What Affects A Credit Score

While every credit scoring model is different, there are a number of common factors that affect your score. These factors include:

- Payment history

- Balances on your active credit

- Available credit

- Number of accounts

Each factor has its own value in a credit score. If you want to keep your number at the higher end of the credit score scale, its important to stay on top of paying your bills, using your approved credit, and limiting inquiries.

However, if you are in the market to purchase a house or loan, there is an annual 45-day grace period in which all credit inquiries are considered one cumulative inquiry. In other words, if you go to two or three lenders within a 45-day period to get find the best rate and terms available for a loan, this only counts as one inquiry. This means that they are not all counted against you and will not affect your credit score.

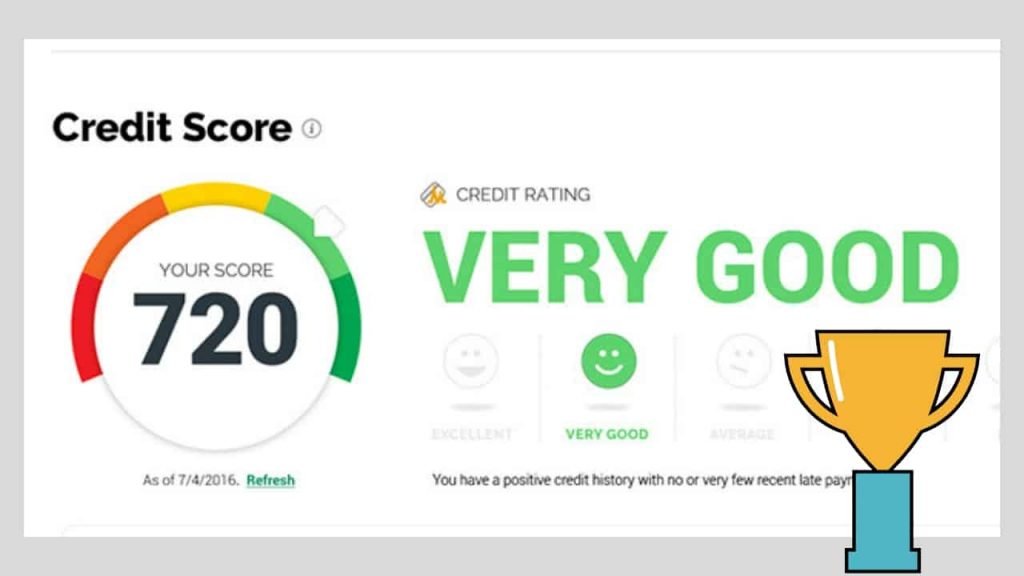

Whats Considered A Good Credit Score

If youre trying to build or maintain healthy credit, knowing whats considered a good score can be helpful. A good credit score can help you get approved and lock in better rates for loans and other credit.

Higher is generally better, but its hard to say specifically what a good score is. Whats considered a good score can differ by lender and the type of credit youre applying for. The score you see when you obtain credit monitoring or buy a credit score along with your credit report may not be the score that the lender is using. There are also different scoring models. That said, read on to learn what a good credit score range is when you check your score with TransUnion. Plus, youll find tips on how to maintain healthy credit.

What An Excellent/exceptional Credit Score Means For You:

Borrowers with exceptional credit are likely to gain approval for almost any credit card. People with excellent/exceptional credit scores are typically offered lower interest rates. Similar to “exceptional/excellent” a “very good” credit score could earn you similar interest rates and easy approvals on most kinds of credit cards.

You May Like: Old Address On Credit Report

Qualifying For A Mortgage And Buying A Home Is Much Easier

Back in early 2021, you needed a credit score of 680 to qualify for a CHMC insured mortgage. The CHMC insures mortgages where the lender puts down less than twenty percent of the asking price. Without this insurance, most Canadians would not be able to buy a home.

