How Do I Check My Credit Score For Free

You now have a legal right to access your credit report for free from any credit reference agency.

These statutory reports offer a snapshot of your credit history and dont include a credit score.

But the three main credit reference agencies all offer more comprehensive services for a monthly fee.

These provide unlimited access to your credit report, plus extra features, such as a score and alerts when major changes are made to your report.

However, it’s now possible to access both your credit report and score without having to pay for a subscription.

Monitoring & Extra Features

Some services also include credit monitoring alerts, security scans, and identity theft insurance. Alerts are a great way of getting a heads up on any changes in your credit report and may even offer some identity theft protection. Each time theres a change in your credit report, the service sends out an email or push notification alerting you of the change. If these dont relate to your usual credit activity or are otherwise unfamiliar, it could mean someone else is using your personal information.

We also took a look into services that included identity theft insurance or security scans. These features are usually available only for premium members but they could interest people who fear their personal information might have been exposed to hackers.

Are Bills Up To Date New Brunswick Auto Insurance Companies Are Interested In Your Credit Score

According to insurance companies, studies show bad credit drivers are more likely to have an accident than those with similar driving records, and they want premiums in New Brunswick to reflect that. Several insurance companies in New Brunswick recently gained approval to ask for the introduction of credit scores when setting auto premiums for insurance.

The insurance companies claim studies show that motorists with bad credit are more likely to get into accidents than those with similar driving records, and they want New Brunswick premiums to reflect that.

In Canada, insurance companies believe your is an accurate predictor of risk and therefore future claims. As a result, policyholders are said to be given rates based on the justest risk segmentation. The application they submitted for approval argued this.

A policyholder will be charged more if they are likely to generate the highest costs than a policyholder who is likely to generate lower costs, according to the New Brunswick Insurance Board. According to the board, it was satisfied there is a relationship between bad credit and bad driving and, as a result, granted the right to set rates using a persons .

As part of the risk assessment, a raises a number of concerns:

Read Also: Syncb/ppc On Credit Report

What Are Credit Bureaus

Credit bureaus compile and about individual borrowers primarily for governments and lenders. They deal with consumer .

Credit bureaus are private companies that are highly regulated under the Fair Credit Reporting Act . They are limited in how they collect, disburse, and disclose consumer information and have come under increased scrutiny since the Great Recession of 2007-2009.

One interesting feature of the credit bureau business model is how information is exchanged. Banks, financing companies, retailers, and landlords send consumer credit information to the credit bureaus for free, and the credit bureaus turn around and sell consumer information right back to them.

Request Your Free Medical History Report

You have the right to get one free copy of your medical history report, also known as your MIB consumer file, each year. You can request a copy for:

- Yourself

- Someone else, as a legal guardian

- Someone else, as an agent under power of attorney

You can request a medical history report online from MIB or by phone at 1-866-692-6901.

Not everyone has a medical history report. Even if you currently have an insurance plan, you won’t have a report if:

- You haven’t applied for insurance within the last seven years

- Your insurance policy is through a group or employer policy

- The insurance company isnt a member of MIB

- You didnt give an insurer permission to submit your medical reports to MIB

Don’t Miss: Aargon Debt Collector

Q Are Results Guaranteed With Credit Repair Services

It is nearly impossible for even the best credit repair companies to promise 100% guaranteed results. It is because credit reports are highly complex documents, and they change rapidly. For example, it changes when you make payments and when you miss a payment.

Therefore, as a client, you should be aware that you cannot expect guaranteed results. However, they can always provide the best results possible for your credit score.

Nonetheless, some companies provide better results than others. Therefore, you need to pick the right company for your needs and budget for the best results.

How To Dispute Credit Report Errors With Bureaus

If you notice incorrect information on your credit report, it’s in your best interest to dispute it right away. One in four Americans have an error on their credit report, according to a 2012 study by the Federal Trade Commission.

If you notice an error on your Experian credit report, check if it’s also present on your TransUnion and Equifax reports. Then dispute the error directly with the credit bureau. Legally, the credit bureau has to report the issue to the other two bureaus. Regardless, you should dispute it directly with each credit bureau to cover all the bases.

The simplest way to dispute a credit report error is online with Experian, Equifax or TransUnion .

Read Also: Speedy Cash Payment Plan

Report Details & Frequency

Free credit services are never as detailed as the report you get directly from the credit bureaus. Since we favored free memberships, we compared the reports they offered and selected the ones that provided the most comprehensive information.

We preferred free memberships that included personal information, open and closed accounts, account numbers, balances and status of accounts, payments, credit age and usage, derogatory items , public records, and inquiries.

Your credit report is constantly changing as creditors send new information about your credit accounts and payments to the major credit bureaus. However, not all creditors send information to the bureaus with the same frequency and credit bureaus dont update your credit report with the same frequency either.

