Credit Score Mortgage Loan Options

Experts say you need a minimum credit score of 620 to be approved for a conventional mortgage loan. As a result, a credit score of 756 should make a mortgage approval highly likely.

Your 756 credit score will likely get you an average interest rate of 2.36 percent on a 30-year loan. In comparison, if you had credit in the good range, youd get an average mortgage interest rate of 2.58 percent.

That difference of 0.22 percent might not seem like a significant variation. However, lets look at the loan term calculations. Assuming you purchase a property for $350,000 with a credit score of 756 and an interest rate of 2.36 percent, over a 30-year loan term, youll pay $14,379 less in interest than a person with a 2.58 percent interest rate.

When it comes to large loans or long loan terms, a slight decrease in interest can mean thousands of dollars saved.

What An Excellent/exceptional Credit Score Means For You:

Borrowers with exceptional credit are likely to gain approval for almost any credit card. People with excellent/exceptional credit scores are typically offered lower interest rates. Similar to “exceptional/excellent” a “very good” credit score could earn you similar interest rates and easy approvals on most kinds of credit cards.

Canadian Credit Ratings And What They Mean

Lenders and creditors typically use a credit score to determine youre likelihood of making payments on time. Its important to note that your is only one of the factors that lenders will evaluate when approving you for new credit.

- Excellent Individuals with a rate of 780 or over may enjoy the best interest rates on the market. They also will typically always be approved for a loan.

- Very Good This is considered near perfect and individuals with a rate in this range may still enjoy some of the best rates available.

- Good An individual who has a credit score that falls within this range has good credit and will typically have little to no trouble getting approved for the new credit.

- Average While this is still a good range, individuals with this score may receive slightly higher interest rates than those with higher scores. According to Equifax, at the end of 2012, the average national credit score was 696.

- Poor Scores in this range indicate that the individual is high risk. It may be difficult to obtain loans and if approved, they will be offered higher interest rates.

- Very Poor Scores in this range are rarely approved for anything, but credit can be repaired.

- Terrible Individuals whose credit scores are less than 500 may not get approved for new credit and should seek credit improvement help.

Loans Canada Lookout

Recommended Reading: Can Someone Check Your Credit Without Permission

How To Solve Common Credit Issues When Buying Ahouse

If your credit score orcredit history is standing in the way of your home buying plans, youll need totake steps to improve them.

Some issues like errorson your credit report can be a relatively quick fix and have an immediateimpact on your score. Other issues can take much longer to resolve.

You should start checking your credit early on, ideally 6-12 months before you want to buy a house. This will give you time to identify issues with your score or report and work on solving them before you apply for mortgage pre-approval.

Here are tips on solvingsome of the most common credit issues faced by home buyers.

How To Improve Your Credit Score From 756 To 800+

A credit score of 756 is on the brink of perfection, and you probably wont have to change much to join the 800+ credit score club. Your personalized credit analysis from WalletHub will tell you what needs improvement and exactly how to fix it.

A few things in particular tend to stand between a credit score of 756 and perfect credit, though. And if you do nothing else, make sure to take the following steps.

You May Like: Carecredit Credit Score Requirements

How A 756 Credit Score Can Benefit Your Finances

Having a good credit score means that youll end up saving a lot of money on loans and other types of credit. This is because youll be able to take advantage of the low interest rates and other financial benefits of a good credit score.

Loans and Credit You Can Get with a 756 Credit Score

| Installment loans | Mortgage | Eligible for all types of mortgages, including FHA-backed mortgages with a 3.5% down payment, conventional mortgages, VA loans, USDA loans, and jumbo mortgages |

| Car loan | Eligible for the best interest rates | |

| Private student loan | ||

| Eligible without a deposit | ||

| Utilities | Eligible, but you may need to pay a deposit if youve previously had any late payments | |

| Charge cards | Usually eligible |

In addition to helping you qualify for better credit card and loan terms, having good credit can help you snag your dream job or apartment. This is because many landlords and employers run credit checks. A high score can also save you money on services like insurance.