The requirement for this insurance now is a credit score of 600 and a downpayment of five percent. This five percent can come from your savings, the RRSP Home Buyers Plan, relatives, you name it. If you are self-employed, your high credit score will help you get mortgage default insurance from CHMC alternative mortgage lenders, which helps self-employed borrowers with good credit buy a home.

If you are not in the market to buy a new home, your credit score will help when renting an apartment. The rental marketplace in Canada is very competitive. Landlords can do on a potential renter and having a great credit score can give you a leg up over other potential renters.

Can I Get A Credit Card With A 700 Credit Score

With good credit scores, you might qualify for credit cards that come with enticing perks like cash back, travel rewards, or an introductory 0% APR offer that can help you save on interest for a period of time.

Still, the very best and most-exclusive credit cards may be out of reach to those with merely good credit. You may need excellent credit to be approved for these cards, so theres still room for improvement if thats your goal.

Of course, your credit scores are only one piece of the puzzle. A credit score can be a helpful gauge in measuring your progress, but issuers may also consider other factors before making a lending decision.

For example, an issuer may consider eligibility requirements not accounted for in your credit scores, like your job status or income. Or they may give more weight to one aspect of your credit reports than another. This means its possible that two people with similar credit scores may not be approved for the same offer and even if theyre both approved, their rates and terms may be different.

This can make it difficult to understand why youre not approved but lenders are required to tell you why you were denied credit if you ask. Its illegal for lenders to discriminate against you, and getting an answer as to why you werent approved can be a first step to protecting your rights when it comes to credit and lending.

Compare offers for on Credit Karma to learn more about your options.

Read Also: Does Opensky Report To Credit Bureaus

Nomortgageinsurance Loans And Down Payment Assistance

One last strategy to consider is a portfolio loan from a bank or mortgage lender.

These are specialty loans for which lenders set their own rules so they dont have to follow requirements set by regulators like Fannie Mae and Freddie Mac.

That means they often have special perks, like:

- Down payment and closing cost assistance to help you cover your outofpocket costs

Thus, a portfolio loan might be a great option if you have a 700+ credit score but have a tough time with other mortgage requirements, like making a down payment.

Watch Out For The Balance Transfer Trap

A 0% introductory APR is an outstanding benefit to have, but only if you use it the right way. And the right way is to pay off any balance transferred before the 0% APR introductory term ends.

To do otherwise is to put yourself in a potential trap.

Heres why

- Balance transfer fees. Credit cards routinely charge an upfront fee of between 3%-5% of the balance transferred. If you transfer $10,000, that will be $300 to $500, paid up front.

- The 0% introductory APR could convince you to keep the balance outstandingafter all, it wont be costing you any money.

- The 0% introductory APR will end, and then youll be subject to the regular interest rate. Its possible that rate will be higher than the one youre paying on the card you transferred the balance from.

If you wont be able to pay the balance in full within the introductory term you might want to avoid a balance transfer entirely. In that situation, itll just be moving debt from one credit line to anotherwith an interest rate reprieve in the middle.

Don’t Miss: When Does Capital One Report To Credit Bureau

Is A 700 Credit Score Good Or Bad

How Student Loan Hero Gets Paid

Student Loan Hero is compensated by companies on this site and this compensation may impact how and where offers appear on this site . Student Loan Hero does not include all lenders, savings products, or loan options available in the marketplace.

Student Loan Hero Advertiser Disclosure

Student Loan Hero is an advertising-supported comparison service. The site features products from our partners as well as institutions which are not advertising partners. While we make an effort to include the best deals available to the general public, we make no warranty that such information represents all available products.

Editorial Note: This content is not provided or commissioned by any financial institution. Any opinions, analyses, reviews or recommendations expressed in this article are those of the authors alone, and may not have been reviewed, approved or otherwise endorsed by the financial institution.

Weve got your back! Student Loan Hero is a completely free website 100% focused on helping student loan borrowers get the answers they need. Read more

How do we make money? Its actually pretty simple. If you choose to check out and become a customer of any of the loan providers featured on our site, we get compensated for sending you their way. This helps pay for our amazing staff of writers .

