Inquiries Arent A Major Factor In Your Credit Score

Examples of soft inquiries include when a utility company considers whether they need security deposit from you, when credit card companies decide what types of credit cards to market to you and for setting premiums on insurance. Additionally, when you pull a credit check on yourself through a credit monitoring service, itâs a soft inquiry. Since these credit inquiries do not deal with lending you money, but still provide valuable information about your credit history, it would be unfair if they counted against your credit score.

According to Experian, inquiries wonât affect you unless you also have other – more serious – issues impacting your credit score. Multiple credit inquiries are ultimately a reality of life. For example, when you are looking to buy a car and want the best auto loan rates, a dealership might engage in rate shopping, where they send your information to an array of lenders. Due to this issue, all inquiries related to an auto loan that are sent within 14 days will all count as one inquiry.

Additionally, there are even credit scoring systems that will not count a credit inquiry after more than one year. As noted above, hard inquiries will not remain on your credit report for more than two years. So over time, an individual inquiry counts less.

How Many Hard Inquiries Is Too Many

The effect of a hard inquiry on your credit scores ultimately depends on your overall credit health. In general, adding one or two hard inquiries to your credit reports could lower your scores by a few points, but its unlikely to have a significant impact.

Having a lot of hard inquiries within a short time frame though will likely have a greater impact on your scores. This is because lenders and in effect, credit-scoring models look at multiple credit applications in a short amount of time as a sign of risk. Though there can be exceptions when youre shopping for specific types of loans, like car loans, student loans or mortgages.

How Long Will Hard Inquiries Last

Hard inquiries stay on your credit reports for 24 months, but their effect on your credit score diminishes with time. For instance, many people can fix a marginal drop in their credit score after a hard inquiry within a few months by maintaining responsible financial habits.

Your FICO score only accounts for hard inquiries that have taken place in the preceding 12 months. You may expect even more leniency with your VantageScore, which tends to rebound within three to four months of a hard inquiry, so long as there is no further negative activity.

Also Check: Notifying Credit Bureaus Of Death

What Triggers A Hard Inquiry On Your Credit Report

If you see a hard inquiry listed on your credit report it is because you have applied for credit in the last two years.

This could mean that you applied for a credit card, whether it be a rewards card, a cash-back card or even a balance transfer card like the U.S. Bank Visa® Platinum Card.

A hard inquiry will also end up on your personal credit report when you open a business credit card. This is because your personal credit is usually reviewed by the issuer even when applying for a small business credit card, such as the Capital One Spark Classic for Business.

When you apply for a mortgage, student or auto loan, a hard inquiry will be noted on your credit report. There’s a difference, however, between applying for multiple credit cards in a short amount of time and shopping around for the best mortgage rate in a short amount of time.

“There are certain instances, such as applying for a car loan or a mortgage, that only count as one inquiry for scoring purposes as long as they occur within a certain window of time, typically 14 to 45 days,” Shon Anderson, a certified financial planner and president at Anderson Financial Strategies, tells CNBC Select. “The reason is they know you are probably shopping around for the best terms, and you are probably not going to get three or four car loans or mortgages all at once.”

