Check Your Credit With A Secure Credit Check From Birchwood Credit

Finding out your credit score may bring on feelings of stress, but it doesnt have to. Understanding your credit situation will help you become financially independent, work towards realistic goals and empower you to feel confident with managing your finances.

Now you can get a complimentary, secure credit report so you can know where your credit stands. Start your Secure Credit Check and take your first step to financial independence.

If you need a new vehicle and are looking for an affordable payment plan, our credit experts are ready to help you, even if you have bad credit. You can fill out an online Car Loan Application and our credit experts will help you find a payment plan that meets your budget and lifestyle.

If Youve Applied For A Credit Card Auto Loan Mortgage Or Some Other Form Of Credit Odds Are Youve Heard The Phrase Fico Score

When you apply for credit, potential creditors may want to gauge how likely you are to pay your bills on time. Many creditors use FICO® credit scores to assess applicants, manage accounts, and determine rates and terms.

A FICO® score is a three-digit number ranging from 300 to 850 . These scores are largely based on your and can help creditors assess how likely you are to repay debt.

Fair Isaac Corporation, or FICO, introduced the first credit risk score in 1981. The organizations reputation as one of the primary credit-rating companies in the U.S. has grown since then, reaching different industries with scores geared toward different credit products.

Even though you may hear FICO score and think of it as a single credit score, you can actually have several of FICO scores, which can differ by industry. Read on to learn more.

Your Credit Scores Are Different Depending On What You Apply For

The model for credit cards more heavily weighs your revolving credit payment history, while the auto version is going to pay more attention to your past car payments.

There are a couple of tricky parts that come with these alternative scoring models. The first is that you probably wont know which credit scoring model your lender is going to use unless you ask.

Additionally, the credit score ranges are different from the traditional FICO model. Instead of ranging between 300 and 850, the industry-specific scores range between 250 and 900.

On the auto credit range, for example, youll want at least a 750 to get the best interest rates. So you can see how the numbers vary slightly for each different model.

Read Also: How Long For Things To Fall Off Credit Report

Final Thoughts About What Is A Good Credit Score

It is essential to know that your credit score is not mentioned in your credit report, nor are they mentioned in your credit history. Your credit score is only calculated when you request it. Based on your credit history, the credit score can keep on changing over time, so there is nothing to worry about if you have a poor credit score.

There are certain reasons why you may not have a credit score. One of those reasons is that you may not have an adequate credit history to have a credit score. However, you can still get a if you are under 21. You need to have a cosigner who can guarantee that you will pay back any credit that is due.

About Oleg Stogner

Since 2005, Oleg has been involved with over $1 Billion in mortgage fundings and is recognized as an expert in residential mortgage lending. Oleg is licensed and able to originate mortgage loans in all 50 states. You can contact me here.

What Is The Fico Credit Score Range

Most FICO credit scores range from 300 to 850. However, auto lenders and credit card companies use a range between 250 to 900.