Open A Secured Credit Card

If you dont qualify for unsecured credit cards, then a secured card could be the way to go. Secured credit cards are backed by a cash deposit, so even borrowers with poor credit scores can get one. Through this card, youll be able to improve your credit score by proving your creditworthiness with on-time payments.

Read Also: Credit Score Needed For Affirm

How Is The Credit Score Calculated

Various factors determine the outcome of anyones scores. The following are the things that dictate someones credit score.

i) Payment history

The way you have been paying your debts contributes a lot to your overall credit score. Out of the 100% covering all factors, 35% comes from your payment history. Paying your debts on time boosts your scores significantly. People with late payment history tend to generally score low.

ii) Current debts

The amount of money you owe determines your credit score by 30%. Small balances increase your scores while large debts lower your credit scores. You should ensure that you do not have a lot of debts to avoid low credit scores.

In the event that you find yourself in a mix of many debts to the extent that your scores fall badly to the poor category, do not worry as you can still regain back your scores. The can be of great help Im such a situation.

iii) Length of your credit history

For how long have you been using credit services? The length of your credit history contributes up to 15% of your credit score. If you started utilizing credit services many years ago, then you are probably going to score higher as compared to someone who started recently.

iv) Number of credits

Mixing various credits such as credit cards, mortgage loans, personal loans, and so on contributes up to 10% of your overall score. The more you have different kinds of credits, the more your score.

v) Recent credit activities

Benefits Of A High Credit Score

- More favorable loan terms

- Lower interest rates, which can save you money

- A better chance of qualifying for loans and credit cards

The reason higher scores come with these benefits is because a high credit score shows a lender that youre good at handling your debt and are a responsible borrower. Lenders are able to offer better terms because youre seen as less of a risk.

Read Also: How To Get An Eviction Off Your Credit

What Is A Good Fico Score

FICO® creates different types of consumer credit scores. There are “base” FICO® Scores that the company makes for lenders in multiple industries to use, as well as industry-specific credit scores for credit card issuers and auto lenders.

The base FICO® Scores range from 300 to 850, and FICO defines the “good” range as 670 to 739. FICO®’s industry-specific credit scores have a different range250 to 900. However, the middle categories have the same groupings and a “good” industry-specific FICO® Score is still 670 to 739.

Can You Get A Personal Loan With A Credit Score Of 700

Most lenders will approve you for a personal loan with a 700 credit score. However, your interest rate may be somewhat higher than someone who has Very Good or Excellent credit.

Its best to avoid payday loans and high-interest personal loans as they create long-term debt problems and just contribute to a further decline in credit score.

See Also:12 Best Personal Loans for Good Credit

Recommended Reading: Student Loans Fall Off Credit Report

Have A Good Payment History: 35%

Your payment history is the most important aspect of your credit score. It is the easiest to use in your favor, but also the most difficult to repair if it begins dragging your score down.

Lenders are primarily concerned with whether they will get their money back from the people they lend it to.

Having a track record of making payments on time is the best way to boost their confidence in you. It isnt fast or glamorous, but paying your loans over the course of a couple of years has a massive impact on raising your credit score.

If you miss a payment, how much you miss it by can affect the ding it puts in your credit score. The good news is that many lenders will work with you if you have a history of on-time payments and will forgive the first offense.

If you ever miss a payment or send one in late, contact the lender, explain the situation, and ask if they can work with you to avoid the black mark on your credit report.

Why Is My Credit Score Low

Lower credit scores arent always the result of late payments, bankruptcy, or other negative notations on a consumers credit file. Having little to no credit history can also result in a low score.

This can happen even if you had established credit in the past if your credit report shows no activity for a long stretch of time, items may fall off your report. Credit scores must have some type of activity as noted by a creditor within the past six months.If a creditor stops updating an old account that you dont use, it will disappear from your credit report and leave FICO and or VantageScore with too little information to calculate a score.