We preferred credit reporting services that updated your information weekly over those that did so on a monthly basis. This should show you a more accurate view of your credit data, and how it can fluctuate over time.

Errors On Your Credit Report

If you find errors on your credit report, write a letter disputing the error and include any supporting documentation. Then, send it to:

Find a sample dispute letter and get detailed instructions on how to report errors.

The credit reporting agency and the information provider are liable for correcting your credit report. This includes any inaccuracies or incomplete information. The responsibility to fix any errors falls under the Fair Credit Reporting Act.

If your written dispute does not get the error fixed, you can file a complaint with the Consumer Financial Protection Bureau .

Also Check: Does Paypal Credit Report To Credit Bureaus

Place A Credit Freeze

Contact each credit reporting agency to place a freeze on your credit report. Each agency accepts freeze requests online, by phone, or by postal mail.

Experian

PO Box 26Pittsburgh, PA 15230-0026

Your credit freeze will go into effect the next business day if you place it online or by phone. If you place the freeze by postal mail, it will be in effect three business days after the credit agency receives your request. A credit freeze does not expire. Unless you lift the credit freeze, it stays in effect.

Q6 Are Credit Repair Services Legitimate

Like any other industry, some credit repair companies are legitimate while others are unscrupulous. Thankfully, there are different ways to sniff out scammers. For example, if a company claims that it can remove every negative from your report, you are likely dealing with credit repair scammers. Also, if a company wants to create a new identity for you, chances are its not legitimate. Therefore, you need to do thorough due diligence when you are looking for the best credit repair company.

Recommended Reading: What Score Do You Need For Care Credit

What Information Do I Have To Give

To keep your account and information secure, the credit bureaus have a process to verify your identity. Be prepared to give your name, address, Social Security number, and date of birth. If youve moved in the last two years, you may have to give your previous address. Theyll ask you some questions that only you would know, like the amount of your monthly mortgage payment. You must answer these questions for each credit bureau, even if youre asking for your credit reports from each credit bureau at the same time. Each credit bureau may ask you for different information because the information each has in your file may come from different sources.

The Fair Credit Reporting Act

The Fair Credit Reporting Act is a federal law that regulates how credit information is managed and collected by consumer reporting agencies. It also establishes who can have access to your credit report and under what circumstances. Basically, it aims to make sure the information included in credit reports will always be accurate and used fairly.

The law was passed in 1970 to stop credit reporting agencies like Retail Credit CompanyEquifaxs original namefrom including information regarding social, political and even sexual preferences in peoples credit reports.

Since then, three acts have helped strengthen the FCRA: the Fair and Accurate Credit Transactions Act of 2003, the Dodd-Frank Act of 2010, and The Economic Growth, Regulatory Relief, and Consumer Protection Act of 2018. Together they have given people more control over the security and accuracy of their credit reports.

The Consumer Financial Protection Bureau The Federal Trade Commission are in charge of enforcing the act.

Your rights under the FCRA

Sure, the FCRA–along with the three supplementary laws of 2003, 2010, 2018–dictate how consumer reporting agencies collect and share information, but sometimes mistakes are made and rules are broken. If you want to stay on top of your credit report, this is a summary of your rights according to the CFPB:

You are entitled to an additional free credit report in special instances:

You May Like: Do Lending Club Loans Go On Your Credit Report

Do I Need To Get My Credit Score

It is very important to know what is in your credit report. But a credit score is a number that matches your credit history. If you know your history is good, your score will be good. You can get your credit report for free.

It costs money to find out your credit score. Sometimes a company might say the score is free. But if you look closely, you might find that you signed up for a service that checks your credit for you. Those services charge you every month.

Before you pay any money, ask yourself if you need to see your credit score. It might be interesting. But is it worth paying money for?

Information On Credit Report Companies

Most of us all know or have heard of the three large credit bureaus, Experian, TransUnion, and Equifax, but did you know the list of credit reporting agencies is much larger than just those three? Below, is a comprehensive list of CRAs, along with how to contact these credit reporting agencies. The credit reporting agency contact information includes: phone numbers, addresses, and websites.

