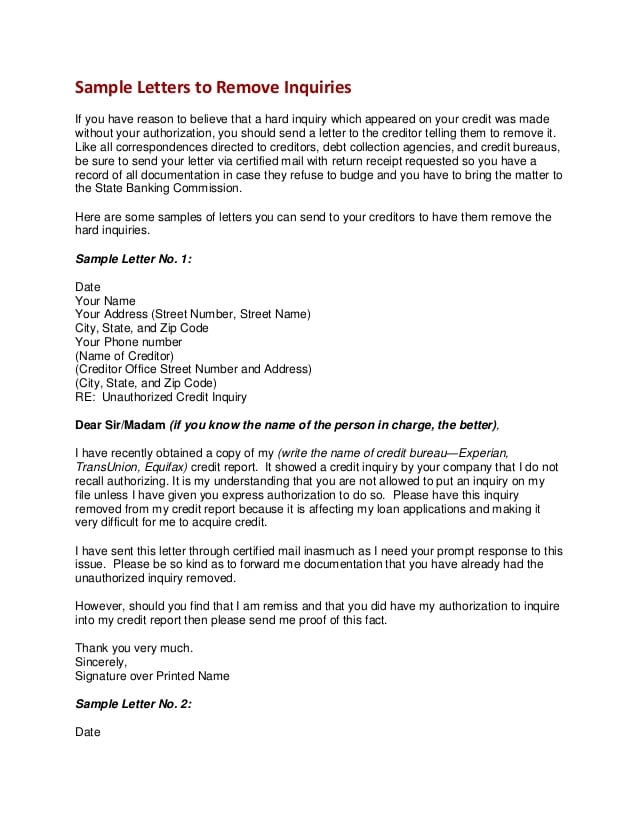

How To Contact The Credit Bureaus To Remove Inquiries

The easiest way to remove questionable inquiries is by contacting the credit bureaus. You can contact any, or all the three bureaus, to remove the inquiries from your credit report.

Removing Inquiries on Experian:

- Experian does not allow for inquiries to be disputed online through their dispute center. The other ways to contact Experian to dispute inquiries are as follows:

- 1-714-830-7000 then press 1, 8 am 10 pm CST weekdays, 10 am-7 pm CST weekends,

- Experian, P.O. Box 4500, Allen TX 75013

- 1-972-390-4925

Removing inquiries on Equifax:

- Equifax is the only bureau that allows you to dispute inquiries online, by mail, and by fax. Their phone, mail, and fax details are also given below.

- Online: Equifax Online Dispute Portal

- 1-800-846-5279, goes to live agent

- Equifax, P.O. Box 740256, Atlanta, GA 30374-0256

- 1-888-826-0598

Removing inquiries from Transunion:

- Although Transunion does not allow inquiries to be disputed online, you can reach them via call, mail, or fax.

- 1-800-916-8800: then press 0, 8 am-11 pm EST, Monday through Friday

- Transunion, P.O. Box 2000, Chester PA 19016

- 1-610-546-4657

Read Also: Does Klarna Build Credit

Also Check: Is Cbe Group Legit

Is It Possible To Remove A Hard Inquiry

I started this column out by saying that removing accurate and timely information from your report is generally not possible. This is true for hard inquiries as well. If you did apply for creditagain, whether or not you were approvedthose inquiries will show up on your credit report and affect your credit score.

However, there is one big fat exception to this: identity theft. In the case of identity theftwhere someone else applied for credit in your name without your knowledge or approvalthose inquiries can and should be removed.

This can be a detailed process, but the Federal Trade Commission has listed out the necessary steps here. As with all disputes, keep good records and in the case of identity theft, be sure to get a police report documenting the theft.

Review Your Credit Reports

You should make it a habit to regularly review your credit reports from the three major consumer credit bureaus Equifax, Experian and TransUnion. The may not know which information is incorrect unless you flag it.

To check for incorrect hard inquiries on your credit reports, look for a section labeled something like

- Requests viewed by others

- Regular inquiries

There may also be a separate section for soft inquiries, which should be labeled something like requests viewed only by you. Unlike hard inquiries, soft inquiries wont affect your credit scores.

Not sure how to read the information your credit reports? Learn more about whats on your credit reports and how to read them.

Recommended Reading: Carmax Finance Rates 2015