Get Your Free Score And More Credit Karma

Some lenders report to all three major credit reference agencies, but others report to only one or two. Check out these 10 tips that will help you improve your credit score. On the customer review site consumeraffairs, some people have reported that their credit karma score is quite a bit higher than their fico scores.20 whether . Which is more accurate for your credit scores?

Check out these 10 tips that will help you improve your credit score. Nate’s experian fico score 9,. In contrast to experian, credit karma provides credit scores calculated using the . On the customer review site consumeraffairs, some people have reported that their credit karma score is quite a bit higher than their fico scores.20 whether .

Heres The Backstory On The Score

To understand the intricacies of the differing results, you must understand how the scores are calculated. Throughout the U.S, there are several types of credit scores, but most people will be familiar with the FICO Score.

FICO is used by 90% of banking institutions and has been incorporated into the lending business since 1986. While FICO Scores range between 300 to 850, a good score is between 670 and 739. This will get you better mortgage rates and lower interest.

Its undoubtedly a veteran in the field, but a new system arrived on the market in 2006: VantageScore, created by Equifax, Experian, and TransUnion.

What Does Your Credit Karma Score Tell You

Experian and FICO scores are roughly in the same range as Equifax and TransUnion. Having a high credit score according to Credit Karma usually means that you also have a high credit with Experian and FICO.

The only problem is that a difference of a few points can be the difference between a loan application being accepted and denied.

Even worse, more than 90 percent of top lenders use FICO Score 8. So if youâre looking to take out a large loan, it might be a good idea to find your FICO score first.

You May Like: How To Update Name On Credit Report

Types Of Credit Scores Available

In the world of consumer credit, there are several different credit scores that may be used by creditors to evaluate the risk of a new borrower.

Regardless of the type used, information like an individuals account payment history, number of accounts open and used, credit utilization percentage, and any negative credit issues are all included in the calculation of ones credit score.

An in-depth algorithm is applied to these details to derive a three-digit number ranging from 300 to 850, in most cases. The higher the credit score, the more sound a borrower the individual is perceived to be when a new application for credit is submitted.

While Credit Karma boasts its free credit score to anyone who wants it, the company provides access to an individuals VantageScore 3.0, not the FICO Score that the majority of lenders use to evaluate an individual. The VantageScore 3.0 has the same credit score range as FICO and uses some of the same information a FICO Score does, but the way in which the information is used to determine ones credit score is different.

When Credit Karma users see their credit score details on the site or the mobile app, they are viewing their VantageScore 3.0.

In addition to using a different type of credit score than most lenders and financial institutions, Credit Karma also offers access to only two credit scores from two of the credit reporting agencies.

When Does Credit Karma Update Credit Scores

Updates from TransUnion and Equifax are usually available through Credit Karma every seven days. Youâll be able to see the exact date of your most recent score on the dashboard of the Credit Karma site or mobile app.

The original intention of Credit Karma was to help users easily monitor their credit scores. Any significant upswing or downshift can be crucial information to know. Thatâs why Credit Karma works tirelessly to ensure that your credit scores are as accurate and up to date as possible.

The only thing to remember is that the credit bureaus and lenders arenât nearly as quick to update your account as Credit Karma. Generally, a lender will take around 30 to 45 days to report customer activity to a credit bureau.

You May Like: How To Get An Accurate Credit Score

If Youre Trying To Improve Bad Credit

If you want to improve your credit score and avoid having it fall into one of the lower ranges, there are a few steps you can take.

- Pay off delinquent bills or accounts: accounts that have gone to collections stay on your credit for years. Thats why youll want to take care of them as soon as youre able.

- Negotiate a payment plan with your creditors: if youre unable to pay off delinquent accounts, reach out to your creditors and explain your situation.

- Get a secured credit card to rebuild your credit: as stated above, a secured credit card can help demonstrate you can responsibly handle credit.

- Make sure there are no errors on your credit report: if there are any errors, learn how to dispute credit report errors ASAP so you can get them off your report.

Why Credit Scores Matter

Your credit scores are three-digit values assigned to you by different credit reporting bureaus. There are three distinct reporting bureausTransUnion, Equifax, and Experian. Each one might use slightly different information available to calculate the scores.

Lenders refer to these scores to determine a persons creditworthiness, or how safe it is for them to offer you a loan. A higher credit score can mean a better interest rate on a home loan or auto loan, which could save you a lot of money in the long run.