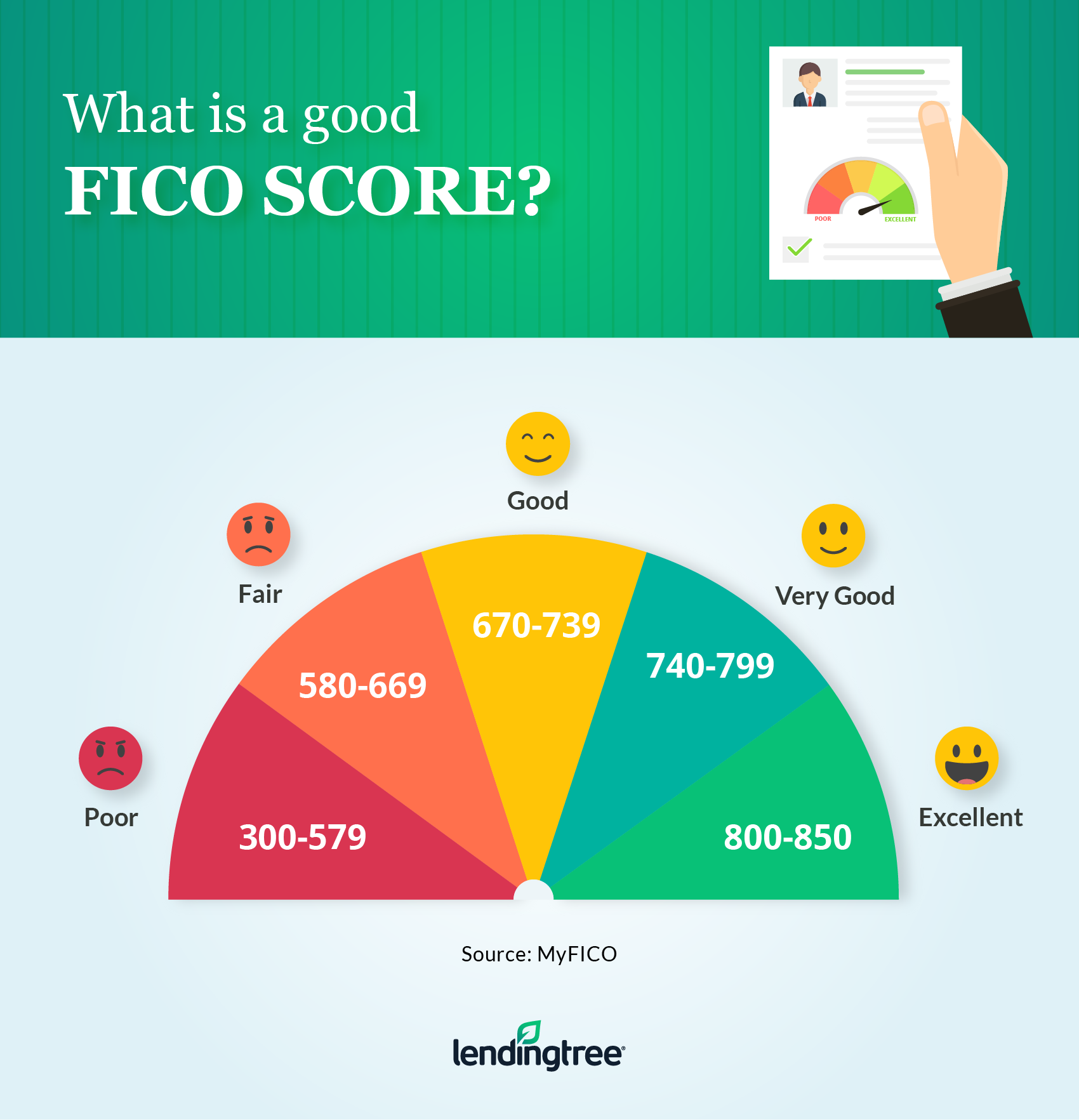

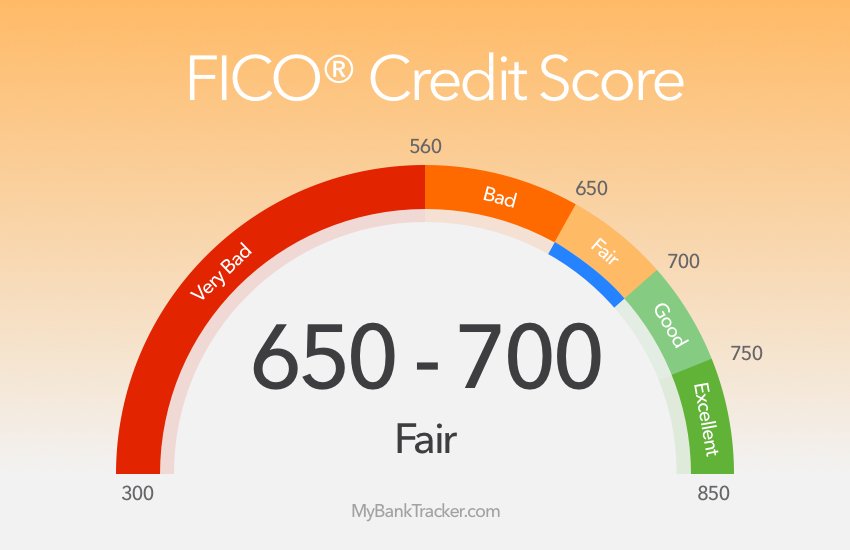

Here is the general FICO credit score range:

- Poor: Less than 580

- Fair: Between 581 and 669

- Good: Between 670 and 739

- Very Good: 740 and 799

- Excellent: 800 and more

The range you fall into as a borrower can mean the difference between thousands of dollars in interest over the life of the loan. If youre buying a house, a good credit score can save you tens of thousands.

Conventional mortgages usually require a score of 620 or higher. If you have a credit score less than 580, you wont even be able to qualify for an FHA mortgage unless you have a 10% down payment.

Many high-paying rewards or travel credit cards are only available to those with scores of 700 or higher.

Some careers and specific positions require a credit check during the application process, especially those dealing with some level of financial responsibility.

The military can even use a low credit score as grounds for revoking security clearance.

Recommended Reading: How Long Does It Take Capital One To Report Authorized User

What Is A Credit Bureau

A credit bureau, also known as a consumer reporting agency, collects and stores individual credit information and provides it to creditors so they can make decisions on granting loans and other credit activities. Typical clients include banks, mortgage lenders, and credit card issuers. The three largest credit bureaus in the U.S. are Equifax®, Experian®, and TransUnion®.

What Is A Good Credit Score For My Age

Your age doesnât directly influence your credit scores. But as FICO and VantageScore show, the age of your credit accounts is one factor that affects how scores are calculated.

That could be a reason peopleâs credit scores tend to increase as they get older. Their accounts have simply been open longer. But credit scores can rise or fall no matter how old you are. And having good credit scores comes down to more than just your age.

Read Also: How To Get Credit Report Without Social Security Number

What Does A Credit Bureau Do