Examples Of Hard Credit Inquiries And Soft Credit Inquiries

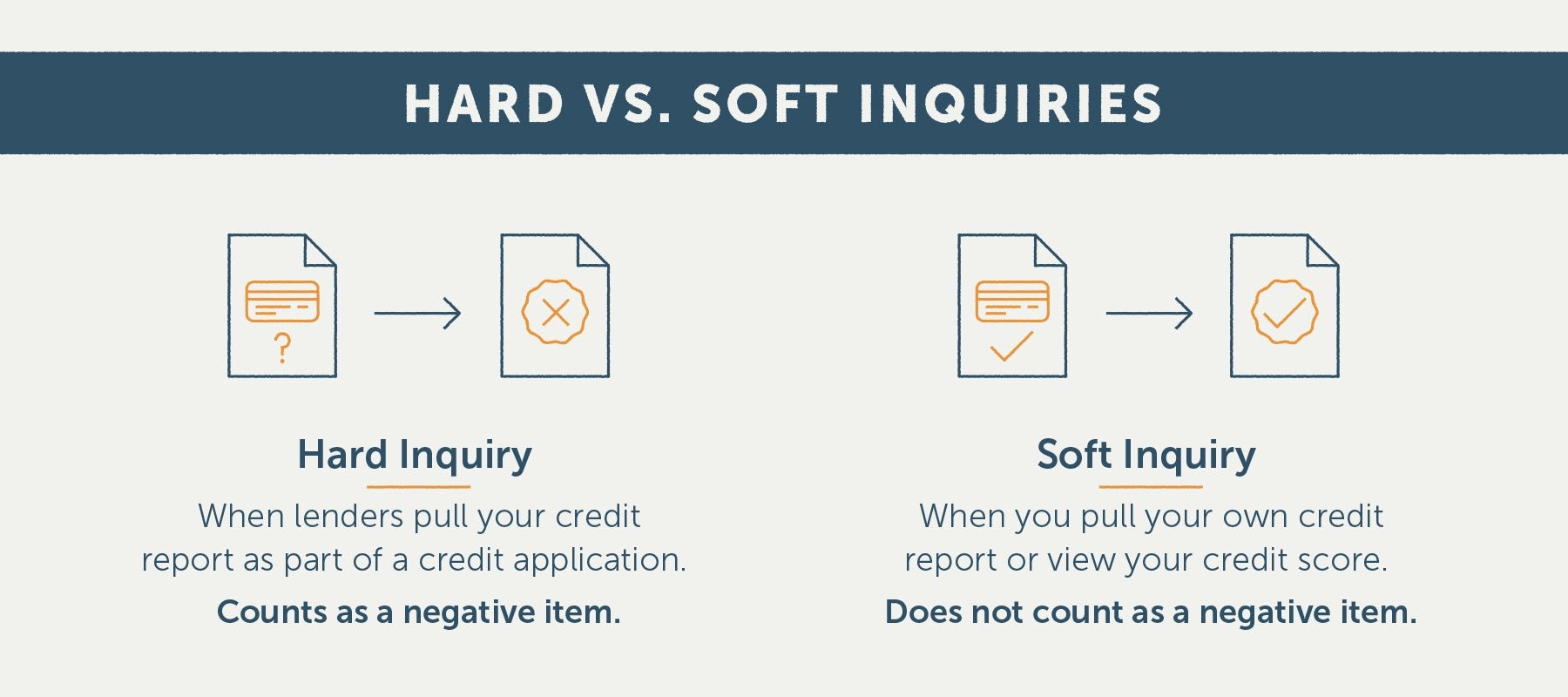

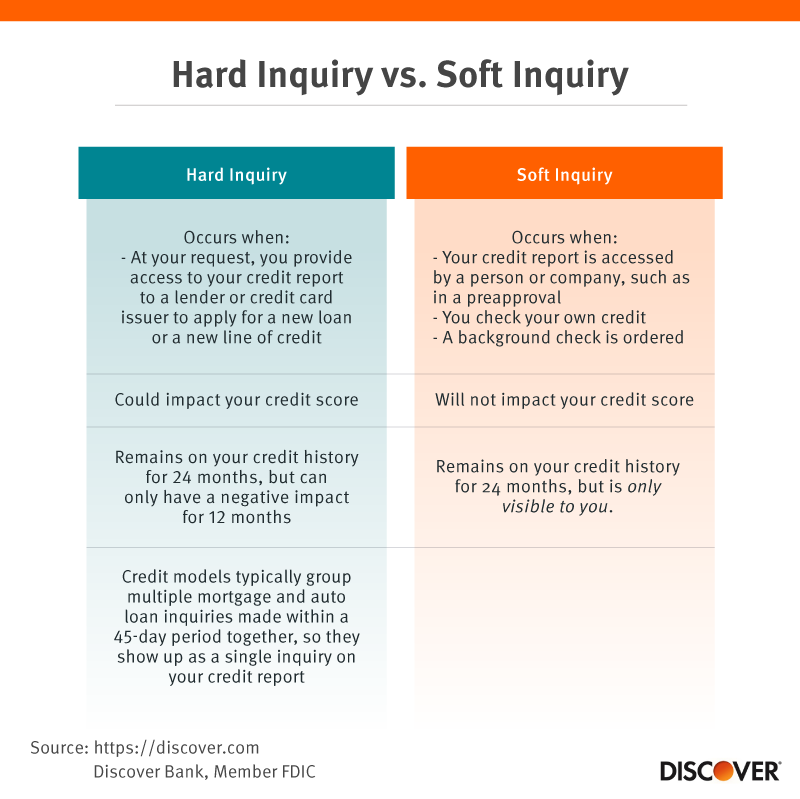

The difference between a hard and soft inquiry generally boils down to whether you gave the lender permission to check your credit. If you did, it may be reported as a hard inquiry. If you didnt, it should be reported as a soft inquiry.

Lets look at some examples of when a hard inquiry or a soft inquiry might be placed on your credit reports. Note: The following lists are not exhaustive and should be treated as a general guide.

You May Like: How To Get Public Records Off Your Credit Report

Types Of Credit Inquiries

A hard credit inquiry occurs when a potential lender examines your credit report and uses that information to decide whether to extend an offer for credit. For instance, if you apply for a home mortgage or a car loan, your lender will make a hard inquiry of your credit to help determine if you qualify for the loan.

A soft credit inquiry, on the other hand, is a more routine check that can be done without your permission. A common example of a soft inquiry is when a lender youre currently doing business with checks your credit to make sure youre still creditworthy. You can also trigger a soft inquiry yourself if you check your own credit.

Hard Inquiries May Affect Your Credit Soft Inquiries Do Not

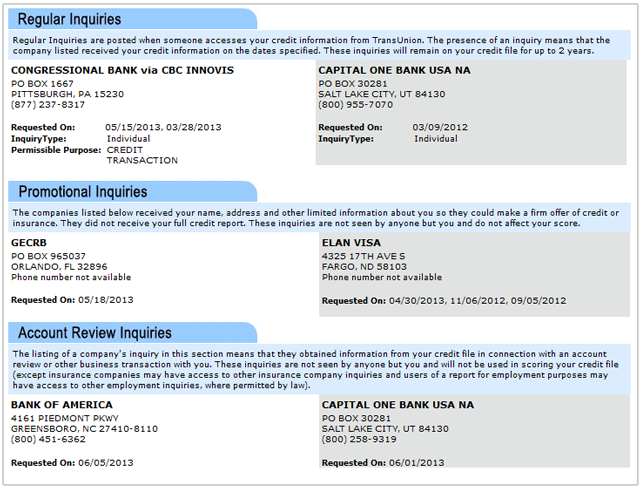

There are three major credit reporting agencies or credit bureaus in the United States. They are Experian, TransUnion, and Equifax. The credit bureaus gather information about you and around 220 million other consumers and maintain that information in their credit file database.

Lenders, credit card issuers, insurance providers, and you can request to see the details of your credit file a.k.a. your credit report for a variety of reasons.