Also Check: Minimum Credit Score For Carmax

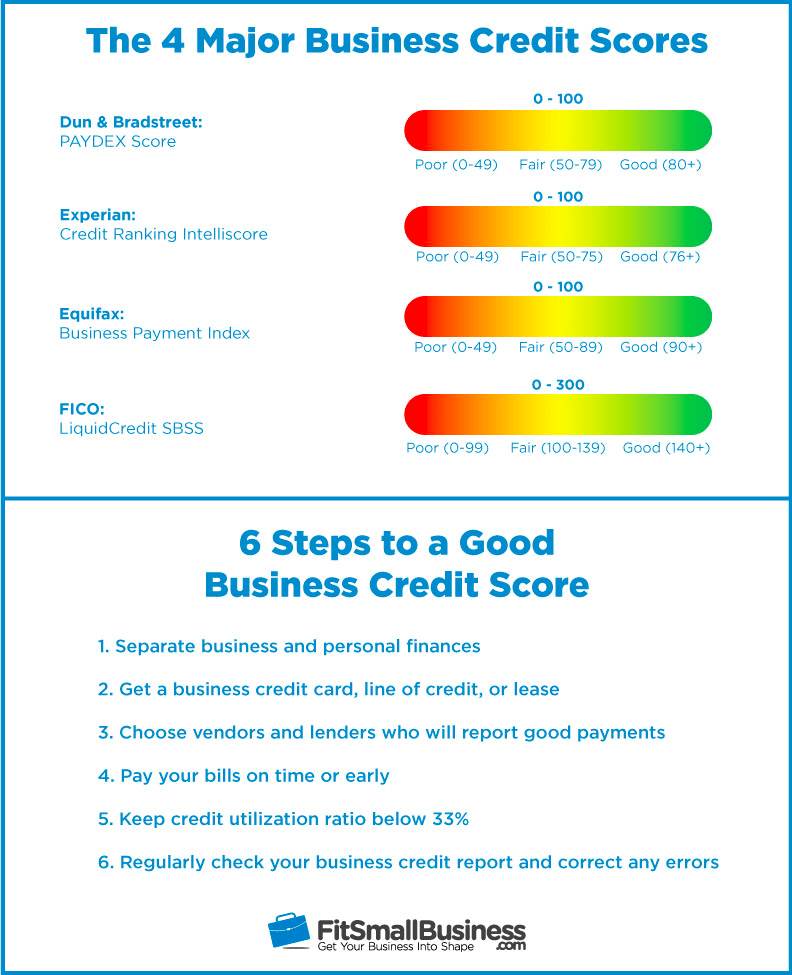

Whats A Good Credit Score Range

A good credit range depends on where a score comes from and whoâs judging it. Itâs important to remember that lenders set their own and standards to determine creditworthiness. That means what FICO, VantageScore or anyone else considers good may not all be the same.

Keep that in mind as you read what might be considered a good credit score range.

Whatâs a Good FICO Credit Score Range?

When it comes to âwhatâs good,â FICO says scores between 670 and 739 qualify. Scores in that range, it adds, are near or slightly above the U.S. average.

Whatâs a Good VantageScore Credit Score Range?

When it comes to VantageScore, scores between 661 and 780 might be considered good.

A Quick Guide Explaining Credit Scores Including How They Work What Range Is Considered Good And Why Theyre Valuable

- FICO says good credit scores fall between 670 and 739. Thatâs on a scoring range from 300 to 850.

- VantageScoreâs good scores are reported to fall between 661 and 780, also on a 300â850 range.

But thereâs a lot more to it than that. So keep reading to take a closer look at credit scores, including how theyâre determined, whoâs looking at them and what you can do to monitor and improve yours.

Also Check: 24 Hour Credit Inquiry Removal

Check Your Credit Report From Each Bureau

Free credit reporting services provide information from a single credit bureau. Remember that there are still two other reports you absolutely have to check out. Its possible the information across all three reports could be slightly different.

Most importantly, the credit report youre seeing could be squeaky clean while the one from the other bureaus includes inaccurate or outdated information. These errors could potentially affect your credit health. Its of utmost importance to compare the information across all three reports. Anything that shouldn’t be there can and must be removed.

Keep in mind, though, that information won’t be removed if you can’t provide enough evidence to the bureaus of its inaccuracy.

Why Is My Credit Report Important

Businesses look at your credit report when you apply for:

- loans from a bank

- jobs

- insurance

If you apply for one of these, the business wants to know if you pay your bills. The business also wants to know if you owe money to someone else. The business uses the information in your credit report to decide whether to give you a loan, a credit card, a job, or insurance.