However, if you want the very best rates and terms on your loans and credit cards, then there are still some things you can do to further improve your credit score. This is easy to do once you understand how credit scores work and how theyre calculated.

Can I Get A Personal Loan Or Credit Card W/ A 756 Credit Score

Like home and car loans, a personal loan and credit card is easy to get with a 756 credit score.

You donât need to apply for a secured card with Discover or Capital One, who may make you pay $500-$1000 just for a deposit.

You can get even better terms on your personal loan or credit card by repairing your credit and waiting a few short months until your score improves.

A 756 score means you likely have few-no negative items on your report. Removing any outstanding negative items is usually the quickest way to fixing your report.

We recommend speaking with a friendly credit repair expert online to help guide you through this process. Your consultation is completely free, no-pressure, and will set you on the right path toward boosting your score.

Don’t Miss: What Credit Score Is Needed To Buy A Car At Carmax

+ Credit Scores By Income

700+ Credit Scores by Income

People who make at least $50,000 per year are significantly more likely to have a credit score of at least 700. And people who pull in $75,000 to $99,999 per year are in the sweet spot for a score that begins with a 7 or an 8. But note that it is possible to get into the 700-plus club if you earn less or wind up with a way lower score even if you make a lot more. Its all about spending within your means.

Why Your Credit Score Matters

There are real benefits to staying on top of your credit score.

Thats because a strong credit score can translate into real perks, like access to a wider range of products and services including loans, credit cards and mortgages. You could also enjoy better interest rates and more generous credit limits. Meanwhile, if your credit score isnt quite where you want it to be, knowing the score is the first step to improving it.

Either way, it pays to know your credit score. Its your financial footprint the way companies decide how financially reliable you are. A higher credit score means lenders see you as lower risk.

Recommended Reading: Attcidls

Only Spend What You Can Afford

Dont use a credit card to live beyond your means, or to roll over the costs of everyday expenses to the next month, Nitzsche recommends. This will only lead to spiraling debt that will be difficult to get out of.

People with an 800+ credit score dont apply for more credit than they can afford and dont spend more than they earn.

While using a credit card for everyday expenses is OK if you can pay the credit card bill off in full each month while gaining awards points in the process, dont let the accumulation of points convince you to spend more, Nitzsche says. And if youre running to your credit card when your car, refrigerator, or something else breaks down, start an emergency fund to pay for such repairs.

Bill Balderaz, president of Fathom Healthcare, has an excellent credit score and attributes it to his family living below their means. As our income rises, we keep our spending flat, Balderaz says.

They also pay off all credit card bills each month, pay off their vehicle loans early, and have paid off their mortgage early to help get them to an 800+ credit score.

Their excellent credit score has allowed them to get the most preferred loan rate. After three houses and eight vehicles, Balderaz estimates theyve saved tens of thousands of dollars on loans by getting the lowest loan rates.

What Does A 756 Credit Score Mean Pros And Cons Of Having This Credit Score

Those that have this credit score do not really have any cons, as this is one of the highest scores they can get. Though they are not at the very top of the ladder, they have a couple ways they can improve the score to get it to the top such as paying their payments on time, using the right amount of credit and never defaulting on their loans.

In terms of pros, a 756 credit score shows that you are a trustworthy, reliable borrower and that you would be ideal to loan money too for mortgage loans, vehicle loans, credit cards, lines of credit and a wealth of other money loaning services offered through various financial institutions.

Read Also: When Does Affirm Report To Credit Bureaus

The Best Mortgages For Buying A House With Lowcredit

If you have a low credit score, or past red marks on your credit report, the first type of mortgage you should look at is an FHA loan.

FHA loans

FHA loans are mortgages insured bythe Federal Housing Administration. This insurance protects mortgage lenders,making it possible for them to lend to borrowers with lower credit scores andsmall down payments.

In fact, the FHA mortgage programwas specifically designed for credit-challenged home buyers. It allows thelowest credit score of any loan program 500 although you need a 10% downpayment if your score is below 580. Those with a score above 580 onlyneed to put 3.5% down.