For example, when you apply for a new loan, a lender can review your credit report to see how youve managed credit obligations in the past before it decides whether to approve your application.

If a credit bureau sells or otherwise makes available a copy of your credit report, the Fair Credit Reporting Act requires the bureau to record that access. This record is known as a credit inquiry or an inquiry for short.

The FCRA also dictates how long inquiries must remain on your credit reports. Certain credit inquiries, including those made for employment screening purposes, must remain on your credit report for at least two years. Other types of credit inquiries must stay on your report for at least 12 months.

All credit inquiries informally fall into one of two categories, hard inquiries and soft inquiries. The terms hard and soft are not legal terms and wont be found in the FCRA regarding inquiries.

Also Check: Is 586 A Bad Credit Score

Our Editorial Review Policy

Our site is committed to publishing independent, accurate content guided by strict editorial guidelines. Before articles and reviews are published on our site, they undergo a thorough review process performed by a team of independent editors and subject-matter experts to ensure the contents accuracy, timeliness, and impartiality. Our editorial team is separate and independent of our sites advertisers, and the opinions they express on our site are their own. To read more about our team members and their editorial backgrounds, please visit our sites About page.

Can You Remove Inquiries From Your Credit Report

You cannot remove a hard inquiry from your credit score unless it is the result of fraud. For example, if someone tries to use your Social Security number to apply for a car loan, then the hard pull on your credit is fraudulent.