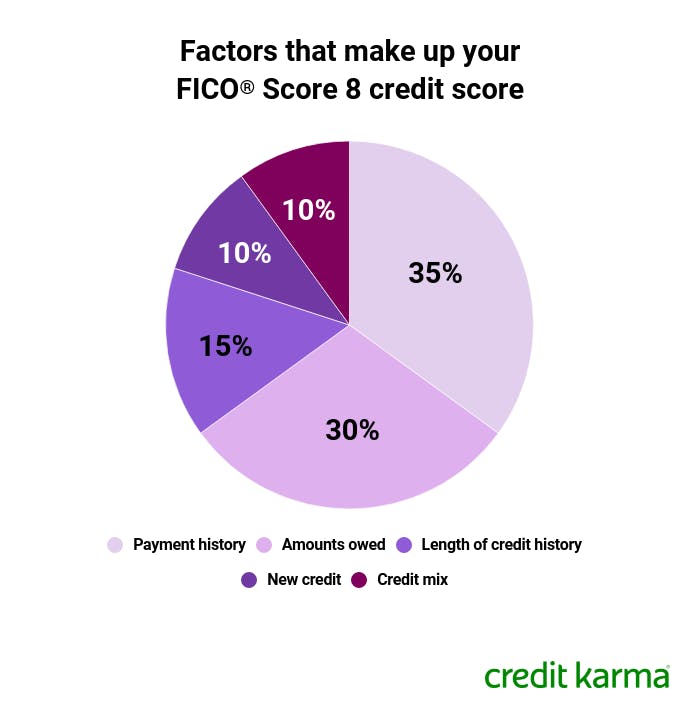

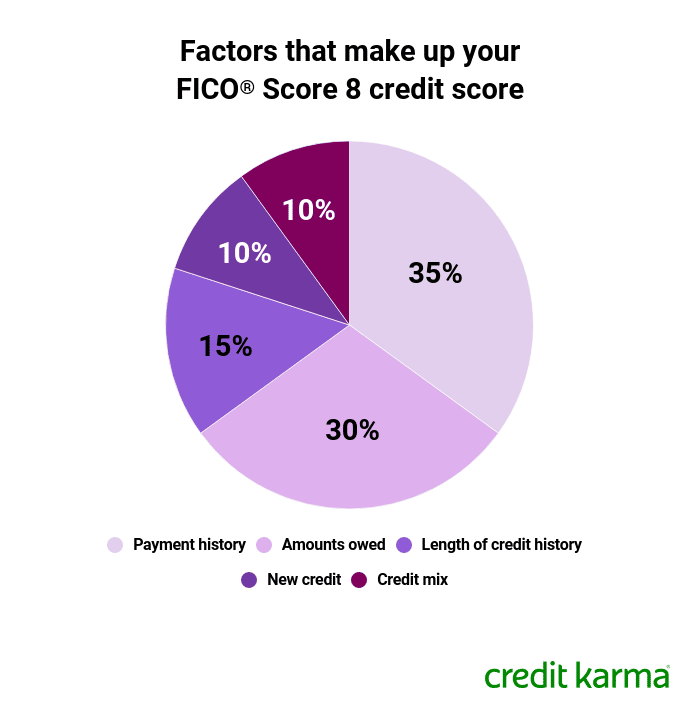

VantageScore generally uses the same customer information in calculations as FICO, but it might weigh each factor differently, which could result in a different score. VantageScore and FICO look at factors like your payment history, length of credit history, amounts owed, credit utilization, and types of credit.

Read Also: Do Late Fees Affect Credit Score

Is Experian More Accurate Than Credit Karma

Experian vs. Credit Karma: Which is more accurate for your credit scores? You may be surprised to know that the simple answer is that both are accurate. Read on to find out what’s different between the two companies, how they get your credit scores, and why you have more than one credit score to begin with.

Does Credit Karma Hurt Your Credit Score

Asked by: Stanton O’Hara DVM

Checking your free credit scores on Credit Karma doesn’t hurt your credit. These credit score checks are known as soft inquiries, which don’t affect your credit at all. Hard inquiries generally happen when a lender checks your credit while reviewing your application for a financial product.

Recommended Reading: How Long Does Information Stay On Credit Report

Is My Actual Credit Score Higher Than Credit Karma

You can find your Equifax and TransUnion VantageScore 3.0 credit scores on Credit Karma.