A credit bureau uses the info gathered on you to build and generate your credit report. They may also use this information to calculate your credit score. These reports can be used by lenders when considering whether or not to extend credit to you. As a consumer, credit bureaus are federally mandated to provide a copy of your credit report at no cost once per year.

Fico Score Vs Credit Score

Believe it or not, the FICO score is actually just one type of credit scoreits not the only kind of credit score out there. Sure, the FICO credit score is the most commonly used across the board, but its not the only credit score in town.

Your credit score can actually be different, depending on what scoring model is used and whether its Equifax, Experian or TransUnion reporting the information.

Still, FICO has such a presence that when someone is talking about their credit score, theyre pretty much just talking about their FICO score .

Also Check: What Credit Score Does Les Schwab Require

What Is Your Credit Score

The most common credit score range is 300 to 850. In other words, 850 is the best credit score you can have, while 300 is the worst. And a good credit score is anything from 700 to 749. All of the most popular credit-scoring models, including those from VantageScore and FICO, now use that 300-to-850 credit score scale. Thats good because knowing the possibilities for what a credit score could be is the first step toward truly understanding what your credit score means.

To help you better understand the significance of your score, whichever it happens to be, WalletHub analyzed every single credit score from 300 to 850. Below, you can take a closer look at the different tiers in the credit score range, learn everything you need to know about your particular score, and see what steps you can take to improve.

How To Check Your Fico Score

Knowing your FICO Score can help you get a handle on your finances and prepare you for the loan or credit card application process. Luckily, there are a number of ways to check your credit score. Start by reviewing your credit card statements and card providers website. Many issuers offer customers free FICO scores each month, while others even offer the service to non-cardholders.