You cannot request the removal of hard inquiries purely because you dont want them on your records. If you are worried that these inquiries might affect your ability to get funding, prepare documents that address these concerns.

For example, if you have multiple hard inquiries by mortgage companies, you can show your current mortgage agreement as proof that you were just shopping around for a home loan.

Read Also: Klarna Credit Approval Odds

How To Remove Hard Inquiries

You should check your credit reports from all three credit bureaus regularlyat least once each yearwhich you can do for free at AnnualCreditReport.com. You can also check your Experian credit report for free anytime. One thing to look for is any hard inquiry you don’t recognize. Unexplained hard inquiries, while rare, can lower your credit scoresbut more importantly, they can be signs of criminal activity.

If you see a hard inquiry you don’t recognize, reach out to the creditor in question, using the contact information included in your credit report. Suspicious inquiries aren’t always connected to illegitimate activity: An unfamiliar creditor may turn out to be the lending partner of a retailer where you applied for a credit card or a dealership where you applied for an auto loan, for instance.

If you confirm a hard inquiry is connected to fraudulent activity such as someone applying for credit with your information, take these steps:

- Report it to the appropriate law-enforcement agencies.

- Consider protecting your credit reports with a fraud alert or security freeze.

- Dispute the inquiry to have it removed from your credit report.

Why Hard Inquiries Matter

When a lender pulls your credit report, theres a potential for your credit score to decline. The reason why comes down to simple math. Statistics show that consumers who apply for new credit are riskier compared with consumers who do not.

According to FICO, consumers with five or more credit inquiries in the past 12 months are six times more likely to become 90+ days past due on a credit obligation than consumers with zero inquiries. People with six or more credit inquiries may be eight times more likely to file bankruptcy compared with zero-inquiry consumers.

Lenders and other companies use credit scores to help predict the risk of doing business with you. Both FICO and VantageScore credit scores predict the likelihood that a consumer will default on any credit obligation within the next 24 months.

If something on your credit report shows youre more likely to default on a credit obligation, your score could decline. This is true of hard credit inquiries and any other actions that increase your credit risk, such as high , late payments and other derogatory credit information.

Also Check: Do Evictions Show Up On Your Credit Report

Why You Can Trust Bankrate

At Bankrate we strive to help you make smarter financial decisions. While we adhere to strict editorial integrity, this post may contain references to products from our partners. Here’s an explanation for how we make money. The content on this page is accurate as of the posting date however, some of the offers mentioned may have expired. Terms apply to the offers listed on this page.

What Is A Soft Inquiry

Soft inquiries typically occur when a person or company checks your credit as part of a background check. This may occur, for example, when a credit card issuer checks your credit without your permission to see if you qualify for certain credit card offers. Your employer might also run a soft inquiry before hiring you.

Unlike hard inquiries, soft inquiries wont affect your credit scores. Since soft inquiries arent connected to a specific application for new credit, theyre only visible to you when you view your credit reports.

Also Check: Leasingdesk Screening Reviews

What Is A Credit Inquiry

Anytime someone checks your credit report including yourself, lenders, banks or even landlords, its recorded on your report as a soft or hard credit inquiry.

Each of the three credit bureausEquifax, Experian and TransUnionkeep track of the inquiries on your report because it can say a lot about the risk you pose to lenders. While lenders arent too worried about soft inquiries because it doesnt impact your credit score, they do take caution around hard inquiries. In the lenders eye, multiple hard inquiries can indicate youre taking on more credit than you may be able to afford.

For example, according to FICO, People with six inquiries or more on their credit reports can be up to eight times more likely to declare bankruptcy.

Check Your Credit Report

You can check your own credit report for free every year at AnnualCreditReport.com. When you look over your report, youll be able to see if any hard credit checks occurred recently.

When reviewing your credit report, check to see if there are any errors or credit inquiries you didnt authorize. These could be a sign of identity theft. You can dispute credit errors with individual credit bureaus like Experian, TransUnion, or Equifax.

If you find any inquiries on your report that you didnt authorize, you can submit a complaint with The Consumer Financial Protection Bureau about a financial product or service that used your information without your permission.