You have many different credit scores, so some of your credit scores might be higher than the TransUnion and Equifax scores you see on Credit Karma, while others might be lower.

But as long as youre looking at the same version of the same score, the TransUnion and Equifax credit scores you see on Credit Karma should be the same as the Equifax and TransUnion credit scores you find on other websites.

Why Credit Scores Can Vary

- Information may be incorrect on a credit report. If information is wrong on your credit report, it will affect your score. Fortunately, you can dispute inaccurate information using the . Getting incorrect information fixed on any credit report is vital, especially if you purchase a home shortly. You can learn how to dispute errors in a credit report in this helpful article from Norton.

- Some lenders do not report to all three major credit report companies. If a lender does not report to a credit report company, that companys score for you will be different from the score you have at a credit report company with that lenders info.

- Scoring models differ among credit reporting companies. Each credit reporting company has its own scoring model the model they use to weigh the importance of different aspects of your credit. Since they use different models, they can come up with different scores using the same information. You will notice that all credit agencies have slightly different scores.

So, hopefully, you now have a better understanding of Credit Karma accuracy.

Recommended Reading: Does Requesting A Credit Increase Hurt Score

Can I Trust Credit Karma

Q: Im trying to increase my credit score ahead of applying for a large loan, so Im considering signing up for Credit Karma to track my score. How accurate are the credit scores it shares? Is there anything I need to be aware of before signing up for this service?

A: Credit Karma is a legitimate company however, for a variety of reasons, its scores may vary greatly from the number your lender will share with you when it checks your credit. We have answers to all your questions about Credit Karma.

What is Credit Karma?

How does Credit Karma calculate my score?

How do other lenders calculate my score?

How does Diamond Valley decide if Im eligible for a loan?

Dont Go Into Debt To Improve Your Credit Score

There are a lot of myths on how credit scores work and how to improve them, some of which can be disastrous to your finances. All you have to remember is that whatever keeps you financially sound will help you improve your credit.

In other words, if you want to appear to be a responsible borrower, use credit. But, pay it off every month so you dont go into debt.

And if thats not possible , then pay it off as soon as you can.

Most importantly, always pay your bills on time. And dont co-sign on accounts you cant afford to pay off should the borrower default.

In the end, if any credit scoring advice coming your way promises a quick fix or seems too good to be true, it probably is. Building a good credit score takes time, but in the end, the doors it opens for you will be well worth the effort.

Also Check: How To Get A 700 Credit Score

Experian Vs Credit Karma: Whats The Difference

Experian is one of the three major credit bureaus, along with Equifax and TransUnion. These companies compile information about your credit into reports that are used to generate your credit scores.

Instead, we work with Equifax and TransUnion to provide you with your free credit reports and free credit scores, which are based on the VantageScore 3.0 credit score model. We also offer recommendations for credit cards, personal loans, auto loans and mortgages.

Improve Your Score With A Little Help

Youâll also get recommendations about different ways to build up your credit. While there are plenty of ways to build up your credit, few of them offer the unique benefits of Yotta.

Yotta is a financial account service offering a unique set of benefits you wonât find in a bank. For starters, the Yotta Credit Card can help you build up your credit as each swipe is reported to all three credit bureaus.

You wonât have to pay any interest or fees when using the Yotta Credit Card, and your account balance is your limit. That means you canât run up a large credit card debt, and itâs impossible to ever make a late payment.

But thatâs not even the best part. Using the Yotta Credit Card will get you more entry tickets in the weekly sweepstakes drawing. Depending on how many numbers you match, you could win a cash prize that ranges between 10 cents and 10 million dollars. Improving your credit score can be much easier with that kind of cash on hand.

Visit Yotta today to create an account and make your first deposit. You can request a Yotta Credit Card and get to work improving your credit score. And who knows? You might win a large enough prize that you wonât need to rely on credit for a long time.

Don’t Miss: What Does My Credit Score Mean

Credit Score: Is It Good Or Bad

A FICO® Score of 650 places you within a population of consumers whose credit may be seen as Fair. Your 650 FICO® Score is lower than the average U.S. credit score.

17% of all consumers have FICO® Scores in the Fair range

.

Statistically speaking, 28% of consumers with credit scores in the Fair range are likely to become seriously delinquent in the future.