Alternatively, you can visit FICOs website and choose from one of three monthly plans that provide access to FICO scores, credit reports, identity monitoring and other services.

Don’t Miss: When Does Usaa Report To Credit Bureaus

What It The Highest Credit Score

Most credit scoring models follow a credit score range of 300 to 850 with that 850 being the highest score you can have. However, there can be other ranges for different models, some of which are customized for a particular industry . While the majority follow the 300 to 850 range, there are some scores that range from 250 to 900 and others that may use other score ranges. For more information on the different scoring models, view Understanding the difference between credit scores.

How Does A Bankruptcy Impact My Fico Score

A bankruptcy is considered a very negative event by FICO® Scores. As long as the bankruptcy is listed on your credit report, it will be factored into your scores. How much of an impact it will have on your score will depend on your entire credit profile. As the bankruptcy item ages, its impact on a FICO® Score gradually decreases. Typically, here is how long you can expect bankruptcies to remain on your credit reports :

- Chapter 11 and 7 bankruptcies up to 10 years.

- Completed Chapter 13 bankruptcies up to 7 years.

These dates and time periods refer to the public record item associated with filing for bankruptcy. All of the individual accounts included in the bankruptcy should be removed from your credit reports after 7 years.

You May Like: How To Check Itin Credit Score

How The Fico Score Works

FICO scores are calculated based on information collected by the three main credit bureausExperian, Equifax and TransUnionand summarized in a consumers . Using this data, FICO scores are calculated based on five general metrics: payment history, amount owed, length of credit history, credit mix and new credit. Specific criteria and considerations vary slightly, however, depending on the type of FICO Score.

In addition to FICOs base scoresFICO Score 8 and FICO Score 9the company has a number of industry-specific versions, including for mortgages and auto lending. While FICO Score 8 is still the most widely used version, the majority of auto lending scenarios use FICO Auto Scores, and mortgage lending typically uses FICO Scores 2, 4 and 5.

Why Is This Fico Score Different Than Other Scores Ive Seen

There are many different credit scores available to consumers and lenders. FICO® Scores are the most widely used credit scores and are the only credit scores used in over 90% of U.S. lending decisions. Its important to know that there are also several different versions of FICO® Scores. Different lenders may use different versions of FICO® Scores. In addition, your FICO® Score is based on credit report data from a particular credit bureau, so differences in your credit reports may create differences in your FICO® Scores. The FICO® Score Wells Fargo is providing you for free is for educational purposes. When reviewing any of your credit scores from any source, take note of the date, bureau credit report source, version, and range for that particular score. For more, see Understanding the difference between credit scores.

Read Also: Getting A Repo Off Your Credit

Industry Specific Credit Scores

Now that you know what a good credit score is, its time to get more specific.

While traditional FICO scores from the popular scoring company Fair Isaac Corporation range from 300 to 850, there are actually several different models that lenders might use when judging your creditworthiness. These vary depending on what type of credit youre applying for.

A few examples include versions specifically for mortgages, car loans, credit cards, and student loans. Each one will look at slightly different information that is more relevant to the exact type of credit you want.

Why Can I See My Fico Score But Others On My Account Cant See Theirs

You can see your FICO® Score because you are the primary account holder of an eligible account.

Others may not be able to view their scores if:

- They recently opened a new account

- Theyre an authorized user on someone elses account

- They have a billing statement in someone elses name

- They do not have an eligible account in Wells Fargo Online®

You May Like: What Credit Card Is Syncb Ppc

Get A Free Credit Consultation

Most companies, like Lexington Law Firm, offer a free consultation so you can ask questions about your specific situation and find out exactly what they can help you with.

Knowledge is power, and finding out your credit score and learning what range you fall in can help you plan the next steps in your financial future.

Never assume the worst-case scenario theres no such thing as a lost cause. Everyone, no matter how bad their credit score is, has the potential to improve their financial situation.