Similarly, consumers new to credit must be aware that they will have no established credit history for FICO or VantageScore to appraise, resulting in a low score. Despite not making any mistakes, you are still considered a risky borrower because the credit bureaus dont know enough about you.

Recommended Reading: Lowes 0 Financing For 18 Months

What A Fair Good Or Excellent Credit Score Means For You

The better your credit score, the more choices youll have when it comes to applying for a loan or credit card. Thats the bottom line.

If you have a fair credit score and are approved for a credit card, you may be offered a slightly higher interest rate. Your initial credit limit may also be on the lower side. But if you make your payments on time and demonstrate financial stability, you might be able to have your limit increased after 6-12 months.

If you have a good credit score, your chances of being approved for loans and credit cards increases. Youre also more likely to be offered a more competitive interest rate, as well as a more generous credit limit.

Finally, an excellent credit score makes borrowing money and getting credit cards much easier. Its also more likely to get you the best available interest rates and generous credit limits.

Credit Score Mortgage Loan Options

A conventional mortgage usually requires a minimum credit score of 620. This means that with a score of 700, you have a high probability of being approved for a mortgage loan. But lenders wont be offering you the best interest rates out theresome experts suggest that you need score of 760 to get those.

Its important to note that having a score of 700 doesnt guarantee youll be approved for a mortgage. People who have insufficient income or a history of filing for bankruptcy can still be denied loans, mortgages or credit cards even with a good score.

If youve been denied a mortgage with a 700 score, you can check if you qualify for a USDA loan or a VA loan. Otherwise, youll have to improve your credit score, increase your down payment or speak to your lender on how you can work toward a mortgage approval.

Read Also: Itin Credit Report

Check Your Credit Before Applying

If you’re not sure where you stand, you can check your FICO® Score for free with Experian. You’ll also see which factors are helping or hurting your score, and can track your score over time. Additionally, you may be able to see which credit card or loan offers you’re a good match for, or get prequalified for offers from Experian’s lending partners through Experian CreditMatch.

How To Find The Best Credit Cards If Your Fico Score Is 700 To 749

If youre in this credit score range, the best credit cards arent hard to find. Nearly all types of cards will be available to you.

At this credit score range, it will be less a matter of finding cards you qualify for, and more about selecting the ones you like best.

Whats more, traditional factors, like annual fee and interest rate become less important. Credit cards in the 700 to 749 range offer the kinds of perks that can actually enable you to come out ahead in using the card. That is, the rewards and benefits will be higher than the annual fee, and even the interest expense if you make a habit of not carrying an outstanding balance.

This guide will offer nine different credit cards if your FICO Score is 700 to 749. You can simply choose the card that offer the best combination of rewards and benefits for you.

You May Like: 641 Credit Score Credit Card

Canadian Credit Ratings And What They Mean

Lenders and creditors typically use a credit score to determine youre likelihood of making payments on time. Its important to note that your is only one of the factors that lenders will evaluate when approving you for new credit.

- Excellent Individuals with a rate of 780 or over may enjoy the best interest rates on the market. They also will typically always be approved for a loan.

- Very Good This is considered near perfect and individuals with a rate in this range may still enjoy some of the best rates available.

- Good An individual who has a credit score that falls within this range has good credit and will typically have little to no trouble getting approved for the new credit.

- Average While this is still a good range, individuals with this score may receive slightly higher interest rates than those with higher scores. According to Equifax, at the end of 2012, the average national credit score was 696.

- Poor Scores in this range indicate that the individual is high risk. It may be difficult to obtain loans and if approved, they will be offered higher interest rates.

- Very Poor Scores in this range are rarely approved for anything, but credit can be repaired.

- Terrible Individuals whose credit scores are less than 500 may not get approved for new credit and should seek credit improvement help.

Loans Canada Lookout