You May Like: Itin Number Credit Report

The Rate Shopping Exception

As mentioned, some hard inquiries might harm your credit score. Frequent credit applications indicate higher risk and could be a sign that youre in financial distress. Rate shopping, however, is an exception to the rule.

When you take the time to search for the best interest rate before taking out a new loan it shows financial responsibility, not higher risk. Because rate shopping doesnt indicate that youre more likely to default, FICO and VantageScore both include special logic in their credit scoring models that treats these types of inquiries differently.

This special logic is known as deduplication. Heres a look at how it works.

- 45-Day Safe Harbor Period: FICO considers all student loan, auto loan, and mortgage inquiries as one hard inquiry, as long as they occur within a 45-day window. Older versions of FICO scoring models feature a 14-day window instead.

- 14-Day Safe Harbor Period: VantageScore treats all inquiries that take place within a 14-day window as one inquiry, regardless of the application type.

What Is A Hard Inquiry

When a lender or company makes a request to review your credit reports as part of the loan application process, that request is recorded on your credit reports as a hard inquiry, and it usually will impact your credit scores. This is different from a soft inquiry, which can result when you check your own credit reports or when a promotional credit card offer is generated. Soft inquiries do not impact your credit scores.

Hard inquiries serve as a timeline of when you have applied for new credit and may stay on your credit reports for up to 36 months. Depending on your unique credit history, they could indicate different things to different lenders.

Recent hard inquiries on your credit reports tell a lender that you were recently shopping for new credit. This may be meaningful to a potential lender when assessing your creditworthiness.

Also Check: Report Death To Experian

How Many Points Does A Hard Inquiry Affect Your Credit Score

In general, hard inquiries dont have as much of an impact on your credit score as other credit factors. Credit inquiries are only responsible for 10% of your credit score while your payment history makes up 35% of your score.

For most people, according to FICO, a new hard credit inquiry will only drop your credit score between one and five points. While a hard inquiry stays on your credit report for two years, it only impacts your score for one year.

Its important to note that these inquiries can stack up. For example, if you get a new mobile phone and service plan in January and then apply for a new credit card in February, you may see a bigger hit to your credit score than just five points due to multiple hard inquiries.

However, there is a way around racking up multiple hard inquiries if youre rate shopping for a loan or mortgage. Heres how.

Dont Worry About The Rest

Legitimate hard inquiries can ding your credit score, but not by much and not for long. Hard inquiries … represent potential new debt that doesnt yet appear in the credit report as an account, says Rod Griffin, Experians director of public education.

Typically, any impact drops off dramatically after a month or two, Griffin says, either because you did not add the debt, so theres no risk, or you did open an account and its now wrapped into other credit factors.

Some companies say they can remove even legitimate inquiries from your report for a fee but NerdWallet advises against using them. As long as youre not continuing to pile up applications, time will repair any damage to your credit.

Griffin advises keeping perspective because other things influence your credit score more .

Hard inquiries alone will never be the reason a person is declined for credit, he says. Inquiries may be the proverbial straw that broke the camels back, but they will not be the entire bale of hay.

About the author:Bev O’Shea writes about credit for NerdWallet. Her work has appeared in the New York Times, Washington Post, MarketWatch and elsewhere.Read more

Also Check: Aargon Agency Inc Collections

Merced School Employees Federal Credit Union Merced Ca

Category: Credit 1. Merced School Employees Federal Credit Union Reviews Read reviews and see what people are saying. Marketing Manager at Merced School Employees Federal Credit Union. Merced School Employees Federal Merced, California, United States348 connections. Merced School Employees Federal Credit UnionMerced Community College District. Merced, California, United States120

How Long Does A Hard Inquiry Last

A hard inquiry will stay on your credit report for two years. While lenders can see all inquiries made during that time, the inquiries only directly affect your credit score for one year at most.

That means that when you apply for a credit card, for instance, you may initially see a small drop in your credit score. Over time, that impact will diminish, and with responsible credit behavior, you’ll recover from the drop fairly quickly.

To keep your score strong, apply only for the credit you truly need. If you plan to apply for a major new credit product, like a mortgage, in the next several months, experts say you should avoid applications for other new credit to keep your score as high as possible.

Don’t Miss: Do Klarna Report To Credit Bureaus