Conventional/conforming loans

Conventional loans also allow amodest credit score of 620 with a down payment of just 3%.

However, the cost of privatemortgage insurance can make conventional loans unattractive forlower-credit borrowers with less than 20% down.

Conventional and FHA loans both require mortgage insurance. The difference is that FHA charges the same mortgage insurance premiums for all borrowers, regardless of credit.

Conventional mortgages, on the otherhand, have steeply increased PMI rates for borrowers with low credit and alow down payment. As a result, FHA financing can sometimes be cheaper forborrowers with credit in the low- to mid-600s.

VA loans

For veterans and active-duty service members, a VA mortgage is normally the best bet.

Vantagescore Vs Fico Credit Score Calculation Methods

VantageScore and FICO take the same factors into account to produce your score, but they weigh them slightly differently . Here are just a couple of the differences between FICO and VantageScore: 3

- VantageScore groups the length of your credit history and your credit mix into one category called Depth of Credit.

- In addition to your credit utilization , VantageScore also looks at your current balances and your remaining available credit .

The tables below show how the models weigh your financial decisions to produce your score:

| -96 | 688 |

Given time, you can get your credit score into the top ranges. This can mean developing your credit profile if you dont have much of a credit history or recovering from negative marks that brought your score down.

Don’t Miss: Carmax Credit Score Requirements

Is 756 A Good Credit Score For A Car Loan

Now that Iâm commuting again, I want to buy a more fuel-efficient car. Iâve never taken out a car loan before, though. I have a credit score of 756âwill it be easy to get a car loan?