Recommended Reading: Transunion Credit Report Without Ssn

How Do I Order My Free Annual Credit Reports

The three national credit bureaus have a centralized website, toll-free telephone number, and mailing address so you can order your free annual reports in one place. Do not contact the three national credit bureaus individually. These are the only ways to order your free credit reports:

- Complete the Annual Credit Report Request Form and mail it to:

Annual Credit Report Request Service

P.O. Box 105281

Atlanta, GA 30348-5281

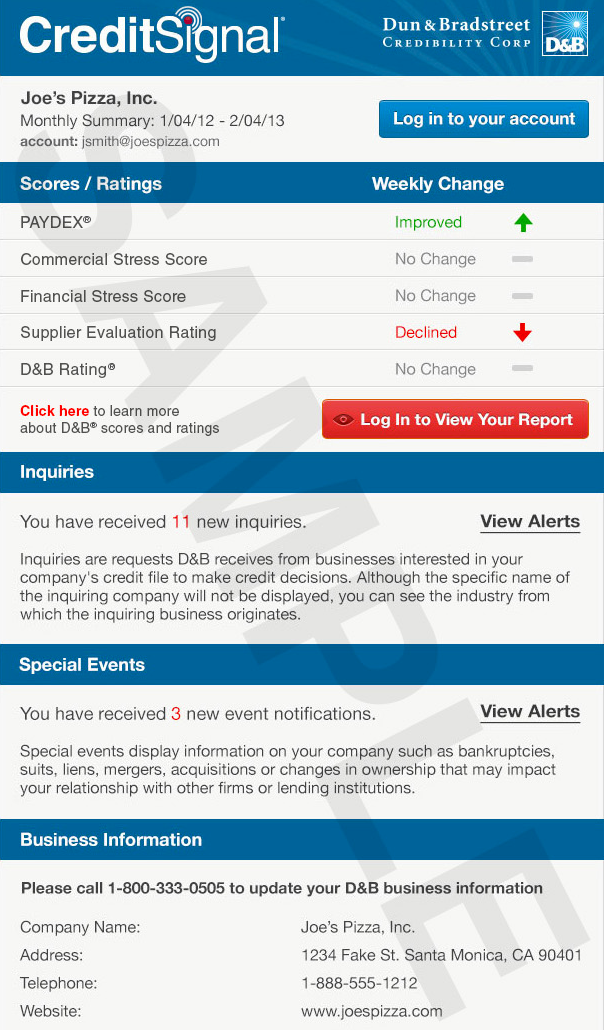

Financial Stress Credit Score

The Financial Stress Credit Score indicates the likelihood that a company will cease operations within the next 12 months. This is useful to suppliers, lenders, and other business partners in assessing the risk that a business may fail in the short-term.

Dun & Bradstreet calculates this credit score using information from different sources. That data can include comparative financial ratios, public filings, past payment experiences, and other demographic data.

The Commercial Credit Score measures the likelihood of a business acting in a severely delinquent manner in regards to bills. Delinquency is defined as paying bills 91 days or more past the terms. The score also predicts the chance of a company obtaining legal relief from its creditors or failing within the next 12 months without paying off any outstanding debts.

D& B uses public filings, financial information, and demographic data to derive its statistical models that determine this score.

Also Check: Carmax Credit Score Requirements

What Does A Credit Bureau Do

A credit bureau is a credit reporting agency that aggregates information about your credit history into a credit report. This typically includes payment history, number of credit accounts and length of credit history.

Information in your credit report is shared with financial institutions and other parties, such as real estate and auto companies, when you apply for , mortgages and auto loans. Credit bureaus do not make lending decisions they only collect and provide information to lenders. Lenders use this information to determine your eligibility for credit.

What Goes Into A Credit Score

Each company has its own way to calculate your credit score. They look at:

- how many loans and credit cards you have

- how much money you owe

- how long you have had credit

- how much new credit you have

They look at the information in your credit report and give it a number. That is your credit score.

It is very important to know what is in your credit report. If your report is good, your score will be good. You can decide if it is worth paying money to see what number someone gives your credit history.

The report will tell you how to improve your credit history. Only you can improve your credit history. It will take time. But if any of the information in your report is wrong, you can ask to have it fixed.

Also Check: When Does Capital One Report To Credit

Top 10 Surprising Benefits Of Repairing Your Credit Score

Repairing your credit score can change your life literally.

A good credit score makes it easier to rent a home and get a mortgage. It can increase your chances of getting a job. It can save you thousands of dollars on auto and home insurance. It could even make it easier to find a partner!

Here are the top 10 most important benefits of repairing your credit score, including the perks of having a good credit score.

As reported by Market Watch, 58% of Americans said they would not marry someone with significant debt. Some people even go as far as to run a credit report on someone before a relationship gets serious! A bad credit score can be a red flag. It could prevent you from marrying the person of your dreams even if everything else feels right. Dont let bad credit get in between you and the love of your life.

Get Cheaper Auto Insurance: The average American pays $1,450 per year for full coverage car insurance. The average American with bad credit, meanwhile, pays over $2,100 per year. If you have a bad credit score, you could pay $1,000 more per year than the average American. By law, insurance companies in almost every state can use your credit score to calculate premiums. Statistically, drivers with low credit scores are riskier to insure, so insurers charge much higher rates. Lowering your credit score could save you thousands of dollars in insurance premiums over the next few years.