Some lenders dislike those odds and choose not to work with individuals whose FICO® Scores fall within this range. Lenders focused on “subprime” borrowers, on the other hand, may seek out consumers with scores in the Fair range, but they typically charge high fees and steep interest rates. Consumers with FICO® Scores in the good range or higher are generally offered significantly better borrowing terms.

What Is The Best Way To Use Credit Karma

But it is a free tool, and it can still be useful in the following ways:

- With Credit Karma, you can get a general idea for your score. If it is really low, for example, there is no reason to expect your FICO score will be high.

- You can view trends in your scorewhether it seems to be improving or declining over time.

Since you now know the differences between FICO and VantageScore in terms of how factors are weighted, you also can make some educated guesses about your FICO score.

For example, lets say you have a pretty good credit mix. That will reflect well in your VantageScore, since that factor is highly influential. But as it only accounts for 10% of your FICO score, you can guess your FICO score might be lower, all other things being equal.

Still, that is not a guarantee you will be right. The only way to know your FICO score is to check it.

So, feel free to use Credit Karma to monitor your overall credit healthbut do not make assumptions about your FICO score.

Instead, you should look up your FICO score before you attempt to apply for a mortgage. In fact, you can purchase your credit score directly from the three bureaus.

Other options might include checking your score through your bank or credit union, or through certain credit cards.

There is also a program called Discover Credit Scorecard that is available to customers and non-customers alike for free.

We Can Answer All Your Questions About Your Credit Scores

Don’t Miss: What Is The Best Credit Score You Can Get

How Do You Get A 800 Credit Score

How to Get an 800 Credit Score

How Does Credit Karma Compare To Actual Credit Scores

A lot of people also wonder how Credit Karma compares to actual credit scores. Well, Credit Karma generates credit reports from two of the three credit report agencies that are at the top. As already mentioned, they create these credit reports through agencies like Equifax and TransUnion. The score reported from these two is very close, and even if the points will be a bit off, they wont be by much.

The only top credit agency that does not report to Credit Karma is Experian. This is basically where the few points that are off are coming from. This relates to the actual credit or FICO score, so that is why it is affected.

Read Also: What Is The Lowest Possible Credit Score

Once People See That Credit Karma Offers Access To Your Credit Scores For Free They Usually Follow Up With Questions Like Is Credit Karma Accurate Or Whats The Catch

Whether its your first time visiting Credit Karma or youve been a member for years, you might want some more insight into where Credit Karma gets your credit scores and why you should trust a company that claims to offer something for free.

Heres the short answer: The and reports you see on Credit Karma come directly from TransUnion and Equifax, two of the three major consumer credit bureaus. The credit scores and reports you see on Credit Karma should accurately reflect your credit information as reported by those bureaus.

This means a couple of things:

- The scores we provide are actual credit scores pulled from two of the major consumer credit bureaus, not just estimates of your credit rating. This, by the way, is one of the reasons why we ask for your Social Security number and other personal information in order to create a Credit Karma account so that we can match you up to what the bureaus have on file for you.

- We dont gather information from creditors, and creditors dont report information directly to Credit Karma.

Understandably, you may still have some questions about how Credit Karma gets your credit scores and why your scores from Credit Karma might look different from scores you got somewhere else.

Well dig into some of those questions below. Well also explain how Credit Karma can offer free credit reports from TransUnion and Equifax along with your free credit scores from each of those credit bureaus.

An Easy Way To Get Your Credit Report

The three major credit reporting bureaus, TransUnion, Equifax, and Experian, are required to give you a free credit report once a year by federal law. You have to apply for your reports through AnnualCreditReport.com.

While these reports are handy to see what lenders have reported to the credit reporting agencies and find inaccuracies to correct and improve your credit they do not include your actual credit score.

Since you need to know your credit score to get an idea of where you stand when applying for credit, the reports lack of a credit score is problematic. The reporting agency provided a less than an adequate solution offering to sell you your score for a steep price.

In 2007, Credit Karma came on the scene with a better option. They partnered with Equifax and TransUnion to give members ongoing access to their credit reports and credit scores.

Instead of having to wait once a year to check your reports or being price gouged to get your actual credit score, you could sign up for Credit Karma and get what you needed. This is how Credit Karma works and one of its best features.

So, to be crystal clear the company offers a free service where youll have access to your credit profile.

Also Check: Does Cifas Show On Credit Report