between 3% and 5%less than 72 monthsas low as 3.64%saves $887 a year

Improving Your 756 Credit Score

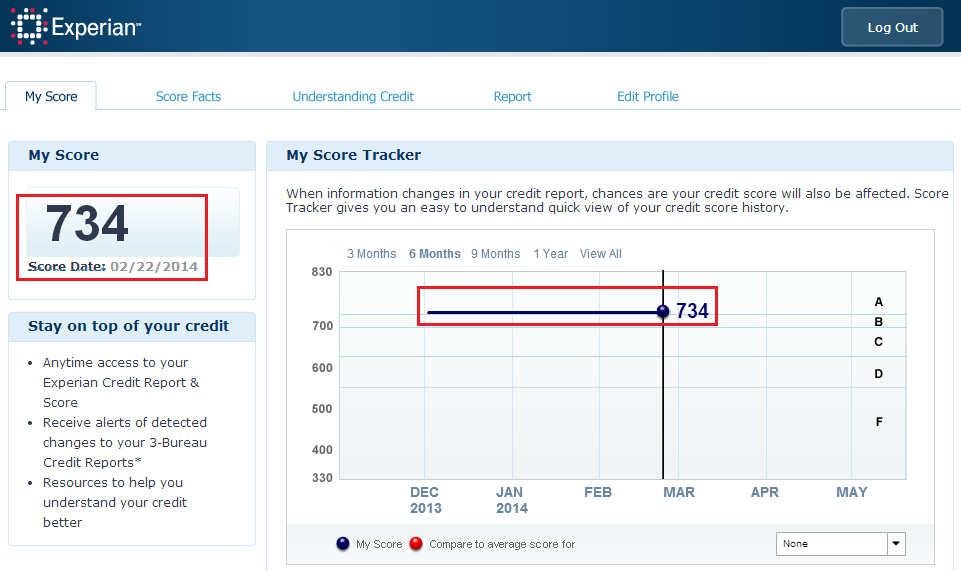

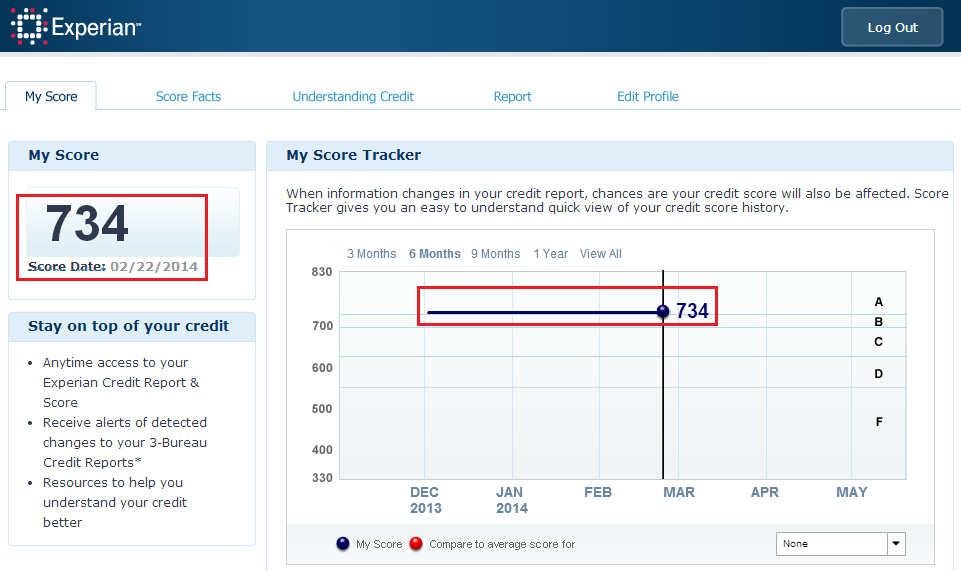

A FICO® Score of 756 is well above the average credit score of 711, but there’s still some room for improvement.

Among consumers with FICO® credit scores of 756, the average utilization rate is 31.8%.

The best way to determine how to improve your credit score is to check your FICO® Score. Along with your score, you’ll receive information about ways you can boost your score, based on specific information in your credit file. You’ll also find some good general score-improvement tips here.

Also Check: Will Eviction Show Up On Credit Report

How To Maintain A Good Credit Score

Practicing healthy credit habits can help keep your score in a good range. Its smart to keep your balances as low as possible. Your credit utilization, which is how much of your available credit limit youre using, is a major factor in credit score calculations. Popular advice is to keep your utilization rate below 30%. But the lower the better its smart to leave some breathing room should an unexpected expense come up.

Because your payment history is another important credit score factor, youre likely to achieve and maintain a good credit score by not missing payments. Automate payments when you can because with multiple services, subscriptions and accounts, it can be easy to let one accidentally slip.

Aim to only apply for credit when needed. Of course, theres no need to avoid credit altogether. For many people, lifes major purchases may require loans or other credit, and a good credit score lays the groundwork for your credit goals. But because new credit may result in hard inquiries on your report its smart to limit credit applications.

Some people like to take advantage of rewards credit cards that are geared toward those with good credit scores. Just make sure youre mindful in your approach and not overspending and over-applying for the sake of some cash back or travel points.

What Is The Perfect Credit Score To Have A Credit Card Application Approved

A credit score is just three digits and the importance given to those three digits by banks and other lenders has grown significantly over the years. Any loan a person is looking for: home loan, car loan, personal loan, or a credit card, the prospective lender check the applicants credit history before approving the application.

So, what is the perfect score to avail a credit card? You can read on to find out.

A typical credit score ranges from 0 to 850 and the score between these are categorised into 5 different levels. The higher the score is, the better a persons chances are of getting a loan or a credit card. So, in the search of a perfect score, lets first see how they are categorised.

0 – 600:

Any score between this means that the lender will most likely be running for the hills when you apply for a line of credit line. This score shows that you are really Poor with money and handling loans. So, the only option for a person with score to get a credit card is by getting a secured card.

601 – 700:

While score between this range isnt as bad, as the previous category, it is still bad. Some lenders may not outright reject an applicant of this category, but they certainly will waste their time, scratching their head thinking if the applicant is worth the risk. There is a slightly high chance of rejection involved here though, unless they can opt for a secured card, as in the case of the previous category.

701 – 750:751 – 850:

Recommended Reading: How To Check Credit Score With Itin Number