It might take a little time and effort, but its always doable. Professional credit repair companies that have been in the business for a long time have truly seen it all. Dont be afraid to give one a call today and find out what you can do to increase your credit score.

Are Fico Scores Unfair To Minorities

No. FICO® Scores do not consider your gender, race, nationality or marital status. In fact, the Equal Credit Opportunity Act prohibits lenders from considering this type of information when issuing credit. Independent research has shown that FICO® Scores are not unfair to minorities or people with little credit history. FICO® Scores have proven to be an accurate and consistent measure of repayment for all people who have some credit history. In other words, at a given FICO® Score, non-minority and minority applicants are equally likely to pay as agreed.

You May Like: How To Unlock My Experian Credit Report

Fico Scores Are The Most Widely Used Credit Scoring Model

FICO is perhaps the most recognizable name in . The Fair Isaac Corporation , which developed the FICO algorithm, says its scores are used by 90% of top U.S. lenders in more than 90% of lending decisions. There are currently several types of FICO scores available. The most widely used model is FICO 8, though the company has also created FICO 9 and FICO 10 Suite, which consists of FICO 10 and FICO 10T. There are also older versions of the score that are still used in specific lending scenarios, such as for mortgages and car loans.

What Impacts Your Fico Score

In general, FICO scores are calculated based on five major factors, each with its own weight. Heres what impacts your FICO Score.

Payment History

Accounting for 35% of your credit score calculation, payment history is the most impactful component of your credit score. This metric includes several factors like the number and severity of late payments and the presence of adverse public records like lawsuits and bankruptcies. To improve your credit scoreor keep it strongmake consistent, on-time payments on all of your accounts.

Amounts Owed

The amounts owed category represents the total outstanding balances on all of your accountsor how much money you owe. As the second most important element of your credit score, it accounts for 30% of the calculation. For that reason, making more than the minimum payment each month and paying down debts quickly can improve your credit score.

Length of Credit History

In general, the longer your credit history, the higher your score. Even though the length of your credit history only accounts for 15% of your score calculation, it can be a frustrating metric to manageespecially if youre building credit for the first time. While you cant go back in time and open credit accounts sooner, you can strengthen this portion of your score by keeping your oldest accounts open and in good standing.

New Credit

Read Also: Does Klarna Report To Credit

Why Do Fico Scores Fluctuate

There are many reasons why your score may change. The information on your credit report changes each time lenders report new activity to the credit bureau. So, as the information in your credit report at that bureau changes, your FICO® Scores may also change. Keep in mind that certain events such as late payments or bankruptcy can lower your FICO® Scores quickly.

FICO® Scores consider five main categories of information in your credit report.

- Your payment history

- Types of credit in use

Factors That Can Affect A Credit Score

There are 5 main factors that can affect the calculation of a credit score. If youre interested in improving your credit these are the areas that you should focus on.

History of Payments

This is determined by the payments you have made to lenders or creditors. This ultimately reflects on how frequently you pay your loans or bills on time. Anyone looking to improve their credit scores should always make their payments on time, without fail.

Debt/ Credit Utilization

This shows the amount of outstanding debt a consumer has compared to the amount of available credit they have. For example, if you have a total credit limit of $5,000 and consistently carry a high balance, your credit score may be negatively affected. To help improve your credit scores, pay down your debt and make sure you need your balance to lower than 35% of your available credit.

This factor is straightforward, the longer a credit account has been open, the better it is for your credit scores. If youre considering cancelling a credit card, make sure you cancel a new one and keep the older ones open.

New Inquiries

Every time a potential lender or creditor pulls your credit, your credit score may take a small and temporary hit. If you apply for a lot of new credit within a short period of time, your credit score may drop and other creditors will be able to see that youve recently applied for a lot of credit which they may consider to be a red flag.

Diversity

Loans Canada Lookout

Read Also: Does Capital One Report Authorized Users To Credit Bureaus